The Semi-annually Excel Template for Tax Calculation streamlines the process of estimating and tracking taxes owed every six months, ensuring compliance with tax deadlines. It features automated formulas that accurately compute tax liabilities based on inputted income and deductible expenses. Utilizing this template minimizes errors and saves time for individuals and businesses managing semi-annual tax obligations.

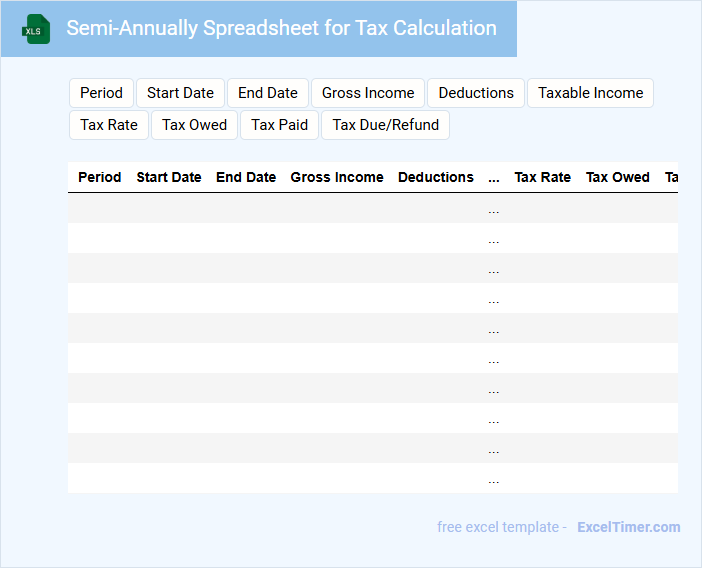

Semi-Annually Spreadsheet for Tax Calculation

A Semi-Annually Spreadsheet for Tax Calculation typically contains detailed financial data recorded every six months, including income, expenses, deductions, and tax liabilities. This document helps individuals or businesses accurately track their taxable earnings and prepare for tax payments in a structured manner. It is crucial to ensure all entries are updated and categorized correctly to avoid errors and facilitate smooth tax filing.

Excel Template for Semi-Annual Tax Payment Tracking

An Excel Template for Semi-Annual Tax Payment Tracking is designed to help individuals or businesses systematically record and monitor their tax payments due every six months. It streamlines the process of calculating taxes owed and ensures timely payments.

This document typically includes fields for payment dates, amounts, tax periods, and notes for any discrepancies or adjustments. Regular updates and accurate data entry are essential to maintain effective tracking and avoid penalties.

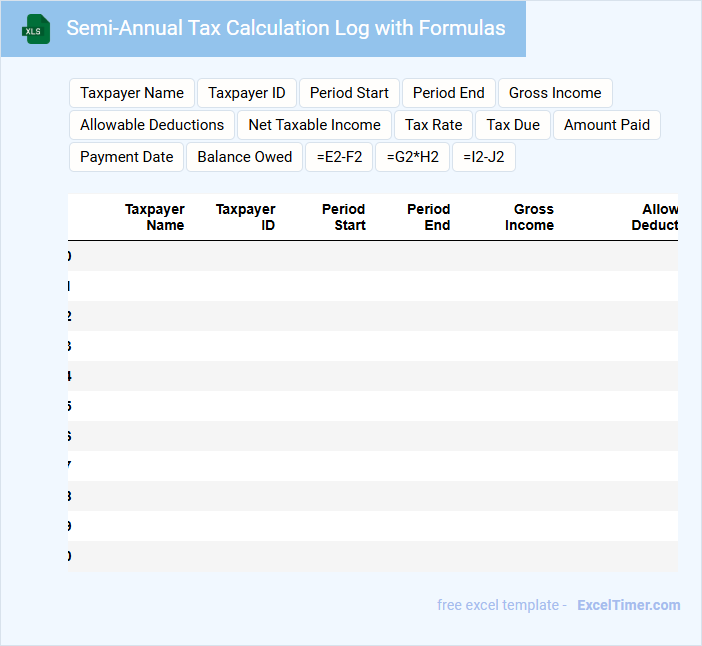

Semi-Annual Tax Calculation Log with Formulas

What does a Semi-Annual Tax Calculation Log with Formulas usually contain? This document typically includes detailed records of income, expenses, and tax deductions for a six-month period, along with corresponding calculations and formulas to determine tax liabilities. It serves as a structured tool to ensure accurate semi-annual tax reporting and compliance.

What is an important consideration when preparing this log? It is crucial to use precise formulas that automatically update with new data entries to minimize errors and maintain consistency. Additionally, regularly verifying the accuracy of inputted financial figures is essential for reliable tax calculations.

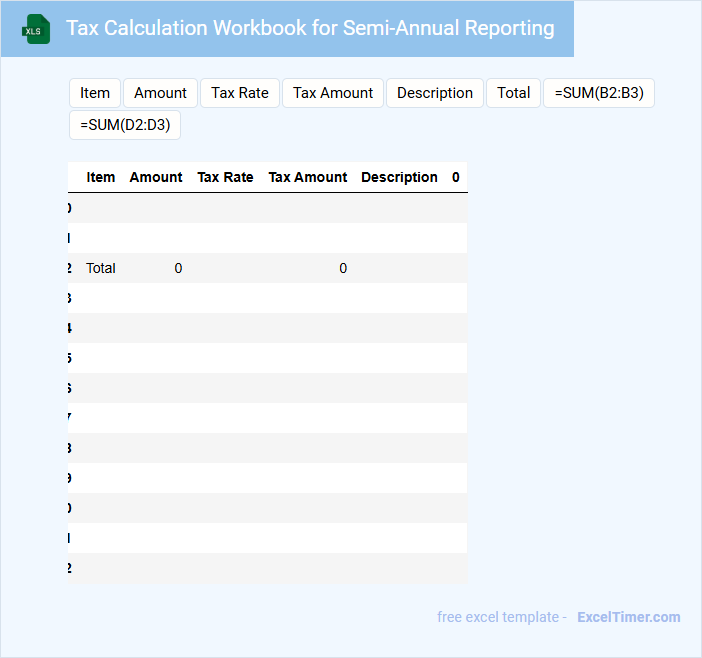

Tax Calculation Workbook for Semi-Annual Reporting

A Tax Calculation Workbook for Semi-Annual Reporting typically contains detailed worksheets for income, deductions, and tax credits computed for the relevant six-month period. It includes schedules summarizing taxable income and supporting calculations required for accurate reporting to tax authorities. Ensure formulas are updated and validated to reflect the latest tax laws and rates. The workbook also provides space for recording estimated tax payments and reconciliation entries to track any discrepancies. Maintaining clear documentation and version control is important for audit readiness and compliance. Always include a summary sheet highlighting key figures and assumptions used in the calculations.

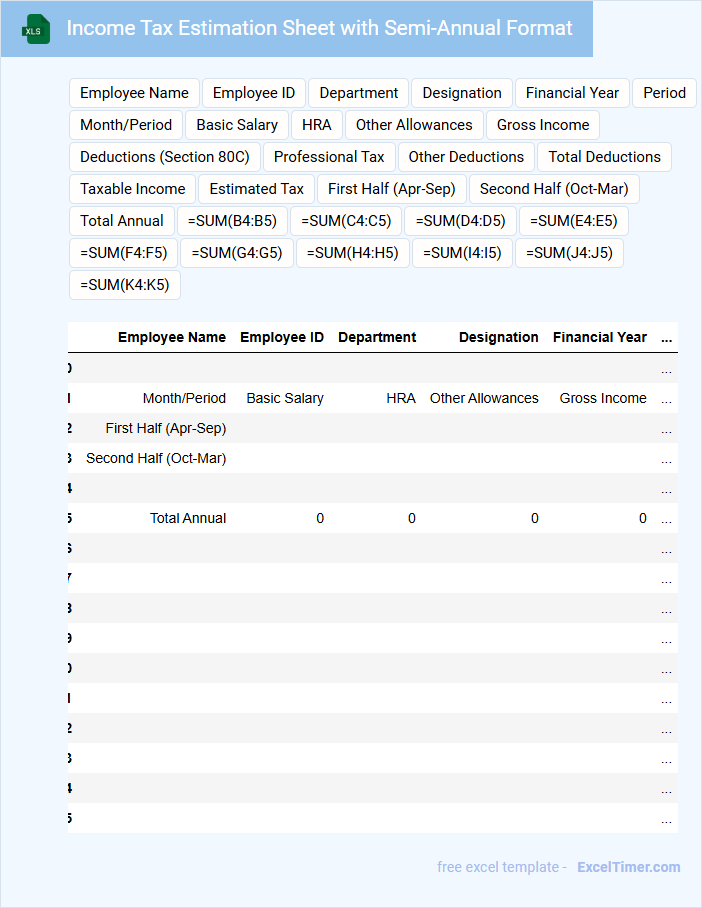

Income Tax Estimation Sheet with Semi-Annual Format

Income Tax Estimation Sheets with a Semi-Annual Format are documents used to project income tax liabilities and payments over two six-month periods within a fiscal year. They help individuals and businesses plan their tax payments in alignment with their incomes and expenses.

- This document usually contains sections for income details, deductible expenses, and tax calculation summaries for each half of the year.

- It is important to accurately update all income sources and allowable deductions to ensure precise tax estimation.

- Regular review and adjustment of estimates are recommended to reflect any changes in income or tax laws.

Semi-Annually Tax Planning Excel Document

A Semi-Annually Tax Planning Excel Document typically includes detailed financial data such as income, expenses, deductions, and estimated tax payments for two six-month periods. It allows individuals or businesses to track and forecast their tax obligations systematically. This document helps ensure timely compliance and efficient tax management.

Important elements to focus on are accurate data entry and periodic updates to reflect changes in financial status or tax laws. Including visual aids like charts and summaries improves clarity and decision-making. Consistent review and adjustment of tax planning strategies are crucial for optimizing tax liabilities.

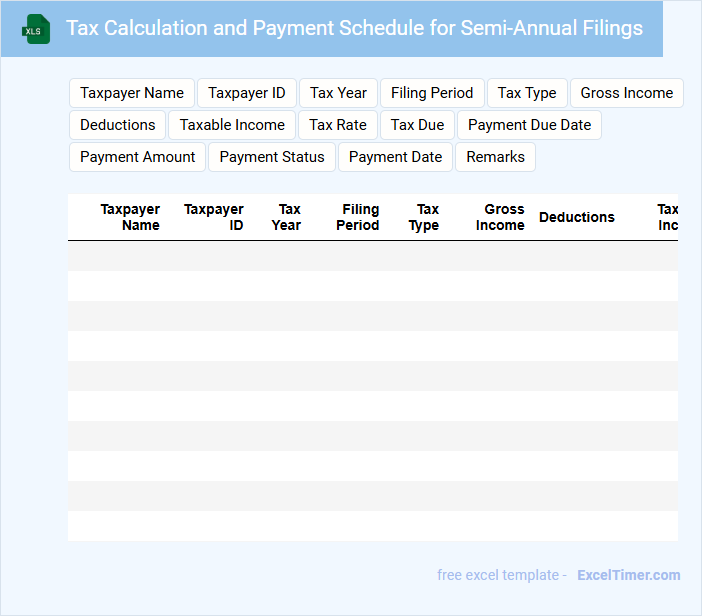

Tax Calculation and Payment Schedule for Semi-Annual Filings

A Tax Calculation and Payment Schedule document typically contains detailed information on how to compute taxes owed for a specific period. It outlines the deadlines and amounts for semi-annual tax payments, ensuring compliance with fiscal regulations. Properly following this schedule helps businesses avoid penalties and optimize cash flow throughout the year.

Semi-Annually Tax Records Excel Template

This Semi-Annually Tax Records Excel Template is designed to help individuals and businesses efficiently track and organize their tax-related financial data over six-month periods. It simplifies tax preparation by consolidating income, expenses, and tax payments in one accessible document.

- Include separate sheets for income sources, deductible expenses, and tax payments for clear categorization.

- Utilize formulas to automatically calculate totals and taxable amounts to reduce manual errors.

- Incorporate sections for notes and reminders to ensure important tax deadlines and regulations are adhered to.

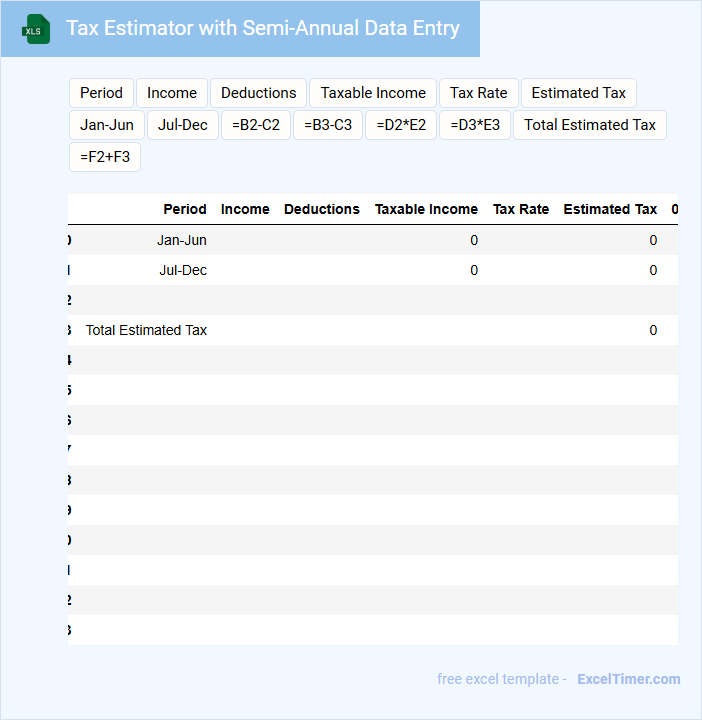

Tax Estimator with Semi-Annual Data Entry

What information is typically included in a tax estimator with semi-annual data entry? This type of document generally contains estimated income, deductions, and tax payments recorded twice a year to help individuals or businesses project their tax obligations accurately. It is used to monitor financial data periodically, ensuring timely adjustments and compliance with tax regulations.

What is an important consideration when using this tax estimator? Consistently updating the semi-annual data entries with accurate and detailed financial information is crucial for precise tax forecasting. Additionally, reviewing any changes in tax laws or rates during the year can help maintain the estimator's reliability and effectiveness.

Semi-Annual Report of Tax Liabilities Spreadsheet

A Semi-Annual Report of Tax Liabilities Spreadsheet is a financial document that summarizes an entity's tax obligations over a six-month period. It helps in tracking and managing tax payments to ensure compliance with tax regulations.

- Include detailed records of all taxable transactions within the period.

- Ensure accuracy and clarity in presenting tax liabilities by category.

- Highlight due dates and payment statuses to avoid penalties.

Tax Deduction Tracker for Semi-Annually Filing

A Tax Deduction Tracker for semi-annually filing is a document used to monitor and record deductible expenses over a six-month period. It helps individuals and businesses keep accurate records of their financial transactions to ensure they claim all eligible deductions. This type of tracker is essential for maintaining compliance with tax regulations and avoiding last-minute filing errors.

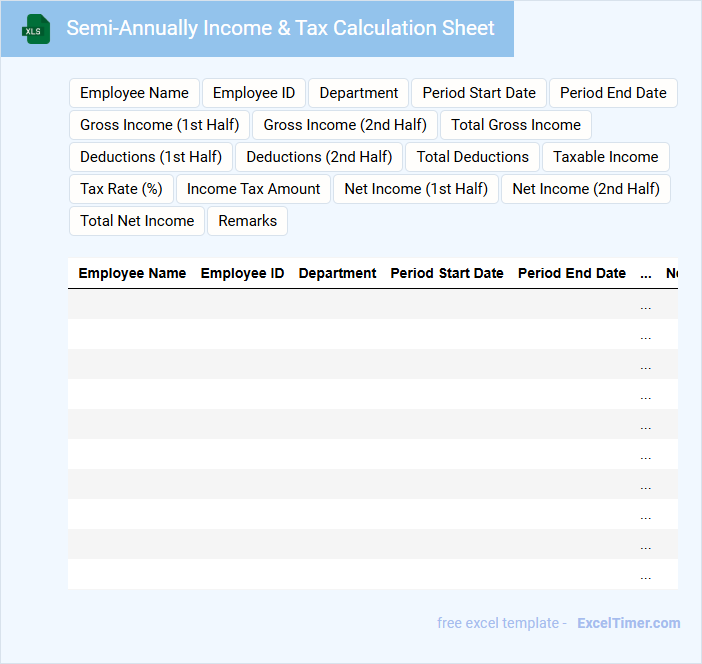

Semi-Annually Income & Tax Calculation Sheet

What information is typically included in a Semi-Annually Income & Tax Calculation Sheet? This document usually contains detailed records of income earned and taxes withheld over a six-month period. It helps individuals or businesses accurately assess their tax liabilities and plan for payments accordingly.

Why is it important to review this sheet carefully? Ensuring all income sources and tax deductions are correctly reported prevents errors in tax filings and potential penalties. It is also advisable to keep supporting documents organized for verification during audits or financial reviews.

Tax Provision Schedule with Semi-Annual Tracking

A Tax Provision Schedule with Semi-Annual Tracking is a financial document that outlines the tax liabilities and adjustments for a company within a six-month period. It helps ensure accurate tax reporting and compliance with tax regulations.

- Track all tax payments and adjustments made during each half of the fiscal year.

- Include detailed reconciliations between tax provisions and actual tax payments.

- Regularly update estimates to reflect changes in tax laws or financial performance.

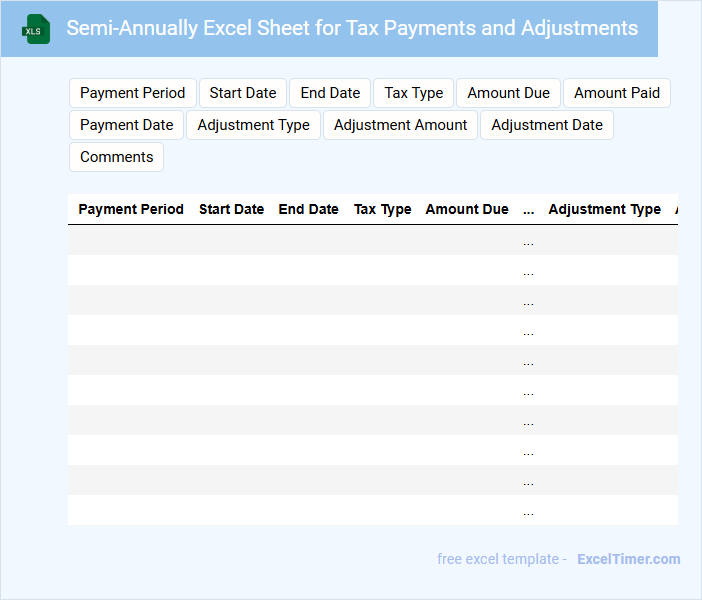

Semi-Annually Excel Sheet for Tax Payments and Adjustments

What information does a Semi-Annually Excel Sheet for Tax Payments and Adjustments typically contain? This document generally includes detailed records of all tax payments made and any adjustments applied over a six-month period. It helps in tracking compliance with tax obligations and ensures accurate financial reporting.

What important aspects should be considered when preparing this Excel sheet? It is crucial to maintain clear categorization of payment dates, amounts, and adjustment reasons to avoid errors and facilitate audits. Additionally, including formulas for automatic calculations can save time and reduce manual mistakes.

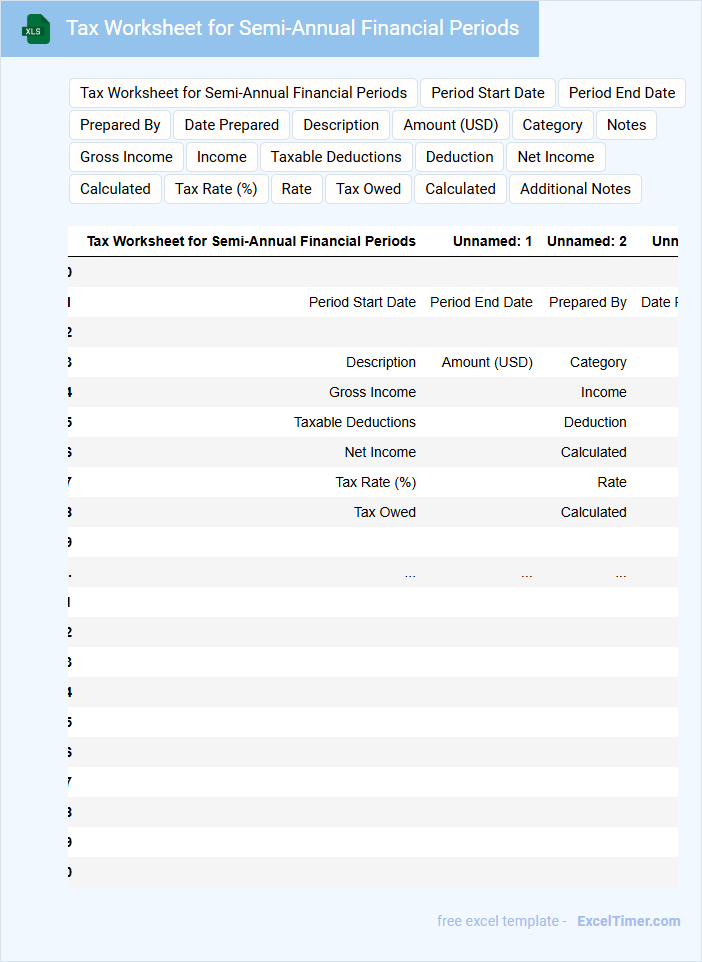

Tax Worksheet for Semi-Annual Financial Periods

What information is typically contained in a Tax Worksheet for Semi-Annual Financial Periods? This document usually includes detailed sections for income, deductions, tax credits, and calculations relevant to the semi-annual reporting timeframe. It helps taxpayers and accountants systematically organize financial data to accurately estimate and report taxes owed for each half-year period.

What is an important consideration when using this worksheet? Ensuring all income sources and deductible expenses are comprehensively documented and matched to the correct period is crucial for compliance and accurate tax filing. Regularly updating tax rates and regulations in the worksheet can also prevent errors and optimize tax obligations.

How does semi-annual compounding affect tax calculations in an Excel document?

Semi-annual compounding in tax calculations increases the effective interest earned or owed by applying interest twice per year, impacting the taxable amount. In an Excel document, formulas using semi-annual compounding typically adjust the interest rate and number of periods to reflect two compounding intervals annually. This approach provides more accurate tax liability or deduction estimates based on the compounding effect within the fiscal year.

What Excel formulas are used to compute taxes on semi-annually earned interest?

To compute taxes on semi-annually earned interest in Excel, use the formula =Interest_Amount * Tax_Rate, where Interest_Amount is the semi-annual interest earned and Tax_Rate is your applicable tax percentage. Convert annual rates to semi-annual by dividing the annual interest rate by 2 for accurate calculations. Your spreadsheet can automate tax calculations using these formulas to ensure precise semi-annual tax reporting.

How do you structure a tax calculation spreadsheet for semi-annual periods in Excel?

Create a tax calculation spreadsheet in Excel by dividing the year into two semi-annual periods, labeling columns for each period's income, deductions, and tax rates. Use formulas to calculate taxable income and tax owed per semi-annual period, incorporating tax brackets and relevant rates. Summarize the total annual tax by summing the results from both semi-annual calculations.

What are the key cell references for tracking semi-annual income and tax in Excel?

The key cell references for tracking semi-annual income in Excel typically include the income input cells, such as A2 for January-June earnings and B2 for July-December earnings. Tax calculation cells often refer to these income cells, for example, C2 for calculated tax on the first half and D2 for the second half. You should set formulas in cells like E2 to sum semi-annual income and F2 to compute the total tax owed based on those amounts.

How is the annual tax liability reconciled from semi-annual tax calculations in Excel?

Annual tax liability in Excel is reconciled by summing the semi-annual tax amounts and comparing the total with the calculated annual tax based on taxable income. Formulas such as SUM and IF help validate discrepancies and adjust tax credits or payments. PivotTables and conditional formatting highlight differences to ensure accurate tax reconciliation.