The Semi-annually Budget Planner Excel Template for Small Businesses offers a streamlined way to track income and expenses every six months, ensuring better financial control and forecasting. It includes customizable categories and automated calculations to simplify budget management and enhance accuracy. Small business owners benefit from its user-friendly layout, enabling efficient planning and cash flow monitoring.

Semi-Annually Budget Planner Excel Template for Small Businesses

The Semi-Annually Budget Planner Excel template is designed to help small businesses track and manage their finances over two six-month periods within a fiscal year. It typically includes sections for income, expenses, savings, and cash flow projections to ensure balanced budgeting.

Using this template allows businesses to monitor financial performance, adjust spending, and plan for future growth efficiently. Regular updates and accurate data entry are essential to maximize the effectiveness of the planner.

Expense Tracker with Semi-Annual Overview for Small Businesses

An Expense Tracker with Semi-Annual Overview is a document designed to help small businesses monitor and manage their expenditures efficiently over a six-month period. It typically contains detailed records of daily or monthly expenses categorized by type, along with summarized data to give a clear financial snapshot. This tool is essential for identifying spending trends and making informed budgeting decisions.

Key components often include categorized expense entries, date tracking, and a semi-annual summary highlighting total costs in each category. Businesses should focus on consistency in data entry, clear categorization, and regular review of the semi-annual reports to ensure accurate financial management. Additionally, integrating visual aids like charts or graphs can enhance comprehension and strategic planning.

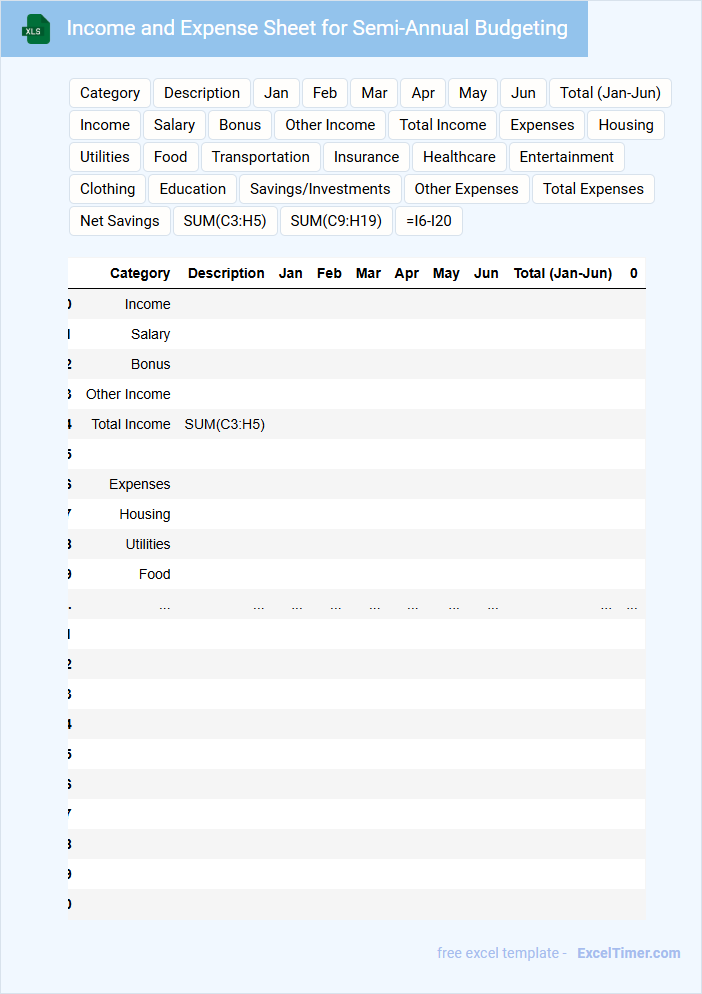

Income and Expense Sheet for Semi-Annual Budgeting

An Income and Expense Sheet for semi-annual budgeting is a financial document that outlines the anticipated revenue and expenditures over a six-month period. It helps organizations track cash flow and manage resources efficiently. This type of document typically contains detailed categories for income sources and expense items.

The sheet also often includes projected amounts, actual amounts, and variances to monitor budget adherence. Having clear categories and periodic updates is crucial to maintain accuracy and relevance. It is recommended to review and adjust the sheet regularly to reflect any financial changes or unexpected costs.

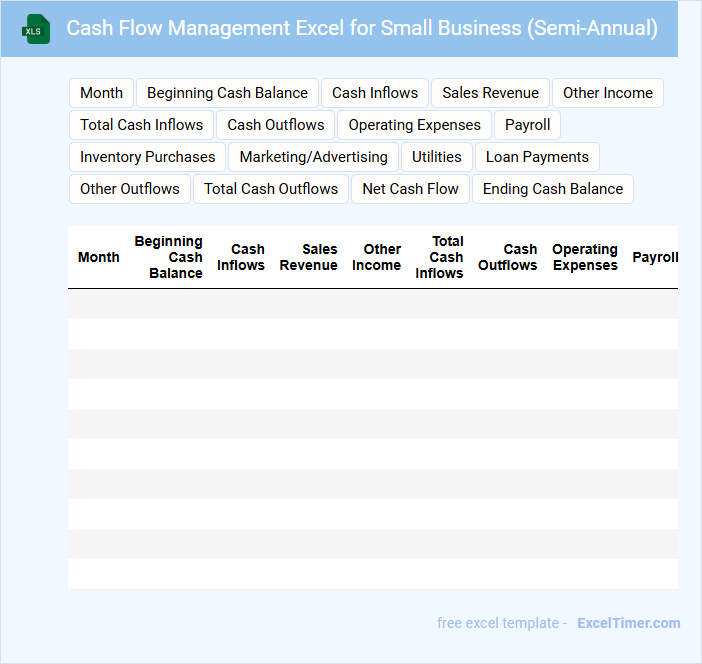

Cash Flow Management Excel for Small Business (Semi-Annual)

What information does a Cash Flow Management Excel for Small Business (Semi-Annual) typically contain? This document usually includes detailed records of cash inflows and outflows over six months, helping business owners track financial health. It also summarizes key metrics such as net cash flow, operating expenses, and projected cash balances to ensure effective budgeting and planning.

Why is managing cash flow semi-annually important for small businesses? Semi-annual analysis provides a balanced view of trends and seasonal fluctuations, allowing businesses to make informed decisions and prepare for upcoming expenses. It is crucial to regularly update the spreadsheet with actual data and forecast future cash movements to avoid liquidity problems and optimize growth opportunities.

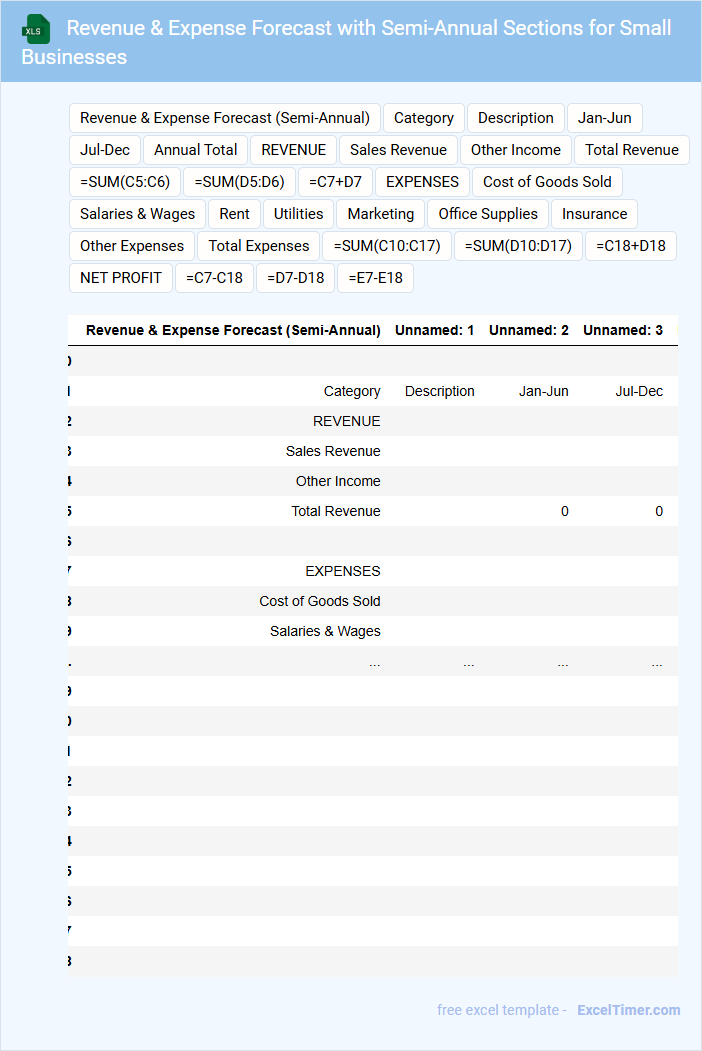

Revenue & Expense Forecast with Semi-Annual Sections for Small Businesses

A Revenue & Expense Forecast with Semi-Annual Sections for Small Businesses is a financial document that projects income and expenditures over two six-month periods. It helps business owners plan cash flow and make informed decisions throughout the year.

- Include detailed revenue sources and categorize all expenses clearly for accurate forecasting.

- Use historical data and market trends to make realistic assumptions in the forecast.

- Regularly update the forecast to reflect actual performance and adjust for unexpected changes.

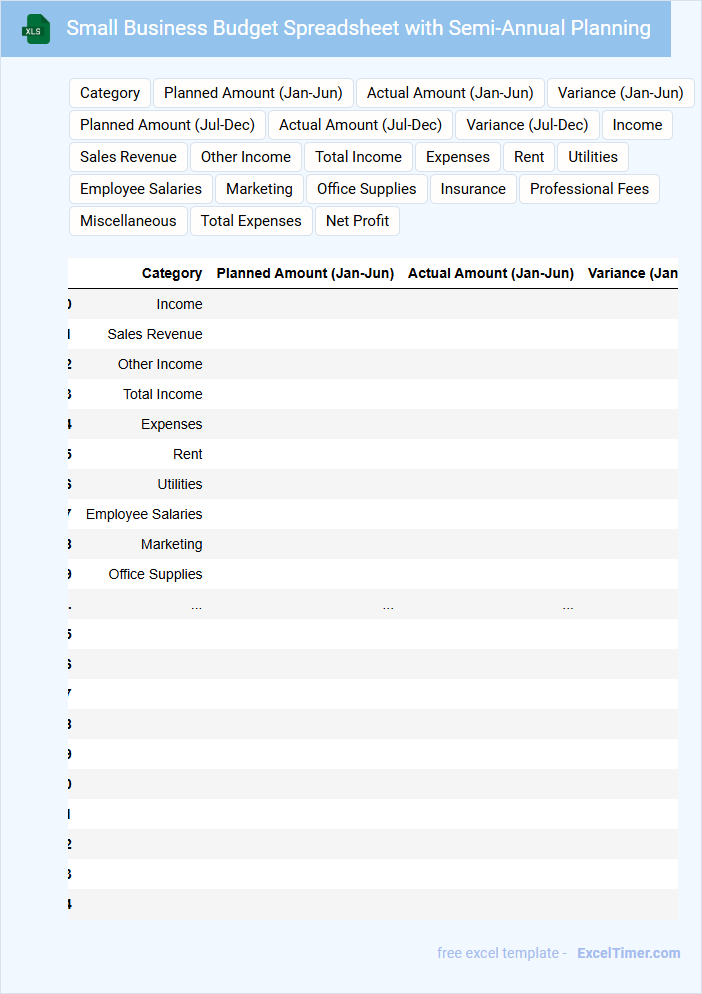

Small Business Budget Spreadsheet with Semi-Annual Planning

What information is typically included in a Small Business Budget Spreadsheet with Semi-Annual Planning? This document usually contains detailed income and expense projections, cash flow statements, and budget adjustments for each six-month period. It helps businesses monitor financial performance, allocate resources efficiently, and plan strategic initiatives effectively over short-term intervals.

An important consideration when using this spreadsheet is to regularly update actual figures against projections to identify variances early. Additionally, including contingency plans for unexpected expenses and revenue fluctuations ensures better financial stability.

Semi-Annual Financial Tracker for Business Owners

What information is typically included in a Semi-Annual Financial Tracker for Business Owners? This document usually contains detailed income statements, expense reports, cash flow summaries, and key performance indicators over a six-month period. It helps business owners monitor financial health, make informed decisions, and plan for future growth effectively.

What important aspects should business owners focus on when using a Semi-Annual Financial Tracker? They should pay close attention to trends in revenue and expenses, ensure accuracy in data entry, and regularly compare results against budgets or forecasts to identify areas for improvement. Tracking key metrics like profit margins and liquidity ratios can enhance strategic planning and operational efficiency.

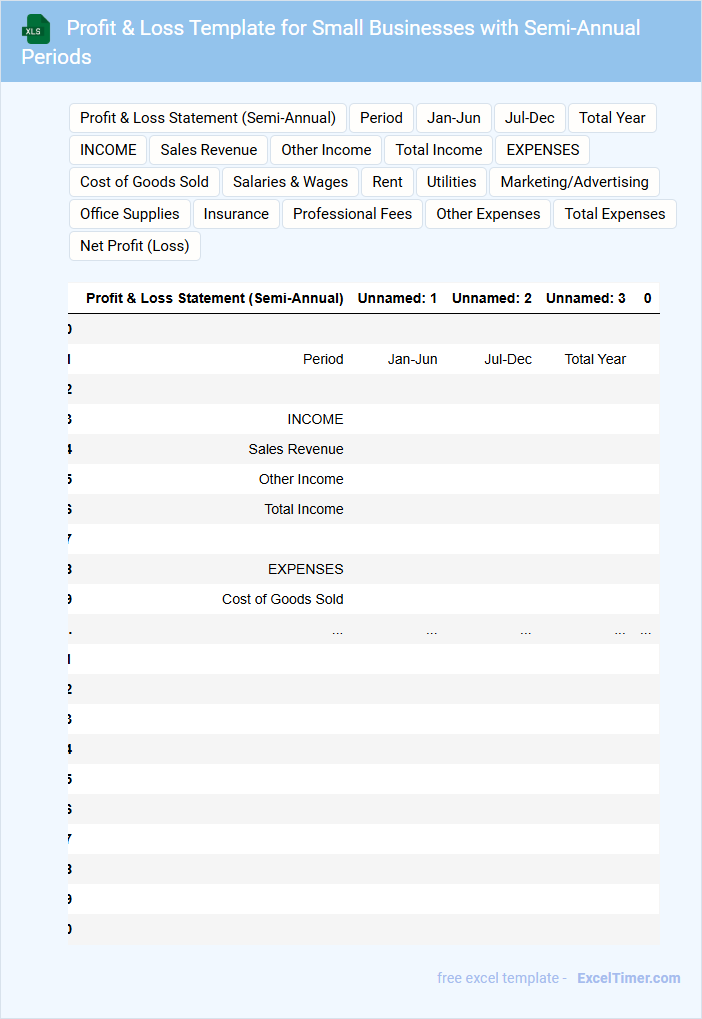

Profit & Loss Template for Small Businesses with Semi-Annual Periods

A Profit & Loss Template for small businesses is a financial document that summarizes revenues, costs, and expenses over a specific period, typically six months in this case. It helps business owners assess profitability and make informed decisions. Regularly updating this template ensures accurate financial tracking and easier tax preparation.

This template typically includes sections for income, cost of goods sold, operating expenses, and net profit or loss. For semi-annual periods, it is important to clearly separate data into two halves of the year to identify trends and seasonal impacts. Maintaining consistency in categorizing expenses aids in effective financial analysis and budgeting.

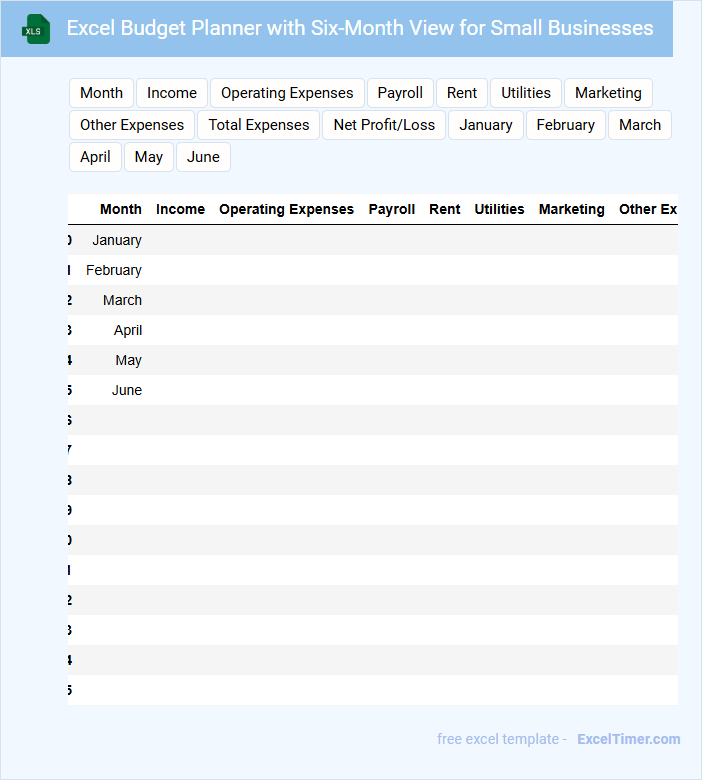

Excel Budget Planner with Six-Month View for Small Businesses

What information does an Excel Budget Planner with Six-Month View for Small Businesses typically contain? This type of document generally includes detailed monthly income and expense projections over a six-month period, allowing small business owners to monitor cash flow and plan strategically. It usually features categorized budget items, comparison of forecasted versus actual figures, and summary charts to provide clear financial insights.

What important elements should be considered when creating an Excel Budget Planner for small businesses? It is essential to ensure accuracy in data input, include contingency sections for unexpected costs, and update the planner regularly to reflect real-time financial changes. Additionally, incorporating visual aids such as graphs and conditional formatting enhances readability and facilitates quick decision-making.

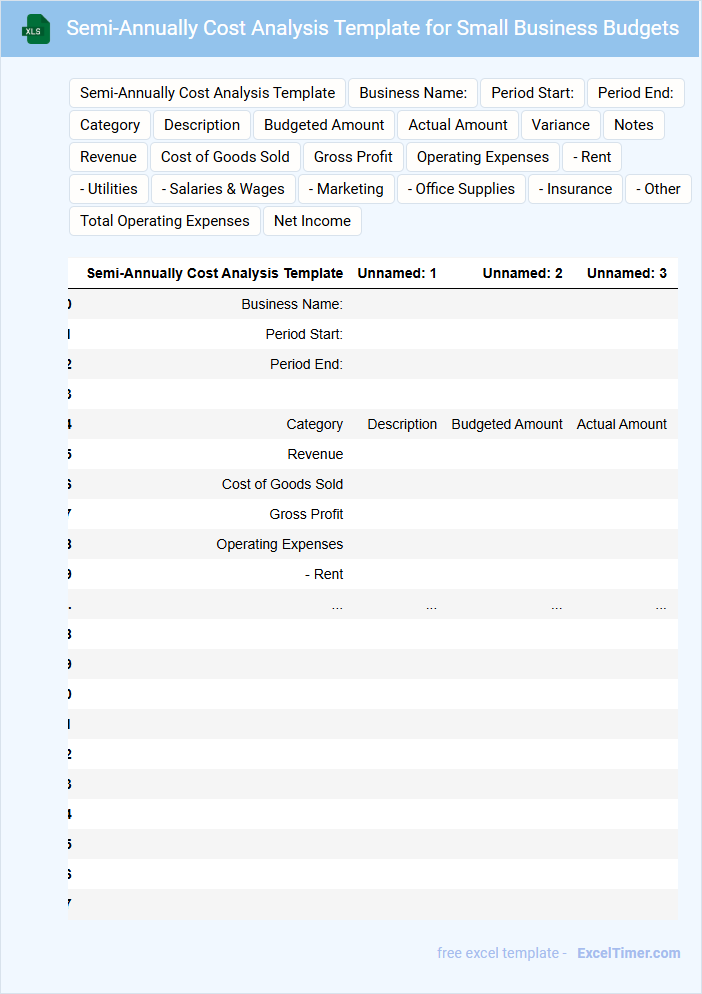

Semi-Annually Cost Analysis Template for Small Business Budgets

A Semi-Annually Cost Analysis Template is an essential financial tool used by small businesses to track and evaluate expenses over six-month periods. It typically contains sections for categorizing costs, comparing budgeted versus actual expenses, and analyzing trends to identify saving opportunities. Utilizing this template helps businesses maintain accurate records and make informed budgeting decisions efficiently.

Small Business Expense Breakdown for Semi-Annual Tracking

This document typically contains a detailed summary of all expenses incurred by a small business over a six-month period to facilitate financial tracking and budgeting.

- Accurate categorization of expenses ensures clear visibility of spending patterns.

- Consistent updating every month helps maintain up-to-date financial records.

- Comparison against budget aids in identifying areas for cost-saving and improvement.

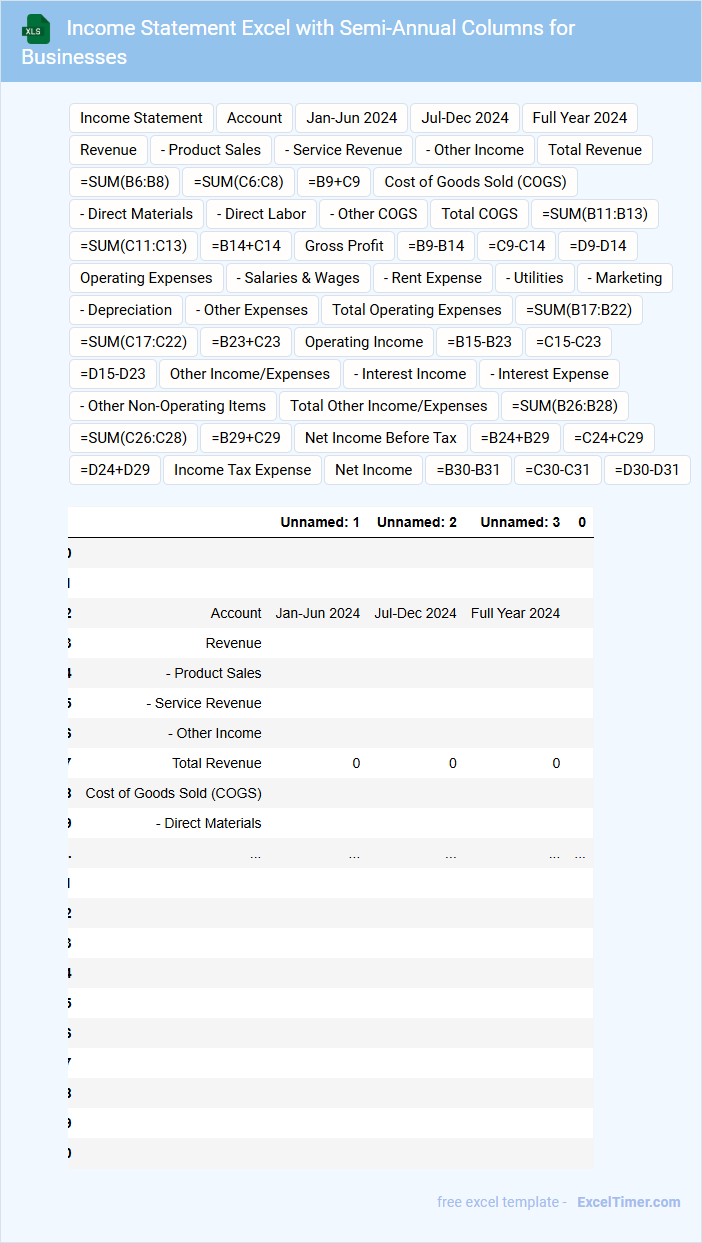

Income Statement Excel with Semi-Annual Columns for Businesses

An Income Statement Excel with Semi-Annual Columns typically contains revenue, expenses, and net profit or loss organized into two six-month periods within a fiscal year. This format allows businesses to assess financial performance in more granular intervals than annual statements, aiding in identifying trends and making timely decisions. It is essential to ensure accuracy in categorizing income and expenses to maintain reliable financial insights.

Businesses should focus on including all relevant operating and non-operating items to provide a complete financial picture for each semi-annual period. Using semi-annual columns helps in comparative analysis and forecasting future financial outcomes more effectively. A clear layout with consistent data entry improves usability for stakeholders reviewing the statement.

Budget Comparison Template for Small Businesses (Semi-Annually)

A Budget Comparison Template for small businesses typically contains detailed financial data, including projected and actual income and expenses over a semi-annual period. This document helps business owners track financial performance, identify variances, and make informed decisions. It is crucial for maintaining financial discipline and planning future budgets effectively.

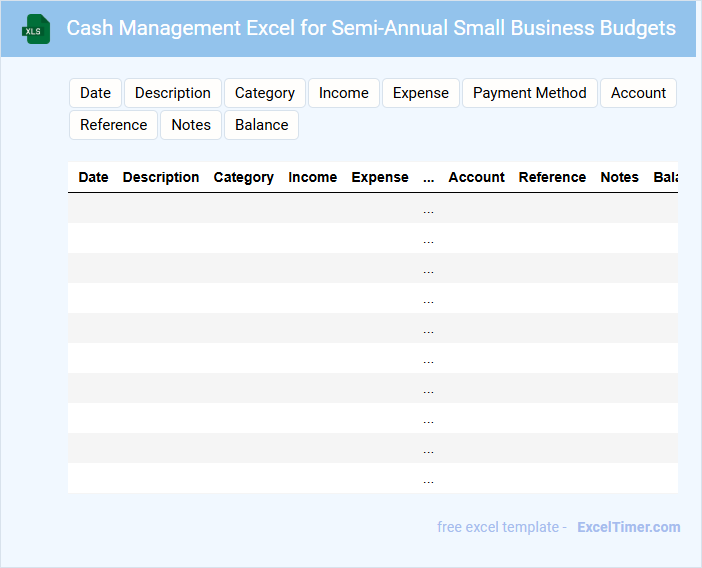

Cash Management Excel for Semi-Annual Small Business Budgets

What information is typically included in a Cash Management Excel for Semi-Annual Small Business Budgets? This type of document usually contains detailed records of cash inflows and outflows over a six-month period, helping businesses monitor liquidity and plan expenses. It often includes sections for projected revenue, operating costs, and cash reserves to ensure financial stability and informed decision-making.

What are the important elements to focus on when creating this document? It is essential to include accurate forecasting, regular updates, and clear categorization of income and expenses to maintain effective cash flow control. Additionally, incorporating alerts for potential cash shortages and visual charts can enhance understanding and proactive financial management.

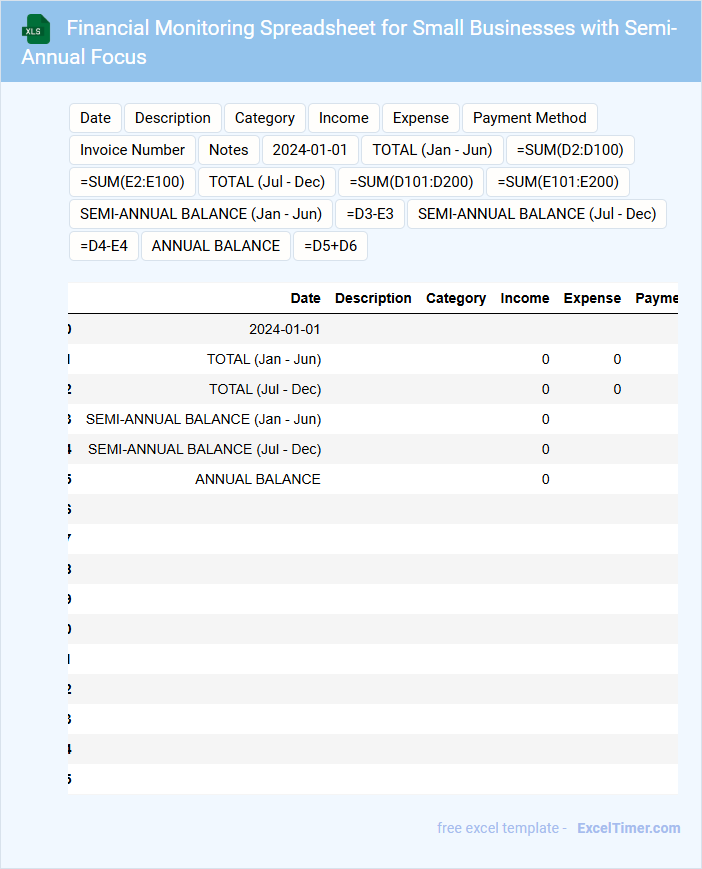

Financial Monitoring Spreadsheet for Small Businesses with Semi-Annual Focus

A Financial Monitoring Spreadsheet for small businesses is a vital tool designed to track income, expenses, and cash flow over a specific period, typically six months. This document helps business owners maintain accurate financial records and make informed decisions based on their financial health.

Such spreadsheets often include sections for revenue tracking, expense categorization, budget comparisons, and profit analysis with semi-annual summaries. To maximize effectiveness, it is important to regularly update the data and include clear visual charts for quick financial insights.

What key income and expense categories should be included in a semi-annual budget planner for small businesses?

A semi-annual budget planner for small businesses should include key income categories such as sales revenue, service income, and any investment returns. Essential expense categories encompass operational costs, payroll, marketing expenses, and taxes. Your budget should also account for contingencies and growth investments to ensure financial stability over six months.

How can cash flow forecasting be integrated into a semi-annual budget document in Excel?

Cash flow forecasting can be integrated into a semi-annual budget planner in Excel by creating monthly income and expense tracking sheets linked to a summary dashboard that projects cash flow trends over six months. Use Excel formulas to automate calculations of inflows, outflows, and net cash position, highlighting periods of potential shortfalls or surpluses. Incorporate visual charts and conditional formatting to provide small businesses with a clear, real-time cash flow overview for informed financial decision-making.

What formulas or functions ensure accurate semi-annual profit and loss calculations in the planner?

Use SUMIFS and IF functions to aggregate income and expenses accurately within each six-month period. Incorporate the DATE and EOMONTH functions to define semi-annual date ranges dynamically. Apply the SUBTOTAL function to capture filtered data sums, ensuring precise semi-annual profit and loss calculations.

How does the Excel document track budget variance between projected and actual expenditures over six months?

The Semi-annually Budget Planner for Small Businesses in Excel tracks budget variance by calculating the difference between projected and actual expenditures for each category over six months. Your data inputs for planned expenses are automatically compared against real-time spending, with variance values highlighted to identify overspending or savings. This feature enables efficient financial monitoring and adjustment throughout the semi-annual period.

Which dashboard features best visualize financial trends and insights for small business owners using the semi-annual planner?

The Semi-Annually Budget Planner dashboard features interactive line charts and bar graphs that effectively visualize revenue, expenses, and profit trends over six-month periods. Customized KPIs and variance analysis tools highlight key financial insights, enabling you to track budget performance against targets. Heatmaps and pie charts offer a clear breakdown of cost centers and income streams for informed decision-making.