The Semi-annually Loan Repayment Schedule Excel Template for Mortgage Brokers provides a clear and organized way to track loan repayments occurring every six months. This template helps mortgage brokers accurately calculate interest and principal amounts, ensuring precise financial planning and client communication. Its customizable features make it essential for managing semi-annual loan schedules efficiently.

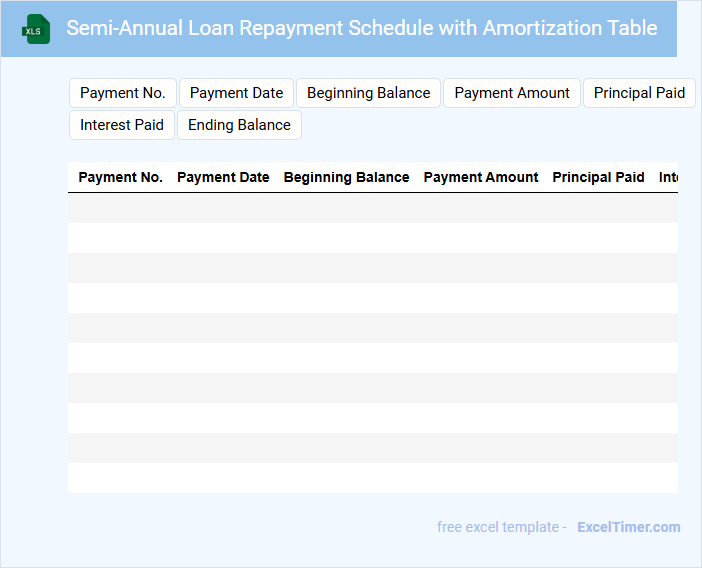

Semi-Annual Loan Repayment Schedule with Amortization Table

What information is typically included in a Semi-Annual Loan Repayment Schedule with Amortization Table? This document usually contains detailed information about loan payments divided into six-month periods, showing principal and interest amounts for each installment. It clearly outlines how the loan balance decreases over time and helps borrowers track their repayment progress.

Important considerations for this type of document include ensuring accurate calculation of interest and principal components for each period, and including a clear breakdown for transparency. Additionally, it is helpful to highlight any additional fees or prepayment options to provide a complete financial picture.

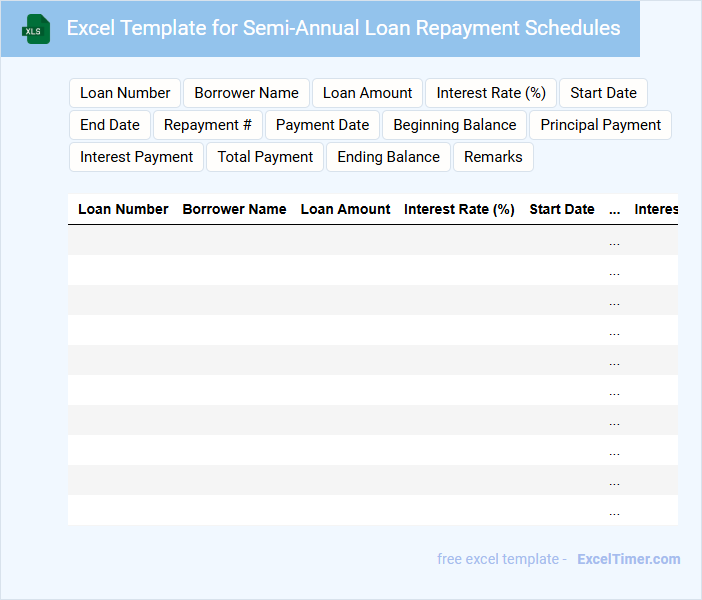

Excel Template for Semi-Annual Loan Repayment Schedules

This document typically contains structured data and formulas designed to calculate and track loan repayment schedules on a semi-annual basis. It helps users manage payment timelines and interest calculations efficiently.

- Include clear input fields for principal, interest rate, and loan term to ensure accurate calculations.

- Incorporate dynamic formulas that automatically update payment amounts as inputs change.

- Provide a summary section highlighting total payments and outstanding balance for quick review.

Semi-Annually Compounded Loan Repayment Tracker for Mortgage Brokers

A Semi-Annually Compounded Loan Repayment Tracker typically contains detailed records of loan disbursements, interest calculations, and repayment schedules. It is essential for mortgage brokers to monitor loan balances and track payment deadlines accurately. Including a clear breakdown of principal and interest components helps ensure precise financial management and timely client updates.

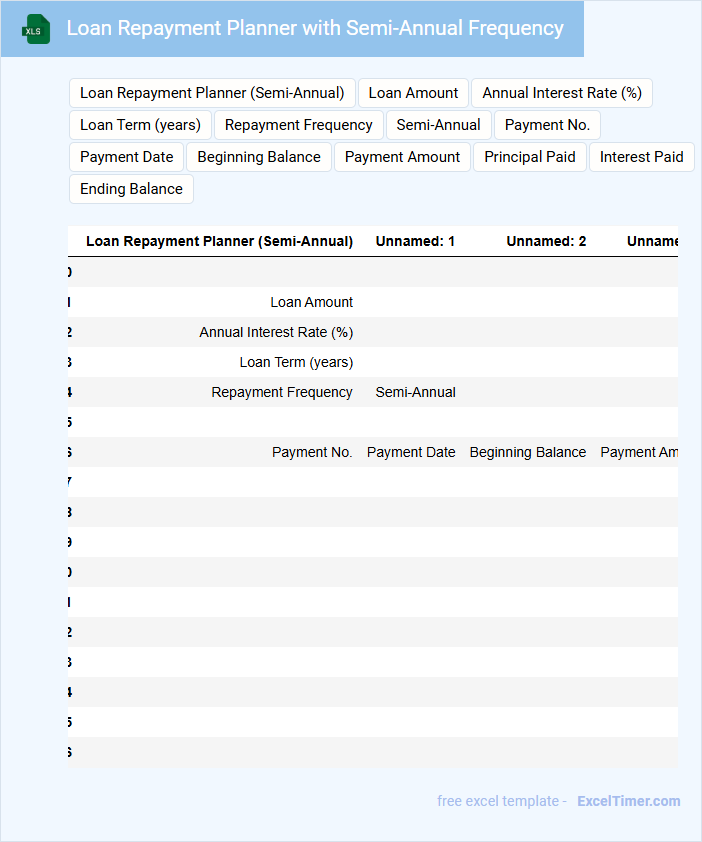

Loan Repayment Planner with Semi-Annual Frequency

A Loan Repayment Planner with Semi-Annual Frequency outlines the schedule and amounts for loan repayments made every six months. It helps borrowers manage their finances by providing clear timelines and payment expectations.

- Include the total loan amount, interest rate, and repayment term to ensure accurate calculations.

- List each semi-annual payment date with corresponding principal and interest amounts.

- Highlight any penalties or fees for late payments to avoid unexpected costs.

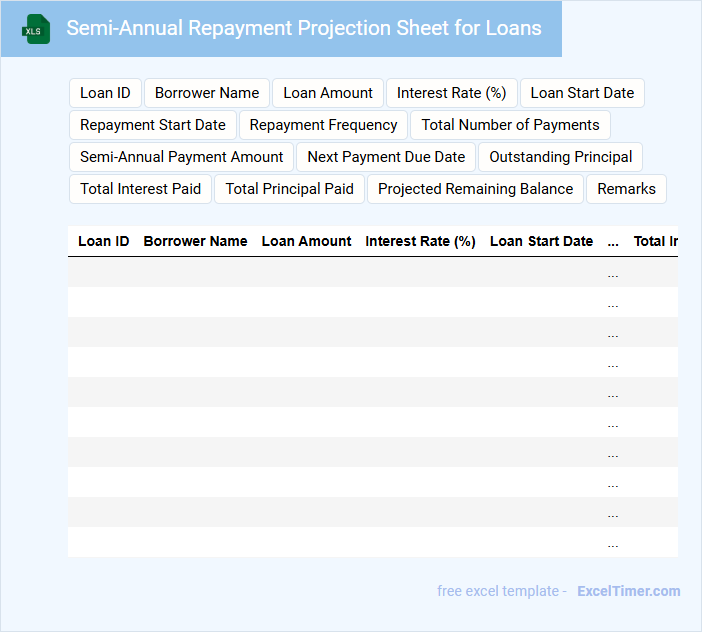

Semi-Annual Repayment Projection Sheet for Loans

A Semi-Annual Repayment Projection Sheet for Loans typically contains detailed forecasts of loan repayments over six-month intervals. It helps borrowers and lenders anticipate payment schedules and manage cash flow effectively.

- Include the loan principal, interest rates, and repayment dates for accuracy.

- Update projections regularly to reflect any changes in interest or payment terms.

- Highlight upcoming payment amounts and remaining loan balances clearly.

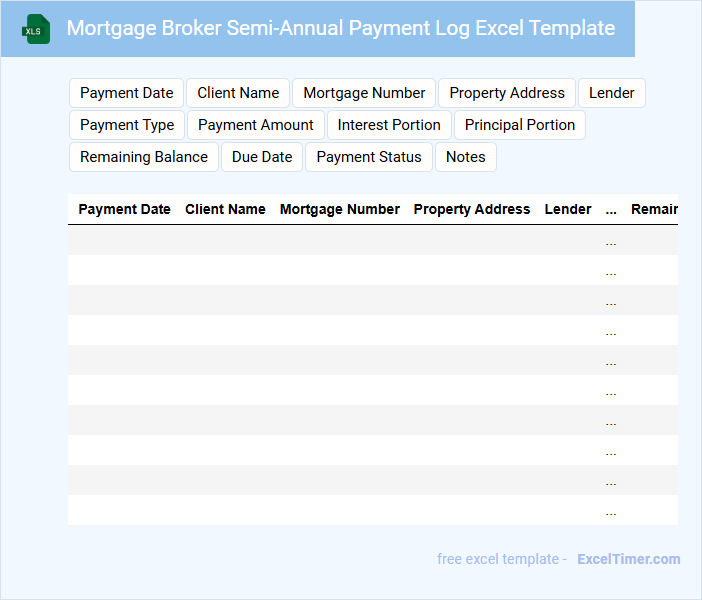

Mortgage Broker Semi-Annual Payment Log Excel Template

What information is typically included in a Mortgage Broker Semi-Annual Payment Log Excel Template? This document usually contains detailed records of mortgage payments made every six months, including payment dates, amounts, and outstanding balances. It helps mortgage brokers track client payment histories and ensures accurate financial management.

Why is maintaining accurate entries in this log important? Keeping precise and up-to-date information allows brokers to monitor payment compliance, identify late or missed payments, and provide reliable reports to clients or lenders. It is essential to regularly update the template and verify the payment details for accuracy.

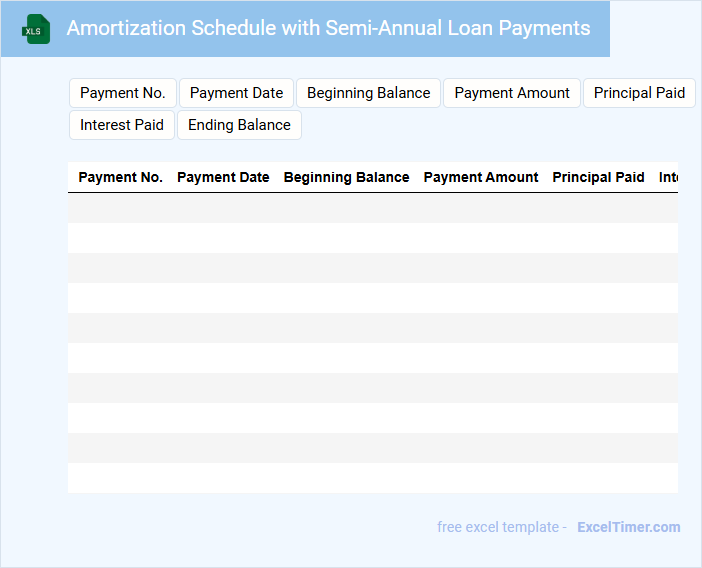

Amortization Schedule with Semi-Annual Loan Payments

An Amortization Schedule with Semi-Annual Loan Payments details the breakdown of each payment over the life of a loan, showing the amount applied to principal and interest every six months. It helps borrowers understand how their loan balance decreases over time and plan their finances accordingly.

- Include clear dates for each semi-annual payment to track payment timing effectively.

- Show separate columns for principal, interest, and remaining balance to enhance transparency.

- Highlight total interest paid over the loan term to provide insight into overall cost.

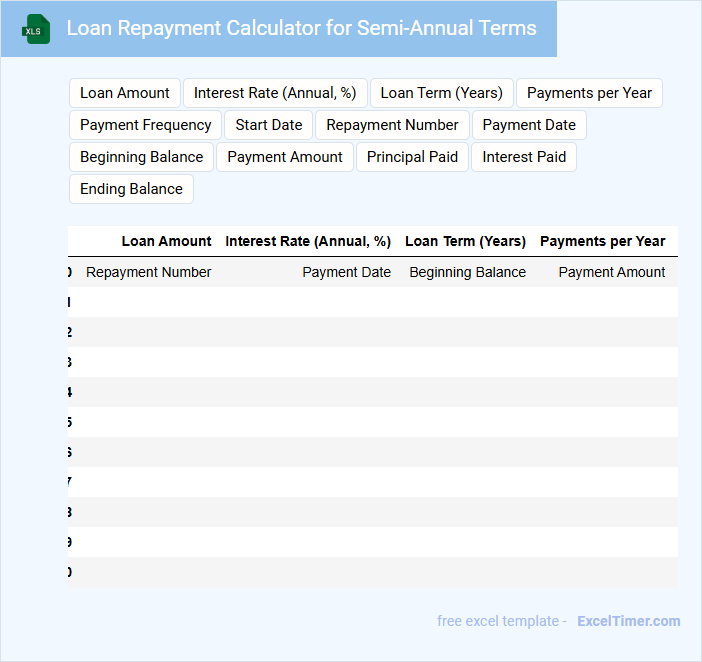

Loan Repayment Calculator for Semi-Annual Terms

This document typically contains a detailed explanation of the loan repayment calculator specifically designed for semi-annual terms, outlining how payments are calculated every six months. It highlights important fields such as loan amount, interest rate, loan duration, and payment schedule to ensure accurate results. Additionally, it suggests including features like amortization tables and early repayment options to enhance user understanding and decision-making.

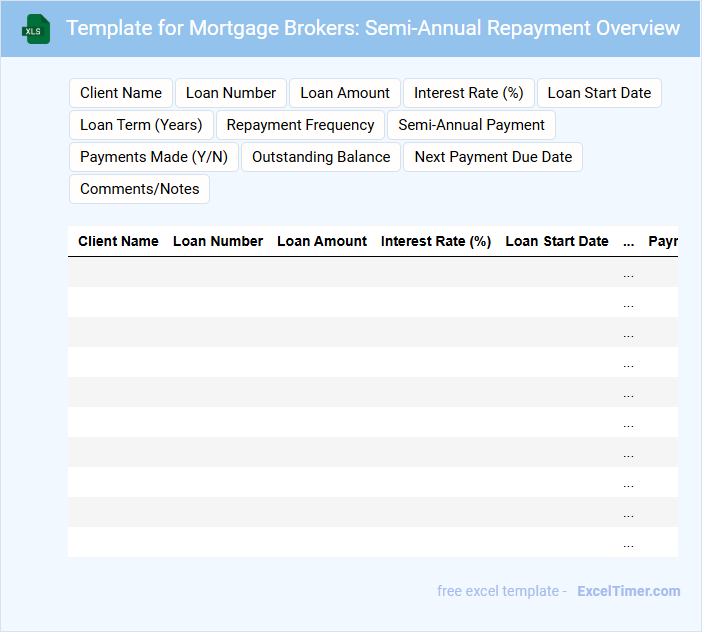

Template for Mortgage Brokers: Semi-Annual Repayment Overview

This document typically contains a detailed overview of mortgage repayments made over a six-month period, helping clients and brokers track payment progress and financial planning.

- Payment Summary: A clear breakdown of all payments made including principal and interest components.

- Outstanding Balance: Updated loan balance reflecting all repayments and any additional fees.

- Future Projection: Estimated future payments and timelines based on current repayment trends.

Semi-Annual Loan Interest and Principal Tracker for Brokers

What information does a Semi-Annual Loan Interest and Principal Tracker for Brokers typically contain? This document usually includes detailed records of loan disbursements, interest calculations, and principal repayments made by borrowers over a six-month period. It serves as a crucial tool for brokers to monitor loan performance and ensure accurate financial tracking.

What is an important aspect to focus on in this tracker? Accurate and timely updates of payment statuses and interest accruals are essential to maintain transparency and support effective loan management. Additionally, including clear summaries and visual aids like charts can enhance understanding and decision-making.

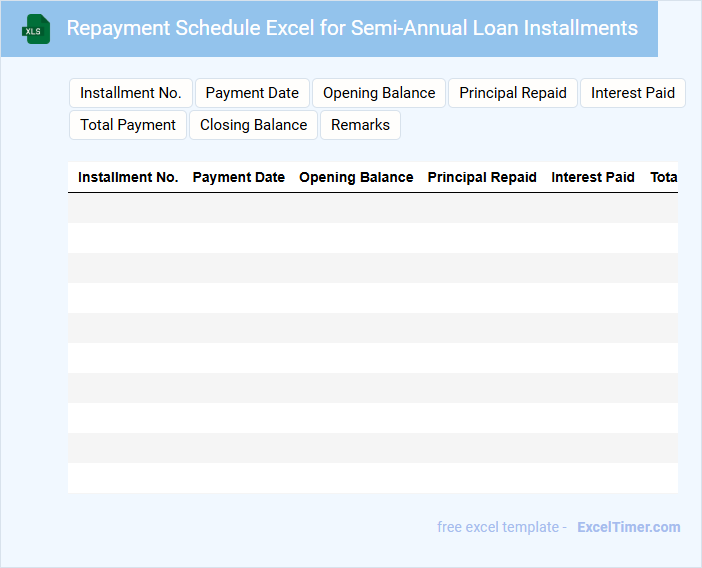

Repayment Schedule Excel for Semi-Annual Loan Installments

A Repayment Schedule in Excel is a detailed document that outlines the timeline and amounts for loan repayments, specifically structured for semi-annual installments. It typically contains dates, principal amounts, interest calculations, and the remaining balance after each payment. This document helps borrowers and lenders track and manage loan repayment efficiently over the loan term.

For a semi-annual loan installment schedule, it is important to accurately calculate the dates occurring every six months, ensure the interest rate is appropriately applied for each period, and clearly display the principal and interest breakdown. Additionally, including a summary section with total payments, total interest paid, and outstanding loan balance can enhance understanding. Using Excel formulas boosts automation and reduces manual errors in the repayment calculation process.

Semi-Annual Loan Repayment Tracker with Outstanding Balance

A Semi-Annual Loan Repayment Tracker typically contains detailed records of loan payments made every six months, including dates, amounts, and remaining balances. It helps borrowers and lenders monitor repayment progress and ensures obligations are met timely. Tracking the Outstanding Balance is crucial to understanding how much principal remains unpaid.

An important aspect to include is clear categorization of principal and interest portions of each payment to give a precise view of how the loan amortizes over time. Additionally, incorporating reminders for upcoming payment due dates can improve on-time repayments.

Ensuring accurate and updated balances after each payment period enhances financial planning and helps avoid missed payments or disputes. Visual aids like charts or progress bars can also provide an intuitive snapshot of the repayment status.

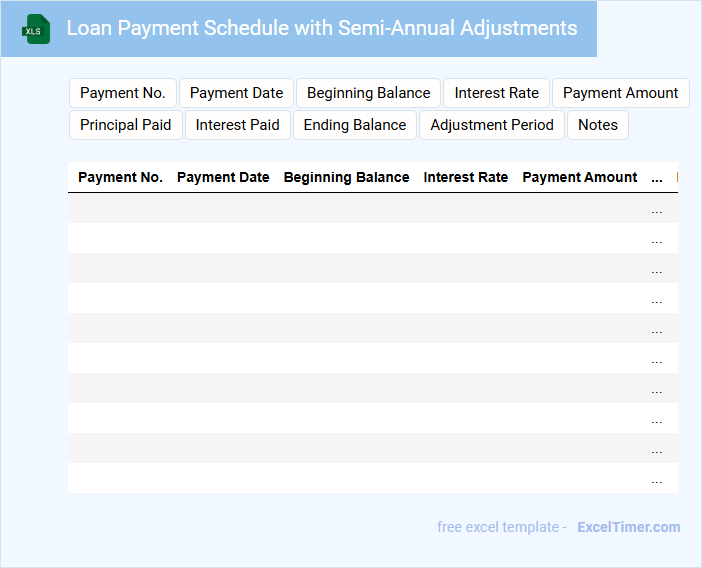

Loan Payment Schedule with Semi-Annual Adjustments

The Loan Payment Schedule is a detailed document outlining the repayment timeline of a loan, including each installment's amount and due date. It usually contains information about the principal, interest rates, and the total number of payments. Ensure clarity on the semi-annual adjustments, which typically affect the interest rate or payment amount every six months.

This type of schedule is essential for both the borrower and lender to track obligations and avoid defaults. The document should clearly state the conditions under which adjustments occur and how they impact the payments. Always review the terms regarding adjustment calculations and notification periods for transparency.

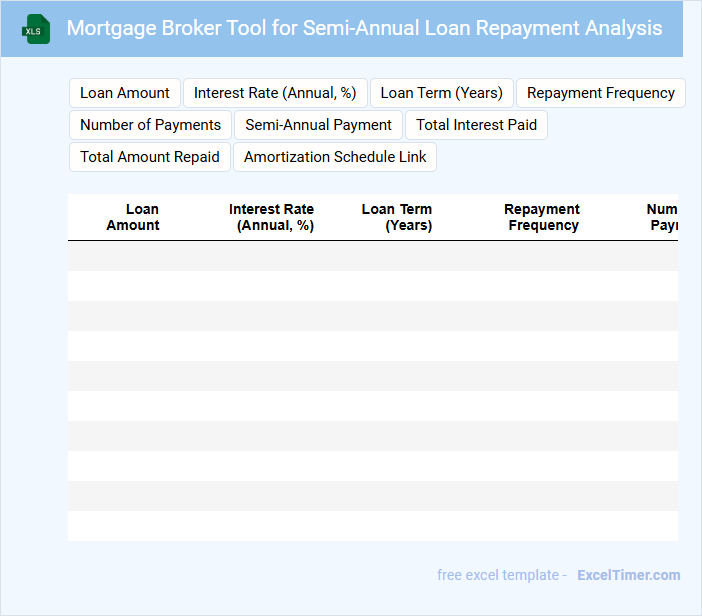

Mortgage Broker Tool for Semi-Annual Loan Repayment Analysis

A Mortgage Broker Tool for Semi-Annual Loan Repayment Analysis typically contains detailed loan amortization schedules, interest rate calculations, and payment timelines. It helps brokers evaluate different loan options and plan client repayments effectively. Key components include principal balances, interest breakdown, and comparison of repayment scenarios.

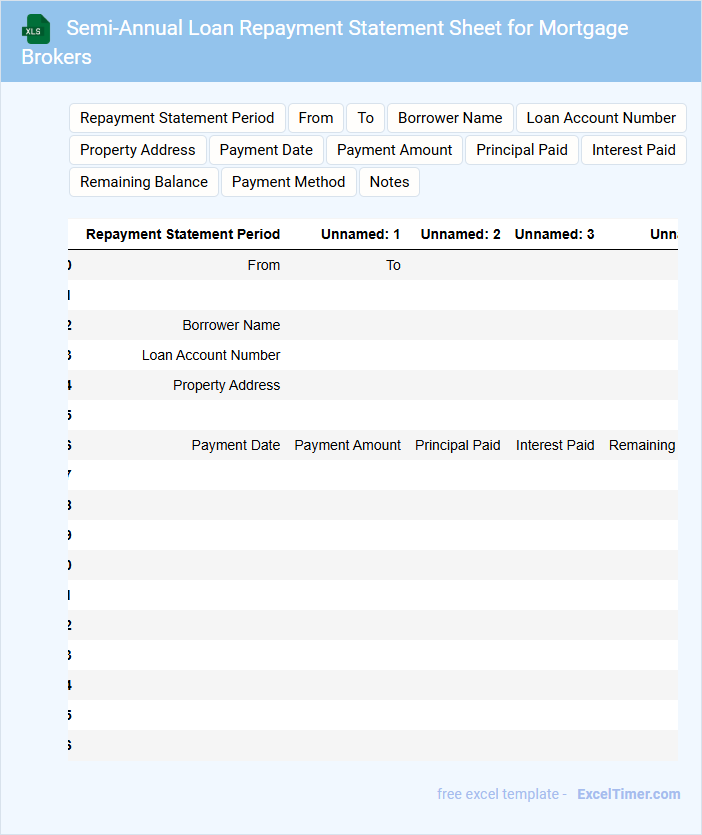

Semi-Annual Loan Repayment Statement Sheet for Mortgage Brokers

A Semi-Annual Loan Repayment Statement Sheet for Mortgage Brokers typically contains detailed information on loan repayments and account status over a six-month period.

- Payment Summary: An overview of all payments made, including dates, amounts, and remaining balances.

- Interest and Principal Breakdown: A clear distinction between amounts applied to interest and principal in each payment.

- Contact Information: Essential borrower and lender details for easy communication and reference.

What formula calculates the semi-annual payment amount for a loan in Excel?

The formula to calculate the semi-annual payment amount for a loan in Excel is =PMT(rate/2, number_of_periods*2, -loan_amount). This formula adjusts the annual interest rate and total periods for semi-annual payments. Your mortgage brokers can use this function to accurately create a semi-annually loan repayment schedule.

How do you structure an amortization table to track principal and interest for each semi-annual period in Excel?

Create columns for Period, Beginning Principal, Interest, Principal Repayment, and Ending Principal to structure an amortization table for semi-annual loan repayments. Use formulas to calculate interest as Beginning Principal multiplied by the semi-annual interest rate, and determine principal repayment by subtracting interest from the total payment. Your Excel sheet will then dynamically track principal and interest for each semi-annual period.

Which Excel functions help accurately split payments between interest and principal for semi-annual schedules?

Excel functions PMT, IPMT, and PPMT accurately split semi-annual loan repayments into interest and principal components. PMT calculates the total payment for each period based on loan amount, interest rate, and number of periods. IPMT and PPMT extract the interest and principal portions respectively for each semi-annual payment.

What essential columns should be included in a semi-annual loan repayment schedule for mortgage brokers?

A semi-annual loan repayment schedule for mortgage brokers should include essential columns such as Payment Date, Principal Amount, Interest Amount, Total Payment, Remaining Balance, and Cumulative Interest Paid. Your schedule must clearly outline each semi-annual installment to track the loan's amortization accurately. Including columns for Payment Number and Loan Term can enhance clarity and usability.

How can mortgage brokers use conditional formatting in Excel to identify late or missed semi-annual payments?

Mortgage brokers can use Excel's conditional formatting to highlight late or missed semi-annual payments by setting rules that compare scheduled payment dates against actual payment dates. They can apply formatting to payment cells that are past due or blank beyond the due date. This visual cue allows quick identification of overdue loan installments in a semi-annually loan repayment schedule.