The Semi-annually Budget Planner Excel Template for Nonprofits enables organizations to efficiently track and manage their finances every six months. This template helps in forecasting expenses, monitoring funding sources, and ensuring transparent financial reporting critical for nonprofit success. Its user-friendly design supports accurate budgeting, making it easier to maintain fiscal responsibility and achieve mission-driven goals.

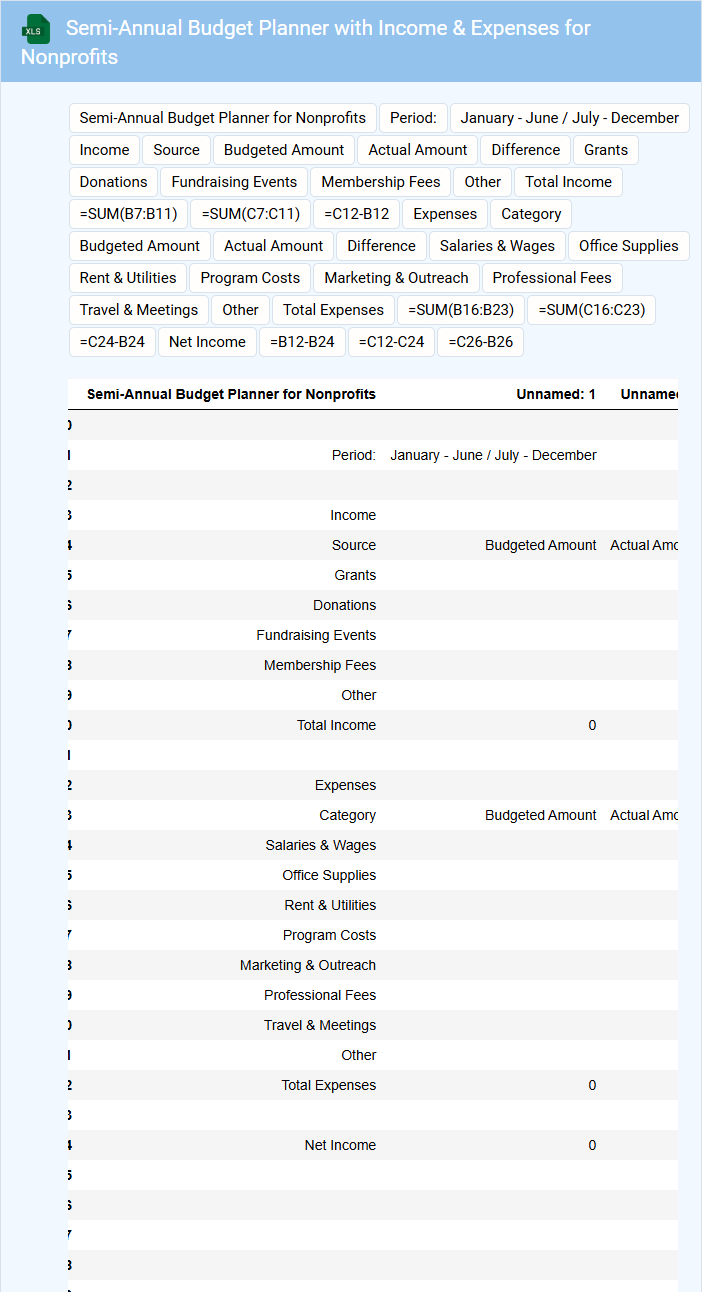

Semi-Annual Budget Planner with Income & Expenses for Nonprofits

A Semi-Annual Budget Planner for nonprofits typically contains detailed forecasts of income and expenses over a six-month period. It helps organizations allocate resources effectively to meet their financial goals. This document is crucial for tracking funding sources and planned expenditures.

Key components include categorizing various income streams such as donations, grants, and fundraising events along with fixed and variable expenses. Maintaining accurate records ensures transparency and accountability. Regular updates and reviews are important to adjust for any financial changes or unexpected costs.

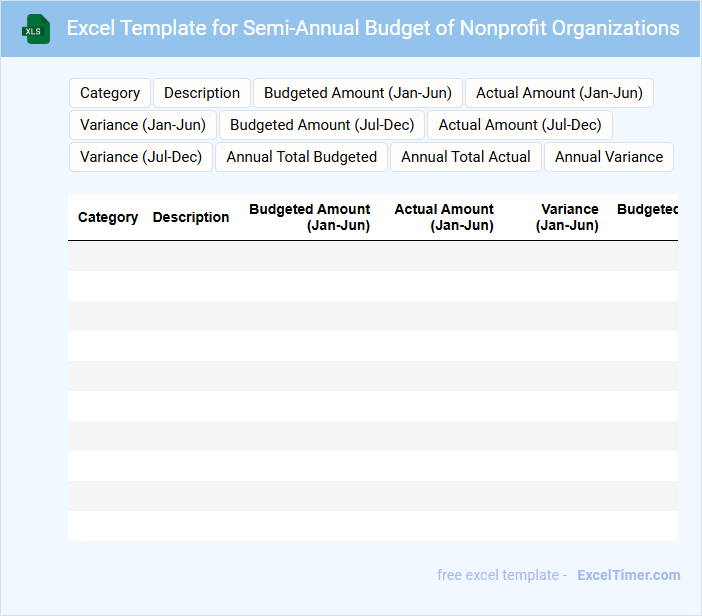

Excel Template for Semi-Annual Budget of Nonprofit Organizations

An Excel Template for Semi-Annual Budget of Nonprofit Organizations is typically designed to track and manage income and expenses over a six-month period. It helps nonprofits maintain financial transparency and ensure funds are allocated according to their mission.

This document usually includes sections for revenue sources, program expenses, administrative costs, and fundraising activities. Including clear categories and automated calculations is important to enhance accuracy and ease of use in budget planning.

Budget Tracking Sheet with Categories for Nonprofit Semi-Annually

A Budget Tracking Sheet with Categories for Nonprofit Semi-Annually typically contains detailed financial records organized by expense and income categories to monitor and manage the organization's budget every six months.

- Expense Categories: Clearly defined expense categories help track spending and ensure alignment with budget goals.

- Income Sources: Identification of all income streams allows for accurate revenue tracking and forecasting.

- Regular Updates: Semi-annual reviews provide opportunities to adjust budget plans based on actual financial performance.

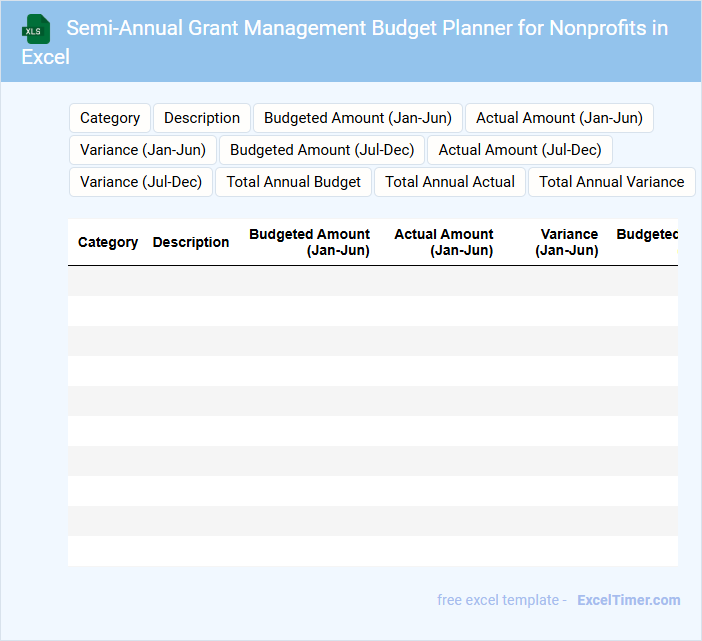

Semi-Annual Grant Management Budget Planner for Nonprofits in Excel

A Semi-Annual Grant Management Budget Planner is a vital document designed to help nonprofits track and allocate funds efficiently over a six-month period. It usually contains detailed budget categories, expense forecasts, and funding sources to ensure transparent and strategic financial planning. For optimal use, nonprofits should regularly update their planner and compare actual expenditures against projections to maintain financial accountability.

Donation Income vs Expense Tracker for Nonprofits with Semi-Annual Focus

A Donation Income vs Expense Tracker for nonprofits is a crucial document that records all incoming donations and outgoing expenses over a specified period. It helps organizations maintain transparency and ensure financial accountability by providing a clear overview of funds. Typically, this tracker emphasizes a semi-annual focus to evaluate financial health and plan future budgeting effectively.

Important elements to include are detailed categories of income sources, clear expense classifications, and regular reconciliation dates. Accurate tracking enables nonprofits to monitor fund allocation, comply with regulations, and report to stakeholders confidently. Integrating visual summaries such as charts or graphs can enhance data interpretation and strategic decision-making.

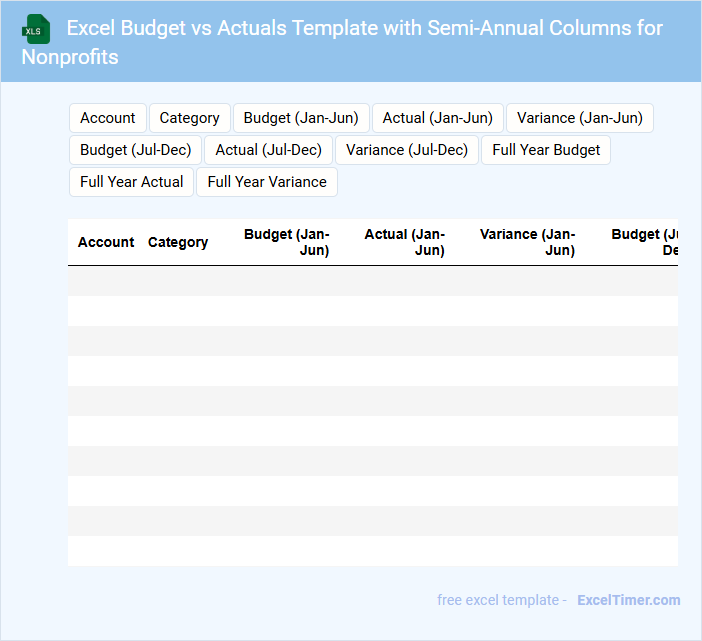

Excel Budget vs Actuals Template with Semi-Annual Columns for Nonprofits

An Excel Budget vs Actuals Template with Semi-Annual Columns is typically used by nonprofits to track and compare their financial performance across two six-month periods. It contains budgeted amounts, actual expenses, and variances to help organizations monitor their financial health effectively.

This type of document also includes detailed line items for income and expenditures, enabling clear visibility of where funds are allocated and spent. For nonprofits, an important suggestion is to ensure accurate and timely data entry to maintain up-to-date financial oversight.

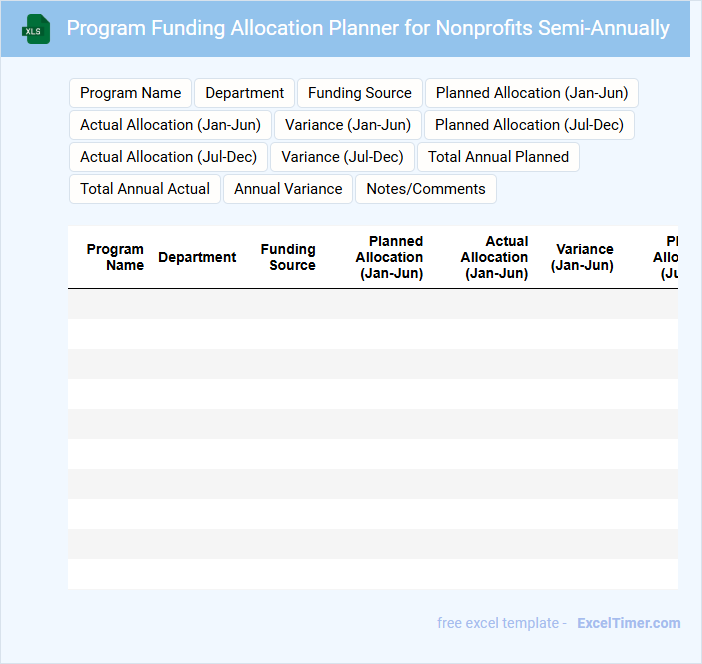

Program Funding Allocation Planner for Nonprofits Semi-Annually

A Program Funding Allocation Planner for nonprofits is a structured document that outlines how financial resources are distributed across various initiatives over a semi-annual period. It helps organizations ensure their budgets align with strategic goals and program priorities effectively.

This type of document typically contains detailed budget breakdowns, funding sources, and timelines for expenditures. An important consideration is regularly updating the planner to reflect changes in funding availability and program needs.

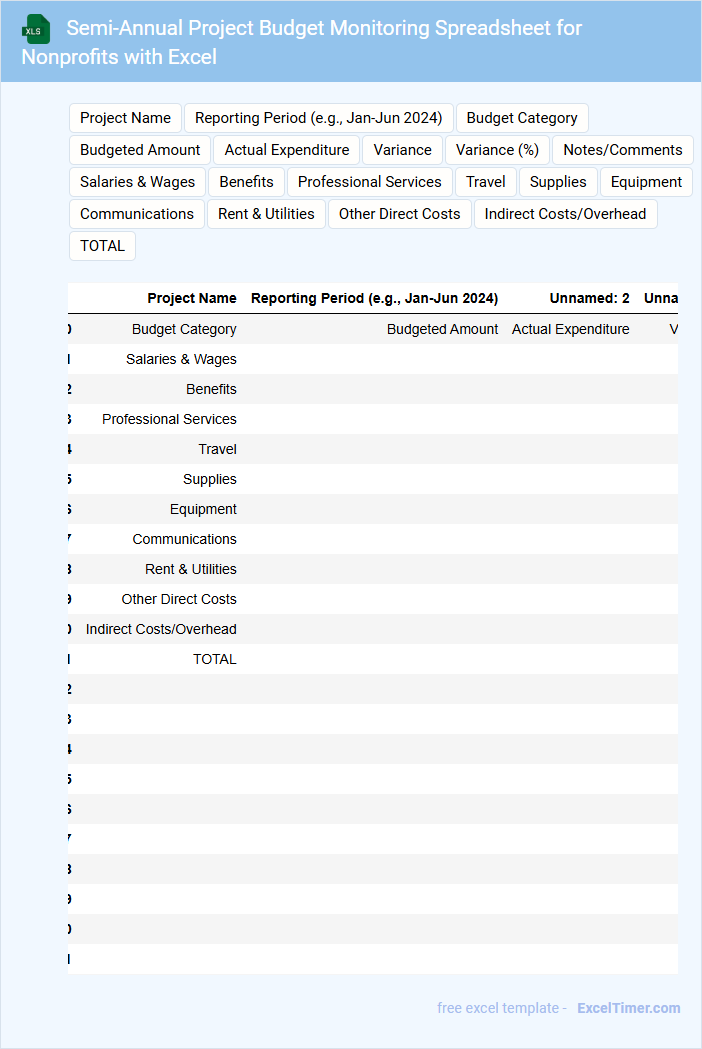

Semi-Annual Project Budget Monitoring Spreadsheet for Nonprofits with Excel

A Semi-Annual Project Budget Monitoring Spreadsheet for nonprofits typically includes detailed financial tracking for expenses and funding across a six-month period. It contains categorized budget items, actual expenditures, and variance analysis to ensure transparency and accountability. Using Excel allows for dynamic updates and easy visualization of financial data, helping organizations maintain control over their project budgets.

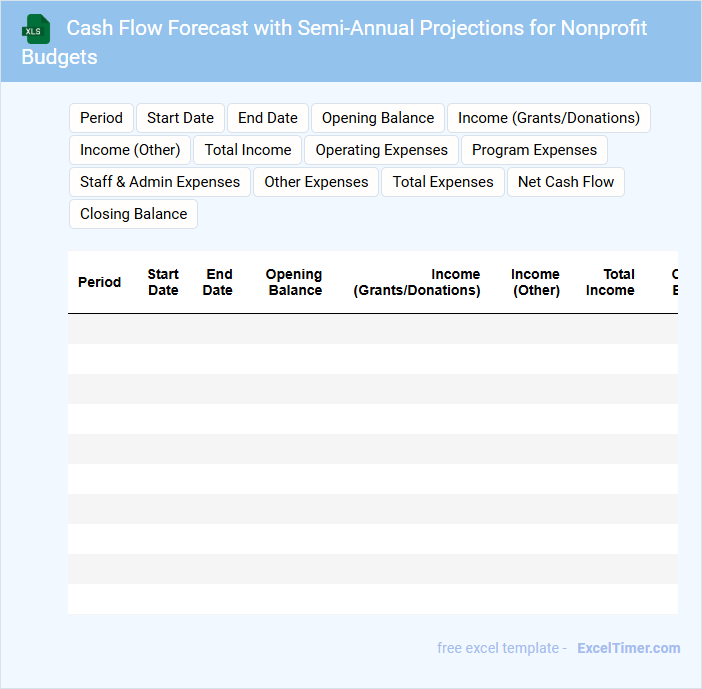

Cash Flow Forecast with Semi-Annual Projections for Nonprofit Budgets

A Cash Flow Forecast with semi-annual projections is a crucial financial document used by nonprofits to predict incoming and outgoing cash over six-month intervals. It helps organizations anticipate periods of surplus or shortfall, ensuring they can maintain operations and meet funding commitments. This forecast typically contains projected revenue streams, expected expenses, and timing details to optimize financial planning and decision-making.

For nonprofits, it is important to include detailed grant disbursement schedules, donor pledge timelines, and periodic program expenditures. Highlighting assumptions for variable income sources and clearly indicating reserve requirements can improve accuracy and reliability. Regular updates based on actual cash flows help maintain the forecast's relevance and support strategic financial stewardship.

Excel Template for Semi-Annual Expense Tracking of Nonprofits

Excel Templates for Semi-Annual Expense Tracking provide nonprofits with an organized way to monitor and manage their finances over a six-month period. These documents typically include categories for different expense types, budget comparisons, and summary reports to ensure financial transparency. Using such templates helps nonprofits maintain accurate records, forecast future expenses, and comply with reporting requirements. It is important to regularly update the template with actual expenses and review variances to stay on budget and identify areas for cost savings.

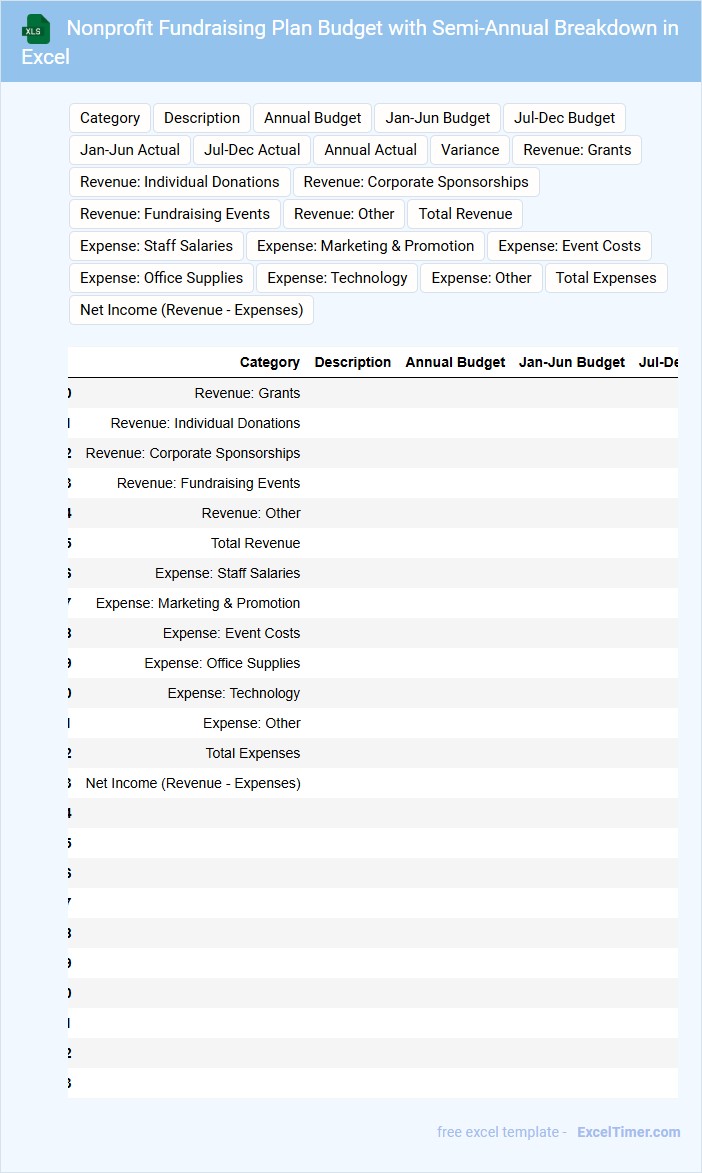

Nonprofit Fundraising Plan Budget with Semi-Annual Breakdown in Excel

A Nonprofit Fundraising Plan Budget with a semi-annual breakdown in Excel typically contains detailed financial projections and expense allocations for fundraising activities over two six-month periods. This document helps organizations plan and track income from donations, grants, and events, ensuring resources are adequately distributed.

Including clear categories such as marketing, event costs, and staff expenses is crucial for transparency and accountability. It is important to regularly update the Excel sheet to reflect actual versus projected figures for effective financial management.

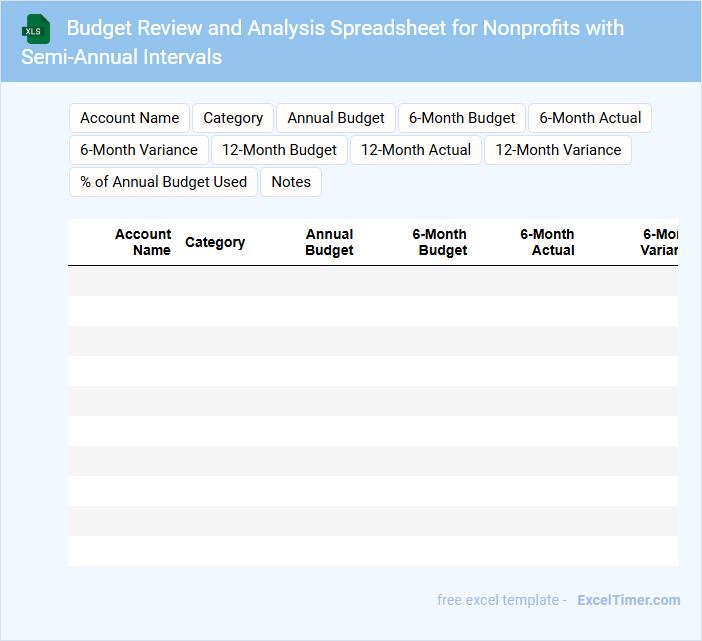

Budget Review and Analysis Spreadsheet for Nonprofits with Semi-Annual Intervals

A Budget Review and Analysis Spreadsheet for nonprofits typically contains detailed financial data, including income sources, expense categories, and allocation summaries segmented by semi-annual intervals. It is designed to help organizations track spending patterns and ensure funds are used effectively to meet program goals.

Such documents often feature comparative analyses between planned and actual budgets, highlighting variances and trends over time for better financial decision-making. Regular updates and clear visualizations within the spreadsheet are crucial to maintain transparency and support strategic adjustments.

Spreadsheet for Tracking Grants and Expenses of Nonprofits Semi-Annually

What information is typically included in a spreadsheet for tracking grants and expenses of nonprofits semi-annually? This type of document usually contains detailed records of all grant funds received, allocated, and spent during a six-month period. It also includes categorization of expenses, dates of transactions, grantor details, and remaining balances to ensure accurate financial monitoring and reporting.

What are important considerations when creating such a spreadsheet? It is essential to maintain clarity and consistency in labeling each entry to facilitate audits and compliance. Additionally, including summary sections and automated formulas for totals and variances can greatly enhance accuracy and ease of financial review.

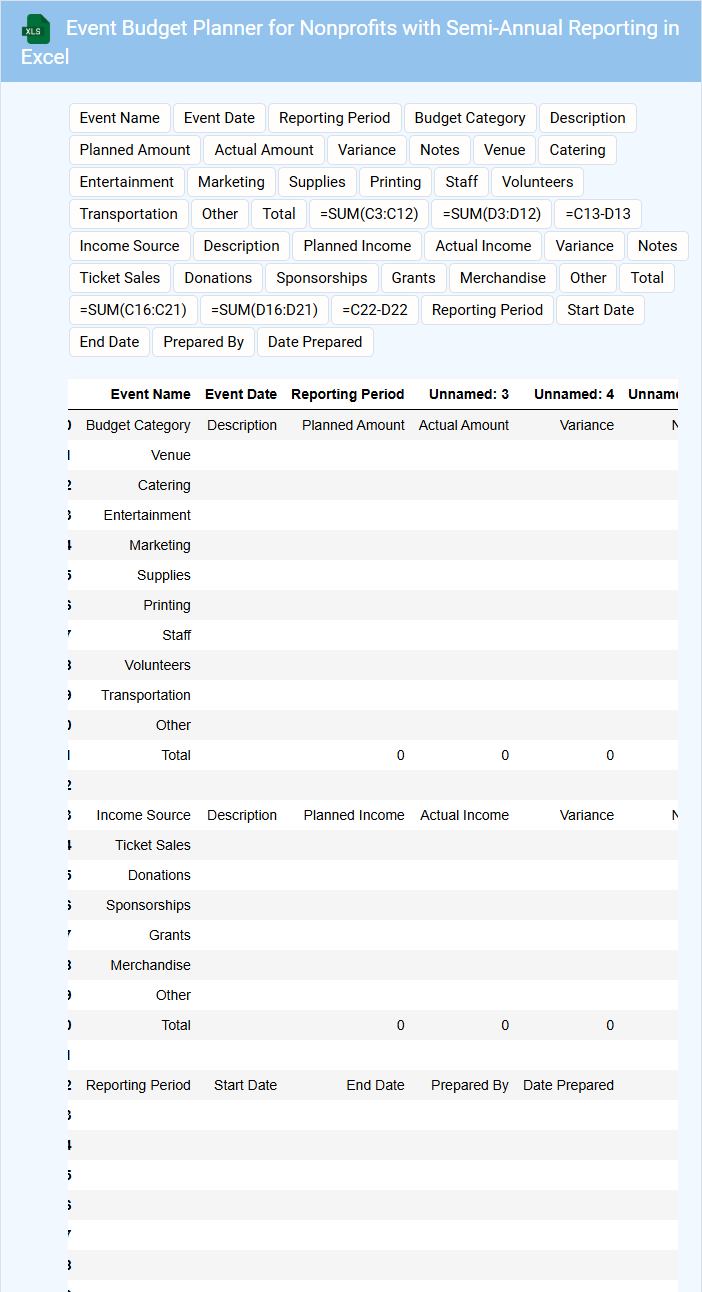

Event Budget Planner for Nonprofits with Semi-Annual Reporting in Excel

An Event Budget Planner for nonprofits typically contains detailed cost estimates, income projections, and expense tracking tailored to organizational goals. This type of document ensures transparent financial management and facilitates semi-annual reporting to stakeholders. Key components include venue costs, marketing expenses, staffing, and projected donations or ticket sales, all organized within an Excel spreadsheet for easy updates and analysis.

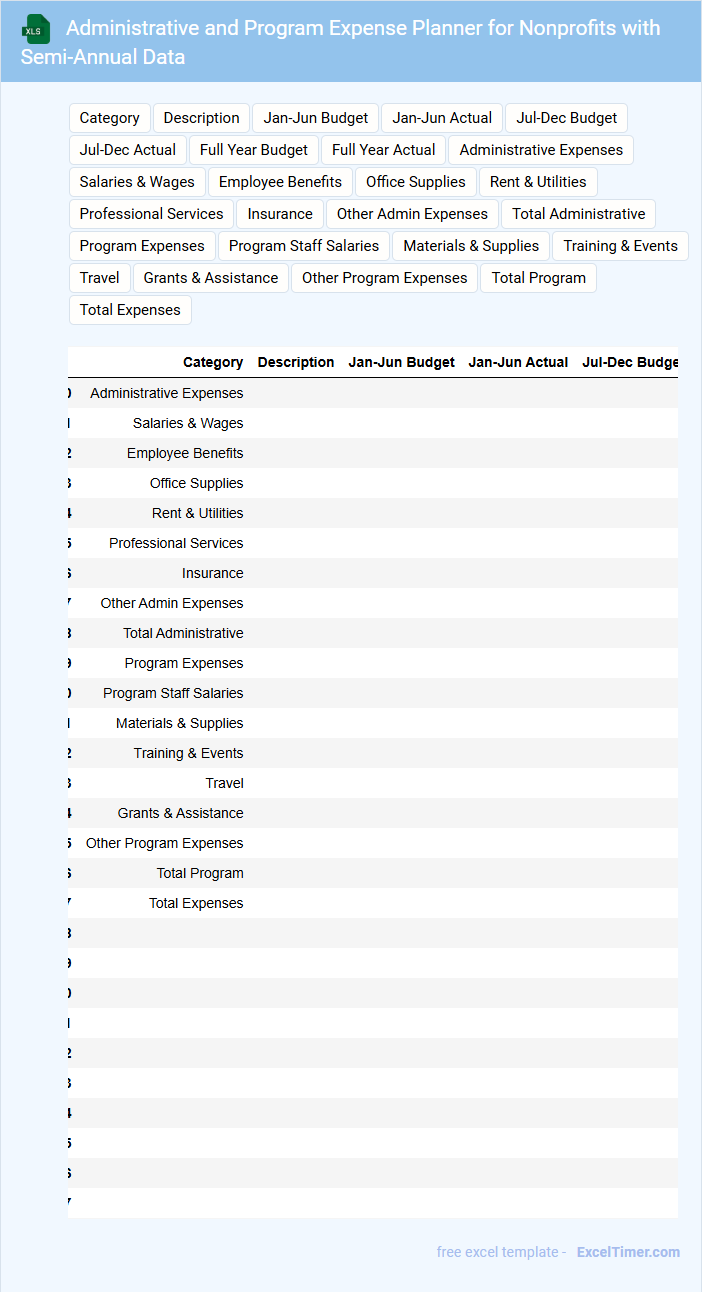

Administrative and Program Expense Planner for Nonprofits with Semi-Annual Data

What information is typically included in an Administrative and Program Expense Planner for Nonprofits with Semi-Annual Data? This document usually contains detailed budgets and actual expense tracking for both administrative and program-related costs over two six-month periods. It helps organizations monitor financial performance, ensure accountability, and allocate resources efficiently.

What are important considerations when using this planner? It is crucial to maintain accurate and timely data entry, distinguish between fixed and variable expenses, and regularly review the planner to identify trends or variances that may impact the nonprofit's financial health.

What key income and expense categories should be included in a semi-annual budget planner for nonprofits?

Key income categories for your semi-annual nonprofit budget planner include grants, donations, fundraising events, and program service revenue. Essential expense categories cover salaries and wages, program costs, administrative expenses, and fundraising costs. Tracking these categories ensures accurate financial planning and resource allocation.

How does the semi-annual timeline affect cash flow projections and funding cycles for nonprofits?

The semi-annual timeline in a budget planner allows nonprofits to forecast cash flow with greater precision by aligning income and expenses every six months. This schedule supports more accurate funding cycles, ensuring timely grant applications and donor engagement. It enhances financial stability by providing clearer visibility into mid-year budget adjustments and resource allocation.

What formulas or functions can automate variance analysis between budgeted and actual figures in Excel?

Use the formula "=Actual - Budgeted" to calculate variance for each category in your Semi-annually Budget Planner for Nonprofits. Incorporate the "ABS" function to analyze the magnitude of variance regardless of direction. Apply conditional formatting or the "IF" function to highlight significant variances exceeding predefined thresholds.

How can restricted and unrestricted funds be tracked and differentiated within the budget spreadsheet?

In the Semi-annually Budget Planner for Nonprofits, restricted and unrestricted funds can be tracked by creating separate columns or tabs labeled specifically for each fund type. Use distinct account codes and detailed descriptions to categorize income and expenses accurately, facilitating clear differentiation. Implement formulas to sum totals separately, providing transparent financial reporting and compliance with funding requirements.

What visual tools (charts, graphs) are most effective for presenting financial trends to nonprofit stakeholders in Excel?

Line charts effectively illustrate financial trends over time, highlighting income and expense fluctuations for nonprofit stakeholders. Bar charts compare budget categories or project expenses, aiding in clear allocation analysis. Pie charts visualize budget proportions, making fund distribution easily understandable for decision-makers.