![]()

The Semi-annually Excel Template for Insurance Premium Tracking provides an efficient way to monitor and manage insurance payments every six months. It helps users keep accurate records of premium due dates, amounts paid, and outstanding balances, ensuring timely payments and avoiding policy lapses. This template is essential for maintaining organized financial records and optimizing budget planning.

Semi-Annually Excel Template for Insurance Premium Tracking

This Semi-Annually Excel Template for Insurance Premium Tracking is designed to help users efficiently monitor and manage insurance premium payments over six-month periods. It typically includes sections for policy details, payment schedules, and premium amounts. Using this template ensures timely payments and accurate financial record-keeping.

Insurance Premium Payment Tracker with Semi-Annual Schedule

What information is typically included in an Insurance Premium Payment Tracker with a Semi-Annual Schedule?

This document usually contains details such as policy numbers, payment due dates every six months, amounts payable, and payment status to help manage and monitor insurance premiums effectively. It ensures timely payments and aids in avoiding lapses in coverage by providing a clear overview of payment schedules and history.

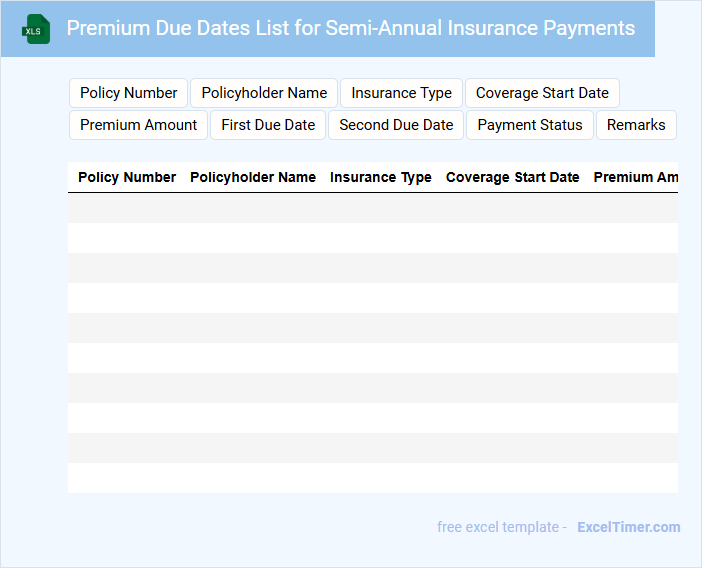

Premium Due Dates List for Semi-Annual Insurance Payments

What information is typically included in a Premium Due Dates List for Semi-Annual Insurance Payments? This document usually contains a detailed schedule of payment deadlines for insurance premiums that are due twice a year. It helps policyholders and insurers track upcoming payments to ensure timely transactions and avoid lapses in coverage.

Why is it important to keep this list updated and accessible? Maintaining an accurate and accessible list ensures that all payments are made on time, preventing penalties or policy cancellations. Additionally, it is recommended to include policy numbers and contact information for quick reference and effective communication.

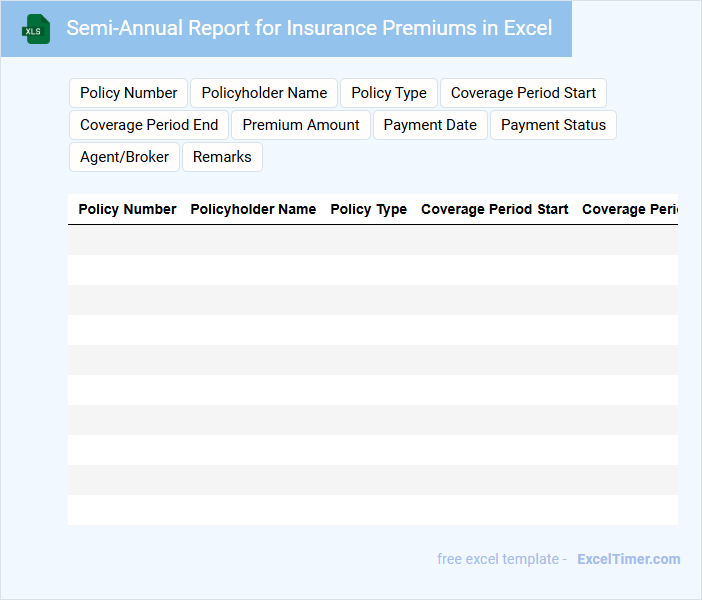

Semi-Annual Report for Insurance Premiums in Excel

A Semi-Annual Report for Insurance Premiums in Excel typically contains detailed records of premium payments made over a six-month period. It organizes data such as policyholder information, payment dates, amounts, and coverage types for efficient tracking and analysis. This document is crucial for monitoring financial performance and compliance within the insurance sector.

Insurance Policy Payment Tracking Sheet with Semi-Annual Columns

An Insurance Policy Payment Tracking Sheet is a document used to monitor premium payments for various insurance policies. It typically contains columns for policy details, payment dates, amounts, and outstanding balances. For a sheet with semi-annual columns, it's important to organize payments clearly to ensure timely tracking and avoid missed premiums.

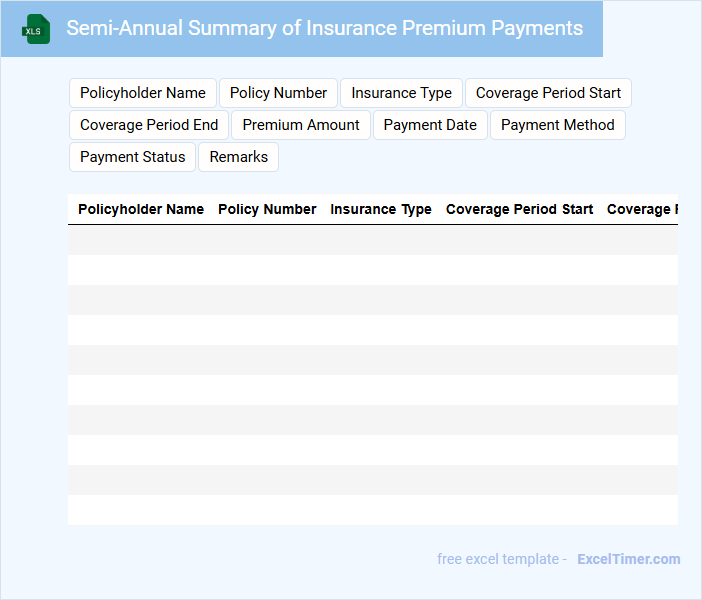

Semi-Annual Summary of Insurance Premium Payments

The Semi-Annual Summary of insurance premium payments typically contains a detailed record of all premiums paid over a six-month period. It includes policy numbers, payment dates, and amounts to ensure accurate financial tracking.

Such a document is crucial for verifying coverage continuity and managing budget forecasts. Always review the summary carefully to catch any discrepancies or missed payments early.

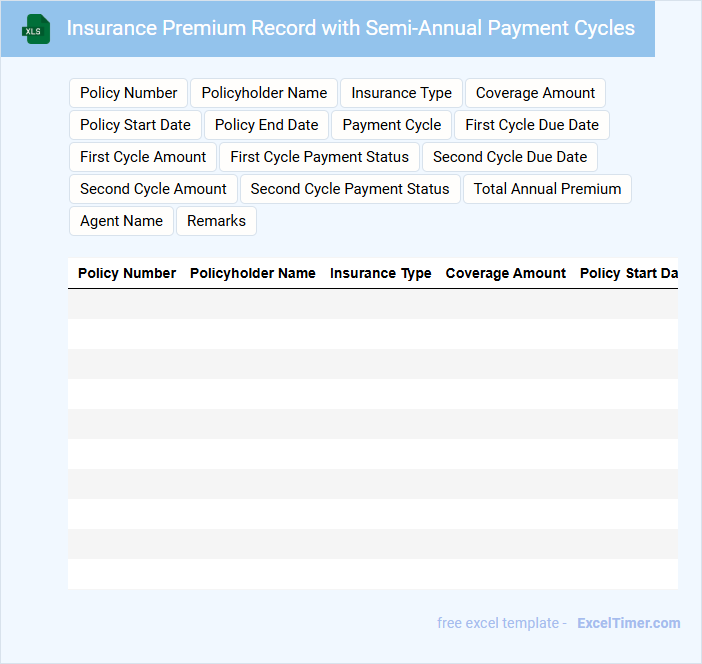

Insurance Premium Record with Semi-Annual Payment Cycles

What information is typically included in an Insurance Premium Record with Semi-Annual Payment Cycles? This document usually contains details about the insured party, policy details, payment dates, and amounts for each semi-annual installment. It helps track timely payments and ensures clarity on coverage periods and premium obligations.

What is important to verify when managing this type of record? It is essential to confirm accuracy in payment amounts and dates to avoid lapses in coverage or penalties. Additionally, keeping copies of all receipts and payment confirmations enhances transparency and serves as proof for both the insurer and insured.

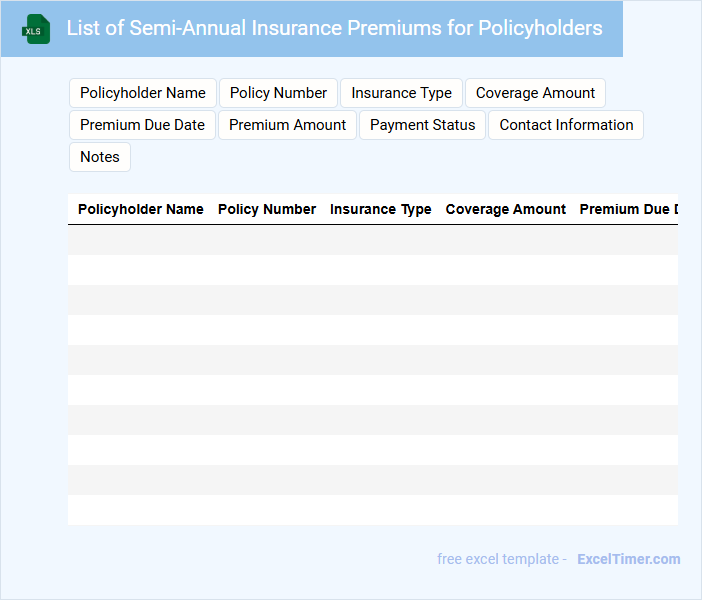

List of Semi-Annual Insurance Premiums for Policyholders

A List of Semi-Annual Insurance Premiums typically contains detailed information about the insurance costs that policyholders are required to pay every six months. It includes the policyholder's name, policy number, coverage details, and the premium amount due. This document is essential for managing payment schedules and tracking insurance expenses efficiently.

Excel Workbook for Semi-Annual Insurance Premium Tracking

An Excel Workbook for Semi-Annual Insurance Premium Tracking typically contains detailed records of insurance policies, premium amounts, due dates, and payment statuses. It helps users efficiently monitor and manage their insurance expenses over a six-month period.

Key features often include automated calculations, summary dashboards, and reminder alerts for upcoming payments. To optimize its utility, ensure accurate data entry and regularly update the workbook to reflect policy changes.

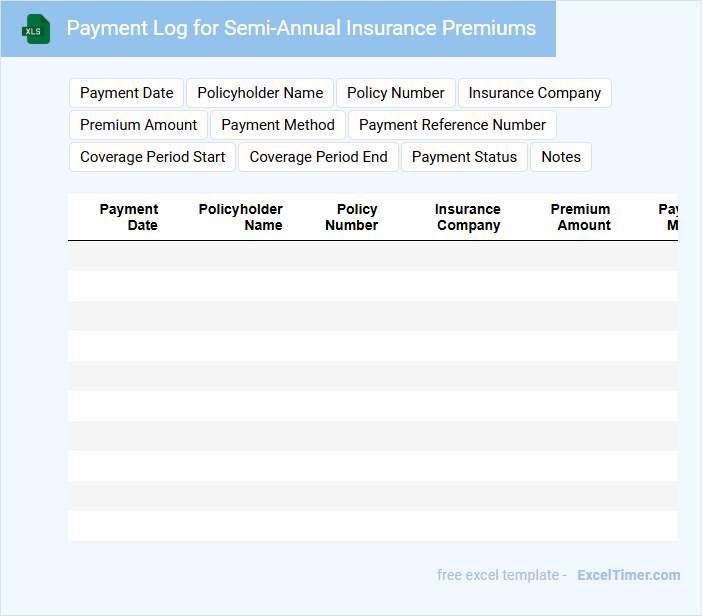

Payment Log for Semi-Annual Insurance Premiums

A Payment Log for Semi-Annual Insurance Premiums typically records all payment transactions made towards insurance policies every six months.

- Payment Dates: Accurate entries of the dates on which premiums were paid are essential for tracking payment schedules.

- Amount Paid: Recording the exact premium amounts ensures financial accuracy and proper reconciliation.

- Payer Information: Including details of the insured party or account holder helps in clear identification and accountability.

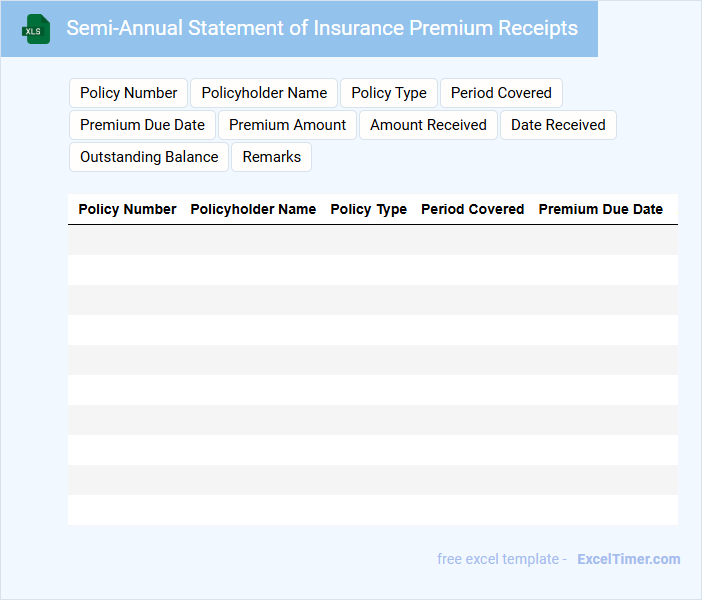

Semi-Annual Statement of Insurance Premium Receipts

The Semi-Annual Statement of Insurance Premium Receipts typically contains a detailed record of premiums collected by an insurance company over a six-month period.

- Accurate Premium Data: Ensure the statement reflects all premiums received within the timeframe without discrepancies.

- Policyholder Information: Include clear identification of each policyholder related to the premiums listed.

- Compliance and Reporting: Verify that the document adheres to regulatory requirements and standard reporting formats.

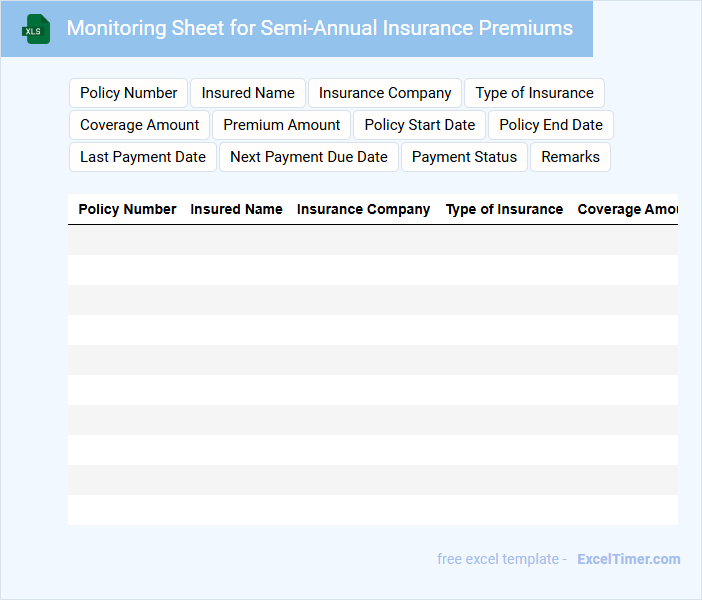

Monitoring Sheet for Semi-Annual Insurance Premiums

A Monitoring Sheet for Semi-Annual Insurance Premiums is a crucial document used to track payment schedules and amounts for insurance policies within a six-month period. It typically contains details such as the policyholder's name, insurance provider, premium amounts, due dates, and payment status. Accurate maintenance of this sheet ensures timely payments and helps avoid lapses in coverage.

Premium Tracking Excel with Semi-Annual Breakdown for Insurance

What information is typically contained in a Premium Tracking Excel with Semi-Annual Breakdown for Insurance? This document usually includes detailed records of insurance premium payments organized by semi-annual periods, allowing for clear tracking of payment schedules and amounts. It helps users monitor their insurance expenses over time and ensures timely payments by providing a structured overview.

What is an important consideration when using this type of document? Ensuring accurate data entry and consistent updates is crucial to maintaining reliable tracking. Additionally, incorporating automated calculations and reminders can greatly enhance the document's effectiveness in managing insurance premiums efficiently.

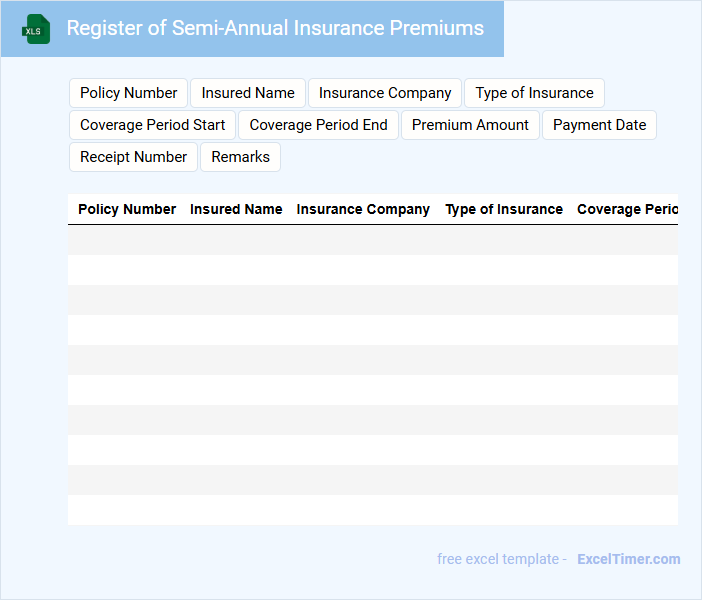

Register of Semi-Annual Insurance Premiums

What information is typically included in a Register of Semi-Annual Insurance Premiums? This document generally records details of all insurance premiums paid semi-annually by an individual or organization, including the policy number, payment dates, amounts, and insurance providers. Maintaining such a register helps ensure accurate tracking of payments and supports timely renewals and compliance with financial regulations.

What important factors should be considered when maintaining this register? It is crucial to keep the register updated regularly to reflect any changes in premium amounts or policies and to safeguard the document for auditing purposes. Additionally, including notes on payment confirmations and due dates can help prevent missed payments and disputes.

Insurance Premium Tracker for Semi-Annual Billing Periods

An Insurance Premium Tracker for semi-annual billing periods is a document designed to monitor and record insurance premium payments made every six months. It typically contains details such as payment amounts, due dates, payment confirmation, and policy information.

This tracker helps ensure timely payments and avoids lapses in coverage, promoting financial organization and peace of mind. Important elements to include are reminders for due dates and a summary of coverage benefits.

What semi-annual date intervals should be set for insurance premium tracking in the Excel document?

Set semi-annual date intervals as January 1 to June 30 and July 1 to December 31 for precise insurance premium tracking in the Excel document. Use these fixed six-month periods to capture premium payments, billing cycles, and policy renewals. This approach ensures accurate financial analysis and reporting aligned with insurance industry standards.

How can conditional formatting highlight upcoming semi-annual insurance premium due dates?

Conditional formatting in Excel can highlight upcoming semi-annual insurance premium due dates by using formulas that compare today's date with premium due dates. You can set rules to change the cell color when the due date falls within a specified range, such as the next 30 days. This visual cue helps you stay informed and manage your insurance payments efficiently.

Which columns are essential for tracking semi-annual insurance payments (e.g., policyholder, start date, next payment due, amount)?

Essential columns for tracking semi-annual insurance payments include Policyholder Name, Policy Number, Coverage Start Date, Next Payment Due Date, Payment Amount, Payment Frequency (set to semi-annual), and Payment Status. Including columns for Insurer Contact and Policy Expiration Date enhances tracking accuracy and communication. These fields enable efficient monitoring of payment schedules and outstanding premiums.

How can Excel formulas automate the calculation of the next semi-annual premium payment date?

Excel formulas can automate the next semi-annual insurance premium payment date by using the EDATE function to add six months to the previous payment date. For example, if the last payment date is in cell A2, the formula =EDATE(A2,6) calculates the next payment due date. This method ensures precise tracking and scheduling of premium payments every six months.

What methods can be used in Excel to generate reminders or alerts for semi-annual insurance premium deadlines?

Excel can generate semi-annual insurance premium reminders using conditional formatting to highlight upcoming due dates based on the premium date plus 6 months. VBA macros can automate email alerts by scanning premium dates and triggering notifications 30 days before deadlines. The combination of date functions like EDATE and logical tests helps track and flag payments due within the current period efficiently.