![]()

The Semi-annually Payment Tracker Excel Template for Freelancers helps organize and monitor payments received every six months, ensuring timely invoicing and cash flow management. It simplifies tracking project milestones and payment statuses, reducing the risk of missed payments. This template is essential for freelancers aiming to maintain accurate financial records and improve income stability.

Semi-Annual Payment Tracker Excel Template for Freelancers

What information is typically included in a Semi-Annual Payment Tracker Excel Template for Freelancers? This document usually contains detailed records of payments received over a six-month period, including client names, payment dates, amounts, and project descriptions. It helps freelancers monitor cash flow, track outstanding invoices, and maintain accurate financial records.

What important features should freelancers look for in this template? Essential elements include customizable payment categories, automatic total calculations, clear status indicators for pending or completed payments, and easy export options for tax reporting. These features ensure streamlined financial management and improve overall payment tracking efficiency.

Excel Tracker for Semi-Annual Freelancer Payments

This document typically contains comprehensive records of payments made to freelancers on a semi-annual basis, helping to track financial transactions accurately. It is essential for managing budgets, ensuring timely payments, and maintaining transparency with contractors.

- Include freelancer names, payment dates, and amounts for clear tracking.

- Incorporate columns for project details and payment status to monitor progress.

- Regularly update the tracker to avoid payment delays and discrepancies.

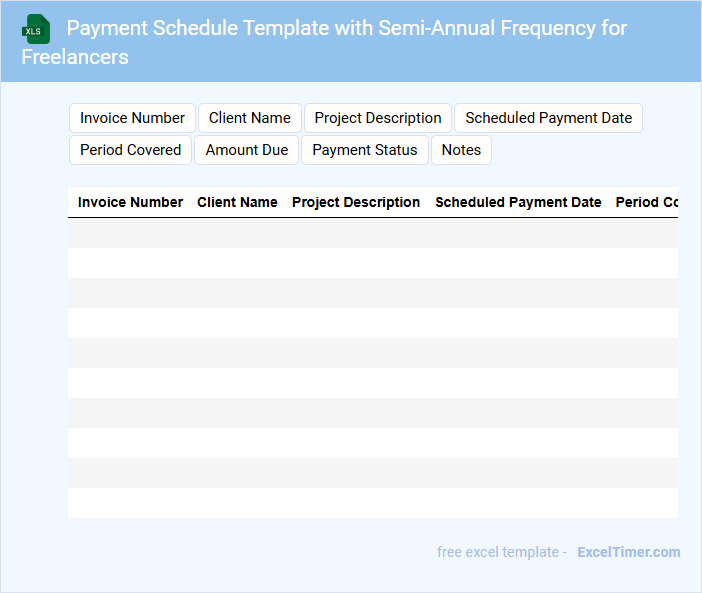

Payment Schedule Template with Semi-Annual Frequency for Freelancers

A Payment Schedule Template with semi-annual frequency outlines the specific dates and amounts freelancers expect to be paid every six months. It helps both parties maintain clear financial expectations and avoid payment disputes. This type of document ensures timely compensation aligned with project milestones or contract terms.

Important elements include the due dates, payment amounts, and any conditions tied to deliverables. Including detailed descriptions and contact information enhances transparency and accountability. Freelancers should also verify terms comply with tax regulations and client agreements.

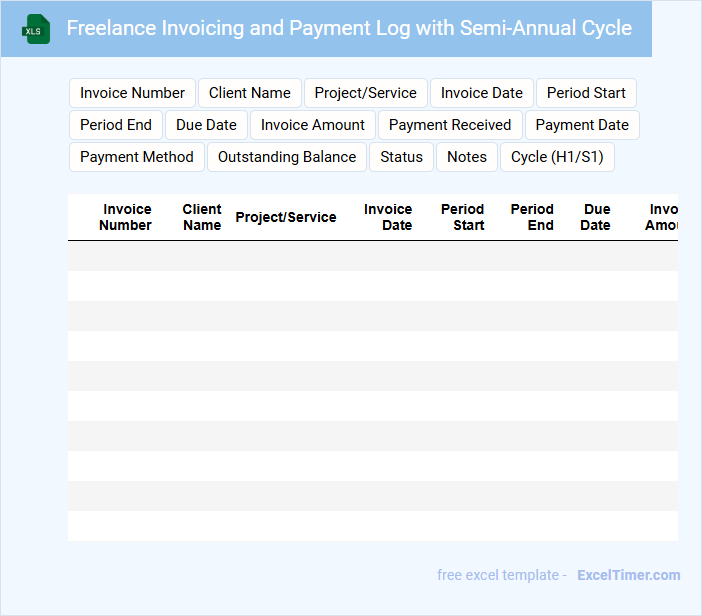

Freelance Invoicing and Payment Log with Semi-Annual Cycle

A Freelance Invoicing and Payment Log with a semi-annual cycle typically contains detailed records of invoices issued and payments received from clients every six months. It includes invoice dates, amounts, payment statuses, and client information for accurate financial tracking. Maintaining this log ensures timely follow-ups and clear budgeting for freelance professionals.

Semi-Annual Earnings Tracker for Freelancers in Excel

This document is a Semi-Annual Earnings Tracker designed specifically for freelancers to monitor and evaluate their income over six-month periods using Excel. It helps in organizing, analyzing, and forecasting freelance earnings, ensuring better financial management.

- Include clear categories for income sources to differentiate various freelance projects.

- Incorporate formulas to automatically calculate totals and averages for efficient tracking.

- Ensure a summary section that highlights net earnings and potential tax obligations.

Freelancer Budget Sheet with Semi-Annual Payment Tracker

Freelancer Budget Sheets with Semi-Annual Payment Trackers typically contain detailed records of income and expenses alongside a schedule for tracking payments received twice a year. This document helps freelancers maintain financial organization and ensure timely payments from clients.

- Include clear categories for different types of income and expenses for accurate budgeting.

- Use the semi-annual tracker to monitor payment timing and avoid overdue invoices.

- Regularly update the sheet to reflect changes in project scope or payment terms.

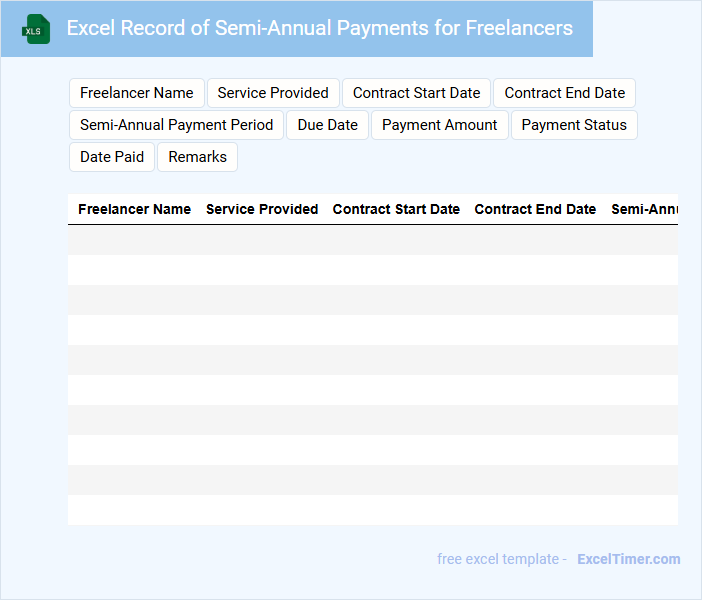

Excel Record of Semi-Annual Payments for Freelancers

An Excel record of semi-annual payments for freelancers typically contains detailed entries of all transactions made within the six-month period, including dates, amounts, and client information. This document helps track income precisely and ensures accurate financial reporting.

Maintaining clear payment records supports hassle-free tax filing and budgeting. It is important to regularly update the sheet and verify all data for accuracy.

Semi-Annually Payment Log with Invoice Tracking for Freelancers

A Semi-Annually Payment Log for freelancers typically contains detailed records of payments received every six months, including dates, amounts, and payment methods. It often pairs with an invoice tracking system to ensure all freelance invoices are accounted for and matched with corresponding payments. Keeping this documentation organized helps maintain clear financial records and aids in tax preparation.

Invoice tracking is an essential feature that allows freelancers to monitor the status of their bills, ensuring timely payments and reducing disputes. This document also helps freelancers analyze cash flow and project future income efficiently. Implementing a consistent log system enhances professionalism and financial management for freelance work.

Cash Flow Tracker with Semi-Annual Payments for Freelancers

A Cash Flow Tracker with Semi-Annual Payments for Freelancers is a financial document designed to monitor income and expenses over a six-month period to ensure timely payments and proper budgeting. It helps freelancers maintain financial stability by organizing cash inflows and outflows systematically.

- Include detailed records of payment dates and amounts to track semi-annual income accurately.

- Highlight upcoming expenses and deadlines to avoid late payments and cash shortages.

- Incorporate a summary section to review total cash flow and adjust financial plans accordingly.

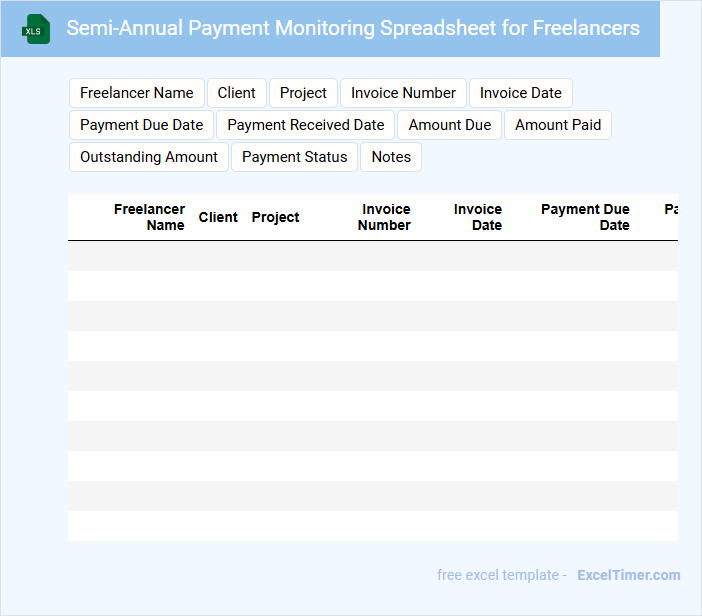

Semi-Annual Payment Monitoring Spreadsheet for Freelancers

A Semi-Annual Payment Monitoring Spreadsheet for freelancers typically contains detailed records of payments received, invoice dates, and outstanding amounts. It helps track financial transactions over a six-month period to ensure timely payments and accurate accounting. Including clear categorizations for clients and payment statuses is essential for effective financial management.

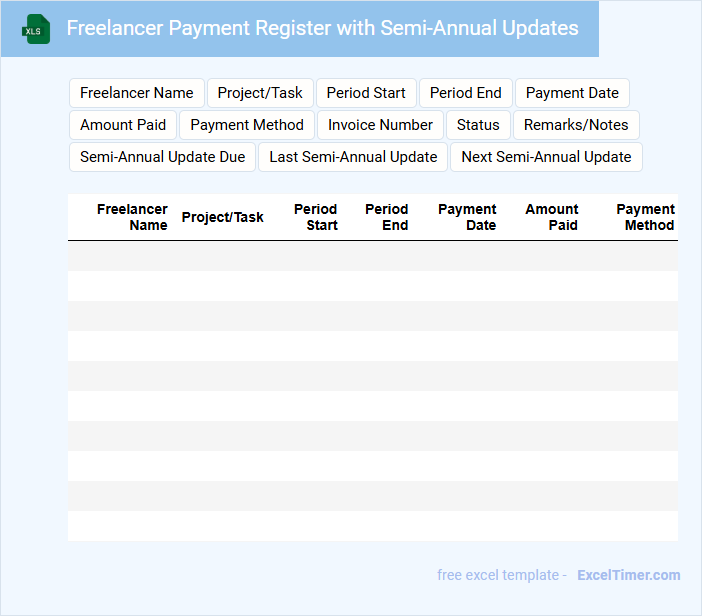

Freelancer Payment Register with Semi-Annual Updates

A Freelancer Payment Register is a document that tracks all payments made to freelancers over a specific period. It typically contains details such as payment dates, amounts, freelancer names, and project descriptions. For semi-annual updates, it is important to ensure accuracy and consistent record-keeping to facilitate financial reviews and budgeting.

Excel Tracking Sheet for Semi-Annual Billing of Freelancers

This document typically contains detailed records of payments, hours worked, and billing cycles for freelancers on a semi-annual basis. It ensures accurate financial tracking and timely invoicing.

- Include freelancer names, contact details, and contract periods for clarity.

- Track hours worked and corresponding rates to calculate payments precisely.

- Maintain a clear timeline for billing and payment deadlines to avoid delays.

Project Payment Tracker with Semi-Annual Periods for Freelancers

A Project Payment Tracker with semi-annual periods helps freelancers monitor their income efficiently over fixed six-month intervals. It typically includes details like payment dates, client names, amounts received, and pending invoices to ensure timely tracking.

This document is essential for maintaining clear financial records and forecasting cash flow for freelancers managing multiple projects. It is recommended to regularly update the tracker and review it at each semi-annual period for better budgeting and tax preparation.

Invoice Organizer for Freelancers with Semi-Annual Payment Tracking

This document typically contains a detailed overview and systematic arrangement of invoices alongside a biannual payment tracking system designed specifically for freelancers.

- Invoice Details: An organized list of all issued and received invoices including dates, amounts, and client information.

- Semi-Annual Tracking: A timelineed summary that monitors payments and outstanding balances every six months.

- Financial Summary: A section highlighting total income, pending payments, and projections to aid budgeting and tax preparation.

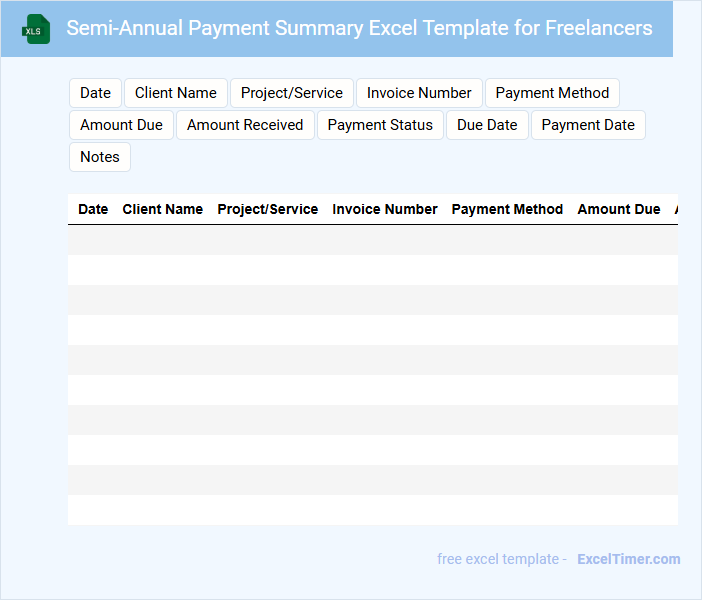

Semi-Annual Payment Summary Excel Template for Freelancers

A Semi-Annual Payment Summary Excel Template for freelancers is a structured document designed to track income received over six months clearly and efficiently. It typically includes detailed records of client names, payment dates, amounts, and project descriptions to facilitate accurate financial management.

This template is essential for monitoring cash flow, preparing tax filings, and evaluating income trends. It is important to ensure data accuracy and regular updates for effective financial analysis and reporting.

What formulas or functions can automate tracking of due and received semi-annual payments for multiple clients?

Use the SUMIF function to total received payments by client and the IF function combined with TODAY() to flag upcoming due dates. VLOOKUP or INDEX-MATCH can retrieve client-specific payment schedules from a master list. Your Semi-annually Payment Tracker in Excel becomes automated by leveraging these formulas to track and manage multiple clients efficiently.

How can conditional formatting highlight overdue or pending payments within the spreadsheet?

Conditional formatting in your Semi-annually Payment Tracker can automatically highlight overdue payments by applying a red fill to dates past today's date and pending payments with a yellow fill for upcoming due dates. This visual distinction enables you to quickly identify unpaid or soon-to-be-due invoices. Using formulas with Excel's conditional formatting rules streamlines monitoring your freelancers' payment status effectively.

What essential columns (e.g., Client Name, Payment Period, Amount, Status) should be included to optimize clarity and reporting?

Your Semi-annually Payment Tracker for Freelancers should include essential columns such as Client Name, Payment Period, Amount, Payment Due Date, Payment Received Date, and Payment Status. Including columns like Invoice Number and Notes enhances clarity and helps track specific details. This structure enables accurate reporting and efficient monitoring of your payments.

How can data validation ensure accurate entry of payment dates and amounts for each semi-annual period?

Data validation in your Semi-annually Payment Tracker restricts payment dates to specific semi-annual periods, preventing errors from incorrect date entries. It also enforces numeric and range constraints on payment amounts, ensuring all figures fall within expected minimums and maximums. This combination guarantees accurate and consistent tracking of payments over each semi-annual period for freelancers.

Which pivot table or chart setup best visualizes payment trends and outstanding balances for freelancers semi-annually?

Create a pivot table with Freelancer Names in rows, Payment Dates grouped by Semi-Annual periods in columns, and Sum of Payments as values. Use a stacked column chart to visualize payment trends alongside a line chart for outstanding balances, overlayed on the same axis. This setup highlights semi-annual income patterns and unpaid amounts for each freelancer effectively.