The Quarterly Tax Summary Excel Template for Self-Employed Individuals streamlines tax calculation by organizing income and expenses into clear categories, ensuring accurate quarterly tax estimates. It helps in tracking deductible expenses and income sources efficiently, reducing the risk of misreported earnings. Using this template allows self-employed individuals to stay compliant with tax deadlines and avoid penalties through timely and precise tax planning.

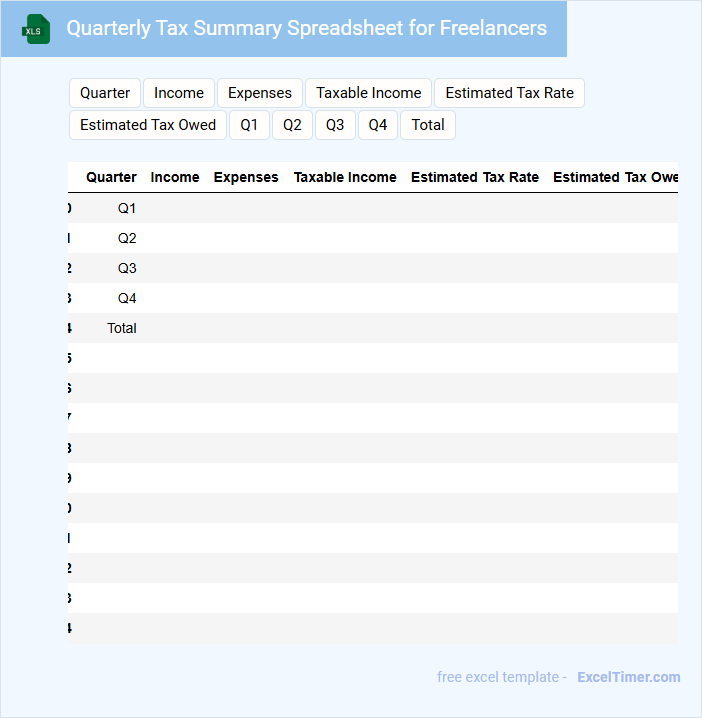

Quarterly Tax Summary Spreadsheet for Freelancers

A Quarterly Tax Summary Spreadsheet for Freelancers is a detailed document used to track income and expenses for accurate tax reporting each quarter. It helps streamline the tax filing process and ensures compliance with tax regulations.

- Include all sources of income and categorize expenses for precise deductions.

- Regularly update the spreadsheet to avoid last-minute data entry errors.

- Use clear labels and formulas to automatically calculate quarterly tax liabilities.

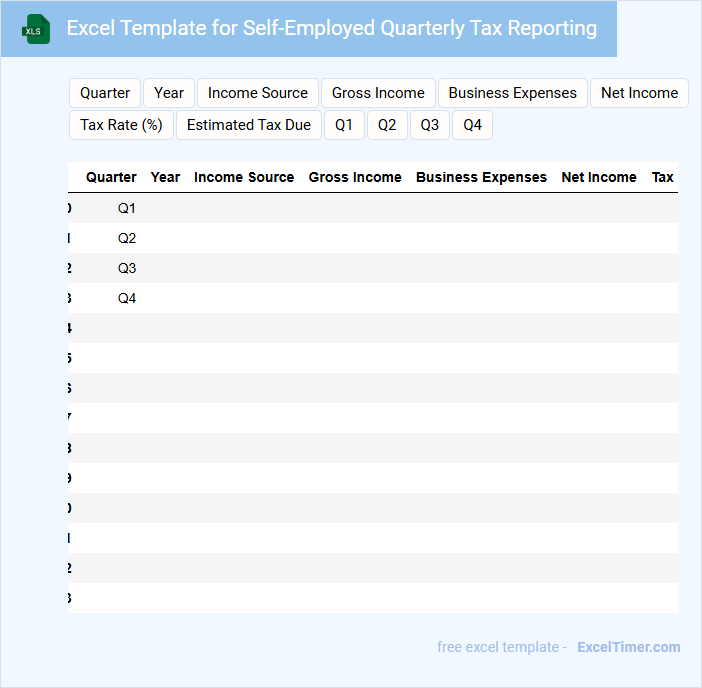

Excel Template for Self-Employed Quarterly Tax Reporting

This Excel template is designed to help self-employed individuals accurately track and report their quarterly tax obligations. It simplifies record-keeping and ensures all necessary financial information is organized for tax filing purposes.

- Include fields for income, expenses, and estimated tax payments to maintain comprehensive records.

- Incorporate automatic calculations to reduce errors and save time during tax preparation.

- Provide clear instructions and reminders for important tax deadlines to ensure timely submissions.

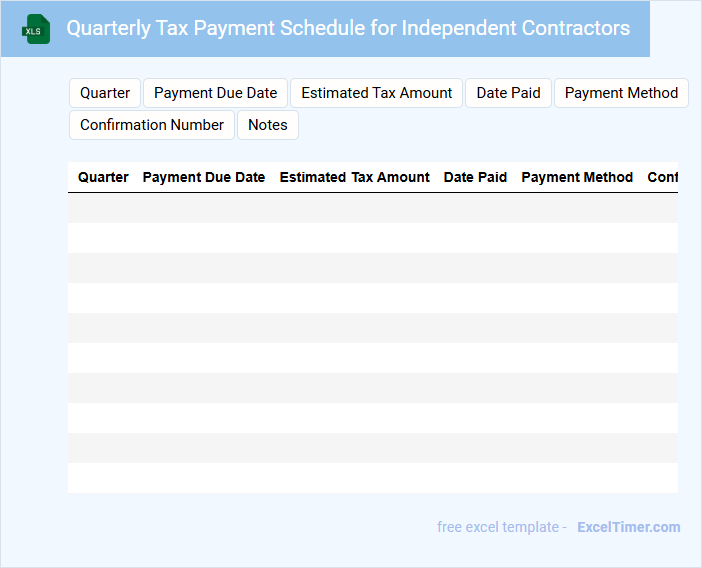

Quarterly Tax Payment Schedule for Independent Contractors

What information is typically included in a Quarterly Tax Payment Schedule for Independent Contractors? This document outlines the dates on which independent contractors must make their estimated tax payments throughout the fiscal year. It usually contains payment deadlines, amounts to be paid, and instructions on how to submit these payments, helping contractors stay compliant with tax regulations.

What is an important consideration when using a Quarterly Tax Payment Schedule? Ensuring that payments are made accurately and on time is crucial to avoid penalties and interest charges. Independent contractors should also keep detailed records of their payments and income to support accurate calculations and future tax filings.

Quarterly Tax Deductions Tracker for Sole Proprietors

A Quarterly Tax Deductions Tracker for Sole Proprietors is designed to organize and monitor business expenses that can be deducted from taxable income on a quarterly basis. This document helps ensure accurate and timely tax filings while maximizing allowable deductions.

- Record all business-related expenses with dates and amounts for each quarter.

- Categorize deductions such as office supplies, mileage, and professional services separately.

- Regularly update the tracker to avoid missed deductions and ease year-end tax preparation.

Excel Workbook with Quarterly Tax Summary Sheets

An Excel Workbook with Quarterly Tax Summary Sheets is a document used to organize and summarize tax-related data for each quarter of the financial year. It helps businesses and individuals keep track of their taxable income, deductions, and payments systematically.

- Include clear headers for each quarter to ensure easy navigation and understanding.

- Use consistent formulas and formatting to accurately calculate tax summaries and avoid errors.

- Regularly update the sheets with relevant financial transactions to maintain accuracy and compliance.

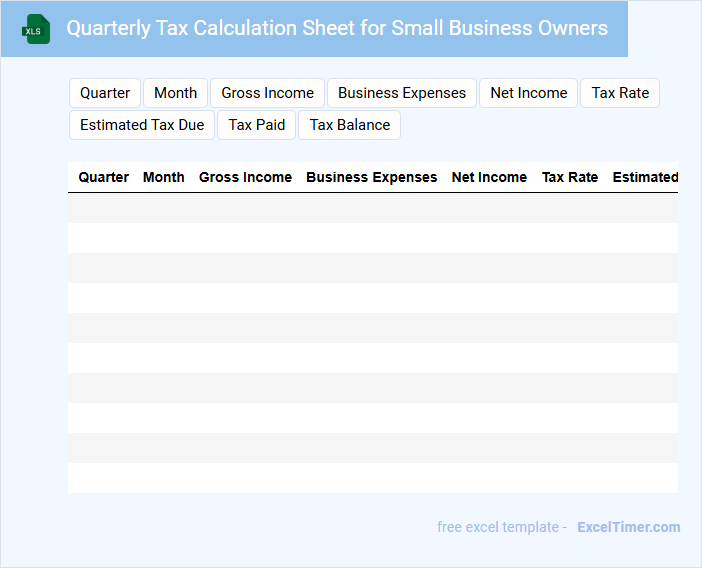

Quarterly Tax Calculation Sheet for Small Business Owners

A Quarterly Tax Calculation Sheet is a vital document used by small business owners to track their income, expenses, and tax liabilities on a quarterly basis. It typically contains detailed records of earnings, deductible expenses, and estimated tax payments made throughout the quarter. Accurate completion of this sheet helps ensure timely tax filing and prevents underpayment penalties.

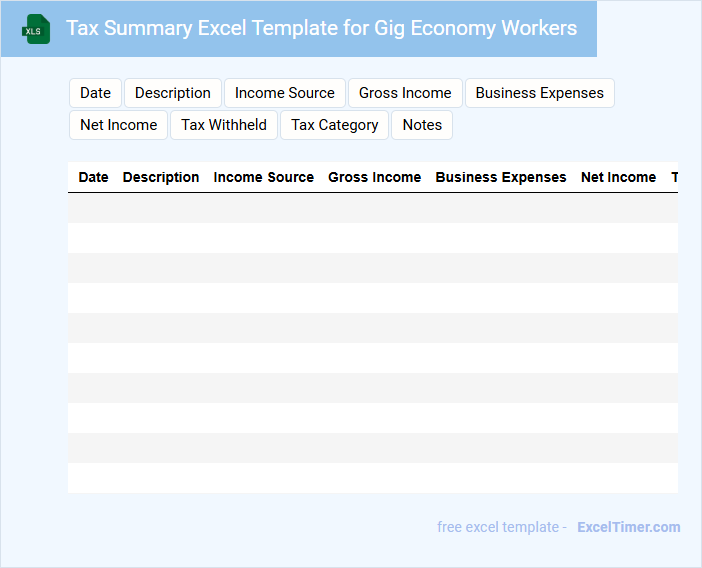

Tax Summary Excel Template for Gig Economy Workers

A Tax Summary Excel Template for gig economy workers typically contains sections for tracking income, expenses, and tax deductions related to freelance or contract work. It helps organize financial data in a systematic way to simplify tax filing and ensure accurate reporting. Key elements to include are detailed income logs, categorized expenses, and summary totals for quick reference.

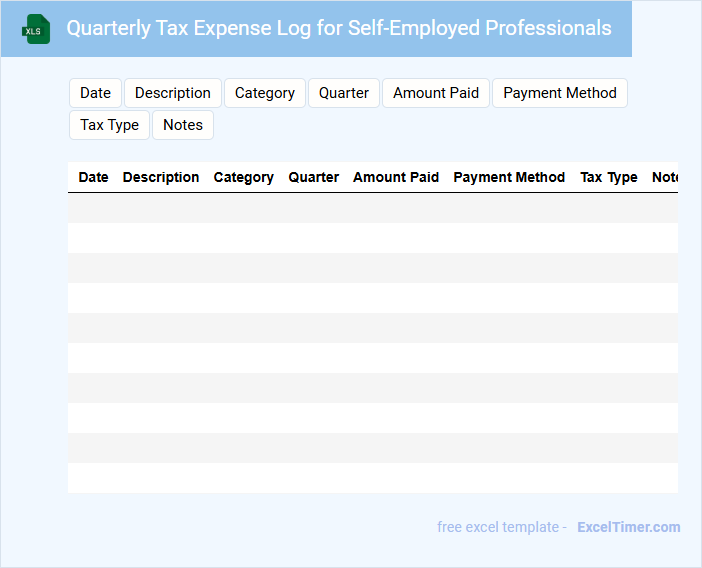

Quarterly Tax Expense Log for Self-Employed Professionals

A Quarterly Tax Expense Log for Self-Employed Professionals is a document used to track all tax-related expenses and payments made throughout each quarter. It helps in maintaining organized financial records and preparing accurate tax filings.

- Include all income sources and corresponding tax withholdings for accurate bookkeeping.

- Record dates and amounts of estimated tax payments to avoid penalties.

- Keep detailed notes of deductible expenses relevant to self-employment.

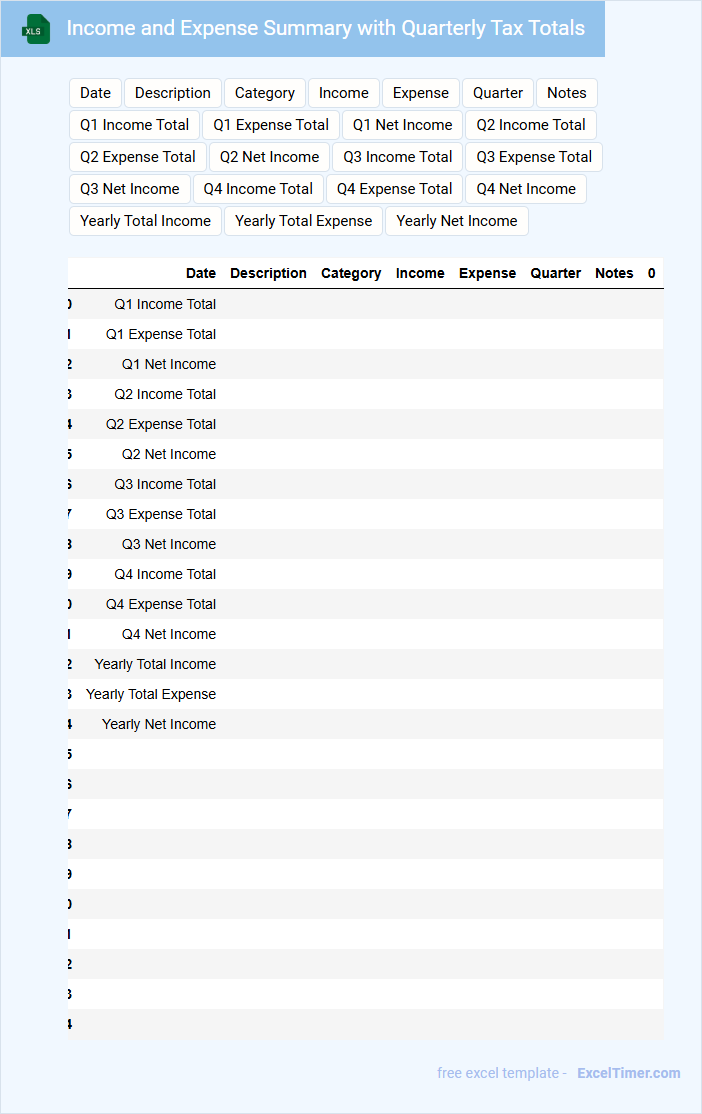

Income and Expense Summary with Quarterly Tax Totals

What information is typically included in an Income and Expense Summary with Quarterly Tax Totals? This document usually contains a detailed record of all income and expenses incurred by an individual or business within a specific period, categorized by quarter. It also summarizes the calculated tax obligations for each quarter, helping in tax planning and financial analysis.

Why is it important to keep an accurate Income and Expense Summary with Quarterly Tax Totals? Maintaining precise records ensures compliance with tax laws and prevents penalties. Additionally, it allows for better budgeting and financial decision-making by providing a clear overview of taxable income and deductible expenses each quarter.

Quarterly Tax Liability Tracker for Self-Employed

A Quarterly Tax Liability Tracker for self-employed individuals is a document designed to record and monitor tax obligations every three months. It typically contains income summaries, estimated tax payments, and deductible expenses. Maintaining accurate and up-to-date entries helps prevent underpayment penalties and ensures financial compliance.

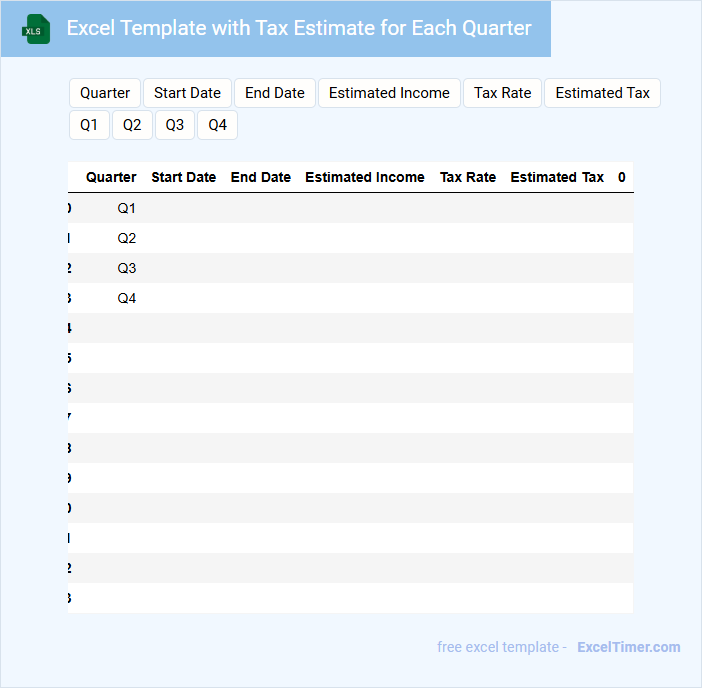

Excel Template with Tax Estimate for Each Quarter

An Excel Template with Tax Estimate for Each Quarter typically contains detailed worksheets designed to calculate and track estimated tax payments on a quarterly basis. It includes fields for income, deductions, and tax rates to provide a clear overview of tax liabilities across different periods.

This document helps individuals or businesses stay organized and compliant by forecasting tax obligations and avoiding penalties. Ensuring accurate input of financial data and regularly updating the template are important for reliable tax planning.

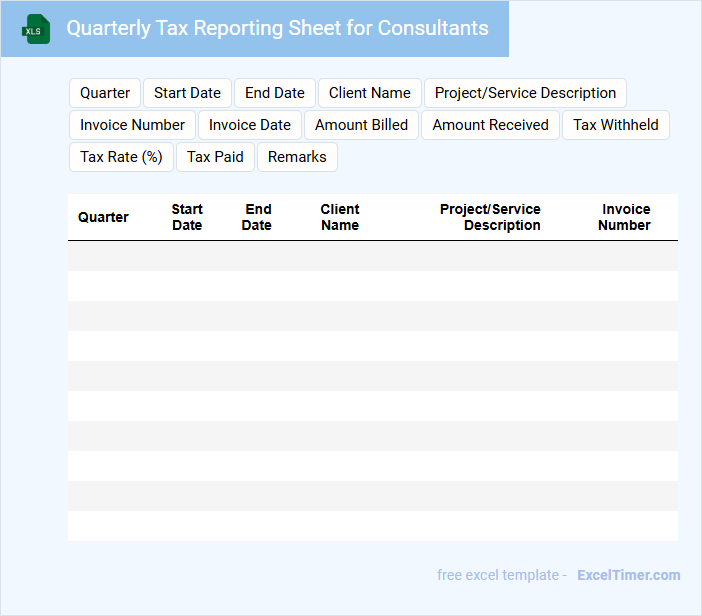

Quarterly Tax Reporting Sheet for Consultants

A Quarterly Tax Reporting Sheet for consultants typically contains detailed records of income, expenses, and tax withholdings related to consulting services rendered within a specific quarter. This document helps in accurately calculating the estimated taxes owed and ensures compliance with tax regulations.

It is important to regularly update the sheet with all relevant financial transactions to avoid discrepancies during tax filing. Using organized and clear data entries enhances accuracy and simplifies the tax reporting process.

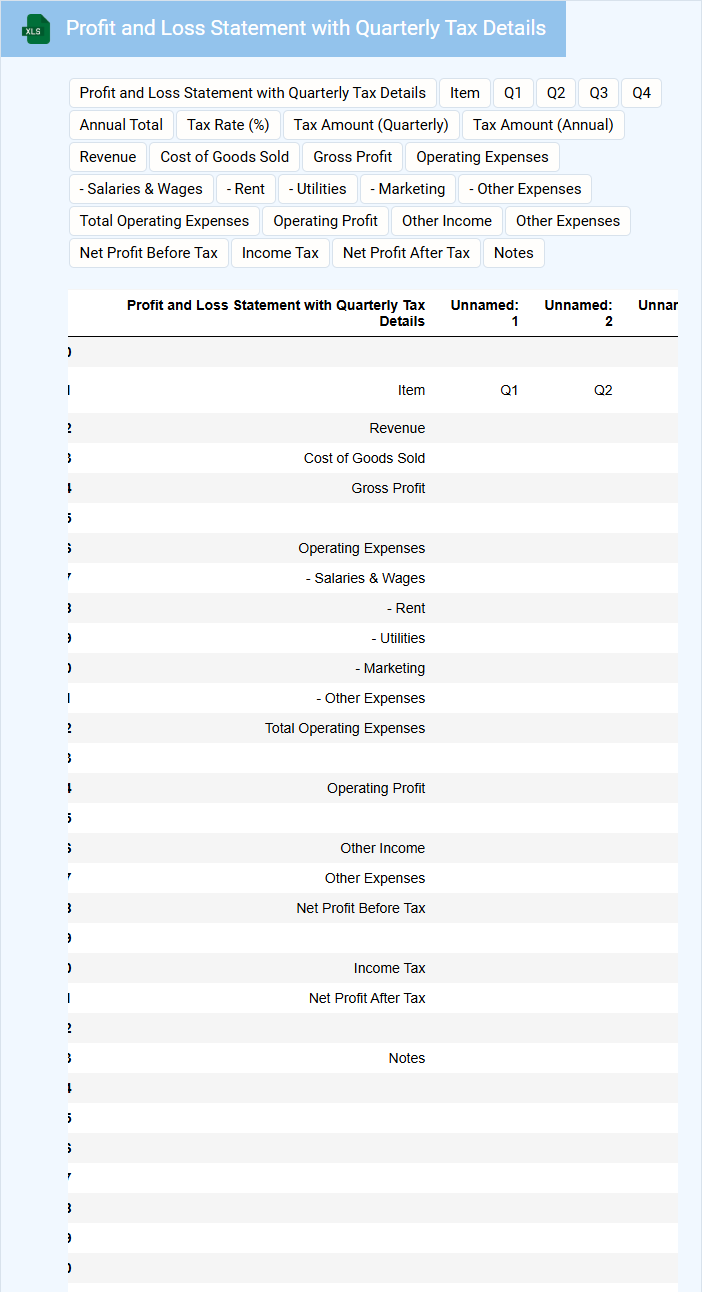

Profit and Loss Statement with Quarterly Tax Details

A Profit and Loss Statement typically contains detailed information about a company's revenues, expenses, and net income over a specific period. It provides insight into the financial performance and profitability of the business.

Including Quarterly Tax Details in the document helps track tax obligations and payments within each quarter accurately. This ensures compliance and aids in effective tax planning strategies.

For better clarity, it is important to highlight key figures such as gross profit, operating expenses, and tax liabilities in the statement.

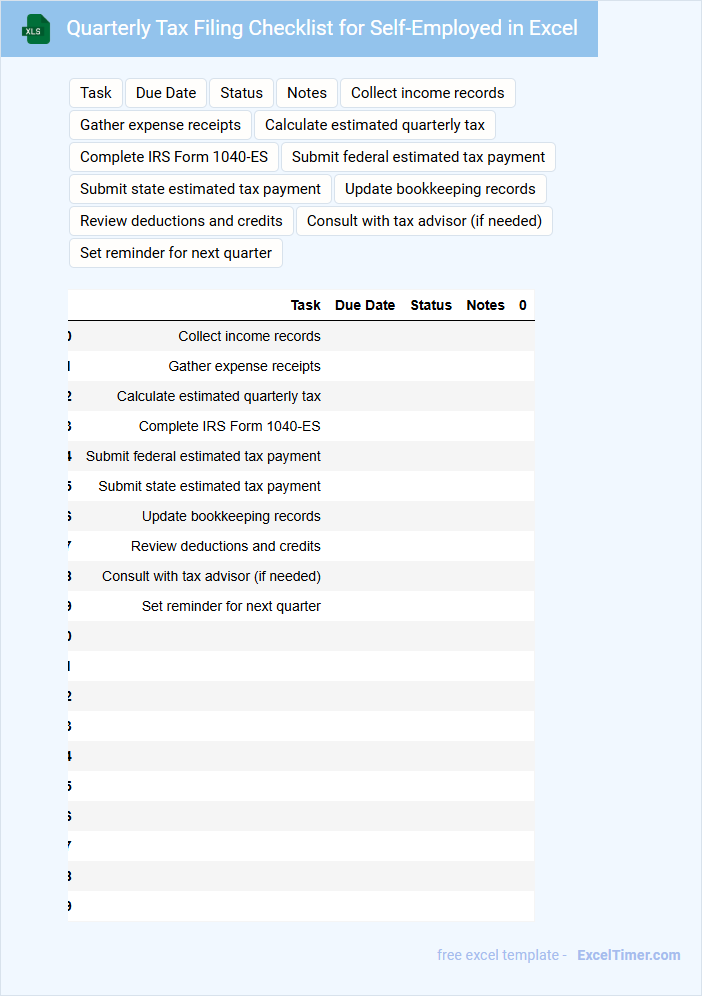

Quarterly Tax Filing Checklist for Self-Employed in Excel

A Quarterly Tax Filing Checklist for self-employed individuals in Excel typically contains a detailed list of income records, expenses, estimated tax payments, and relevant tax forms. This document helps ensure all necessary financial information is organized and accounted for throughout the year.

It is important to regularly update the checklist to avoid missing critical deadlines or deductions. Keeping accurate documentation can simplify tax filing and minimize the risk of errors or penalties.

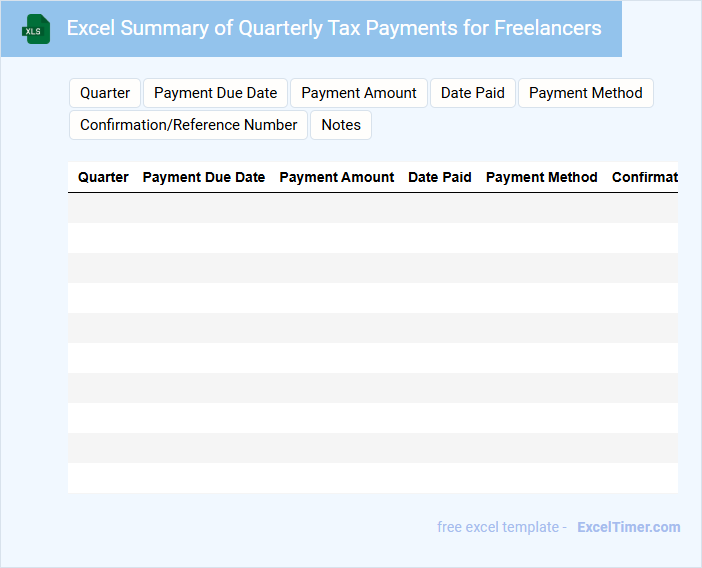

Excel Summary of Quarterly Tax Payments for Freelancers

This type of document typically contains a detailed summary of all tax payments made by a freelancer during a specific quarter, including dates, amounts, and payment methods. It helps in tracking financial obligations and ensuring compliance with tax regulations.

Key information often includes the freelancer's income sources, tax rates applied, and payment deadlines. Keeping this summary up-to-date is crucial for accurate tax filing and avoiding penalties.

What are the main components to include in a quarterly tax summary for self-employed individuals?

A quarterly tax summary for self-employed individuals should include total income earned, deductible business expenses, and estimated tax payments made during the period. It must also detail self-employment tax calculations, including Social Security and Medicare contributions. Accurate reporting of net profit or loss ensures compliance and aids in tax planning for future quarters.

How should self-employment income and allowable business expenses be documented in Excel?

Document self-employment income in Excel by listing all revenue sources with dates and amounts in a dedicated "Income" column. Record allowable business expenses separately, categorized by type (e.g., supplies, travel, utilities) to track deductible costs accurately. Use formulas to calculate total income, total expenses, and net taxable income each quarter for precise quarterly tax summaries.

Which Excel formulas can accurately calculate estimated tax payments and net earnings?

Excel formulas such as =SUM() can total quarterly income and expenses, while =PRODUCT() calculates estimated tax payments based on tax rates. Use =(Income - Expenses)*TaxRate to estimate your net tax liability accurately. Your net earnings can be computed with =Income - Expenses, ensuring precise financial tracking.

What essential categories should be used to organize revenue and deductible expenses quarterly?

Your Quarterly Tax Summary for self-employed individuals should include essential categories such as Gross Revenue, Cost of Goods Sold, Operating Expenses, and Taxes Paid. Organizing deductible expenses into subcategories like Office Supplies, Travel, and Professional Services improves accuracy. Tracking these categories quarterly ensures clear financial insights and simplifies tax filing.

How can Excel be used to track tax payment deadlines and amounts due for each quarter?

Excel can organize quarterly tax payment deadlines and amounts due by creating a detailed spreadsheet with columns for due dates, payment statuses, and estimated tax amounts. Formulas and conditional formatting help automatically calculate totals and highlight upcoming deadlines, ensuring timely payments. Your data remains easily accessible and customizable for accurate tax tracking throughout the year.