![]()

The Semi-annually Excel Template for Loan Payment Tracker helps users efficiently monitor loan payments made twice a year, ensuring accurate tracking of principal and interest. It simplifies financial management by providing clear schedules, due dates, and outstanding balances. This tool is essential for maintaining consistent payments and avoiding late fees.

Semi-Annual Loan Payment Tracker with Balance Overview

A Semi-Annual Loan Payment Tracker is a document designed to monitor loan repayments made every six months. It typically contains payment dates, amounts paid, remaining balance, and due dates. This tracker helps borrowers stay organized and avoid missed payments by providing a clear overview of their loan status and balance over time.

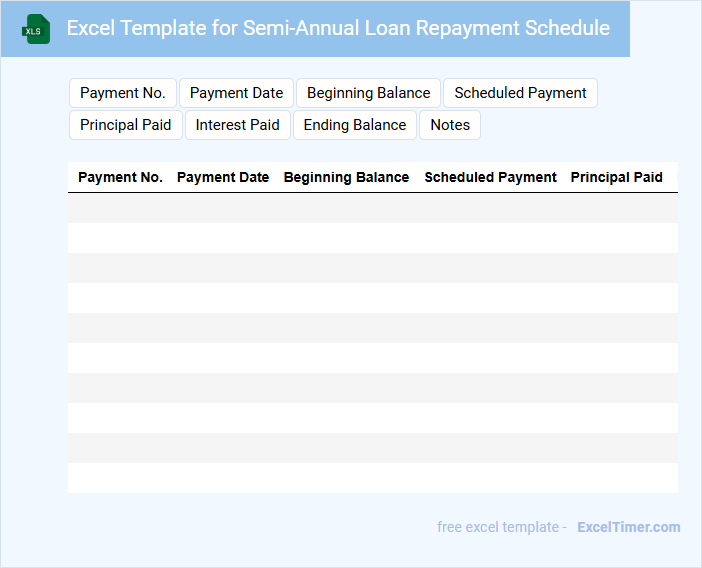

Excel Template for Semi-Annual Loan Repayment Schedule

An Excel Template for Semi-Annual Loan Repayment Schedule typically contains a structured layout outlining loan details such as principal amount, interest rate, and payment dates. It helps track each semi-annual payment including interest and principal portions. Ensuring accuracy in formulas is crucial for maintaining reliable repayment forecasts.

Loan Payment Tracker with Semi-Annual Breakdown

What information does a Loan Payment Tracker with Semi-Annual Breakdown typically contain? This type of document usually includes detailed records of each loan payment, broken down every six months, showing principal, interest, and remaining balance. It helps borrowers and lenders monitor payment progress clearly and ensures accurate financial planning across semi-annual periods.

What important element should be emphasized in such a tracker? It is crucial to maintain precise date entries for each payment alongside a clear distinction between principal and interest amounts. Additionally, including a summary section for total payments made and remaining loan balance at each semi-annual checkpoint enhances transparency and aids in forecasting future payments.

Amortization Schedule for Semi-Annual Loan Payments

An amortization schedule for semi-annual loan payments is a detailed table outlining each payment's breakdown over the loan term.

- Payment Dates: Clearly specify the exact semi-annual payment dates for consistency.

- Principal and Interest Allocation: Separate each payment into principal and interest components to track loan reduction.

- Remaining Balance: Show the outstanding loan balance after each payment for transparency.

Loan Tracker with Semi-Annual Payment Columns

What information is typically included in a Loan Tracker with Semi-Annual Payment Columns? This document usually contains detailed records of loan amounts, interest rates, payment schedules, and balances organized specifically for payments made twice a year. It helps borrowers and lenders monitor repayment progress efficiently over semi-annual periods.

What important features should be considered when creating a Loan Tracker with Semi-Annual Payment Columns? It's essential to clearly label each payment period, include cumulative interest and principal paid, and provide a running balance to avoid confusion. Additionally, incorporating reminders and notes for upcoming payments can enhance tracking accuracy and timely repayments.

Excel Sheet for Tracking Semi-Annual Loan Dues

An Excel sheet for tracking semi-annual loan dues typically contains detailed records of loan payments scheduled every six months, including due dates, amounts, and payment status. It helps in maintaining an organized overview of outstanding balances and payment history. Ensuring accuracy in data entry and regularly updating the sheet are crucial for effective loan management.

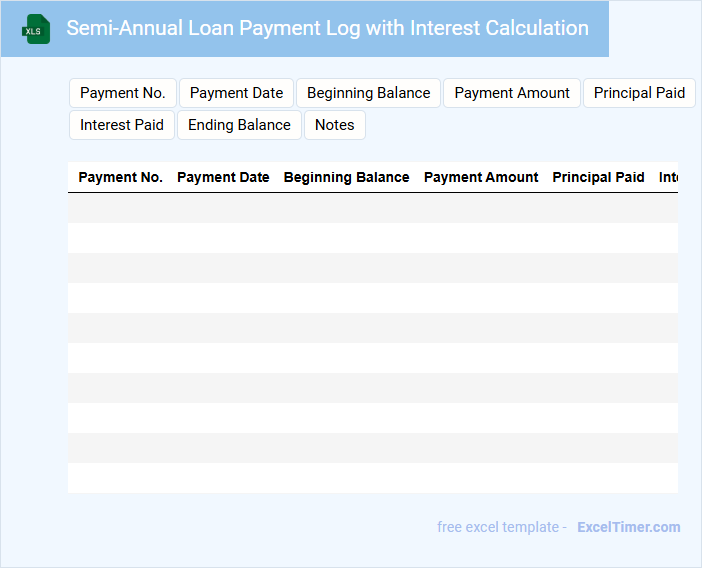

Semi-Annual Loan Payment Log with Interest Calculation

What information is typically included in a Semi-Annual Loan Payment Log with Interest Calculation? This type of document usually contains detailed records of loan payments made every six months, including the principal amount, interest accrued, payment dates, and remaining balance. It helps borrowers and lenders keep track of loan repayment progress and calculate interest accurately over time.

What important aspects should be considered when maintaining a Semi-Annual Loan Payment Log with Interest Calculation? Accuracy in recording payment amounts and dates is crucial, along with precise interest calculation methods that reflect the loan terms. Additionally, updating the remaining balance after each payment ensures clear financial tracking and helps avoid errors in future payments.

Tracker for Loan Payments with Semi-Annual Updates

A Loan Payment Tracker document typically contains detailed records of all loan payments made, including the amount, date, and outstanding balance. It is designed to help borrowers and lenders monitor the progress of loan repayments over time. For a tracker with semi-annual updates, it is important to include periodic summaries and reminders to ensure timely reviews.

Semi-Annual Loan Repayment Tracker with Summary

A Semi-Annual Loan Repayment Tracker with Summary is a document designed to monitor loan payments and provide a concise overview of repayment progress every six months.

- Payment Records: It systematically records each loan payment made within the semi-annual period.

- Outstanding Balances: It highlights the remaining loan balance after each payment.

- Summary Analysis: It summarizes total payments, interest accrued, and progress toward full repayment.

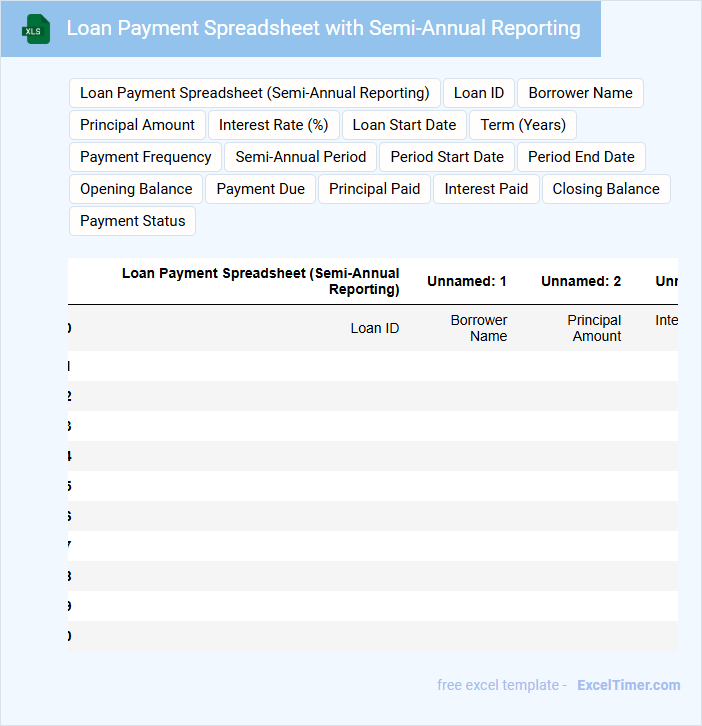

Loan Payment Spreadsheet with Semi-Annual Reporting

A Loan Payment Spreadsheet with Semi-Annual Reporting is a document used to track loan repayments and summarize financial status every six months. It helps borrowers and lenders monitor payment progress and ensure loan terms are met.

- Include detailed payment schedules showing principal and interest breakdowns.

- Incorporate summary sections for semi-annual balances and outstanding amounts.

- Use clear date markers to distinguish each reporting period for accuracy.

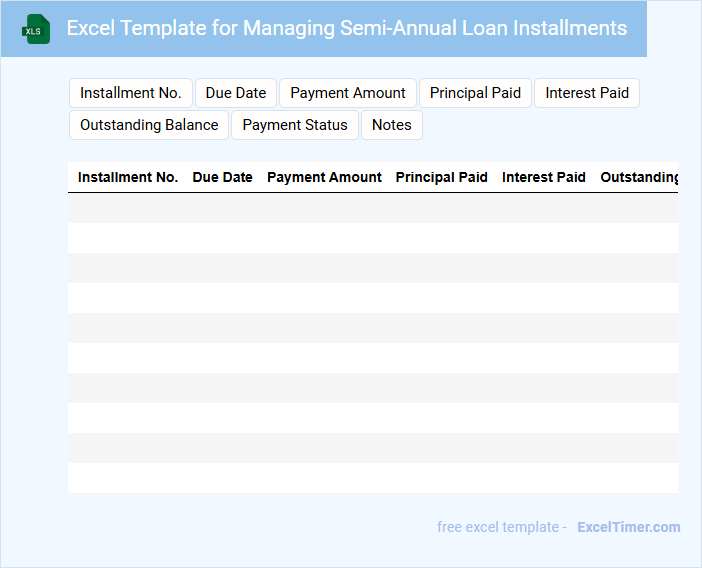

Excel Template for Managing Semi-Annual Loan Installments

An Excel Template for managing semi-annual loan installments typically contains rows and columns designed to track payment schedules, outstanding balances, and interest calculations. It helps users organize and monitor loan repayment progress over specific periods, ensuring timely payments. Important elements include due dates, installment amounts, and cumulative repayment summaries.

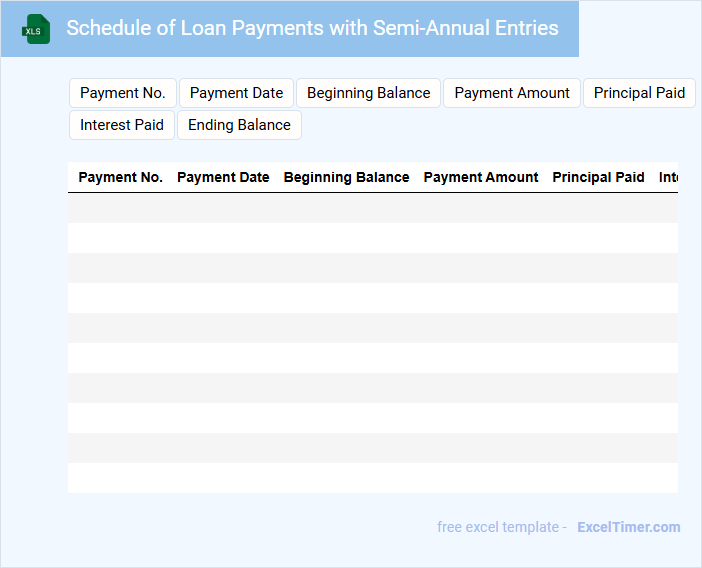

Schedule of Loan Payments with Semi-Annual Entries

A Schedule of Loan Payments with semi-annual entries typically outlines all the payment dates and amounts due every six months throughout the loan term. This document is essential for tracking the repayment progress, including both principal and interest components. It helps borrowers and lenders maintain transparency and avoid missed payments by providing a clear, organized timeline.

Semi-Annually Updated Loan Payment Tracker

What information is typically included in a Semi-Annually Updated Loan Payment Tracker? This type of document usually contains details such as the loan amount, interest rates, payment dates, and outstanding balances tracked every six months. It helps borrowers monitor their loan repayment progress and plan future payments effectively.

Excel Tool for Tracking Semi-Annual Loan Commitments

This document typically contains detailed information on loan commitments made semi-annually, including borrower details, loan amounts, and repayment schedules. It serves as a tool to efficiently track and manage these financial commitments over time.

- Include columns for loan start date, commitment amount, and due date to ensure accurate tracking.

- Incorporate conditional formatting to highlight upcoming or overdue commitments for timely follow-up.

- Use summary sections to provide an overview of total commitments and outstanding balances.

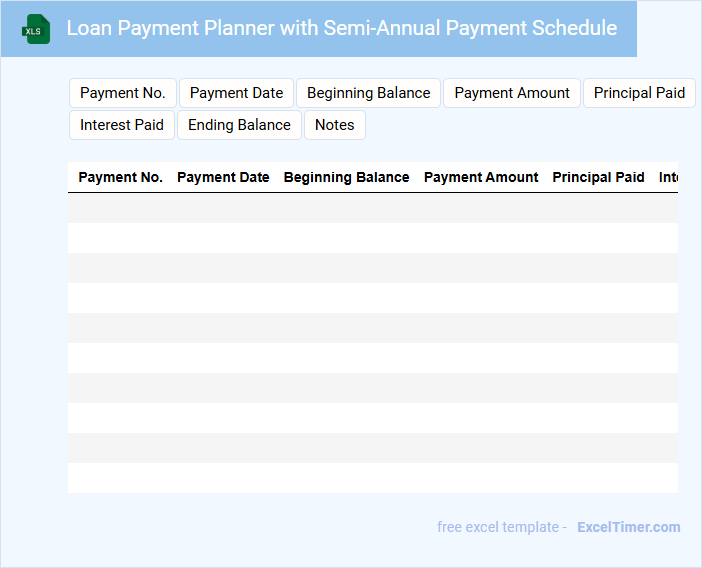

Loan Payment Planner with Semi-Annual Payment Schedule

A Loan Payment Planner with a Semi-Annual Payment Schedule is a document designed to guide borrowers through their loan repayment process with payments made twice a year. It helps in organizing and tracking payment amounts, due dates, and interest accrual.

- Clearly specify the loan amount, interest rate, and loan term.

- Include a detailed payment schedule showing due dates and amounts.

- Provide a summary of the total interest paid over the loan period.

What does "semi-annually" mean in the context of scheduling loan payments in an Excel tracker?

Semi-annually in a loan payment tracker refers to scheduling payments twice per year, typically every six months. This means the borrower makes two payments annually, reducing the loan principal and interest accordingly. Tracking these payments in Excel ensures accurate monitoring of due dates, amounts, and remaining balances on a semi-annual basis.

How do you configure a payment schedule in Excel to reflect semi-annual intervals for a loan?

To configure a semi-annual payment schedule in Excel for your loan, set the payment dates at six-month intervals using the EDATE function, such as =EDATE(start_date, 6*n), where n represents each payment period. Input your principal, interest rate, and payment amount to calculate and track each installment accurately. This setup ensures clear tracking of your loan payments every six months within your Loan Payment Tracker.

Which Excel functions are most useful for calculating due dates and payment amounts for semi-annual loan payments?

Excel functions like EDATE and DATE are essential for calculating semi-annual due dates by adding six-month intervals to the loan start date. PMT function accurately computes payment amounts based on interest rates, loan term, and principal for semi-annual payments. Combining these functions streamlines tracking and managing loan payments every six months in your Loan Payment Tracker.

How can you automate reminders or status updates in Excel for upcoming semi-annual loan payments?

You can automate reminders for upcoming semi-annual loan payments in Excel by using conditional formatting combined with formula-based alerts that highlight due dates approaching within a specified period. Excel's built-in functions like TODAY() and IF() help track payment status, while VBA macros or Power Automate workflows can send email notifications automatically. This setup ensures timely updates and efficient loan payment tracking directly within your spreadsheet.

What columns are essential in a loan payment tracker to effectively monitor semi-annual payments?

Essential columns in a loan payment tracker for semi-annual payments include Payment Date, Payment Amount, Interest Paid, Principal Paid, Remaining Balance, and Due Date. You should also include columns for Loan Account Number and Payment Status to enhance tracking accuracy. These elements ensure clear monitoring of each semi-annual payment and overall loan progress.