The Semi-annually Excel Template for Nonprofit Grant Reporting streamlines the tracking and documentation of grant expenditures and progress every six months. It ensures accurate financial reporting and compliance with grant requirements, helping nonprofits maintain transparency and accountability. Utilizing this template simplifies data organization, enabling efficient updates and detailed reports for stakeholders and funders.

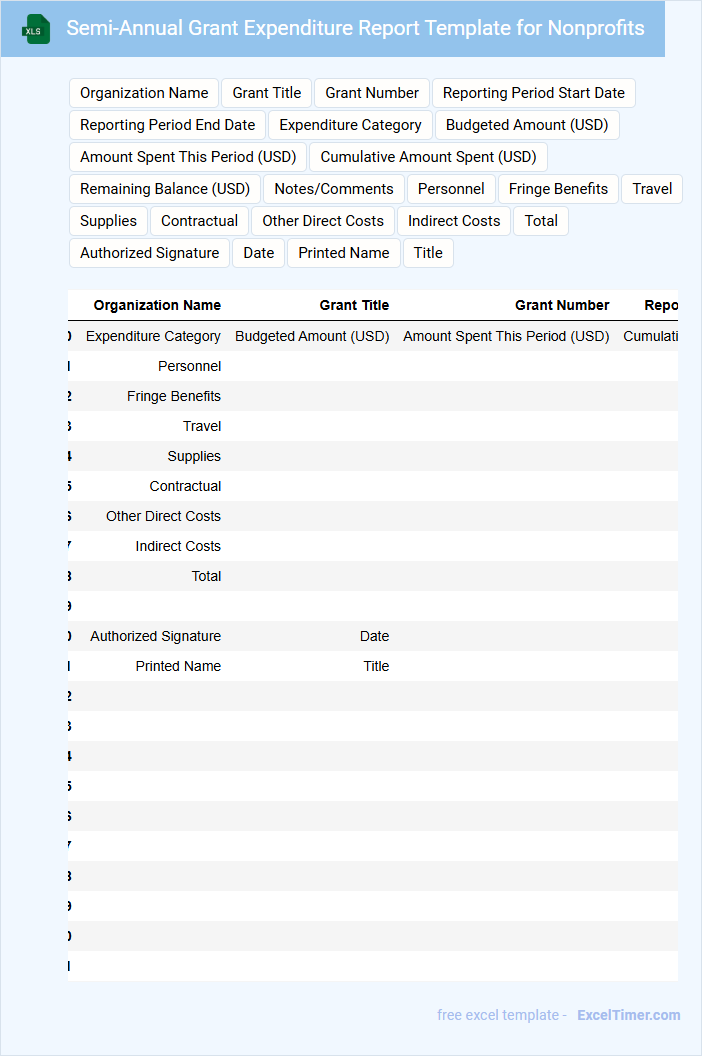

Semi-Annual Grant Expenditure Report Template for Nonprofits

Semi-Annual Grant Expenditure Reports for nonprofits typically detail the use of awarded funds over a six-month period to ensure accountability and transparency. These documents provide a financial overview and demonstrate compliance with grant requirements.

- Include a clear summary of expenses aligned with the grant budget categories.

- Highlight any variances or deviations from the approved budget and provide explanations.

- Attach supporting documentation such as receipts, invoices, and financial statements.

Nonprofit Semi-Annual Funding Utilization Tracker

What information does a Nonprofit Semi-Annual Funding Utilization Tracker typically contain? This document usually includes detailed records of funding sources, expenditure categories, and timelines for spending within a six-month period. It helps organizations monitor financial efficiency and ensure transparency in the allocation of funds.

Why is it important to track funding utilization semi-annually for nonprofits? Tracking allows for timely adjustments in budgeting and resource allocation, ensuring that projects remain on track and funds are used effectively. It also provides documentation for accountability to stakeholders and donors.

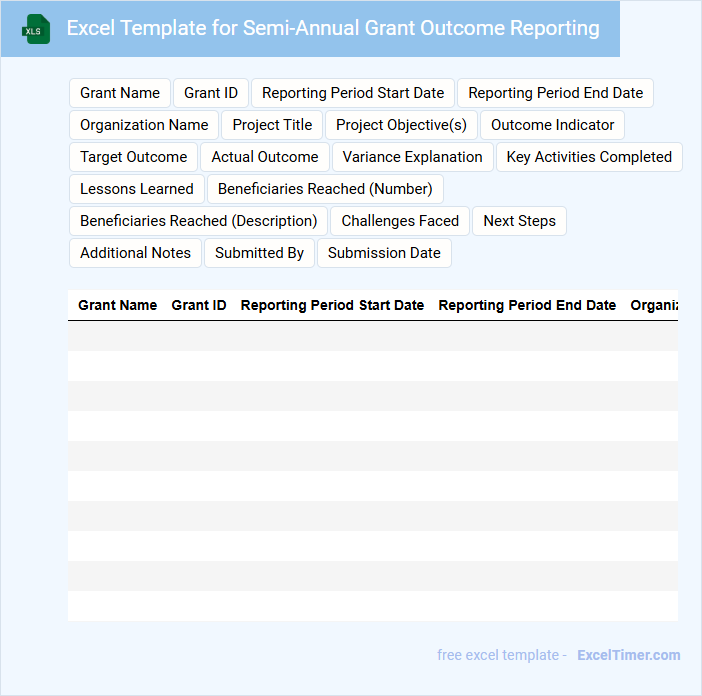

Excel Template for Semi-Annual Grant Outcome Reporting

The Excel Template for Semi-Annual Grant Outcome Reporting typically contains structured sheets for tracking grant activities and outcomes over a six-month period. It includes fields for inputting quantitative data, qualitative narratives, and financial summaries to provide a comprehensive view of progress. Key suggestions for improving this document involve ensuring clarity in data categories, integrating validation rules, and including summary dashboards for quick insight.

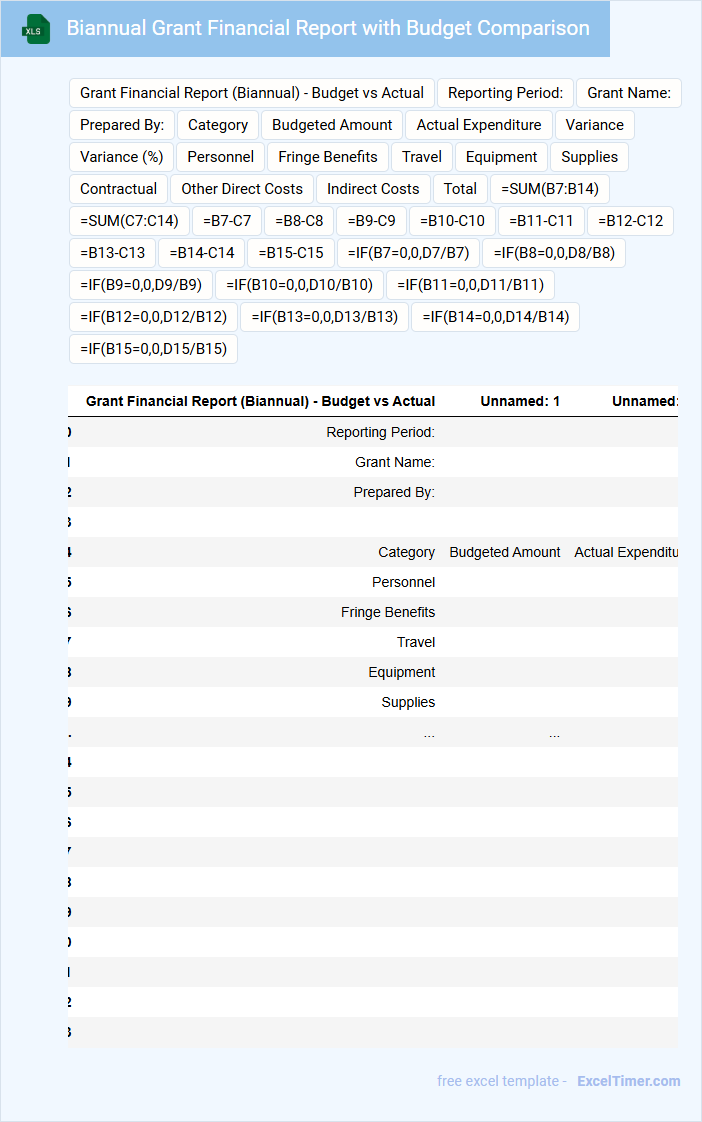

Biannual Grant Financial Report with Budget Comparison

A Biannual Grant Financial Report with Budget Comparison typically contains detailed financial data comparing actual expenditures against the planned budget over a six-month period.

- Financial Summary: Provides an overview of total funds received, spent, and remaining balances.

- Budget Comparison: Highlights variances between budgeted and actual expenses, explaining significant differences.

- Supporting Documentation: Includes receipts, invoices, and other evidence to validate reported expenditures.

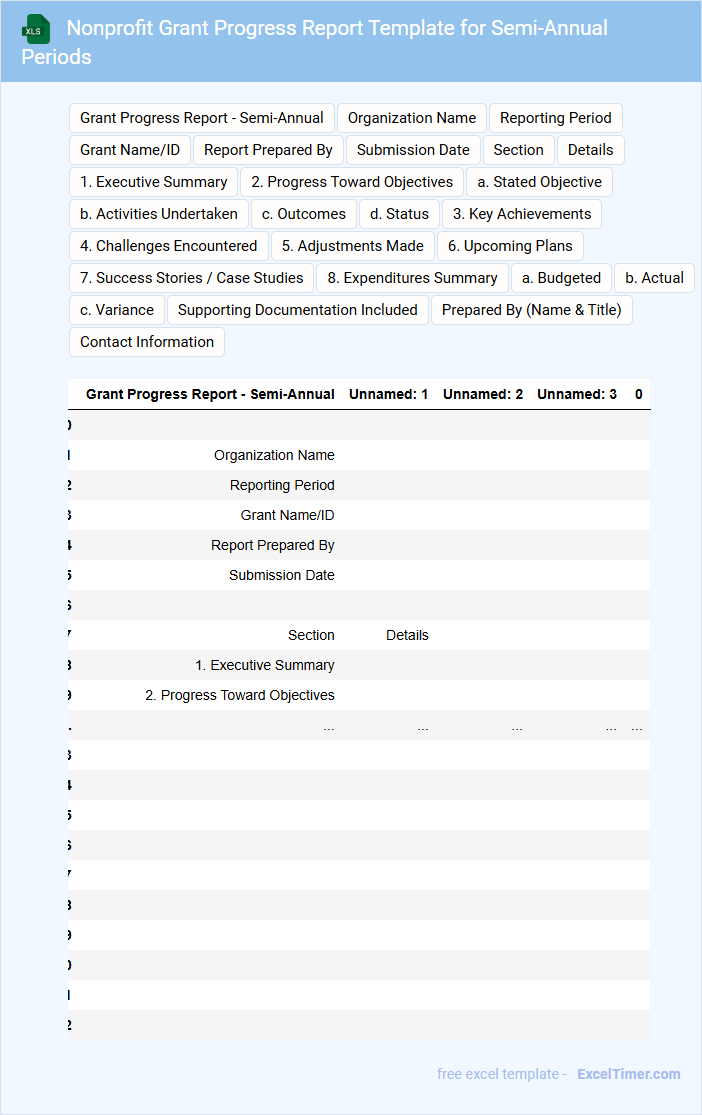

Nonprofit Grant Progress Report Template for Semi-Annual Periods

What information is typically included in a Nonprofit Grant Progress Report Template for Semi-Annual Periods? This type of document usually contains a summary of the funded project's achievements, challenges faced, and financial expenditure updates during the six-month reporting period. It helps grantors understand the nonprofit's progress, ensuring accountability and facilitating continued funding.

What is an important consideration when preparing this report? It is crucial to provide clear, accurate, and concise data that highlights outcomes relative to the grant's objectives, along with any deviations or adjustments made. Including qualitative stories or testimonials alongside quantitative metrics can strengthen the report's impact and demonstrate real-world benefits.

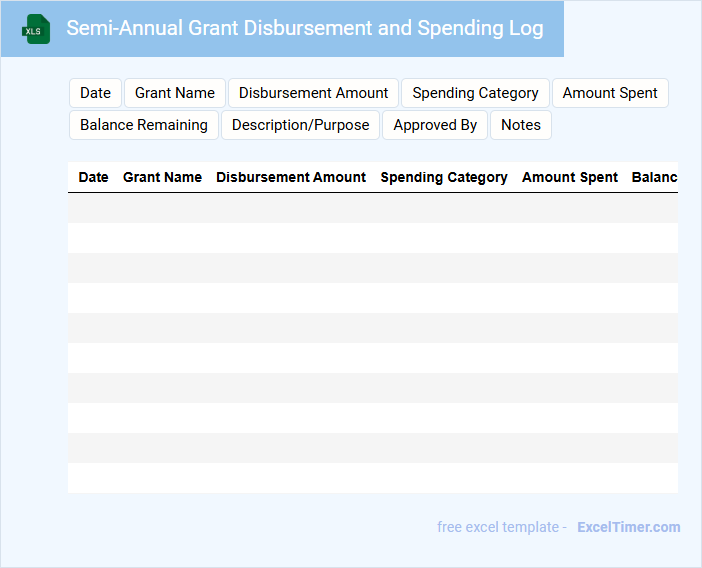

Semi-Annual Grant Disbursement and Spending Log

What information is typically recorded in a Semi-Annual Grant Disbursement and Spending Log? This document usually contains detailed entries of all funds disbursed and expenses incurred within a six-month period under a specific grant. It serves to track financial accountability and ensure funds are used according to grant guidelines.

Why is maintaining accuracy in this log important? Accurate record-keeping helps in transparent reporting to donors and regulatory bodies, aids in auditing processes, and supports effective budget management. It is crucial to regularly update the log with dates, amounts, purposes, and receipts to avoid discrepancies.

Performance Metrics Tracker for Semi-Annual Grant Reporting

A Performance Metrics Tracker for Semi-Annual Grant Reporting is a structured document that collects and monitors key data points related to project outcomes and goals. It typically includes quantitative and qualitative metrics, milestones achieved, and resources utilized within the reporting period. Consistent updating and accurate data entry are crucial to ensure transparency and demonstrate progress to stakeholders effectively.

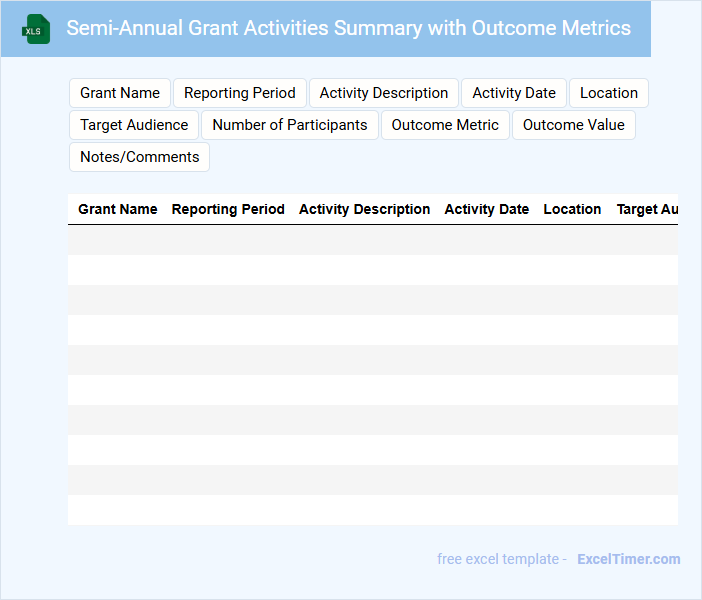

Semi-Annual Grant Activities Summary with Outcome Metrics

The Semi-Annual Grant Activities Summary is a document that typically contains an overview of the funded projects, detailed activities carried out during the reporting period, and the associated outcome metrics. It highlights the progress made towards achieving grant objectives and evaluates the effectiveness of interventions. Including clear, measurable outcome metrics is essential to demonstrate impact and inform future funding decisions.

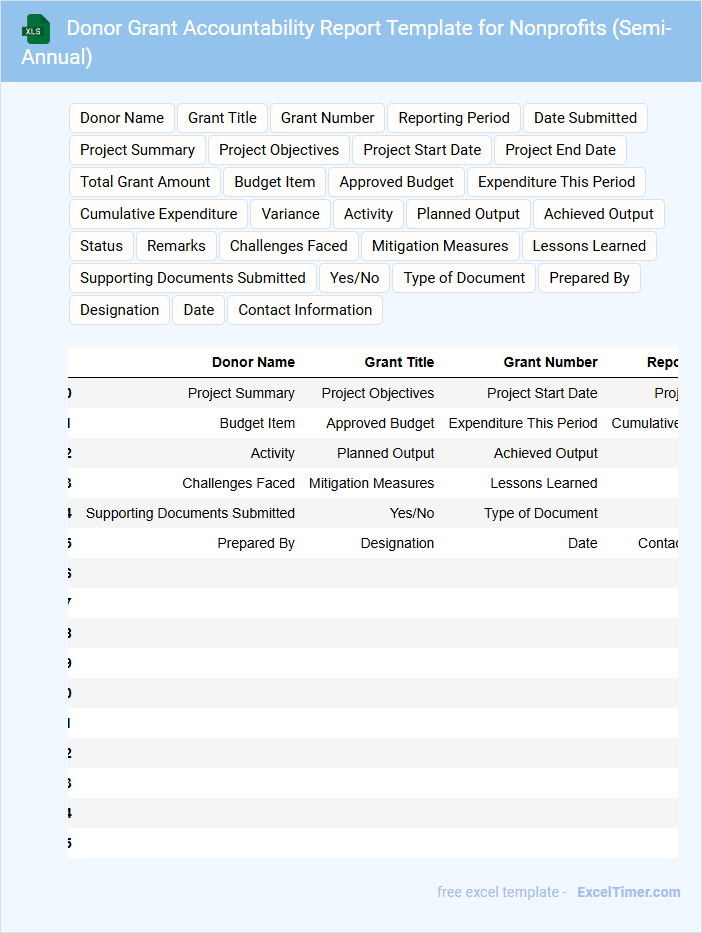

Donor Grant Accountability Report Template for Nonprofits (Semi-Annual)

This Donor Grant Accountability Report Template for Nonprofits (Semi-Annual) typically contains detailed financial summaries, project progress updates, and impact assessments to ensure transparency and stewardship of funds.

- Financial Overview: A clear summary of grant expenditures to date, ensuring funds are used appropriately.

- Project Milestones: Documentation of key activities and achievements within the reporting period.

- Impact Measurement: Evidence of the outcomes and benefits resulting from the grant-funded projects.

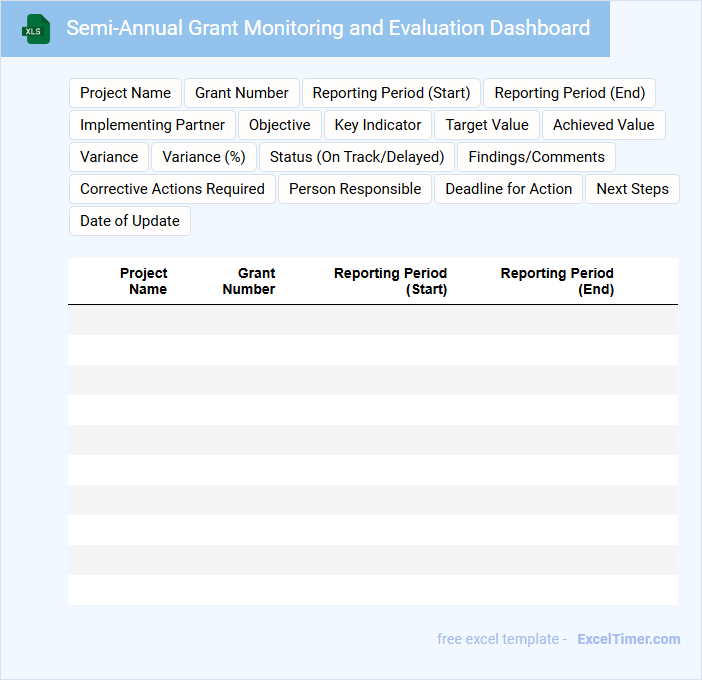

Semi-Annual Grant Monitoring and Evaluation Dashboard

This document provides an overview of grant performances and outcomes evaluated every six months to ensure alignment with project goals. It serves as a tool for tracking progress, identifying challenges, and informing decision-making.

- Include key performance indicators that reflect grant objectives and impact.

- Provide visual data representations such as charts to enhance clarity.

- Highlight recommendations and action items based on findings.

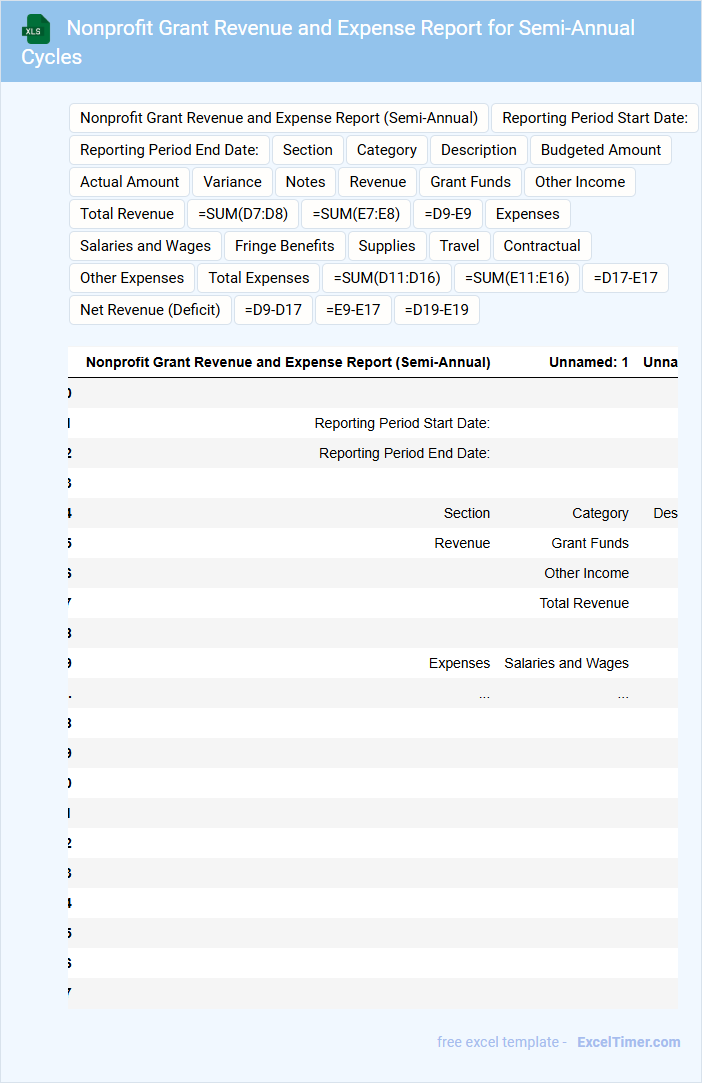

Nonprofit Grant Revenue and Expense Report for Semi-Annual Cycles

This Nonprofit Grant Revenue and Expense Report for Semi-Annual Cycles typically contains detailed financial data reflecting grant income and expenditures over six months to ensure transparent fund management.

- Grant Revenue Tracking: Summarizes all funds received from different grant sources during the reporting period.

- Expense Categorization: Breaks down expenses by category to accurately reflect how grant money is allocated.

- Compliance Verification: Ensures all reported activities meet the grant's requirements and organizational policies.

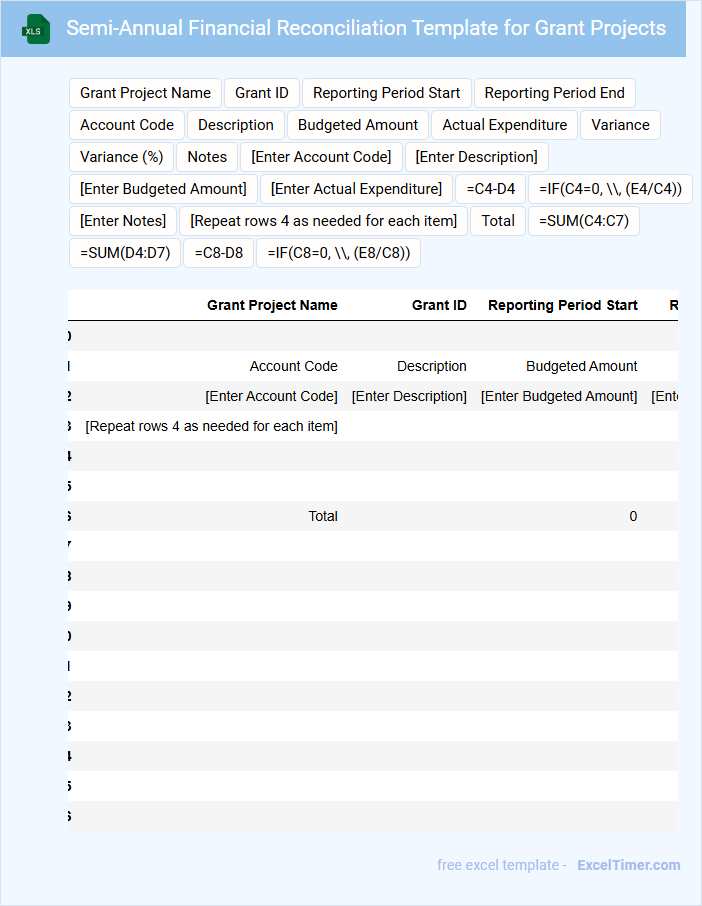

Semi-Annual Financial Reconciliation Template for Grant Projects

What information is typically included in a Semi-Annual Financial Reconciliation Template for Grant Projects? This document usually contains detailed financial summaries, including income, expenditures, and budget variances related to the grant. It helps ensure accurate tracking and accountability of funds over the reporting period.

Why is it important to maintain accuracy and clarity in this template? Precise data entry and clear categorization of costs are essential to comply with grant requirements and facilitate audits. Including supporting documentation and timely updates also enhances transparency and financial management.

Milestone Achievement Report with Budget Status (Semi-Annual)

What information does a Milestone Achievement Report with Budget Status (Semi-Annual) typically contain? This document usually details the progress made towards specific project milestones over a six-month period, including accomplished tasks and any deviations from the planned schedule. It also provides a comprehensive overview of the budget status, highlighting expenditures, remaining funds, and any financial variances.

What are important considerations when preparing this report? Clear alignment between milestones and budget usage is crucial, ensuring transparency and accountability. Additionally, including explanations for any delays or budget overruns helps stakeholders understand challenges and facilitates informed decision-making.

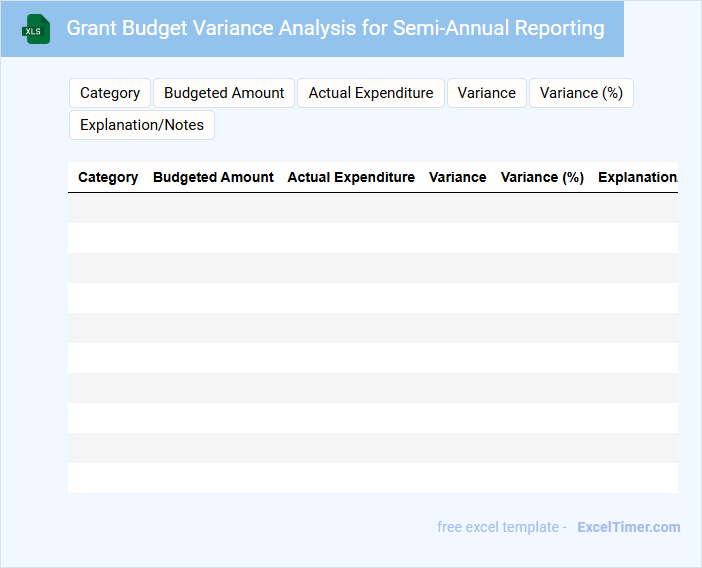

Grant Budget Variance Analysis for Semi-Annual Reporting

Grant Budget Variance Analysis for Semi-Annual Reporting is a critical financial document that compares projected budgets against actual expenditures over a six-month period. It helps organizations identify discrepancies, control spending, and ensure compliance with grant requirements. Key suggestions include accurately tracking all expenses, highlighting significant variances, and providing clear explanations for budget deviations.

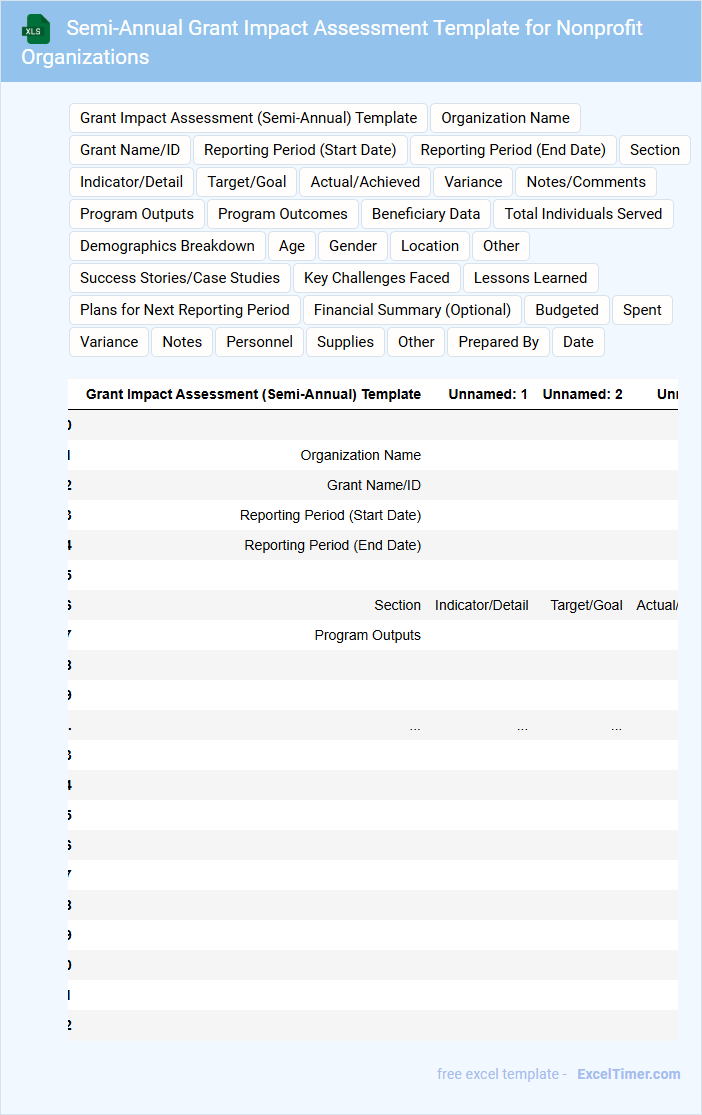

Semi-Annual Grant Impact Assessment Template for Nonprofit Organizations

The Semi-Annual Grant Impact Assessment Template for nonprofit organizations typically contains sections for outlining the objectives of the grant, detailing activities conducted, and measuring outcomes against predefined goals. It usually includes quantitative data and qualitative narratives to provide a comprehensive overview of the grant's effect. This document is essential for assessing progress and ensuring accountability to funders.

Important elements to include are clear metrics for success, evidence of community impact, and challenges encountered with proposed solutions. Incorporating beneficiary feedback and financial summaries can enhance transparency and demonstrate effective resource utilization. Regular updates based on this assessment help improve program strategies and strengthen grant renewal prospects.

What key financial metrics should be reported semi-annually in a nonprofit grant Excel document?

Key financial metrics to report semi-annually in a nonprofit grant Excel document include total grant revenue received, expenses incurred categorized by program and administrative costs, and the remaining grant balance. Tracking cash flow and variance analysis against the budget ensures financial accountability. Detailed reporting on in-kind contributions and matching funds further enhances transparency and compliance.

How should semi-annual grant funds utilization be tracked and presented in Excel?

Track semi-annual grant funds utilization in Excel by creating a detailed ledger with separate columns for grant sources, allocated amounts, expenditures, and remaining balances. Use pivot tables and charts to visualize spending trends and compliance with reporting requirements. Your spreadsheet should be structured for easy updating and clear presentation during nonprofit grant reporting cycles.

What columns are essential for documenting semi-annual program outputs and outcomes?

Essential columns for documenting semi-annual program outputs and outcomes in nonprofit grant reporting include Program Name, Reporting Period, Output Metrics (e.g., number of participants served), Outcome Indicators (e.g., percentage improvement), Data Collection Methods, and Notes on Progress or Challenges. Including Grant ID and Reporting Date ensures clear tracking and timely submissions. These columns enable transparent, data-driven evaluation of program effectiveness over each six-month interval.

How do you structure Excel formulas to calculate variances between budgeted and actual expenses for semi-annual periods?

To calculate variances between budgeted and actual expenses in semi-annual periods within an Excel document for nonprofit grant reporting, structure your formulas by referencing the budgeted amount in one cell and the actual amount in another, then subtract the actual from the budgeted value. For example, use =Budgeted_Cell - Actual_Cell for each semi-annual period to get the variance. Your Excel sheet should organize the budgeted and actual expenses in adjacent columns labeled by semi-annual periods to streamline variance tracking.

What methods can be used in Excel to ensure data accuracy and completeness in semi-annual grant reporting?

Excel offers data validation tools such as drop-down lists and input restrictions to ensure data accuracy in semi-annual nonprofit grant reporting. You can use conditional formatting to highlight incomplete entries or anomalies in your grant data. PivotTables and formula audits provide comprehensive checks for completeness and consistency in reporting periods.