![]()

The Quarterly Budget Tracker Excel Template for Small Businesses helps monitor income and expenses over three months, allowing owners to manage cash flow efficiently. It provides customizable categories to align with specific business needs, ensuring accurate financial tracking. Regular use of this template supports informed decision-making and improved budget control.

Quarterly Budget Tracker Excel Template for Small Businesses

The Quarterly Budget Tracker Excel template is designed to help small businesses monitor and manage their financial performance over a three-month period. It typically contains income statements, expense categories, and cash flow summaries that give a clear overview of the company's budget status.

Using this template regularly allows for better financial planning and identifying areas where cost-saving is possible. An important suggestion is to update entries promptly and review discrepancies monthly to maintain accurate and actionable financial data.

Excel Quarterly Budget Spreadsheet for Small Business Owners

An Excel Quarterly Budget Spreadsheet for small business owners is a detailed financial document used to track income, expenses, and cash flow over three months. It helps in monitoring financial performance and making informed business decisions. This type of document typically includes categories like revenue, operational costs, and profit margins.

One important aspect of this spreadsheet is its ability to compare projected budgets with actual spending, highlighting variances that require attention. It also serves as a tool for forecasting future financial needs and allocating resources efficiently. Ensuring accurate data entry and regular updates is crucial for maintaining its effectiveness.

Quarterly Expense Tracking Sheet for Small Businesses

A Quarterly Expense Tracking Sheet for Small Businesses is a document designed to monitor and record all expenses incurred over a three-month period. It helps business owners manage their finances more efficiently and prepare for tax season.

- Include categories for fixed and variable expenses to get a clear overview.

- Regularly update the sheet to maintain accurate and timely financial data.

- Use the sheet to identify cost-saving opportunities and budget adjustments.

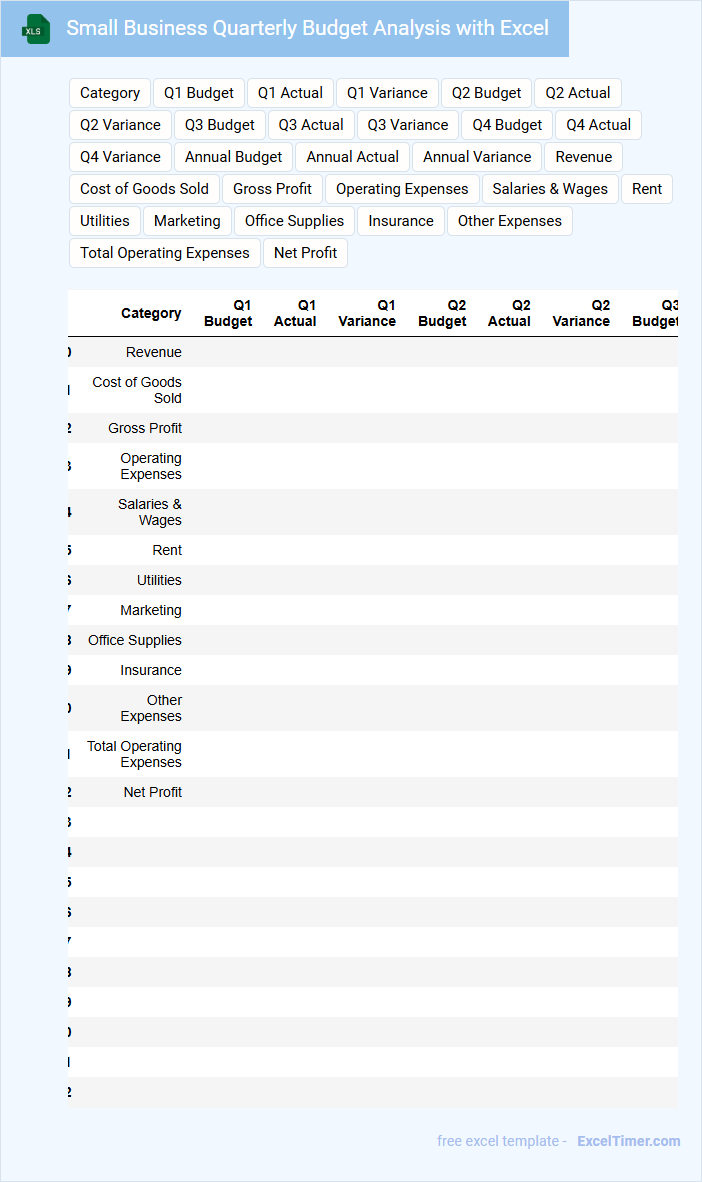

Small Business Quarterly Budget Analysis with Excel

What key information is typically included in a Small Business Quarterly Budget Analysis with Excel?

This document usually contains detailed income and expense tracking, variance analysis, and cash flow projections for the quarter. Using Excel allows for dynamic data visualization and easy adjustment of budget categories to support informed decision-making.

It is important to focus on accurate data entry, regular updates, and clear categorization of costs and revenues to ensure that the analysis reflects the true financial health of the business.

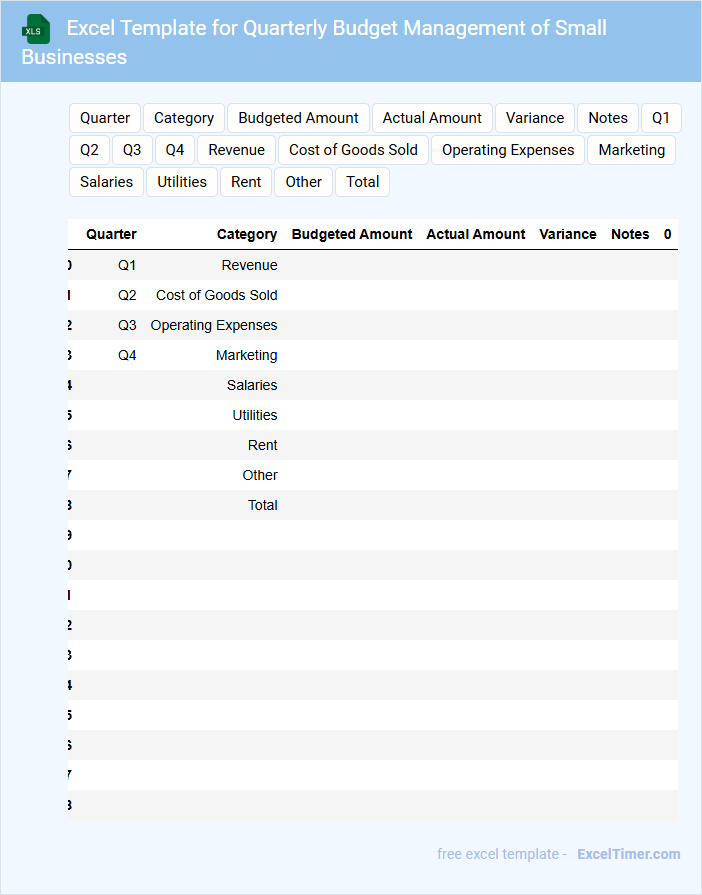

Excel Template for Quarterly Budget Management of Small Businesses

An Excel Template for Quarterly Budget Management typically includes sections for revenue tracking, expense categorization, and profit analysis. It helps small businesses organize financial data efficiently over three-month periods to monitor cash flow and make informed decisions. Key features often involve customizable charts and summary tables to visualize budget performance.

To maximize effectiveness, ensure accuracy by regularly updating figures and categorizing expenses consistently. Incorporate contingency planning for unexpected costs and set realistic quarterly financial goals. Additionally, use clear labeling and data validation to prevent errors and maintain data integrity.

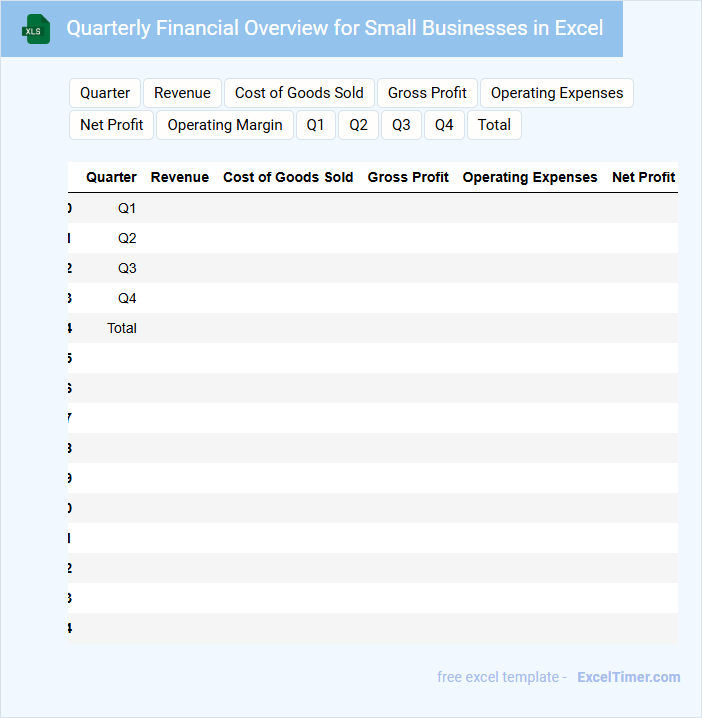

Quarterly Financial Overview for Small Businesses in Excel

A Quarterly Financial Overview for small businesses typically contains summarized financial statements such as income statements, balance sheets, and cash flow summaries. It highlights key performance metrics such as revenue, expenses, and profit margins for the quarter. This document is essential for tracking business health and making informed strategic decisions.

To optimize this overview in Excel, ensure accurate data entry and use clear, labeled tables and charts. Include comparative analysis with previous quarters to identify trends and variances. Additionally, integrating automated formulas and conditional formatting helps streamline updates and emphasize critical financial insights.

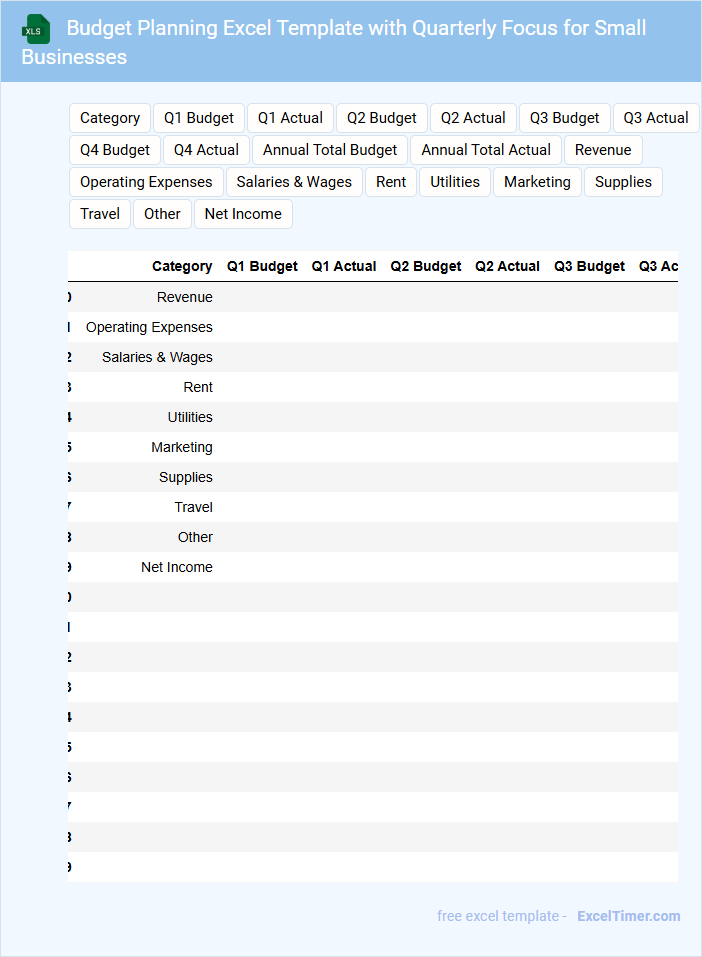

Budget Planning Excel Template with Quarterly Focus for Small Businesses

A Budget Planning Excel Template is designed to help small businesses systematically track income and expenses over each quarter, ensuring effective financial management. It typically includes sections for revenue forecasts, fixed and variable costs, and profit projections to provide a clear overview of finances.

For small businesses, a quarterly focus allows for timely adjustments and better cash flow control throughout the year. Incorporating visual charts and regular review checkpoints is essential to maximize accuracy and usability of the template.

Quarterly Income and Expense Tracker for Small Businesses in Excel

A Quarterly Income and Expense Tracker for small businesses in Excel is a vital financial document used to record and monitor all sources of income and expenditures over a three-month period. It helps entrepreneurs gain insight into their cash flow, ensuring expenses do not exceed income. This tracker allows for better budgeting, making informed financial decisions, and planning for future growth.

Small Business Cash Flow Tracker with Quarterly Sheets

A Small Business Cash Flow Tracker with Quarterly Sheets is a document designed to monitor and manage the inflow and outflow of cash across three-month periods.

- Income Recording: Track all sources of revenue meticulously to understand cash inflows.

- Expense Monitoring: Record all expenses to identify spending patterns and control costs.

- Quarterly Analysis: Review cash flow every quarter to make informed financial decisions and forecast future needs.

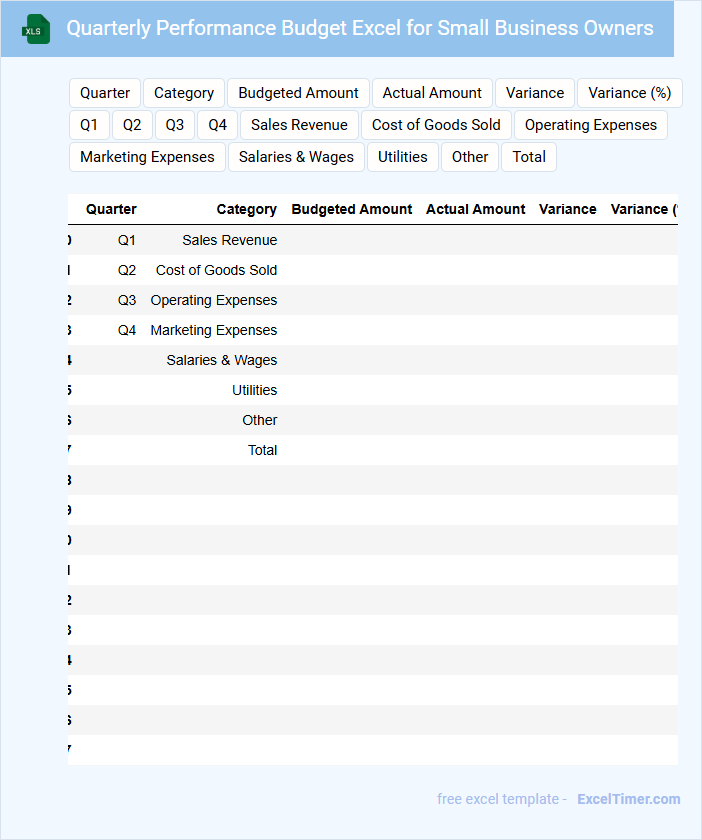

Quarterly Performance Budget Excel for Small Business Owners

What information does a Quarterly Performance Budget Excel typically contain for small business owners? This document usually includes a detailed overview of projected revenues, expenses, and profit margins over a three-month period, helping owners monitor financial progress. It also features key performance indicators and budget variances to facilitate informed decision-making and strategic planning.

What important aspects should small business owners focus on when using a Quarterly Performance Budget Excel? They should ensure accuracy in forecasting sales and costs to avoid cash flow issues, and regularly update actual figures to compare against their budget. Additionally, prioritizing trends and identifying areas for cost reduction or investment can significantly improve financial performance.

Excel Quarterly Budget vs Actual Tracker for Small Businesses

The Excel Quarterly Budget vs Actual Tracker is a document designed to help small businesses monitor their financial performance by comparing planned budgets against actual expenditures and revenues. This tracker typically contains detailed income and expense categories organized by quarter for clear visibility.

Using this tool ensures more accurate financial planning and highlights variances to guide business decisions. It is important to regularly update data and review key performance indicators to maintain financial control and optimize growth.

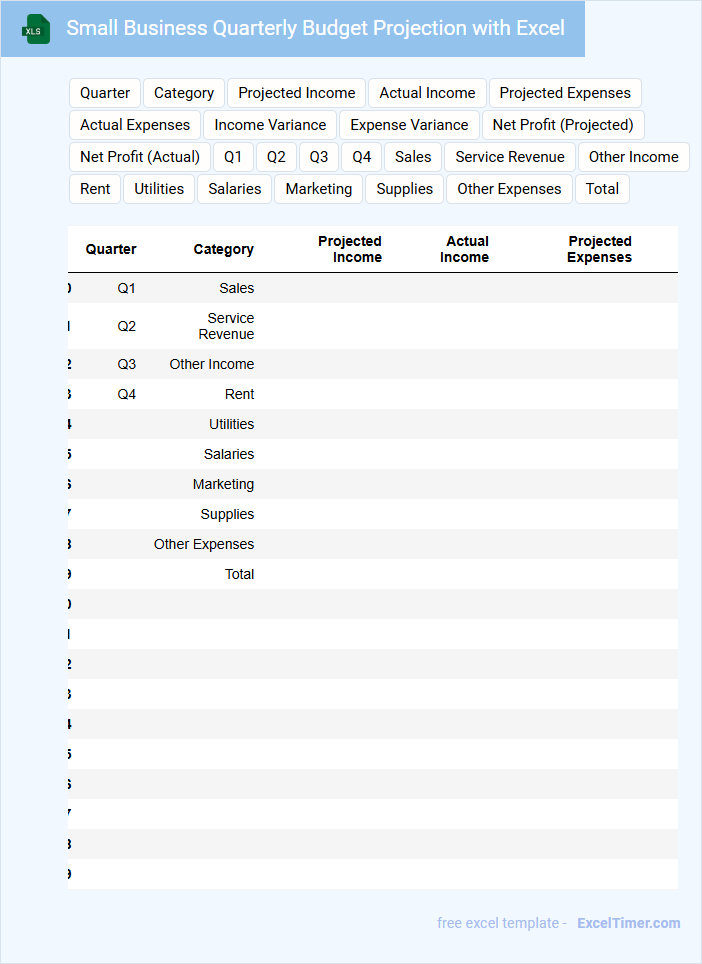

Small Business Quarterly Budget Projection with Excel

Small Business Quarterly Budget Projection documents typically detail anticipated revenues, expenses, and cash flow to help businesses plan financially over a three-month period.

- Accurate Revenue Estimates: Ensure you forecast realistic sales figures based on past trends and market conditions.

- Detailed Expense Breakdown: Include fixed and variable costs to maintain clarity on spending.

- Regular Updates: Frequently revise the projection in Excel to reflect any financial changes or new data.

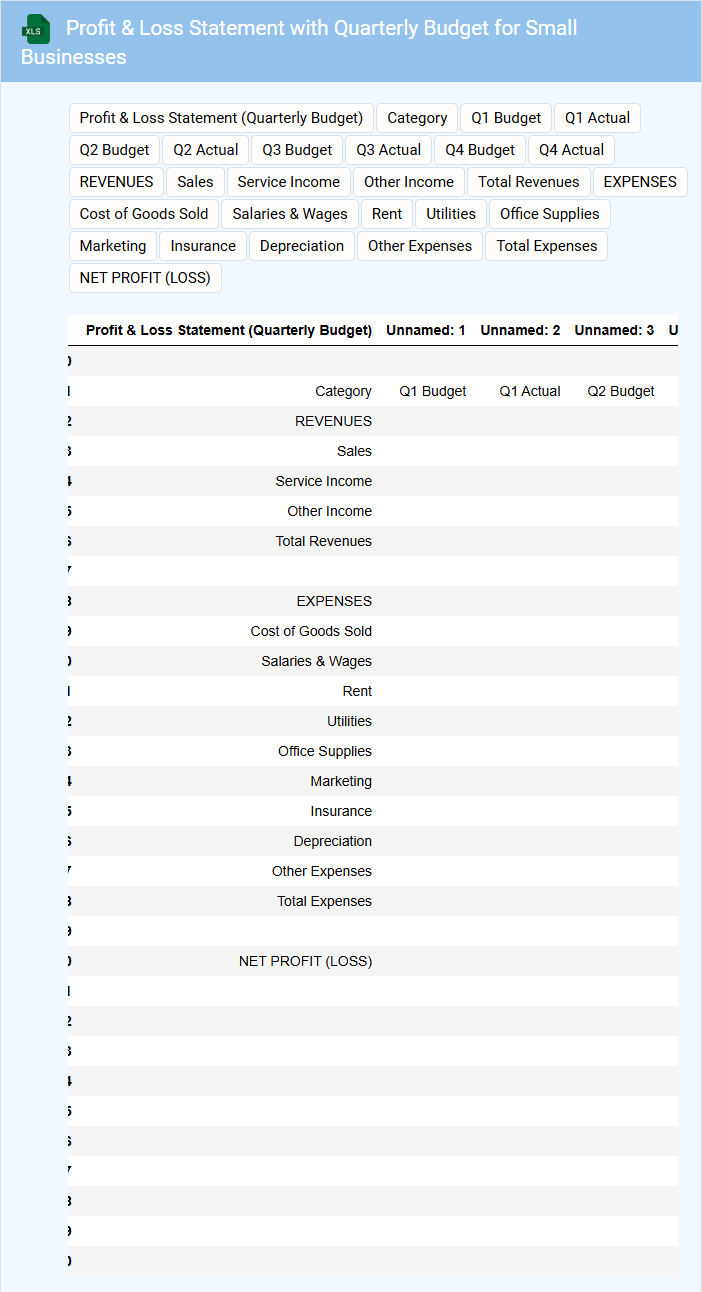

Profit & Loss Statement with Quarterly Budget for Small Businesses

A Profit & Loss Statement with a quarterly budget for small businesses typically includes detailed records of income, expenses, and net profit over each quarter. This document helps business owners track financial performance and make informed decisions based on revenue and cost trends. It is essential for budgeting, identifying profit margins, and planning future growth strategies.

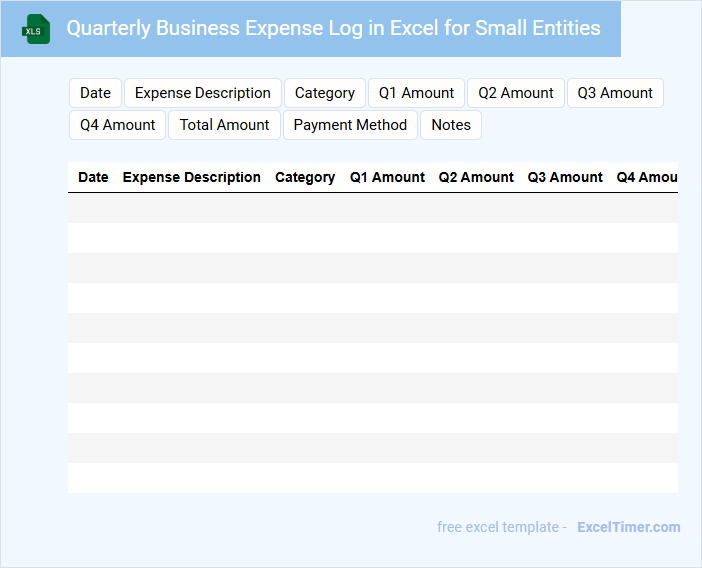

Quarterly Business Expense Log in Excel for Small Entities

A Quarterly Business Expense Log in Excel is typically used to track all financial expenditures made by a small entity over a three-month period. It includes details such as dates, amounts, categories, and payment methods to maintain accurate records.

Such a document is essential for budgeting, tax preparation, and financial analysis. It is important to regularly update the log and categorize expenses properly to ensure clarity and compliance.

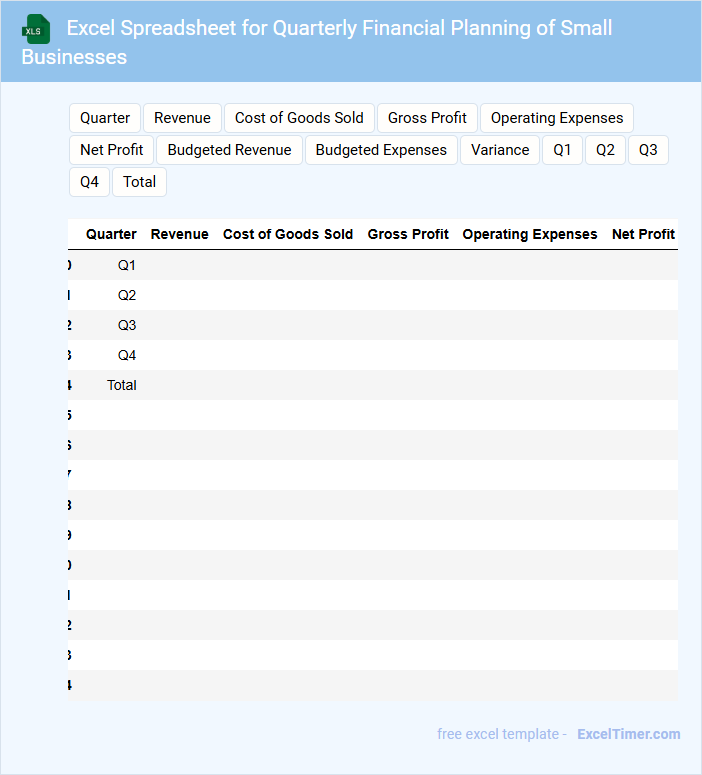

Excel Spreadsheet for Quarterly Financial Planning of Small Businesses

What information is typically included in an Excel spreadsheet for quarterly financial planning of small businesses? This type of document usually contains detailed income statements, expense tracking, cash flow analysis, and budget forecasts. It helps small businesses monitor their financial health and plan resources effectively for upcoming quarters.

What are important elements to include for effective quarterly financial planning in Excel? Key components should be clear categorization of revenues and costs, automated formulas for calculations, and visual charts to track trends over time. Including these features ensures better decision-making and accurate financial projections.

What are the primary revenue sources to include in a Quarterly Budget Tracker for small businesses?

Primary revenue sources to include in a Quarterly Budget Tracker for small businesses are product sales, service fees, and recurring subscriptions. Other key sources may include project-based income, advertising revenue, and affiliate commissions. Tracking these categories ensures accurate financial analysis and informed budgeting decisions.

How should fixed and variable expenses be categorized and tracked in the spreadsheet?

Fixed expenses should be categorized as consistent monthly costs such as rent, salaries, and subscriptions, and tracked with a regular amount for each quarter. Variable expenses, including utilities, raw materials, and marketing costs, must be recorded based on actual incurred amounts each month, reflecting fluctuations. Organizing these categories in separate columns allows for clearer financial analysis and accurate budget forecasting in the quarterly tracker.

Which columns are essential for monitoring actual versus budgeted figures each quarter?

Your Quarterly Budget Tracker should include essential columns such as "Quarter," "Budgeted Amount," "Actual Amount," and "Variance" to effectively monitor actual versus budgeted figures. These columns enable clear comparison and highlight discrepancies for each quarter. Including "Category" ensures detailed tracking across different expense or revenue types.

What formulas or functions are recommended for calculating net profit and identifying budget variances?

Use the SUM function to calculate total income and expenses, then subtract expenses from income for net profit. Employ the IF function combined with subtraction to identify budget variances, flagging over or under-spending. Your Quarterly Budget Tracker benefits from these formulas to maintain accurate financial insights.

How can trends and key performance indicators be visually represented within the Excel document for better decision-making?

Trends and key performance indicators (KPIs) can be visually represented using Excel's built-in tools such as line charts, bar graphs, and sparklines to highlight budget fluctuations and performance over each quarter. Conditional formatting with color scales and data bars emphasizes critical metrics like revenue growth, expense variances, and profit margins for quick analysis. Embedding interactive pivot tables and slicers allows small business owners to filter and compare financial data dynamically, enhancing decision-making efficiency.