![]()

The Semi-annually Expense Tracking Excel Template for Freelancers offers a streamlined way to monitor income and expenses every six months, ensuring accurate financial management. This template simplifies budgeting and tax preparation by organizing data into clear categories and providing automated calculations. Freelancers benefit from improved cash flow insights and better planning for quarterly or biannual financial reviews.

Semi-Annual Expense Tracker for Freelancers

The Semi-Annual Expense Tracker for freelancers is a vital document used to monitor and record all business-related expenses over a six-month period. It typically includes detailed entries such as receipts, invoices, and payment dates to help manage cash flow and budget effectively. Utilizing this document ensures freelancers stay organized and are prepared for tax filings and financial reviews.

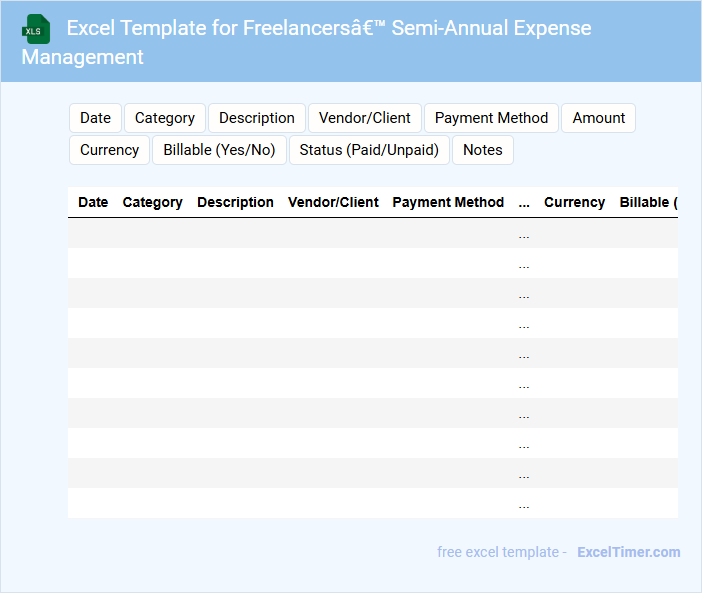

Excel Template for Freelancers’ Semi-Annual Expense Management

This Excel template is designed to help freelancers efficiently track and manage their expenses over a six-month period. It typically contains sections for categorizing costs, inputting dates, and summarizing totals for better financial oversight. Using this tool ensures accurate record-keeping essential for budgeting and tax preparation.

Semi-Annual Financial Overview with Expense Tracking for Freelancers

The Semi-Annual Financial Overview for freelancers provides a concise summary of income and expenses accrued over six months. It typically contains detailed expense tracking data to help freelancers monitor costs and identify saving opportunities. This document is crucial for accurate tax preparation, budgeting, and financial planning.

Freelancers’ Expense Tracking Log for Semi-Annual Reporting

A Freelancers' Expense Tracking Log for Semi-Annual Reporting is a document used to systematically record and organize all business-related expenses incurred by a freelancer over a six-month period. It helps ensure accurate financial tracking and simplifies the process of tax filing and budgeting.

- Include detailed entries for each expense with dates, descriptions, and amounts.

- Regularly update the log to avoid missing any deductible expenses.

- Attach or reference receipts and invoices to validate the recorded expenses.

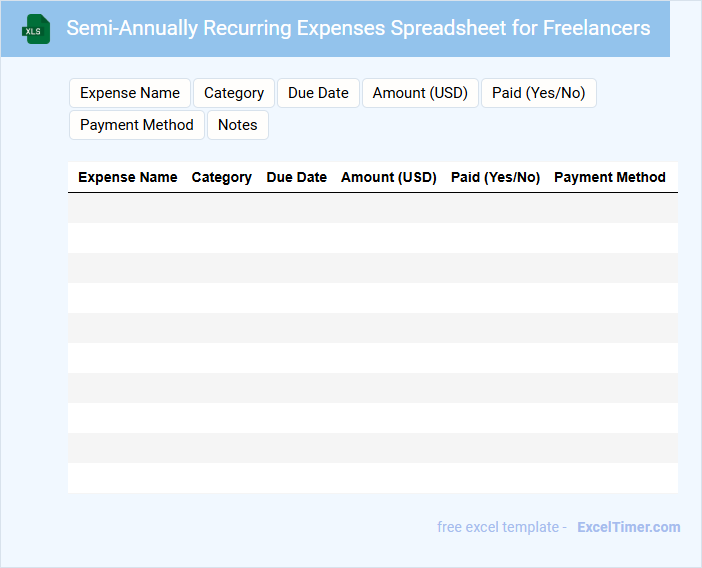

Semi-Annually Recurring Expenses Spreadsheet for Freelancers

The Semi-Annually Recurring Expenses Spreadsheet for freelancers typically includes detailed records of expenses that occur every six months, such as software subscriptions, insurance payments, and professional fees. It helps freelancers track and plan their cash flow efficiently by providing a clear overview of upcoming financial obligations. Organizing expenses in this manner ensures timely payments and better budgeting for business sustainability.

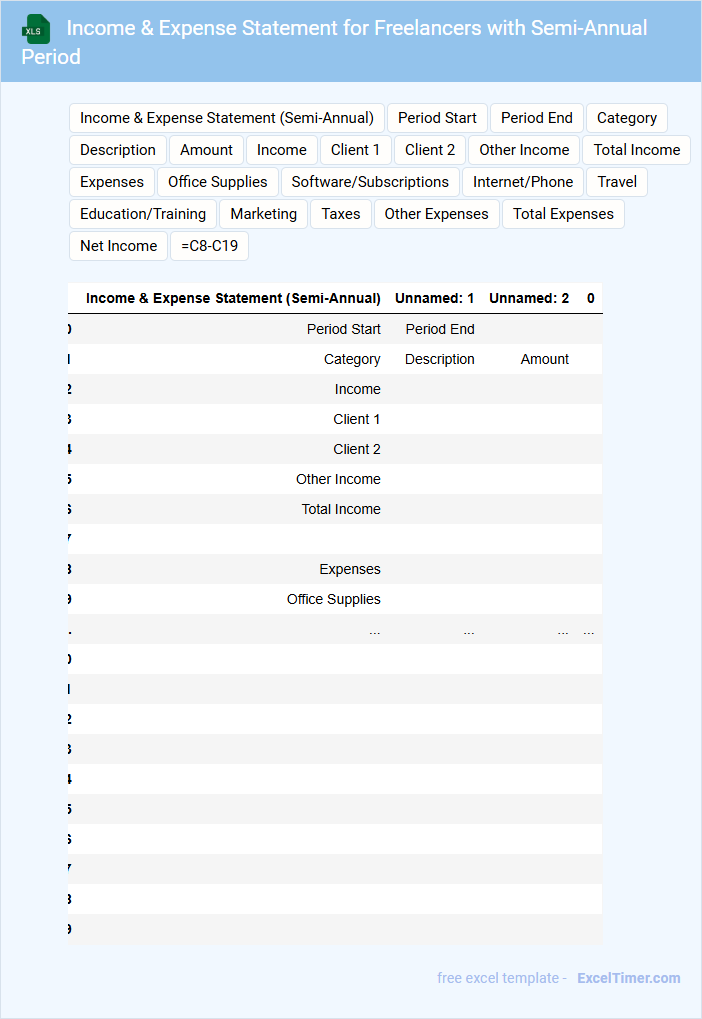

Income & Expense Statement for Freelancers with Semi-Annual Period

What information is typically included in an Income & Expense Statement for Freelancers with a Semi-Annual Period? This document usually contains a detailed record of all income earned and expenses incurred by the freelancer over six months. It helps track financial performance, manage cash flow, and prepare for tax obligations.

What are the important elements to include in this statement? Key items are categorized income sources, deductible business expenses, date ranges, and net profit calculations to ensure accurate financial analysis and compliance with tax regulations.

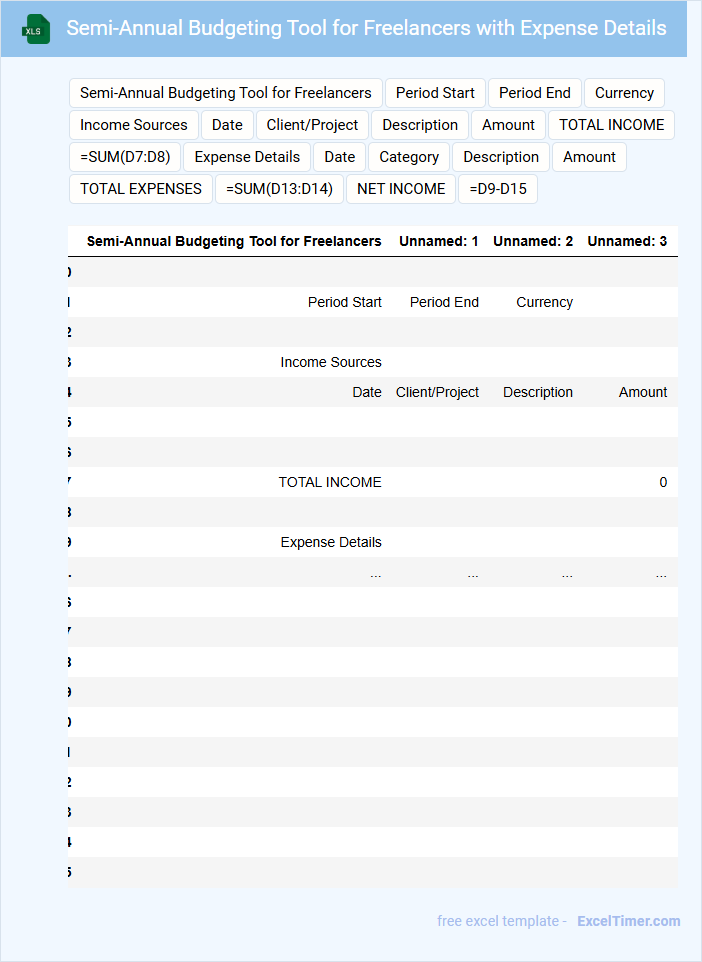

Semi-Annual Budgeting Tool for Freelancers with Expense Details

The Semi-Annual Budgeting Tool for freelancers provides a structured approach to managing finances over six months, capturing income and expenditures accurately. It typically contains detailed expense categories, income sources, and projections to help maintain financial stability. This tool is essential for tracking cash flow, planning savings, and ensuring timely payments of taxes. When using the tool, freelancers should prioritize regular expense updates and categorize spending clearly to spot trends and optimize budgets. Including both fixed and variable costs enhances the accuracy of the budget forecast and supports better financial decision-making. Additionally, integrating reminders for upcoming expenses and tax deadlines can improve overall money management.

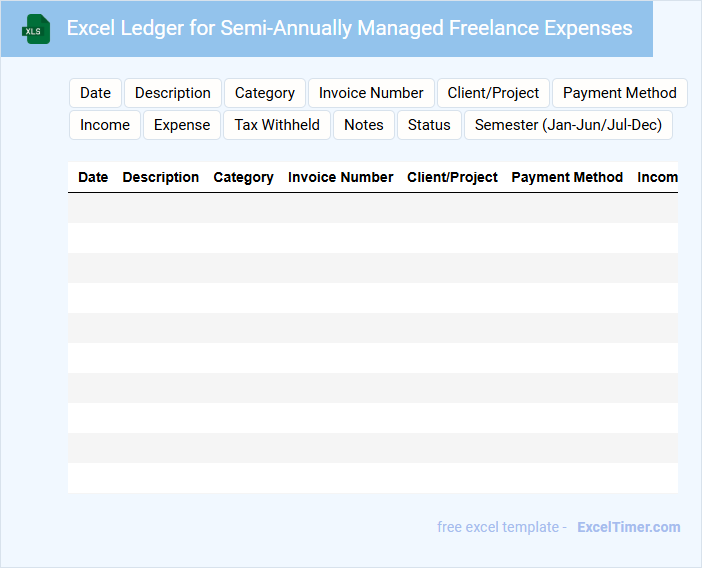

Excel Ledger for Semi-Annually Managed Freelance Expenses

An Excel Ledger for Semi-Annually Managed Freelance Expenses is a structured document used to track and organize payments, receipts, and costs related to freelance work over six-month periods. It typically contains categorized entries for income, operational costs, and tax deductions to ensure financial clarity and accountability. Essential for budgeting and reporting, this ledger helps freelancers monitor their cash flow and prepare for tax season efficiently.

Freelance Project Expense Tracking Sheet with Semi-Annual Review

A Freelance Project Expense Tracking Sheet is typically a detailed document used to monitor and record all costs associated with freelance projects over a specified period. It usually contains categories for expenses, dates, payment methods, and project details, providing a clear financial overview. Including a semi-annual review helps freelancers analyze spending trends and adjust budgets effectively.

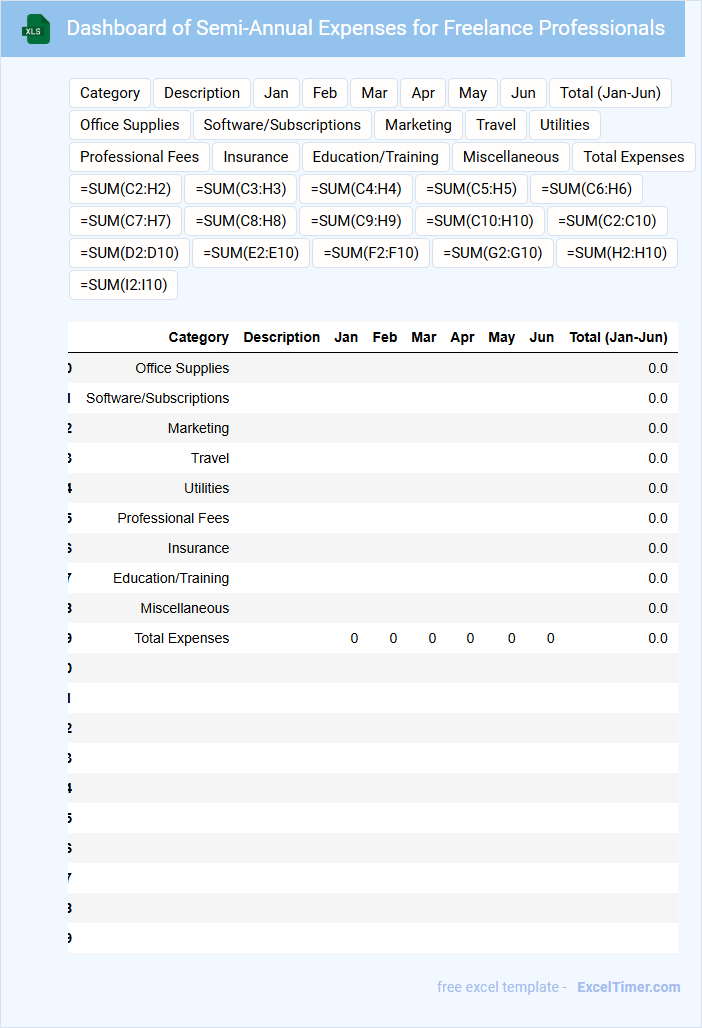

Dashboard of Semi-Annual Expenses for Freelance Professionals

A Dashboard of Semi-Annual Expenses for Freelance Professionals typically contains summarized financial data reflecting expenditures over a six-month period. It includes categorized expenses, trends, and comparison with previous periods to help freelancers understand their spending patterns. This document is essential for budgeting, tax preparation, and financial planning.

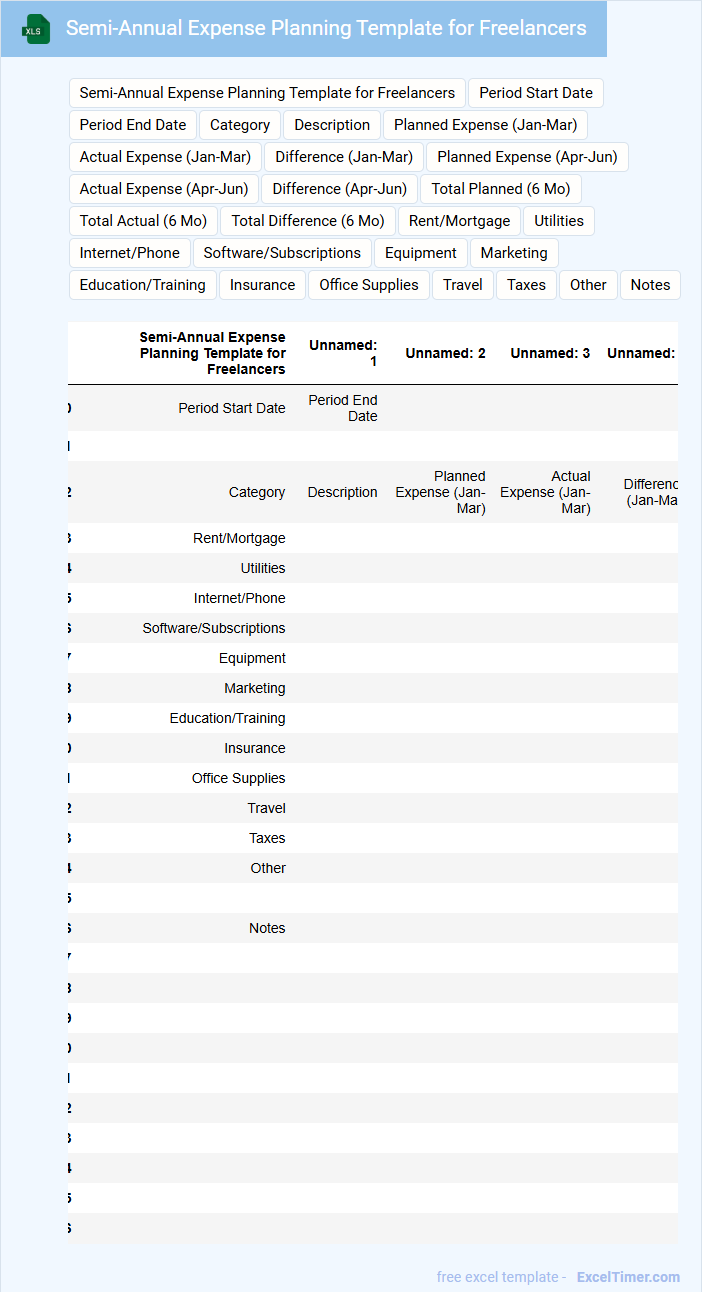

Semi-Annual Expense Planning Template for Freelancers

The Semi-Annual Expense Planning Template for freelancers is a structured document that helps track and forecast expenses over a six-month period. It typically includes categories such as fixed costs, variable expenses, and anticipated business investments.

This template is essential for maintaining financial discipline and ensuring sustainable cash flow. Prioritizing accurate expense categorization and updating the document regularly are crucial for effective budget management.

Excel Register for Freelancers with Semi-Annual Expense Tracking

An Excel Register for Freelancers with Semi-Annual Expense Tracking typically contains financial entries and summaries tailored to monitor freelance income and expenditures every six months.

- Comprehensive Income Logs: Track all sources of freelance income to maintain accurate records for tax and budgeting purposes.

- Detailed Expense Categories: Categorize and record expenses to optimize deductions and financial planning.

- Semi-Annual Reports: Generate summaries every six months for performance analysis and informed decision-making.

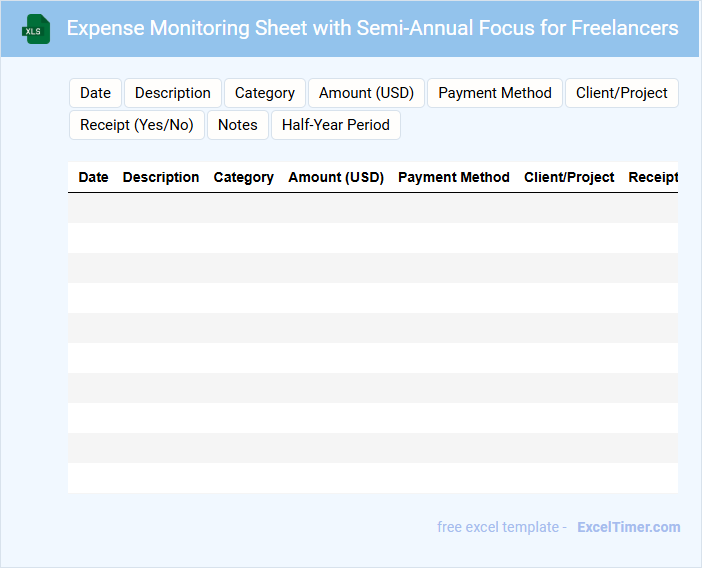

Expense Monitoring Sheet with Semi-Annual Focus for Freelancers

An Expense Monitoring Sheet with a semi-annual focus is designed to help freelancers systematically track and categorize their expenses over six-month periods. This type of document typically contains sections for income sources, fixed and variable expenses, and summary analyses to provide a clear financial overview. It is essential for freelancers to regularly update this sheet to ensure accurate budgeting and tax preparation.

Semi-Annual Cash Flow and Expense Tracker for Freelancers

A Semi-Annual Cash Flow and Expense Tracker for freelancers is a document designed to meticulously record income and expenditures over a six-month period. It helps in monitoring financial health and ensures timely budgeting decisions. Key elements usually include categorized expenses, income sources, and a summary of net cash flow.

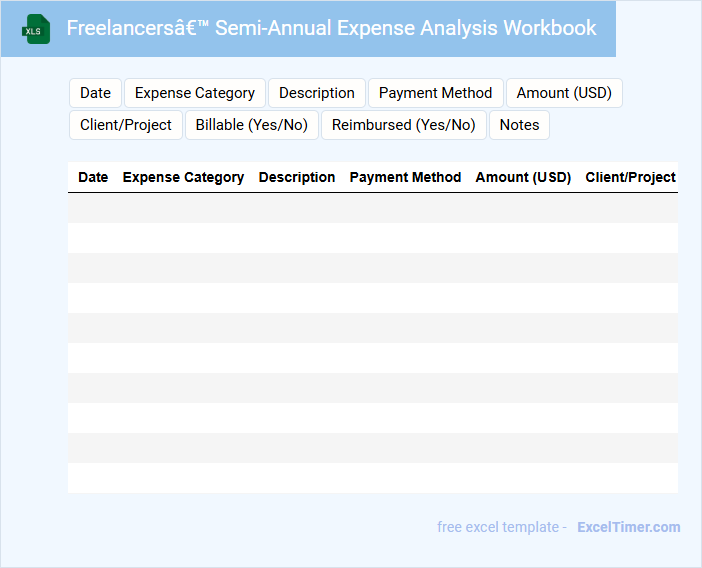

Freelancers’ Semi-Annual Expense Analysis Workbook

What information is typically included in a Freelancers' Semi-Annual Expense Analysis Workbook? This document usually contains detailed records of all expenses incurred by freelancers over a six-month period, categorized by type and date. It also includes summaries and charts to help analyze spending patterns and identify potential areas for cost savings.

Why is it important for freelancers to maintain this workbook? Keeping an organized semi-annual expense analysis helps freelancers manage their finances effectively, prepare accurate tax filings, and make informed budgeting decisions for future projects. Regular updates and precise categorization are essential to maximize its usefulness and ensure financial clarity.

What are the key categories to include when setting up a semi-annual expense tracker for freelancers in Excel?

Key categories for a semi-annual expense tracker for freelancers in Excel include Income, Office Supplies, Software and Subscriptions, Marketing and Advertising, Travel and Meals, Professional Services, Taxes, and Miscellaneous Expenses. Each category should have detailed subcategories and columns for date, description, amount, payment method, and tax deductible status. Incorporating these categories helps freelancers accurately monitor cash flow, optimize deductions, and streamline financial reporting every six months.

How can you automate the calculation of total expenses and net income for each six-month period?

You can automate the calculation of total expenses and net income for each six-month period in your Excel document by using SUMIFS functions to aggregate expenses within defined date ranges. Set up separate columns for income and expenses, then apply formulas referencing these columns with date criteria to calculate totals every six months. Implementing these formulas ensures accurate, time-based financial tracking tailored to freelancers.

Which Excel formulas are most effective for summarizing and filtering expenses by project or client?

Excel formulas like SUMIFS and FILTER are most effective for summarizing and filtering expenses by project or client in semi-annual expense tracking for freelancers. SUMIFS allows precise aggregation of expenses based on multiple criteria such as project name and date range. FILTER dynamically extracts relevant expense records, enhancing data analysis and reporting accuracy in Excel.

How can conditional formatting be utilized to highlight overspending or irregular expense patterns?

Conditional formatting in your semi-annual expense tracking Excel sheet can highlight overspending by applying color scales or icons to expenses that exceed budget limits. You can set rules to automatically flag irregular patterns, such as sudden spikes in spending, using formulas based on historical averages. This visual insight enables quick identification of financial anomalies and better expense management.

What is the best way to organize and visualize semi-annual financial data for easy reporting and tax preparation?

The best way to organize and visualize semi-annual financial data for freelancers is by creating categorized expense tables with clear labels and date ranges in your Excel document. Use pivot tables and charts to summarize expenses by category, enabling quick analysis and easy identification of tax-deductible items. Your semi-annual tracking will become streamlined, allowing for efficient reporting and preparation during tax season.