![]()

The Quarterly Earnings Tracker Excel Template for Freelancers provides a streamlined way to monitor income and expenses over three-month periods, helping freelancers maintain accurate financial records. It features customizable fields for project tracking, client payments, and tax estimations, ensuring clearer cash flow management. Using this template aids in timely financial analysis and simplifies quarterly tax preparation tasks.

Quarterly Earnings Tracker with Automated Charts Excel Template

What information is typically included in a Quarterly Earnings Tracker with Automated Charts Excel Template? This type of document generally contains detailed financial data such as revenue, expenses, net income, and earnings per share for each quarter. It also features automated charts that visualize trends and comparisons, making financial analysis more efficient and accessible.

Why is it important to focus on accuracy and update frequency when using a Quarterly Earnings Tracker with Automated Charts Excel Template? Ensuring data accuracy is crucial because financial decisions rely heavily on precise information, and regular updates help reflect the most current financial performance. Additionally, configuring automated charts correctly enhances clarity and supports strategic insights during earnings reviews.

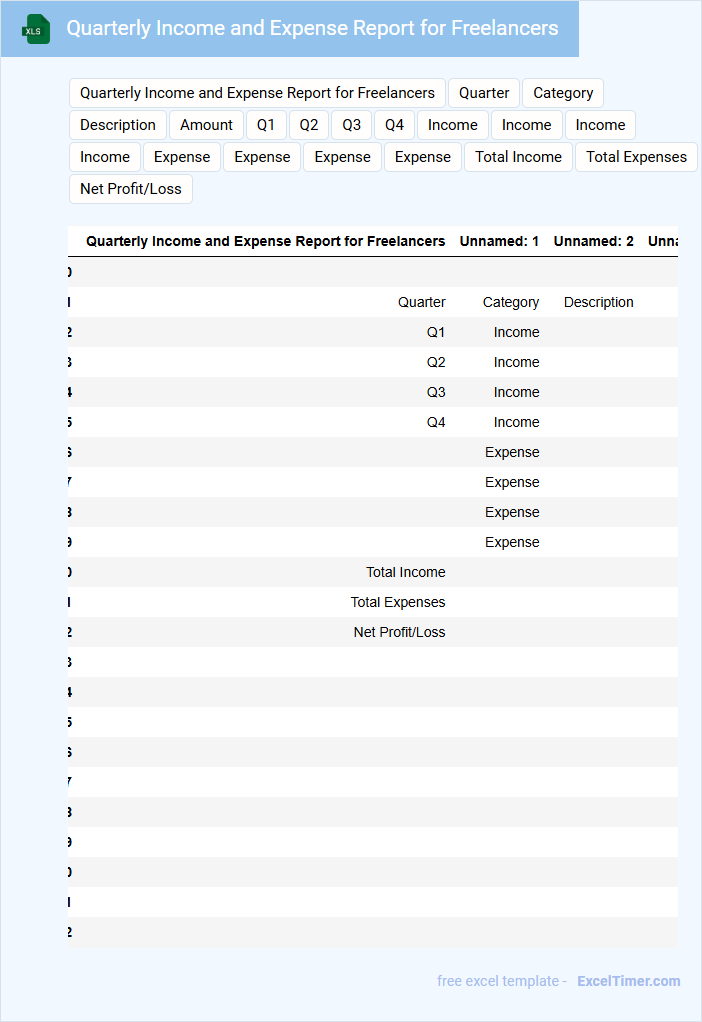

Quarterly Income and Expense Report for Freelancers

The Quarterly Income and Expense Report is a crucial financial document for freelancers, detailing all earnings and expenditures over a three-month period. It helps track profitability and manage cash flow effectively.

Important elements to include are total income, categorized expenses, and net profit figures for clear financial analysis. Maintaining accurate records ensures easier tax filing and financial planning.

Client Payment Tracker for Quarterly Earnings Excel Sheet

What information is typically contained in a Client Payment Tracker for Quarterly Earnings Excel Sheet? This document usually includes client names, payment dates, amounts paid, outstanding balances, and the total earnings for each quarter. It helps businesses monitor cash flow, ensure timely payments, and analyze financial performance over a specific period.

What is an important aspect to focus on when creating or using this tracker? Accuracy in data entry and timely updates are crucial to maintain reliable records. Additionally, incorporating automated calculations and clear visual summaries can enhance efficiency and decision-making.

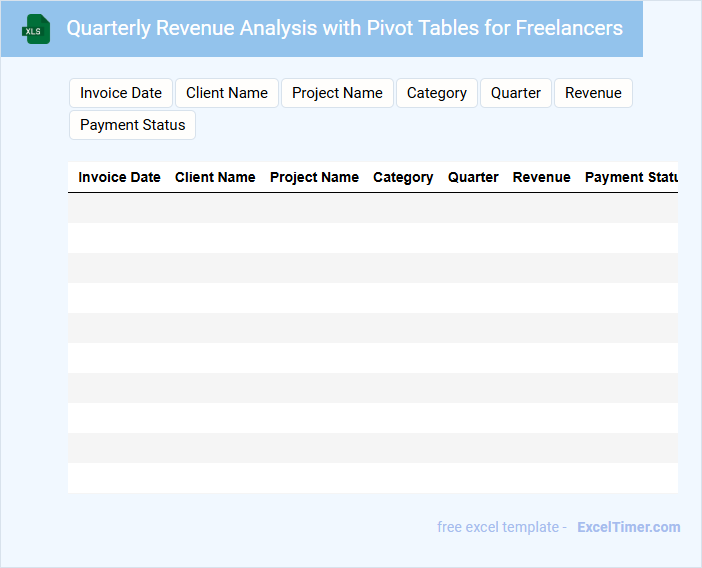

Quarterly Revenue Analysis with Pivot Tables for Freelancers

A Quarterly Revenue Analysis document for freelancers typically contains detailed financial data broken down by projects, clients, and time periods. It uses pivot tables to summarize income streams, highlighting trends and identifying peak earning phases.

This type of document is essential for tracking cash flow, budgeting, and strategic planning to improve profitability. Maintaining accurate and up-to-date data in pivot tables ensures clear insights and informed decision-making.

Important suggestions include regularly updating the pivot tables, categorizing revenue sources consistently, and adding visual charts for easier interpretation.

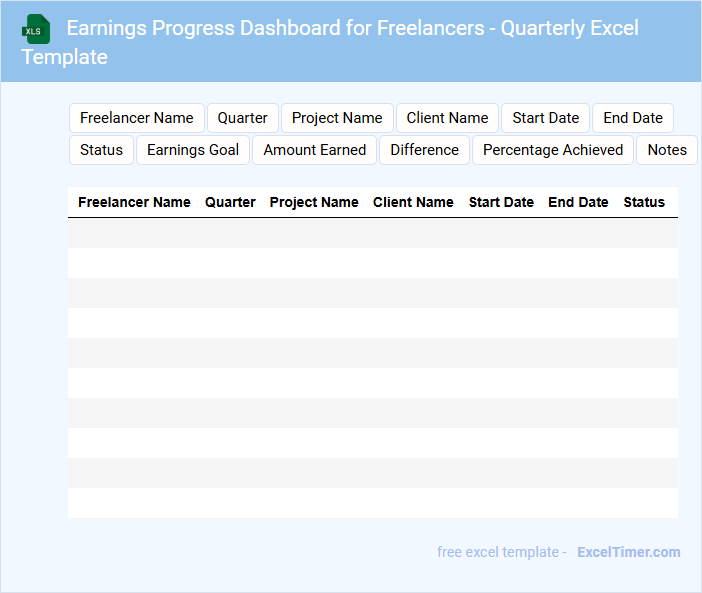

Earnings Progress Dashboard for Freelancers - Quarterly Excel Template

An Earnings Progress Dashboard for freelancers typically contains detailed records of income streams, project timelines, and payment statuses. These dashboards help visualize financial growth and identify trends over the quarter.

Such a quarterly Excel template includes customizable charts, summary tables, and expense tracking sections. It is important to ensure accurate data entry and regular updates for effective financial management.

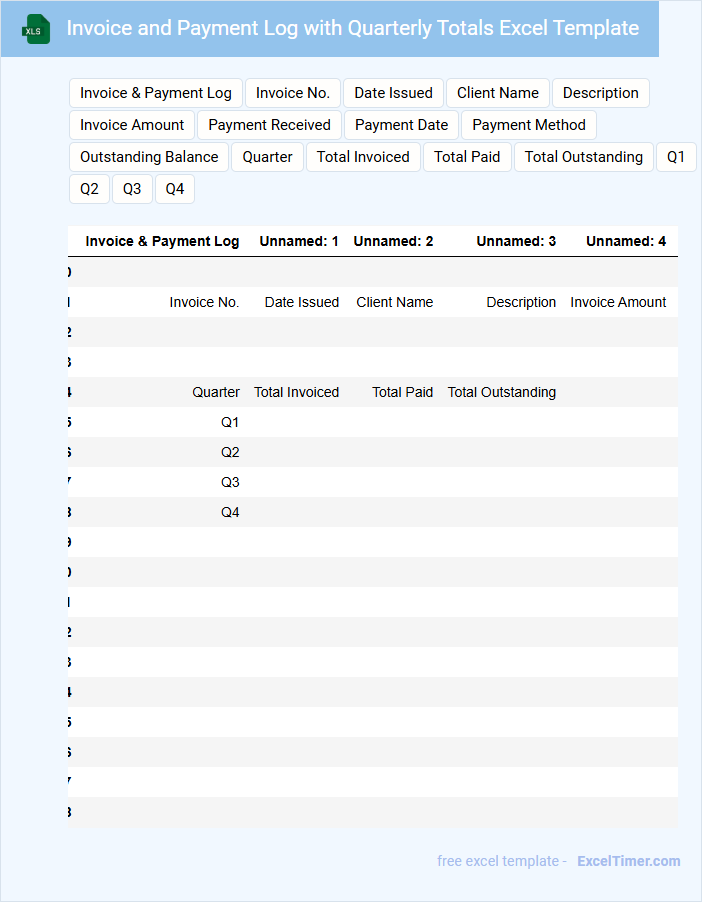

Invoice and Payment Log with Quarterly Totals Excel Template

This document typically contains detailed records of invoices issued and payments received, organized for easy tracking and reconciliation. It helps businesses monitor their financial transactions and ensures accuracy in accounting.

- Include columns for invoice number, client details, payment date, and amount for comprehensive tracking.

- Use formulas to calculate quarterly totals automatically for accurate financial summaries.

- Ensure that the template allows for clear differentiation between paid, pending, and overdue invoices.

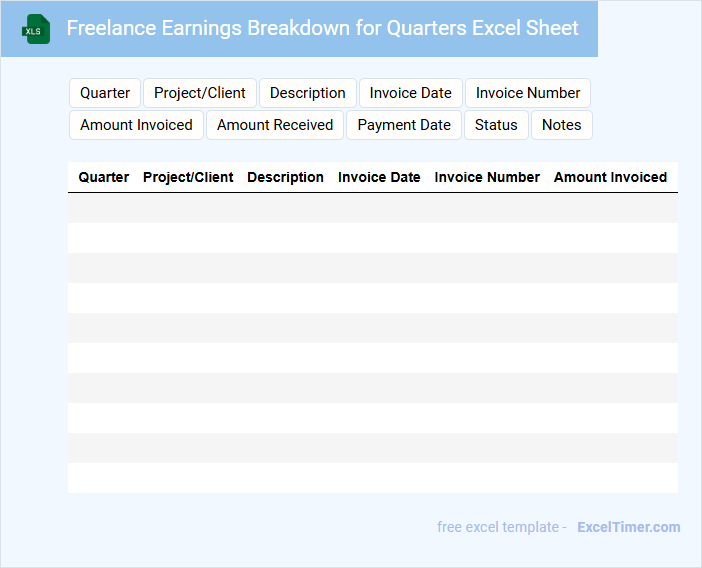

Freelance Earnings Breakdown for Quarters Excel Sheet

A Freelance Earnings Breakdown Excel sheet typically contains detailed records of income generated from various projects over specified quarters. It includes categories such as client names, project descriptions, payment dates, and totals for each quarter. This document helps freelancers track their financial progress and manage taxes efficiently.

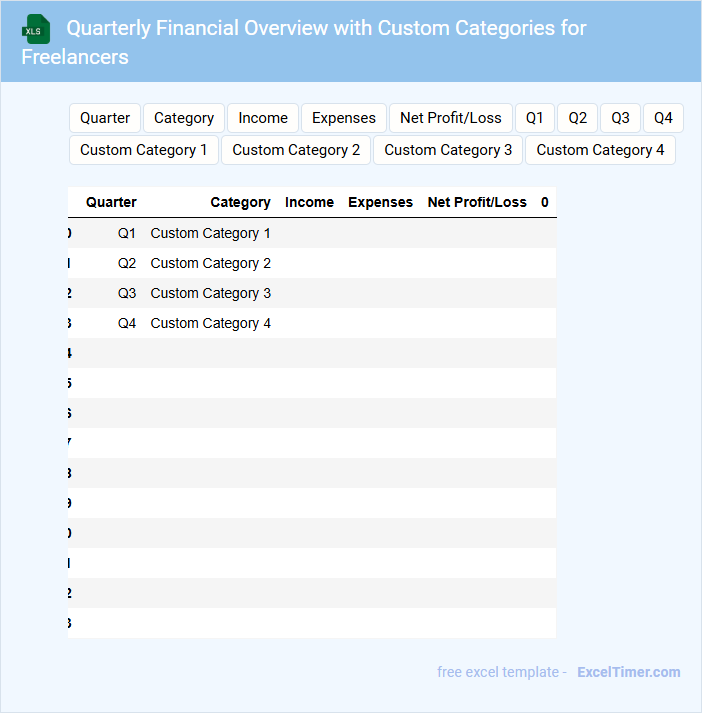

Quarterly Financial Overview with Custom Categories for Freelancers

The Quarterly Financial Overview document typically contains detailed summaries of income, expenses, and profit margins over a three-month period. It helps freelancers track their financial performance and make informed business decisions.

Custom categories tailored for freelancers enhance clarity by organizing transactions into specific areas such as client projects, software subscriptions, and tax deductions. Regularly updating and reviewing these categories is essential for accurate financial management and tax preparation.

Project-Based Quarterly Earnings Tracker for Freelancers

A Project-Based Quarterly Earnings Tracker is a document designed to monitor and analyze a freelancer's income from various projects over each quarter. It typically includes details such as project names, income received, payment dates, and client information.

This type of tracker helps freelancers maintain financial organization and identify trends in their earnings. Important aspects to include are clear categorization of projects, accurate date entries, and summaries for quick assessment of financial performance.

Time Tracking with Quarterly Income Analysis Excel Template

This document is an Excel template designed to help users track their working hours alongside their quarterly income efficiently. It typically includes sections for daily time entries, project or task categorization, and automated calculations of total hours worked versus income earned. Such templates are essential for accurate financial planning and productivity analysis over defined periods.

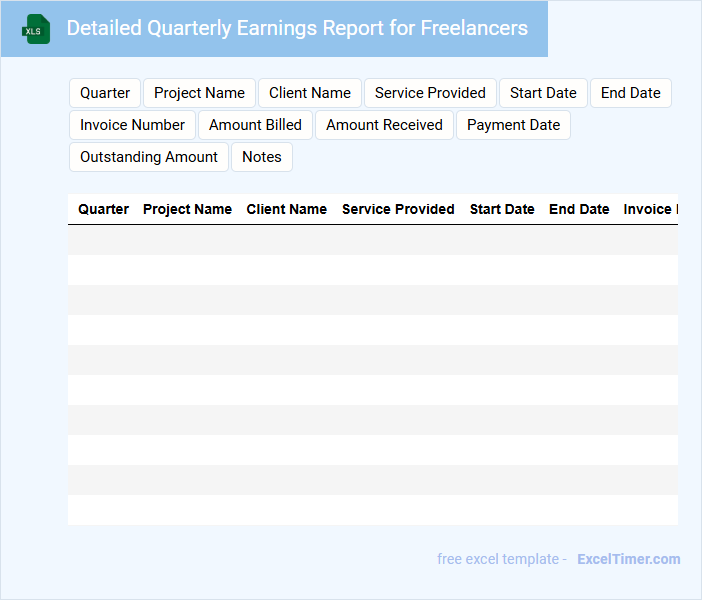

Detailed Quarterly Earnings Report for Freelancers

The Detailed Quarterly Earnings Report for freelancers is a comprehensive summary of income earned over a three-month period. It typically includes total revenue, client details, and payment dates to help track financial performance.

This document is essential for managing taxes, budgeting, and assessing business growth. Including clear categorization of expenses and invoicing status is highly recommended for accuracy.

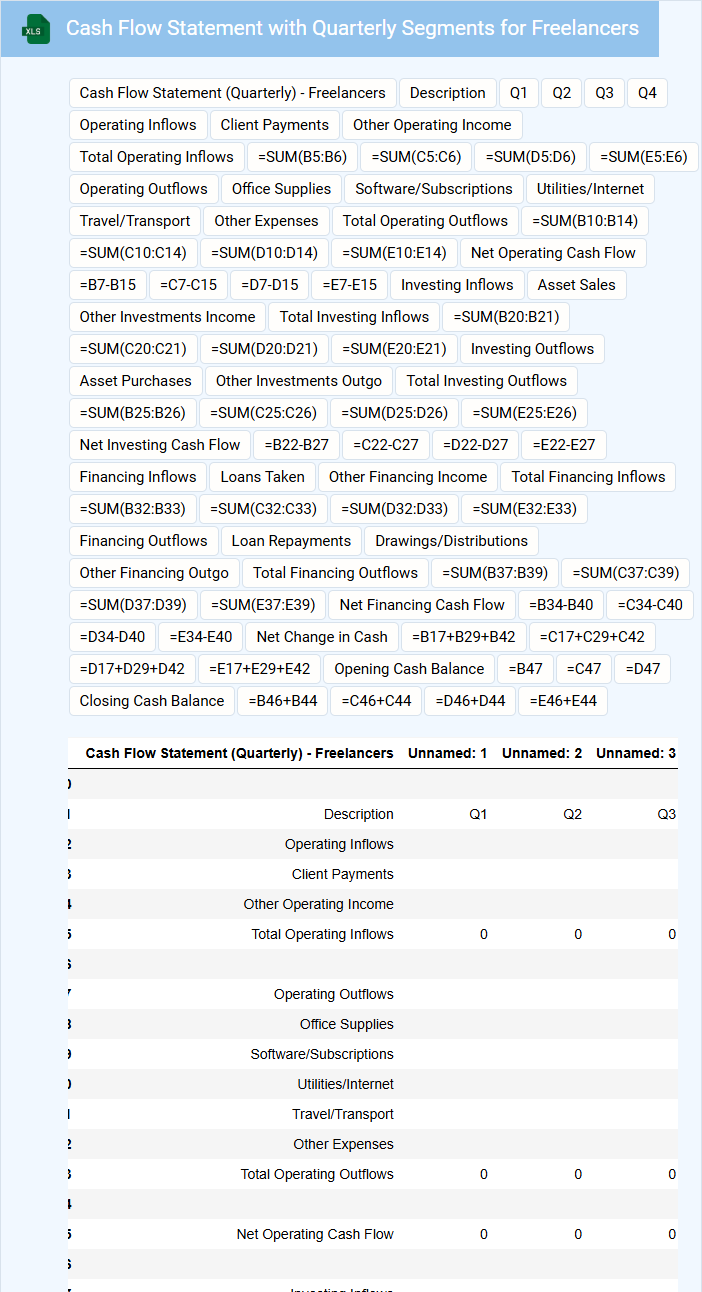

Cash Flow Statement with Quarterly Segments for Freelancers

The Cash Flow Statement is a financial document that outlines the inflows and outflows of cash within a specific period, typically segmented quarterly. It helps freelancers track their liquidity by showing how money moves through their business.

For freelancers, this statement often includes categories like operating activities, investing activities, and financing activities broken down by quarters. Keeping detailed and organized records of income and expenses every quarter is crucial for accurate cash flow analysis.

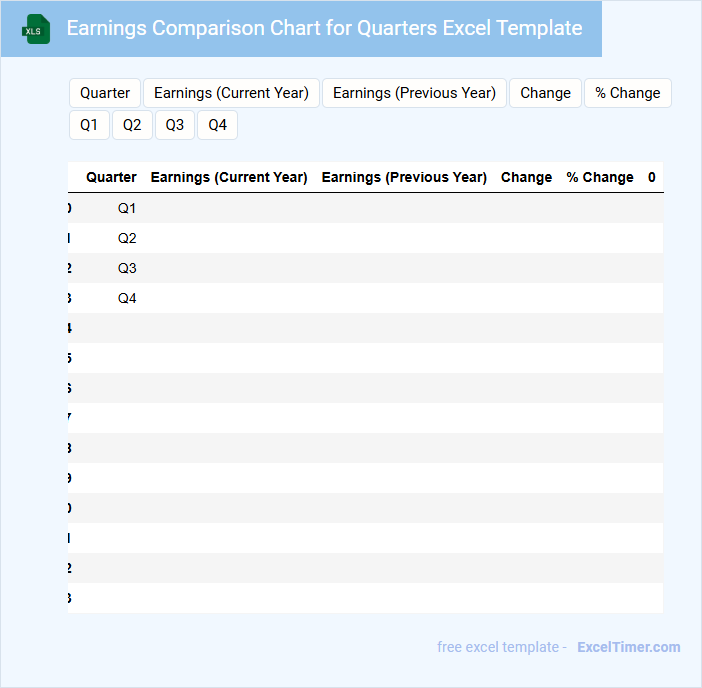

Earnings Comparison Chart for Quarters Excel Template

What information is typically included in an Earnings Comparison Chart for Quarters Excel Template? This type of document usually contains quarterly financial data, including revenue, net profit, and earnings per share for multiple periods. It is designed to help users visually analyze and compare the financial performance of a company across different quarters.

What is an important consideration when using this template? It is essential to ensure accurate and updated data entry for each quarter to maintain the reliability of the comparison. Additionally, including clear labels and color-coded visuals can enhance readability and help stakeholders quickly grasp key financial trends.

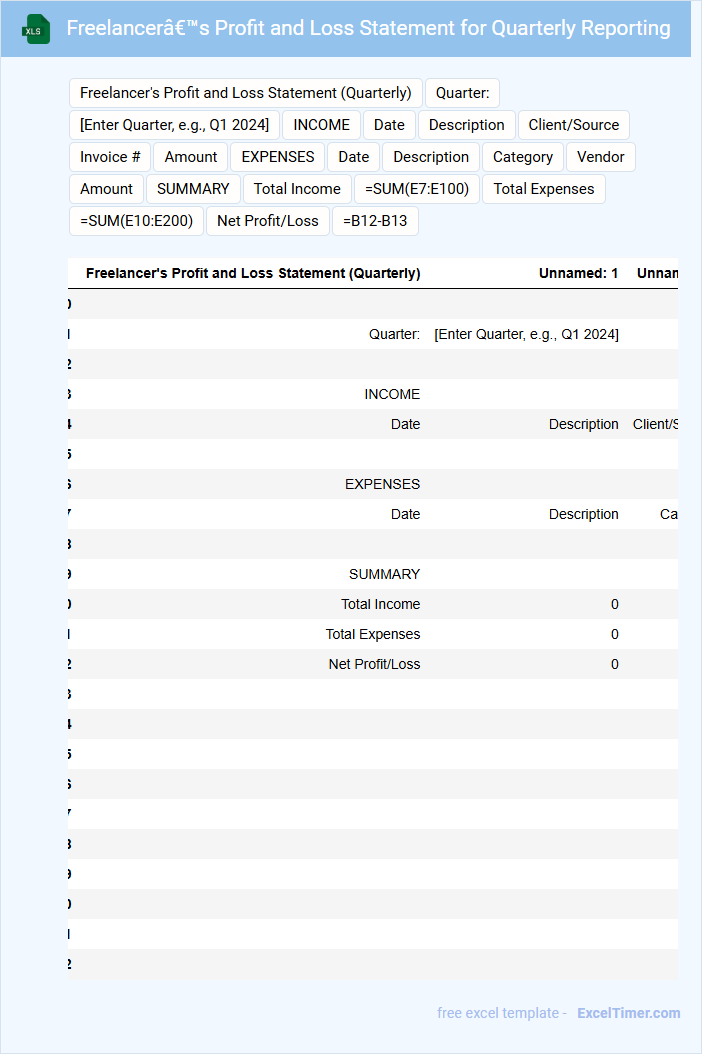

Freelancer’s Profit and Loss Statement for Quarterly Reporting

What information is typically included in a Freelancer's Profit and Loss Statement for Quarterly Reporting? This document usually contains detailed records of all income and expenses related to freelance work over a three-month period. It helps freelancers track their financial performance by summarizing revenues, costs, and net profit or loss.

What are the most important considerations when preparing this statement? Accuracy in recording all sources of income and categorizing expenses correctly is essential, along with timely updates to ensure clear financial insights. Additionally, including tax-related deductions and preparing the statement regularly supports better financial planning and compliance.

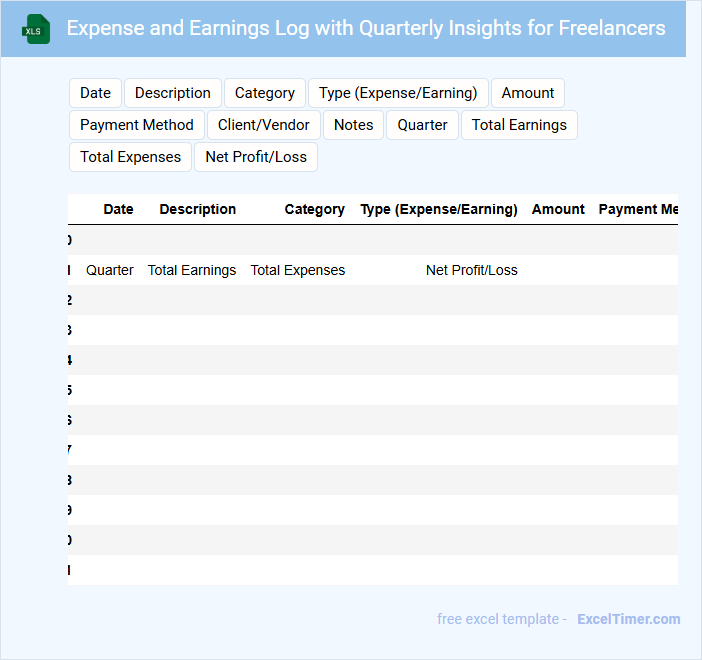

Expense and Earnings Log with Quarterly Insights for Freelancers

An Expense and Earnings Log typically contains detailed records of all income and expenditures over a specific period, helping freelancers keep track of their financial health. It is essential to categorize expenses and earnings accurately to maintain clarity and ease of access.

With Quarterly Insights, freelancers can analyze trends and make informed decisions about budgeting, taxes, and business growth. Regularly reviewing this document ensures better financial planning and improved profitability.

What key metrics should be included in a Quarterly Earnings Tracker for freelancers?

Your Quarterly Earnings Tracker for freelancers should include key metrics such as total income, expenses, net profit, and hourly rates. Tracking client payments, project deadlines, and tax withholdings ensures comprehensive financial management. These metrics help you analyze performance trends and optimize your freelance business growth.

How can you automatically calculate total quarterly income in Excel?

Use the SUM function to automatically calculate total quarterly income in your Freelancers Quarterly Earnings Tracker. Enter =SUM(range) where "range" covers all income cells for the quarter. This formula updates your total as you input new earnings data.

What formulas can track and compare earnings across different clients or projects?

Use SUMIF to total earnings by client or project, enabling clear aggregation of income streams. Apply AVERAGEIF to calculate average earnings per client or project for insightful performance analysis. Implement VLOOKUP or INDEX-MATCH to compare quarterly figures across clients efficiently within your earnings tracker.

How can you visualize your earnings trends per quarter using charts in Excel?

Use Excel's line or column charts to visualize quarterly earnings trends by selecting your earnings data and inserting a chart from the Insert tab. Apply data labels and trendlines to highlight fluctuations and growth patterns over each quarter. Customize chart elements like titles, axes, and colors to improve clarity and emphasize key insights in your freelancer earnings tracker.

Which Excel features help categorize income sources and payment statuses efficiently?

Excel features like PivotTables and Data Validation help categorize income sources and payment statuses efficiently. You can use conditional formatting to highlight payment statuses automatically for quick insights. These tools streamline tracking and improve financial management in your Quarterly Earnings Tracker.