The Semi-annually Excel Template for Loan Amortization provides a clear and efficient way to calculate loan repayments made twice a year. It helps users track principal and interest payments, ensuring accurate financial planning and management. Customizable features allow for easy adjustments based on loan terms and interest rates.

Semi-Annual Loan Amortization Schedule with Extra Payments

A Semi-Annual Loan Amortization Schedule typically contains detailed payment information distributed over six-month intervals, showing both principal and interest breakdowns. This document helps borrowers track how extra payments impact the loan balance and reduce the overall interest paid. Ensuring accuracy in recording extra payments is crucial for maximizing loan savings and managing repayment efficiently.

Excel Template for Semi-Annual Loan Repayment Tracking

An Excel Template for Semi-Annual Loan Repayment Tracking is designed to organize and monitor loan payment schedules efficiently. It helps users keep track of due dates, principal and interest amounts, and payment statuses to avoid missed payments.

Such templates typically include sections for loan details, payment history, and summary reports. It is important to ensure accuracy in data entry and to update the template regularly for reliable financial management.

Amortization Table with Semi-Annual Payment Calculation

An Amortization Table with Semi-Annual Payment Calculation typically contains detailed schedules of loan repayments categorized by date, principal, and interest amounts. It illustrates how each payment contributes to reducing the loan balance over the specified term with payments made twice a year. Important considerations include accurately calculating interest for each period and ensuring the payment intervals are consistently applied.

Semi-Annual Interest Calculation for Loan Amortization

This document typically contains a detailed calculation schedule showing the interest accrued on a loan every six months. It includes principal balances, interest rates, and payment dates to accurately reflect loan amortization. Understanding these details helps in managing repayment timelines efficiently.

An important aspect is the precision of interest computations, which ensures that the loan amortization schedule remains accurate and transparent. It also highlights payment adjustments based on interest accruals during the semi-annual periods. Careful review prevents discrepancies and supports financial planning.

Loan Amortization Spreadsheet with Semi-Annual Frequency

Loan Amortization Spreadsheets with Semi-Annual Frequency typically contain detailed loan schedules that show principal and interest payments every six months. These documents provide clarity on how the loan balance decreases over time based on semi-annual payment intervals. It's important to accurately input the loan amount, interest rate, and term to ensure precise calculations. The spreadsheet also usually includes summaries such as total interest paid and remaining balance after each payment. These summaries help borrowers and lenders track repayment progress efficiently. To optimize usability, ensure formulas are locked and inputs are clearly labeled for easy updates and error prevention.

Semi-Annual Amortization Table for Fixed Rate Loans

A Semi-Annual Amortization Table for Fixed Rate Loans is a document that outlines the scheduled payments over the loan's life, showing principal and interest portions for each semi-annual period. It is essential for borrowers to understand how their payments are applied and how the loan balance decreases over time. This table helps in planning finances and verifying accurate interest calculations. Important considerations include ensuring the correct fixed interest rate is applied, verifying payment dates, and monitoring for any changes in the loan terms.

Excel Template of Semi-Annual Loan Payoff Summary

An Excel Template of a Semi-Annual Loan Payoff Summary typically contains detailed financial data, including the outstanding loan balance, payment schedules, and interest calculations over a six-month period. This document helps track progress towards loan repayment, providing a clear overview of principal and interest amounts paid versus remaining balances. For accuracy, it is important to regularly update payment entries and verify formula integrity within the spreadsheet.

Loan Amortization Sheet for Semi-Annual Installments

A Loan Amortization Sheet typically contains detailed information about the repayment schedule of a loan, outlining each installment's principal and interest components. It helps borrowers track their outstanding balance over time and understand the total cost of the loan.

For Semi-Annual Installments, the sheet must clearly specify payment dates occurring every six months and the respective amounts due. Including a summary of total interest paid and remaining balance at each period is highly recommended to aid financial planning.

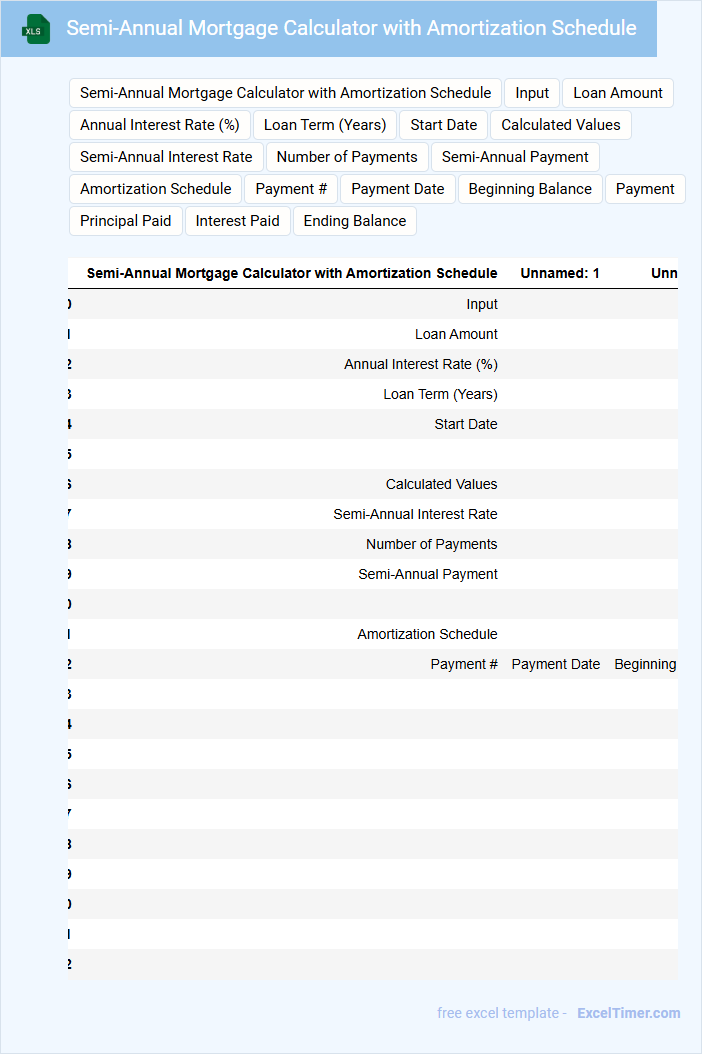

Semi-Annual Mortgage Calculator with Amortization Schedule

This document typically contains a tool designed to calculate mortgage payments and generate an amortization schedule based on semi-annual compounding periods. It helps users understand their payment breakdown and the timeline for loan repayment.

- Include fields for principal amount, interest rate, loan term, and payment frequency.

- Provide a clear, detailed amortization table showing principal and interest portions for each payment.

- Offer an option to export or print the full amortization schedule for reference.

Simple Excel Template for Semi-Annual Loan Amortization

A Simple Excel Template for Semi-Annual Loan Amortization typically contains a structured schedule detailing loan repayments every six months. It helps borrowers and lenders track principal and interest payments over the loan term easily.

- Include clear columns for payment date, principal portion, interest portion, and remaining balance.

- Ensure formulas automatically update balances to minimize manual errors.

- Provide a summary section showing total interest paid and amount amortized to date.

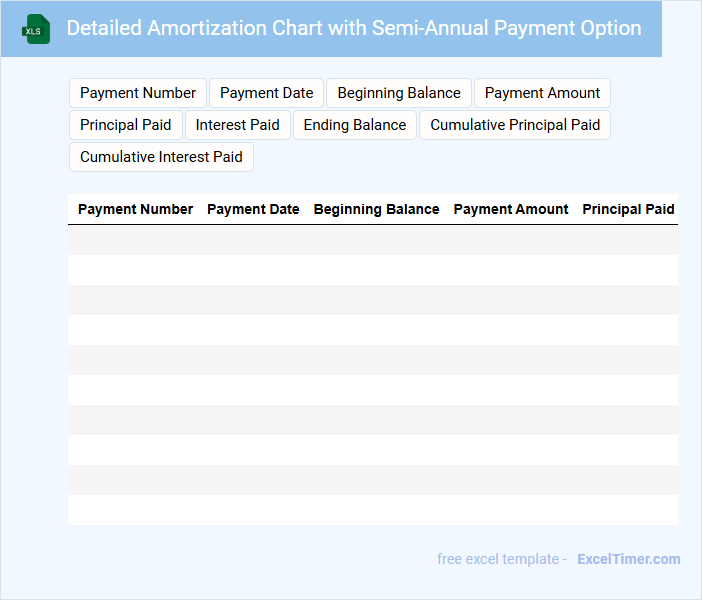

Detailed Amortization Chart with Semi-Annual Payment Option

A Detailed Amortization Chart with Semi-Annual Payment Option provides a comprehensive schedule of loan repayments, showing principal and interest breakdowns for each period. It helps borrowers understand the impact of making payments twice a year instead of monthly or yearly.

- Include clear dates and amounts for each semi-annual payment.

- Highlight the remaining balance after each payment to track progress.

- Show interest accrued separately to improve transparency.

Semi-Annual Amortization Tracker for Business Loans

What information is typically included in a Semi-Annual Amortization Tracker for Business Loans? This document usually contains detailed payment schedules, including principal and interest amounts due every six months, as well as remaining loan balances. It serves as a crucial tool for businesses to monitor their loan repayment progress and manage cash flow effectively.

What is an important aspect to consider when maintaining this tracker? Accuracy in recording payment dates and amounts is essential to avoid discrepancies that can affect financial planning. Additionally, regularly updating the tracker with any changes in loan terms or extra payments ensures the business stays on top of its debt obligations.

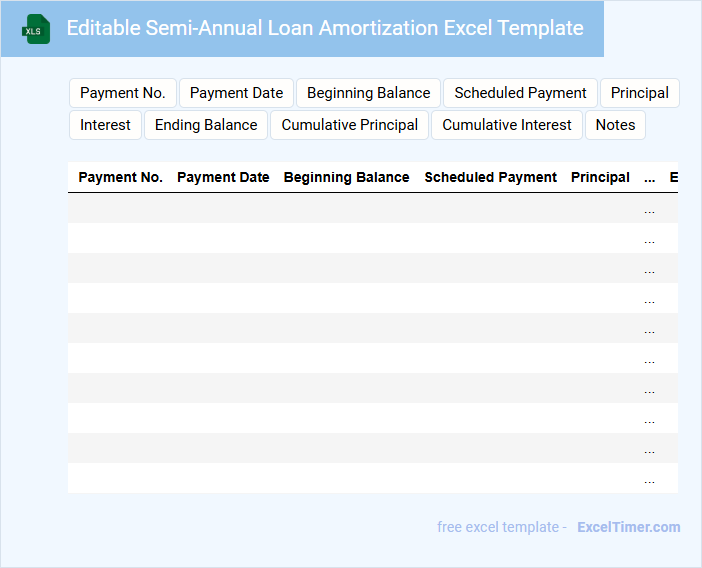

Editable Semi-Annual Loan Amortization Excel Template

An Editable Semi-Annual Loan Amortization Excel Template is typically used to track and calculate loan repayments made every six months. It includes details such as principal amounts, interest rates, payment schedules, and outstanding balances. This document helps users visualize how payments are applied over the life of the loan. Important elements for this template include accurate formulas and clear labels for each column, ensuring ease of understanding and customization. Including options for extra payments and adjustments enhances its usefulness. Regularly updating the template reflects changes in loan terms or payment amounts.

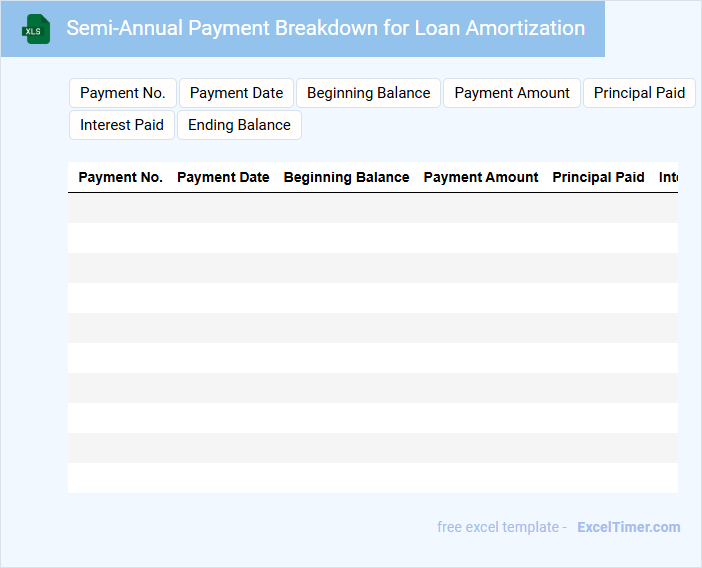

Semi-Annual Payment Breakdown for Loan Amortization

A Semi-Annual Payment Breakdown for loan amortization typically contains detailed information about the payments made every six months towards a loan. It outlines the principal and interest components of each payment and shows how the loan balance decreases over time. This document is essential for borrowers to understand their repayment schedule and track their loan progress accurately.

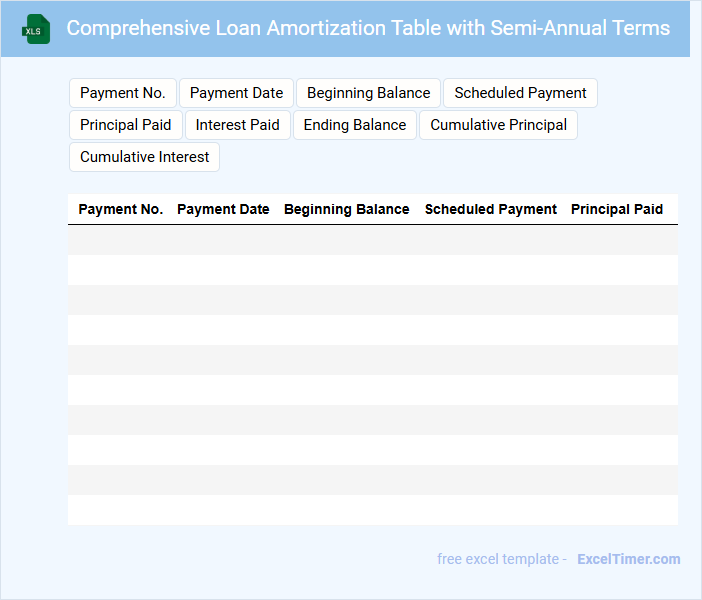

Comprehensive Loan Amortization Table with Semi-Annual Terms

What information is typically included in a Comprehensive Loan Amortization Table with Semi-Annual Terms? This document usually contains detailed breakdowns of loan payments, showing the principal and interest portions for each semi-annual period. It helps borrowers and lenders track payment schedules, outstanding balances, and interest accruals over the life of the loan.

For an effective amortization table, it is important to ensure accuracy in interest calculations and clear presentation of payment dates. Additionally, including a summary of total interest paid and remaining balance after each payment can greatly enhance understanding and financial planning.

How does changing the compounding frequency to semi-annually affect the loan amortization schedule in Excel?

Changing the compounding frequency to semi-annually in an Excel loan amortization schedule reduces the number of interest compounding periods per year from monthly or quarterly to two. This adjustment causes interest to accrue less frequently, potentially lowering the total interest paid over the loan term. The payment amounts and amortization timeline update accordingly, reflecting the revised interest calculations based on semi-annual compounding.

What Excel formula should be used to calculate semi-annual payment amounts for a given principal, rate, and period?

Use the Excel formula =PMT(rate/2, periods*2, -principal) to calculate semi-annual loan payment amounts. This formula divides the annual interest rate by 2 for semi-annual compounding and multiplies the total periods by 2 to reflect semi-annual payments. Replace "rate" with the annual interest rate, "periods" with the total number of years, and "principal" with the loan amount.

How do you adjust the interest rate and number of periods for semi-annual loan amortization in Excel?

To adjust for semi-annual loan amortization in Excel, divide the annual interest rate by 2 and multiply the total loan term in years by 2 to get the number of periods. Your formula for the periodic interest rate becomes =AnnualRate/2, and the total number of periods is =Years*2. This ensures accurate calculation of principal and interest payments every six months.

In a semi-annual loan amortization table, what columns must be included for accurate tracking?

A semi-annual loan amortization table must include columns for Payment Number, Payment Date, Beginning Balance, Semi-Annual Payment Amount, Interest Portion, Principal Portion, and Ending Balance. Including the Interest Rate and Cumulative Interest Paid can enhance accuracy and financial insight. These columns ensure precise tracking of loan repayment progress every six months.

How does semi-annual compounding impact the total interest paid over the life of a loan in Excel calculations?

Semi-annual compounding in loan amortization increases the frequency of interest calculation to twice per year, leading to higher total interest paid compared to annual compounding. Excel calculates this by dividing the annual interest rate by two and doubling the number of periods, which accelerates interest accrual. Your loan amortization schedule will show more frequent interest charges, impacting the overall cost of borrowing.