The Semi-annually Expense Report Excel Template for Small Businesses streamlines financial tracking by organizing expenses every six months, enabling better budget management. This template includes pre-built categories and formulas to ensure accurate calculations, saving time and reducing errors. Small businesses can monitor spending patterns effectively and prepare for tax season with ease using this tool.

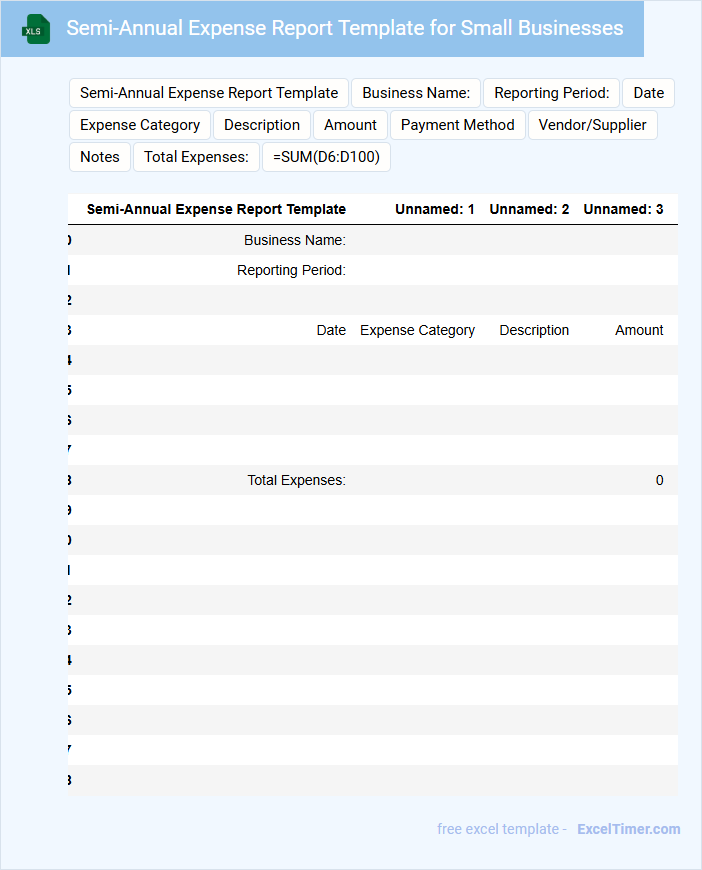

Semi-Annual Expense Report Template for Small Businesses

The Semi-Annual Expense Report Template is a structured document designed to track and summarize expenses over a six-month period. Typically, it includes sections for categorizing costs, recording dates, and noting payment methods. This template helps small businesses monitor their financial health and identify spending patterns.

Excel Template for Semi-Annual Business Expense Tracking

An Excel Template for Semi-Annual Business Expense Tracking is designed to systematically record and monitor expenses over a six-month period. It typically includes categorized expense entries, date tracking, and summary charts for financial insights.

These templates help in maintaining accurate financial records and identifying spending trends. It is important to regularly update the data and review the summary to ensure effective budget management.

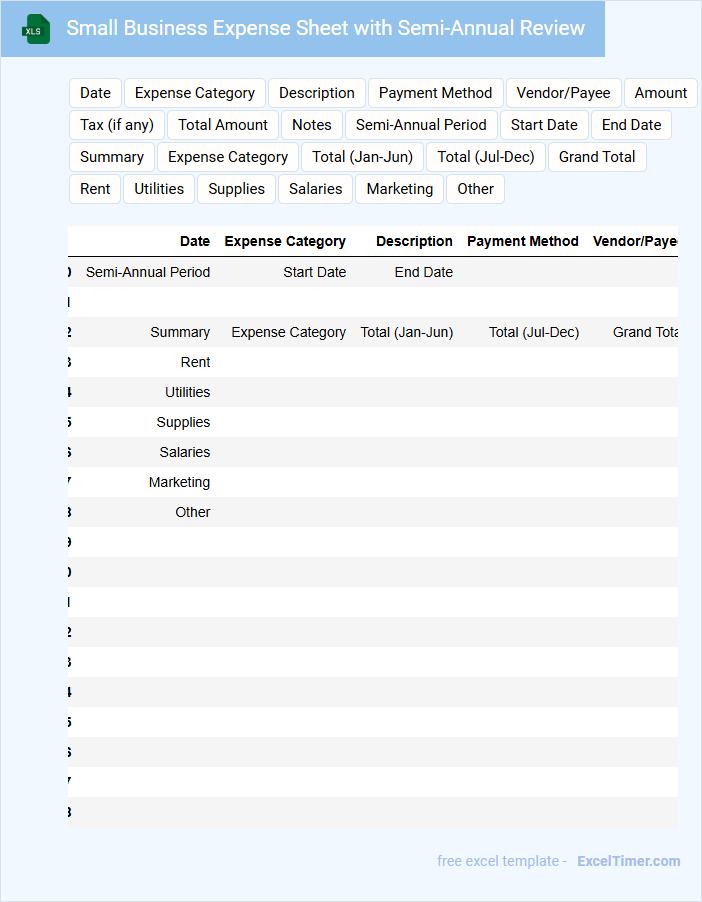

Small Business Expense Sheet with Semi-Annual Review

What information is typically included in a Small Business Expense Sheet with Semi-Annual Review? This type of document usually contains detailed records of all business expenses categorized by type and date to help monitor spending patterns. It also includes a summary section for a semi-annual review to assess financial health and identify cost-saving opportunities.

Why is it important to perform a Semi-Annual Review on this expense sheet? Regular reviews ensure accurate tracking, help detect discrepancies early, and enable better budgeting decisions to support sustainable business growth. It's also recommended to include notes on any unusual expenses and adjustments made during the review period.

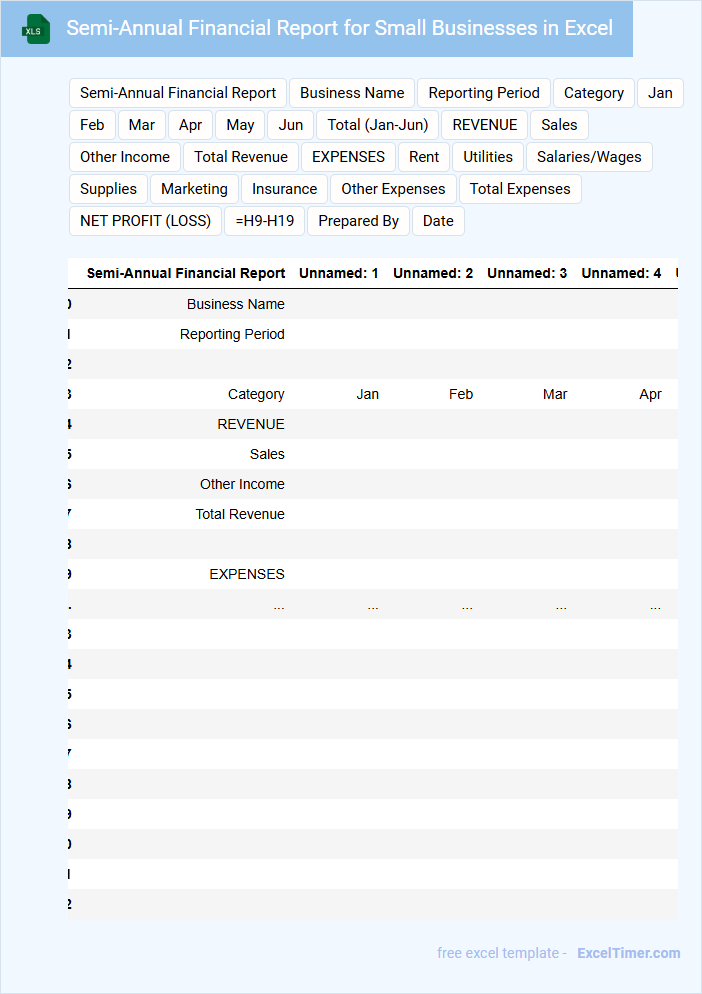

Semi-Annual Financial Report for Small Businesses in Excel

The Semi-Annual Financial Report for small businesses in Excel typically contains detailed financial data such as income statements, balance sheets, and cash flow summaries. This document helps business owners track their financial performance over six months, enabling informed decision-making. It is essential for assessing profitability, managing expenses, and planning future budgets.

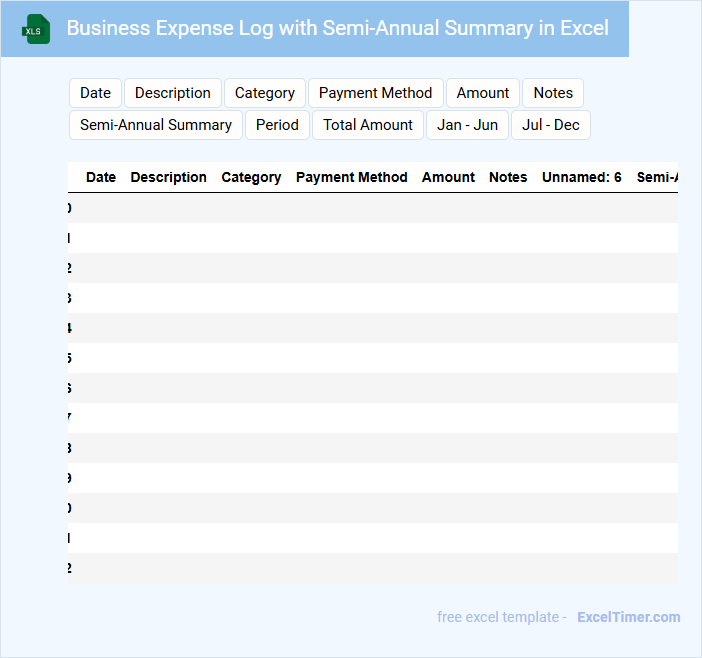

Business Expense Log with Semi-Annual Summary in Excel

A Business Expense Log in Excel typically contains detailed records of all expenditures made by a business over a specific period. This includes categories such as travel, office supplies, utilities, and miscellaneous costs to track spending efficiently.

Incorporating a Semi-Annual Summary helps summarize expenses every six months, enabling easier financial analysis and budget adjustments. It provides insights into spending trends and assists in identifying areas for cost reduction.

Ensure consistent data entry and categorize expenses accurately to maximize the log's effectiveness and maintain clear financial records.

Expense Tracker Excel Template for Semi-Annual Reports

An Expense Tracker Excel Template for Semi-Annual Reports is designed to help individuals or businesses systematically record and monitor their expenditures over a six-month period. This document typically contains categorized expense entries, timestamps, and summaries to facilitate easy analysis. Using such a template ensures accuracy and efficiency in financial tracking for mid-year assessments.

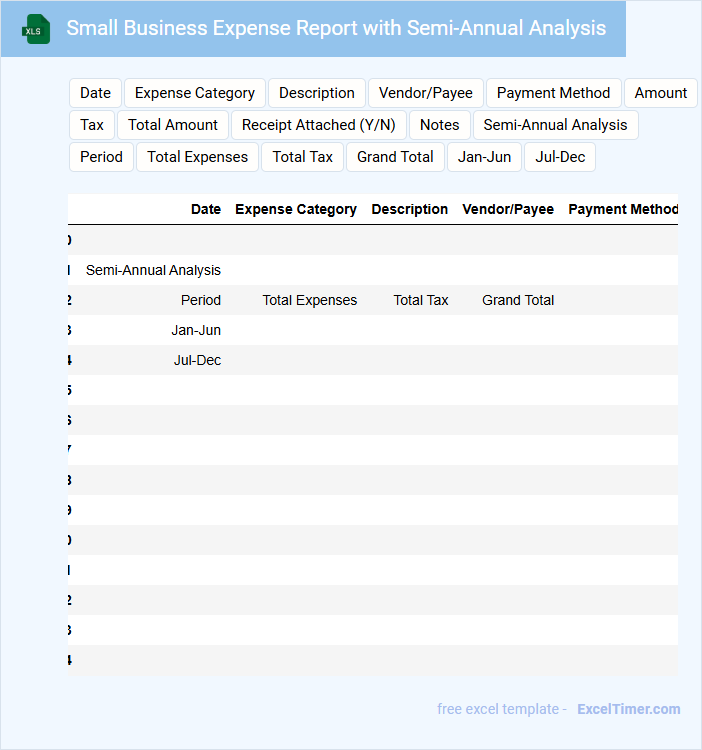

Small Business Expense Report with Semi-Annual Analysis

A Small Business Expense Report typically contains detailed records of all expenditures over a specified period, allowing businesses to track spending and manage budgets effectively. This report is crucial for monitoring cash flow and identifying cost-saving opportunities. Including a semi-annual analysis helps in evaluating trends and making informed financial decisions.

Ensure the report includes categorized expenses, clear timestamps, and supporting receipts or invoices for accuracy. Highlighting significant variances between periods can guide strategic adjustments. Regularly updating and reviewing this document supports compliance and enhances financial planning.

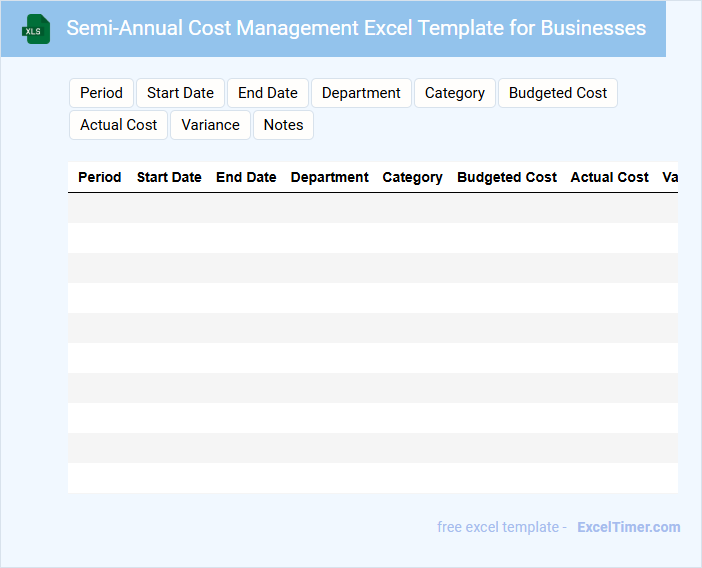

Semi-Annual Cost Management Excel Template for Businesses

This Semi-Annual Cost Management Excel Template for Businesses is designed to track and analyze expenses over a six-month period, helping companies maintain financial control. It typically contains categorized cost entries, budget comparisons, and visual summaries.

- Include detailed cost categories to improve accuracy and insights.

- Incorporate automated formulas for real-time budget variance tracking.

- Use charts and graphs to clearly visualize spending trends and patterns.

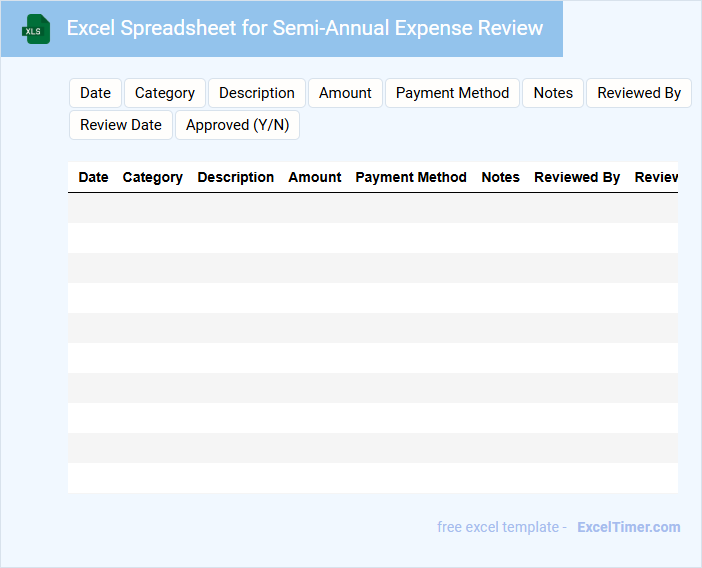

Excel Spreadsheet for Semi-Annual Expense Review

An Excel Spreadsheet for Semi-Annual Expense Review typically contains detailed financial data, categorized expenses, and summary charts for efficient tracking. It helps organizations analyze spending patterns and identify cost-saving opportunities over a six-month period.

A crucial aspect of this document is its ability to provide accurate and up-to-date information for informed decision-making. Ensuring data accuracy and including clear visual representations are important for maximizing its effectiveness.

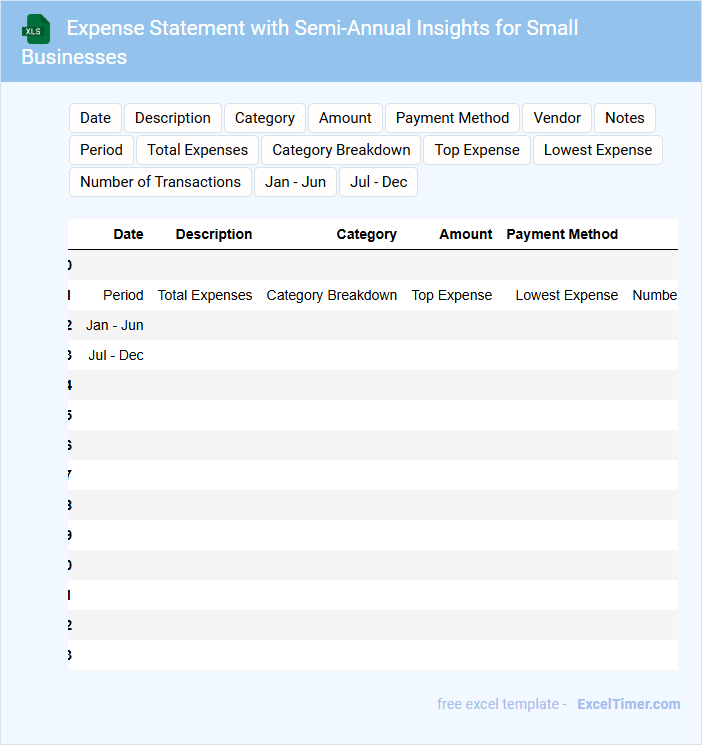

Expense Statement with Semi-Annual Insights for Small Businesses

Expense statements with semi-annual insights for small businesses typically summarize financial outflows over six months and provide actionable analysis for improved budgeting.

- Detailed transaction records help track individual expenses accurately.

- Comparative analysis identifies spending trends and potential cost savings.

- Clear categorization of expenses ensures easier financial review and tax preparation.

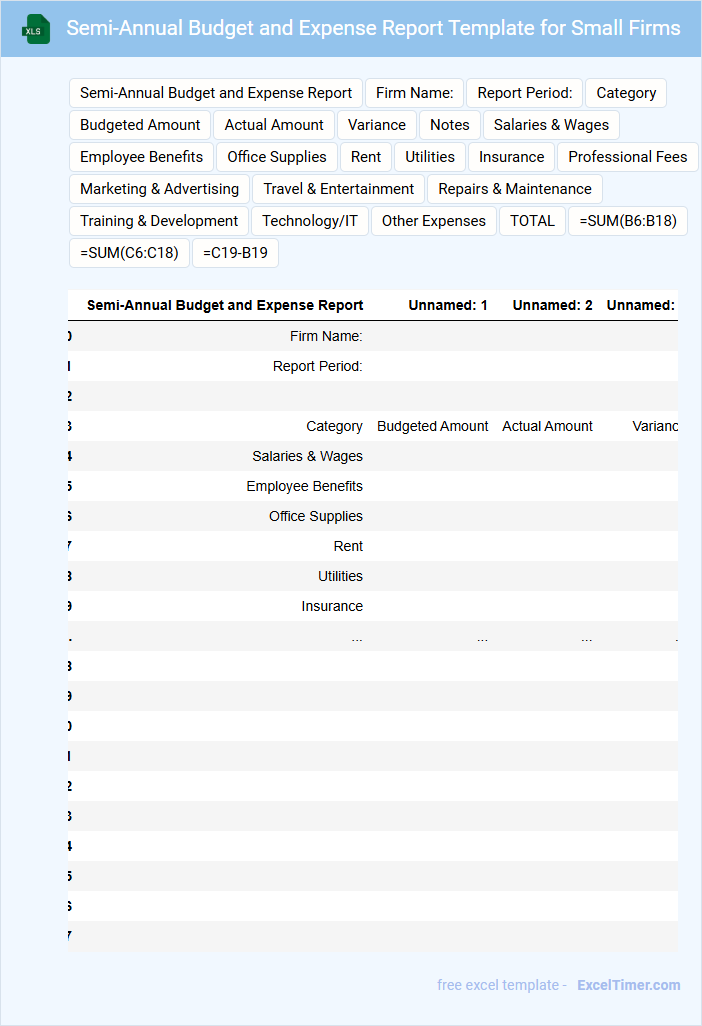

Semi-Annual Budget and Expense Report Template for Small Firms

The Semi-Annual Budget and Expense Report Template is typically used by small firms to track financial performance over six months. This document contains detailed records of income, expenses, budget allocations, and variances. It helps businesses monitor cash flow and make informed financial decisions.

Important elements to include are clear categorization of expenses, actual vs. budget comparisons, and summary insights to identify trends. Accurate data entry and periodic updates ensure reliability and usefulness of the report. Incorporating visual aids like charts can enhance clarity and support strategic planning.

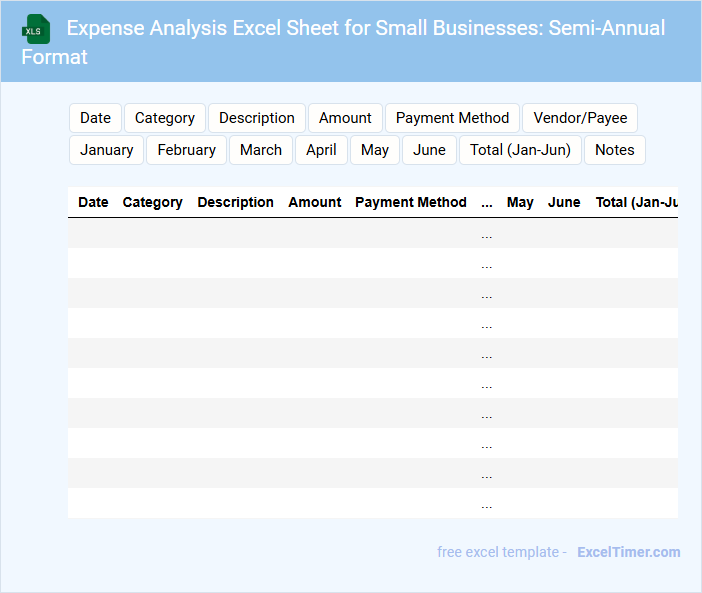

Expense Analysis Excel Sheet for Small Businesses: Semi-Annual Format

Expense Analysis Excel Sheet for Small Businesses: Semi-Annual Format is a structured document used to track and evaluate expenditures over six months to enhance financial decision-making.

- Expense Categorization: Clearly classify all expenses to identify major cost centers and overspending areas.

- Trend Analysis: Monitor expense patterns over the two quarters to detect seasonal fluctuations and optimize budgeting.

- Summary Reports: Provide concise visual summaries such as charts and totals for quick financial insights and planning.

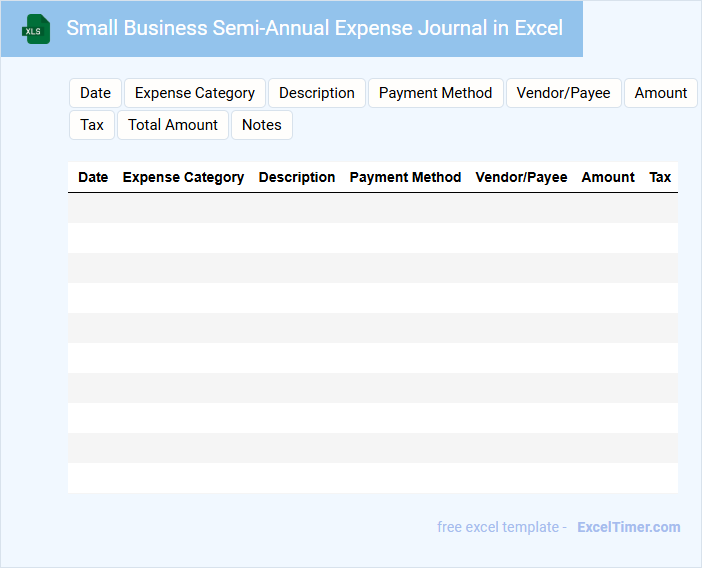

Small Business Semi-Annual Expense Journal in Excel

The Small Business Semi-Annual Expense Journal in Excel is typically a detailed financial record used to track expenses over a six-month period. It includes categories such as utilities, salaries, office supplies, and marketing costs, enabling businesses to monitor spending efficiently. This document aids in budgeting, tax preparation, and financial analysis for small enterprises.

When creating or maintaining this journal, it is important to ensure data accuracy, consistent categorization of expenses, and regular updates to reflect current financial activities. Utilizing Excel's features like formulas, filters, and charts can enhance clarity and reporting. Additionally, backing up the document periodically helps safeguard critical financial information.

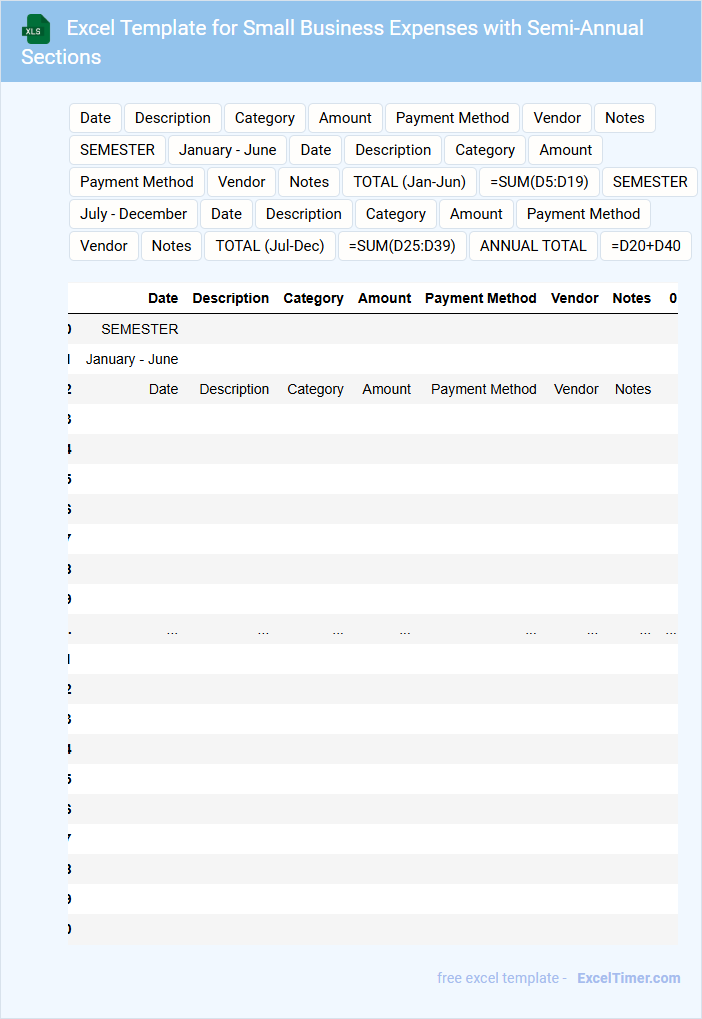

Excel Template for Small Business Expenses with Semi-Annual Sections

An Excel Template for Small Business Expenses typically contains organized sections to track various costs such as utilities, supplies, and payroll over specific periods. Semi-annual divisions help businesses review and analyze expenses efficiently every six months. This format aids in budgeting, forecasting, and financial reporting to improve cash flow management.

Financial Expense Report with Semi-Annual Trends for Small Businesses

A Financial Expense Report is a document that details the expenditures of a business over a given period, helping track where money is spent. For small businesses, this report often highlights semi-annual trends to identify patterns and areas for cost optimization. Including categorized expenses, comparisons with previous periods, and notes on anomalies is crucial for accurate financial planning and decision-making.

What are the key categories to include in a semi-annual expense report for small businesses?

Key categories to include in a semi-annual expense report for small businesses are operating expenses, payroll costs, marketing and advertising expenses, rent and utilities, office supplies, travel and transportation, and professional services. Tracking these categories helps identify spending patterns and manage cash flow effectively. Accurate categorization supports budget planning and tax preparation.

How can Excel formulas be used to automate the calculation of total expenses by category?

Excel formulas like SUMIF and SUMPRODUCT automate calculating total expenses by category in your Semi-Annually Expense Report for Small Businesses. Using SUMIF, you can sum expenses that match specific categories, streamlining the aggregation of costs. These formulas reduce manual errors and save time, enhancing the accuracy and efficiency of your financial tracking.

What methods can be employed in Excel to track and compare expenses across the two quarters?

Excel enables small businesses to track and compare semi-annual expenses using pivot tables, which summarize data by category and quarter for clear insights. Utilizing conditional formatting highlights spending trends and anomalies between the two quarters. Implementing charts such as clustered column or line graphs visually contrasts quarterly expenses, enhancing decision-making.

Which data validation tools in Excel help ensure accuracy when entering semi-annual expense data?

Excel's Data Validation feature allows users to set specific criteria for semi-annual expense entries, such as restricting inputs to numerical values within a defined range. Drop-down lists enable selection of predefined expense categories, reducing errors in data classification. Error alert messages immediately notify users of invalid entries, enhancing overall data accuracy for small business expense reports.

How can pivot tables in Excel be utilized to summarize and analyze semi-annual expenses for better decision-making?

Pivot tables in Excel efficiently summarize semi-annual expenses by categorizing data into meaningful groups like expense type and period, enabling quick identification of cost trends. They allow small businesses to filter, sort, and aggregate expenses, providing clear insights into spending patterns over each half-year. Leveraging pivot tables facilitates informed financial decisions by highlighting areas of high expenditure and potential savings.