The Semi-annually Tax Preparation Excel Template for Freelancers simplifies tracking income and expenses over six-month periods, helping freelancers manage their tax obligations efficiently. This template includes customizable fields for deductions, estimated tax payments, and summary reports to ensure accurate financial records. Using this tool reduces errors and streamlines the tax filing process for self-employed professionals.

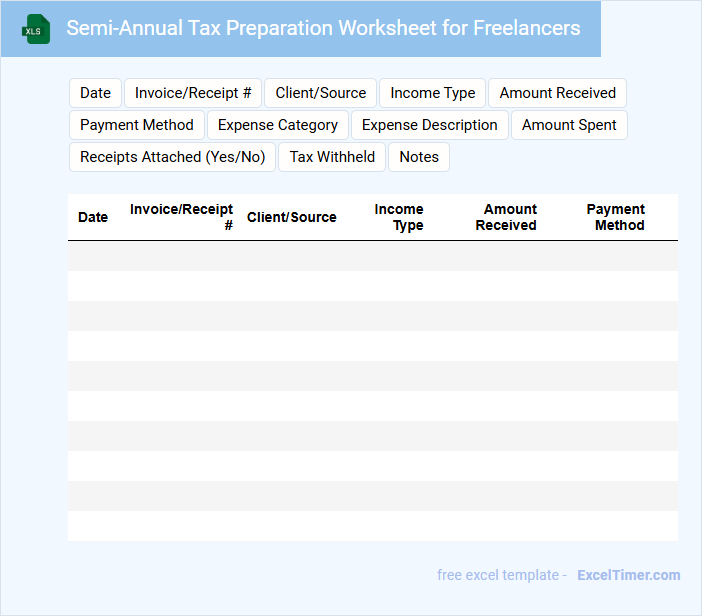

Semi-Annual Tax Preparation Worksheet for Freelancers

The Semi-Annual Tax Preparation Worksheet for freelancers typically contains detailed records of income, expenses, and estimated taxes paid during the first half of the year. It helps freelancers organize financial data to accurately calculate their tax obligations and avoid penalties. Important elements to include are tracked receipts, categorized expenses, and updated income summaries.

Freelancers’ Income & Expense Tracker for Semi-Annual Tax Filing

A Freelancers' Income & Expense Tracker is a crucial document that helps independent contractors organize their earnings and expenditures over a semi-annual period. This tracker typically contains detailed records of invoices, receipts, and payment dates, ensuring accurate financial reporting. Keeping this document updated simplifies the tax filing process and supports compliance with tax regulations.

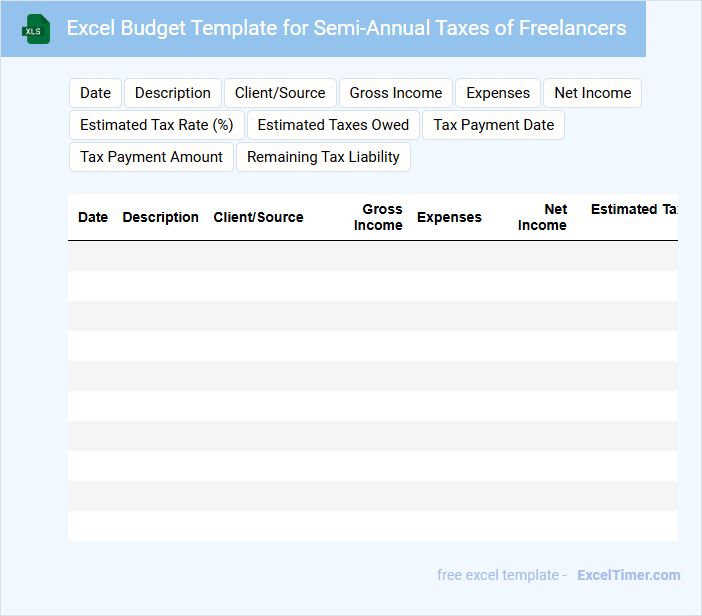

Excel Budget Template for Semi-Annual Taxes of Freelancers

An Excel Budget Template for Semi-Annual Taxes helps freelancers organize and track their income and expenses efficiently. It is designed to simplify tax calculations and ensure timely payments.

This document typically contains categorized expense fields, income tracking sections, and tax due dates. Ensuring accuracy and regular updates is crucial for effective tax management.

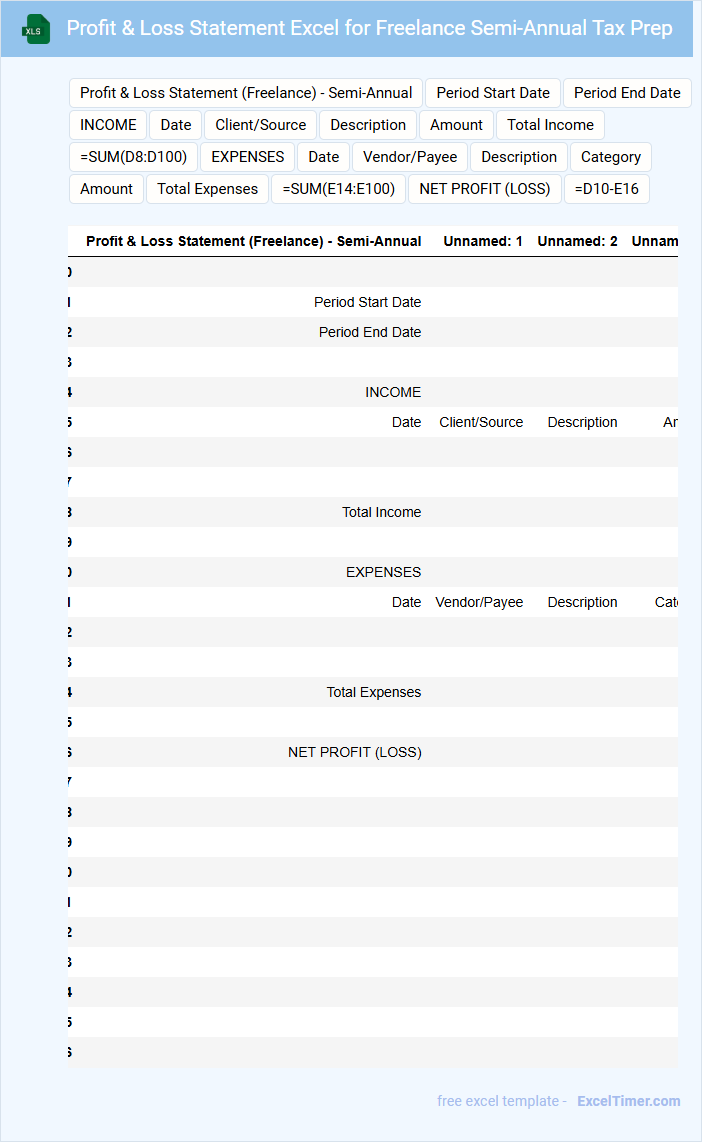

Profit & Loss Statement Excel for Freelance Semi-Annual Tax Prep

A Profit & Loss Statement Excel for freelance semi-annual tax preparation typically contains detailed records of income, expenses, and net profit over a six-month period. This document helps freelancers track their financial performance and prepare accurate tax returns.

Key information includes categorized earnings, deductible expenses, and overall profitability to optimize tax deductions and financial planning. Regularly updating this statement ensures freelancers remain organized and compliant with tax regulations.

Deductions Tracker with Semi-Annual Tax Summary for Freelancers

A Deductions Tracker with Semi-Annual Tax Summary for Freelancers is a crucial document designed to record and organize all deductible expenses throughout the year. It typically contains detailed entries of business-related costs, categorized by type, along with a summary of income and taxes owed every six months. This helps freelancers maintain accurate records, ensuring they can maximize tax deductions and simplify filing processes.

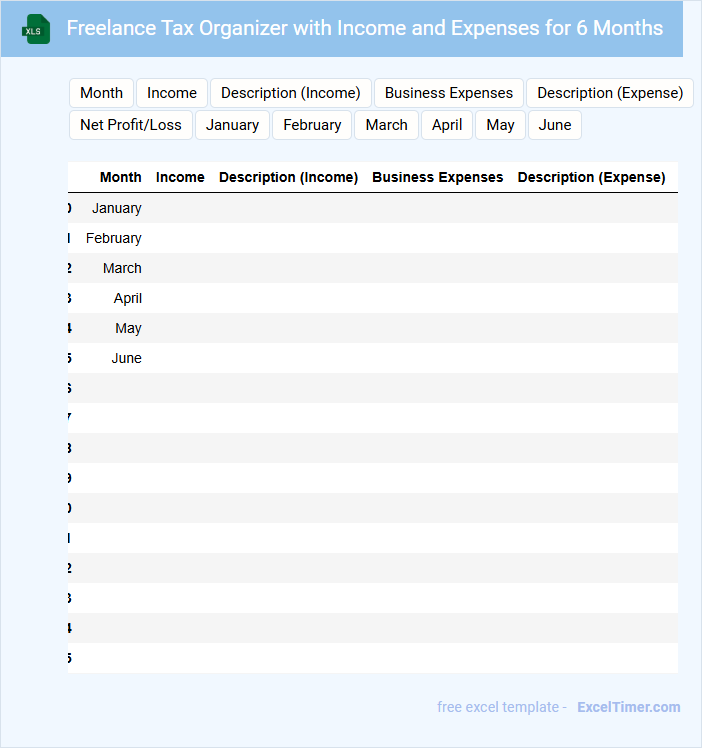

Freelance Tax Organizer with Income and Expenses for 6 Months

What information is typically included in a Freelance Tax Organizer with Income and Expenses for 6 Months? This document usually contains detailed records of all income received and expenses incurred by a freelancer over a six-month period. It helps organize financial data to accurately report earnings and claim deductions when filing taxes.

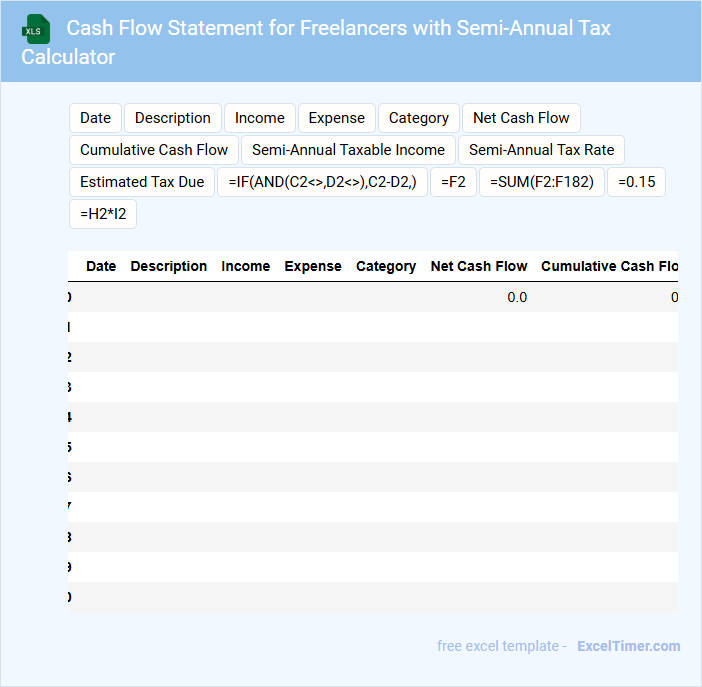

Cash Flow Statement for Freelancers with Semi-Annual Tax Calculator

What information does a Cash Flow Statement for Freelancers with a Semi-Annual Tax Calculator typically include? This document usually details the inflows and outflows of cash over a specific period, highlighting freelance income, expenses, and net cash flow. Additionally, it incorporates a semi-annual tax calculator to estimate tax obligations based on earnings, helping freelancers manage their finances and tax payments efficiently.

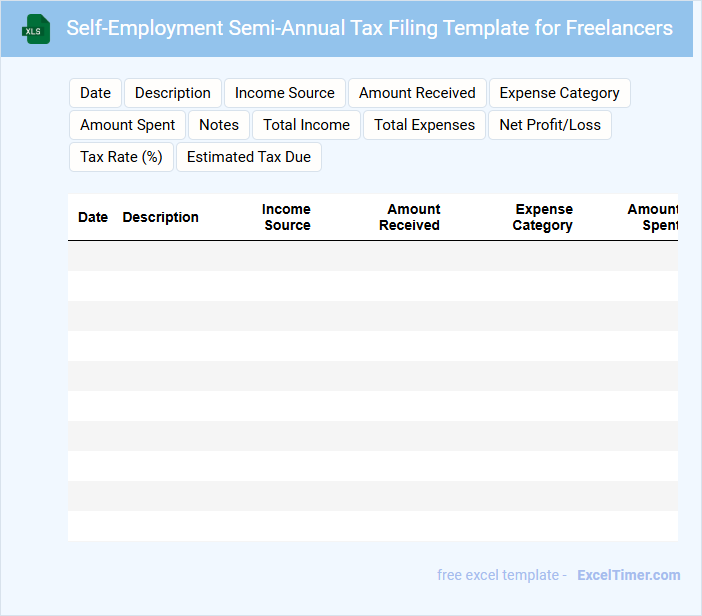

Self-Employment Semi-Annual Tax Filing Template for Freelancers

This Self-Employment Semi-Annual Tax Filing Template is designed to help freelancers organize and report their income and expenses efficiently. It usually contains sections for tracking earnings, deductible expenses, and estimated tax payments made during the year. Using this template ensures accurate record-keeping and helps in timely tax compliance.

Important elements to include are detailed income summaries, categorized expense entries, and calculation of quarterly estimated tax liabilities. Including reminders for important tax deadlines and provisions for self-employment tax is also essential. These features ensure freelancers stay organized and avoid penalties by meeting tax obligations promptly.

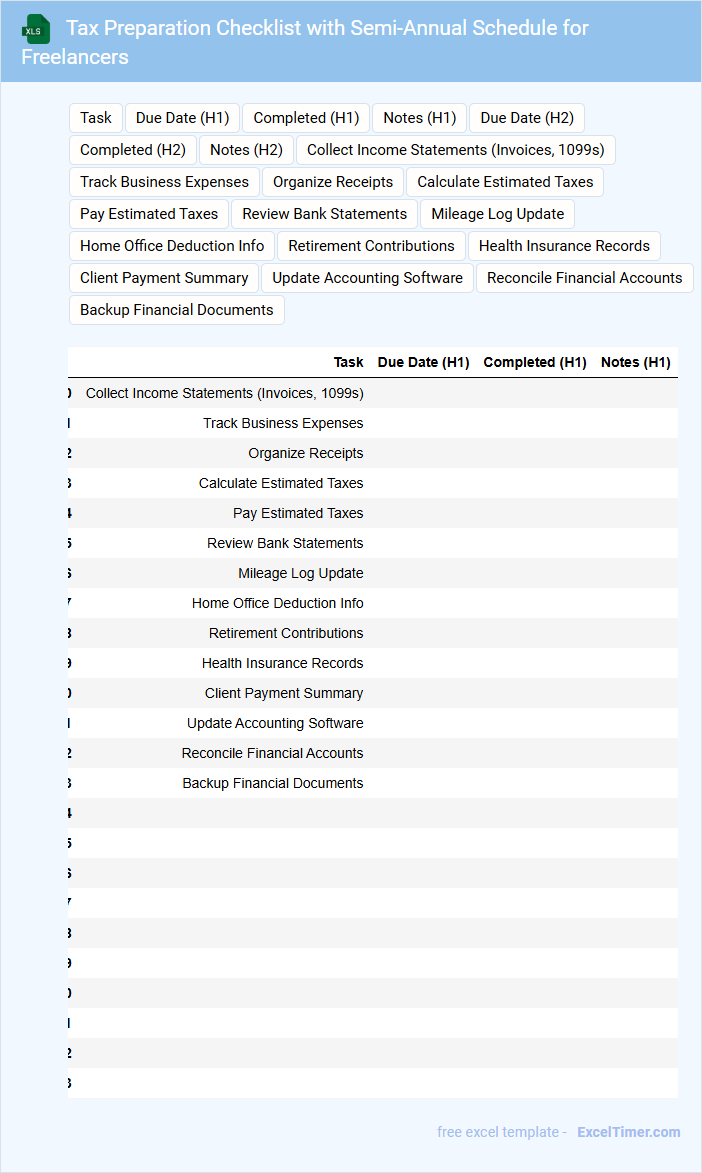

Tax Preparation Checklist with Semi-Annual Schedule for Freelancers

A Tax Preparation Checklist typically contains a detailed list of documents and information needed to file taxes efficiently. It helps freelancers organize their receipts, invoices, and expense records throughout the year.

For a Semi-Annual Schedule, setting reminders for mid-year and year-end tax tasks ensures timely compliance. This schedule includes estimated tax payments and important deadlines to avoid penalties.

Freelancers should focus on tracking income, deductible expenses, and keeping clear records of quarterly estimated tax payments for smooth tax filing.

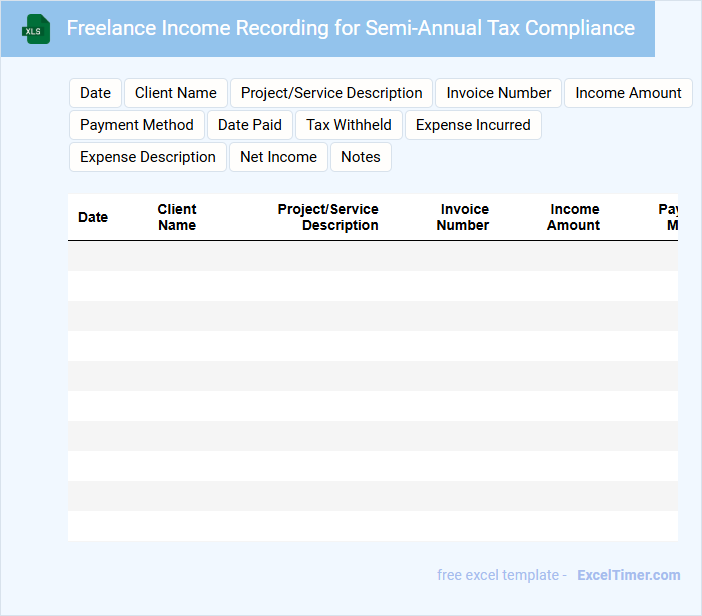

Freelance Income Recording for Semi-Annual Tax Compliance

A Freelance Income Record is a document that typically contains detailed logs of all payments received from freelance work, including dates, client names, and amounts. This record is essential for tracking earnings and verifying income for taxation purposes.

For Semi-Annual Tax Compliance, it is important to keep entries organized and up-to-date to ensure accurate reporting and avoid penalties. Maintaining clear documentation of invoices and receipts supports transparency and simplifies the tax filing process.

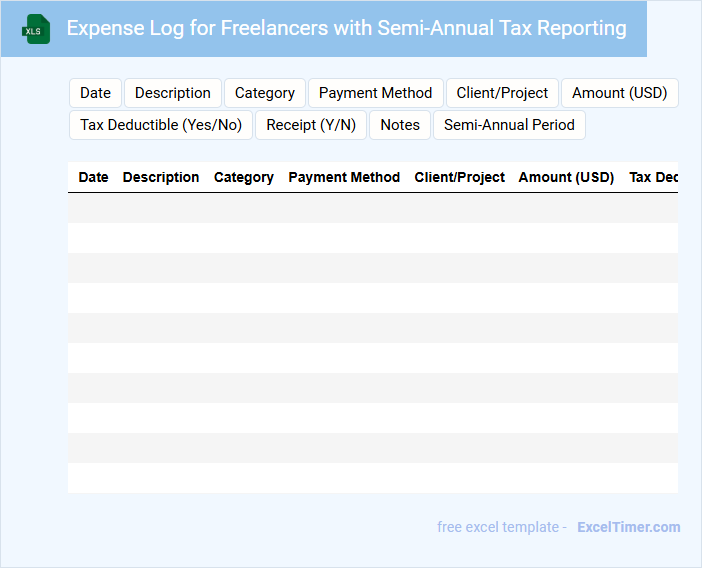

Expense Log for Freelancers with Semi-Annual Tax Reporting

An Expense Log for Freelancers with Semi-Annual Tax Reporting is a document used to record and organize all business-related expenses incurred by a freelancer, enabling accurate financial tracking and tax preparation. It helps freelancers efficiently manage their finances and comply with tax regulations.

- Include date, description, and amount for each expense entry to maintain clear records.

- Separate expenses into categories such as office supplies, travel, and software for easier reporting.

- Regularly update the log to ensure timely and accurate semi-annual tax submissions.

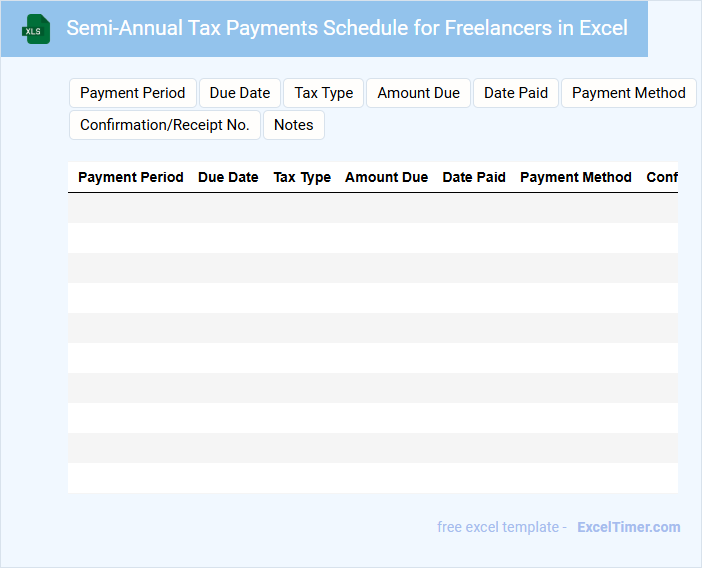

Semi-Annual Tax Payments Schedule for Freelancers in Excel

This document typically contains a semi-annual tax payments schedule tailored for freelancers, outlining exact dates and amounts due. It helps freelancers track and manage their quarterly tax obligations efficiently.

Key sections often include payment deadlines, estimated tax calculations, and reminders for submission. To optimize use, ensure regular updates based on tax law changes and personal income variations.

Invoice and Payment Tracker with Semi-Annual Tax Summary for Freelancers

What information is typically included in an Invoice and Payment Tracker with Semi-Annual Tax Summary for Freelancers?

This document usually contains detailed records of invoices sent, payments received, and outstanding balances to help freelancers manage cash flow effectively. Additionally, it includes a semi-annual tax summary that consolidates earnings and expenses, making tax filing simpler and more accurate.

It is important to keep the tracker updated regularly, ensure all invoice details are accurate, and categorize expenses properly to maximize tax deductions and maintain clear financial records.

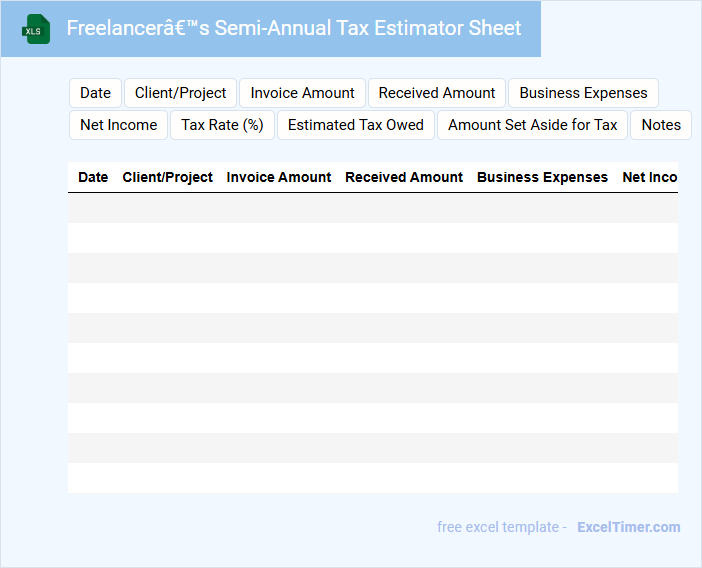

Freelancer’s Semi-Annual Tax Estimator Sheet

Freelancer's Semi-Annual Tax Estimator Sheet is a financial planning tool designed to help self-employed individuals estimate their tax liabilities every six months. It typically contains income summaries, deductible expenses, and estimated tax payments. This document helps freelancers avoid surprises by providing a clear overview of their tax obligations throughout the year.

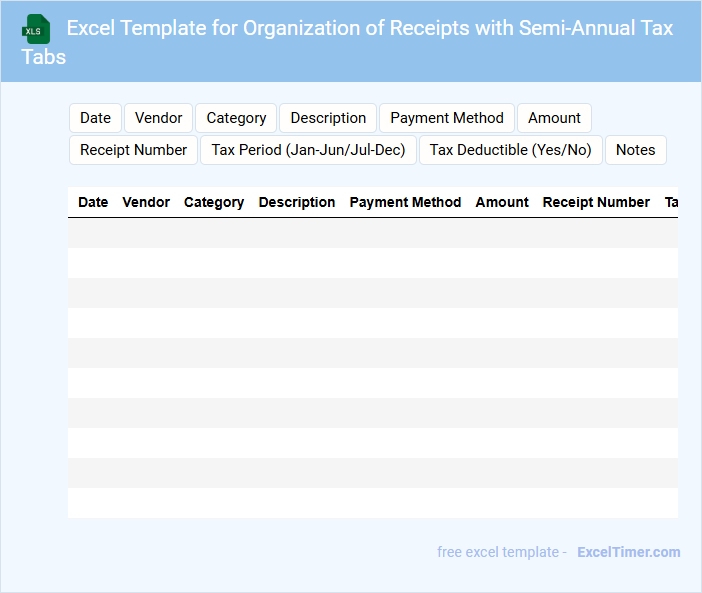

Excel Template for Organization of Receipts with Semi-Annual Tax Tabs

An Excel template for organizing receipts typically contains structured worksheets designed to track and categorize financial transactions systematically. This template often includes semi-annual tax tabs to separate data by periods, facilitating easier tax reporting and compliance. For optimal use, it's important to ensure accurate input of dates, amounts, and receipt descriptions to maintain clear records and improve audit readiness.

What are the key deadlines for semi-annual tax preparation that freelancers must track in Excel?

Freelancers must track the quarterly estimated tax payment deadlines: April 15, June 15, September 15, and January 15 of the following year. Accurate record-keeping of income and expenses before these dates ensures precise tax calculations. Maintaining an Excel sheet with payment statuses and deadline reminders helps avoid penalties and interest charges.

How can you categorize freelance income and expenses in an Excel document for efficient tax reporting?

Categorize freelance income by project types or clients and expenses by business-related categories such as supplies, software, and travel in separate Excel columns. Use date and payment method fields to track semi-annual periods for accurate tax preparation. Implement filters and pivot tables to summarize income and expenses efficiently for tax reporting.

Which Excel formulas or functions are most useful for calculating estimated tax payments every six months?

For semi-annual tax preparation, Excel functions like PMT help calculate periodic tax payments based on income and tax rates. The SUMPRODUCT function efficiently totals variable income streams applicable for estimating taxes. The IF function assists in applying tax brackets or thresholds to determine accurate estimated payments every six months.

What essential documentation should freelancers record and attach in their tax preparation Excel file?

Freelancers should record and attach invoicing records, expense receipts, and 1099 forms in their semi-annual tax preparation Excel file. Tracking income sources, business-related costs, and tax deductions ensures accurate quarterly tax estimates and compliance. Including mileage logs and bank statements further substantiates deductible expenses and income verification.

How do you use Excel to compare semi-annual tax payments versus actual annual tax liabilities for better forecasting?

Use Excel to input semi-annual tax payments and track actual annual tax liabilities in separate columns. Create formulas that calculate the difference and percentage variance to highlight discrepancies. Utilize pivot tables and charts for visual comparison, enabling accurate forecasting and cash flow management.