The Semi-annually Budget Planning Excel Template for Small Businesses is designed to help small business owners efficiently manage their finances by tracking income and expenses every six months. It features customizable categories and automated calculations to simplify budget monitoring and forecasting. This template enhances financial decision-making by providing clear, period-specific insights essential for sustainable growth.

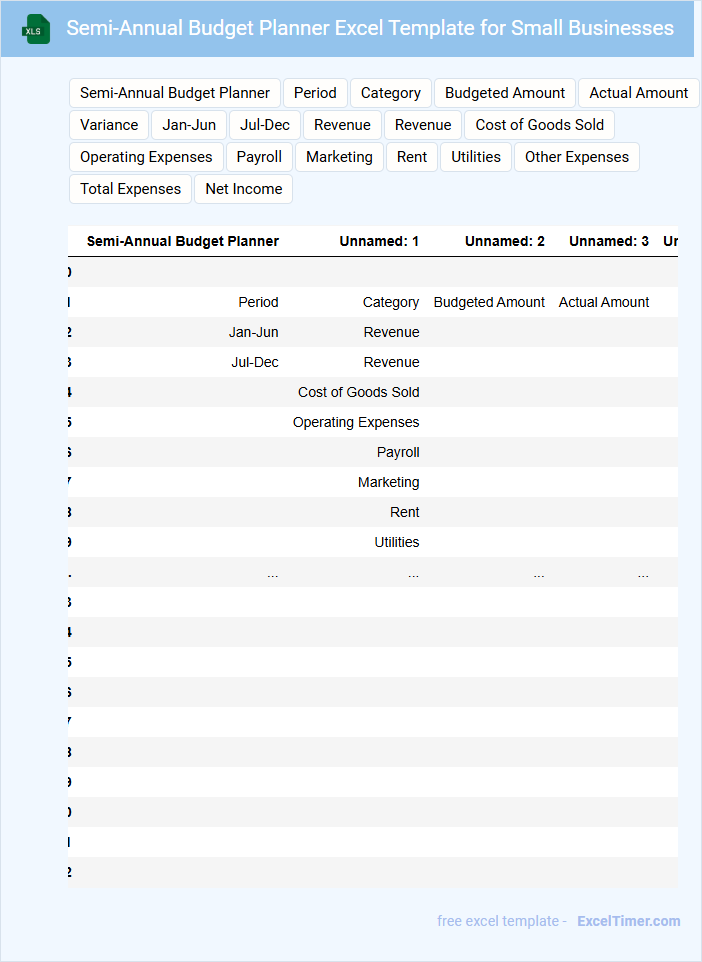

Semi-Annual Budget Planner Excel Template for Small Businesses

The Semi-Annual Budget Planner Excel Template is designed to help small businesses efficiently manage their finances over a six-month period. It typically contains sections for income tracking, expense categorization, and cash flow projections.

Using this template allows business owners to monitor budget performance and make informed financial decisions. Important features to include are customizable expense categories and clear visual charts for easy analysis.

Budget Tracking Spreadsheet with Semi-Annual View for Small Businesses

A Budget Tracking Spreadsheet with Semi-Annual View is a vital tool for small businesses to monitor their financial health over six months. It typically contains income and expense categories, periodic financial data, and summary sections for clear insights. Including automated calculations and visual charts enhances accuracy and helps in making informed financial decisions.

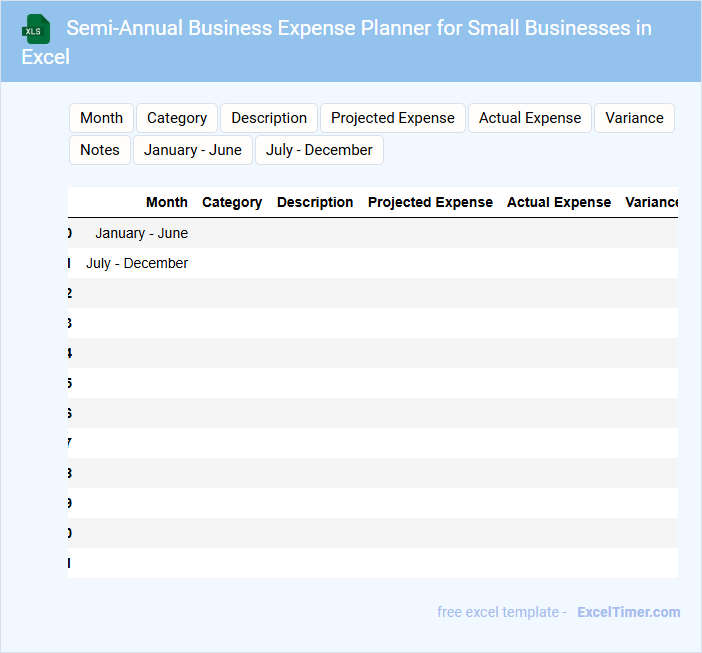

Semi-Annual Business Expense Planner for Small Businesses in Excel

The Semi-Annual Business Expense Planner is a crucial document designed to help small businesses track and manage their expenses over a six-month period. It typically contains detailed categories of costs such as utilities, payroll, marketing, and supplies, allowing for better financial oversight. This planner aids in budgeting, forecasting, and identifying areas to reduce expenses to improve profitability.

For optimal use, ensure the document includes clear expense categories, a timeline for expense tracking, and fields for notes or reminders. Incorporate formulas for automatic calculations to streamline the process and minimize errors. Regularly updating and reviewing the planner will provide valuable insights to guide financial decisions.

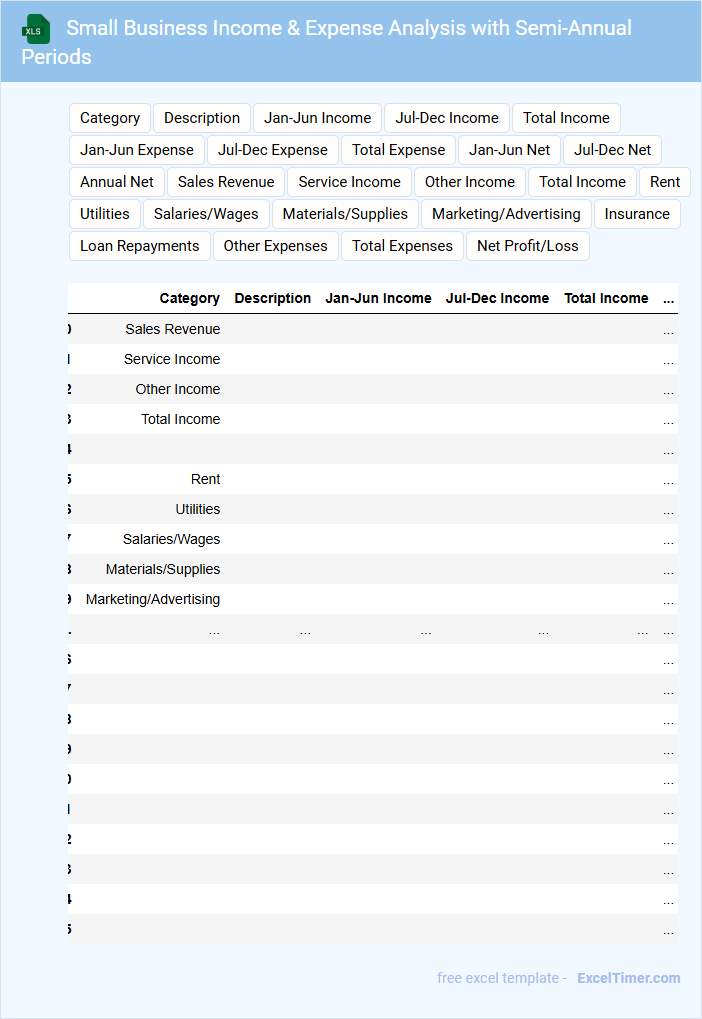

Small Business Income & Expense Analysis with Semi-Annual Periods

This type of document focuses on providing a detailed income and expense analysis for small businesses over semi-annual periods. It typically contains categorized financial data, including revenue streams and operational costs to evaluate profitability. Important elements include clear tracking of cash flow, identification of key expense drivers, and comparison across the two semi-annual periods for trend analysis.

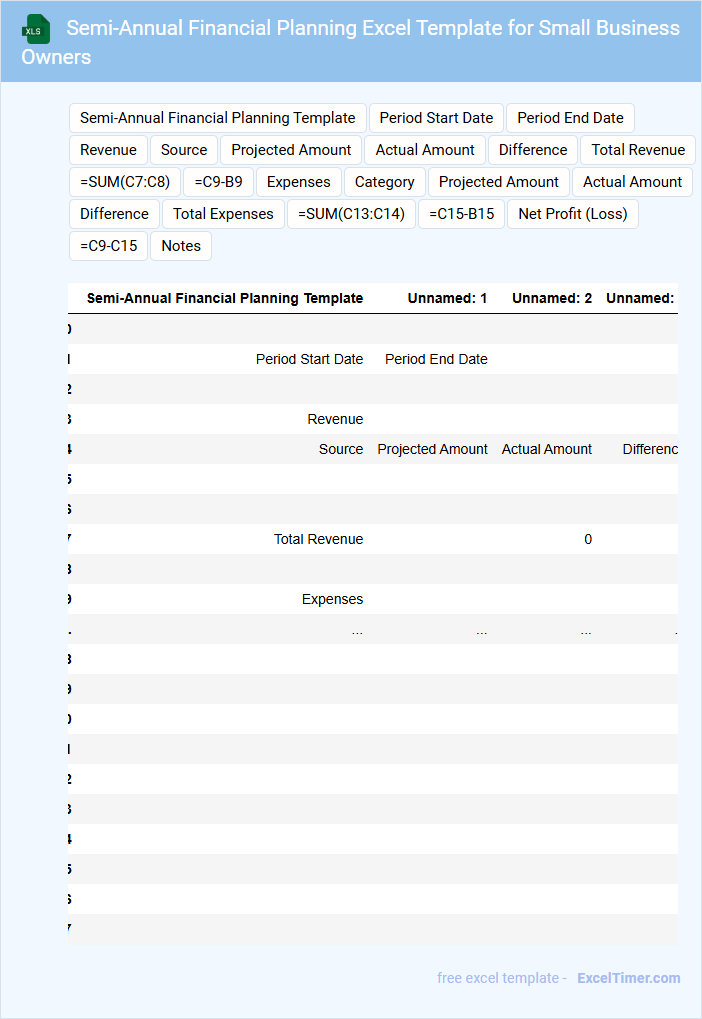

Semi-Annual Financial Planning Excel Template for Small Business Owners

This document is typically a comprehensive Excel template designed to help small business owners systematically organize and project their finances over a six-month period.

- Cash Flow Management: Enables tracking and forecasting of income and expenses to maintain liquidity.

- Budget Allocation: Assists in distributing resources efficiently across different departments or projects.

- Performance Review: Provides tools to analyze financial outcomes against strategic goals to inform decision-making.

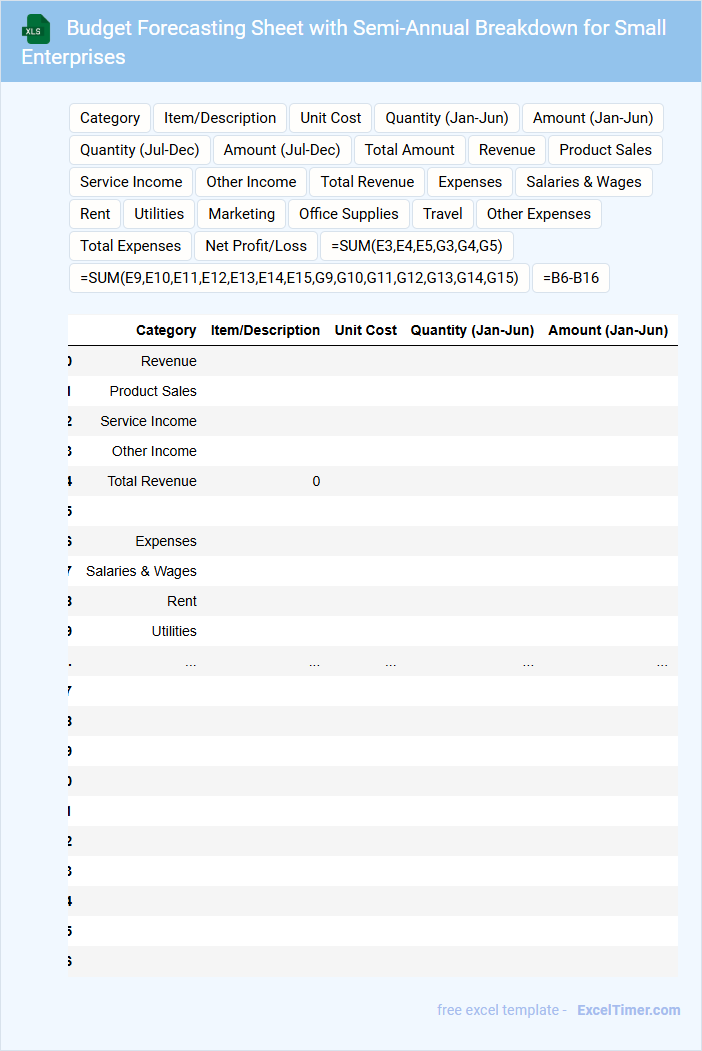

Budget Forecasting Sheet with Semi-Annual Breakdown for Small Enterprises

What information does a Budget Forecasting Sheet with Semi-Annual Breakdown for Small Enterprises typically contain? This document usually includes projected income, expenses, and cash flow divided into two six-month periods, allowing for detailed financial planning and monitoring. It helps small enterprises anticipate financial needs, allocate resources efficiently, and set realistic targets for growth and cost management over the year.

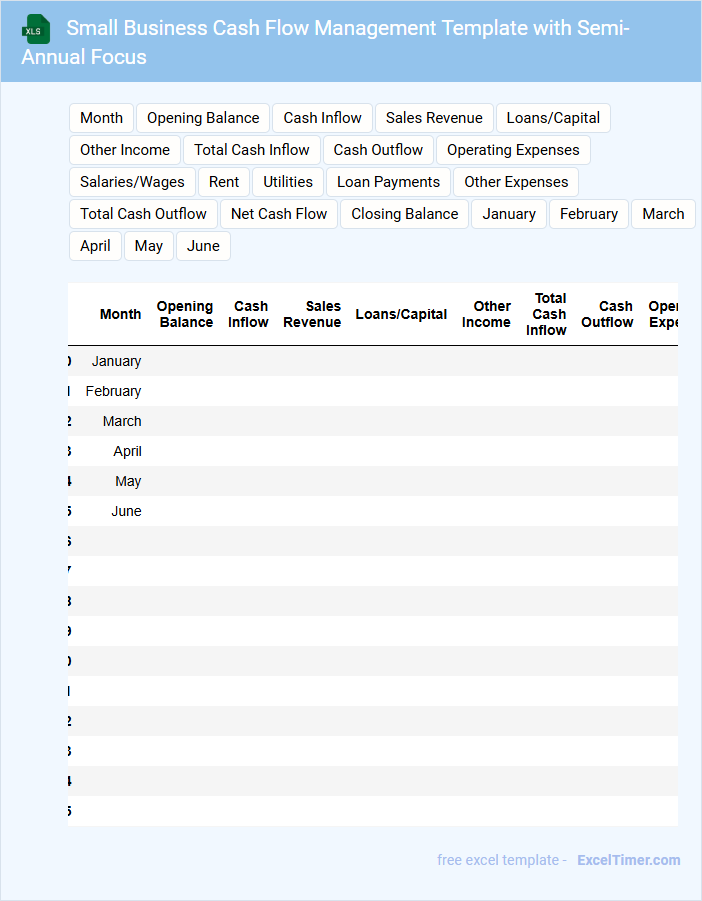

Small Business Cash Flow Management Template with Semi-Annual Focus

A Small Business Cash Flow Management Template is typically designed to help entrepreneurs track the inflow and outflow of cash over a specified period, ensuring liquidity and financial stability. It usually contains sections for income sources, expenses, and net cash flow calculated on a semi-annual basis. For effective use, it is important to regularly update the template and analyze trends to anticipate cash shortfalls and optimize resource allocation.

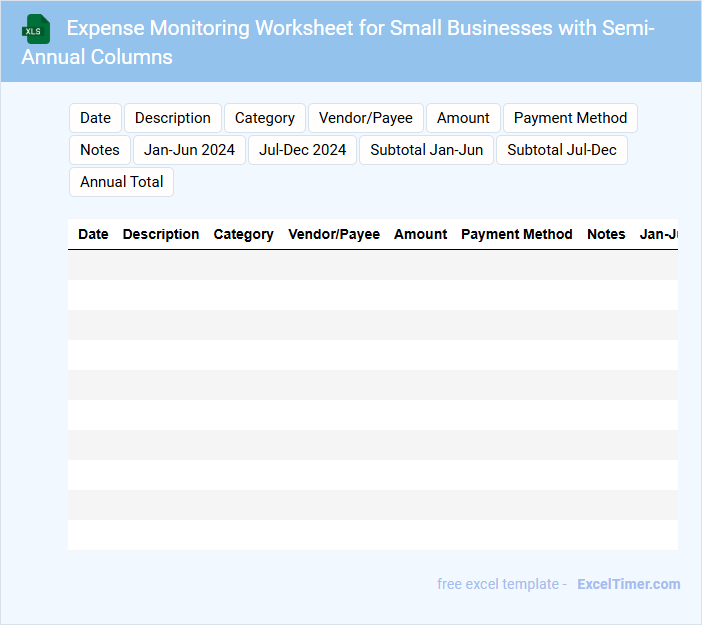

Expense Monitoring Worksheet for Small Businesses with Semi-Annual Columns

An Expense Monitoring Worksheet for small businesses is a critical tool designed to track and manage financial outflows over specified periods. Typically, this type of document includes detailed categories of expenses, organized semi-annually to provide a clear overview of spending patterns. Maintaining accurate semi-annual columns helps business owners identify trends and make informed budgeting decisions.

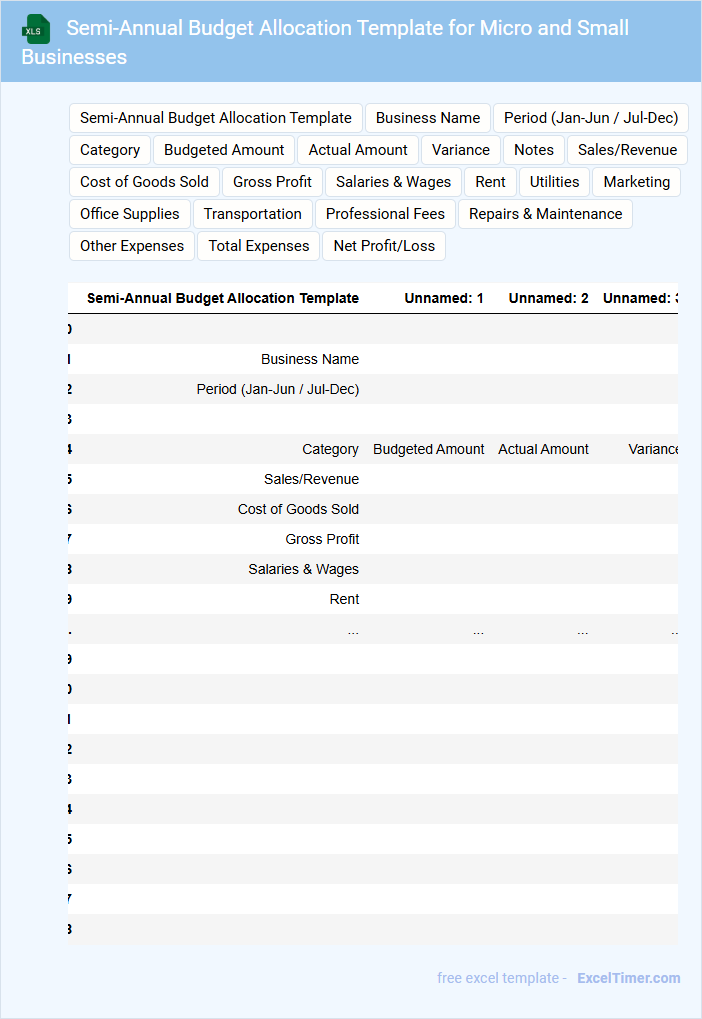

Semi-Annual Budget Allocation Template for Micro and Small Businesses

What does a Semi-Annual Budget Allocation Template for Micro and Small Businesses typically contain? This document outlines the planned income and expenses over a six-month period, helping businesses manage cash flow effectively. It categorizes costs such as operations, marketing, and salaries to ensure balanced financial planning.

Why is it important to include detailed expense categories in this template? Including specific categories helps track spending accurately and identify areas for cost control, which is crucial for small business sustainability. Clear allocation supports strategic decision-making and resource optimization.

Revenue and Expense Tracker with Semi-Annual Overview for Small Businesses

A Revenue and Expense Tracker is a vital document used by small businesses to monitor financial inflows and outflows accurately. It typically contains detailed records of sales, income sources, and various expenses categorized by type and date. The semi-annual overview section provides a summarized snapshot to help assess financial performance over six months efficiently.

Small Business Planning Spreadsheet for Semi-Annual Budget Reviews

What information is typically included in a Small Business Planning Spreadsheet for Semi-Annual Budget Reviews? This document usually contains detailed financial data, including income statements, expense tracking, cash flow projections, and budget comparisons for the past six months. It helps businesses analyze financial performance and adjust strategies for the upcoming period.

What is an important consideration when using this spreadsheet? Ensuring accurate and up-to-date data entry is crucial for meaningful insights, along with regularly reviewing key performance indicators to identify trends and make informed decisions for future budgeting.

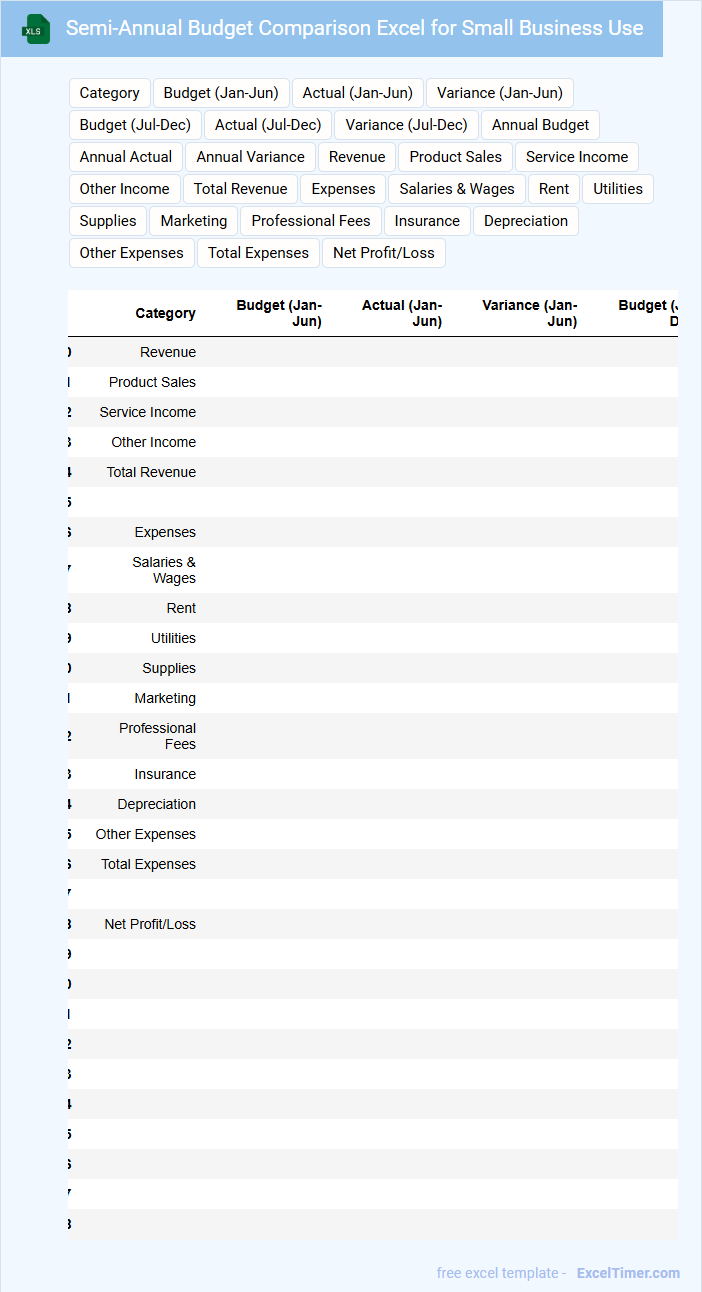

Semi-Annual Budget Comparison Excel for Small Business Use

A Semi-Annual Budget Comparison Excel is a document that typically contains detailed financial data comparing projected and actual expenses over two six-month periods. It helps small businesses monitor cash flow and make informed decisions by highlighting variances between budgeted and real figures.

Important elements to include are categorized income and expenses, along with notes explaining significant differences. This tool is essential for maintaining financial control and planning future budgets more effectively.

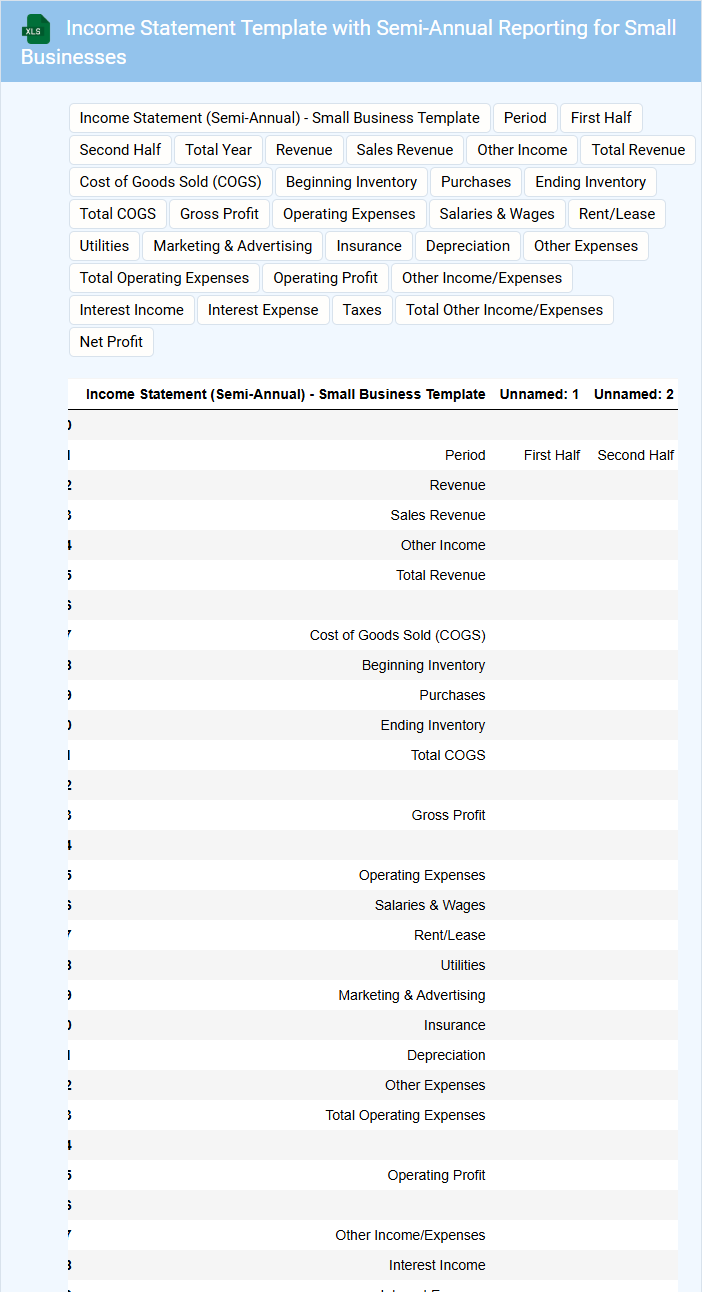

Income Statement Template with Semi-Annual Reporting for Small Businesses

The Income Statement Template with semi-annual reporting is designed to help small businesses track their revenues and expenses over a six-month period. This document typically includes sections for sales, cost of goods sold, operating expenses, and net profit.

Using this template ensures a clear overview of financial performance, aiding in better decision-making and budgeting. It is important to regularly update the template and accurately categorize all income and expenses for precise reporting.

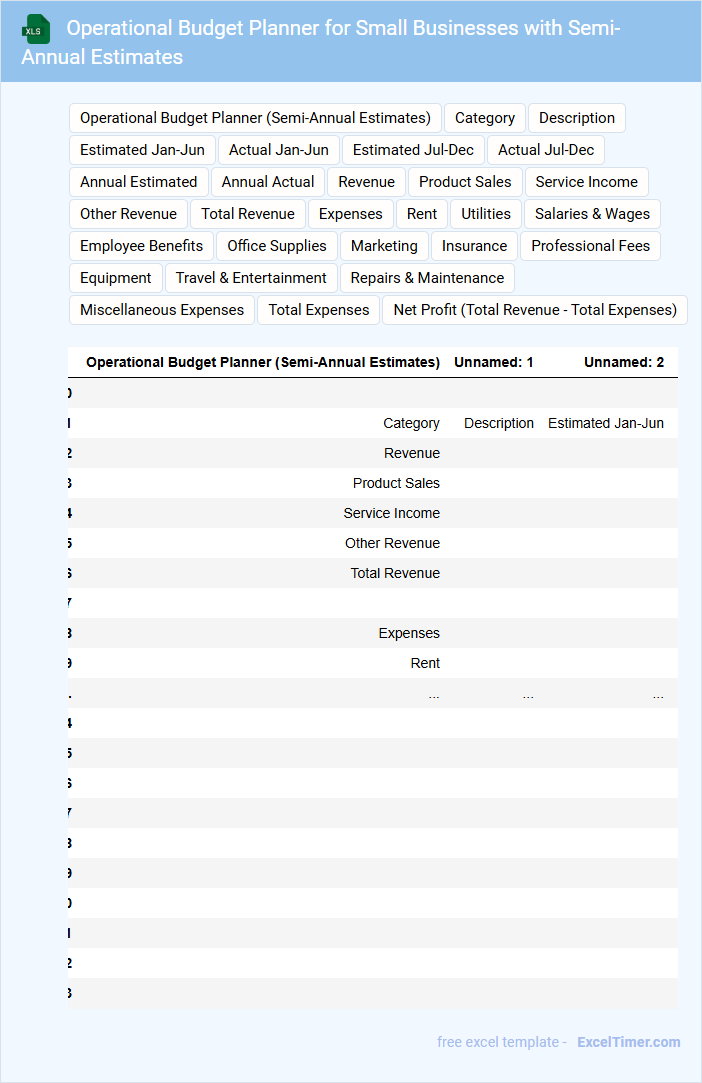

Operational Budget Planner for Small Businesses with Semi-Annual Estimates

What information does an Operational Budget Planner for Small Businesses with Semi-Annual Estimates typically include? This document usually contains detailed projections of income and expenses segmented into six-month periods to help small businesses manage their cash flow effectively. It also includes categories for fixed and variable costs, allowing for strategic adjustments and more accurate financial planning.

Why is it important to include semi-annual estimates in an operational budget planner? Including semi-annual estimates enables businesses to monitor their financial performance in shorter intervals, facilitating timely decision-making and resource allocation. This approach also helps identify trends and adjust strategies before year-end, enhancing overall fiscal control and growth potential.

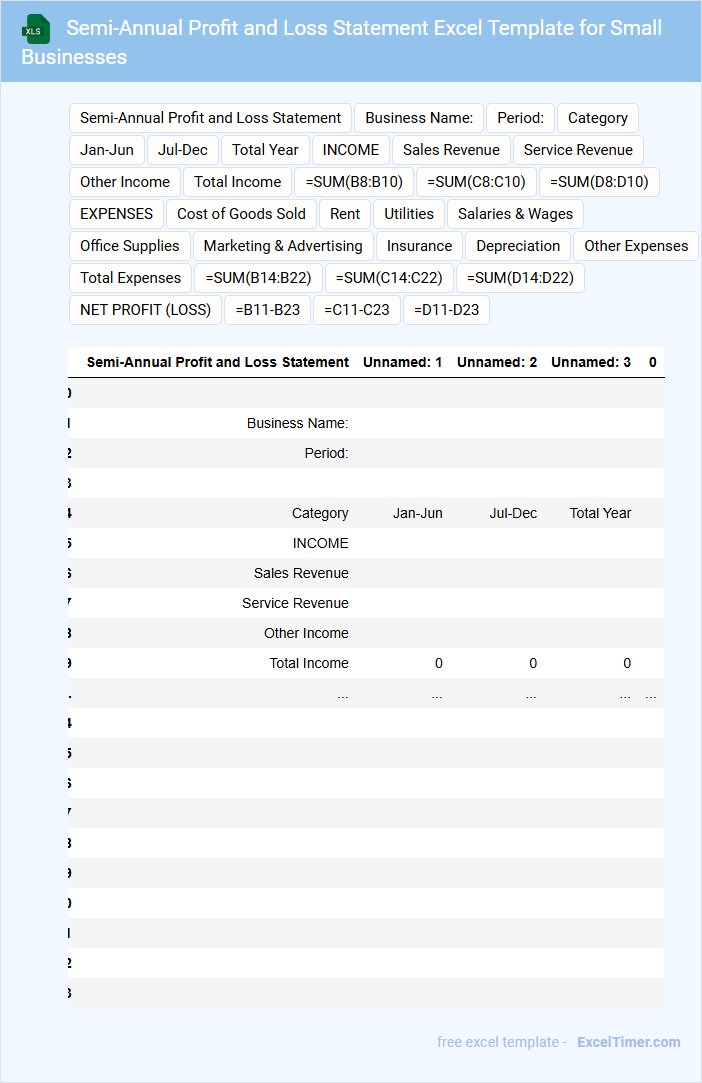

Semi-Annual Profit and Loss Statement Excel Template for Small Businesses

A Semi-Annual Profit and Loss Statement is a financial document that summarizes the revenues, expenses, and profits over a six-month period, helping small businesses track financial performance. This type of document typically contains detailed income sources, cost of goods sold, operating expenses, and net profit or loss. For optimal use, it's important to ensure accurate data entry and regular updates to reflect the true financial health of the business.

What are the critical revenue and expense categories to include in a semi-annual budget for small businesses?

Critical revenue categories to include in a semi-annual budget for small businesses are sales income, service revenue, and any recurring income streams. Expense categories should cover fixed costs like rent and utilities, variable costs such as marketing and supplies, and one-time expenses including equipment purchases. Your budget planning should carefully track these categories for accurate financial forecasting and cash flow management.

How can cash flow projections be effectively incorporated and monitored in the Excel budget document?

Incorporate cash flow projections in your Excel budget document by setting up detailed income and expense categories with monthly and semi-annual timelines. Use formulas to calculate net cash flow and create visual dashboards with charts for quick monitoring. Regularly update and compare actual cash flow against projections to identify variances and adjust planning accordingly.

Which Excel formulas and tools are most useful for tracking budget variances semi-annually?

Excel formulas like SUMIFS, IFERROR, and VLOOKUP are essential for tracking semi-annual budget variances in small businesses. Tools such as PivotTables and Conditional Formatting enhance data analysis and highlight discrepancies effectively. Utilizing these functions and features streamlines budgeting processes and improves financial decision-making accuracy.

What key performance indicators (KPIs) should be included in the budget to evaluate business health every six months?

Include KPIs such as revenue growth, net profit margin, cash flow, operating expenses, and customer acquisition cost to evaluate business health in semi-annual budget planning. Tracking inventory turnover and accounts receivable days provides insights into operational efficiency. Your semi-annual budget should reflect these metrics to ensure informed financial decisions for sustained growth.

How should contingency funds and unexpected costs be addressed within the Excel semi-annual budget planning process?

Contingency funds should be allocated as a fixed percentage of total expenses within the semi-annual budget to cover unexpected costs. Create a dedicated contingency line item in the Excel sheet to track and adjust these reserves dynamically. Regularly review actual expenses against the contingency fund to ensure sufficient coverage and update projections accordingly.