The Semi-annually Excel Template for Financial Forecasting provides a structured framework to project financial performance every six months, enhancing accuracy in budgeting and cash flow analysis. It streamlines data input and automatically updates financial statements, enabling clear visualization of trends over semi-annual periods. Key features include customizable forecast parameters and integrated charts that support strategic decision-making.

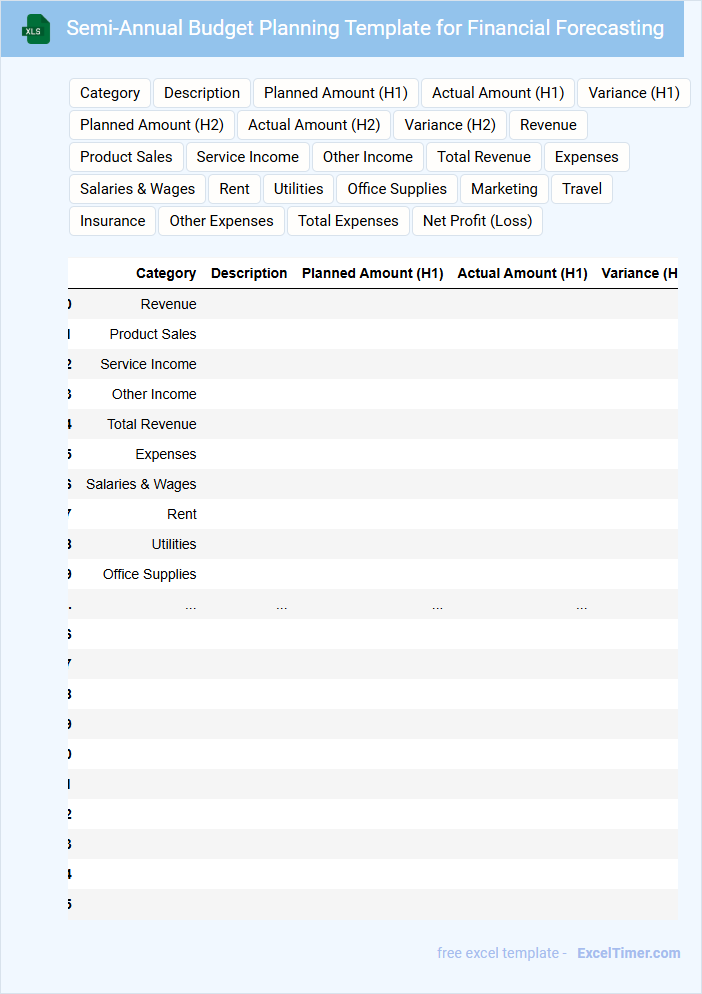

Semi-Annual Budget Planning Template for Financial Forecasting

A Semi-Annual Budget Planning Template is a structured document used to outline financial goals and allocate resources for a six-month period. It typically contains sections for revenue projections, expense estimates, and cash flow analysis to support effective financial forecasting. Utilizing this template helps organizations align their spending with strategic objectives and improve decision-making accuracy.

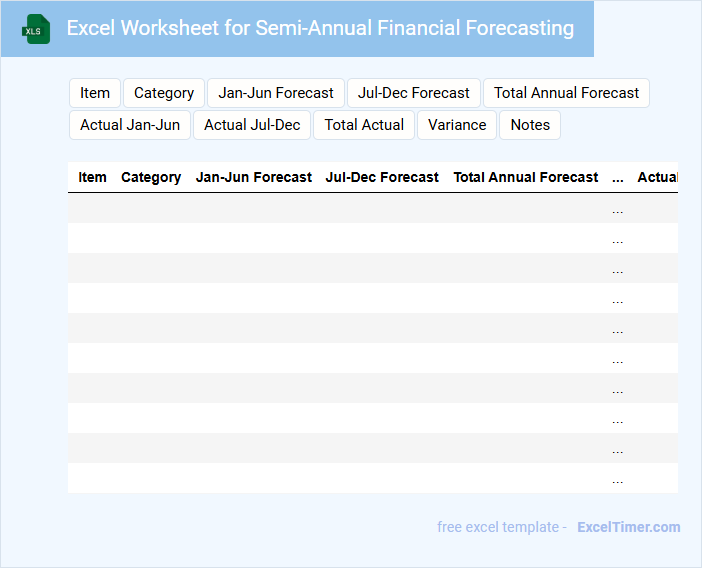

Excel Worksheet for Semi-Annual Financial Forecasting

An Excel Worksheet for Semi-Annual Financial Forecasting typically contains detailed financial data, projections, and analysis tools to help businesses plan for the upcoming six months. It includes revenue estimates, expense tracking, cash flow statements, and key performance indicators to assess financial health. Accurate data input and regular updates are crucial for generating reliable forecasts that support strategic decision-making.

Six-Month Financial Forecast Template with Expense Tracking

A Six-Month Financial Forecast Template with Expense Tracking typically contains detailed projections of income, expenses, and cash flow over a half-year period. It helps businesses or individuals anticipate financial needs and adjust budgets accordingly. Incorporating expense tracking ensures real-time comparison between forecasted and actual spending for better financial management.

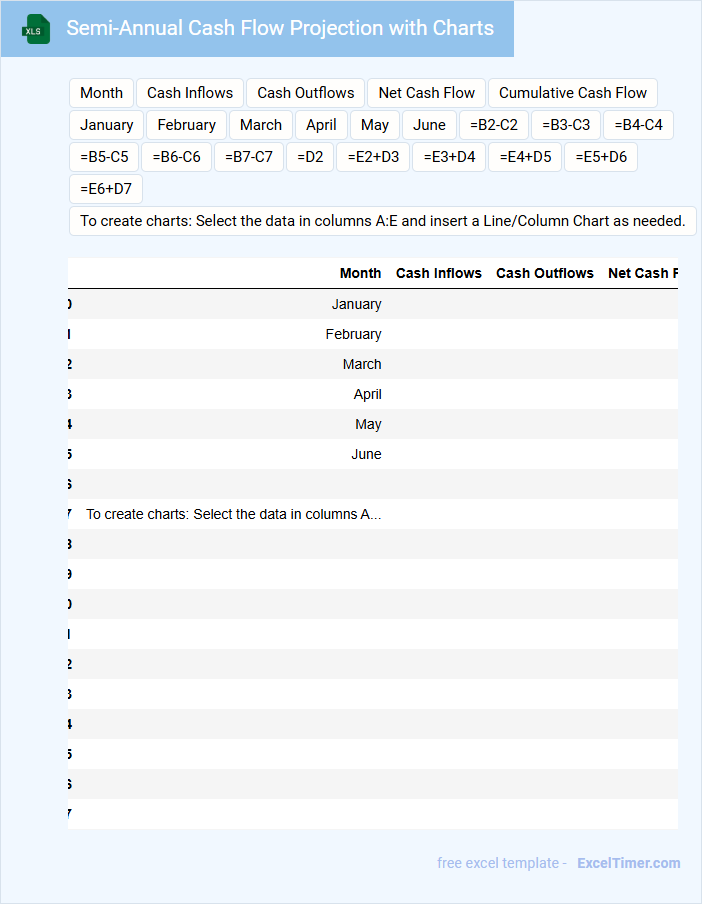

Semi-Annual Cash Flow Projection with Charts

A Semi-Annual Cash Flow Projection typically contains estimated inflows and outflows of cash over a six-month period, helping businesses plan liquidity. It includes key components such as operating activities, investment activities, and financing activities to anticipate future cash availability. Charts are often used to visualize trends and highlight critical periods of surplus or deficit.

This document is essential for financial planning, enabling organizations to manage risks and make informed decisions. An important suggestion is to regularly update the projection with actual data to improve accuracy and reliability. Visual aids like bar graphs or line charts enhance comprehension for stakeholders.

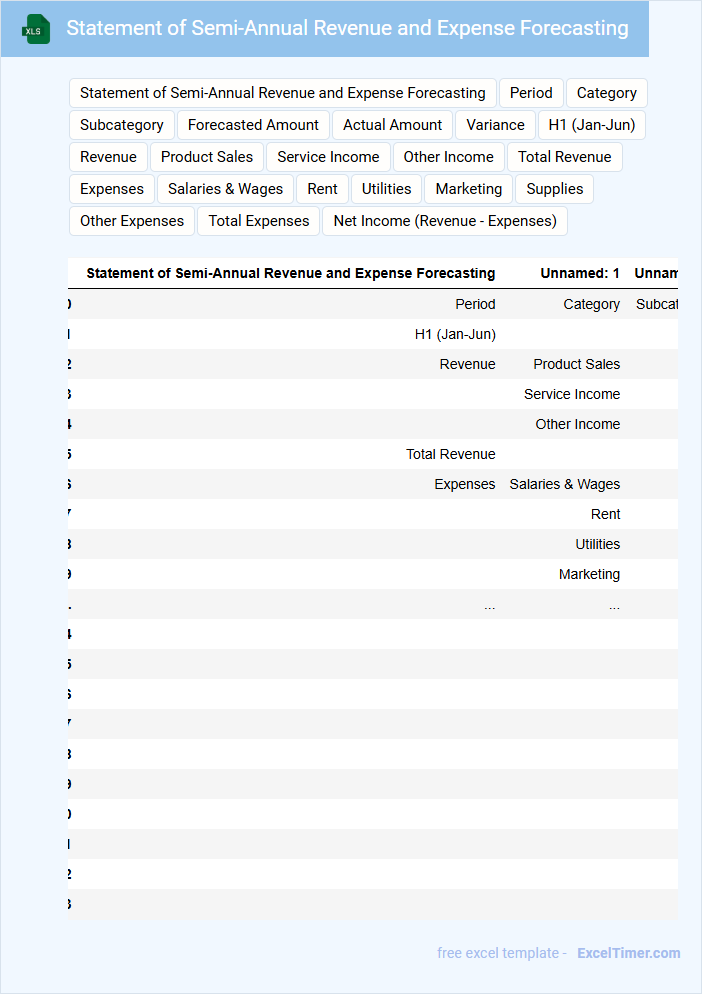

Statement of Semi-Annual Revenue and Expense Forecasting

A Statement of Semi-Annual Revenue and Expense Forecasting outlines the projected income and expenditures for a six-month period to assist in financial planning and management. It provides a detailed overview of expected financial performance to support decision-making and resource allocation.

- Include accurate historical data to improve forecasting reliability.

- Clearly differentiate between fixed and variable expenses for better budget control.

- Regularly update the forecast to reflect any changes in market conditions or business operations.

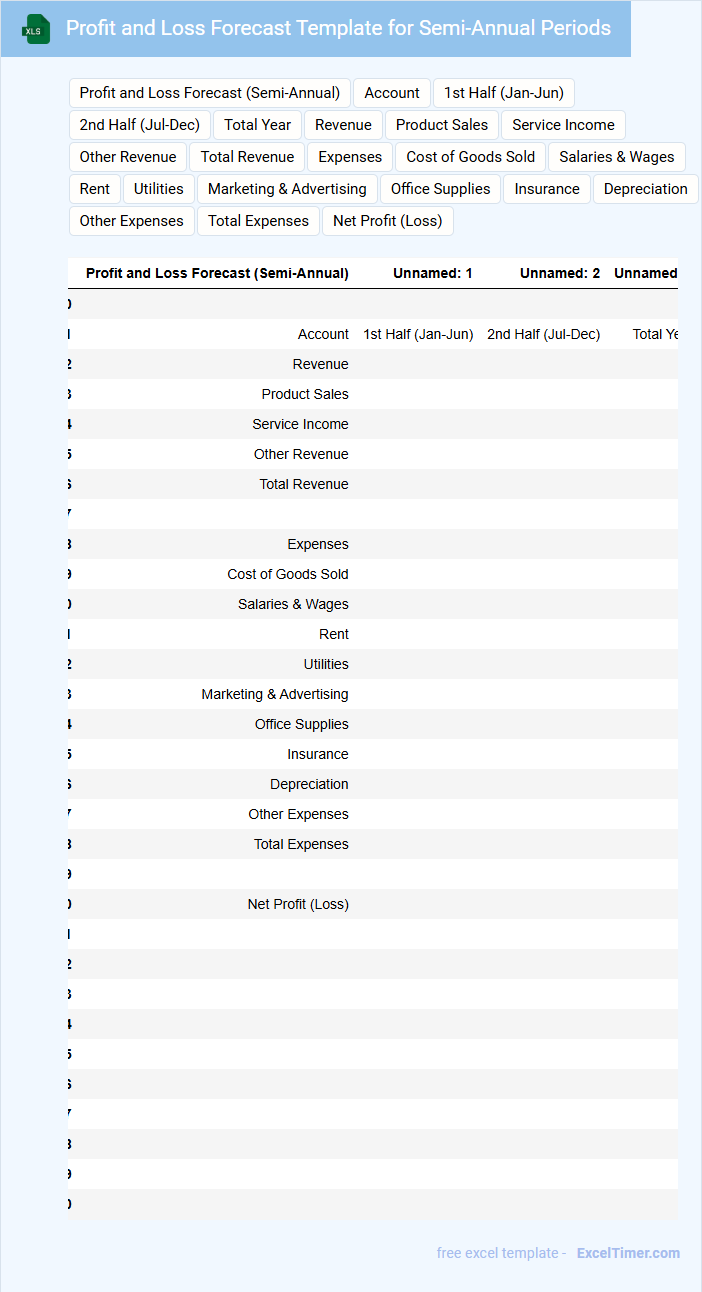

Profit and Loss Forecast Template for Semi-Annual Periods

A Profit and Loss Forecast Template for Semi-Annual Periods typically contains projected revenues, expenses, and net profit for two six-month intervals within a fiscal year. This document helps businesses estimate financial performance and plan budgets effectively. Key components often include sales forecasts, cost of goods sold, operating expenses, and expected profitability.

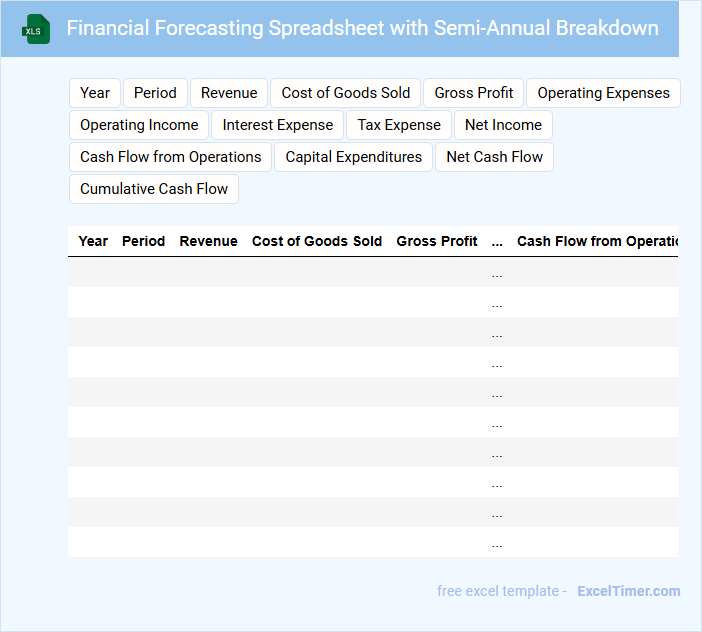

Financial Forecasting Spreadsheet with Semi-Annual Breakdown

Financial Forecasting Spreadsheet with Semi-Annual Breakdown typically contains projected financial data organized in six-month periods, aiding in strategic planning and budget management. It allows businesses to analyze trends and allocate resources efficiently over shorter fiscal intervals.

- Include clear assumptions for revenue and expense growth rates to maintain accuracy.

- Incorporate key performance indicators such as profit margins and cash flow for better insights.

- Use consistent formatting and formulas to ensure easy updates and reduce errors.

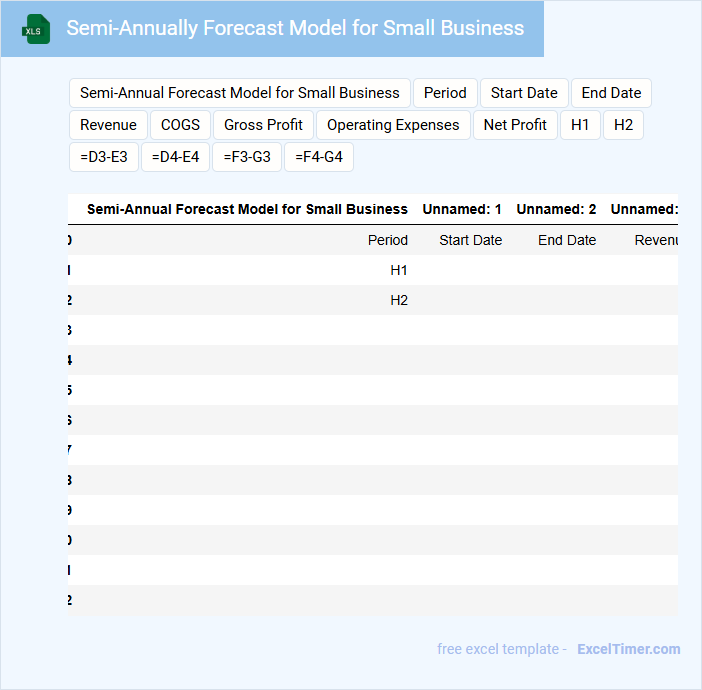

Semi-Annually Forecast Model for Small Business

The Semi-Annually Forecast Model for small business typically includes projected revenues, expenses, and cash flows for the upcoming six months. It helps in setting realistic financial goals and preparing for seasonal fluctuations in the market.

Essential components also cover sales trends, inventory needs, and staffing plans to ensure operational efficiency. Regularly updating the forecast based on actual performance is crucial for accurate decision-making and growth planning.

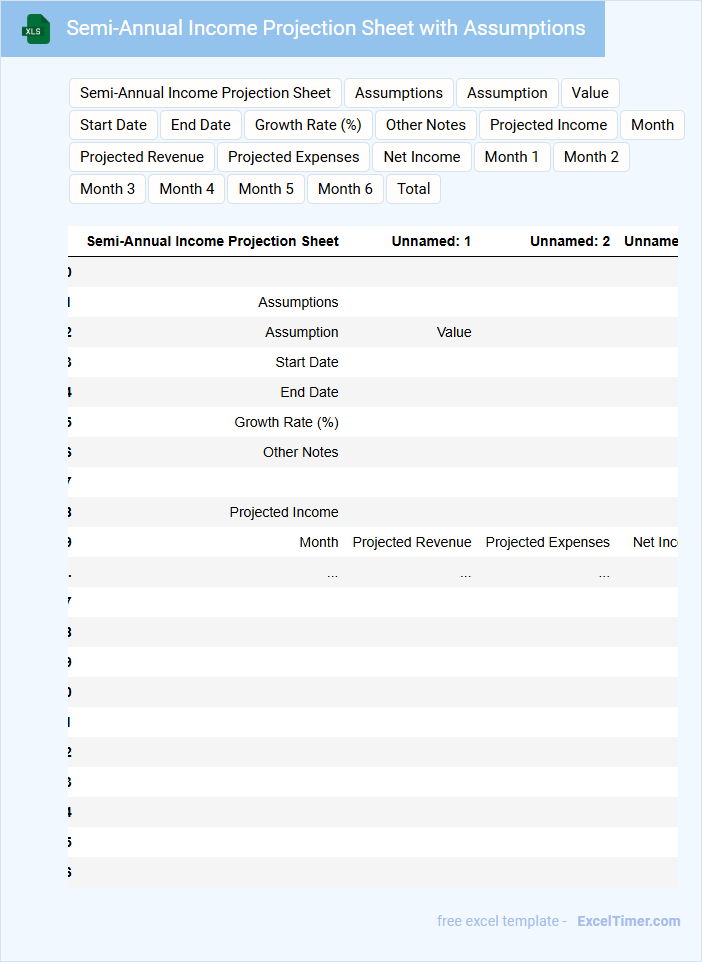

Semi-Annual Income Projection Sheet with Assumptions

The Semi-Annual Income Projection Sheet typically contains financial estimates for revenue and expenses over a six-month period. It is used to forecast income and track financial performance against set goals.

This document includes key assumptions such as sales growth rates, cost trends, and market conditions, which impact the projections. Ensuring these assumptions are realistic and regularly updated is crucial for accuracy.

Detailed Semi-Annual Financial Forecasting Template for Startups

A Detailed Semi-Annual Financial Forecasting Template for startups typically contains projected income statements, cash flow analyses, and balance sheets covering a six-month period. It is crucial for startups to outline revenue streams, anticipated expenses, and funding needs clearly. Emphasizing accuracy and flexibility in assumptions ensures better planning and investor confidence.

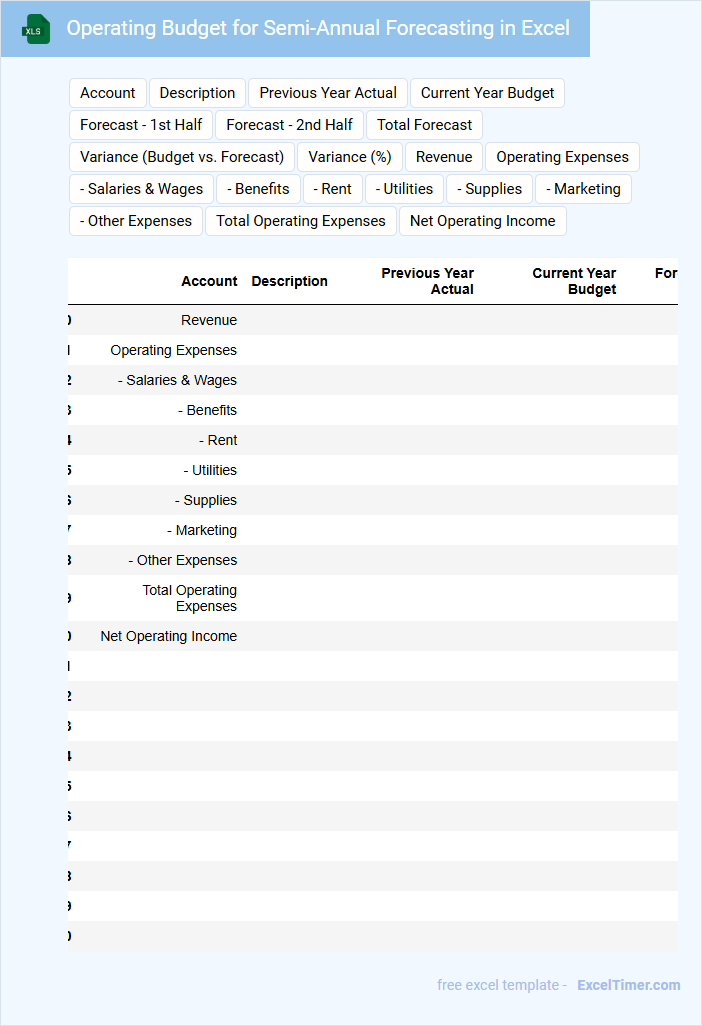

Operating Budget for Semi-Annual Forecasting in Excel

Operating Budget for Semi-Annual Forecasting in Excel is typically a financial plan document outlining expected revenues and expenses for a six-month period.

- Revenue Projections: Include detailed estimates of income streams based on historical data and market trends.

- Expense Categories: Clearly categorize fixed and variable costs to manage cash flow effectively.

- Review and Adjustment: Schedule regular updates to compare forecasted and actual figures for accuracy.

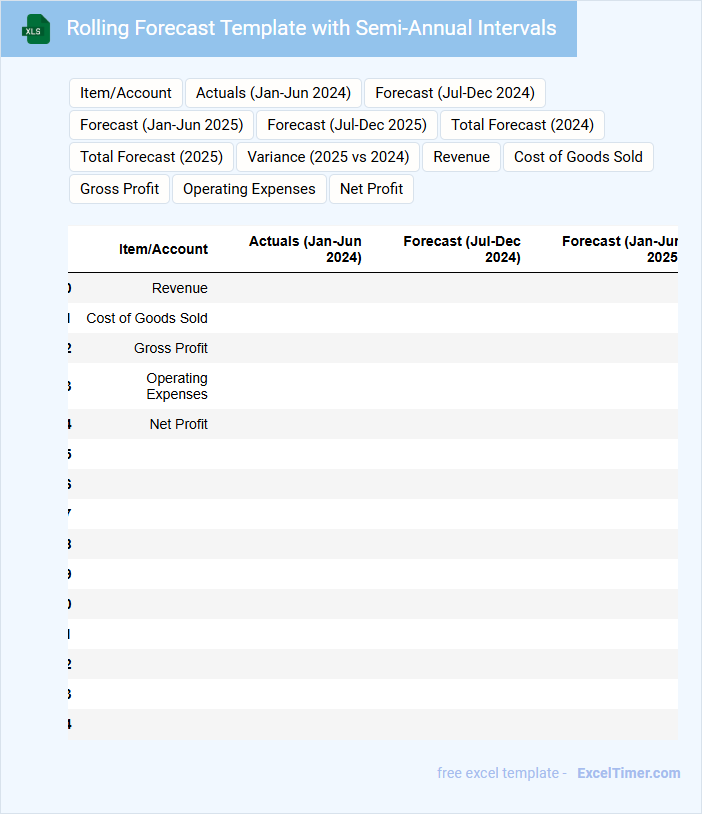

Rolling Forecast Template with Semi-Annual Intervals

A rolling forecast template with semi-annual intervals is a dynamic financial planning document that projects future performance in six-month increments. It helps businesses adjust strategies based on ongoing results and market trends.

This type of document usually contains revenue projections, expense estimates, and key performance indicators updated every six months. Maintaining accurate historical data and regularly reviewing assumptions are important to ensure reliable forecasts.

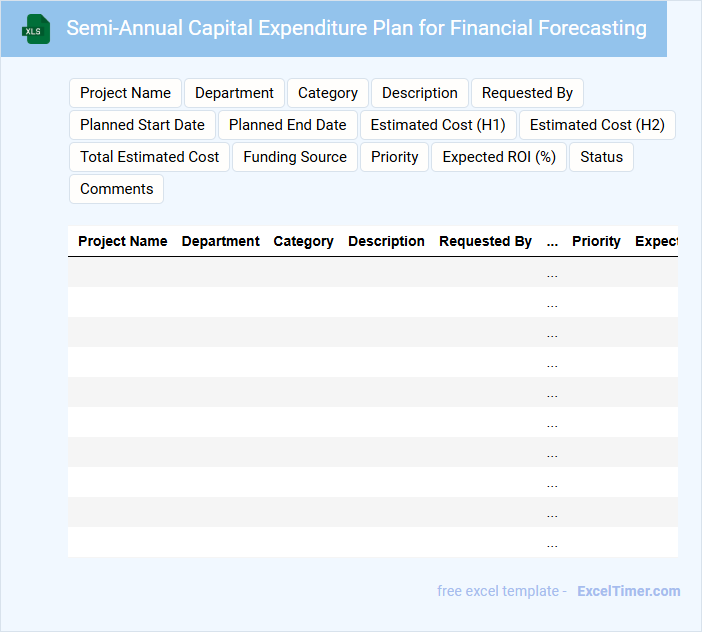

Semi-Annual Capital Expenditure Plan for Financial Forecasting

A Semi-Annual Capital Expenditure Plan typically outlines the projected investments in physical assets such as equipment, property, and infrastructure over a six-month period. It serves as a critical document for financial forecasting, helping organizations allocate budgets efficiently and anticipate future cash flow needs. Key components usually include detailed cost estimates, timelines, and justification for each capital project.

Scenario Analysis Sheet for Semi-Annual Financial Forecasts

A Scenario Analysis Sheet for Semi-Annual Financial Forecasts typically contains detailed projections of financial outcomes based on varying assumptions and external factors. It includes best-case, worst-case, and most-likely scenarios to help businesses prepare for uncertainties. This document is crucial for strategic planning and risk management by illustrating potential impacts on revenue, expenses, and cash flow.

Important elements to include are clearly defined assumptions, key financial metrics, and comparison charts for different scenarios. Ensuring data accuracy and regularly updating the sheet as new information emerges will enhance its reliability. Additionally, incorporating qualitative insights alongside quantitative data offers a comprehensive understanding of possible financial trajectories.

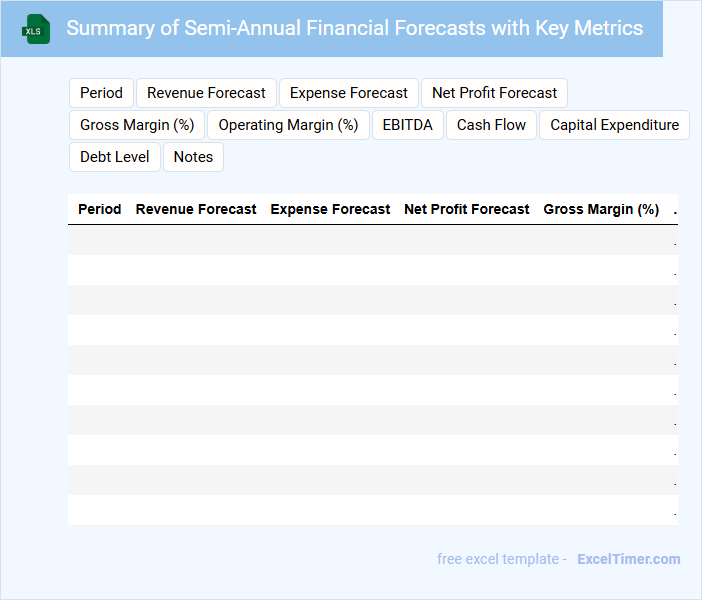

Summary of Semi-Annual Financial Forecasts with Key Metrics

This document typically contains an overview of the company's expected financial performance for the next six months. It highlights key metrics to provide stakeholders with an informed projection of growth and risks.

- Include clear and concise forecasts of revenue, expenses, and profitability.

- Highlight significant assumptions and potential risks affecting the forecast.

- Use visual aids like charts or tables to enhance data comprehension.

How does semi-annual compounding impact financial forecasting models in Excel?

Semi-annual compounding in Excel financial forecasting models increases the frequency of interest calculations, resulting in more accurate projections of investment growth compared to annual compounding. This method affects cash flow analysis, discounting future cash flows at semi-annual intervals, which refines net present value (NPV) and internal rate of return (IRR) metrics. Incorporating semi-annual compounding formulas in Excel enhances precision in forecasting loan amortizations, bond yields, and portfolio valuations.

Which Excel formulas are best used to calculate semi-annual interest or growth rates?

The best Excel formulas to calculate semi-annual interest or growth rates include =EFFECT(rate, nper) to find the effective annual rate from a nominal rate and =RATE(nper, pmt, pv, fv) to determine the interest rate per period. Use =POWER((1 + annual_rate), 1/2) - 1 to convert an annual rate to a semi-annual rate. These formulas help accurately model financial forecasting with semi-annual compounding.

What is the correct way to structure a semi-annual timeline in a financial projection spreadsheet?

A semi-annual timeline in a financial projection spreadsheet should be structured with columns representing each six-month period, labeled clearly as H1 (first half) and H2 (second half) along with the corresponding year. Rows must detail key financial metrics such as revenue, expenses, and net profit to track performance within each period. Use consistent date formatting and ensure formulas aggregate data properly for accurate semi-annual forecasting.

How do you adjust annual financial figures to represent semi-annual periods in Excel?

To adjust annual financial figures for semi-annual periods in Excel, divide the annual totals by 2 in your calculations. Use formulas such as =AnnualValue/2 to split data accurately across two periods. This method ensures your financial forecasting reflects semi-annual intervals clearly and precisely.

What are common errors to watch for when modeling semi-annual cash flows in forecast spreadsheets?

Common errors when modeling semi-annual cash flows in financial forecasts include misaligning payment dates, overlooking interest compounding differences, and inconsistent period labeling. You should verify that all cash flow entries correspond precisely to the correct semi-annual intervals to maintain forecast accuracy. Ensuring correct formulas and date formats prevents data misinterpretation and enhances the reliability of your financial model.