The Semi-annually Depreciation Schedule Excel Template for Fixed Assets provides a streamlined way to calculate and track asset depreciation every six months, ensuring accurate financial reporting. This template helps businesses comply with accounting standards by automatically adjusting depreciation values based on asset lifespan and purchase date. Users benefit from clear visualization and easy customization, improving asset management efficiency.

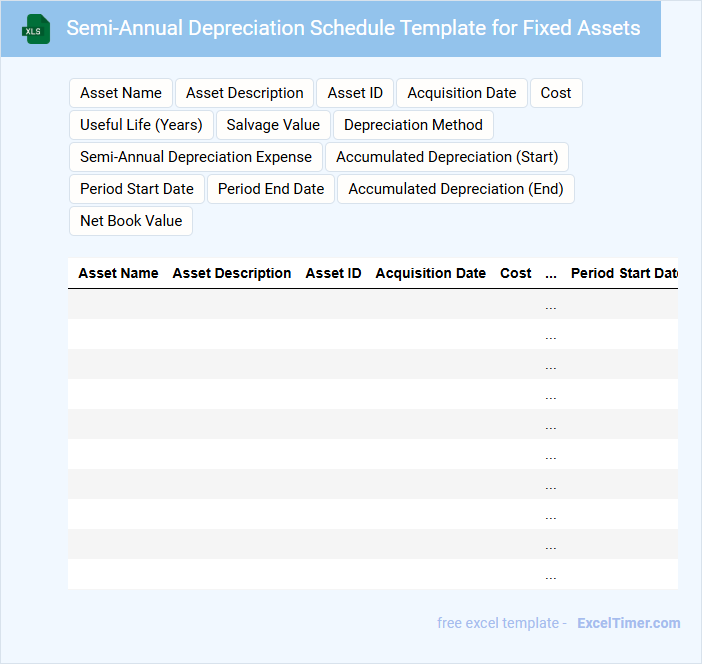

Semi-Annual Depreciation Schedule Template for Fixed Assets

A Semi-Annual Depreciation Schedule Template for fixed assets typically contains a detailed breakdown of asset values, depreciation methods, and accumulated depreciation over six-month periods. It tracks the reduction in value of fixed assets such as machinery, vehicles, or equipment, helping companies align their financial reporting with accounting standards. This document is essential for accurate budgeting and tax compliance, ensuring assets are depreciated correctly within each fiscal year. An important aspect to consider is including clear columns for asset description, acquisition date, cost basis, depreciation rate, and book value at the start and end of each period. Additionally, specifying the depreciation method-such as straight-line or declining balance-provides clarity on calculations. Ensuring the template is easy to update semi-annually will improve accuracy and facilitate financial audits.

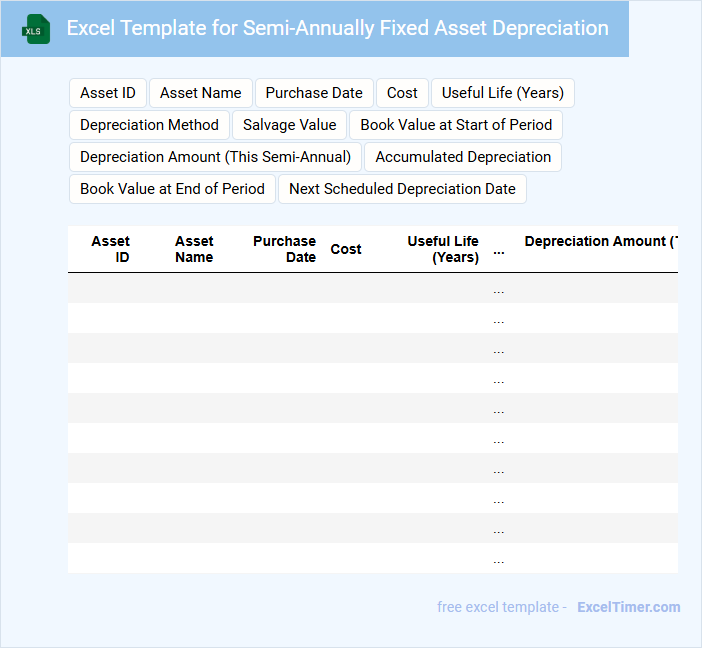

Excel Template for Semi-Annually Fixed Asset Depreciation

An Excel Template for Semi-Annually Fixed Asset Depreciation typically contains detailed schedules to calculate asset depreciation over six-month intervals. It includes asset acquisition costs, depreciation methods, useful life, and accumulated depreciation values. This document is essential for maintaining accurate financial records and ensuring compliance with accounting standards.

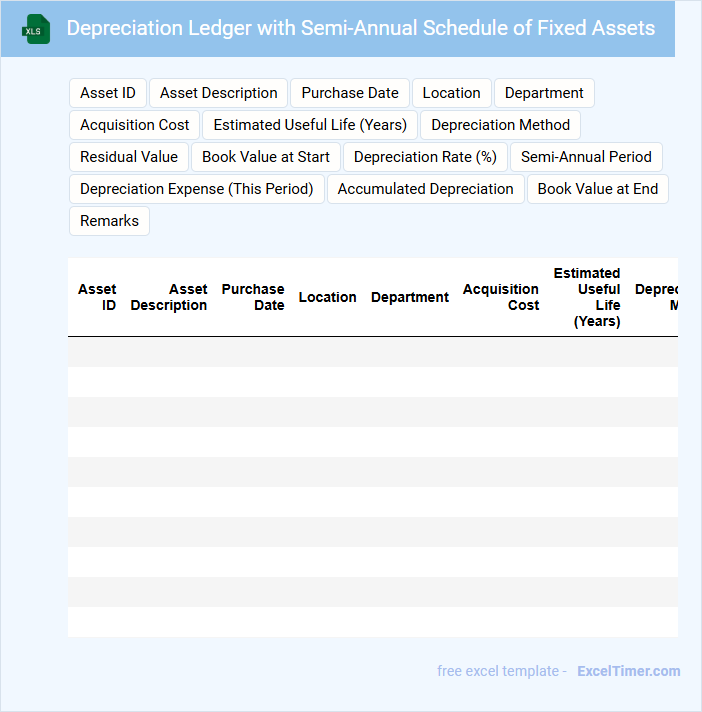

Depreciation Ledger with Semi-Annual Schedule of Fixed Assets

The Depreciation Ledger with Semi-Annual Schedule of Fixed Assets is a detailed financial record that tracks the depreciation expenses for assets over six-month periods. It helps organizations allocate the cost of tangible assets systematically, reflecting their reduced value due to use and wear. This document typically contains asset descriptions, acquisition dates, depreciation methods, and semi-annual depreciation amounts.

For effective use, it is important to ensure accuracy in asset valuation and consistent application of depreciation methods. Regular reconciliation of the ledger with the general ledger helps maintain financial integrity. Additionally, the schedule should be updated promptly to reflect disposals or asset impairments for correct financial reporting.

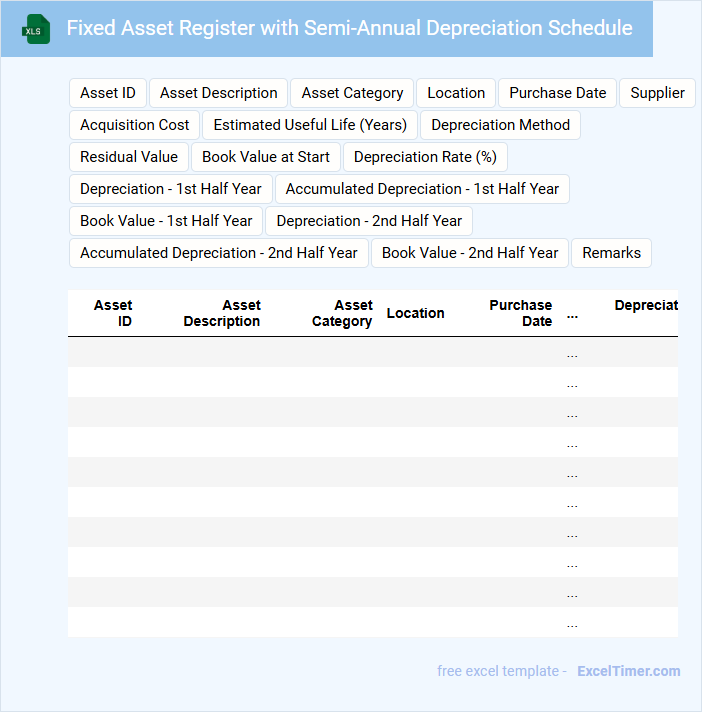

Fixed Asset Register with Semi-Annual Depreciation Schedule

A Fixed Asset Register with Semi-Annual Depreciation Schedule is a detailed record that tracks an organization's tangible fixed assets and their depreciation over time, updated every six months. It ensures accurate accounting and compliance with financial regulations.

- Include asset identification details such as serial numbers, purchase dates, and locations.

- Record semi-annual depreciation amounts calculated using appropriate accounting methods.

- Regularly update the register to reflect disposals, impairments, or revaluations of assets.

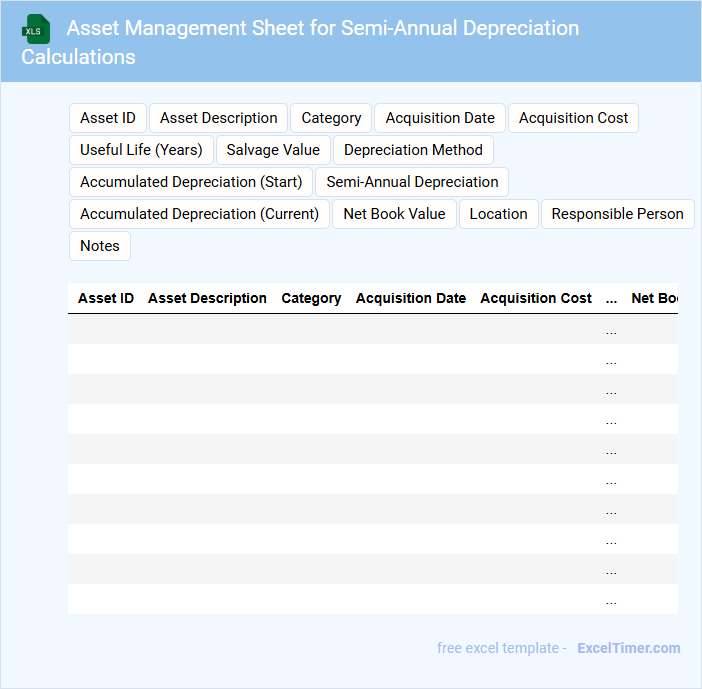

Asset Management Sheet for Semi-Annual Depreciation Calculations

This document typically contains detailed records of assets, their depreciation values, and calculation periods for accurate financial reporting.

- Asset Details: Comprehensive listing of each asset including purchase date, cost, and description.

- Depreciation Schedule: Clear timelines and methods used to compute semi-annual depreciation values.

- Valuation Updates: Regular adjustments reflecting asset impairments or disposals for precise accounting.

Depreciation Tracking Workbook for Fixed Assets (Semi-Annual)

The Depreciation Tracking Workbook for Fixed Assets is a crucial document that helps organizations monitor the loss in value of their tangible assets over time. It typically contains detailed asset information, acquisition dates, cost, depreciation methods, and accumulated depreciation balances.

This workbook is updated on a semi-annual basis to ensure accurate financial reporting and asset management. An important suggestion is to regularly verify the depreciation calculations and update asset conditions to maintain data integrity.

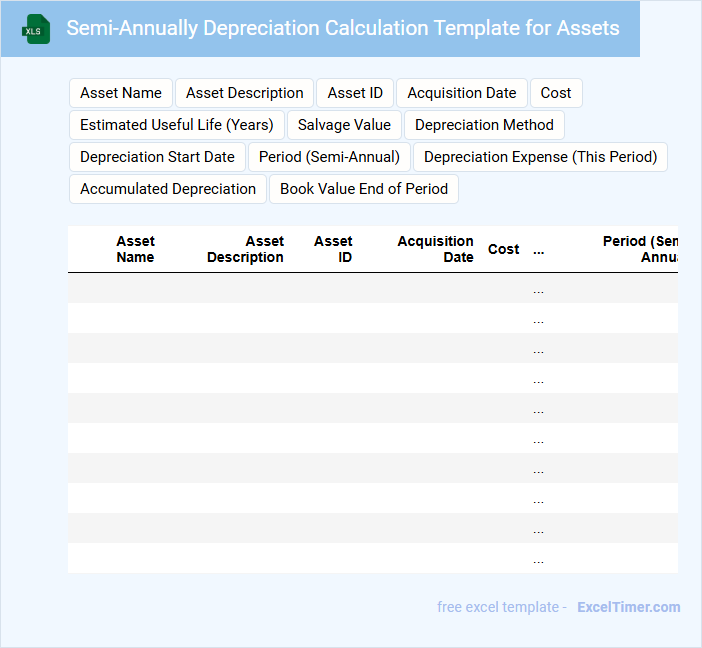

Semi-Annually Depreciation Calculation Template for Assets

A Semi-Annually Depreciation Calculation Template is designed to systematically record and calculate the depreciation of assets every six months. This type of document typically contains asset details, acquisition dates, depreciation rates, and calculated depreciation values for each half-year period. It ensures accurate financial reporting and asset management by providing a clear, structured format for tracking asset value reduction over time.

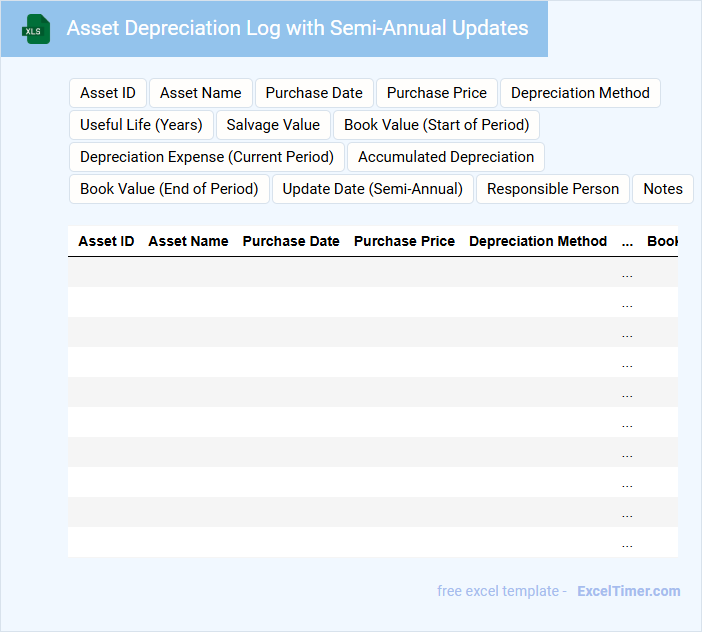

Asset Depreciation Log with Semi-Annual Updates

An Asset Depreciation Log is a financial document that tracks the reduction in value of an organization's assets over time. It typically includes the asset description, acquisition date, depreciation method, and calculated depreciation amounts. For semi-annual updates, it's important to maintain accurate dates and record adjustments promptly to ensure precise financial reporting.

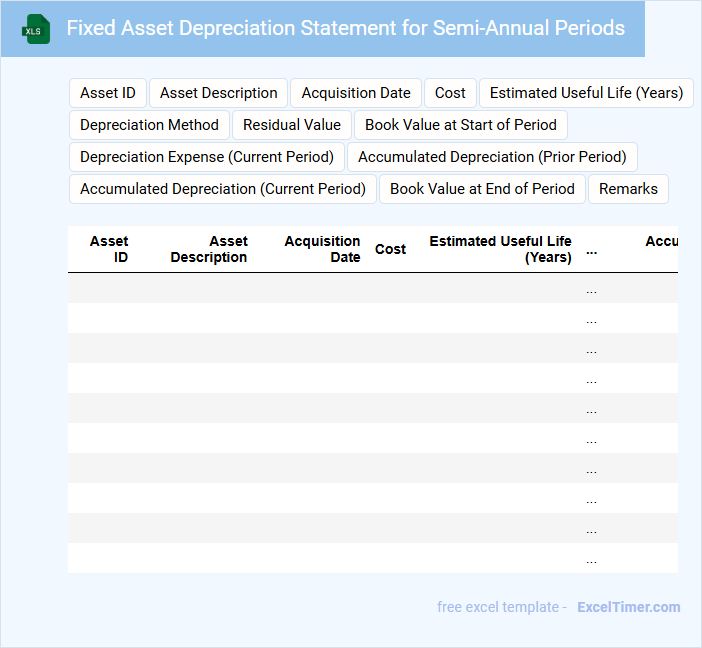

Fixed Asset Depreciation Statement for Semi-Annual Periods

The Fixed Asset Depreciation Statement for semi-annual periods typically contains detailed records of the depreciation expenses related to an organization's fixed assets over a six-month timeframe. It includes information on asset acquisition costs, accumulated depreciation, and net book values to provide a clear financial snapshot. This statement is crucial for accurately reflecting asset value changes and ensuring compliance with accounting standards.

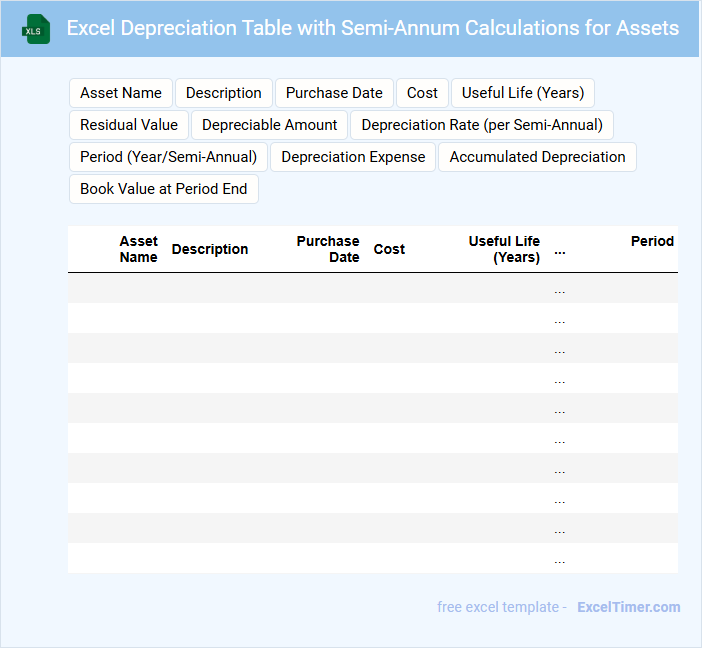

Excel Depreciation Table with Semi-Annum Calculations for Assets

What does an Excel Depreciation Table with Semi-Annum Calculations for Assets typically contain? This document usually includes asset details, acquisition cost, useful life, and depreciation amounts calculated semi-annually. It helps in tracking the reduction in value of assets over time with biannual adjustments for accurate financial reporting.

Why is it important to include both acquisition dates and depreciation rates? Including these details ensures precise calculation of depreciation for each half-year period, reflecting true asset value. Accurate dates and rates are critical for compliance with accounting standards and financial analysis.

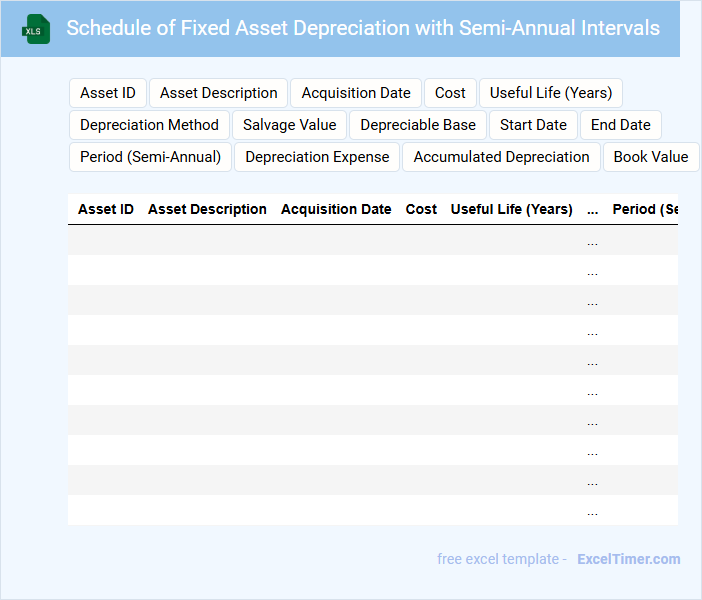

Schedule of Fixed Asset Depreciation with Semi-Annual Intervals

A Schedule of Fixed Asset Depreciation with Semi-Annual Intervals is a financial document detailing the periodic reduction in value of fixed assets over time.

- Asset Identification: Clearly list each fixed asset with its description and acquisition date.

- Depreciation Method: Specify the depreciation method applied, such as straight-line or declining balance.

- Semi-Annual Breakdown: Provide depreciation amounts calculated for each six-month period to track asset value decline accurately.

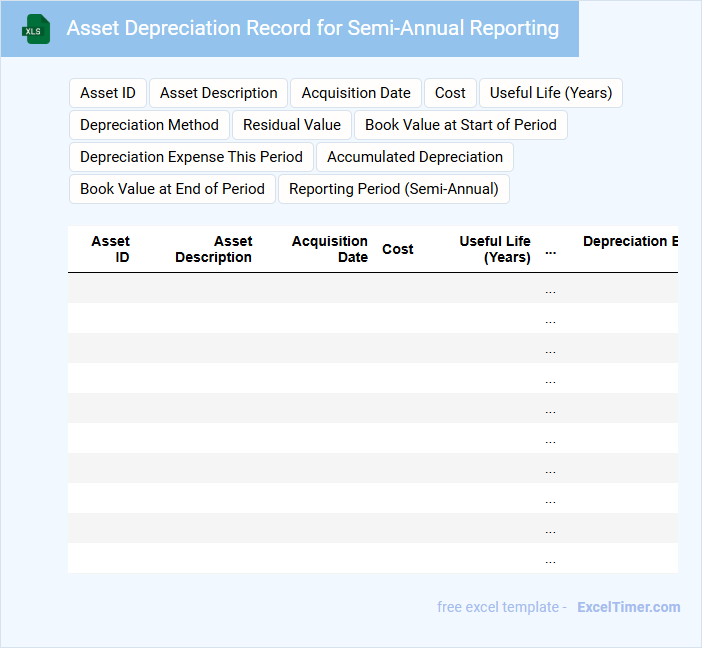

Asset Depreciation Record for Semi-Annual Reporting

An Asset Depreciation Record for semi-annual reporting typically contains detailed information about the depreciation of company assets over a six-month period. This document includes asset identification, acquisition dates, depreciation methods, and accumulated depreciation values. Maintaining accurate and up-to-date records ensures compliance with accounting standards and supports financial transparency.

Important considerations include regularly updating asset values, verifying depreciation calculations, and reconciling records with financial statements to prevent discrepancies. Consistent documentation aids in tax reporting and internal audits. Clear categorization of assets by type and useful life enhances the report's clarity and usability.

Template for Semi-Annual Depreciation Management of Fixed Assets

This template is designed to facilitate the semi-annual tracking and management of fixed asset depreciation. It typically includes asset details, depreciation schedules, and accumulated depreciation values for accurate financial reporting.

Important aspects to consider are maintaining up-to-date asset records and ensuring compliance with accounting standards. Regularly reviewing asset condition and value adjustments is essential for precise depreciation management.

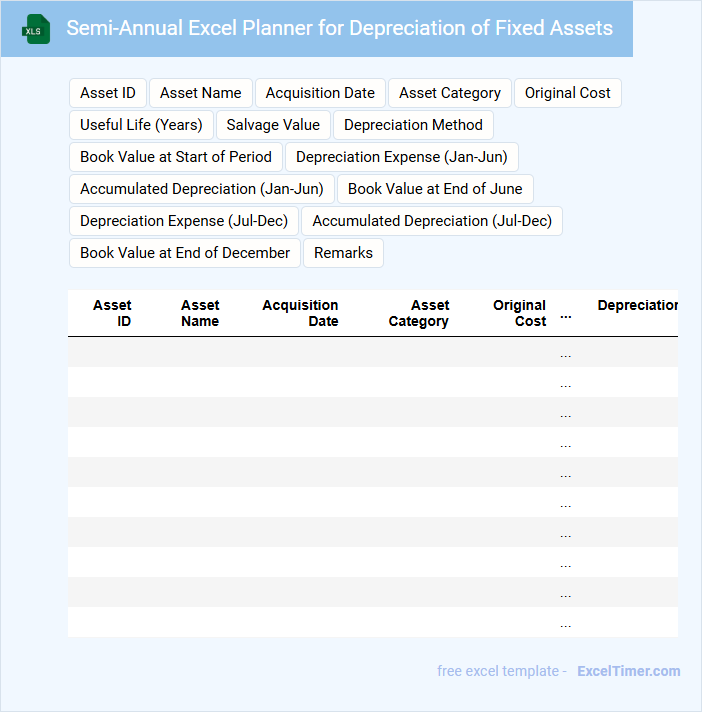

Semi-Annual Excel Planner for Depreciation of Fixed Assets

This document typically contains a detailed schedule to track and calculate the depreciation of fixed assets over a six-month period using Excel. It helps in financial planning and asset management by providing clear visibility of asset value reductions.

- Include asset details such as purchase date, cost, and useful life.

- Incorporate formulas to automatically calculate depreciation expenses for each period.

- Provide summary tables for easy review of accumulated depreciation and book value.

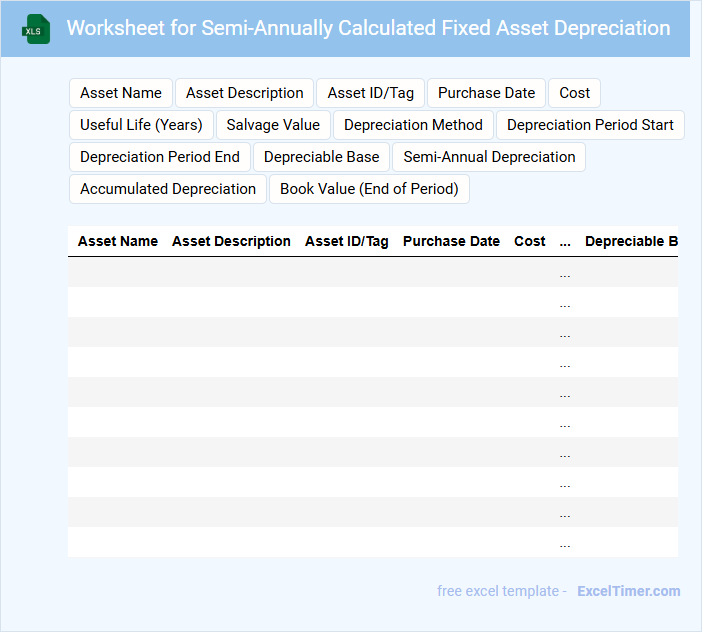

Worksheet for Semi-Annually Calculated Fixed Asset Depreciation

A Worksheet for Semi-Annually Calculated Fixed Asset Depreciation typically contains detailed information on the asset's cost, useful life, and accumulated depreciation calculated every six months. It helps track the reduction in value of fixed assets systematically for accurate financial reporting. Essential components include the asset's purchase date, depreciation method, and semi-annual depreciation expense.

Important suggestions for this worksheet include ensuring consistent use of the chosen depreciation method, verifying asset details periodically, and clearly documenting all calculations for audit purposes. Regular updates and reconciliation with the general ledger enhance financial accuracy. Maintaining precise records supports compliance with accounting standards and tax regulations.

What formula is used to calculate semi-annual depreciation of fixed assets in Excel?

The formula to calculate semi-annual depreciation of fixed assets in Excel is typically =SLN(cost, salvage, life*2)/2, where cost is the asset purchase price, salvage is the residual value, and life is the useful life in years. This formula applies the straight-line depreciation method adjusted for semi-annual periods by doubling the life and halving the depreciation expense. Using SLN ensures a consistent depreciation expense allocation across each half-year period for accurate fixed asset accounting.

How are purchase date and salvage value factored into a semi-annual depreciation schedule?

The purchase date determines the starting point for calculating depreciation periods in the semi-annual schedule, ensuring accurate allocation of expense. Salvage value is subtracted from the asset's cost to establish the depreciable base, which is then divided over the asset's useful life. This approach aligns depreciation expense with the asset's economic use and residual worth.

Which Excel functions help automate the update of book value after each semi-annual period?

Excel functions like SUM, IF, and DATE help automate the update of book value after each semi-annual period in a depreciation schedule. The SUM function calculates cumulative depreciation, while IF can apply conditional logic for asset status. Using DATE functions assists in tracking semi-annual intervals and ensuring timely updates to book value.

How can conditional formatting highlight assets nearing the end of their depreciation schedule?

You can use conditional formatting in your Excel Semi-annually Depreciation Schedule to highlight assets nearing the end of their useful life by setting a rule that flags assets with remaining depreciation periods less than a specified threshold. This involves creating a formula that compares the current semi-annual period to the asset's total depreciation duration, signaling when the asset is close to full depreciation. Utilizing this approach helps you quickly identify assets requiring replacement or revaluation.

What columns are essential for tracking each asset's value and depreciation over each semi-annual period?

Essential columns for a Semi-Annually Depreciation Schedule include Asset Name, Asset ID, Acquisition Date, Cost Basis, Useful Life (in years), Depreciation Method, Accumulated Depreciation, Depreciation Expense per Period, Net Book Value, and Period End Date. These columns enable accurate tracking of each asset's value and depreciation accumulated during each six-month interval. Including Semi-Annual Period Number or Date ranges helps organize depreciation calculations chronologically.