The Semi-annually Excel Template for Payroll Planning streamlines employee salary scheduling by dividing the year into two payment periods, enhancing budget management. This template allows precise tracking of payroll expenses and ensures timely payments while simplifying tax calculations. Key features include customizable fields for employee details, automated calculations, and clear summaries to support efficient financial planning.

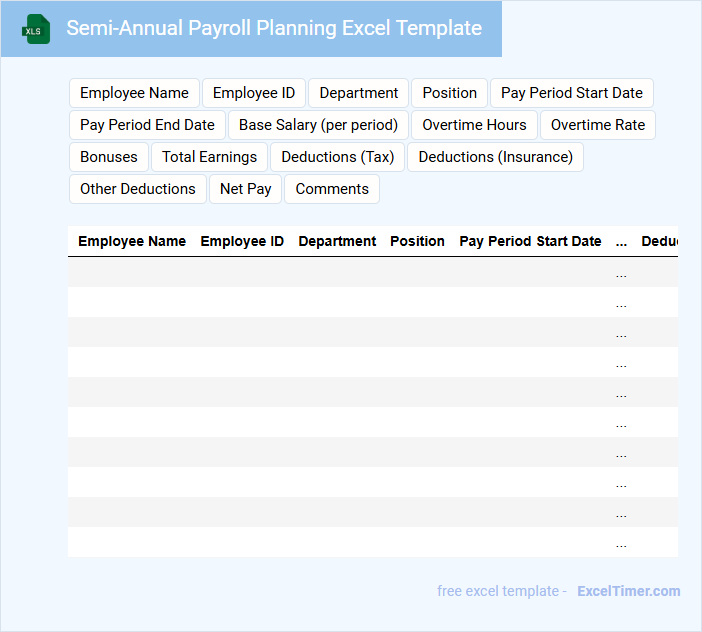

Semi-Annual Payroll Planning Excel Template

The Semi-Annual Payroll Planning Excel Template is designed to help organizations efficiently manage payroll processes for two six-month periods within a fiscal year. It typically contains employee salary details, deductions, bonuses, and tax calculations organized for easy review and updates.

This document aids in forecasting payroll expenses, ensuring compliance with tax regulations, and scheduling payments accurately. Including clear sections for employee information, payment dates, and tax rates is essential for accuracy and smooth payroll operations.

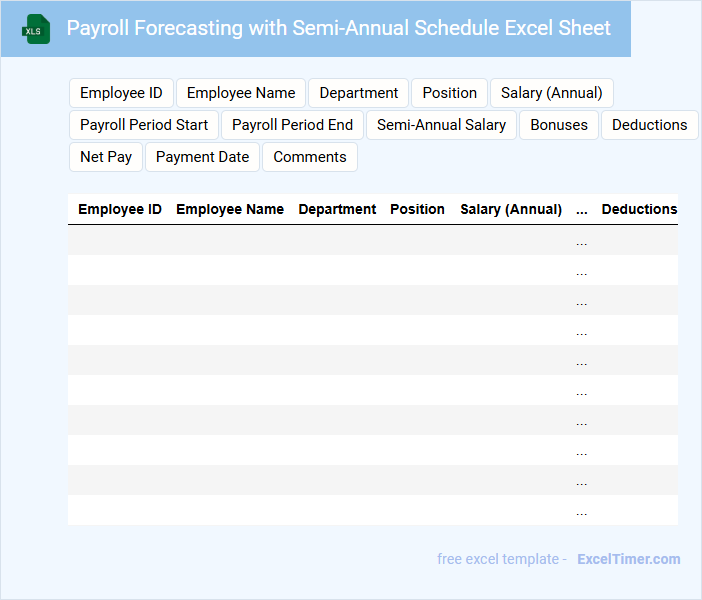

Payroll Forecasting with Semi-Annual Schedule Excel Sheet

Payroll Forecasting with a Semi-Annual Schedule Excel Sheet typically contains projected salary expenses for employees over a six-month period. It includes details such as employee names, job titles, salary amounts, bonuses, and deductions to help manage budgeting efficiently. This document is essential for anticipating cash flow needs and aligning payroll with financial planning cycles. Important considerations include ensuring accuracy in employee data, updating projections regularly, and accounting for any expected changes in staffing or compensation.

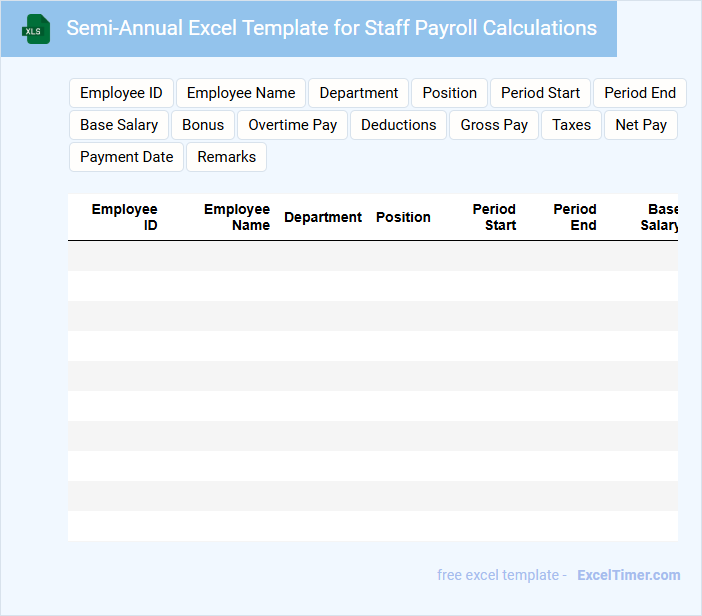

Semi-Annual Excel Template for Staff Payroll Calculations

What information is typically included in a Semi-Annual Excel Template for Staff Payroll Calculations? This type of document usually contains details such as employee names, hours worked, pay rates, tax deductions, and net pay for a six-month period. It is designed to help streamline payroll processing and ensure accurate compensation tracking over the semi-annual timeframe.

Payroll Budgeting Workbook for Semi-Annual Cycles

The Payroll Budgeting Workbook is a comprehensive document designed to manage and forecast employee compensation expenses over a specified period. It typically includes salary details, benefits, taxes, and overtime calculations for accurate budget planning.

For a Semi-Annual Cycle, this workbook divides payroll data into two six-month segments, helping organizations track and adjust financial allocations efficiently. Regular updates and contingency planning are crucial for staying within budget and accommodating staffing changes.

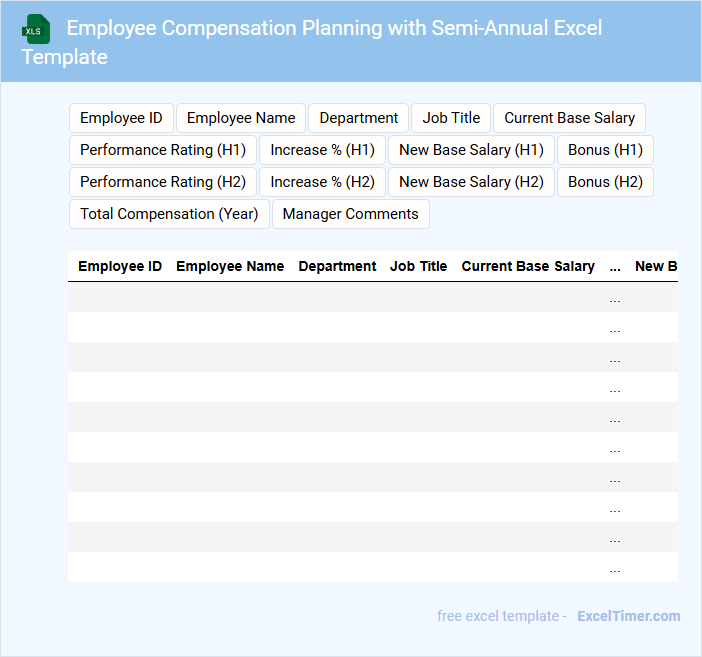

Employee Compensation Planning with Semi-Annual Excel Template

This document typically contains detailed information on employee compensation planning, including salary structures, bonus schedules, and benefit allocations. It utilizes a semi-annual Excel template to organize and forecast payroll expenses effectively. The template helps in monitoring compensation changes and budgeting for upcoming periods.

For optimal usage, ensure that all employee data is up-to-date and accurately reflected in the Excel sheets. Incorporate clear formulas for automatic calculations of raises, bonuses, and deductions. Regularly review and adjust the plan to align with company goals and market standards.

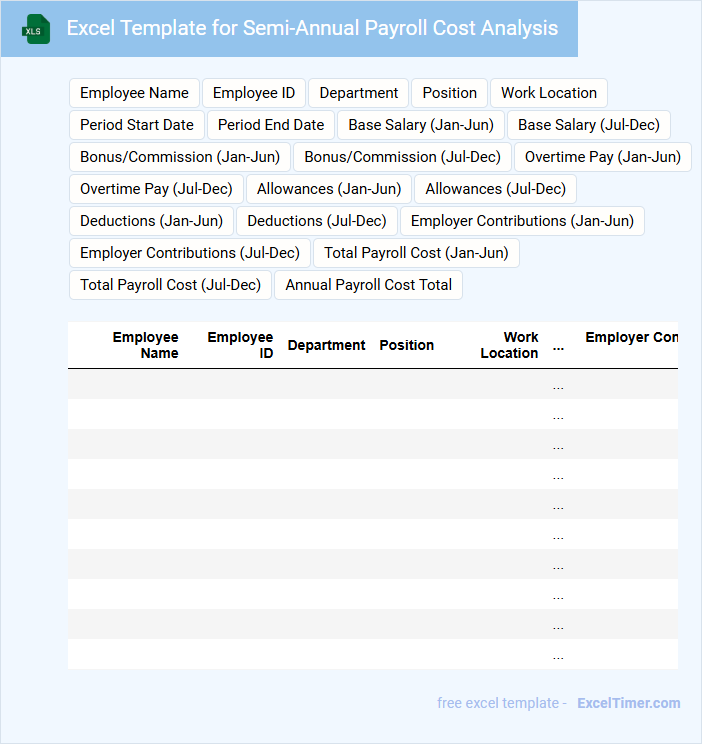

Excel Template for Semi-Annual Payroll Cost Analysis

An Excel Template for Semi-Annual Payroll Cost Analysis typically contains detailed employee salary data and cost breakdowns to help manage and evaluate payroll expenses over a six-month period.

- Comprehensive Data Entry: Ensure the template includes fields for employee names, positions, salaries, bonuses, and benefit costs.

- Automated Calculations: Incorporate formulas to calculate total payroll expenses, tax deductions, and overtime costs accurately.

- Visual Reporting: Use charts and graphs for easy visualization of payroll trends and cost distribution over the semi-annual period.

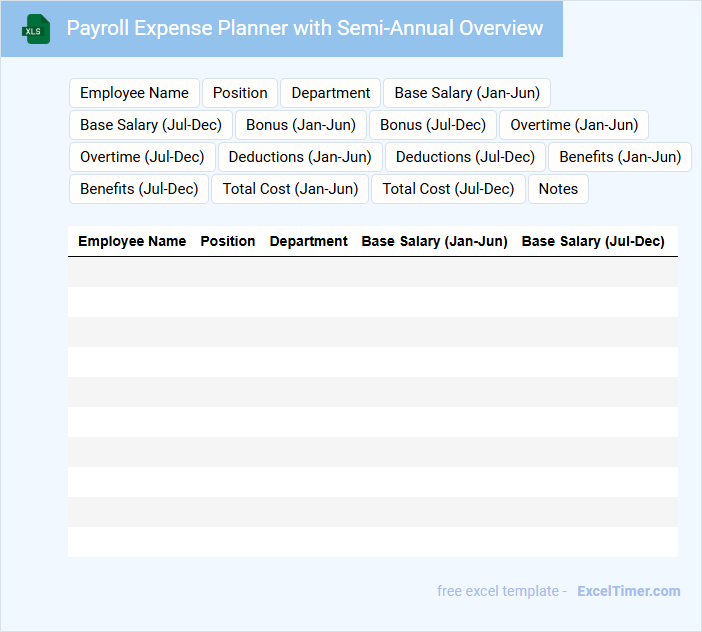

Payroll Expense Planner with Semi-Annual Overview

A Payroll Expense Planner with Semi-Annual Overview is a financial document that tracks and forecasts employee compensation costs over six months to ensure budget accuracy and control.

- Comprehensive Salary Records: It includes detailed breakdowns of salaries, wages, and bonuses for each pay period within the six-month timeframe.

- Expense Forecasting: The planner provides projections of payroll expenses, helping businesses anticipate cash flow needs and adjust budgets accordingly.

- Compliance and Deductions Tracking: It tracks tax withholdings, benefits, and other deductions to ensure adherence to legal and company policies.

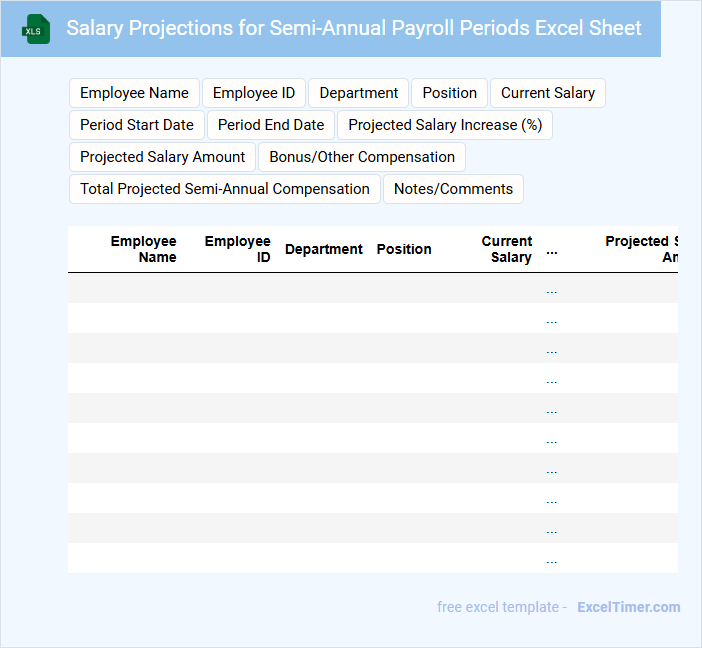

Salary Projections for Semi-Annual Payroll Periods Excel Sheet

The Salary Projections document typically outlines estimated employee earnings over specific time frames, such as semi-annual payroll periods. It provides a detailed forecast of wages, bonuses, taxes, and deductions to assist financial planning.

For an Excel sheet designed for salary projections, accurate input of employee data and up-to-date tax rates are crucial to ensure reliability. Including formulas for automatic calculations can improve efficiency and reduce manual errors.

Semi-Annual Payroll Allocation and Tracking Excel Template

This document is a Semi-Annual Payroll Allocation template designed to systematically record and manage salary disbursements over a six-month period. It typically contains employee details, salary breakdowns, department allocations, and tracking columns for payments made and pending.

Using this Excel template helps maintain financial accuracy and transparency in payroll processing. Ensure to regularly update employee salary changes and reconcile totals to avoid discrepancies.

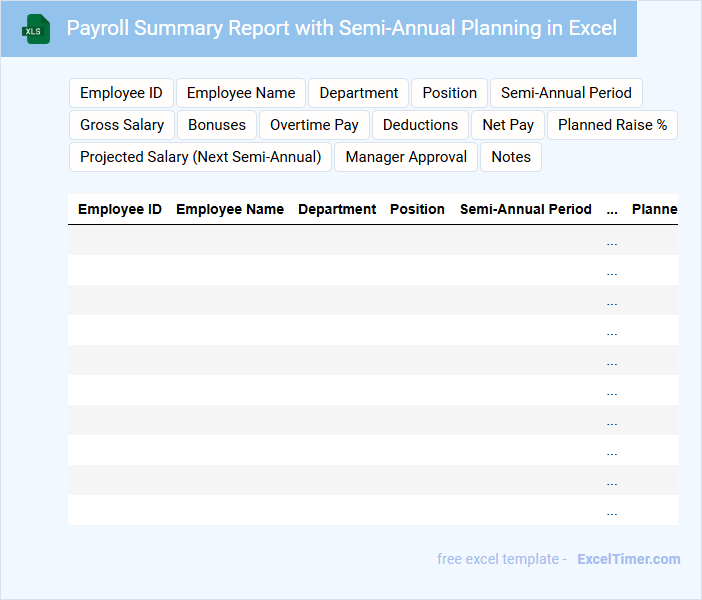

Payroll Summary Report with Semi-Annual Planning in Excel

A Payroll Summary Report typically contains detailed employee wage information, tax deductions, and total payroll expenses within a specific period. It provides a concise overview of salaries, bonuses, and benefits, ensuring accurate financial tracking. For effective Semi-Annual Planning in Excel, focus on clear data organization, use of formulas for automatic calculations, and visual charts to track trends and forecasts.

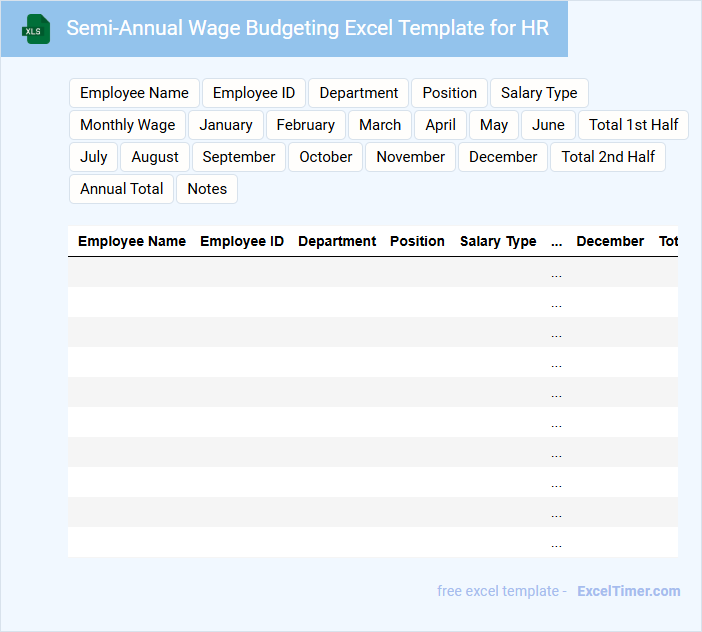

Semi-Annual Wage Budgeting Excel Template for HR

Semi-Annual Wage Budgeting Excel Template for HR is a structured document designed to facilitate accurate and efficient wage planning over a six-month period. It typically contains employee salary data, projected wage increases, and budget allocation summaries.

- Include detailed employee information such as position, department, and current salary.

- Incorporate formulas to automatically calculate total wages and percentage increases.

- Provide clear sections for budget approval and adjustment tracking.

Benefits and Deductions Planning for Semi-Annual Payroll Excel

This document typically contains a detailed overview of benefits and deductions applicable to employees in a semi-annual payroll cycle. It outlines specific categories such as tax withholdings, insurance premiums, retirement contributions, and other deductions relevant to payroll processing. Proper planning ensures accuracy and compliance, reducing errors and enhancing employee satisfaction.

Payroll Schedule Calendar for Semi-Annual Period Excel

The Payroll Schedule Calendar is a document that outlines the specific dates for employee salary payments within a designated period. It helps organizations systematically track pay periods and ensure timely compensation.

In a Semi-Annual Period Excel version, the calendar highlights all pay dates and relevant payroll deadlines over six months. Important considerations include precise date formatting and automated calculations for accuracy and efficiency.

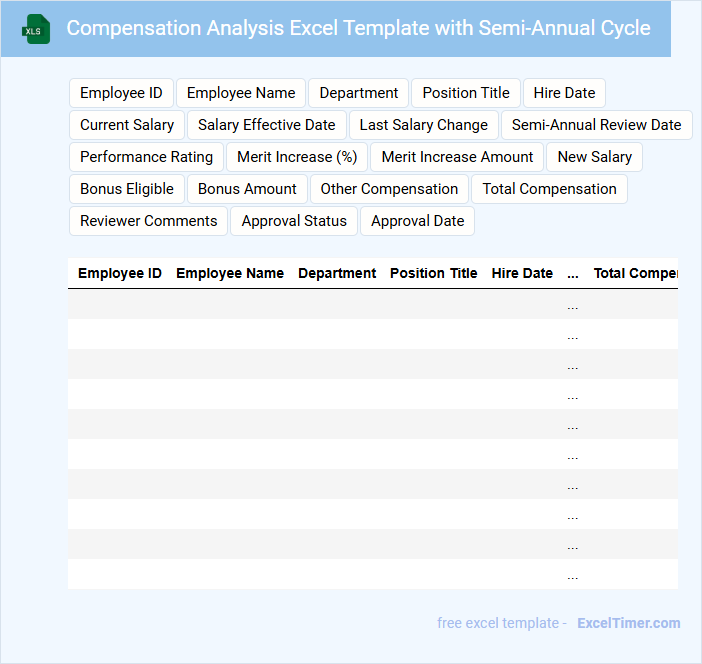

Compensation Analysis Excel Template with Semi-Annual Cycle

A Compensation Analysis Excel Template with a semi-annual cycle is typically used to track and evaluate employee salaries and benefits twice a year. It contains organized data on pay grades, performance metrics, and market comparison figures, which help ensure competitive and fair compensation. This template also supports decision-making for salary adjustments, bonuses, and budget planning based on biannual reviews.

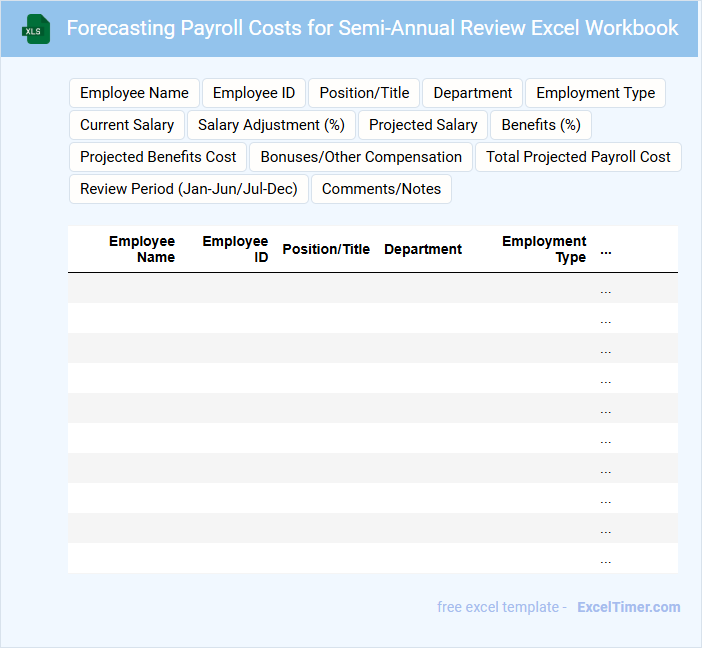

Forecasting Payroll Costs for Semi-Annual Review Excel Workbook

The Forecasting Payroll Costs document typically contains detailed projections of employee salaries, bonuses, and benefits across a specified period. It uses historical data and assumptions about future staffing levels to estimate total payroll expenses accurately.

This document is essential for budgeting and financial planning during the semi-annual review cycle. Ensure the Excel Workbook is regularly updated with current salary data and includes scenarios for potential changes in headcount or wage adjustments.

How does selecting semi-annual pay periods affect payroll planning accuracy in Excel?

Selecting semi-annual pay periods in Excel payroll planning simplifies data entry by consolidating two payments per year, reducing transaction frequency. This approach can impact accuracy by increasing the importance of precise calculations for tax withholding and benefits spread over longer periods. Proper formula design and validation ensure reliable semi-annual payroll forecasts and compliance with financial regulations.

What formulas are essential for calculating semi-annual gross and net payroll?

To calculate semi-annual gross payroll, use the formula =SUM(Employee_Salaries_Range)*6, multiplying monthly salaries by six months. For net payroll, apply =Gross_Payroll - SUM(Deductions_Range), subtracting total deductions like taxes and benefits from the gross amount. Your Excel document should automate these formulas to streamline accurate semi-annual payroll planning.

How should overtime and bonuses be incorporated into a semi-annual payroll plan in Excel?

Incorporate overtime and bonuses into a semi-annual payroll plan in Excel by creating dedicated columns for each category within your payroll sheet. Use formulas to calculate the total amounts based on hours worked or performance metrics, ensuring accurate aggregation every six months. Your Excel plan will provide clear insights for budgeting and compensations during each semi-annual period.

What are the key statutory deductions to schedule for semi-annual payroll calculations?

Key statutory deductions to schedule for semi-annual payroll calculations include federal income tax, Social Security, Medicare, and state tax withholdings. You must also account for retirement contributions and any applicable local taxes or wage garnishments. Properly scheduling these deductions ensures compliance and accurate payroll planning.

How can Excel be used to forecast cash flow for semi-annual payroll obligations?

Excel can forecast cash flow for semi-annual payroll obligations by using built-in functions like SUMIFS and DATE to calculate total payroll expenses for each period. Creating a structured cash flow model with separate columns for payroll dates, amounts, and cumulative balances enables clear visualization. Incorporating historical payroll data and projected salary increases enhances accuracy in semi-annual cash flow forecasts.