The Semi-annually Financial Analysis Excel Template for Real Estate Investors provides a clear and organized way to track investment performance every six months. This template includes key metrics such as cash flow, ROI, and expense tracking, allowing investors to make informed decisions. Its semi-annual format helps identify trends and adjust strategies for maximizing real estate investment profitability.

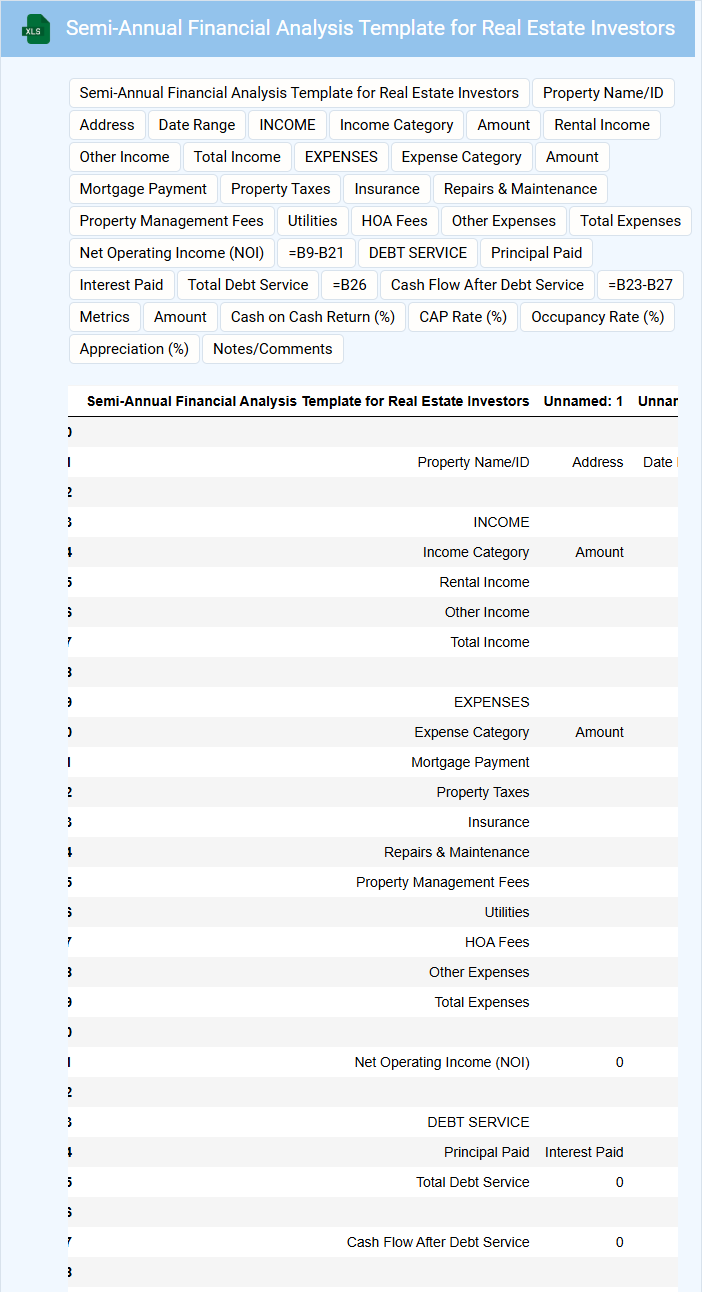

Semi-Annual Financial Analysis Template for Real Estate Investors

This type of document typically contains a detailed overview of a real estate investor's financial performance over a six-month period. The focus is on tracking income, expenses, and profitability to ensure accurate monitoring of investment returns. A Semi-Annual Financial Analysis Template helps investors make informed decisions by consolidating key financial data in a clear, organized manner.

Important elements to include are detailed cash flow statements, asset valuation updates, and comparisons against budgeted projections. Additionally, incorporating visual aids like charts and graphs enhances comprehension of financial trends. Regularly updating this document ensures that investors remain proactive in managing risks and opportunities in their real estate portfolio.

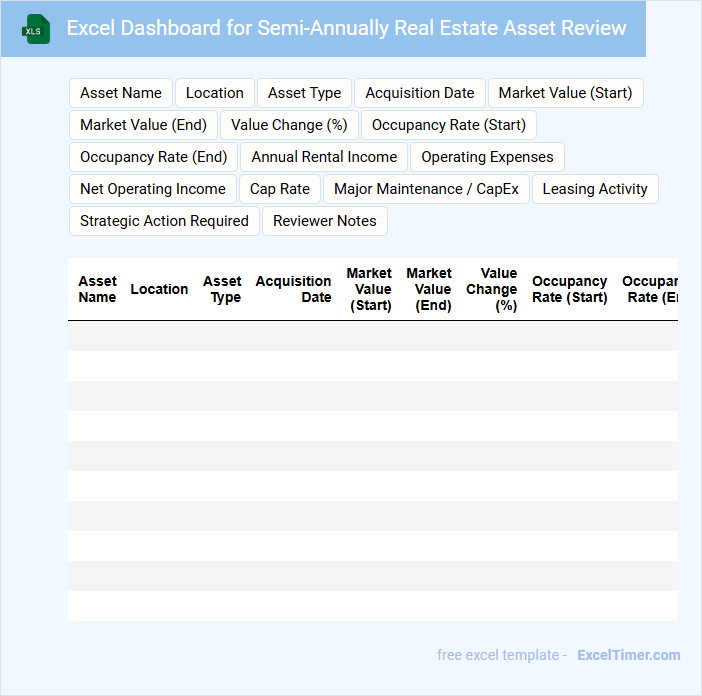

Excel Dashboard for Semi-Annually Real Estate Asset Review

An Excel Dashboard for a Semi-Annually Real Estate Asset Review consolidates key financial and performance data of real estate assets into an interactive and visually accessible format. It typically contains metrics such as rental income, occupancy rates, market value changes, and expense summaries to provide a comprehensive overview. This document aids stakeholders in making informed decisions by tracking trends and identifying areas needing attention.

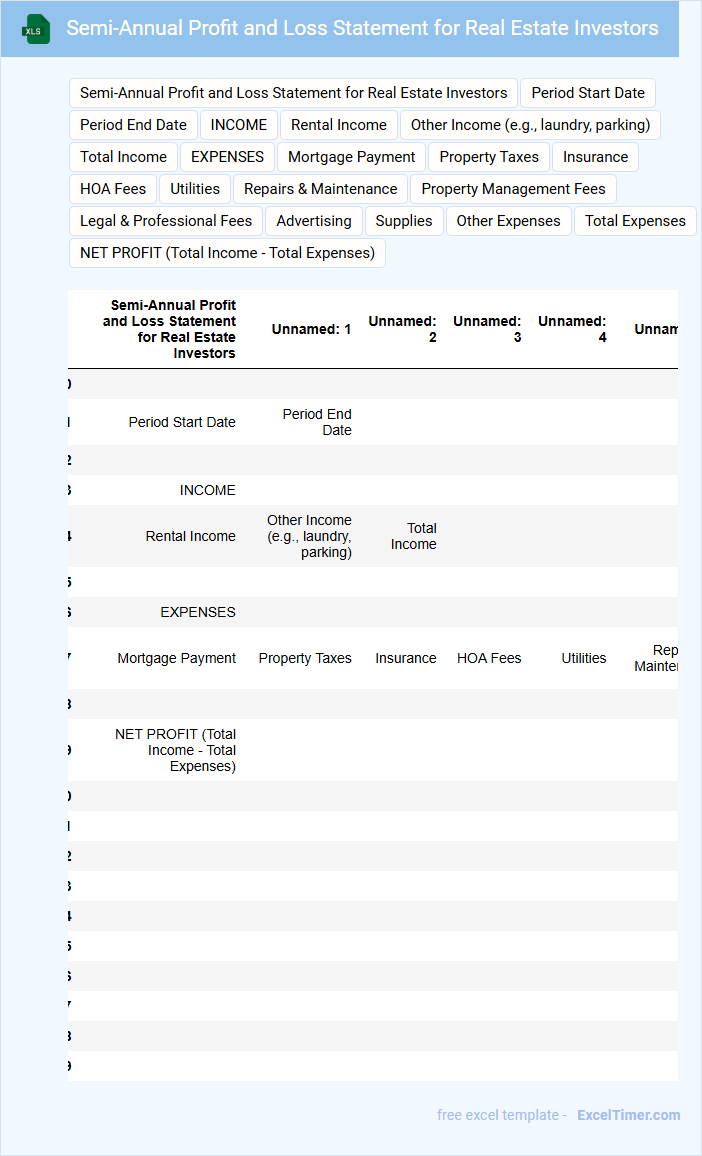

Semi-Annual Profit and Loss Statement for Real Estate Investors

A Semi-Annual Profit and Loss Statement for Real Estate Investors is a financial document summarizing income and expenses over six months. It helps investors evaluate property performance and make informed decisions.

- Include rental income, property expenses, and net profit or loss clearly.

- Highlight any significant changes in operating costs or revenue streams.

- Provide comparisons with previous periods to track financial trends.

Income & Expense Tracker for Real Estate Investors (Semi-Annually)

An Income & Expense Tracker for Real Estate Investors typically contains detailed records of rental income, mortgage payments, property taxes, maintenance costs, and other related expenses, tracked over a set period such as semi-annually. It helps investors monitor cash flow and assess the financial health of their real estate portfolios. Keeping accurate and timely records is essential for making informed investment decisions and preparing tax documents.

This type of document should emphasize semi-annual summaries to provide a clear overview of income and expenses, allowing investors to spot trends and make adjustments. Including categories like repairs, utilities, and management fees ensures all costs are accounted for accurately. Regular review of this tracker can optimize profitability and assist in budgeting future investments.

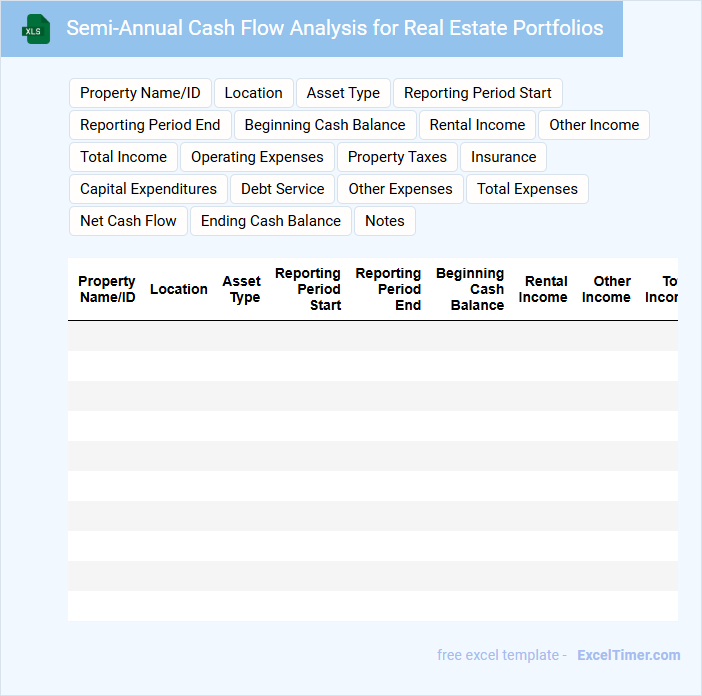

Semi-Annual Cash Flow Analysis for Real Estate Portfolios

The Semi-Annual Cash Flow Analysis for real estate portfolios typically contains detailed records of income and expenses over a six-month period. It highlights net operating income, capital expenditures, and debt service payments to provide a clear financial performance snapshot.

Including a comprehensive breakdown of rental income versus operational costs is crucial for accurate portfolio assessment. A well-prepared analysis supports strategic decision-making and optimizes investment returns.

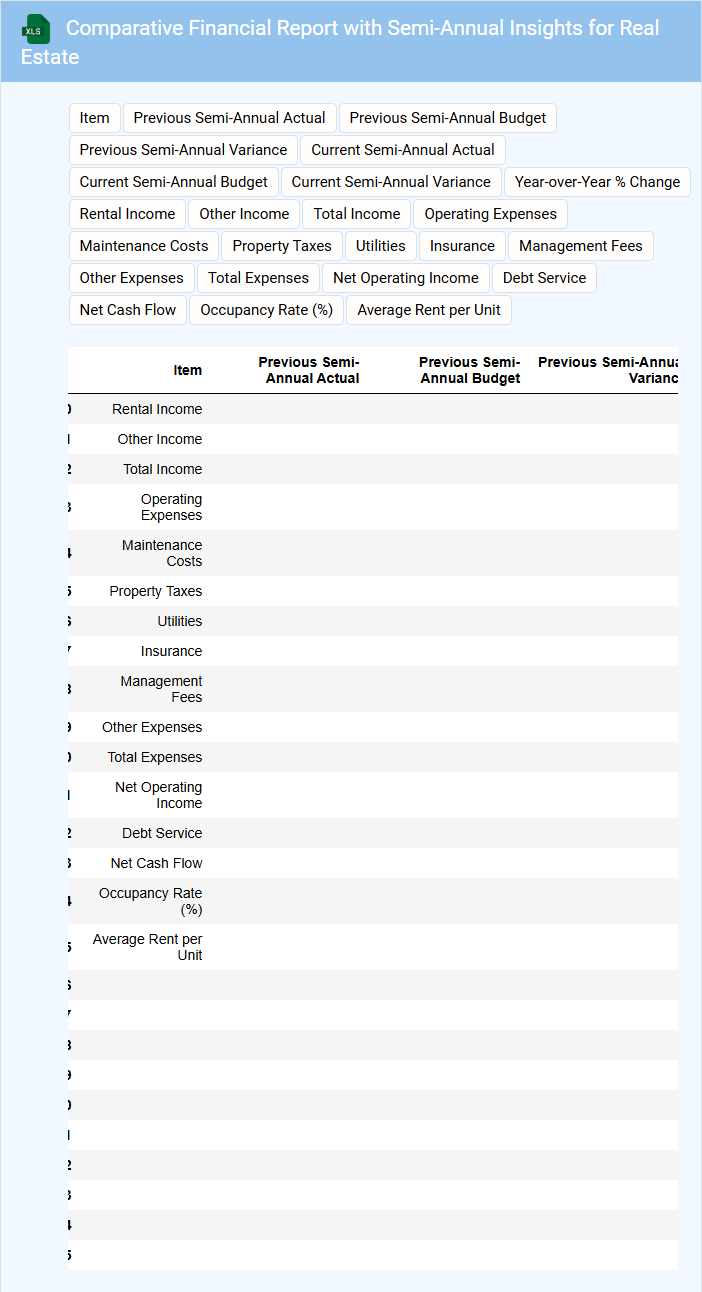

Comparative Financial Report with Semi-Annual Insights for Real Estate

Comparative Financial Reports with Semi-Annual Insights for Real Estate typically contain detailed financial data, performance comparisons, and strategic analysis relevant to property investments over a six-month period.

- Financial Metrics: Highlight key indicators such as revenue, expenses, and profit margins for clear comparison.

- Market Trends: Include analysis of market conditions impacting real estate values and investment opportunities.

- Risk Assessment: Address potential financial risks and mitigation strategies to inform stakeholders.

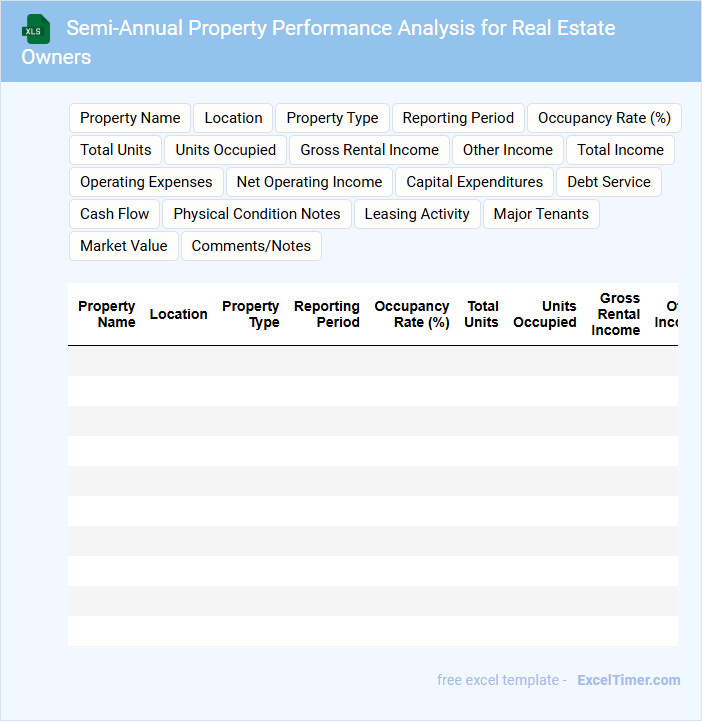

Semi-Annual Property Performance Analysis for Real Estate Owners

What information does a Semi-Annual Property Performance Analysis for Real Estate Owners typically contain? This document usually includes a detailed financial summary, occupancy rates, maintenance reports, and market trends impacting the property. It provides owners with a comprehensive overview to assess investment performance and make informed management decisions.

Why is it important to focus on both financial metrics and physical asset conditions in this analysis? Monitoring income, expenses, and cash flow alongside property condition helps owners identify potential risks and opportunities for value enhancement. This balanced approach ensures sustainable profitability and long-term asset preservation.

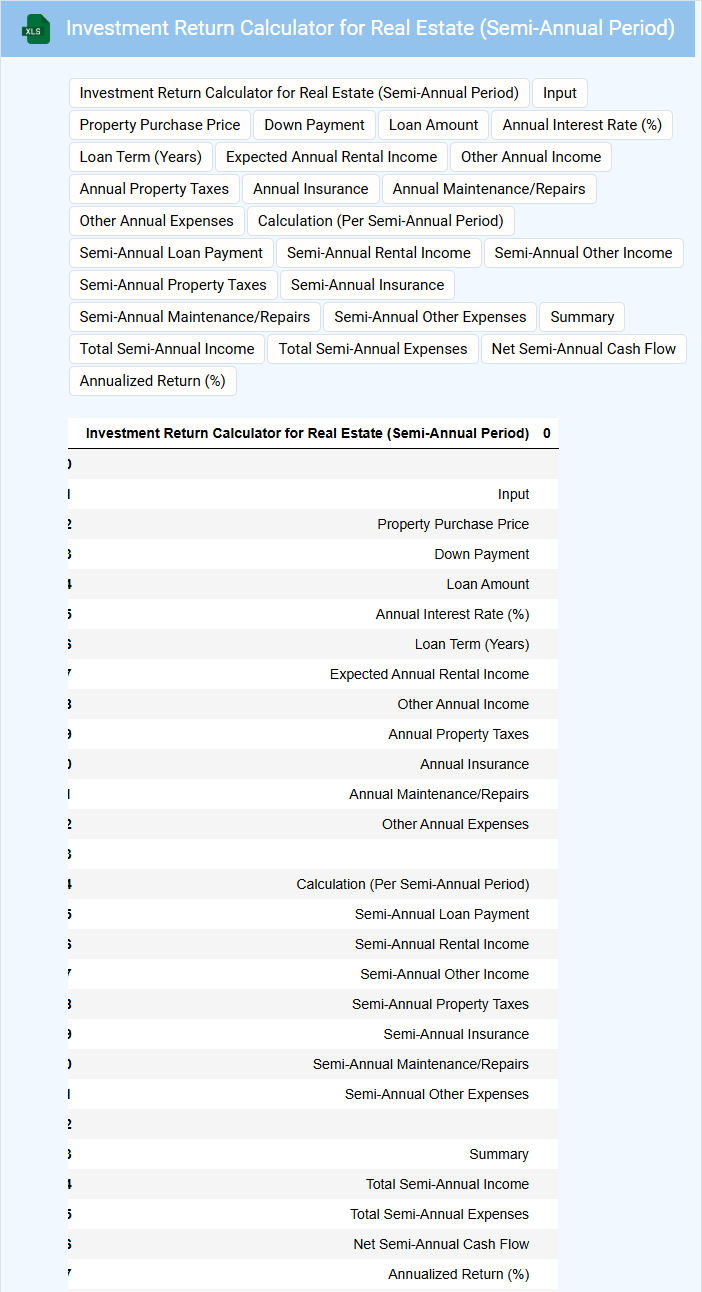

Investment Return Calculator for Real Estate (Semi-Annual Period)

An Investment Return Calculator for real estate with a semi-annual period typically contains financial inputs such as purchase price, rental income, expenses, and projected appreciation data. It calculates the returns based on these inputs over discrete six-month intervals, allowing investors to understand performance more precisely. Important considerations include accurately estimating cash flows, incorporating vacancy rates, and accounting for tax implications to ensure realistic projections.

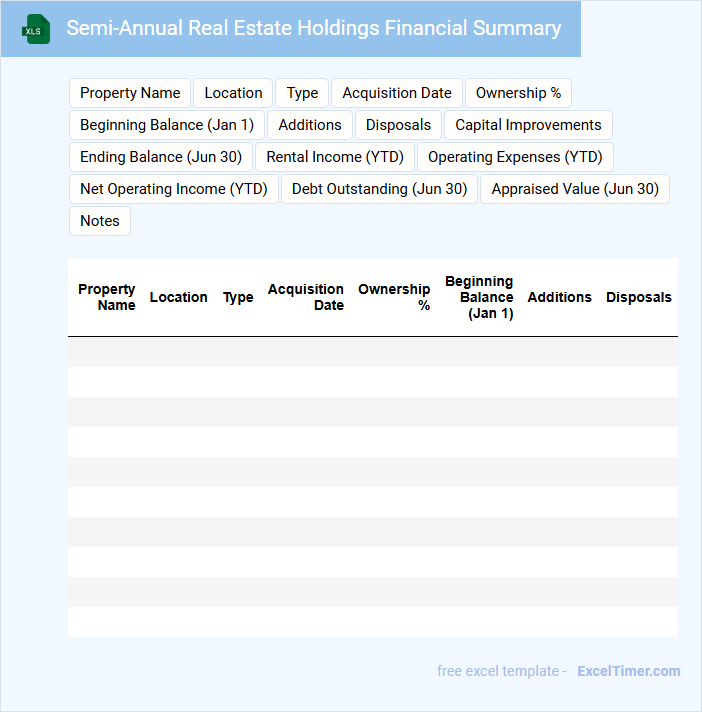

Semi-Annual Real Estate Holdings Financial Summary

The Semi-Annual Real Estate Holdings Financial Summary typically contains detailed financial data related to property assets, including income, expenses, and valuation changes over the six-month period. It highlights performance metrics such as rental income, operating costs, and net operating income to assess profitability.

Key elements in this document often include asset appreciation, cash flow statements, and capital expenditure details. It is important to ensure accuracy in data aggregation and provide clear visualizations for stakeholders to make informed investment decisions.

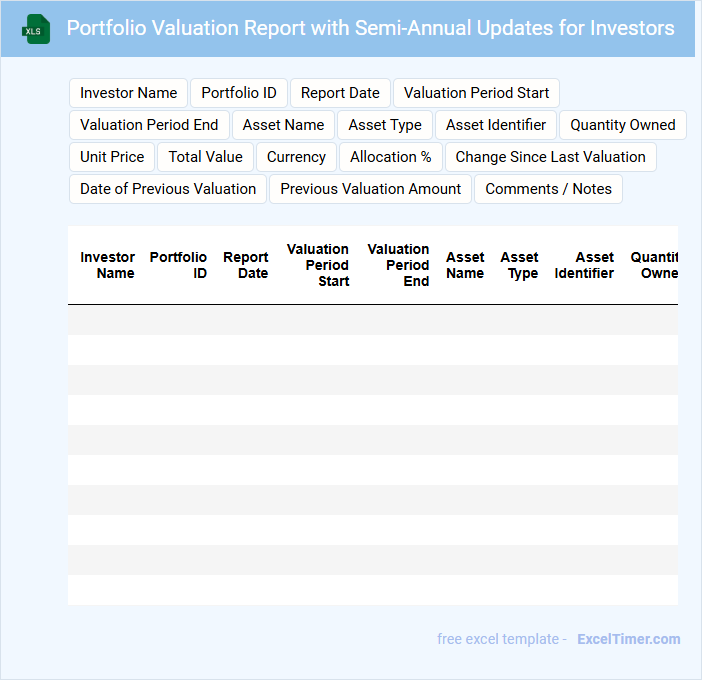

Portfolio Valuation Report with Semi-Annual Updates for Investors

The Portfolio Valuation Report typically contains detailed assessments of asset values, performance metrics, and risk analyses tailored for investors. It provides a comprehensive overview of how investments have evolved over the reporting period.

Including Semi-Annual Updates ensures timely insights into market fluctuations and portfolio adjustments, helping stakeholders make informed decisions. Clear presentation and transparency in methodology are crucial for investor confidence.

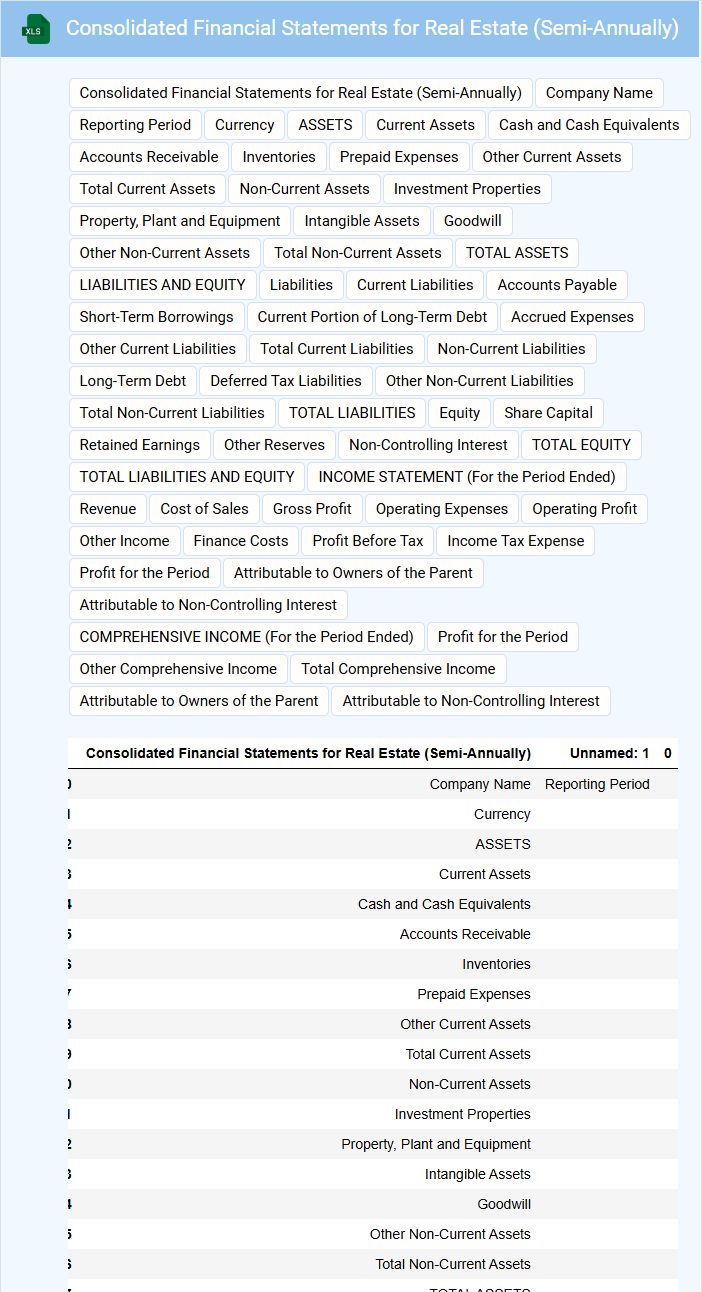

Consolidated Financial Statements for Real Estate (Semi-Annually)

Consolidated Financial Statements for Real Estate (Semi-Annually) provide a comprehensive overview of the financial position and performance of a real estate company and its subsidiaries. These documents typically include balance sheets, income statements, cash flow statements, and notes detailing significant accounting policies and transactions. It is crucial to ensure accuracy in asset valuation and consolidation methods to reflect the true financial health of the organization.

Debt Service Coverage Analysis for Real Estate (Semi-Annual Excel)

Debt Service Coverage Analysis for Real Estate is a crucial document that evaluates a property's ability to generate enough income to cover its debt obligations. This financial analysis typically includes income statements, loan details, and cash flow projections presented in a semi-annual Excel format. It helps lenders and investors assess the risk and sustainability of real estate investments by measuring the ratio of net operating income to debt service payments.

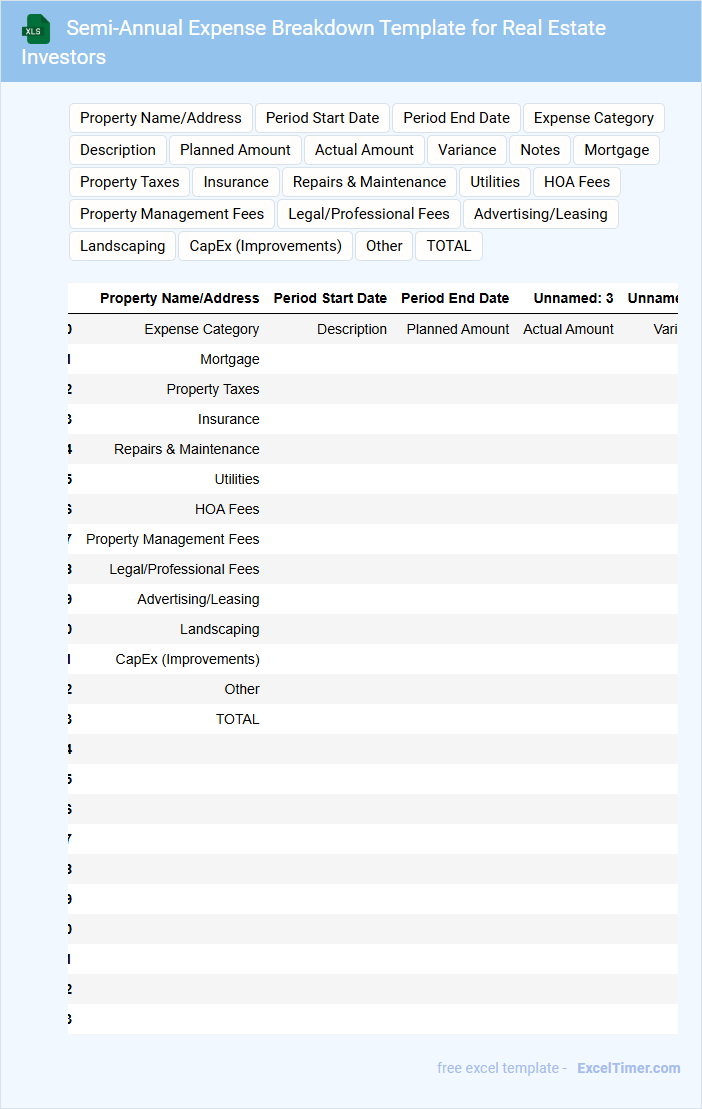

Semi-Annual Expense Breakdown Template for Real Estate Investors

What information does a Semi-Annual Expense Breakdown Template for Real Estate Investors usually contain? This document typically includes detailed records of all expenses related to real estate properties over a six-month period, such as maintenance costs, property taxes, insurance, and management fees. It helps investors track spending patterns and plan budgets effectively for optimal financial management.

What important elements should be included in this template? Key components include categorized expense sections, date and amount columns, property identification details, and summary totals to provide clear insight into spending trends. Additionally, incorporating notes or comments sections can help clarify unusual expenses and support better investment decisions.

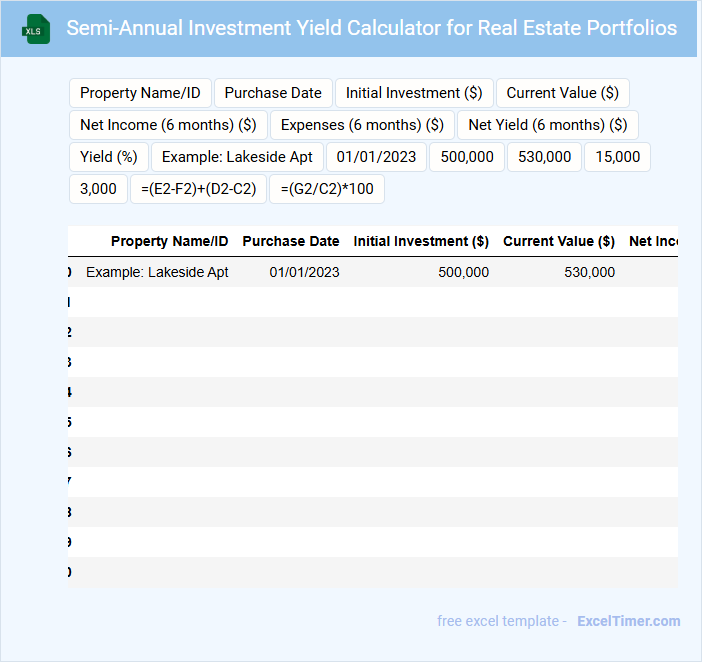

Semi-Annual Investment Yield Calculator for Real Estate Portfolios

The Semi-Annual Investment Yield Calculator for real estate portfolios typically contains detailed inputs such as property values, rental income, expenses, and market appreciation rates to evaluate investment performance. It calculates the semi-annual return on investment by analyzing cash flows and changes in property value, helping investors track portfolio growth. For better accuracy, it is important to regularly update market data and include both direct and indirect costs in the calculation.

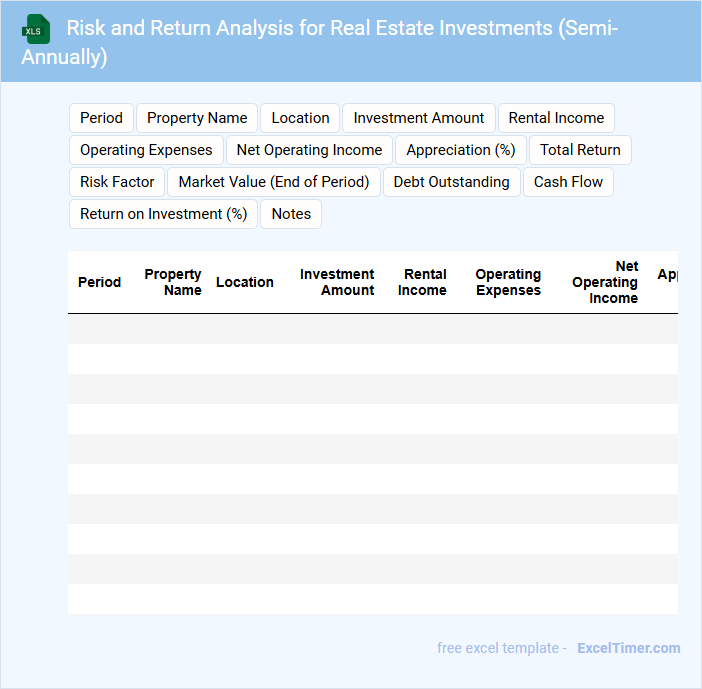

Risk and Return Analysis for Real Estate Investments (Semi-Annually)

Risk and Return Analysis for Real Estate Investments (Semi-Annually) typically contains a detailed evaluation of potential risks and expected financial returns associated with real estate assets over a six-month period.

- Market Trends: Overview of current and projected real estate market conditions affecting asset values.

- Risk Assessment: Identification and analysis of potential risks including economic, regulatory, and environmental factors.

- Performance Metrics: Summary of key financial indicators such as ROI, cash flow, and volatility for informed decision-making.

What key financial metrics should be included in a semi-annual financial analysis for real estate investments?

Key financial metrics for semi-annual real estate analysis include Net Operating Income (NOI), Cash on Cash Return, and Debt Service Coverage Ratio (DSCR). Tracking Internal Rate of Return (IRR) and Loan-to-Value (LTV) ratio helps assess investment performance and risk. Including Capitalization Rate (Cap Rate) provides insight into property yield relative to market value.

How do you track and compare actual income versus projected income for each property in your portfolio?

You can track and compare actual income versus projected income for each property in your portfolio using a semi-annual financial analysis Excel document designed specifically for real estate investors. The spreadsheet captures rental income, expenses, and net operating income to highlight variances between forecasted and actual figures. Regularly updating this data helps you make informed investment decisions and optimize property performance.

Which methods are most effective for identifying anomalies or trends in operating expenses over the past six months?

Time series analysis and moving average methods effectively identify anomalies and trends in operating expenses over six months. Ratio analysis highlights expense deviations relative to revenue, aiding in pinpointing irregularities. Visual tools like line charts and heat maps enhance detection by illustrating expense fluctuations clearly.

How is cash flow analyzed and reported for individual properties and the overall real estate portfolio semi-annually?

Cash flow for individual properties is analyzed by tracking rental income, operating expenses, and debt service to calculate net cash flow semi-annually. The overall real estate portfolio cash flow consolidates these metrics, highlighting total income, expenses, and net cash flow across all properties. Detailed cash flow reports include variance analysis and performance trends to support informed investment decisions.

What strategies can be incorporated into Excel to assess and visualize property appreciation and portfolio equity growth?

In Excel, use dynamic formulas like CAGR and conditional formatting to calculate and highlight property appreciation and portfolio equity growth trends. Incorporate PivotTables and slicers for detailed, interactive data segmentation by property type or location. Employ charts such as line graphs and waterfall charts to visually represent growth trajectories and equity changes over semi-annual periods.