The Semi-annually Excel Template for Investment Portfolio Review provides a structured format to track and analyze portfolio performance every six months. It includes key metrics such as asset allocation, returns, and risk assessment, enabling investors to make informed decisions. Regular use of this template helps maintain a balanced and optimized investment strategy over time.

Semi-Annually Excel Template for Investment Portfolio Review

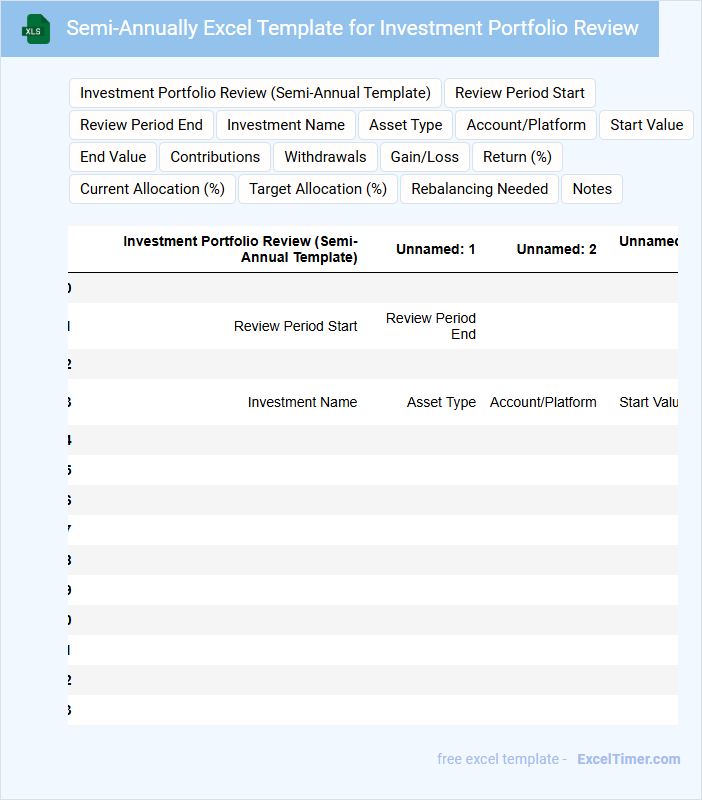

What information does a Semi-Annually Excel Template for Investment Portfolio Review typically contain?

This type of document usually includes detailed summaries of investment performance, asset allocation, and transaction history over a six-month period. It helps investors track progress and make informed decisions by providing clear data visuals and comparison charts. To optimize its effectiveness, ensure it incorporates up-to-date market values, risk assessments, and concise notes on strategy adjustments.

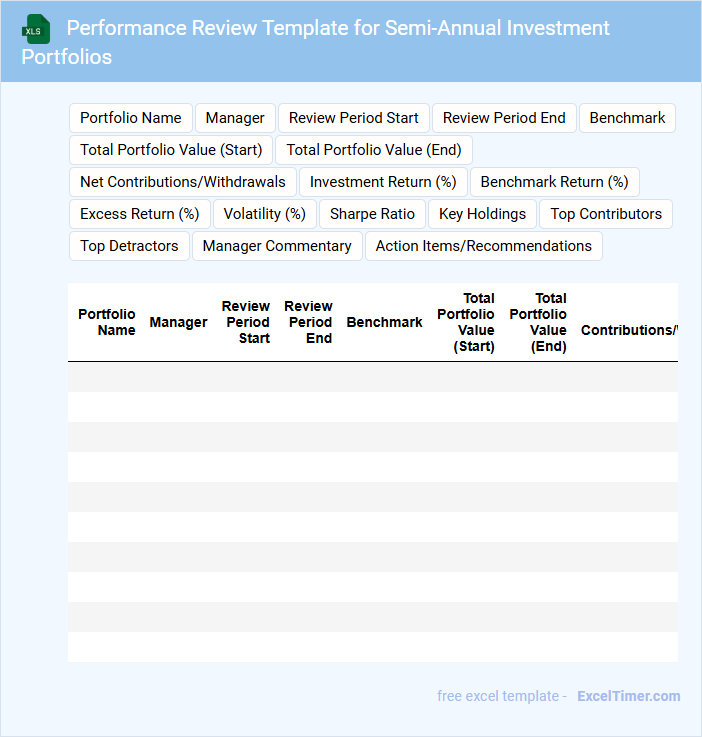

Performance Review Template for Semi-Annual Investment Portfolios

A Performance Review Template for Semi-Annual Investment Portfolios typically contains detailed summaries of investment returns, asset allocation, and risk assessments. It provides a structured overview to evaluate portfolio growth against benchmarks and strategic objectives.

The document highlights key performance metrics, manager commentary, and recommendations for adjustments based on market conditions. Including clear visuals like charts and tables enhances understanding and decision-making.

Ensure the template emphasizes both quantitative data and qualitative insights to support comprehensive performance analysis.

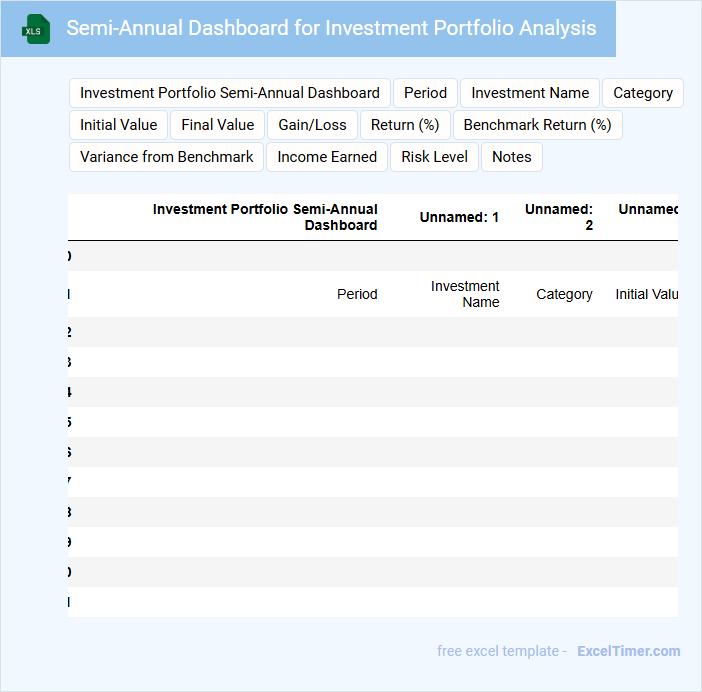

Semi-Annual Dashboard for Investment Portfolio Analysis

What information is typically included in a Semi-Annual Dashboard for Investment Portfolio Analysis? This document usually contains a comprehensive overview of the investment portfolio's performance over the past six months, including asset allocation, risk assessment, and return metrics. It provides key insights and visualizations to help stakeholders make informed decisions and adjust strategies accordingly.

What are important aspects to focus on when creating this dashboard? It is crucial to include clear and concise data visualizations, incorporate benchmarking against relevant indices, and highlight any significant changes or trends in the portfolio. Additionally, ensuring up-to-date and accurate data along with actionable recommendations can greatly enhance the dashboard's effectiveness.

Excel Sheet for Semi-Annual Investment Tracking

An Excel Sheet for Semi-Annual Investment Tracking is a document used to monitor and evaluate investment performance over six-month periods. It helps investors stay organized and make informed decisions based on accurate financial data.

- Include columns for investment types, initial amounts, and current values to track growth effectively.

- Incorporate formulas to calculate gains, losses, and overall portfolio performance automatically.

- Use clear headings and date markers to distinguish each semi-annual period for easy reference.

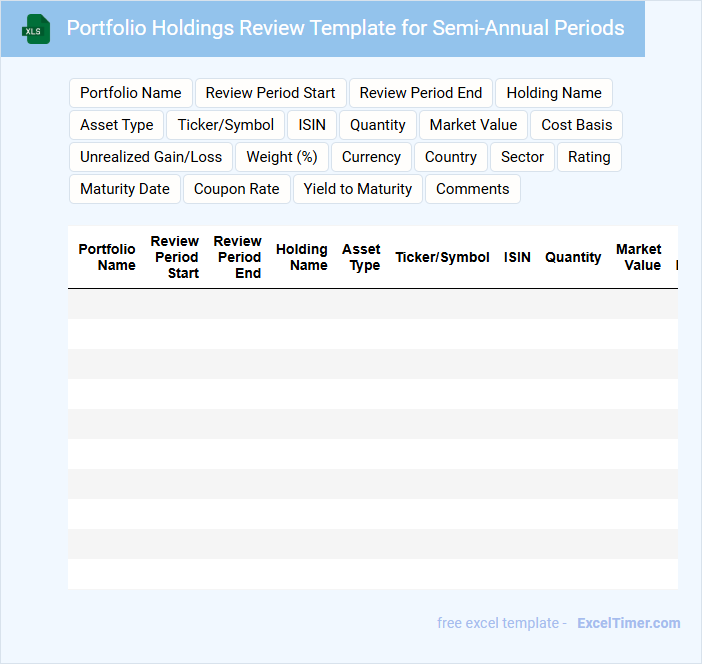

Portfolio Holdings Review Template for Semi-Annual Periods

A Portfolio Holdings Review Template for semi-annual periods typically contains a detailed summary of the assets held within a portfolio, including performance metrics and allocation percentages. It helps investors and managers assess the portfolio's alignment with investment goals and risk tolerance.

Important aspects include updating asset values accurately and noting any significant changes or rebalancing decisions. Consistently reviewing holdings ensures informed decision-making and effective portfolio management over time.

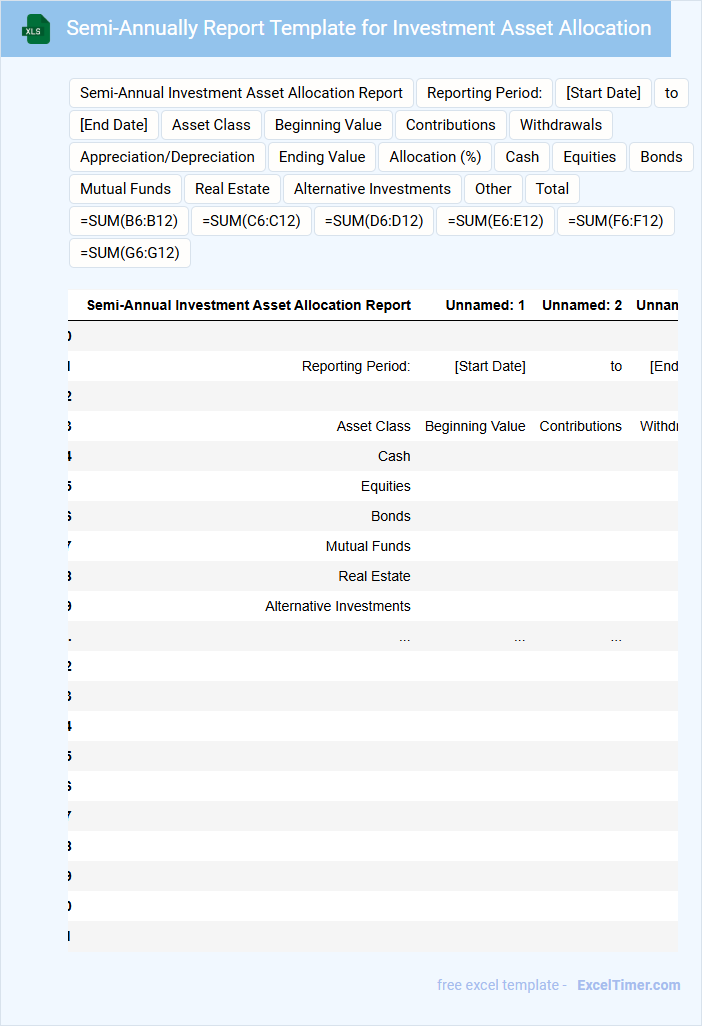

Semi-Annually Report Template for Investment Asset Allocation

A Semi-Annual Report for Investment Asset Allocation typically contains a detailed overview of the portfolio's performance over six months. It includes analysis of asset classes, allocation changes, and market conditions impacting investments. This report helps stakeholders track progress and make informed decisions.

Important elements to include are the current allocation percentages, comparisons to target allocations, and risk assessments. Visual aids like charts and graphs enhance clarity for diverse audiences. Clear disclosure of fees, returns, and any strategic adjustments is essential for transparency.

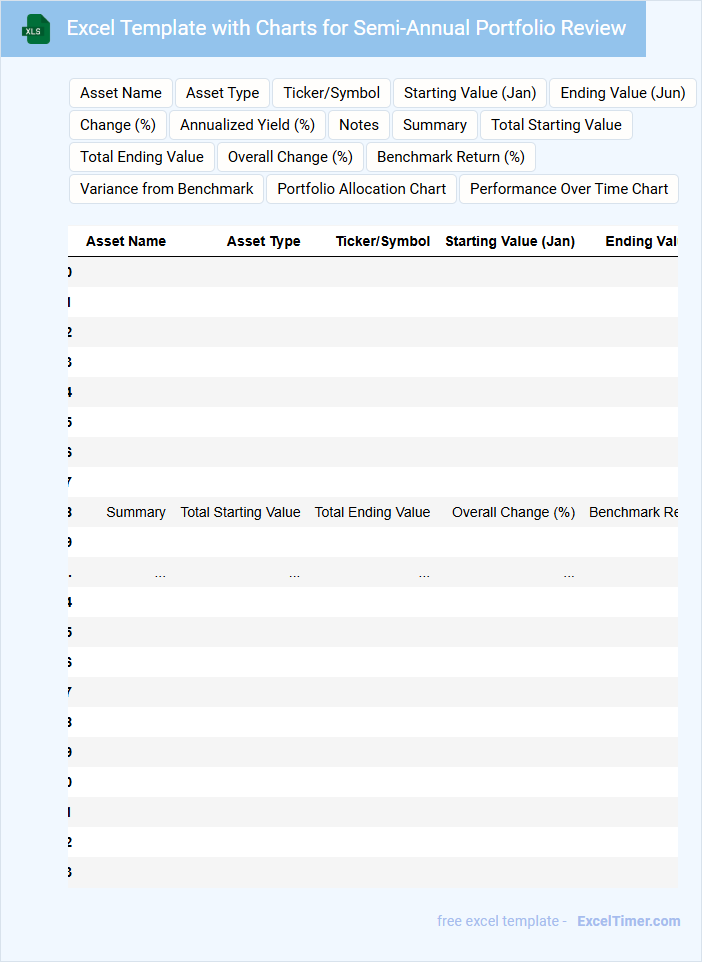

Excel Template with Charts for Semi-Annual Portfolio Review

An Excel Template with charts for a Semi-Annual Portfolio Review typically contains detailed financial data, performance metrics, and visual representations to help analyze investment progress over six months. This document often includes asset allocation, risk assessment, and return comparisons to provide a comprehensive overview.

Key components of the template are dynamic charts and tables that automatically update based on input data, enabling clear insights and trend detection. For effective use, it is important to regularly update the input data and customize charts to reflect specific portfolio goals and benchmarks.

Semi-Annual Investment Review Spreadsheet with Performance Metrics

A Semi-Annual Investment Review Spreadsheet with Performance Metrics typically summarizes the performance of various investments over a six-month period, providing a clear overview of gains, losses, and value changes. It helps investors make informed decisions by presenting key metrics and trends concisely.

- Include detailed performance indicators such as ROI, volatility, and benchmark comparisons.

- Ensure clear categorization of asset classes and investment types for easy analysis.

- Incorporate visual elements like charts or graphs to highlight performance trends.

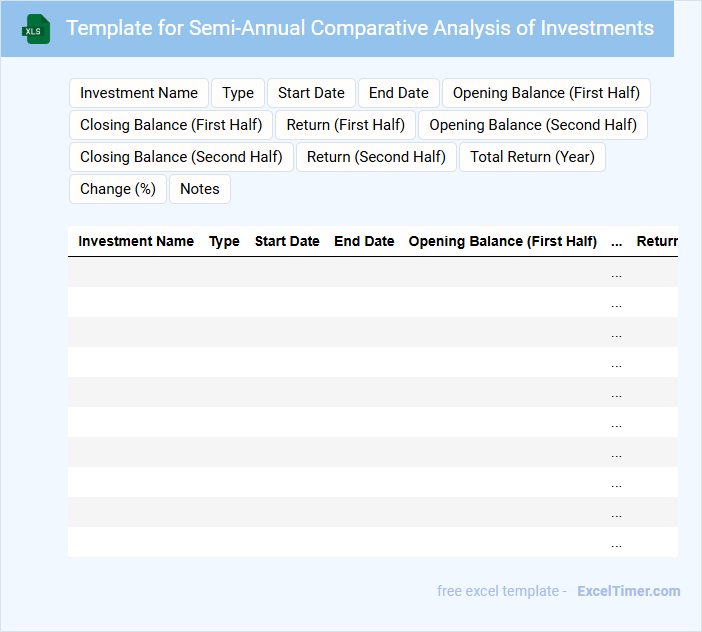

Template for Semi-Annual Comparative Analysis of Investments

The Semi-Annual Comparative Analysis document typically contains a detailed review of investment performance over two consecutive six-month periods. It highlights key financial metrics and market trends to evaluate the relative success of different investment options.

This type of analysis focuses on identifying growth patterns, risks, and returns to guide strategic decision-making. Including clear charts and comparative tables enhances understanding and aids stakeholders in making informed choices.

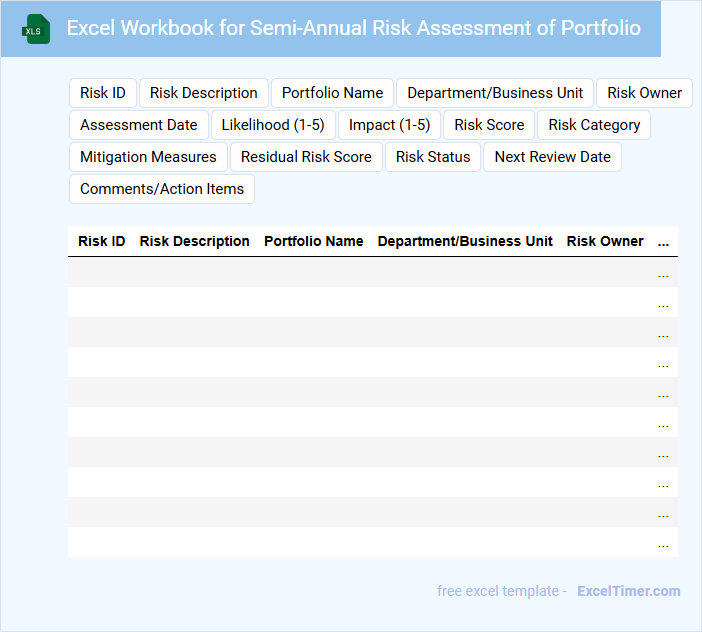

Excel Workbook for Semi-Annual Risk Assessment of Portfolio

What information is typically contained in an Excel Workbook for a Semi-Annual Risk Assessment of a Portfolio? This type of document usually includes data on asset performance, risk metrics, and diversification analysis, allowing for a comprehensive evaluation of potential vulnerabilities. It provides a structured framework to monitor portfolio risks regularly and make informed investment decisions.

What important factors should be considered when preparing this workbook? Ensuring accurate and up-to-date financial data, incorporating both quantitative and qualitative risk indicators, and maintaining clear visualization through charts and summaries are crucial for effective risk analysis and communication with stakeholders.

Template for Tracking Gains and Losses of Portfolio Semi-Annually

What information is typically contained in a Template for Tracking Gains and Losses of Portfolio Semi-Annually? This document usually includes details such as the initial investment amount, current value, realized and unrealized gains or losses, and transaction dates. It helps investors monitor the performance of their portfolio over a six-month period by providing a clear summary of financial changes.

What is an important consideration when using this template? Ensuring accurate and up-to-date data entry is crucial, as it directly impacts the reliability of the financial analysis. Additionally, categorizing investments correctly and including relevant fees or dividends can provide a more comprehensive view of portfolio performance.

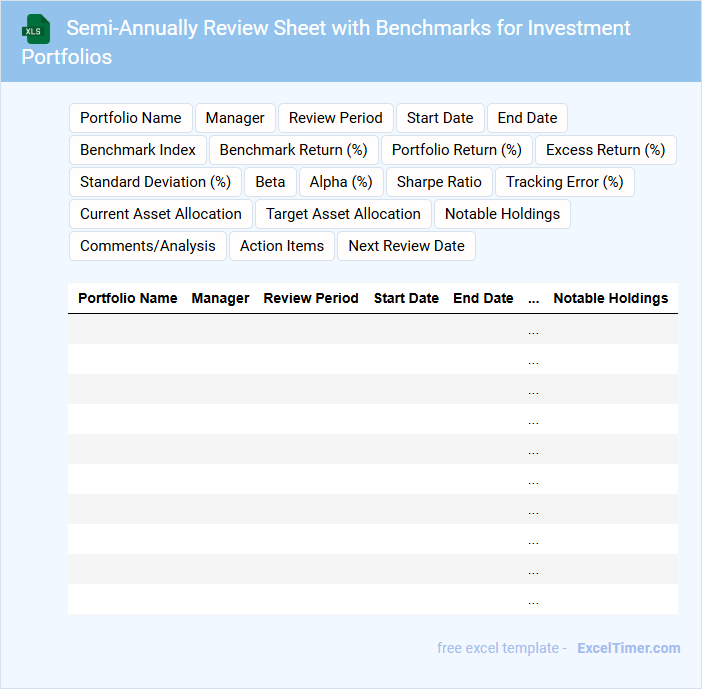

Semi-Annually Review Sheet with Benchmarks for Investment Portfolios

What information is typically included in a Semi-Annually Review Sheet with Benchmarks for Investment Portfolios? This document usually contains detailed performance data over the past six months, comparisons against relevant benchmarks, and notes on portfolio adjustments. It helps investors assess progress, identify trends, and make informed decisions for future strategy revisions.

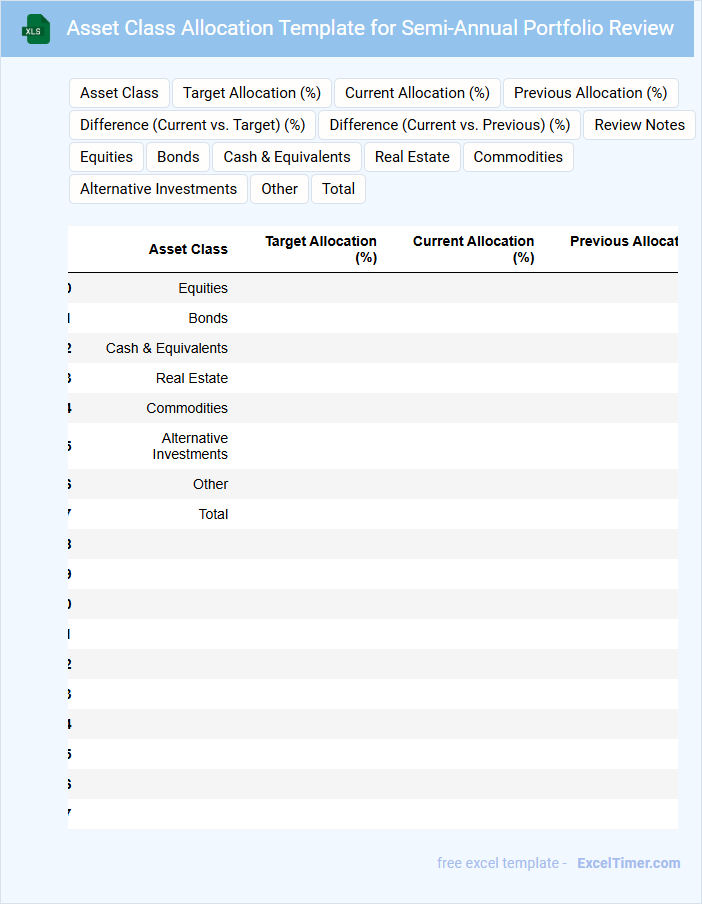

Asset Class Allocation Template for Semi-Annual Portfolio Review

What information is typically included in an Asset Class Allocation Template for a Semi-Annual Portfolio Review? This document usually contains detailed breakdowns of investment categories such as stocks, bonds, real estate, and cash equivalents, along with their respective percentages of the total portfolio. It helps investors evaluate diversification, assess risk, and make informed adjustments based on market performance and financial goals.

What important considerations should be highlighted in this template? Key elements include target allocation ranges, current allocation versus targets, performance metrics, and notes on market trends affecting each asset class. Including these fundamentals ensures effective monitoring and strategic rebalancing during the semi-annual review process.

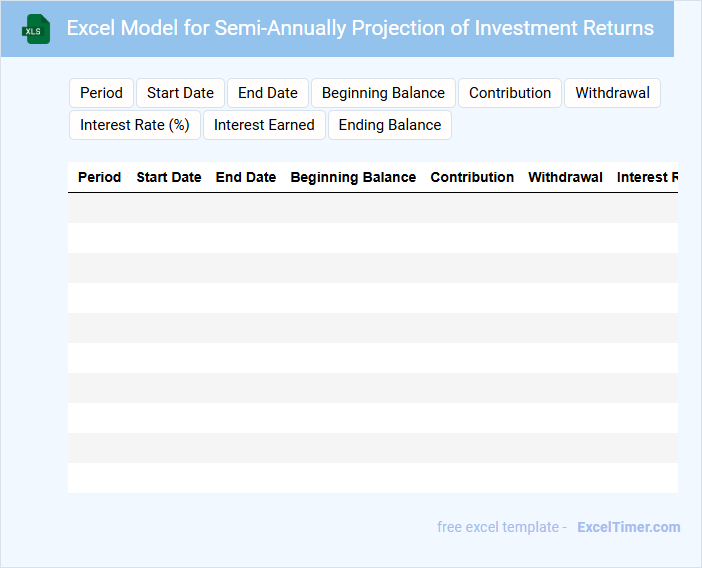

Excel Model for Semi-Annually Projection of Investment Returns

This document typically contains detailed financial projections and assumptions used to estimate investment returns on a semi-annual basis. It is designed to help investors and analysts evaluate potential performance over time.

- Include clear assumptions for interest rates, growth rates, and reinvestment periods.

- Ensure formulas are accurate and linked to input variables for easy updates.

- Provide visual summaries such as charts or graphs to illustrate projected returns.

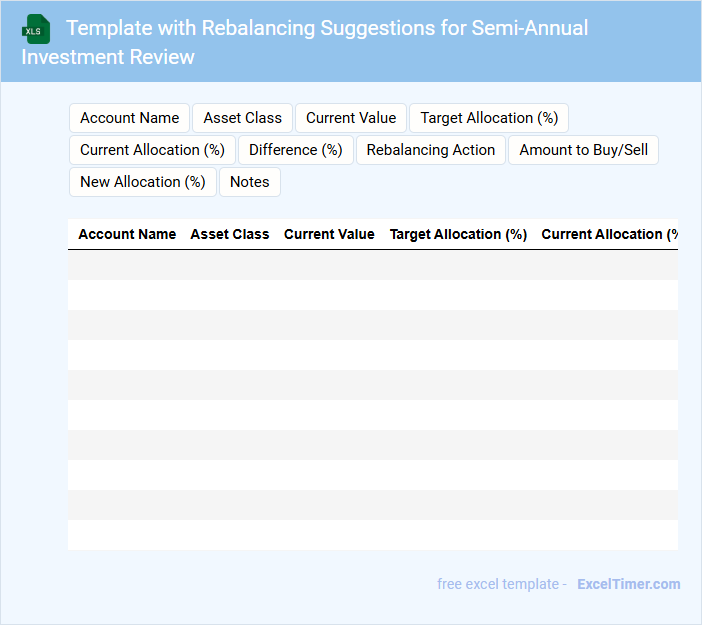

Template with Rebalancing Suggestions for Semi-Annual Investment Review

What does a Template with Rebalancing Suggestions for Semi-Annual Investment Review usually contain? This document typically includes a detailed overview of current portfolio allocations, performance analysis, and recommended adjustments to maintain target risk and return objectives. It also offers specific buy, sell, or hold suggestions tailored to changing market conditions and individual investment goals.

What impact does a semi-annual investment portfolio review have on long-term portfolio performance?

A semi-annual investment portfolio review improves long-term performance by enabling timely rebalancing and risk management, ensuring alignment with financial goals. Regular reviews help identify underperforming assets for strategic adjustments, optimizing returns. This disciplined approach supports sustained portfolio growth and reduces exposure to market volatility.

How does reviewing asset allocation semi-annually help optimize diversification?

Reviewing your investment portfolio semi-annually ensures asset allocation remains aligned with your financial goals by identifying shifts in market conditions and risk exposure. This regular assessment helps optimize diversification by rebalancing assets to maintain an ideal mix of equities, bonds, and alternatives. Consistent semi-annual reviews reduce the risk of overconcentration, enhancing long-term portfolio stability and growth.

What key financial metrics should be monitored during a semi-annual review in Excel?

Key financial metrics to monitor during a semi-annual investment portfolio review in Excel include portfolio return, asset allocation percentages, and risk measures such as standard deviation or beta. Tracking dividend yields, price-to-earnings ratios, and portfolio beta provides insight into income, valuation, and systematic risk. Regularly updating these metrics helps assess performance against benchmarks and rebalance the portfolio effectively.

How can you track risk-adjusted returns semi-annually in your investment portfolio spreadsheet?

You can track risk-adjusted returns semi-annually in your investment portfolio spreadsheet by calculating metrics such as the Sharpe Ratio and Sortino Ratio every six months. Incorporate columns for portfolio returns, risk-free rate, and standard deviation of returns to automate these calculations. This approach provides a clear, periodic assessment of your portfolio's performance relative to its risk.

Which Excel formulas are essential for analyzing semi-annual growth and rebalancing needs?

For analyzing semi-annual growth in your investment portfolio, essential Excel formulas include XIRR to calculate accurate internal rates of return over irregular periods and EOMONTH to identify period ends for semi-annual intervals. Use SUMPRODUCT to evaluate weighted returns and IF statements to flag when portfolio weights deviate beyond rebalance thresholds. These formulas enable precise tracking of growth and timely rebalancing decisions every six months.