The Quarterly Profit and Loss Excel Template for Restaurants provides a structured format to track revenue, expenses, and net profit over three-month periods, enabling restaurant owners to analyze financial performance efficiently. This template helps identify trends in sales and costs, offering crucial insights for optimizing operations and budgeting. Regular use of this tool ensures accurate financial reporting and supports strategic decision-making to enhance profitability.

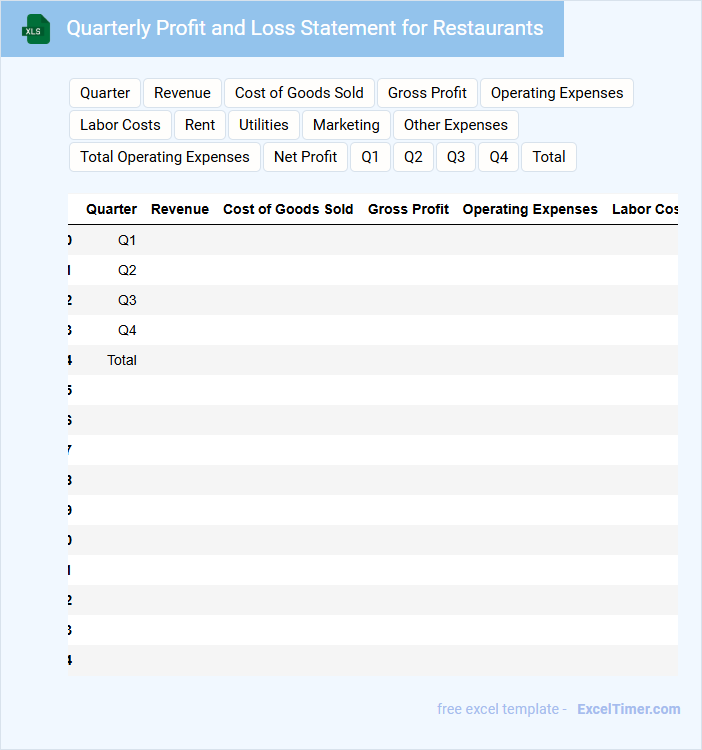

Quarterly Profit and Loss Statement for Restaurants

A Quarterly Profit and Loss Statement for restaurants is a financial document that summarizes the revenues, costs, and expenses incurred during a three-month period. It provides insight into the restaurant's operational efficiency and profitability. Key figures include total sales, cost of goods sold, and net profit.

Important elements to focus on are food and labor costs, as they heavily impact profit margins. Tracking seasonal trends and comparing quarterly results helps in strategic planning. Ensuring accurate categorization of expenses and revenues enhances the statement's usefulness for decision making.

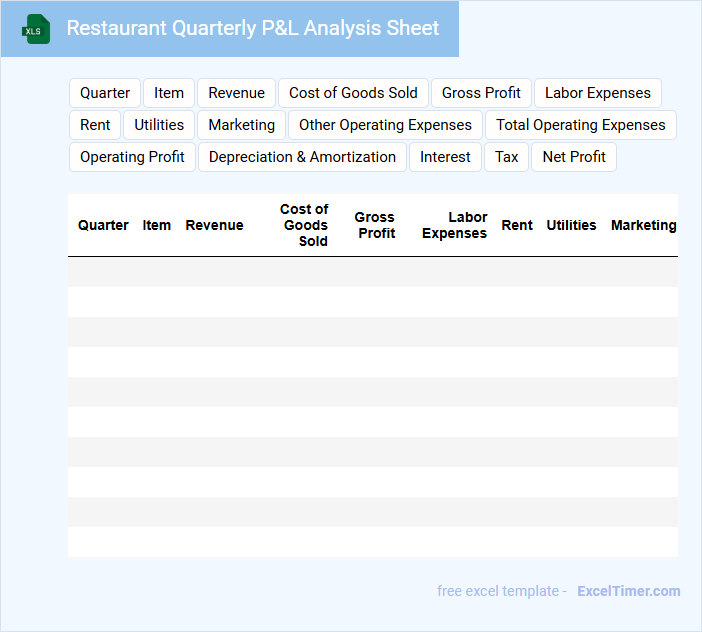

Restaurant Quarterly P&L Analysis Sheet

A Restaurant Quarterly P&L Analysis Sheet typically contains detailed financial data summarizing revenues, expenses, and net profit over a three-month period to assess business performance.

- Revenue Tracking: Accurately record all income sources including food sales, beverages, and catering services.

- Expense Categorization: Break down costs such as labor, food supplies, rent, and utilities for clear expense management.

- Profit Analysis: Regularly compare gross profit, operating profit, and net profit margins to identify trends and areas for improvement.

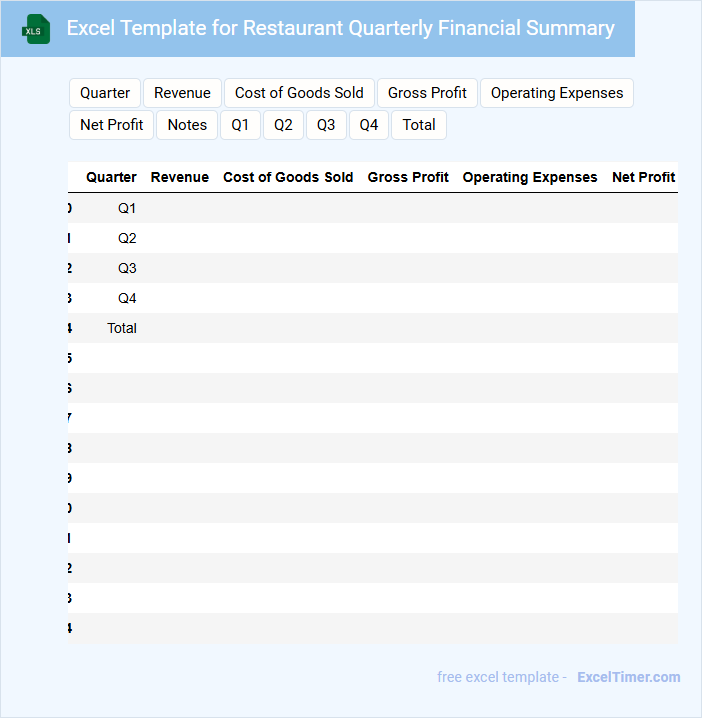

Excel Template for Restaurant Quarterly Financial Summary

This Excel Template for Restaurant Quarterly Financial Summary typically contains detailed financial data used to track and analyze the restaurant's economic performance over three months.

- Revenue tracking: It is crucial to include all income streams such as dine-in, takeout, and delivery sales for accurate total revenue calculation.

- Expense categorization: Organize costs into key categories like food supplies, labor, and overhead to monitor where funds are spent.

- Profit and loss analysis: Summarize earnings and expenses to assess profitability and identify trends or areas for improvement.

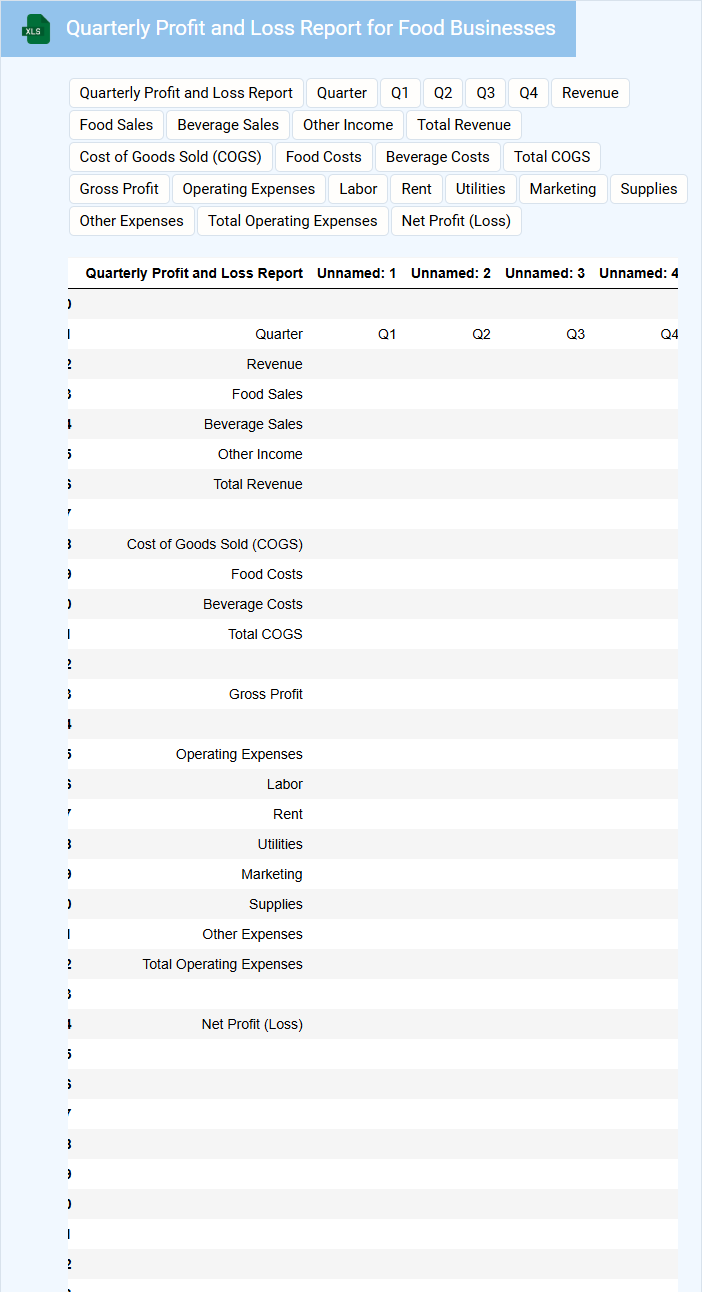

Quarterly Profit and Loss Report for Food Businesses

A Quarterly Profit and Loss Report for food businesses typically includes detailed financial data covering revenue, expenses, and net profit for the three-month period. It highlights key cost areas such as ingredient procurement, labor, and operational expenses crucial to the food industry. This report helps stakeholders assess the business's financial health and guide strategic decisions.

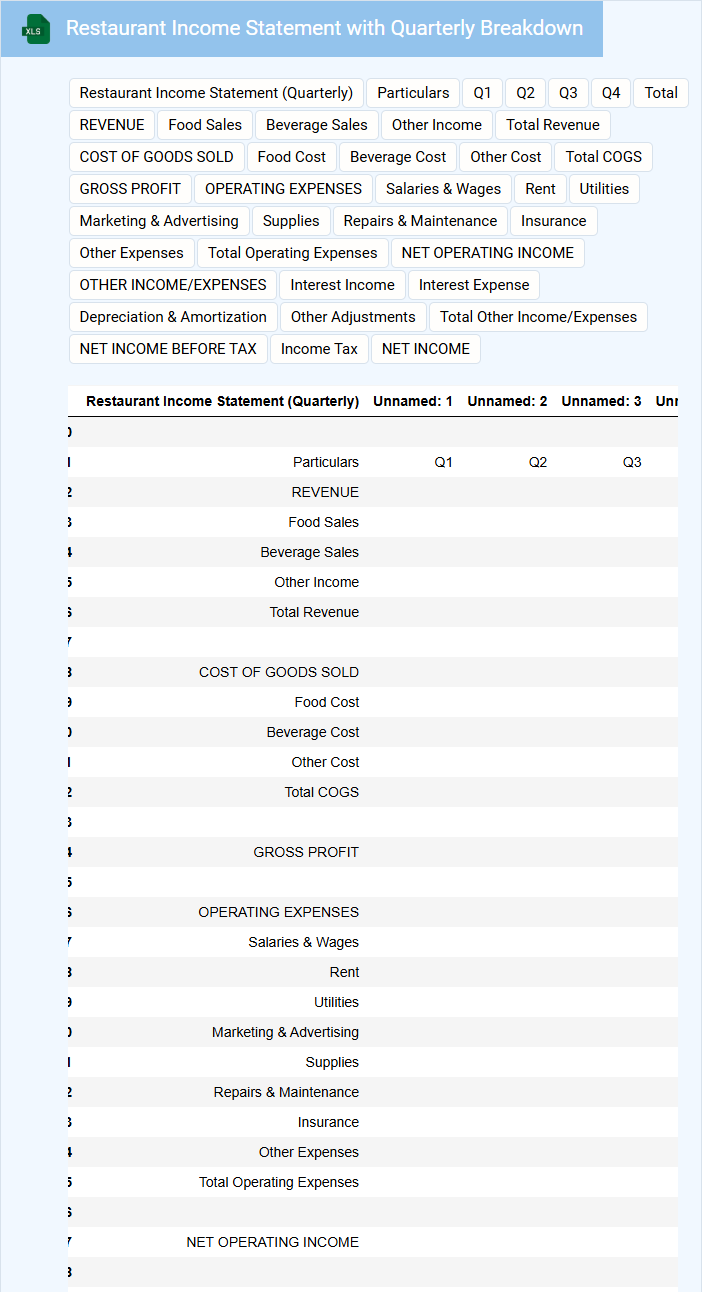

Restaurant Income Statement with Quarterly Breakdown

A Restaurant Income Statement with Quarterly Breakdown provides detailed financial performance data over each quarter of the year, helping to track revenue and expenses systematically. This document is essential for identifying trends and making informed business decisions.

- Include total sales, cost of goods sold, and operating expenses for each quarter.

- Highlight net profit or loss to assess overall profitability by quarter.

- Use clear, consistent categories to enable easy comparison between quarters.

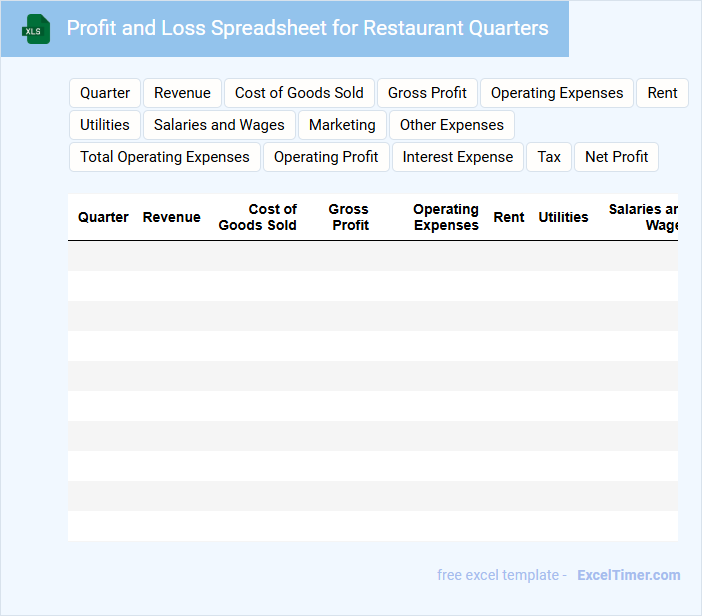

Profit and Loss Spreadsheet for Restaurant Quarters

A Profit and Loss Spreadsheet for Restaurant Quarters typically contains detailed financial data summarizing the income and expenses over a three-month period. It helps restaurant owners analyze profitability, control costs, and make informed business decisions.

- Include categories for revenue streams such as food sales, beverage sales, and other income.

- List all relevant expenses including food costs, labor, rent, and utilities to track operational costs.

- Incorporate a summary section showing net profit or loss and key financial ratios for quick performance assessment.

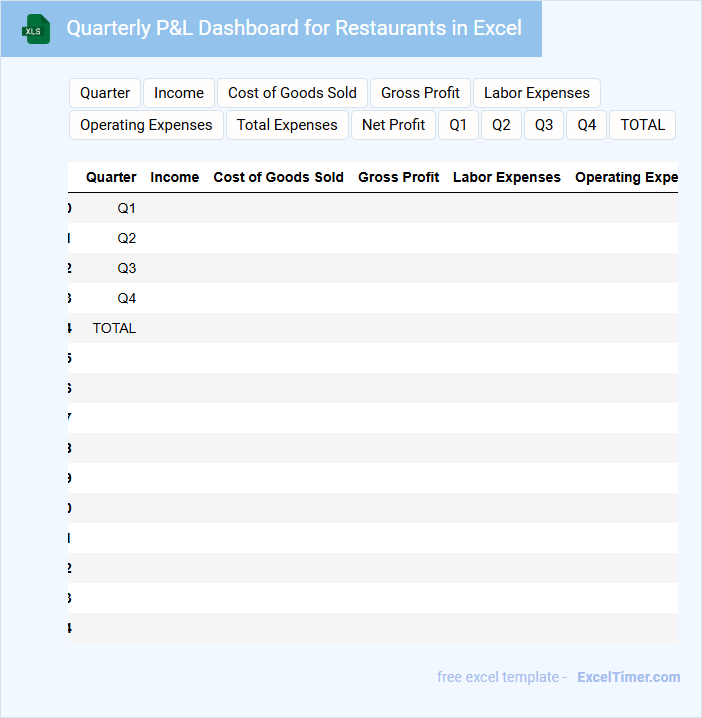

Quarterly P&L Dashboard for Restaurants in Excel

The Quarterly P&L Dashboard is a comprehensive financial document that displays profit and loss data over a three-month period for restaurants. It typically contains revenue, expenses, and net profit figures, providing valuable insights into the restaurant's financial health. Visual charts and trend analyses help stakeholders make informed decisions and track performance effectively.

Excel Sheet for Tracking Quarterly Restaurant Profits

An Excel Sheet for Tracking Quarterly Restaurant Profits typically contains detailed financial data organized by quarters, including revenue, expenses, and net profit. This type of document helps restaurateurs monitor their business performance and make informed decisions. It usually features tables, charts, and formulas to automate calculations and visualize trends effectively.

To optimize its usefulness, it is important to include clear labels, consistent data entry, and regularly updated information. Incorporating key performance indicators (KPIs) such as gross margin and operating costs can enhance analysis. Additionally, protecting sensitive data with passwords and backups ensures data security and reliability.

Restaurant Quarterly Financial Tracker with P&L

This Restaurant Quarterly Financial Tracker typically contains detailed records of income, expenses, and profits over a three-month period. It offers insights into sales trends, operational costs, and financial health of the restaurant.

The Profit and Loss (P&L) statement is a crucial component, summarizing revenue, cost of goods sold, and operational expenses to calculate net profit or loss. This helps managers make informed decisions about budgeting and resource allocation.

For accuracy, it is important to regularly update the tracker with timely and precise data from all revenue streams and expenditures.

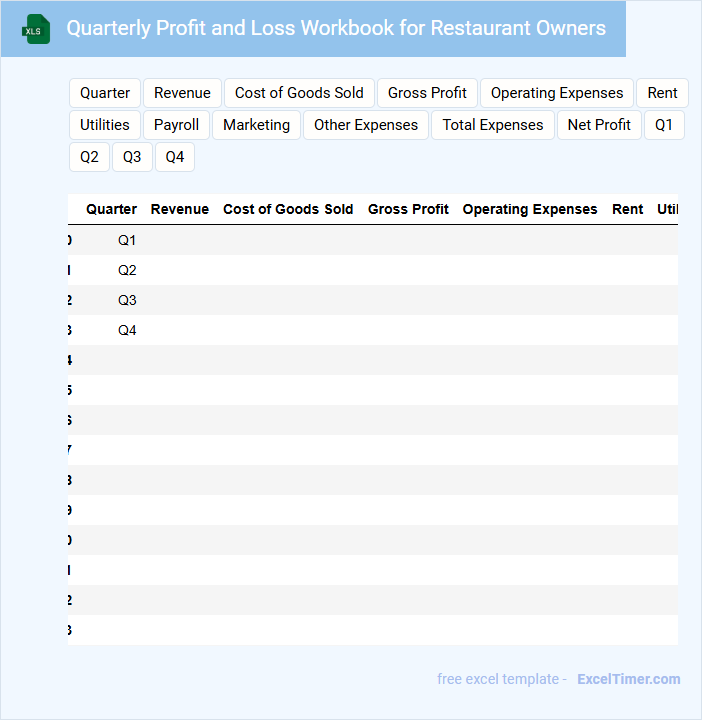

Quarterly Profit and Loss Workbook for Restaurant Owners

What information is typically contained in a Quarterly Profit and Loss Workbook for Restaurant Owners? This document usually includes detailed records of income, expenses, and net profit over a three-month period, helping owners understand their financial performance. It summarizes revenues from sales, cost of goods sold, operating expenses, and other financial activities to provide a clear picture of profitability.

Why is accurate data entry and regular updates important in this workbook? Consistent and precise recording enables restaurant owners to track trends, identify areas for cost savings, and make informed business decisions. Ensuring the data is up-to-date allows timely adjustments to budgets and strategies to improve overall financial health.

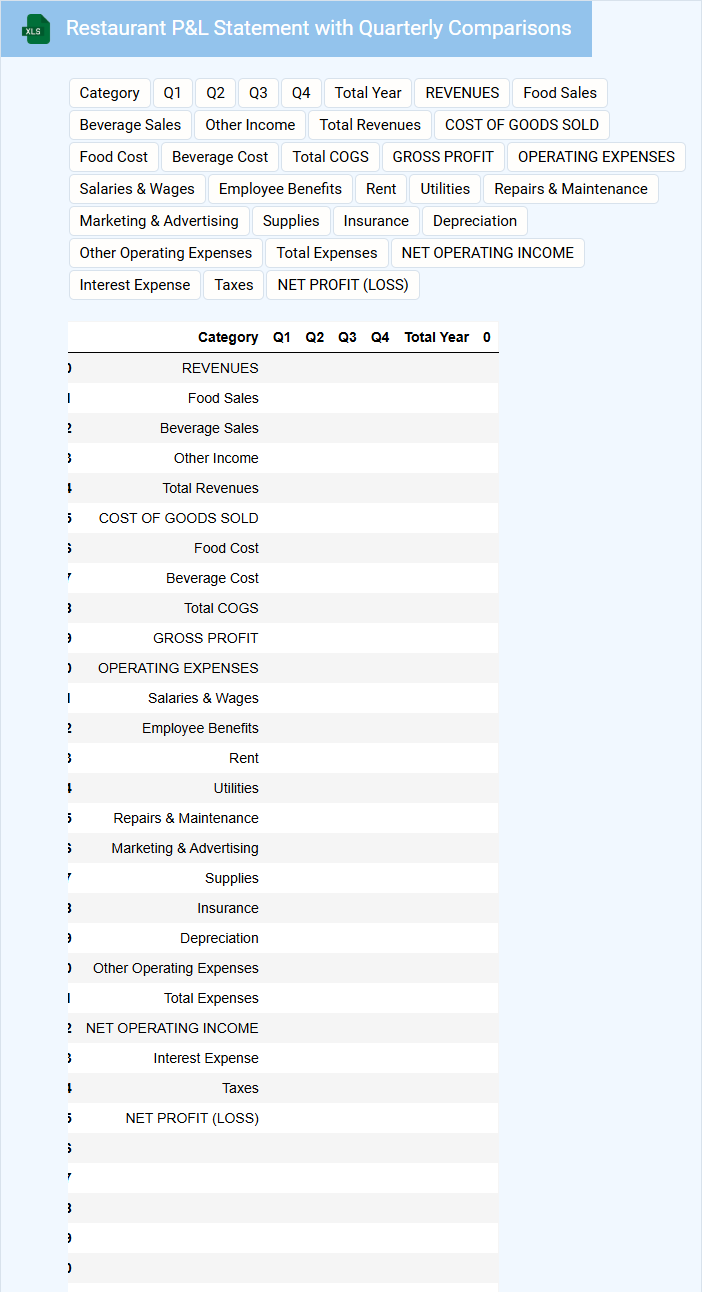

Restaurant P&L Statement with Quarterly Comparisons

A Restaurant P&L Statement typically contains detailed financial data including revenue, costs, and expenses to assess profitability over a specific period. It highlights key metrics such as food and labor costs, gross profit, and net income, crucial for operational analysis. Quarterly comparisons provide insights into trends and performance fluctuations across different seasons or business cycles.

Important elements to focus on include accurately categorizing expenses, monitoring cost percentages relative to sales, and analyzing changes in revenue streams to identify growth opportunities or areas for cost control. Regular review assists management in making informed financial decisions and strategizing for improved profitability. Ensuring timely and precise data entry is essential for effective quarter-over-quarter comparison.

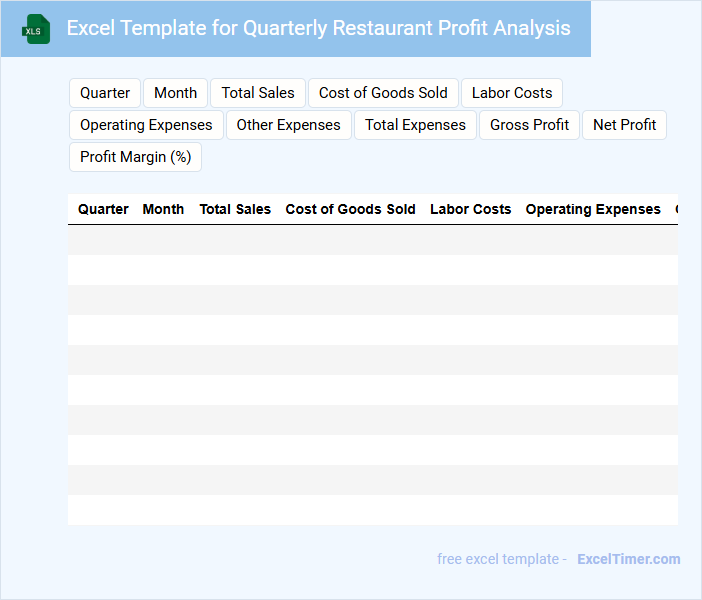

Excel Template for Quarterly Restaurant Profit Analysis

This document typically contains detailed financial data and performance metrics to evaluate a restaurant's profitability over a quarter. It helps in identifying trends and making informed business decisions.

- Summary of revenue streams and cost breakdowns.

- Comparative analysis of quarterly expenses and profits.

- Key performance indicators such as food cost percentage and labor cost ratio.

Quarterly Performance and Loss Report for Restaurants

What information is typically included in a Quarterly Performance and Loss Report for Restaurants? This type of document usually contains detailed financial data such as revenue, expenses, profit margins, and losses incurred during the quarter. It also includes operational metrics like customer footfall, average check size, and inventory costs to provide a comprehensive overview of the restaurant's performance.

What important factors should be considered when preparing this report? It is crucial to ensure accuracy in financial data and include comparative analysis with previous quarters to identify trends. Additionally, highlighting key areas for improvement, such as cost control or sales growth opportunities, helps stakeholders make informed decisions for future strategies.

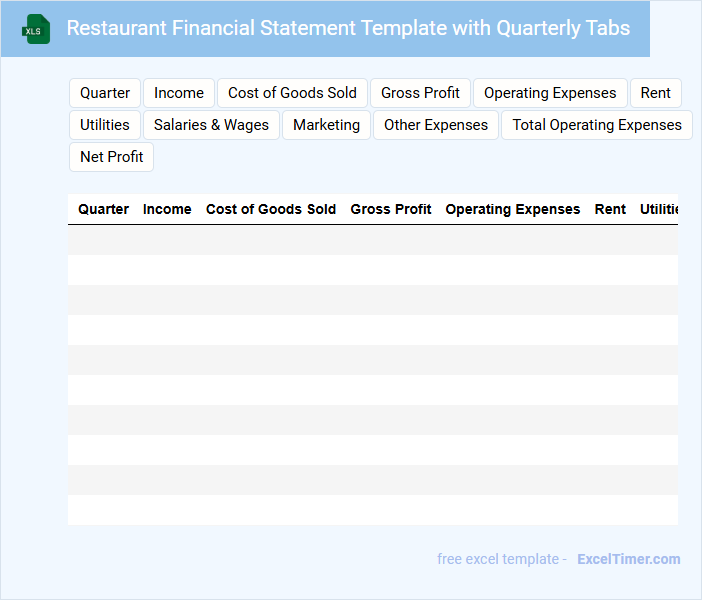

Restaurant Financial Statement Template with Quarterly Tabs

A Restaurant Financial Statement Template with quarterly tabs typically contains detailed financial data such as income, expenses, profits, and losses organized by each quarter. This format helps track seasonal trends and financial performance efficiently. It is essential to include sections for revenue breakdown, cost of goods sold, and operating expenses to provide a comprehensive overview. The template should emphasize accuracy and clarity to assist in budgeting and forecasting. Including tabs for each quarter allows easy comparison and identification of financial patterns throughout the year. Regular updates and reconciliations will ensure the document remains a reliable tool for financial decision-making.

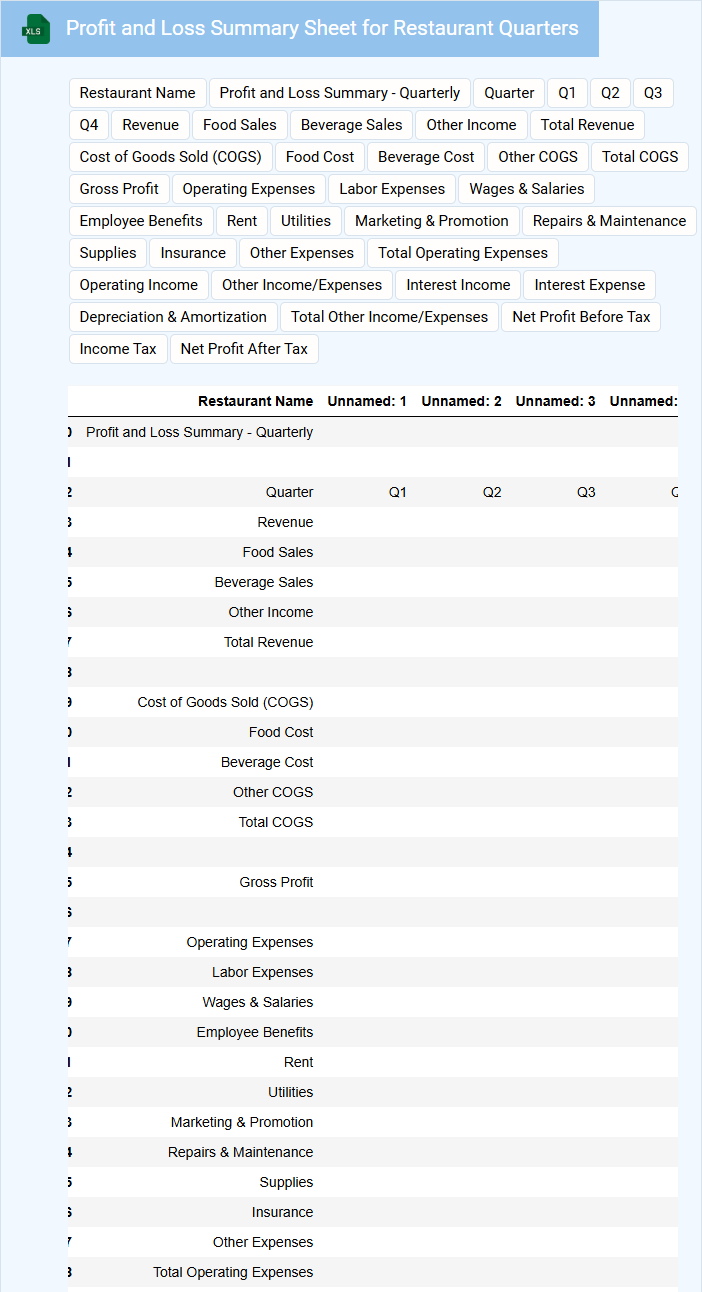

Profit and Loss Summary Sheet for Restaurant Quarters

What information is typically included in a Profit and Loss Summary Sheet for Restaurant Quarters? This document usually contains a detailed breakdown of revenues, costs, and expenses related to restaurant operations over a specific quarter. It helps stakeholders quickly assess the financial performance and profitability of the restaurant during that timeframe.

Why is it important to include key metrics such as sales, food and labor costs, and net profit in this summary? Including these figures allows management to identify trends, control expenses, and make informed decisions to improve financial efficiency. Highlighting quarterly comparisons and variances also provides valuable insights for strategic planning and budgeting.

How do you accurately categorize and input revenue and expense streams specific to restaurant operations in a quarterly Profit and Loss (P&L) Excel document?

Accurately categorize restaurant-specific revenue streams by separating dine-in sales, takeout orders, catering, and delivery income within the Excel quarterly P&L document. Input expense streams by detailing food and beverage costs, labor wages, operating expenses such as utilities and rent, and marketing expenditures according to standard restaurant accounting practices. Use consistent account codes and date ranges to ensure precise tracking and comparison of quarterly financial performance.

What key financial metrics and ratios should be included to analyze restaurant performance over each quarter?

Include Gross Profit Margin to measure profitability from sales, Operating Expense Ratio to assess control over costs, and Net Profit Margin for overall profitability evaluation. Track Revenue Growth Rate quarterly to evaluate sales trends and Cash Flow from Operations to monitor liquidity. Analyze Inventory Turnover and Average Check Size to understand operational efficiency and customer spending behavior.

How can you use Excel formulas to automatically calculate gross profit, operating profit, and net profit for each quarter?

Use Excel formulas by inputting revenue and expense data into designated cells, then apply formulas such as =SUM() to total revenues and deduct costs for gross profit. Calculate operating profit by subtracting operating expenses from gross profit using straightforward cell references. Finally, derive net profit by factoring in taxes and interest costs in a formula like =gross_profit - operating_expenses - taxes - interest, helping you accurately analyze your restaurant's quarterly financial performance.

What methods can be used in Excel to compare quarterly trends and pinpoint areas of concern, such as rising food or labor costs?

Use Excel's PivotTables to summarize quarterly profit and loss data, highlighting key metrics like food and labor costs. Conditional formatting helps you visually spot cost increases or unusual trends in your restaurant's expenses. You can also apply line charts or sparklines for clear trend analysis, enabling you to quickly pinpoint areas of concern.

How should you structure your Excel document to provide a clear, at-a-glance dashboard for restaurant owners and stakeholders?

Structure the Excel document with separate sheets for Revenue, Expenses, and Summary Dashboard. Use pivot tables and charts on the Summary tab to visualize quarterly profit and loss trends clearly. Incorporate key performance indicators (KPIs) like gross profit margin, net profit, and expense ratios for quick stakeholder insights.