The Quarterly Expense Management Excel Template for Freelancers is designed to help track and categorize expenses efficiently over a three-month period. It simplifies financial oversight by providing a clear format for recording income, expenses, and calculating net profits. Using this template ensures freelancers maintain accurate records for budgeting and tax purposes.

Quarterly Expense Tracker with Category Breakdown

What information is typically included in a Quarterly Expense Tracker with Category Breakdown?

This type of document usually contains detailed records of expenses categorized by type, such as utilities, groceries, and entertainment, tracked over a three-month period. It helps users analyze spending patterns and manage budgets more effectively by providing clear insights into where money is being allocated each quarter.

An important suggestion for maintaining this document is to ensure consistent categorization and timely updates to accurately reflect all expenditures, which enhances financial planning and decision-making.

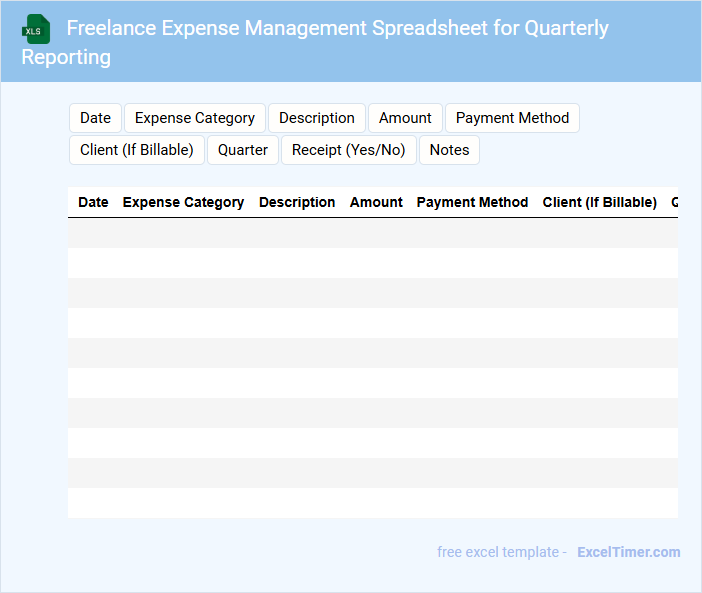

Freelance Expense Management Spreadsheet for Quarterly Reporting

A Freelance Expense Management Spreadsheet is designed to track and organize all expenses incurred by freelancers, ensuring accurate financial records. It typically includes categories such as office supplies, travel, software subscriptions, and client-specific costs.

For Quarterly Reporting, the spreadsheet helps summarize expenses over three-month periods, making it easier to analyze spending patterns and prepare tax documents. Including clear labels and formulas to automatically calculate totals and subtotals is essential for efficiency and accuracy.

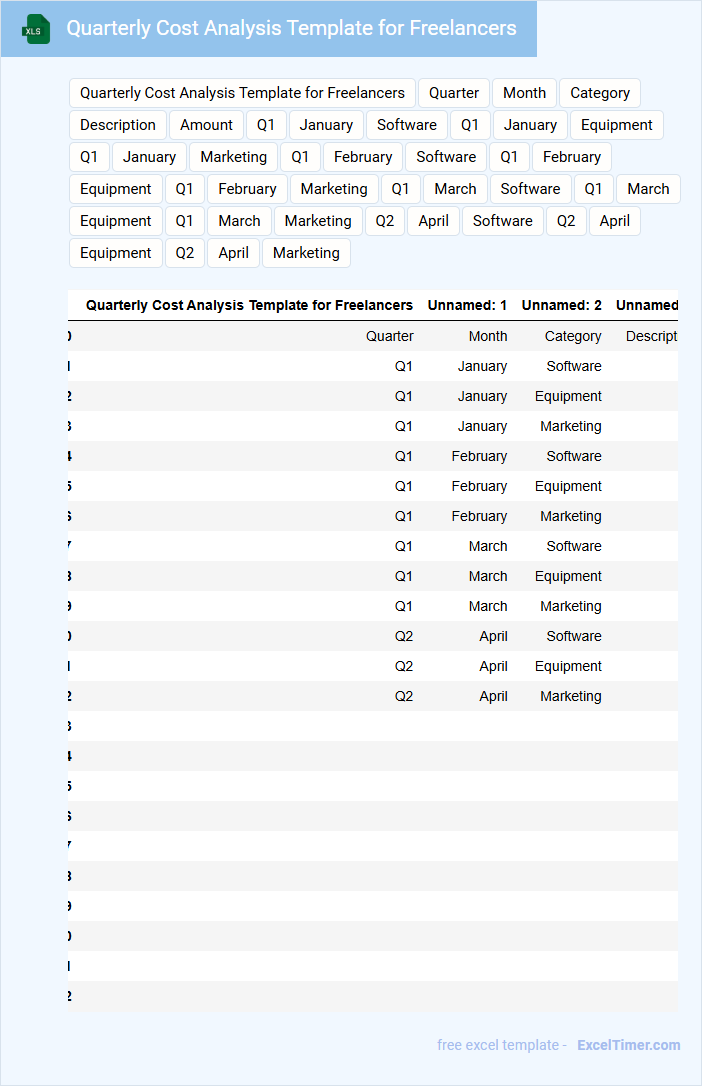

Quarterly Cost Analysis Template for Freelancers

A Quarterly Cost Analysis Template for Freelancers typically contains detailed records of income, expenses, and profit margins to help track financial health and optimize budgeting.

- Income Tracking: Monitor all sources of revenue to understand cash flow trends.

- Expense Categorization: Organize costs into categories like software, marketing, and supplies for clearer insights.

- Profit Calculation: Analyze net profit to assess overall financial performance and plan future expenses.

Excel Template for Tracking Quarterly Expenses of Freelancers

What information does an Excel Template for Tracking Quarterly Expenses of Freelancers usually contain?

This type of document typically includes categories for various expense types such as office supplies, software subscriptions, travel, and client-related costs. It helps freelancers organize and monitor their spending over each quarter to manage budgets effectively.

What is an important suggestion for using this Excel template efficiently?

It's essential to regularly update the template with accurate transaction details to maintain up-to-date financial records. Additionally, incorporating formulas to automatically calculate totals and summaries can save time and reduce errors.

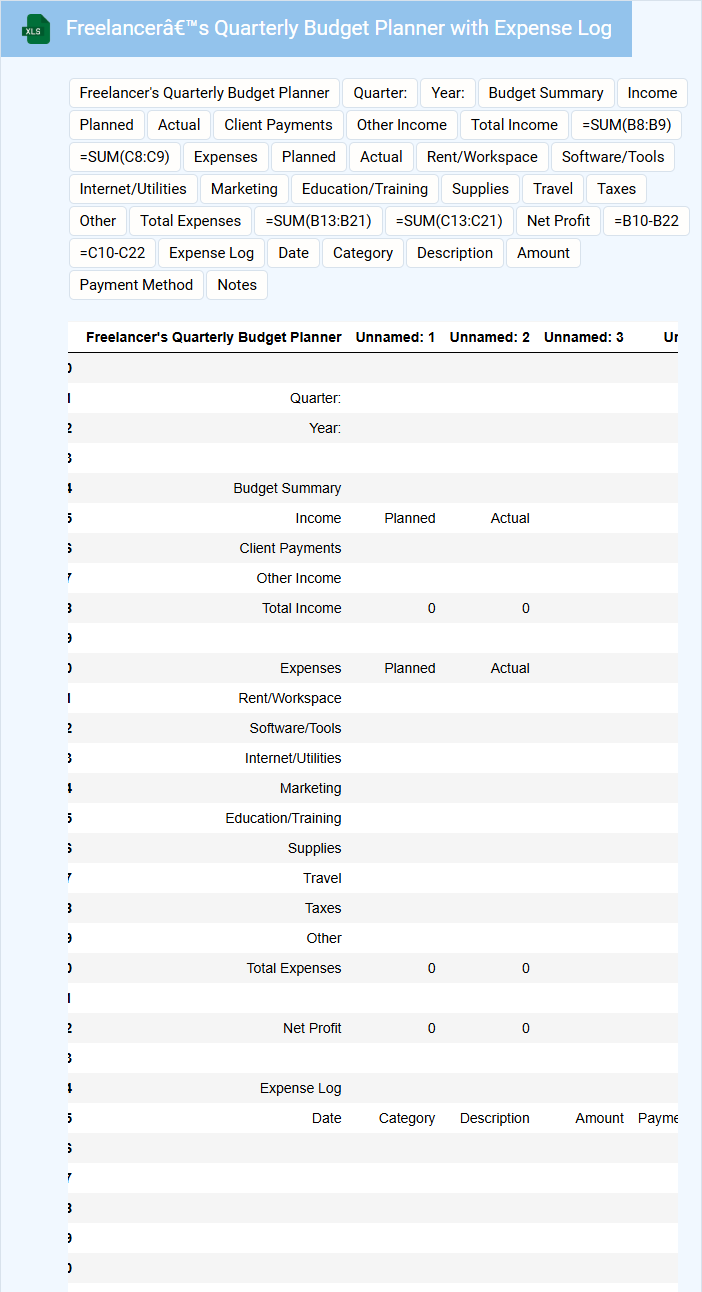

Freelancer’s Quarterly Budget Planner with Expense Log

What information does a Freelancer's Quarterly Budget Planner with Expense Log typically contain? This document usually includes detailed records of income sources, categorized expenses, and savings goals for the quarter. It helps freelancers track their financial progress, manage cash flow, and plan for taxes efficiently.

What is an important tip for using this planner effectively? Regularly updating all income and expense entries ensures accuracy, while setting realistic budget limits helps prevent overspending and promotes better financial management throughout the quarter.

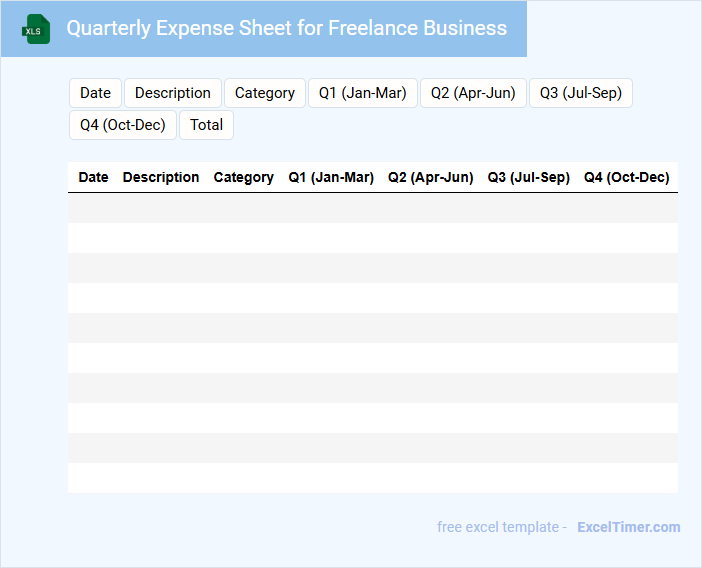

Quarterly Expense Sheet for Freelance Business

A Quarterly Expense Sheet for a freelance business typically contains detailed records of all expenses incurred over three months. It helps freelancers track their spending on supplies, services, and other business-related costs. Keeping an accurate and organized expense sheet is essential for financial management and tax preparation.

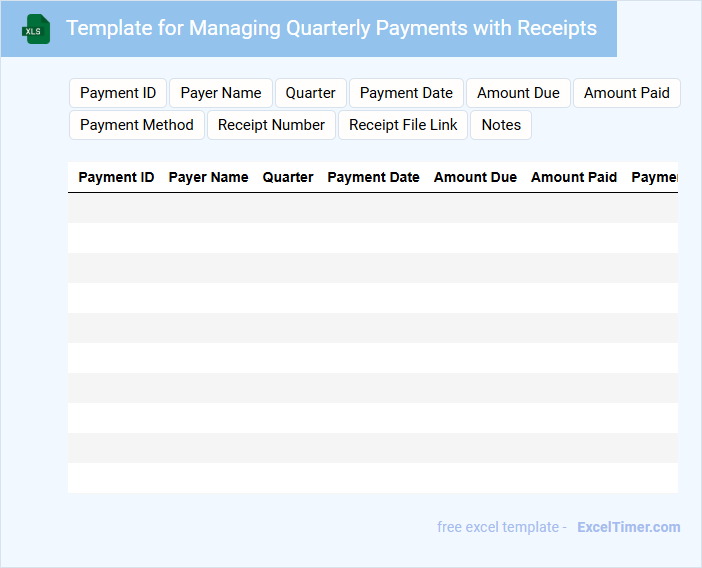

Template for Managing Quarterly Payments with Receipts

This document typically contains detailed records of payments made on a quarterly basis, including date, amount, and payment method. It also includes attached receipts to verify each transaction for accuracy and auditing purposes.

Important elements to include are a clear summary of payment schedules and a reliable system for organizing receipts. Ensuring consistency and accuracy in documentation helps maintain financial transparency and accountability.

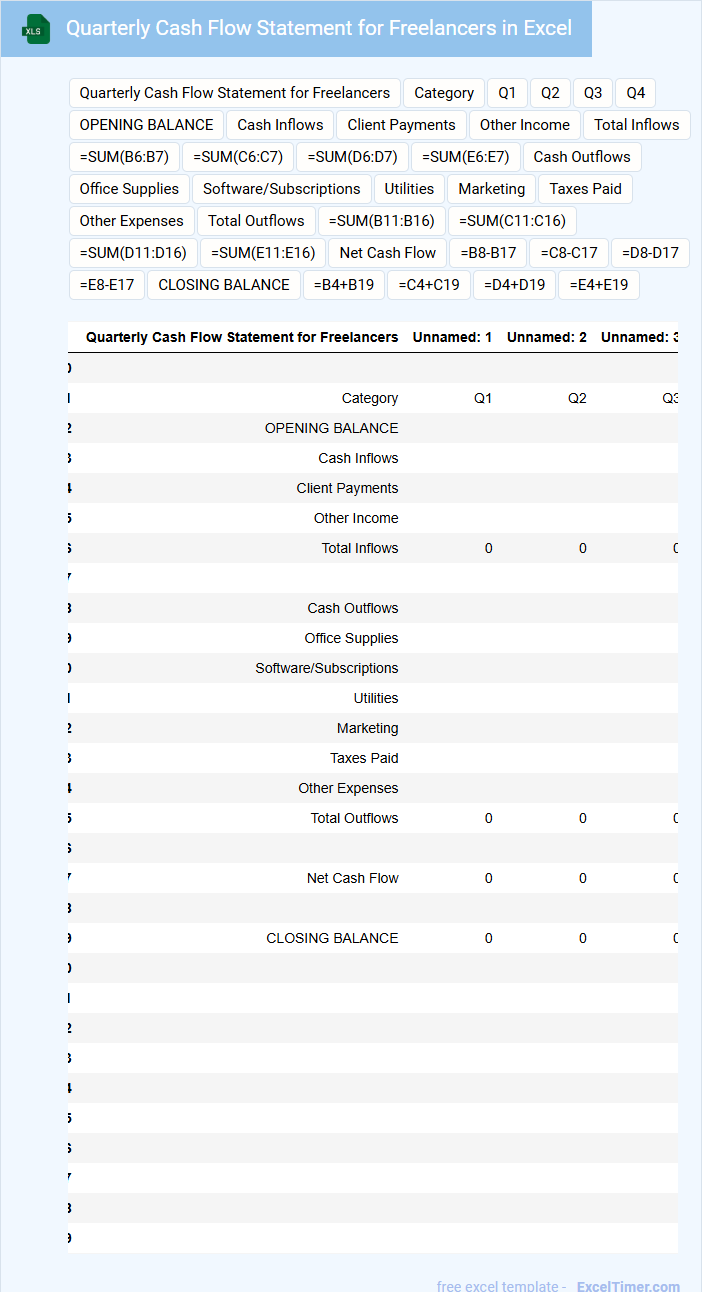

Quarterly Cash Flow Statement for Freelancers in Excel

The Quarterly Cash Flow Statement for Freelancers in Excel is a financial document that outlines the inflows and outflows of cash over a three-month period. It typically includes income from freelance projects, operational expenses, and savings or investments made during the quarter. This report helps freelancers track their cash liquidity and make informed financial decisions.

An important aspect to include is a detailed breakdown of both recurring and one-time expenses to capture an accurate cash position. Using Excel's built-in formulas and charts enhances data visualization and makes the statement easy to analyze. Additionally, freelancers should regularly update their statement to forecast future cash flows and prepare for tax obligations.

Expense Reconciliation Sheet for Quarterly Freelance Projects

An Expense Reconciliation Sheet for Quarterly Freelance Projects typically documents all incurred expenses related to freelance work within a specific quarter, facilitating accurate financial tracking and reimbursement. It ensures transparency and helps in maintaining organized financial records.

- Include detailed descriptions and receipts of all expenses to support accurate reconciliation.

- Clearly separate project-related costs to avoid confusion and ensure proper budgeting.

- Summarize total expenses and compare them against budgets or payments received for accountability.

Simple Quarterly Expense Tracker with Visual Charts

This Simple Quarterly Expense Tracker typically contains organized tables of income and expenses, categorized by month and type. It includes summary sections highlighting total expenditures and remaining budget for the quarter.

Visual charts, such as pie charts or bar graphs, are often integrated to provide a clear overview of spending patterns. These visuals enhance understanding and help identify areas for cost-saving improvements.

It is important to regularly update the tracker and review the charts to maintain accurate records and make informed financial decisions.

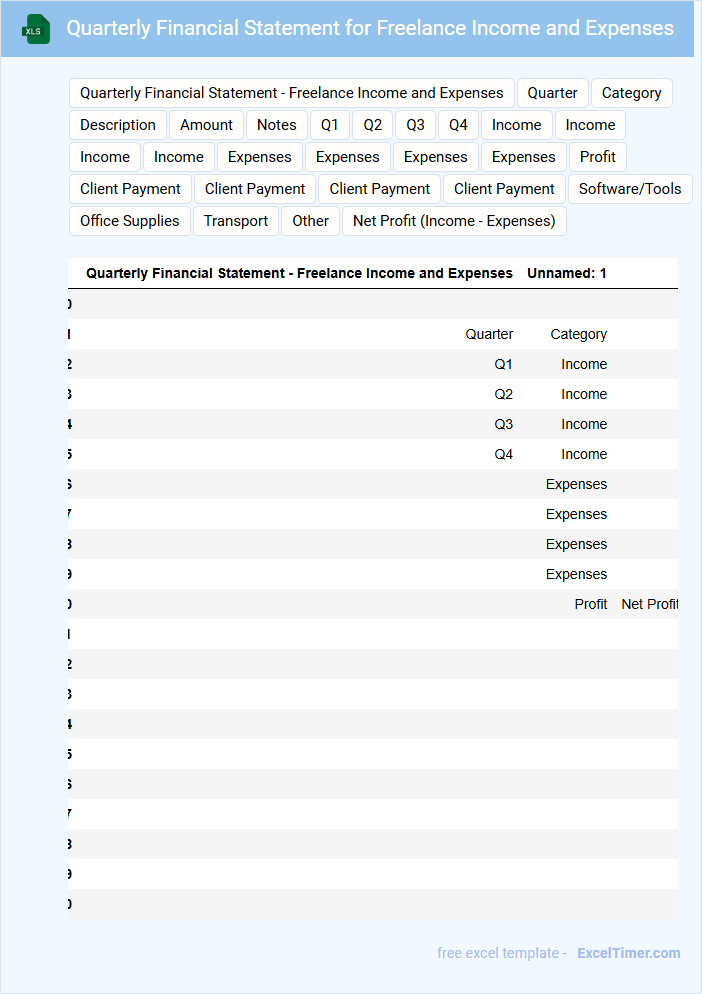

Quarterly Financial Statement for Freelance Income and Expenses

What does a Quarterly Financial Statement for Freelance Income and Expenses typically include? It usually contains a detailed summary of all income earned and expenses incurred during the quarter. This document helps freelancers track their financial performance and prepare for tax filings.

Why is it important to maintain an accurate Quarterly Financial Statement? Keeping precise records of income and expenses ensures better financial management and aids in identifying deductible costs. It also provides a clear overview to help plan budgets and forecast future cash flow.

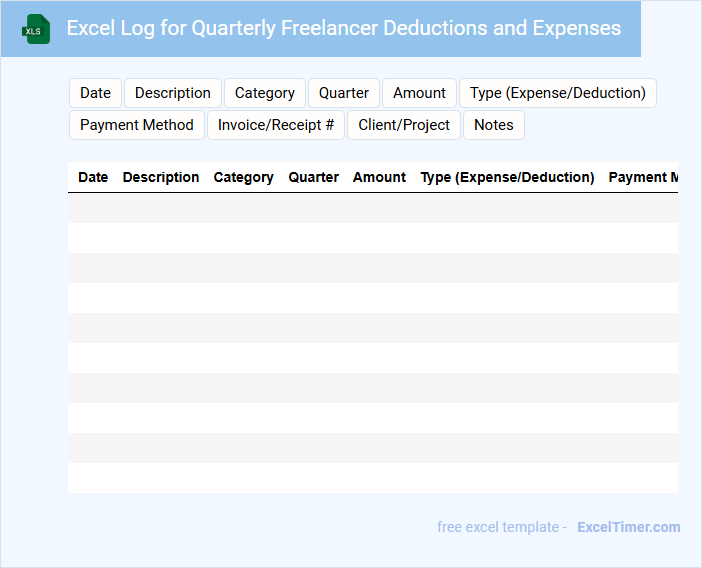

Excel Log for Quarterly Freelancer Deductions and Expenses

What information is typically included in an Excel log for quarterly freelancer deductions and expenses? This document usually contains detailed records of payments made to freelancers, categorized expenses, and applicable deductions for tax and accounting purposes. It helps ensure accurate financial tracking and simplifies the process of quarterly reporting and audits.

What are important considerations when maintaining this log? Ensuring consistent data entry, verifying receipt accuracy, and regularly reconciling the log with bank statements and invoices are essential for preventing errors and maintaining financial transparency.

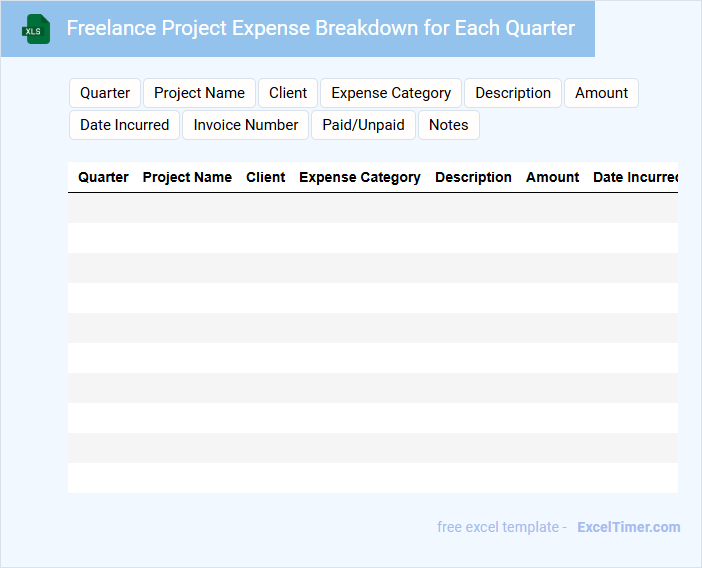

Freelance Project Expense Breakdown for Each Quarter

What information does a Freelance Project Expense Breakdown for Each Quarter typically contain? This document usually details all costs related to freelance projects organized by quarter, including materials, software, subcontractor fees, and miscellaneous expenses. It serves to provide clear financial insight and helps in budgeting and tax preparation throughout the year.

Why is it important to maintain an accurate expense breakdown each quarter? Keeping precise records enables freelancers to track spending trends, optimize resource allocation, and justify deductions during tax filing. Regular updates ensure financial transparency and better decision-making for future projects.

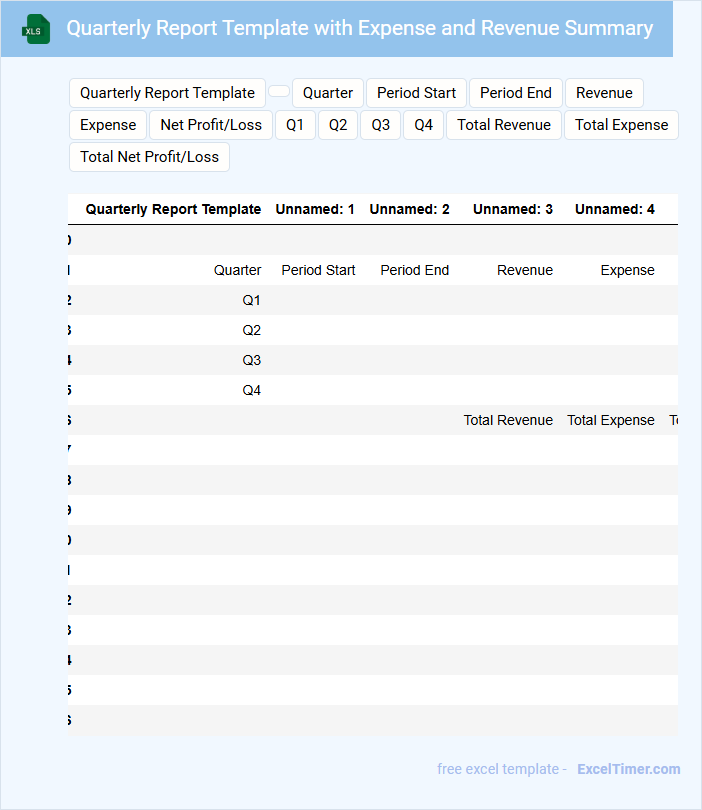

Quarterly Report Template with Expense and Revenue Summary

A Quarterly Report Template typically contains a detailed summary of a company's financial performance over a three-month period. It includes sections on expenses, revenues, and key financial metrics to provide a clear overview of business health. Important suggestions for such a document include accurate data entry, clear categorization of expenses and revenue sources, and visual representation like charts for easier analysis.

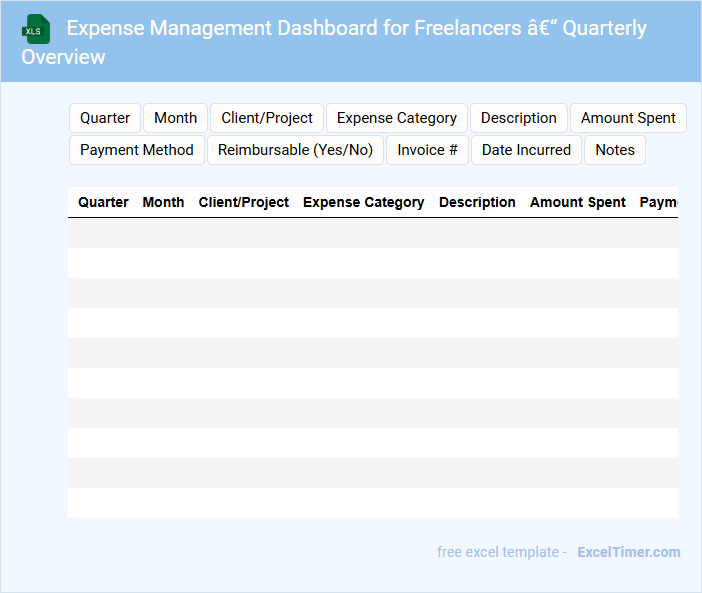

Expense Management Dashboard for Freelancers – Quarterly Overview

An Expense Management Dashboard for freelancers typically consolidates all financial data related to expenditures in one accessible place. This type of document provides a clear quarterly overview, helping users track spending patterns and maintain budget discipline. It is crucial that the dashboard includes categorized expenses, visual charts, and real-time updates for maximum efficiency.

What are the key categories for tracking quarterly expenses specific to freelancers in Excel?

Key categories for tracking quarterly expenses specific to freelancers in Excel include Office Supplies, Software Subscriptions, Marketing Costs, Travel Expenses, and Professional Services Fees. You should also include Income Tax Payments and Health Insurance premiums to accurately manage your financial obligations. Categorizing these expenses helps optimize budgeting and simplifies tax preparation for your freelance business.

How can Excel formulas automate the calculation of total quarterly expenses and income for accurate financial overview?

Excel formulas like SUM and SUMIFS automate total quarterly expenses and income by aggregating categorized transaction data with date criteria. Using named ranges and structured tables enhances accuracy and dynamic updates for real-time financial overviews. Conditional functions such as IF and DATEVALUE help filter and classify entries, streamlining quarterly expense management for freelancers.

What methods can be used in Excel to differentiate between reimbursable and non-reimbursable expenses each quarter?

Use Excel formulas like IF combined with data validation to label reimbursable versus non-reimbursable expenses automatically. Apply conditional formatting to visually distinguish expense categories each quarter, enhancing clarity and accuracy. Create PivotTables to summarize and filter reimbursable and non-reimbursable expenses for efficient quarterly expense management.

How can freelancers use Excel to visualize quarterly spending patterns and identify cost-saving opportunities?

Freelancers can use Excel to create detailed quarterly expense charts and pivot tables that clearly visualize spending patterns across categories. Your data analysis helps identify trends, highlight excessive costs, and pinpoint potential savings by comparing expenses over time. Custom dashboards in Excel streamline tracking and enhance decision-making for effective quarterly expense management.

What Excel features assist in monitoring and setting quarterly expense budgets for freelance projects?

Excel offers features like PivotTables to summarize quarterly expenses, conditional formatting to highlight budget overruns, and data validation to ensure accurate budget entries for freelance projects. You can use built-in templates and charts to visualize spending patterns effectively. These tools help maintain control over your quarterly expense budgets and enhance financial decision-making.