The Quarterly Expense Report Excel Template for Nonprofits streamlines financial tracking by organizing expenses into clear, easy-to-read categories. This template ensures accurate budget management and transparency, crucial for maintaining trust with donors and stakeholders. Its customizable format allows nonprofits to monitor spending over each quarter, improving financial oversight and reporting efficiency.

Quarterly Expense Report Template for Nonprofits

What information is typically included in a Quarterly Expense Report Template for Nonprofits?

This document usually contains detailed records of all expenses incurred by the nonprofit during the quarter, categorized by type such as program costs, administrative expenses, and fundraising activities. It helps organizations track financial performance and ensure transparency and accountability.

Important elements to include are accurate dates, clear expense descriptions, budget comparisons, and summaries to provide stakeholders with a comprehensive view of the organization's financial health.

Excel Template for Nonprofit Quarterly Expense Reporting

What information is typically included in an Excel template for nonprofit quarterly expense reporting? This type of document usually contains detailed records of all expenses incurred by the nonprofit organization during the quarter, categorized by type and department. It is designed to help nonprofits track spending, ensure accountability, and simplify financial analysis for better budgeting and reporting purposes.

What is an important consideration when using this template? Accuracy in data entry is crucial to maintain trust and transparency with stakeholders. Additionally, including clear categories and notes can enhance clarity and make it easier to identify spending patterns and areas for cost optimization.

Nonprofit Quarterly Financial Expense Report Excel

A Nonprofit Quarterly Financial Expense Report Excel is a detailed document used to track and analyze an organization's expenses over a three-month period. It typically includes categories such as program expenses, administrative costs, and fundraising expenditures. This report helps ensure transparent financial management and assists in budgeting and compliance efforts.

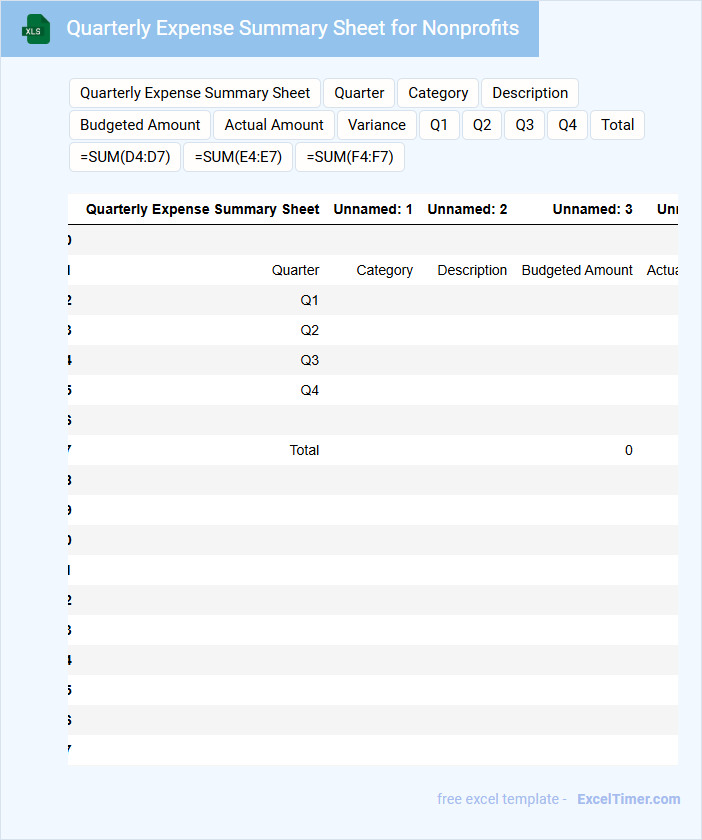

Quarterly Expense Summary Sheet for Nonprofits

The Quarterly Expense Summary Sheet for nonprofits typically contains detailed records of all expenditures made during the quarter, categorized by type and department. It helps in tracking budget adherence and financial transparency for stakeholders.

Suggestions for an effective summary sheet include ensuring accuracy in data entry and including notes for any unusual expenses or variances. Regular review of this document aids in strategic financial planning and accountability.

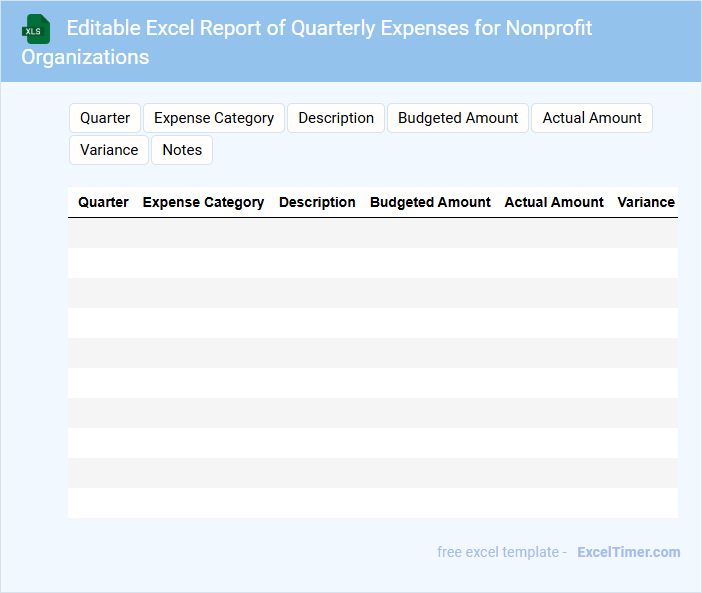

Editable Excel Report of Quarterly Expenses for Nonprofit Organizations

An Editable Excel Report of Quarterly Expenses for Nonprofit Organizations is a structured document designed to track and manage financial expenditures over a three-month period. It typically contains detailed categories of expenses, budget comparisons, and summarized totals to ensure transparency and accountability. This report is essential for analyzing spending patterns and making informed budgeting decisions.

Important elements to include are clear headers for each expense category, formulas for automatic calculations, and a summary section highlighting total expenses against budgeted amounts. Additionally, incorporating charts or graphs can visually represent the financial data for easier interpretation. Ensuring the report is user-friendly and customizable enhances its effectiveness for different organizational needs.

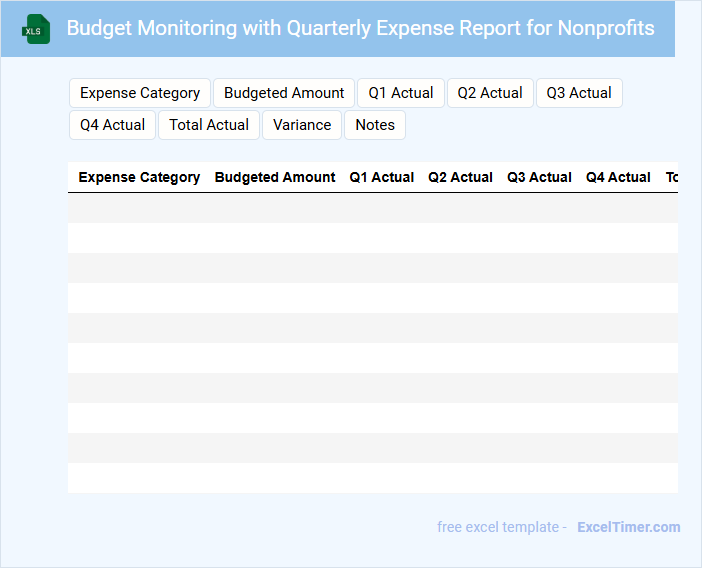

Budget Monitoring with Quarterly Expense Report for Nonprofits

Budget Monitoring with Quarterly Expense Report for Nonprofits typically contains detailed financial data to track spending, assess budget adherence, and inform strategic decisions.

- Comprehensive Expense Breakdown: Clearly categorize and itemize all expenses to ensure transparency and accuracy.

- Quarterly Financial Comparison: Compare current expenses against previous quarters and the approved budget to identify trends and variances.

- Actionable Insights: Highlight significant deviations and recommend adjustments to optimize resource allocation for program effectiveness.

Detailed Expense Tracking with Quarterly Report for Nonprofits

What information is typically included in a Detailed Expense Tracking with Quarterly Report for Nonprofits? This type of document usually contains comprehensive records of all expenses categorized by type and date, along with summaries that highlight financial trends over each quarter. It provides transparency and helps stakeholders monitor budget adherence and financial health effectively.

What important elements should nonprofits focus on when preparing this report? Ensuring accurate data entry, categorization of expenses, and including a comparative analysis with previous quarters are essential. Additionally, clear visual representations like graphs and tables can enhance understanding and decision-making.

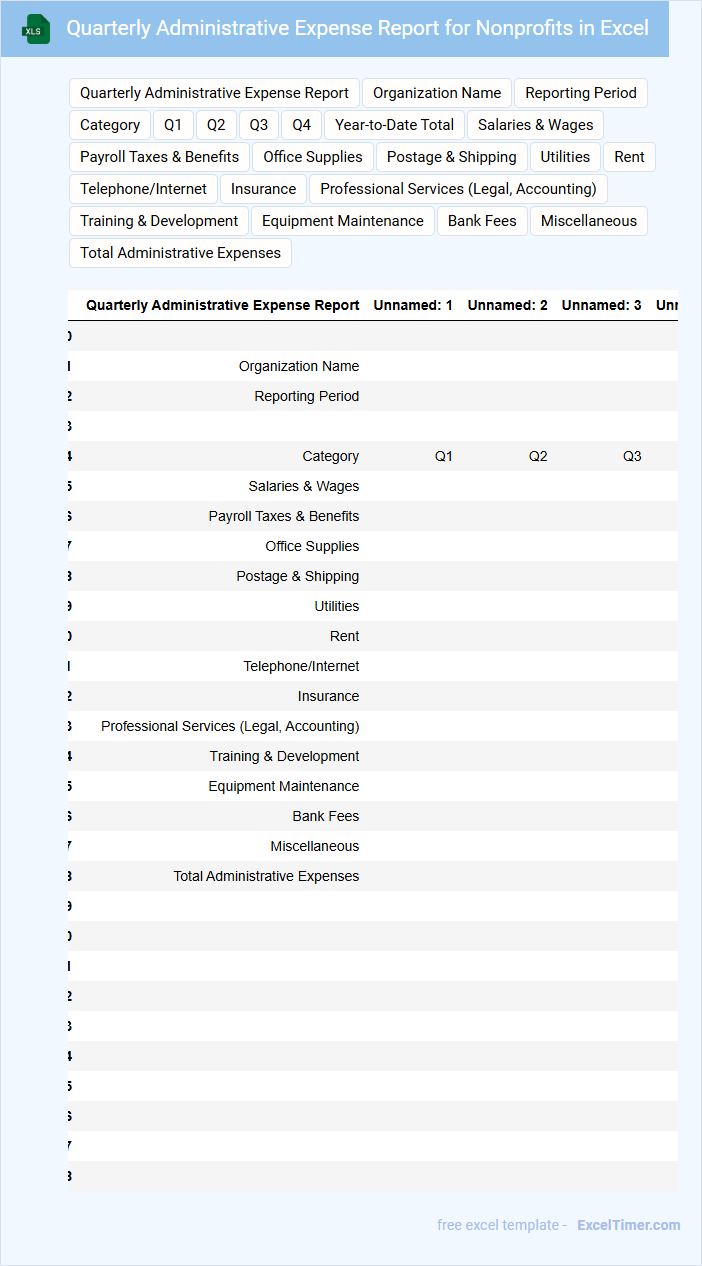

Quarterly Administrative Expense Report for Nonprofits in Excel

The Quarterly Administrative Expense Report for nonprofits typically contains detailed records of all administrative costs incurred during the quarter. These expenses include salaries, office supplies, rent, and utilities essential for organizational operations.

Such reports help track financial efficiency and ensure transparency in the use of funds. For accurate reporting in Excel, it is important to maintain clear categories and consistently update data to facilitate easy analysis and auditing.

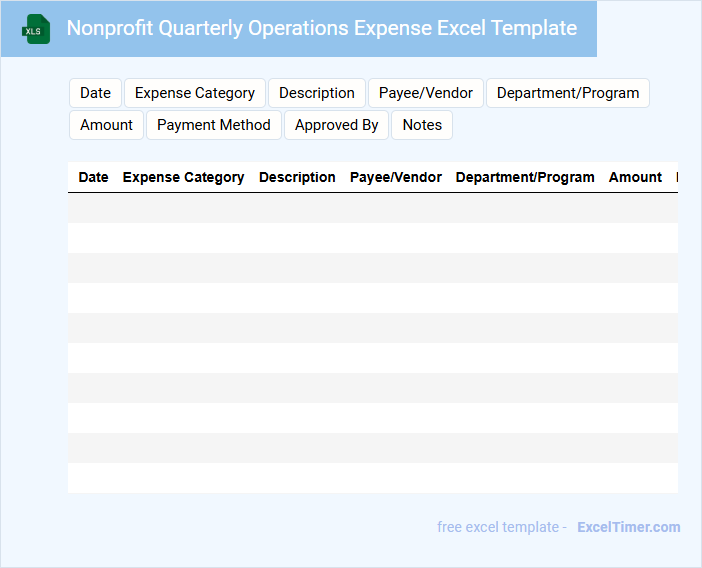

Nonprofit Quarterly Operations Expense Excel Template

This type of document typically contains detailed records of a nonprofit organization's operational expenses to facilitate budgeting and financial transparency.

- Expense Categorization: Clearly defined categories help track and manage different operational costs effectively.

- Monthly Tracking: Allows for monitoring expenses on a month-by-month basis to identify trends and variances.

- Budget Comparison: Features sections for comparing actual expenses against budgeted amounts to ensure financial control.

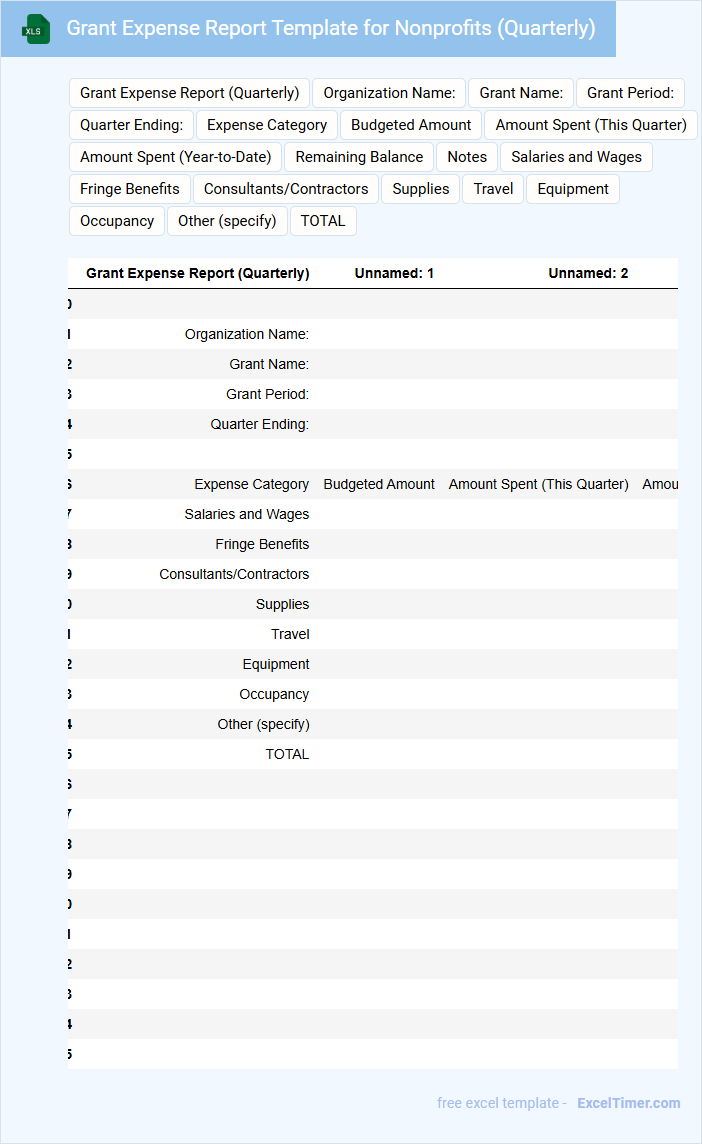

Grant Expense Report Template for Nonprofits (Quarterly)

What information is typically included in a Grant Expense Report Template for Nonprofits on a quarterly basis? This document usually contains detailed records of how grant funds were allocated and spent within the quarter, including categories such as personnel, supplies, and administrative costs. It provides transparency and accountability, ensuring nonprofit organizations meet grant requirements and financial reporting standards.

What key elements should be emphasized in this report? It is important to include accurate expense tracking, clear categorization of expenditures, and documentation to support each cost. Additionally, summarizing the financial status relative to the grant budget and any variances will improve clarity and aid in ongoing grant management and compliance.

Cash Flow and Expense Report for Nonprofits (Quarterly Excel)

This document typically contains detailed records of income and expenditures for nonprofits over a quarter, presented in Excel for clear financial tracking.

- Income Tracking: A comprehensive list of grant money, donations, and fundraising proceeds received during the quarter.

- Expense Categorization: Breakdown of operational costs, program expenses, and administrative fees for transparency.

- Cash Flow Analysis: Summary of cash inflows and outflows to ensure sufficient liquidity for ongoing activities.

Program Expense Tracking with Quarterly Report for Nonprofits

What does a Program Expense Tracking with Quarterly Report for Nonprofits typically contain? It usually includes detailed records of all expenses related to specific programs, categorized by type and date. The report also summarizes financial data quarterly to provide clear insights into budget adherence and funding utilization, ensuring transparency and accountability to stakeholders.

Why is it important to include accurate and timely data in this document? Accurate tracking helps nonprofits monitor their financial health and make informed decisions about resource allocation. Timely reporting supports compliance with grant requirements and fosters trust among donors and board members.

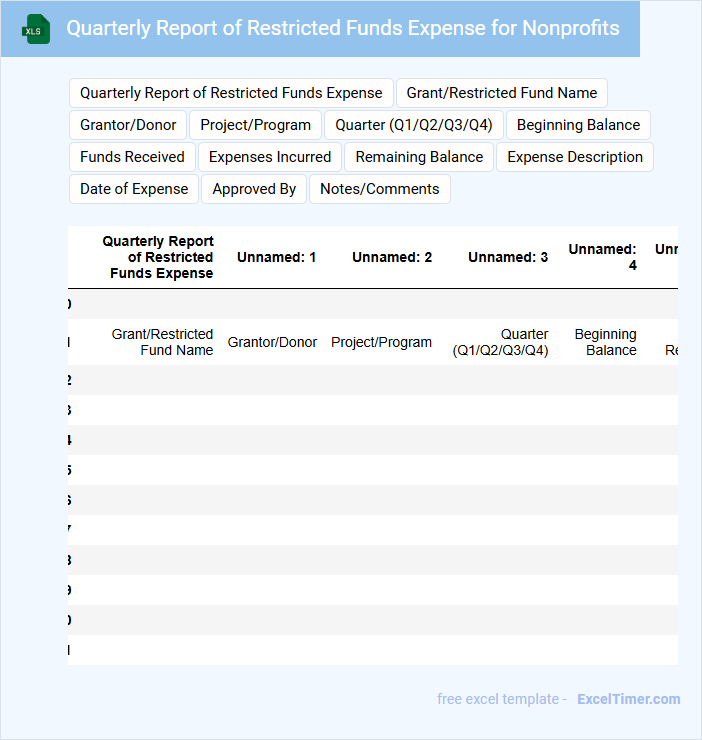

Quarterly Report of Restricted Funds Expense for Nonprofits

A Quarterly Report of Restricted Funds Expense for Nonprofits details the financial activities related to funds that are restricted by donors or grantors. It ensures transparency and accountability in how these designated funds are spent within a specified quarter.

- Include a clear breakdown of expenses categorized by program or project.

- Provide comparisons to the approved budget for each restricted fund.

- Highlight any variances and explanations for significant deviations from planned spending.

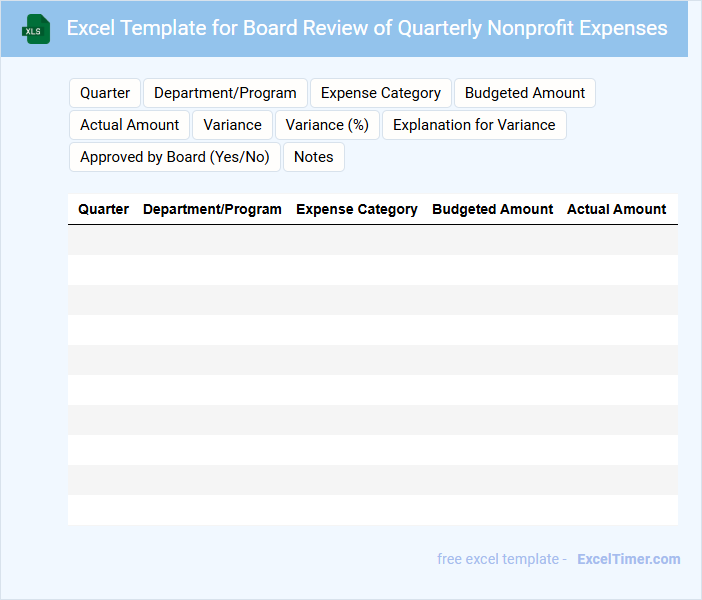

Excel Template for Board Review of Quarterly Nonprofit Expenses

This Excel Template for Board Review of Quarterly Nonprofit Expenses typically contains detailed financial data, categorized by various expense types and timelines. It helps in tracking and analyzing the organization's spending to ensure transparency and accountability.

Key sections often include summaries of quarterly expenses, variance analysis, and budget comparisons to actual expenditures. It is important to maintain accurate data entry and include clear notes for any unusual expenses or variances.

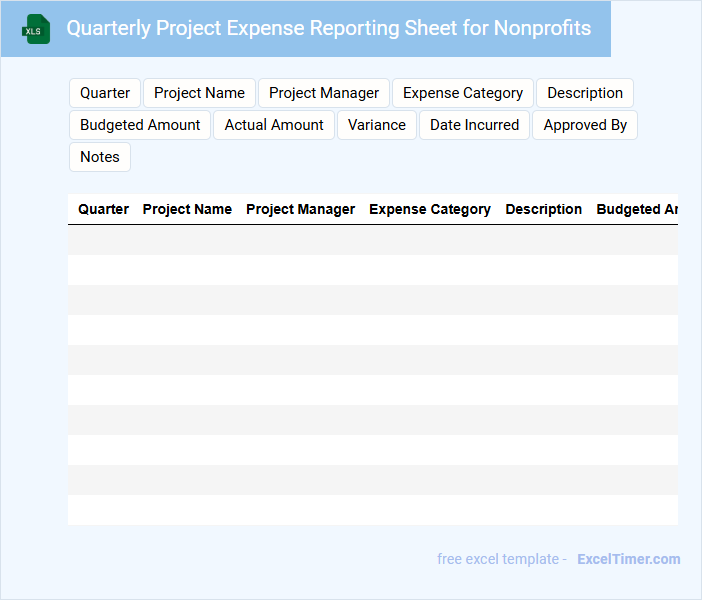

Quarterly Project Expense Reporting Sheet for Nonprofits

What information is typically included in a Quarterly Project Expense Reporting Sheet for Nonprofits? This document generally contains detailed records of all expenses related to a specific project during a quarter, including categories such as salaries, supplies, travel, and other operational costs. It is used to ensure transparency, track budget adherence, and assist in financial planning for funding sources.

Why is accuracy important when filling out this report? Accurate expense reporting helps maintain trust with donors and stakeholders by demonstrating responsible fund management, and it also enables nonprofits to identify potential overspending or underspending. Consistent and precise documentation supports audits and improves future budgeting processes.

What key categories should be included in a nonprofit's Quarterly Expense Report for clarity and compliance?

Your Quarterly Expense Report for nonprofits should include key categories such as Program Expenses, Administrative Costs, Fundraising Expenses, and Operational Overheads. Detailed tracking of salaries, office supplies, and grant disbursements ensures transparency and compliance with regulatory standards. Accurate categorization supports effective financial analysis and reporting to stakeholders.

How do you ensure the accurate allocation of expenses to programs, administration, and fundraising in Excel?

Use Excel's data validation and custom formulas to categorize expenses accurately into programs, administration, and fundraising. Create separate sheets or tables for each category and link transactions with unique identifiers to avoid misallocation. You can also use PivotTables to summarize and verify expense distribution for precise quarterly reporting.

What Excel formulas or functions are essential for summarizing and analyzing quarterly spending variances?

Essential Excel formulas for analyzing quarterly spending variances in nonprofits include SUMIFS to calculate total expenses by category and quarter, and VLOOKUP or INDEX-MATCH to cross-reference budgeted versus actual amounts. The IF and ABS functions help identify and quantify variances, while conditional formatting highlights significant deviations. PivotTables provide dynamic summaries for detailed quarterly analysis and trend visualization.

How can you structure an Excel sheet to compare quarterly expenses against budgeted amounts for nonprofit transparency?

Create a structured Excel sheet with columns for Expense Category, Budgeted Amount, Q1 Expense, Q2 Expense, Q3 Expense, and Q4 Expense. Include rows for total expenses and variance calculations to highlight differences between actual and budgeted amounts each quarter. Use conditional formatting to visually emphasize overspending and support nonprofit financial transparency.

What best practices should be followed for documenting and attaching supporting evidence of expenses within an Excel report for audits?

Ensure each expense entry in your Quarterly Expense Report includes detailed descriptions, dates, and categorized amounts to maintain clarity. Attach or link scanned receipts, invoices, and signed approval forms directly within the Excel document or in a clearly referenced folder for easy audit verification. Maintain consistent formatting and use audit trail features to track any changes made to expense data for full transparency.