![]()

The Semi-annually Excel Template for Loan Payment Tracking simplifies monitoring loan payments made every six months, ensuring accuracy and timeliness. It provides clear visualization of payment schedules, outstanding balances, and interest accrued, helping users manage their loans efficiently. Utilizing this template reduces errors and enhances financial planning by keeping precise semi-annual payment records.

Semi-Annually Loan Payment Tracker with Amortization Schedule

A Semi-Annually Loan Payment Tracker with an amortization schedule typically contains detailed information on loan repayments made every six months. It outlines the principal and interest components of each payment along with the remaining balance after each interval. This type of document is essential for monitoring loan progress and managing repayment plans effectively.

Important elements to include in such a tracker are the payment dates, amounts allocated to interest versus principal, and the updated loan balance after each payment. Additionally, providing a clear amortization schedule helps borrowers visualize the payoff timeline and interest expense over the life of the loan. Ensuring accuracy and clarity in these records supports better financial planning and loan management.

Excel Template for Tracking Semi-Annual Loan Payments

An Excel Template for tracking semi-annual loan payments is typically designed to organize and monitor payment schedules, interest calculations, and outstanding balances efficiently. It helps users maintain a clear overview of their loan obligations over each six-month period.

Such documents often include columns for payment dates, amounts, interest rates, and cumulative totals to ensure accuracy and timely payments. It's important to regularly update the template and verify formulas to prevent errors and maintain financial clarity.

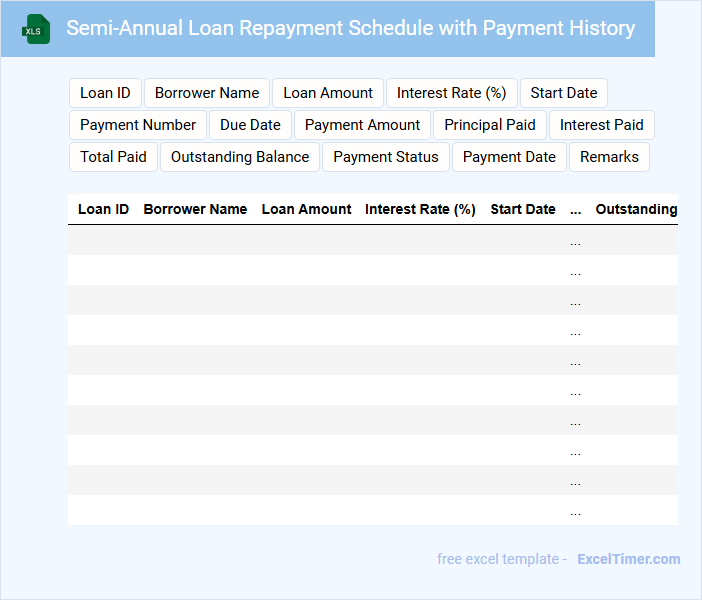

Semi-Annual Loan Repayment Schedule with Payment History

A Semi-Annual Loan Repayment Schedule document typically contains a detailed timeline of payment dates and amounts due every six months. It includes a comprehensive payment history that tracks all past payments, showing dates, amounts, and any outstanding balances. This information is crucial for borrowers and lenders to monitor loan progress and ensure timely repayments. Important suggestions for this document include maintaining accurate records, updating payment statuses promptly, and clearly highlighting any missed or late payments for transparency.

Loan Payment Tracker with Semi-Annual Frequency

A Loan Payment Tracker with semi-annual frequency is a document designed to monitor and record loan repayments made every six months. It typically contains details such as payment dates, amounts paid, outstanding principal, and accrued interest. This tracker helps borrowers stay organized and ensures timely payments, preventing defaults and maintaining a good credit score.

Important features to include are clear due dates, payment status indicators, and a summary of total interest paid. Including a section for notes on any changes in loan terms or payment delays can be helpful. Accurate record-keeping in this document simplifies financial planning and loan management.

Detailed Semi-Annual Loan Ledger for Payment Tracking

A Detailed Semi-Annual Loan Ledger for Payment Tracking typically contains comprehensive records of all loan transactions and payment statuses over a six-month period.

- Transaction Details: Clearly itemize each payment date, amount, and remaining balance to ensure accuracy in tracking.

- Interest Calculations: Include detailed interest accrued and applied for full transparency on loan costs.

- Payment History Summary: Provide a concise overview of on-time and late payments to monitor borrower reliability.

Semi-Annual Payment Tracking Template for Personal Loans

What information is typically included in a Semi-Annual Payment Tracking Template for Personal Loans? This type of document usually contains details such as payment dates, amounts paid, remaining balances, and any interest accrued over the period. It helps borrowers monitor their payment schedule and manage loan repayments efficiently.

What important aspects should be considered when using this template? It is essential to keep the template updated with accurate payment records and include reminders for upcoming payments to avoid missed deadlines. Additionally, summarizing total payments made and interest paid can provide a clear financial overview for better planning.

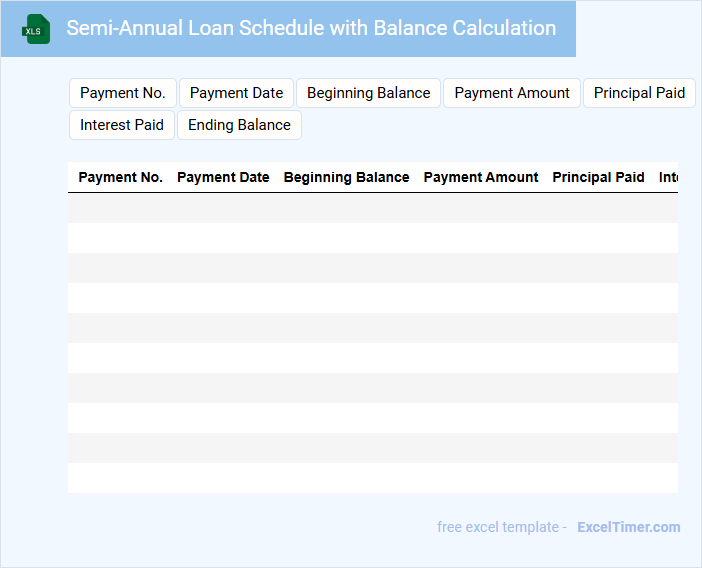

Semi-Annual Loan Schedule with Balance Calculation

A Semi-Annual Loan Schedule typically contains a detailed timeline of payment dates and amounts due every six months. It includes calculations of remaining balances after each payment to provide a clear financial overview. This document is essential for tracking loan repayment progress and forecasting future obligations.

Excel Tracker for Semi-Annual Loan Installments

An Excel Tracker for Semi-Annual Loan Installments typically contains detailed entries of payment dates, amounts, and outstanding balances. It enables users to monitor loan repayment schedules efficiently and avoid missed payments.

Important components include precise due dates and accurate installment calculations to maintain financial discipline. Regular updates and clear formatting enhance usability and accuracy for effective loan management.

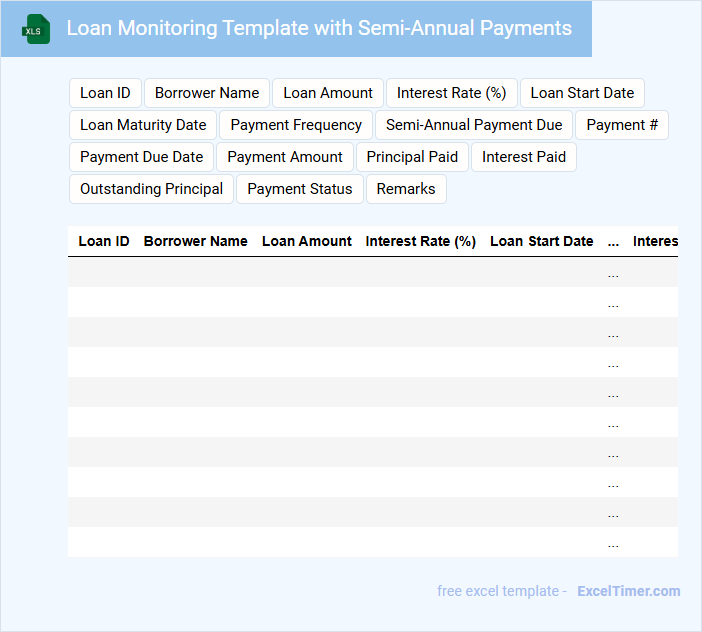

Loan Monitoring Template with Semi-Annual Payments

A Loan Monitoring Template with Semi-Annual Payments is a structured document used to track loan repayments every six months. It helps ensure timely payments and accurate record-keeping for both lenders and borrowers.

- Include details of the loan amount, interest rate, and payment schedule for clarity.

- Record each payment date and amount to monitor adherence to the repayment plan.

- Track outstanding principal and interest balances after every semi-annual payment.

Semi-Annual Loan Payment Log for Financial Planning

A Semi-Annual Loan Payment Log is a document used to track loan payments made every six months, ensuring accurate financial records. It typically contains payment dates, amounts paid, remaining balances, and interest calculations. This log is essential for effective financial planning and helps in managing debt repayment schedules efficiently.

Loan Repayment Register with Semi-Annual Tracking

A Loan Repayment Register with semi-annual tracking is a document used to systematically record and monitor loan repayments over six-month intervals. It typically contains details such as payment dates, amounts paid, remaining balances, and interest accrued. This register helps ensure accurate financial management and timely repayments by providing a clear overview of obligations and progress.

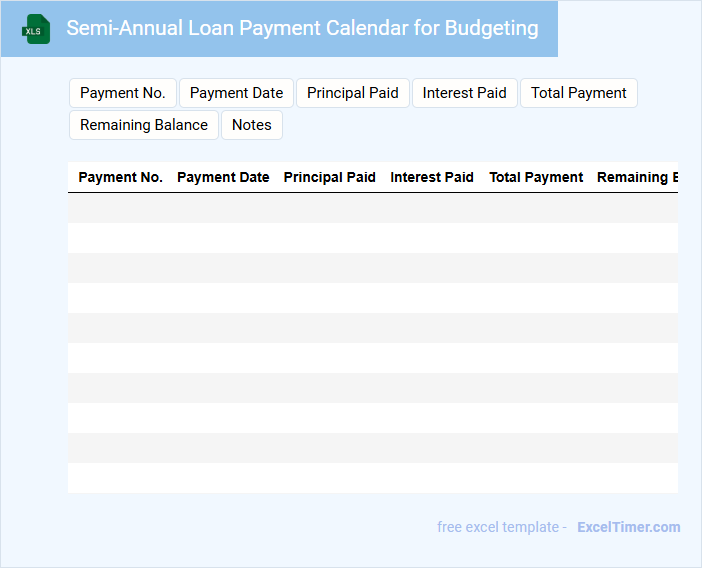

Semi-Annual Loan Payment Calendar for Budgeting

A Semi-Annual Loan Payment Calendar typically contains scheduled dates and amounts for loan repayments made twice a year. This document helps individuals or businesses track due dates to ensure timely payments, avoiding penalties and maintaining good credit. For effective budgeting, it is crucial to include interest rates, payment breakdowns, and any potential fees in the calendar.

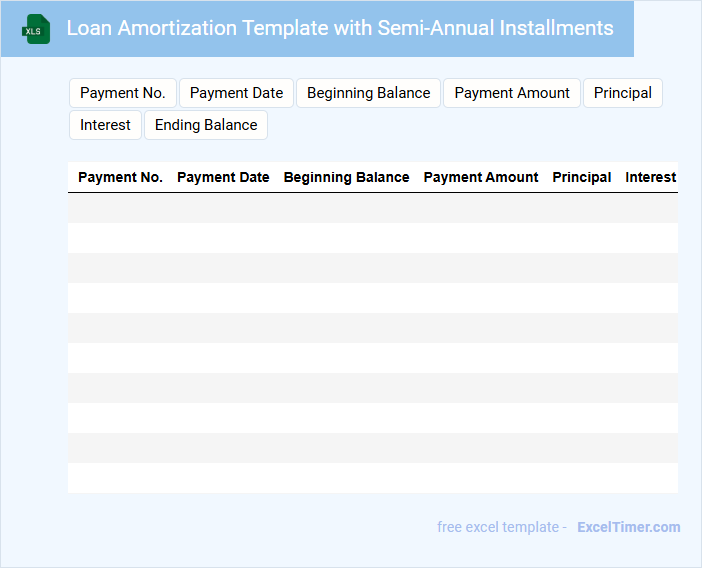

Loan Amortization Template with Semi-Annual Installments

What information does a Loan Amortization Template with Semi-Annual Installments typically contain? This type of document usually includes the loan amount, interest rate, payment schedule, and the breakdown of principal and interest for each semi-annual installment. It is designed to help borrowers and lenders track loan repayment over time in equal half-yearly payments.

What important factors should be considered when using this template? It is essential to ensure the correct interest compounding period matches the semi-annual payment frequency, and to verify that each installment accurately reflects both principal reduction and interest charges. Additionally, the template should provide a clear summary of total payments and remaining balance after each installment.

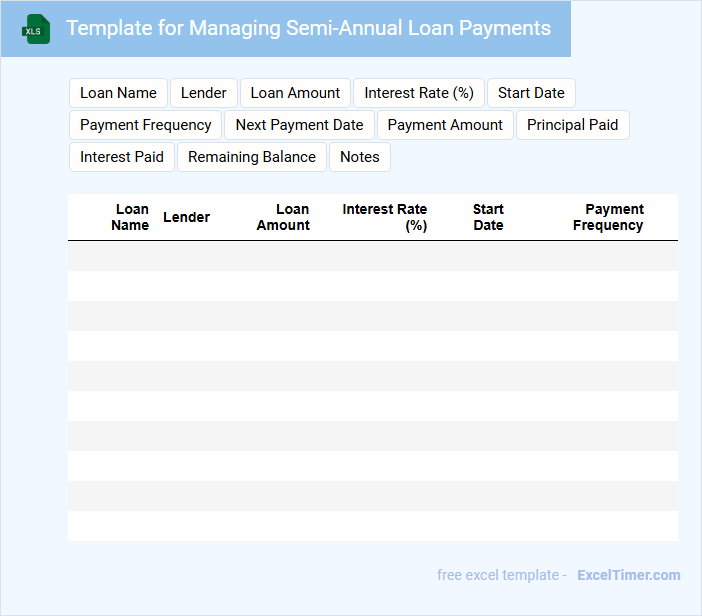

Template for Managing Semi-Annual Loan Payments

A Template for Managing Semi-Annual Loan Payments typically contains detailed schedules outlining payment dates and amounts. It helps borrowers and lenders keep track of interest calculations and principal reductions over time. Ensuring accurate payment records and clear documentation is essential for effective loan management.

Semi-Annual Loan Dues Tracking Excel Sheet

The Semi-Annual Loan Dues Tracking Excel Sheet typically contains detailed records of loan amounts, due dates, and payment statuses updated every six months. It helps in maintaining a clear overview of outstanding balances and payment schedules.

Key elements include borrower information, principal and interest details, and reminders for upcoming payments. Ensuring accuracy and timely updates in this document is crucial for effective loan management and avoiding defaults.

How does setting loan payments to a semi-annual schedule affect interest calculations in the Excel document?

Setting loan payments to a semi-annual schedule in your Excel document adjusts interest calculations by compounding interest twice a year instead of monthly or quarterly. This change reduces the number of payment periods, affecting the total interest accrued and the amortization timeline. Your loan tracking becomes more aligned with less frequent, higher payment amounts, which is crucial for accurate financial planning.

What Excel functions can be used to accurately track semi-annual payment dates for a loan?

You can use the EDATE function in Excel to calculate semi-annual payment dates by adding six months to the original loan date. The DATE and YEAR functions help verify the accuracy of payment intervals by breaking down and reconstructing the dates. Combining these functions ensures precise tracking of your loan's semi-annual payment schedule.

How do you structure amortization tables in Excel for loans with semi-annual payments?

Create amortization tables in Excel by listing payment dates every six months alongside calculated principal, interest, and remaining balance for each semi-annual payment. Use the PMT, IPMT, and PPMT functions to accurately compute payment amounts based on loan terms, rate, and payment frequency. Organize columns for Payment Number, Payment Date, Payment Amount, Interest Portion, Principal Portion, and Ending Balance for clear loan tracking.

What key columns are necessary in an Excel spreadsheet to monitor semi-annual loan payments and remaining balances?

Key columns for tracking semi-annual loan payments in Excel include Payment Date, Payment Amount, Interest Accrued, Principal Paid, and Remaining Balance. Including Loan ID and Due Date helps organize multiple loans and ensures timely payments. Adding columns for Payment Status and Notes enhances tracking accuracy and communication.

How can Excel formulas be used to flag missed or late semi-annual payments in a loan tracking document?

Excel formulas like IF, TODAY, and DATE can flag missed or late semi-annual loan payments by comparing scheduled payment dates with the current date. Using conditional formatting alongside a formula such as =IF(TODAY()>DATE(year, month+6, day), "Late", "On Time") highlights overdue payments. This method streamlines tracking by automatically identifying semi-annual payments not made by their due dates.