The Semi-annually Excel Template for Tax Preparation streamlines the process of tracking and calculating taxes every six months, ensuring accuracy and timely submissions. This template includes pre-built formulas and organized sections for income, expenses, and deductions, reducing manual errors and saving valuable time. It is essential for businesses and individuals looking to stay compliant and efficiently manage their tax liabilities on a semi-annual basis.

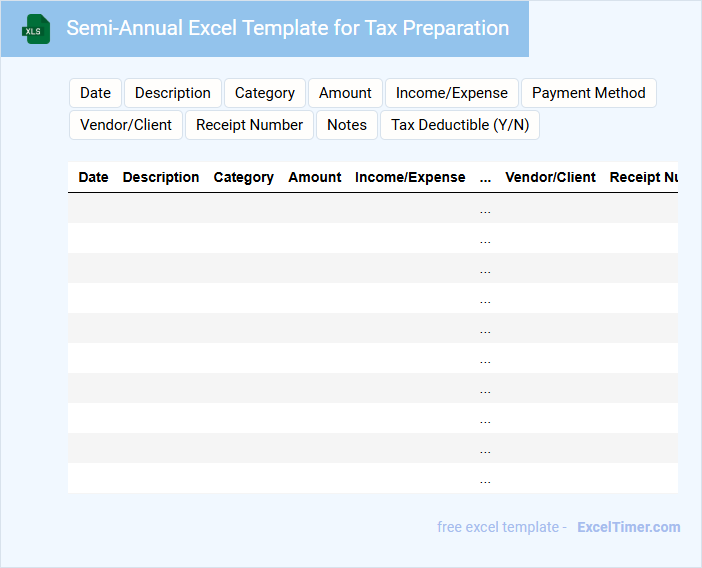

Semi-Annual Excel Template for Tax Preparation

A Semi-Annual Excel Template for Tax Preparation typically contains structured financial data, including income statements, expense records, and tax deductions over a six-month period. It helps organize and summarize key monetary transactions to ensure accurate tax reporting. This document is essential for maintaining clarity and efficiency during tax filing. The template often includes fields for categorizing expenses, calculating totals, and projecting tax liabilities, making it easier to prepare and review financial information. Using a consistent format reduces errors and saves time for both individuals and accountants. Regular updates and accuracy in data entry are crucial to maximize its effectiveness.

Expense Tracker with Semi-Annual Tax Preparation

An Expense Tracker is a financial document used to record and monitor daily spending. It helps individuals and businesses maintain a clear overview of their *expenditures* over a specific period.

Semi-Annual Tax Preparation involves organizing financial data every six months to efficiently plan for tax payments. This ensures accuracy and timely submission to avoid penalties.

For an effective Expense Tracker with Semi-Annual Tax Preparation, regularly update entries and categorize expenses clearly to simplify tax calculations and financial analysis.

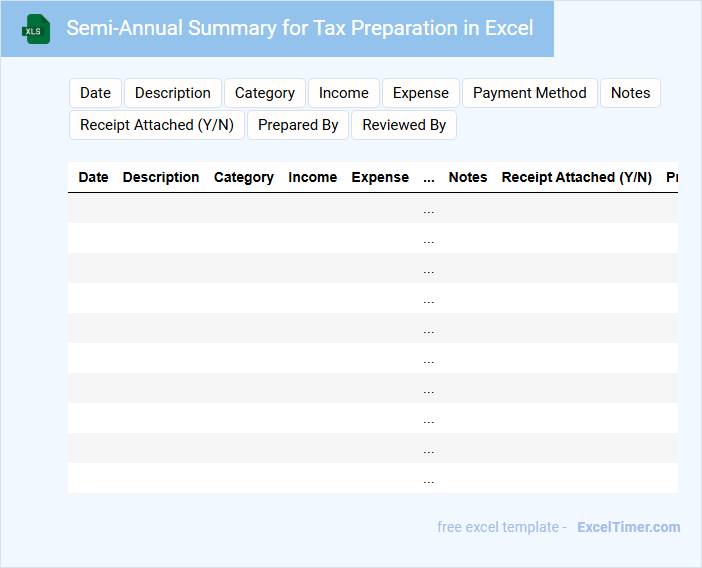

Semi-Annual Summary for Tax Preparation in Excel

What information is typically included in a Semi-Annual Summary for Tax Preparation in Excel? This document usually contains a detailed record of all financial transactions, including income, expenses, deductions, and credits for the first or second half of the year. It is organized in a clear, tabular format to facilitate accurate tax filing and financial review.

Why is it important to maintain accuracy and completeness in this summary? Ensuring all entries are up-to-date and correctly categorized helps prevent errors during tax submission and maximizes potential tax benefits. Including clear labels and consistent formatting enhances readability and simplifies future audits or adjustments.

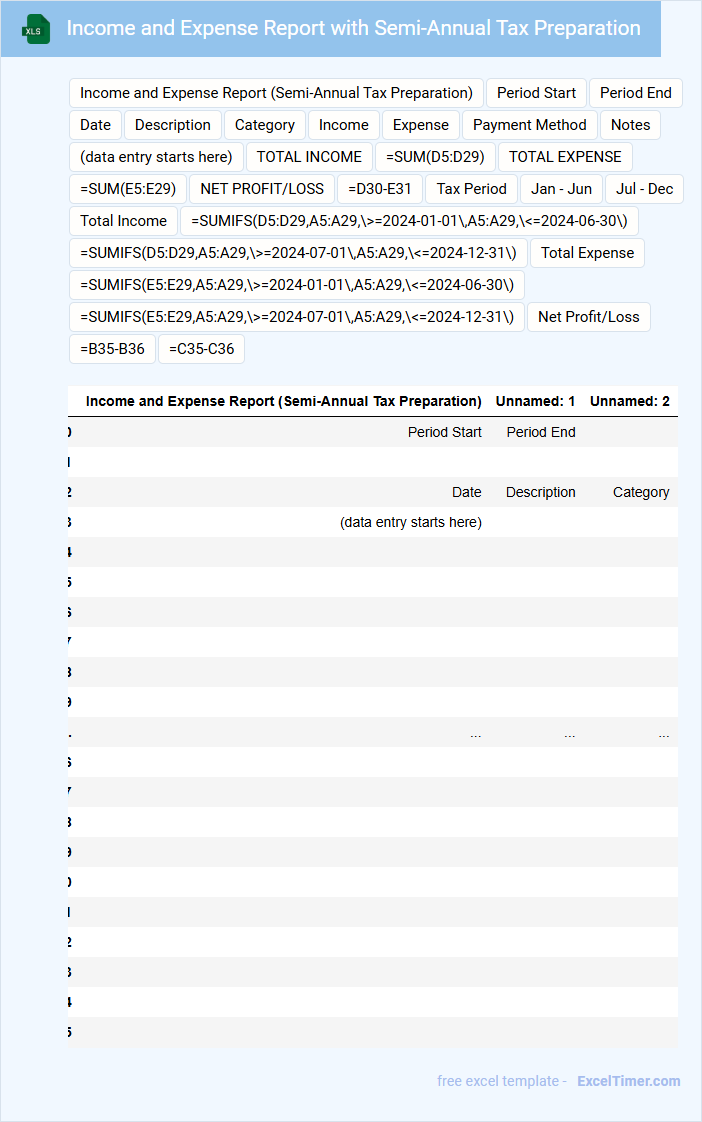

Income and Expense Report with Semi-Annual Tax Preparation

An Income and Expense Report typically contains a detailed summary of all earnings and expenditures over a specific period, helping individuals or businesses track their financial performance. This document plays a crucial role in semi-annual tax preparation by organizing financial data to ensure accurate tax filings. For effective use, it is important to maintain clear records of all transactions and categorize them correctly to avoid discrepancies during tax assessment.

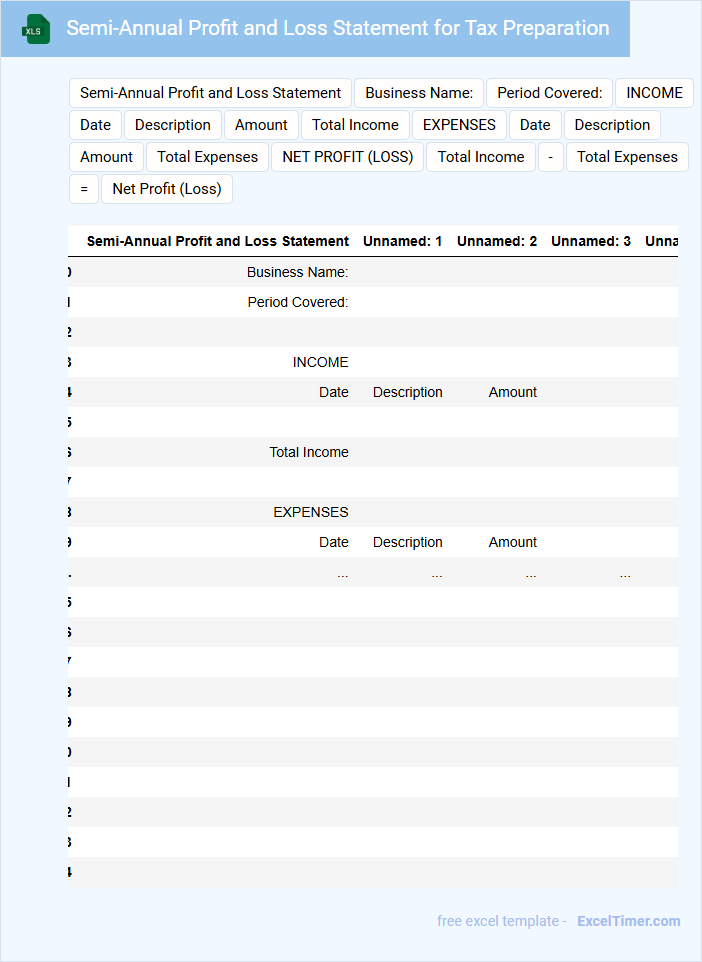

Semi-Annual Profit and Loss Statement for Tax Preparation

What information is typically contained in a Semi-Annual Profit and Loss Statement for Tax Preparation? This document usually includes a summary of revenue, expenses, and net profit over a six-month period, providing a clear financial overview. It is essential for accurately reporting income and calculating tax liabilities in compliance with tax regulations.

Tax Preparation with Semi-Annual Financial Overview

What information is typically included in a Tax Preparation document with a Semi-Annual Financial Overview? This document usually contains detailed records of income, expenses, deductions, and tax payments for the first half of the fiscal year. It also provides a summarized evaluation of financial performance to help ensure accurate tax filing and financial planning.

Semi-Annual Cash Flow Tracker for Tax Preparation

A Semi-Annual Cash Flow Tracker is a document that records all income and expenses during a six-month period to help individuals or businesses monitor their financial status. It typically includes detailed entries of cash inflows and outflows to provide a clear picture of liquidity.

For tax preparation, this document ensures accurate reporting of earnings and deductions by organizing financial transactions chronologically. Maintaining consistent updates and categorizing expenses correctly are crucial for effective tax filing and audit readiness.

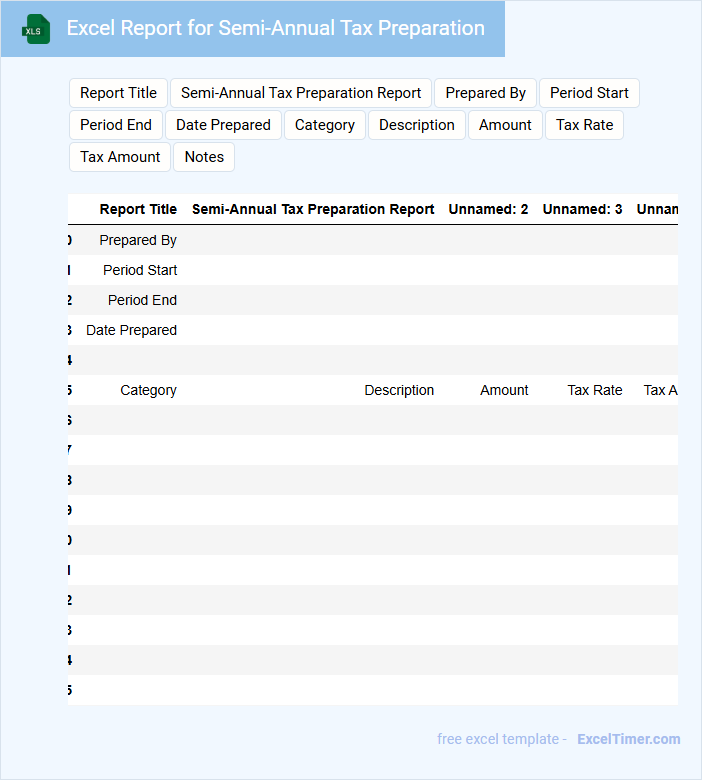

Excel Report for Semi-Annual Tax Preparation

An Excel Report for Semi-Annual Tax Preparation typically contains detailed financial data, including income, expenses, and tax deductions from the relevant period. It summarizes key figures to ensure accuracy in calculating owed taxes and assists in compliance with tax regulations. Essential elements to include are clearly labeled categories, formulas for automatic calculations, and a section for notes or discrepancies.

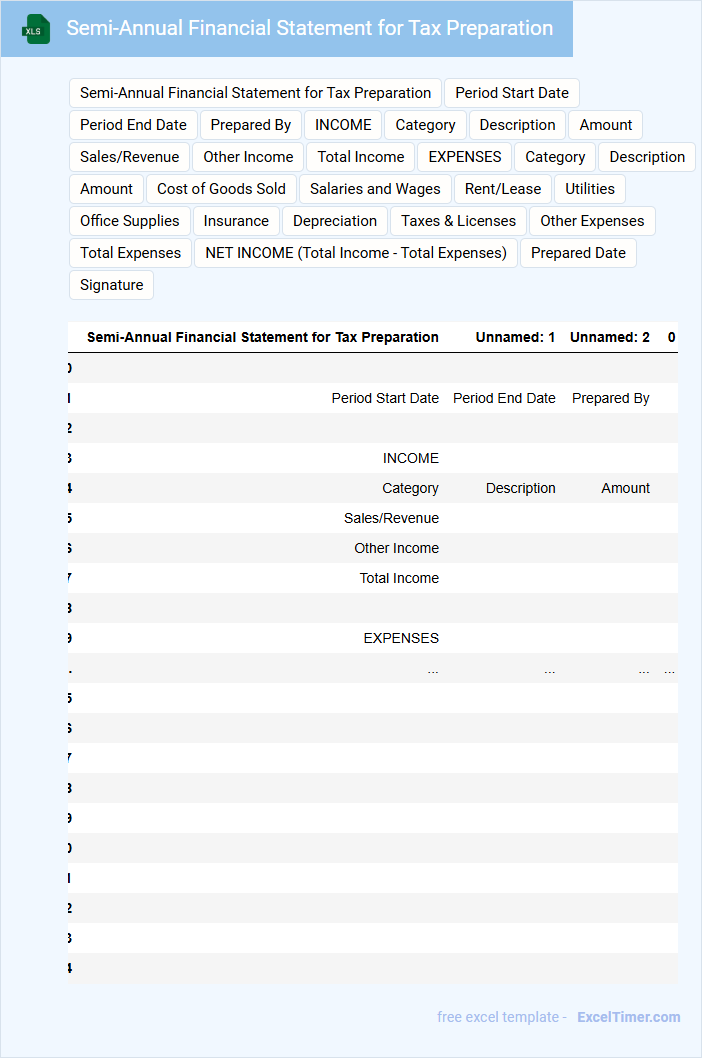

Semi-Annual Financial Statement for Tax Preparation

The Semi-Annual Financial Statement typically contains detailed records of a company's financial activities over a six-month period, including income, expenses, assets, and liabilities. This document is essential for providing an accurate snapshot of financial health and performance, aiding in thorough tax preparation. Ensuring that all revenues and deductible expenses are accurately reported is a critical step for compliance and optimizing tax outcomes.

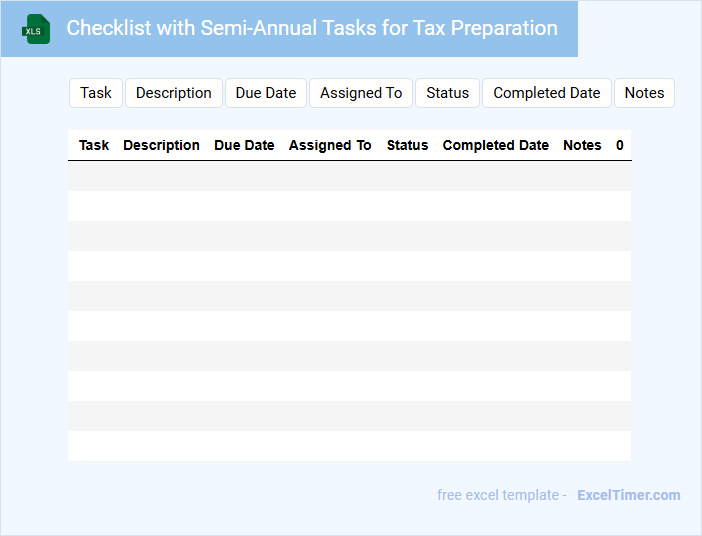

Checklist with Semi-Annual Tasks for Tax Preparation

What typically is included in a checklist with semi-annual tasks for tax preparation? This type of document usually contains a detailed list of important financial activities and deadlines that need to be reviewed or completed every six months to ensure accurate tax filing. It helps individuals or businesses organize and track their tax-related responsibilities systematically.

What is an important consideration when using this checklist? It is essential to regularly update and customize the checklist based on changing tax laws and personal or business financial situations. This ensures compliance and maximizes potential deductions or credits during tax preparation.

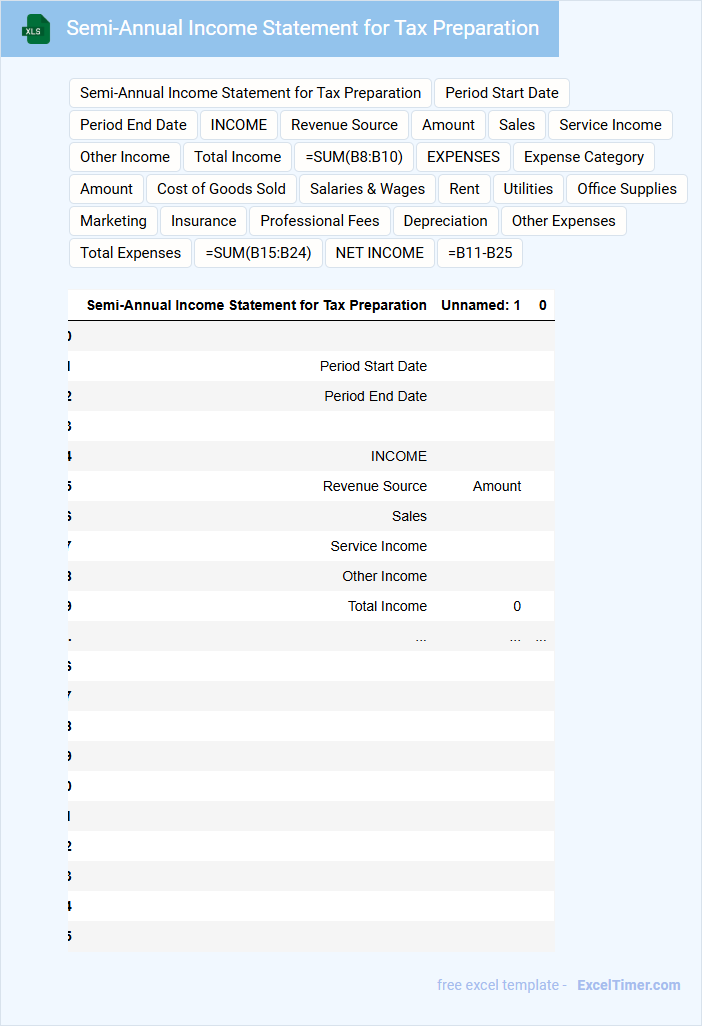

Semi-Annual Income Statement for Tax Preparation

The Semi-Annual Income Statement is a financial document summarizing a company's revenues, expenses, and profits over a six-month period. It provides a clear overview of business performance to assist in accurate tax preparation. Key components usually include total income, cost of goods sold, operating expenses, and net income.

For effective tax preparation, ensure all revenue sources and deductible expenses are thoroughly documented and categorized. It is crucial to verify the accuracy of figures to avoid discrepancies during tax filing. Maintaining detailed supporting records for each entry enhances compliance and simplifies audits.

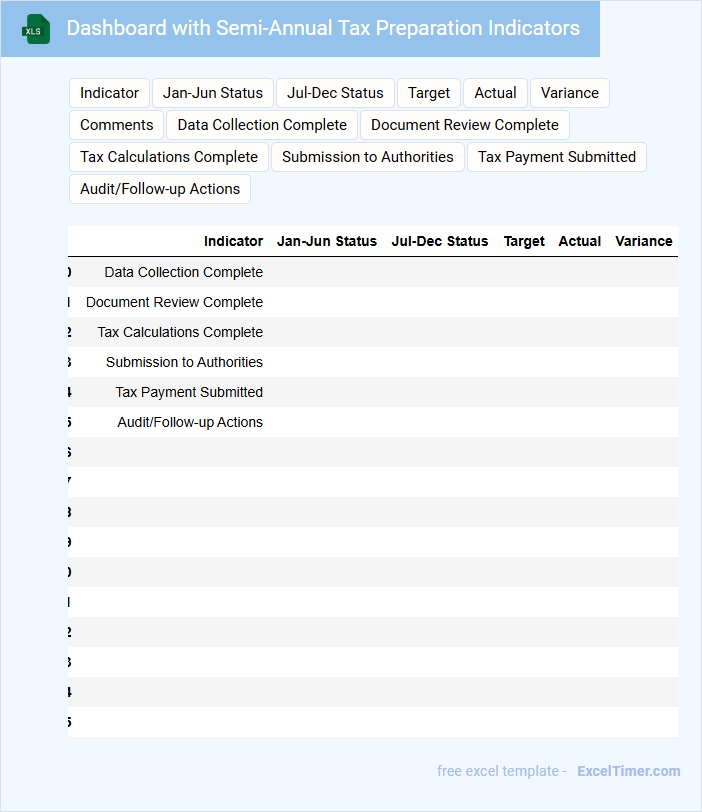

Dashboard with Semi-Annual Tax Preparation Indicators

What information is typically included in a dashboard with semi-annual tax preparation indicators? This type of document usually contains key financial metrics, progress tracking, and compliance deadlines related to tax preparation over a six-month period. It visually summarizes data such as tax liabilities, payment statuses, and remaining tasks to ensure timely and accurate filing.

What important factors should be considered when designing this dashboard? It should prioritize clarity, include real-time updates, and highlight critical deadlines to avoid penalties. Additionally, integrating comparison with previous periods can help identify trends and improve tax planning efficiency.

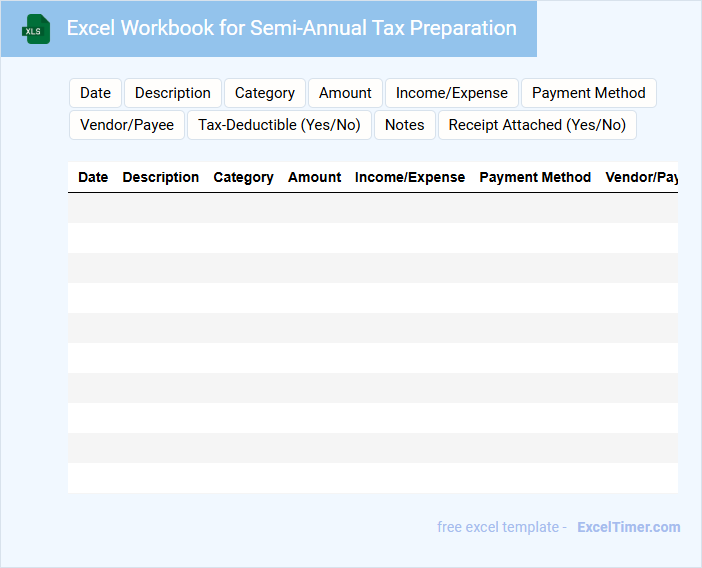

Excel Workbook for Semi-Annual Tax Preparation

An Excel Workbook for Semi-Annual Tax Preparation typically contains organized financial data, including income, expenses, and tax deductions. It is designed to help users efficiently track and calculate their tax liabilities every six months. Ensuring accuracy in data entry and regularly updating the workbook are important for maximizing tax benefits and minimizing errors.

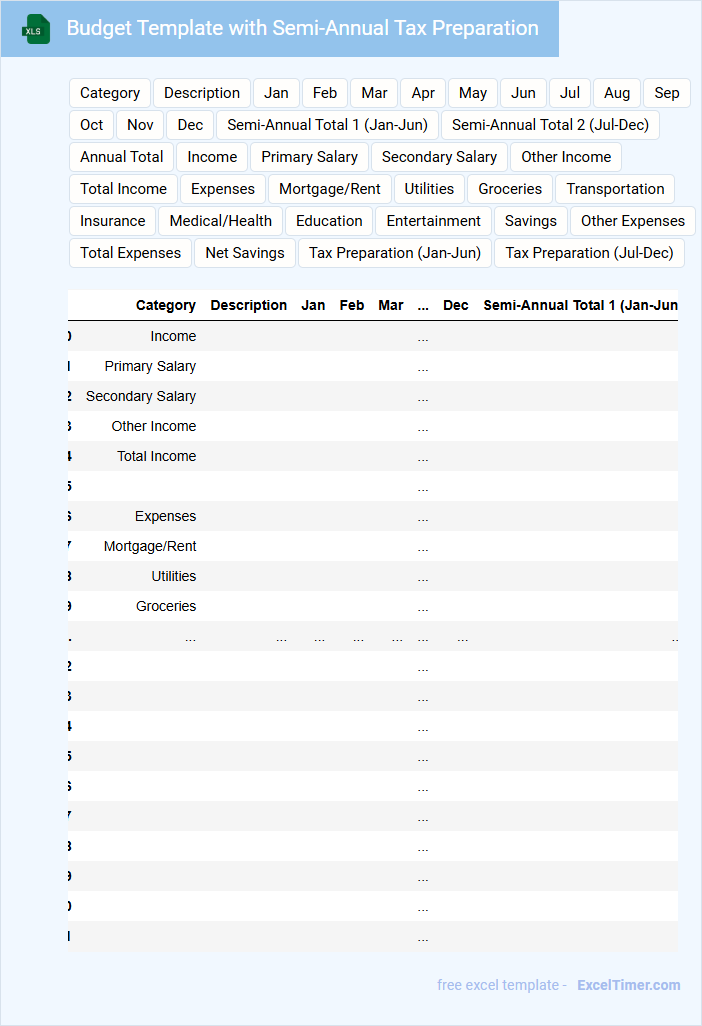

Budget Template with Semi-Annual Tax Preparation

What does a Budget Template with Semi-Annual Tax Preparation typically contain? It usually includes detailed sections for income, expenses, and anticipated tax liabilities to help individuals or businesses manage their finances effectively. This template is designed to facilitate accurate tracking and timely preparation for semi-annual tax payments, ensuring compliance and financial clarity.

What is an important consideration when using this type of document? It is crucial to regularly update all financial entries and review tax regulations relevant to your jurisdiction to maintain accuracy and avoid penalties. Additionally, incorporating reminders for payment deadlines within the template can greatly improve organization and timely tax submissions.

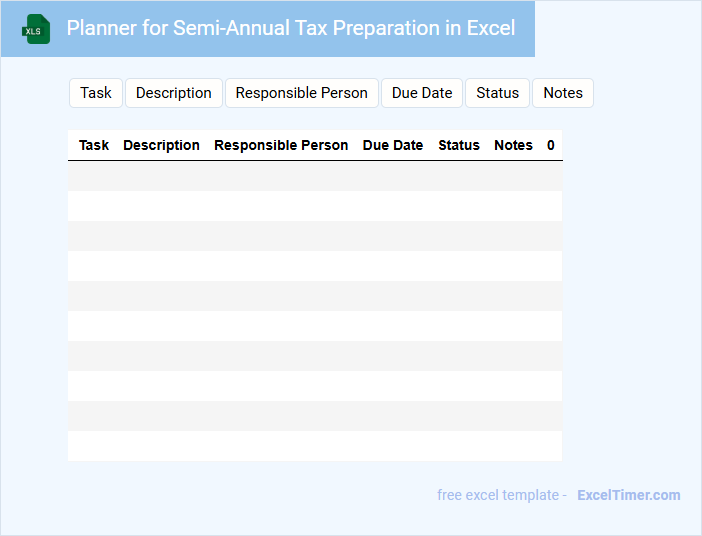

Planner for Semi-Annual Tax Preparation in Excel

A Planner for Semi-Annual Tax Preparation in Excel is a vital document used to organize and track financial information over a six-month period for accurate tax reporting. It typically contains sections for income, expenses, deductions, and payment schedules to ensure timely compliance with tax obligations. Maintaining this planner helps prevent last-minute filing errors and supports efficient tax management throughout the year.

How do you record semi-annual tax payments using Excel formulas for accurate tracking?

Record semi-annual tax payments in Excel by setting a payment schedule with dates using the DATE and EDATE functions. Use SUMIF or SUMIFS formulas to total payments made within each half-year period for precise tracking. Ensure columns include payment date, amount, and tax period for organized and accurate tax preparation.

What key columns are needed in an Excel sheet to document semi-annual tax preparation tasks?

Key columns for semi-annual tax preparation in Excel include Task Description, Due Date, Assigned To, Status, and Notes. Incorporate columns for Estimated Tax Amount and Payment Date to track financial obligations. Use Reminder Date and Completion Date to ensure timely task management and documentation.

How can you use conditional formatting in Excel to highlight upcoming semi-annual tax deadlines?

Use Excel's conditional formatting to highlight upcoming semi-annual tax deadlines by applying a formula that checks if the deadline dates fall within a specific upcoming range, such as the next 30 days. Set the rule to format cells containing dates that are greater than or equal to TODAY() and less than or equal to TODAY()+30. This approach ensures tax preparation deadlines for semi-annual filings are visually emphasized for timely compliance.

Which Excel functions help summarize semi-annual tax amounts by category or period?

Excel functions such as SUMIFS and PIVOT TABLES efficiently summarize semi-annual tax amounts by category or period. The SUMIFS function allows for conditional summation based on tax categories and date ranges, while Pivot Tables enable dynamic grouping and aggregation of tax data semi-annually. Using DATE or EOMONTH functions can help define semi-annual periods precisely for accurate tax preparation analysis.

How do you set up Excel reminders for semi-annual tax filing and payment dates?

To set up Excel reminders for semi-annual tax filing and payment dates, create a spreadsheet with key dates listed in one column and corresponding tasks in another. Use Excel's conditional formatting or formulas like TODAY() to highlight upcoming deadlines automatically. Your spreadsheet will help track deadlines efficiently, ensuring timely semi-annual tax compliance.