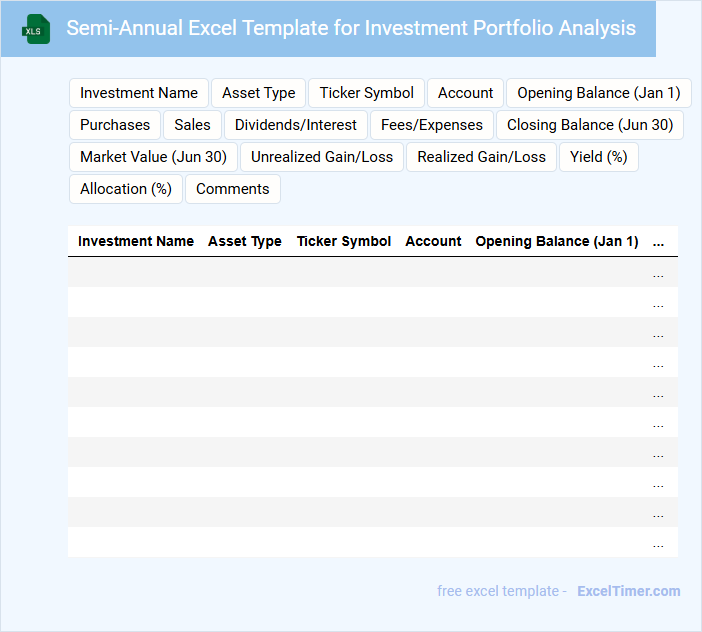

The Semi-annually Excel Template for Investment Portfolio Analysis enables investors to track and evaluate their portfolio performance every six months efficiently. This template offers a clear summary of returns, asset allocation, and risk assessment, helping users make informed decisions. Its user-friendly design and automated calculations save time while enhancing accuracy in investment tracking.

Semi-Annual Excel Template for Investment Portfolio Analysis

This type of document typically contains financial data and analysis tools to evaluate investment portfolio performance semi-annually.

- Asset Allocation: Breakdown of investments by category to assess diversification.

- Performance Metrics: Key indicators like ROI and volatility for evaluating returns.

- Risk Assessment: Tools and formulas to measure potential investment risks.

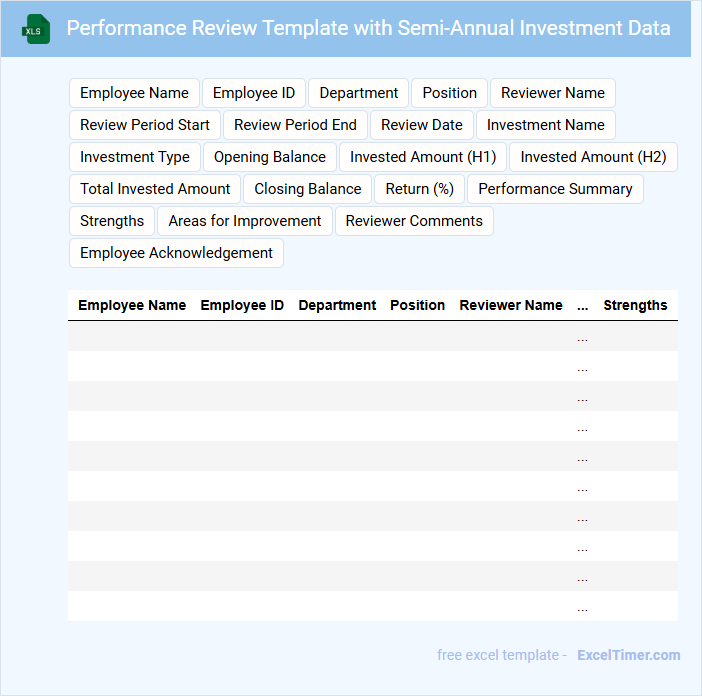

Performance Review Template with Semi-Annual Investment Data

A Performance Review Template with Semi-Annual Investment Data typically contains an evaluation of investment outcomes over a six-month period, focusing on key financial metrics and portfolio adjustments. It serves as a structured document to assess performance and guide future investment strategies.

- Include comparative data highlighting growth trends and benchmarks.

- Incorporate qualitative feedback on strategy effectiveness and market conditions.

- Ensure clear visualization of data through charts or tables for easy interpretation.

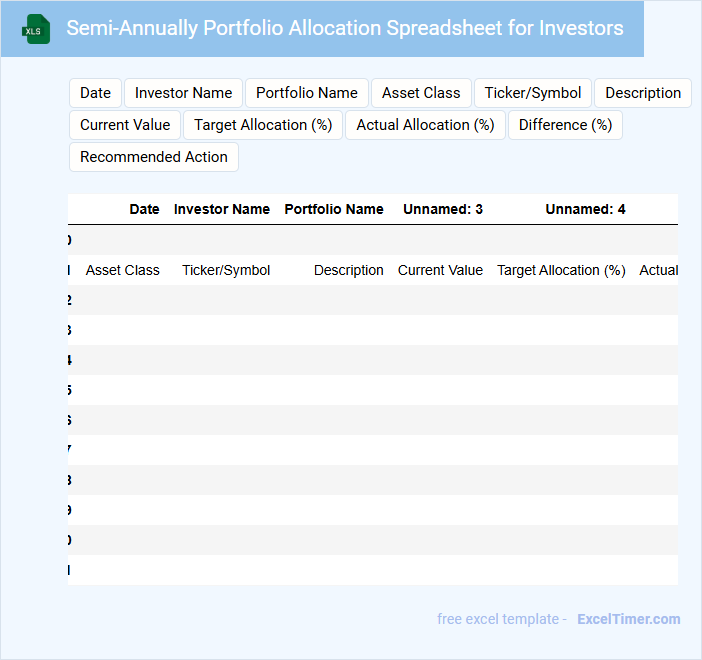

Semi-Annually Portfolio Allocation Spreadsheet for Investors

The Semi-Annually Portfolio Allocation Spreadsheet is a document typically used by investors to track and manage their investment distributions every six months. It contains detailed information about asset classes, percentages allocated to each, and performance metrics over the period. This spreadsheet helps investors maintain a balanced and diversified portfolio aligned with their financial goals.

For effective use, it is important to regularly update the data, include clear categorization of assets, and incorporate visual aids like charts to easily interpret portfolio shifts. Ensuring accuracy in input values and monitoring changes in market conditions are crucial for making informed decisions. Using this tool consistently aids in optimizing returns and minimizing risks in investment strategy.

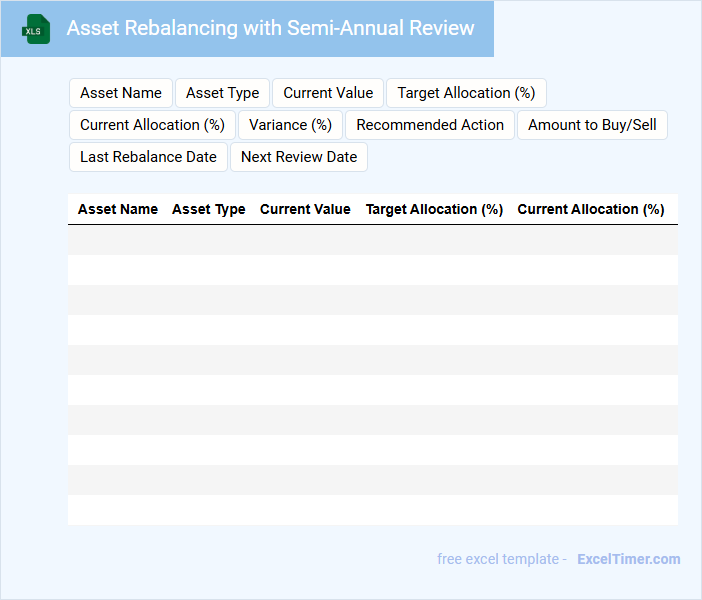

Asset Rebalancing with Semi-Annual Review

This document typically contains an overview of the current asset allocation, detailing the proportions of various asset classes in the portfolio. It also includes performance metrics and market analysis to guide decision-making.

A semi-annual review focuses on the rebalancing strategy, ensuring the portfolio alignment with investment goals and risk tolerance is maintained over time. This process helps mitigate risks and capitalize on market opportunities.

It is important to record all changes and rationale clearly for transparency and future reference during subsequent reviews.

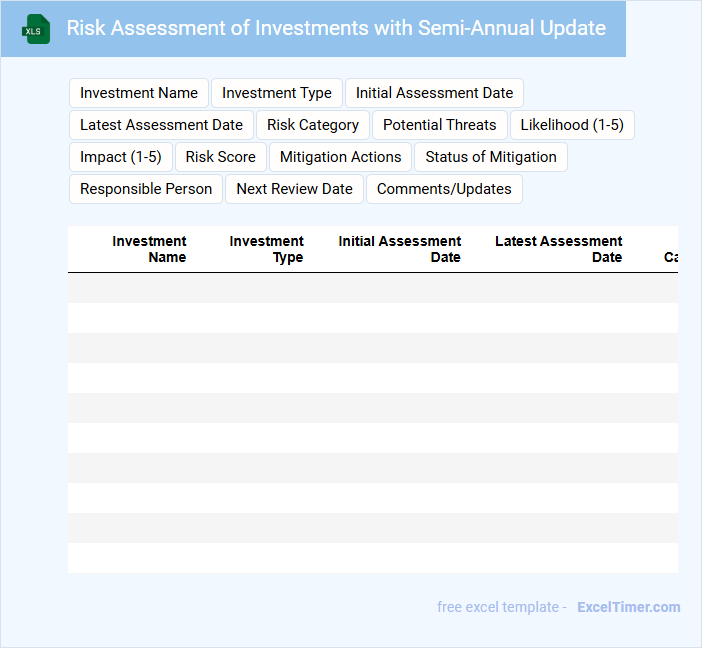

Risk Assessment of Investments with Semi-Annual Update

A Risk Assessment of investments with a semi-annual update typically contains a detailed analysis of potential financial risks associated with investment portfolios. It includes quantitative data, market trends, and forecast scenarios to help investors understand and mitigate risks. Regular updates ensure that emerging risks and changes in market conditions are promptly addressed. Important considerations include accurate data collection, clear risk indicators, and timely review processes to maintain relevance and reliability.

Spreadsheet for Semi-Annual Investment Performance Tracking

A spreadsheet for semi-annual investment performance tracking typically contains detailed records of investment activities and returns over a six-month period to monitor financial progress efficiently.

- Portfolio Summary: This section provides an overview of all investments including types, amounts, and current market values.

- Performance Metrics: Key indicators such as returns, growth percentages, and benchmarks are tracked to evaluate investment success.

- Transaction Records: Detailed logs of buys, sells, dividends, and fees to maintain accuracy and transparency in investment tracking.

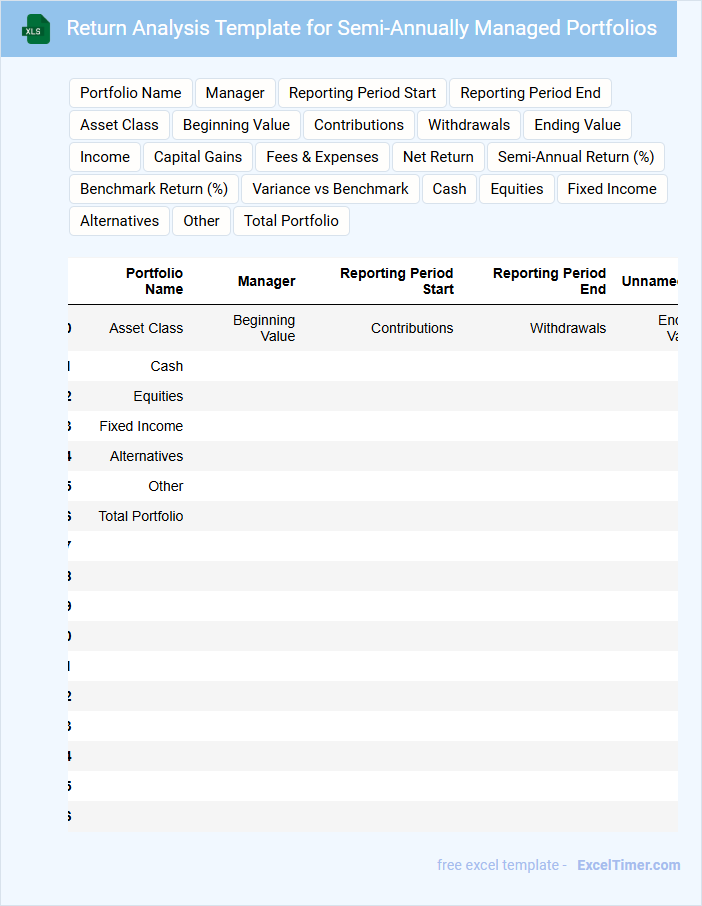

Return Analysis Template for Semi-Annually Managed Portfolios

The Return Analysis Template for Semi-Annually Managed Portfolios is designed to systematically evaluate the performance of investment portfolios over a six-month period. It typically contains detailed data on portfolio returns, benchmarks, and risk-adjusted performance metrics.

Key elements include summaries of income, capital gains, and comparative analysis against targets or indices. For optimal use, ensure accurate data input and consistent review intervals to identify trends and inform decision-making.

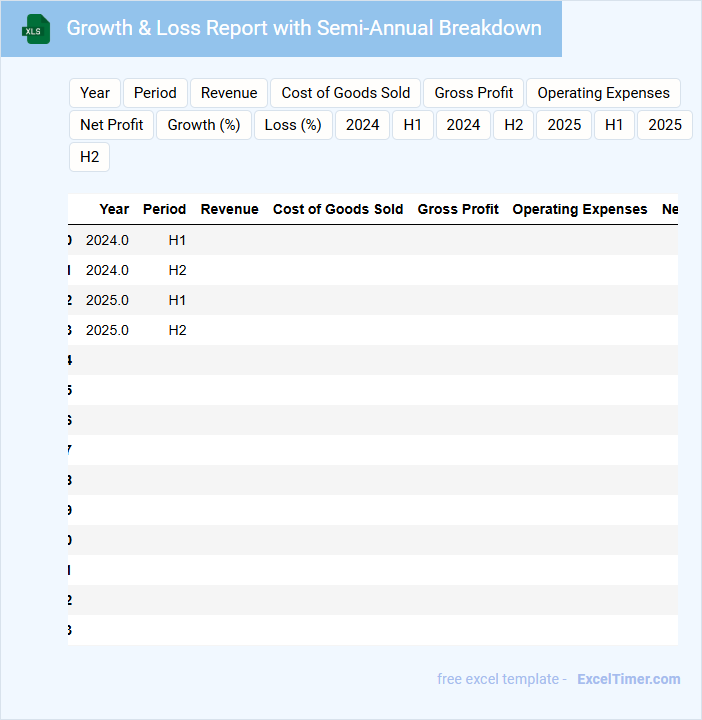

Growth & Loss Report with Semi-Annual Breakdown

The Growth & Loss Report with Semi-Annual Breakdown typically contains financial data divided into two main periods within the year, highlighting trends in revenue, expenses, and net profit or loss. This document is essential for assessing a company's performance over time and identifying areas of improvement. For better analysis, it is crucial to ensure accuracy in data representation and to include comparative highlights from previous periods.

Investment Income Tracker for Semi-Annual Periods

An Investment Income Tracker for semi-annual periods is a crucial financial document used to monitor and record the income generated from various investments over six months. It typically contains detailed entries of dividends, interest payments, capital gains, and any other investment-related earnings. Accurate tracking helps investors evaluate their portfolio performance and make informed decisions on asset allocation and taxation.

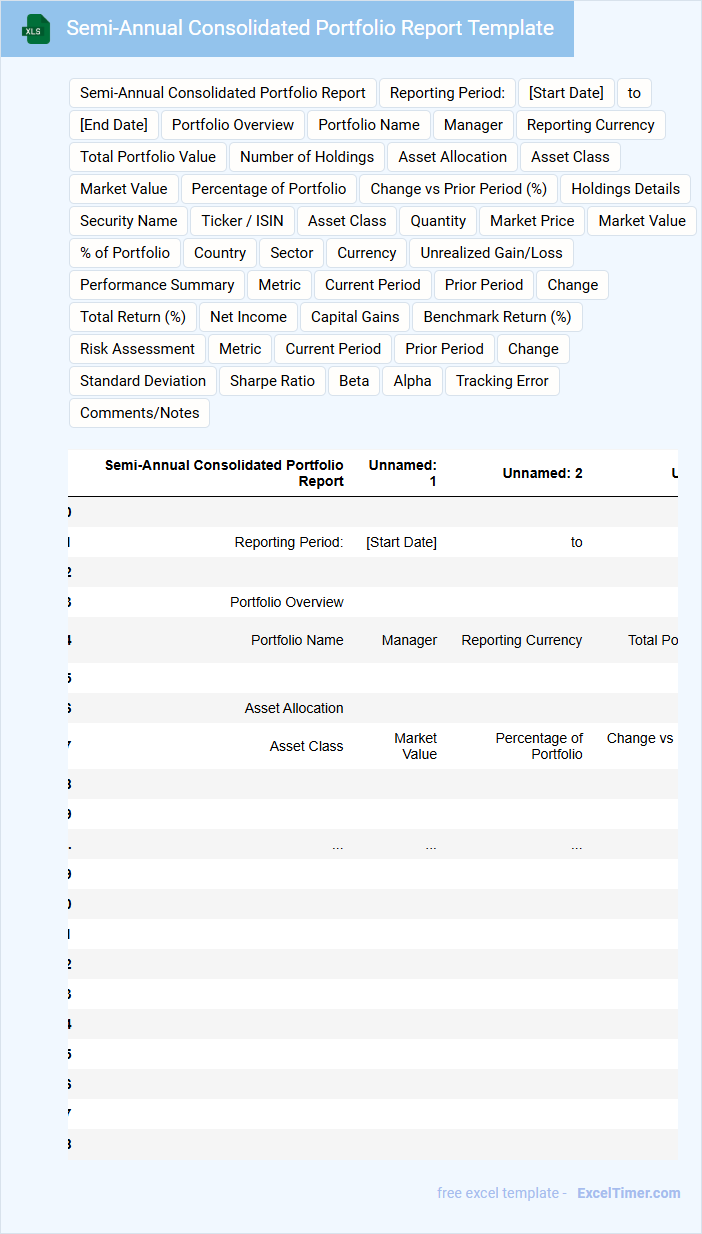

Semi-Annual Consolidated Portfolio Report Template

What information is typically included in a Semi-Annual Consolidated Portfolio Report Template? This document usually contains a comprehensive overview of the financial performance and asset allocation of an investment portfolio over a six-month period. It highlights key metrics such as returns, risks, investments breakdown, and market analysis to provide stakeholders with a clear understanding of portfolio health and progress.

What important elements should be included in a Semi-Annual Consolidated Portfolio Report? It is essential to incorporate accurate performance data, detailed asset allocation, and comparative benchmarks to evaluate growth effectively. Additionally, including risk assessments, market updates, and management commentary helps inform strategic decisions and increases transparency for investors.

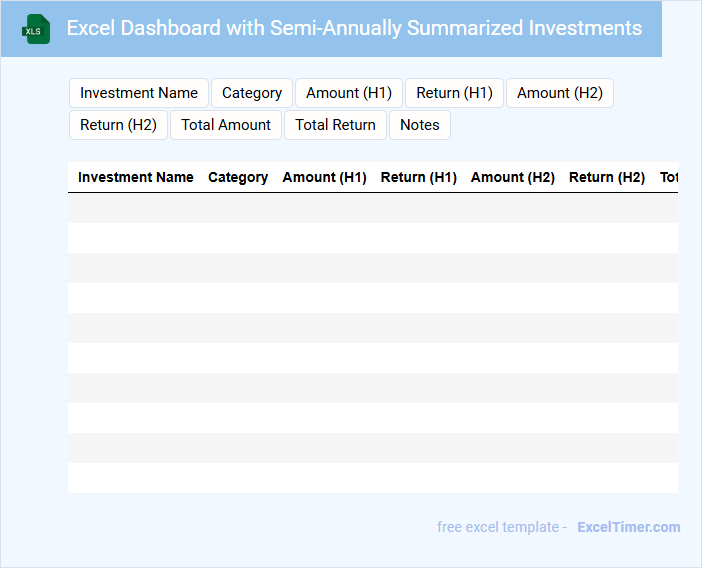

Excel Dashboard with Semi-Annually Summarized Investments

An Excel Dashboard with semi-annually summarized investments typically contains key financial metrics and visual summaries that track investment performance over two six-month periods. This document organizes data into charts, tables, and summary statistics for quick decision-making. It is essential to include clear trend analysis and risk assessments to effectively guide investment strategies.

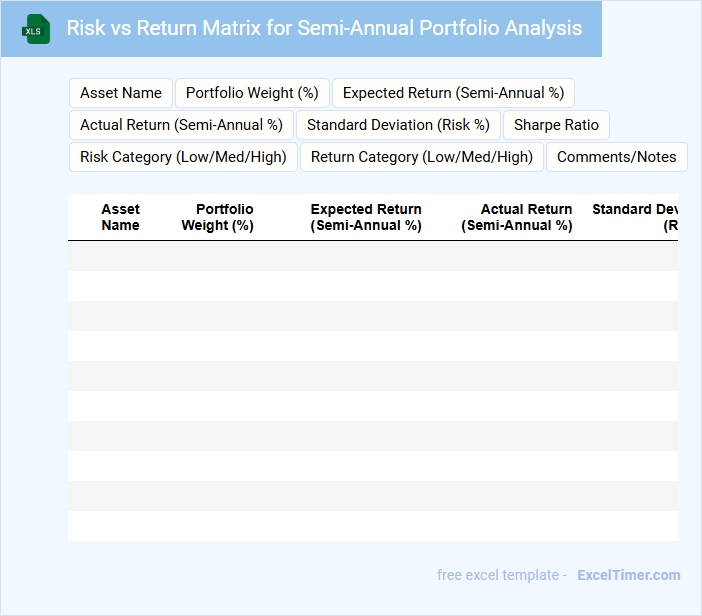

Risk vs Return Matrix for Semi-Annual Portfolio Analysis

This document typically contains an analysis that maps potential investment risks against expected returns over a six-month period. It aids in visualizing portfolio performance to balance risk and reward effectively.

- Identify asset classes with the best risk-return trade-offs.

- Highlight areas requiring portfolio rebalancing based on risk exposure.

- Inform strategic decisions to optimize returns while controlling risk levels.

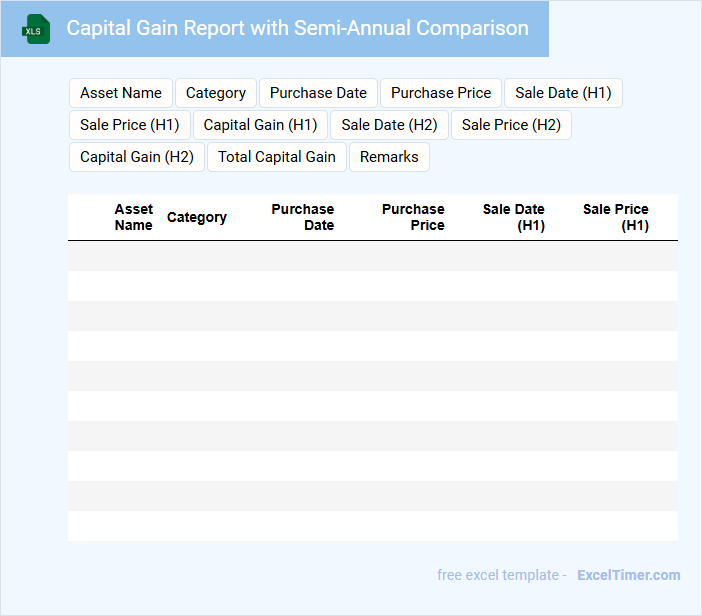

Capital Gain Report with Semi-Annual Comparison

A Capital Gain Report with Semi-Annual Comparison typically details the profits or losses realized from investments over a six-month period, comparing them to the previous half-year to identify trends. This document is essential for investors to assess portfolio performance and tax implications.

- Include clear distinctions between short-term and long-term capital gains for accurate tax reporting.

- Highlight significant market events that may have impacted the investment values during each period.

- Ensure all figures are verified and presented with consistent formatting to facilitate easy comparison.

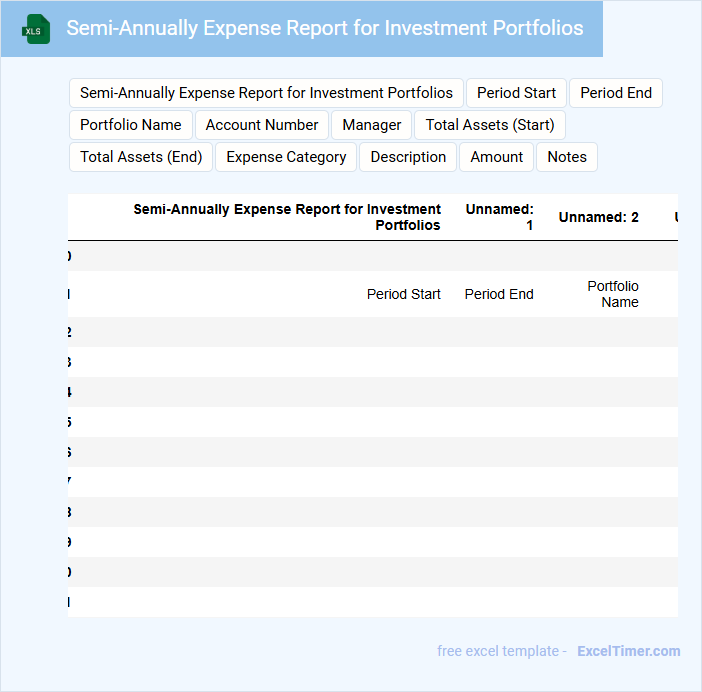

Semi-Annually Expense Report for Investment Portfolios

A Semi-Annually Expense Report for Investment Portfolios typically contains detailed information on all expenses accrued over a six-month period. It includes transaction fees, management fees, and any other operational costs associated with the portfolio. This document is crucial for assessing the cost efficiency and overall financial health of investments. Important elements to focus on are transparent fee breakdowns, comparison with previous reports, and analysis of expense trends. Accurate and timely reporting ensures better decision-making and portfolio optimization. Including clear summaries and visual aids can significantly enhance understanding and communication with stakeholders.

Benchmarking Performance of Investments with Semi-Annual Data

Benchmarking Performance of Investments with Semi-Annual Data typically contains quantitative performance metrics that compare investment returns over six-month periods. It includes detailed tables and charts to illustrate trends and assess how investments perform relative to benchmarks. Crucial suggestions for such documents include ensuring data accuracy, consistency over time, and clear visualization for effective decision-making.

How does semi-annual compounding impact the future value calculations in an investment portfolio?

Semi-annual compounding increases the frequency of interest calculations, resulting in higher future value compared to annual compounding. For investment portfolio analysis, this means interest is added twice per year, enhancing growth through compound interest effects. Excel formulas like FV can be adjusted to reflect semi-annual periods by doubling the number of compounding intervals and halving the interest rate per period.

What are the key differences between semi-annual and annual return reporting in portfolio analysis?

Semi-annual return reporting provides investment portfolio performance data twice a year, offering more frequent insights into short-term fluctuations compared to annual reporting. This approach allows investors to identify trends and adjust strategies more promptly, enhancing responsiveness to market changes. Annual return reporting, however, emphasizes long-term performance and reduces the impact of short-term volatility, delivering a broader, less variable view of portfolio growth.

How do you adjust yield to maturity (YTM) calculations for securities that pay interest semi-annually?

To adjust yield to maturity (YTM) calculations for semi-annual interest payments, divide the annual coupon rate by two and double the number of periods in the formula. Calculate the present value of cash flows using these adjusted parameters to reflect semi-annual compounding. This approach provides an accurate YTM reflecting the true earning potential of semi-annual coupon securities.

Which Excel functions are most effective for tracking semi-annual cash flows within a portfolio?

The most effective Excel functions for tracking semi-annual cash flows in investment portfolio analysis include XIRR for calculating internal rate of return with irregular intervals, SUMIFS to aggregate cash flows by specific semi-annual periods, and EDATE to generate dates for semi-annual intervals. Using these functions enables accurate analysis of cash flow timing and performance metrics essential for portfolio management. PivotTables help organize and summarize cash flow data by semi-annual periods for enhanced visualization and reporting.

How does the timing of semi-annual reinvestments affect the overall performance measurement in an investment portfolio?

Semi-annual reinvestments impact overall performance measurement by capturing returns and compounding interest biannually, which can lead to more accurate reflections of portfolio growth compared to annual metrics. This timing helps in aligning cash flows with market fluctuations, improving the precision of net asset value calculations. Semi-annual performance data supports enhanced risk assessment and investment strategy adjustments based on periodic return patterns.