![]()

The Semi-annually Expense Tracker Excel Template for Small Business offers an efficient way to monitor and categorize expenses every six months, ensuring accurate financial management. It helps small business owners identify spending patterns and control budgets, promoting better cash flow and profitability. Customizable features allow for easy adaptation to different industries and specific business needs.

Semi-Annual Expense Tracker with Category Breakdown

A Semi-Annual Expense Tracker is a document used to record and monitor expenditures over a six-month period, providing insight into spending habits and financial management. It typically includes categories such as housing, utilities, groceries, transportation, and discretionary expenses.

Including a Category Breakdown helps users quickly identify which areas consume the most resources, enabling better budgeting and financial planning. This structured approach promotes informed decision-making and encourages cost-saving measures.

It is important to maintain consistent entries and review the tracker periodically to ensure accuracy and effectiveness in controlling expenses.

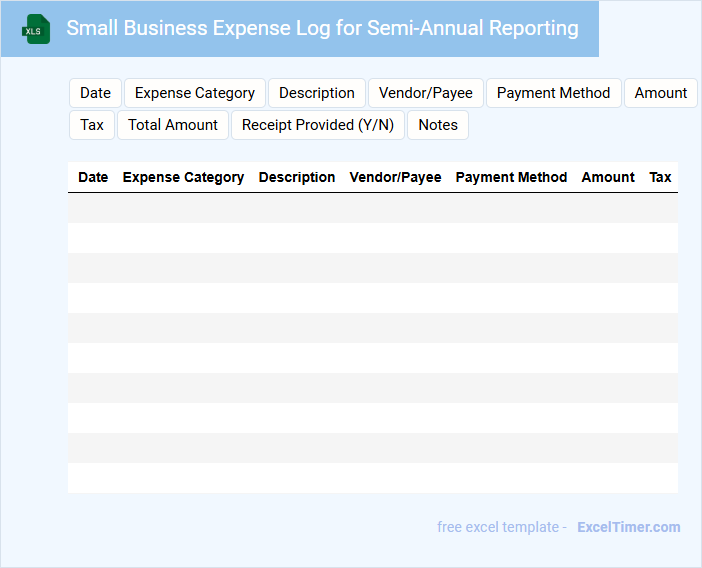

Small Business Expense Log for Semi-Annual Reporting

A Small Business Expense Log is typically a detailed record of all expenditures made by a business over a specific period, essential for tracking financial outflows. This document includes transaction dates, amounts, categories, and vendor details to maintain accuracy.

For Semi-Annual Reporting, it is important to ensure expenses are categorized correctly and all receipts are attached or referenced. Regular updates and reconciliations help prepare a more accurate financial summary for stakeholders.

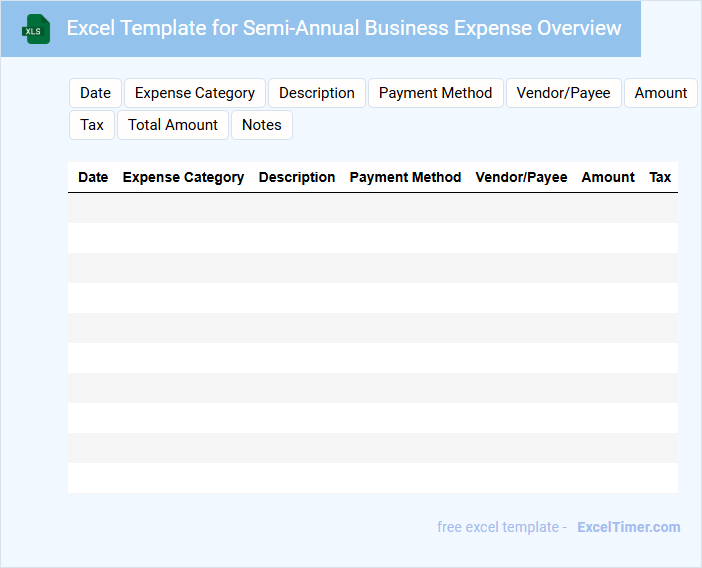

Excel Template for Semi-Annual Business Expense Overview

An Excel Template for a Semi-Annual Business Expense Overview typically contains detailed records of all expenses incurred by a business over a six-month period. It organizes data into categories such as fixed costs, variable expenses, and one-time purchases to facilitate financial analysis. This template helps in tracking spending patterns, budgeting, and generating reports for better fiscal management.

Important elements to include are clear headings for each expense category, automated calculations for totals and subtotals, and visual aids like charts or graphs to illustrate expenditure trends. Adding fields for notes or explanations can provide context for unusual expenses. Ensure the template is user-friendly and allows for easy data entry and updating.

Semi-Annually Expense Tracker with Income Comparison

This document is a Semi-Annually Expense Tracker with Income Comparison designed to monitor and analyze financial transactions over six-month periods. It typically contains categorized expense entries, income records, and comparative charts or tables that highlight spending trends against earnings. The main goal is to provide a clear overview of financial health and support effective budgeting decisions.

Important elements to include are accurate date ranges to separate semi-annual data, detailed income sources, and clearly categorized expense types to enable meaningful comparisons. Incorporating visual aids like graphs or percentage change indicators enhances comprehension and helps identify areas for cost control. Additionally, including notes or remarks fields can assist in explaining unusual variations or one-time expenses.

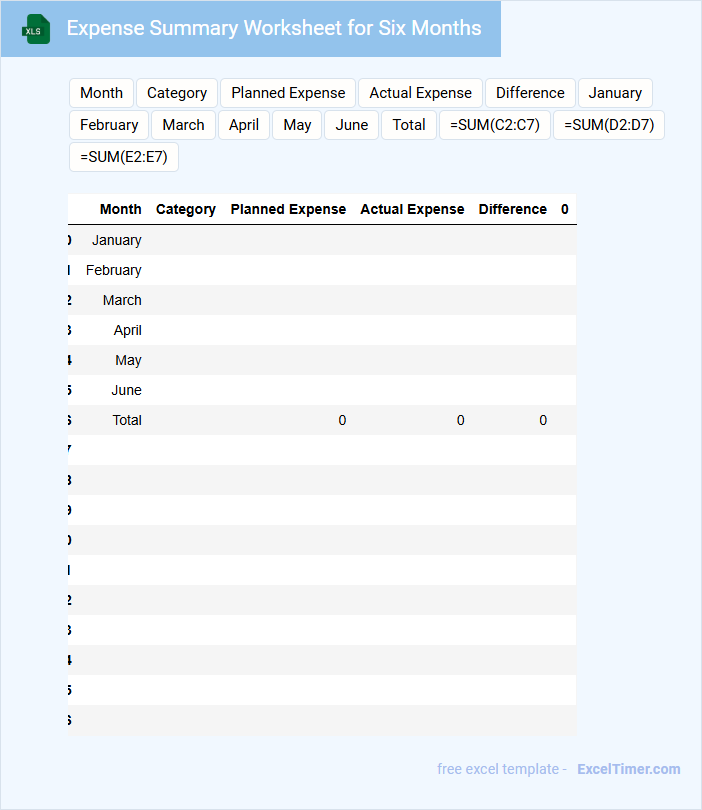

Expense Summary Worksheet for Six Months

An Expense Summary Worksheet for six months typically contains a detailed record of all expenditures categorized by type and month to help track spending habits. It usually includes summaries, totals, and comparisons to establish budget adherence and identify cost-saving opportunities. Important elements to include are clear category labels, consistent date formats, and a summary section highlighting key financial insights.

Small Business Budget Tracker with Semi-Annual Focus

The Small Business Budget Tracker document typically contains detailed records of income, expenses, and financial projections over a specified period. It helps businesses monitor cash flow and allocate resources effectively. For a semi-annual focus, the tracker emphasizes six-month intervals to provide a clearer view of mid-year financial health and adjustments.

Important elements to include are categorized expense tracking, revenue sources, and a comparison between projected and actual figures. Incorporating sections for quarterly reviews within the semi-annual framework aids in spotting trends. Additionally, setting clear financial goals for each half-year enhances strategic planning and decision-making.

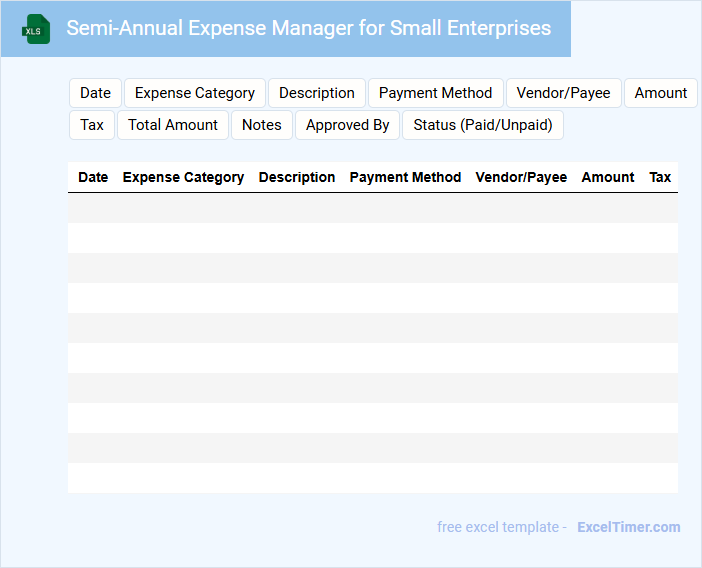

Semi-Annual Expense Manager for Small Enterprises

This type of document, the Semi-Annual Expense Manager, typically contains detailed records of expenses incurred by small enterprises over a six-month period. It highlights monthly spending patterns and categorizes costs to aid in financial assessment.

Its main purpose is to provide a clear overview of operational costs, helping businesses optimize budgets and identify potential areas for savings. Regular updates and accurate data entry are crucial for effective expense management.

It is important to include budget comparisons, highlight any unusual expenditures, and provide actionable recommendations based on the data.

Expense Tracking Excel Sheet for Semi-Annual Review

An Expense Tracking Excel Sheet for Semi-Annual Review typically contains detailed records of all expenditures made within a six-month period. It includes categorized expenses, dates, amounts, and notes to facilitate financial analysis.

This document is essential for identifying spending patterns and budget adherence over the review period. For accuracy, ensure regular updates and reconciliation with bank statements.

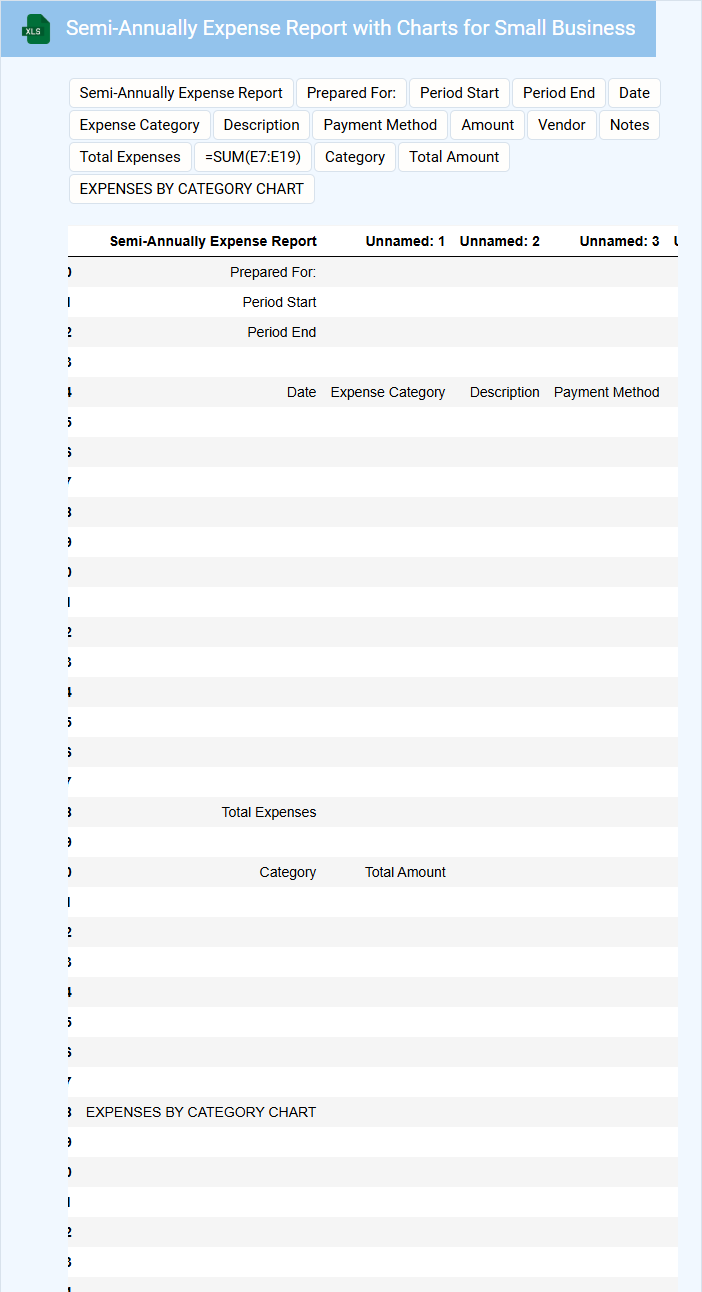

Semi-Annually Expense Report with Charts for Small Business

What information does a Semi-Annually Expense Report with Charts for Small Business usually contain? This document typically includes a detailed breakdown of expenses incurred over a six-month period, categorized by type such as operational costs, payroll, and marketing expenses. It also features visual charts that help illustrate spending patterns, trends, and comparisons to previous periods, allowing for easier financial analysis and decision-making.

What is an important aspect to focus on when preparing this report? Ensuring accuracy in data entry and categorization is crucial, as it directly affects the reliability of insights drawn from the charts. Additionally, highlighting any significant changes or anomalies in expenses can help small business owners make informed budgeting and cost-saving decisions.

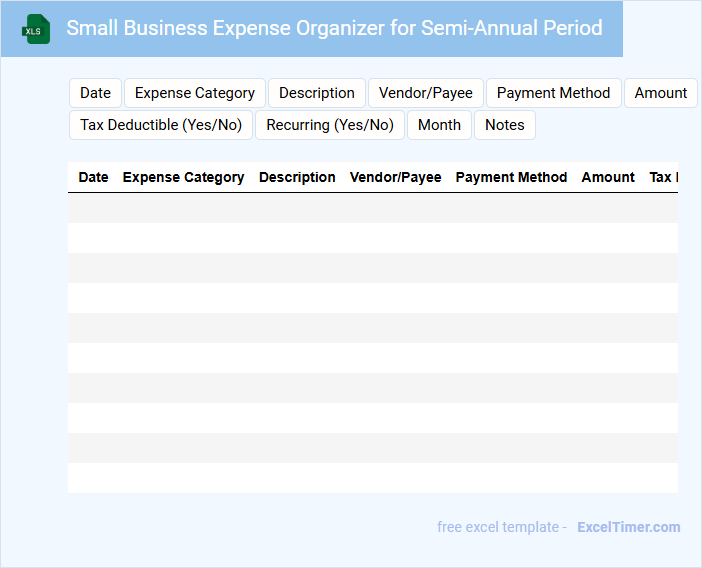

Small Business Expense Organizer for Semi-Annual Period

A Small Business Expense Organizer for a semi-annual period typically contains detailed records of all business-related expenditures over six months. It helps track costs by categories such as office supplies, utilities, and transportation, ensuring thorough financial management. This document is crucial for budgeting, tax preparation, and identifying areas where expenses can be optimized.

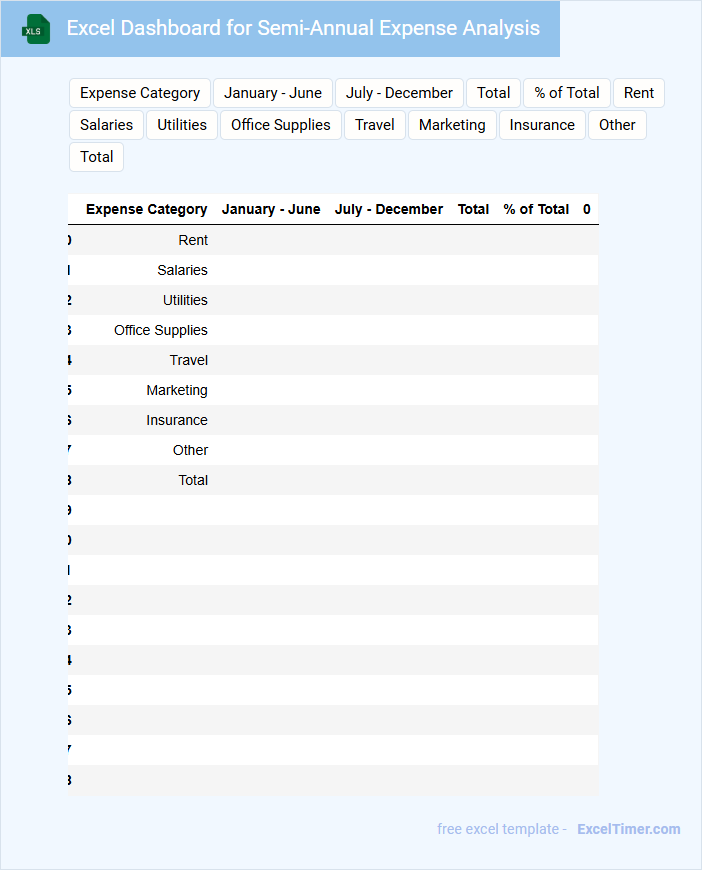

Excel Dashboard for Semi-Annual Expense Analysis

An Excel Dashboard for Semi-Annual Expense Analysis typically contains comprehensive data visualizations, including charts and graphs, summarizing expenses over six months. It organizes financial information to help users easily spot trends and variances in spending.

Important elements include clear categorization of expenses and interactive filters for detailed insights. Ensure the dashboard features real-time updates and concise summaries to facilitate effective decision-making.

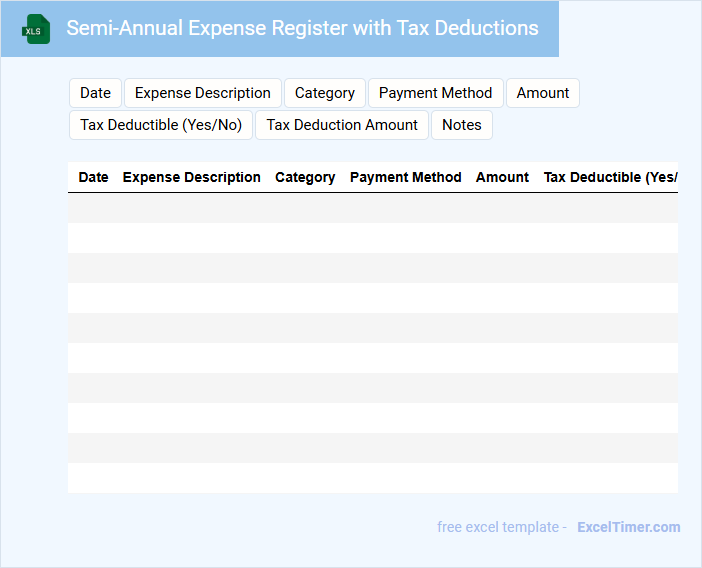

Semi-Annual Expense Register with Tax Deductions

The Semi-Annual Expense Register with Tax Deductions is a crucial financial document summarizing all expenses incurred over a six-month period, categorized to facilitate tax reporting. It typically includes detailed entries of expenditures alongside applicable tax deductions to ensure accurate calculation of taxable income. Maintaining this register helps organizations optimize their tax filings and comply with regulatory requirements efficiently.

Small Business Ledger for Semi-Annually Tracking

What information does a Small Business Ledger for Semi-Annually Tracking usually contain? This type of document typically records financial transactions including income, expenses, and payments, organized over six-month periods. It helps businesses monitor financial health and prepare for tax obligations by summarizing key monetary activities semi-annually.

What is an important suggestion for maintaining this ledger effectively? Regularly updating the ledger with accurate entries and categorizing transactions clearly ensures reliable tracking and easier financial analysis. Additionally, reconciling the ledger with bank statements periodically helps identify discrepancies and maintain financial accuracy.

Semi-Annual Cash Flow Tracker with Expense Details

The Semi-Annual Cash Flow Tracker is a financial document designed to record and monitor cash inflows and outflows over a six-month period. It typically contains detailed expense entries, income sources, and summary totals to provide a clear view of financial health. This tracker helps in budgeting, forecasting, and managing liquidity effectively.

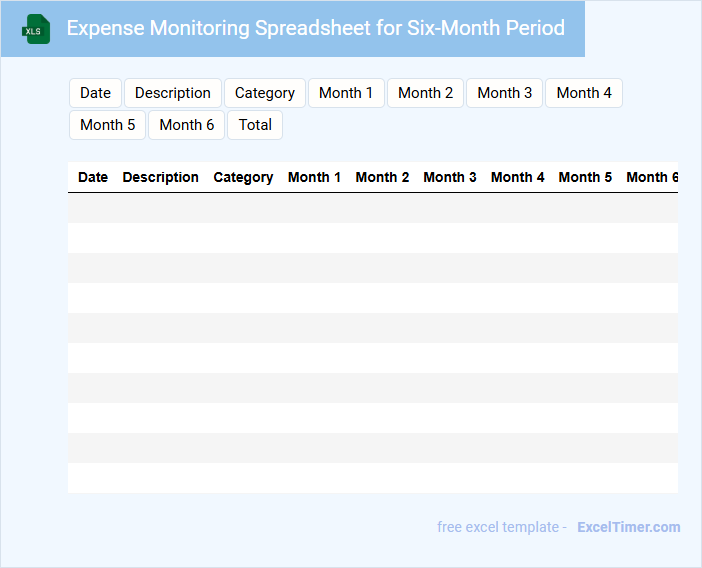

Expense Monitoring Spreadsheet for Six-Month Period

An Expense Monitoring Spreadsheet for a six-month period typically contains detailed financial records, including income, expenses, and category-wise spending. It helps track budget adherence and identify spending patterns over time. For best results, ensure to update the spreadsheet regularly and categorize expenses clearly to maintain accuracy.

How does the semi-annual expense tracker categorize business expenses for accurate reporting?

The Semi-Annually Expense Tracker divides business expenses into categories such as fixed costs, variable costs, and one-time expenditures to ensure precise financial analysis. It uses predefined labels and customizable fields to group transactions by type, date, and amount. This organized categorization enables small businesses to generate accurate semi-annual reports for budgeting and tax purposes.

What formulas are used to auto-summarize expenses for each 6-month period?

The Semi-annually Expense Tracker for Small Business uses SUMIF and EDATE formulas to auto-summarize expenses for each 6-month period. SUMIF calculates total expenses based on date ranges, while EDATE helps define the 6-month intervals dynamically. Your tracker efficiently consolidates financial data to monitor semi-annual spending trends.

Which Excel features enable visual analysis of expense trends in the tracker?

Your Semi-annually Expense Tracker uses Excel features like PivotTables and Sparklines to provide visual analysis of expense trends, highlighting key spending patterns efficiently. Conditional formatting helps identify anomalies or significant changes in expenses, ensuring you can quickly spot trends. Chart tools such as line and column charts further enhance the visualization of your small business's financial data over each six-month period.

How is data validation applied to ensure consistent entry of expense categories and dates?

Data validation in a Semi-annually Expense Tracker for Small Business restricts entries to predefined expense categories using dropdown lists, ensuring consistent classification. Date validation enforces correct semi-annual date ranges and formats, preventing errors and maintaining chronological accuracy. This approach minimizes data entry errors and enhances reliable financial reporting.

What security measures are implemented to protect sensitive business financial data in the tracker?

The Semi-annually Expense Tracker for Small Business employs advanced encryption protocols to safeguard your financial information from unauthorized access. Role-based access controls and password protection ensure only authorized personnel can view or edit sensitive data. Regular backup and secure cloud storage minimize risks of data loss and enhance overall security.