![]()

The Semi-annually Expense Tracker Excel Template for Freelancers is designed to help freelancers efficiently monitor and manage their expenses every six months. It enables clear categorization of income and expenditures, ensuring accurate financial records and easier tax preparation. Utilizing this template improves budget control and enhances financial planning for freelance professionals.

Semi-Annual Expense Tracker for Freelancers

A Semi-Annual Expense Tracker for Freelancers is a document used to monitor and record expenses incurred over a six-month period. It typically contains categories like office supplies, software subscriptions, travel, and client-related costs. This helps freelancers manage their budget, prepare for taxes, and identify spending patterns.

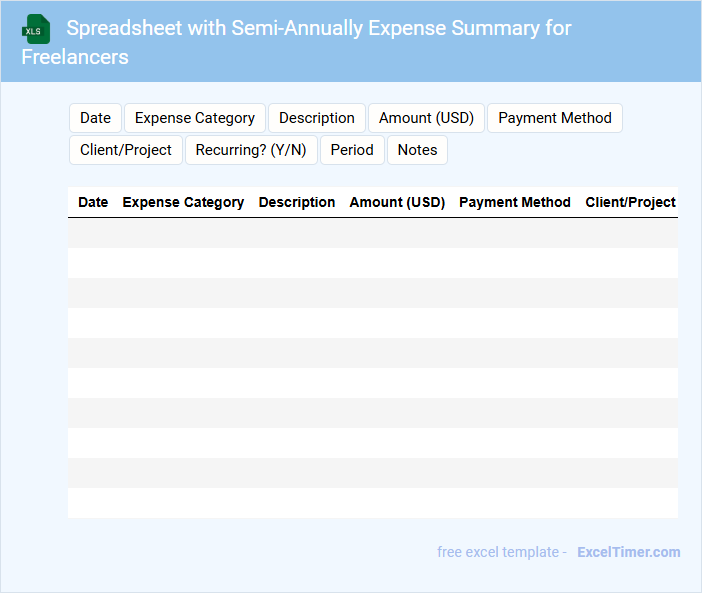

Spreadsheet with Semi-Annually Expense Summary for Freelancers

This type of document typically contains a semi-annual expense summary that tracks income and expenditures over two six-month periods. It helps freelancers monitor their financial health for budgeting and tax purposes. Organizing data by categories such as travel, software, and office supplies is essential for clarity.

Key features include detailed expense entries, totals, and comparisons between each half-year period. Ensuring accurate date and amount entries is crucial for precise financial analysis. Using formulas for automatic calculations improves efficiency and reduces errors.

Freelancers’ Expense Tracker with Semi-Annual Analysis

Freelancers' Expense Tracker with Semi-Annual Analysis is a financial document designed to record and monitor income and expenses over a six-month period. It helps freelancers maintain clear visibility of their cash flow, enabling better budgeting and tax preparation. Including categories such as project expenses, software subscriptions, and travel costs is crucial for accurate tracking and financial assessment.

Excel Template for Tracking Freelance Expenses Semi-Annually

An Excel Template for Tracking Freelance Expenses Semi-Annually typically contains detailed sections for recording income, expenses, and category-wise spending over a six-month period. It includes fields for dates, descriptions, amounts, and payment methods to ensure accurate financial tracking. Using this template helps freelancers maintain organized records for budgeting and tax purposes efficiently.

Important elements to include are clear categorization of expenses, automatic summation for each category, and a summary dashboard to visualize spending trends. Adding space for notes or receipts can enhance tracking accuracy. Ensure the template is easy to update and customize for different freelance projects.

Semi-Annually Billing and Expense Sheet for Freelancers

A Semi-Annually Billing and Expense Sheet for Freelancers is a document that helps track income and expenditures every six months. It usually contains detailed records of invoices sent to clients and all business-related expenses incurred during the period. Maintaining this sheet ensures accurate financial management and simplifies tax preparation for freelancers.

Freelancers' Budget with Semi-Annual Expense Tracker

A Freelancers' Budget with a Semi-Annual Expense Tracker typically contains detailed income sources, categorized expenses, and projected savings over six months. It helps freelancers maintain financial discipline and plan for periodic tax payments or business investments.

This document also includes tools for tracking irregular payments and recurring costs, providing a clear overview of cash flow trends. Ensuring timely updates and categorization is an important step for maximizing its effectiveness.

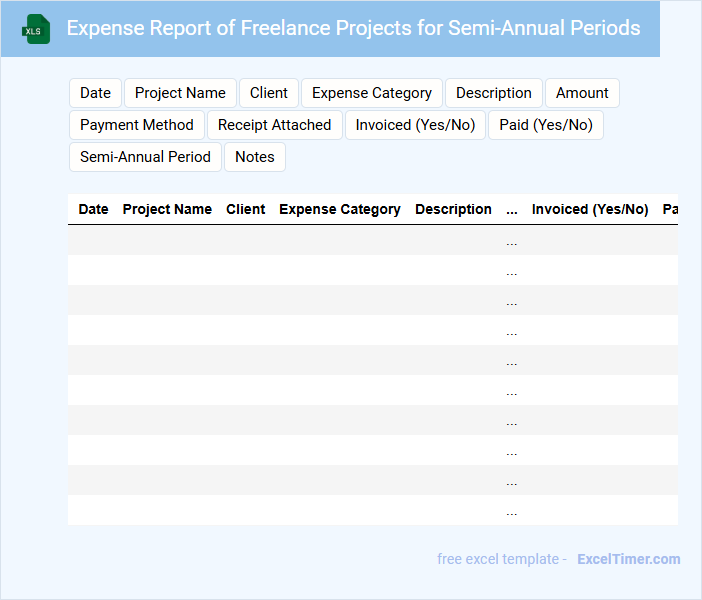

Expense Report of Freelance Projects for Semi-Annual Periods

An Expense Report for freelance projects typically documents all costs incurred over a specified period, such as semi-annual intervals. It includes detailed records of expenditures, receipts, and relevant financial data to track project spending. This report helps ensure transparent and organized financial management for freelancers and clients alike.

Simple Semi-Annual Expenses Tracker for Freelancers

A Semi-Annual Expenses Tracker is a document designed to monitor and record all financial outflows over a six-month period. It helps freelancers keep track of their spending, ensuring better budget management and financial planning. This type of document typically includes categories such as office supplies, software subscriptions, and travel expenses.

Important elements to include are clear date ranges, itemized expenses, and a summary for each category to quickly assess spending patterns. Using this tracker regularly enables freelancers to identify areas for cost reduction and optimize their business expenses. Ensuring accuracy and completeness is crucial for effective financial oversight.

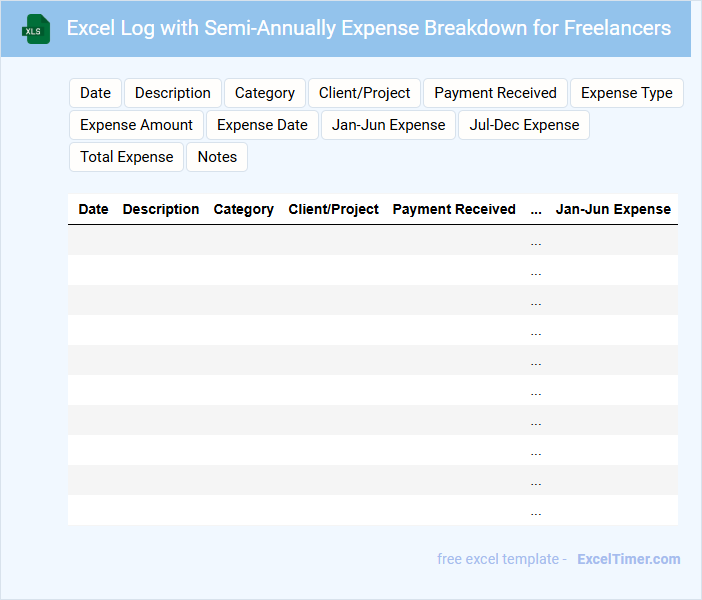

Excel Log with Semi-Annually Expense Breakdown for Freelancers

An Excel log for freelancers is a structured spreadsheet designed to track and manage semi-annual expenses efficiently. It typically contains categories such as invoices, payments, tax deductions, and budget forecasts.

This document helps freelancers maintain financial clarity and prepare accurate tax reports. Important elements to include are detailed expense descriptions and clear date ranges for each semi-annual period.

Freelance Income and Expense Tracker for Semi-Annual Reporting

What does a Freelance Income and Expense Tracker for Semi-Annual Reporting typically contain? This document records all sources of income and detailed expenses related to freelance work over six months to provide an organized financial overview. It helps freelancers accurately report earnings and deductible costs for tax purposes and financial planning.

What important elements should be included in this tracker? Key components include categorized income entries, comprehensive expense lists, dates of transactions, client details, and a summary for easy review. Consistent updates and clear documentation ensure accurate semi-annual reporting and effective financial management.

Personal Finance Tracker for Freelancers with Semi-Annual Overview

A Personal Finance Tracker for Freelancers with a Semi-Annual Overview typically contains detailed records of income, expenses, taxes, and savings, organized to reflect cash flow over six-month periods. It includes categories such as client payments, business expenses, tax deductions, and budgeting summaries to provide a comprehensive financial snapshot.

This document is essential for maintaining accurate financial records and preparing for tax season, helping freelancers manage irregular income streams effectively. To optimize its use, it is important to regularly update entries and review the semi-annual summary to identify spending patterns and adjust financial strategies accordingly.

Semi-Annually Invoice and Expense Tracker for Freelancers

A Semi-Annually Invoice and Expense Tracker is a crucial document for freelancers to maintain organized financial records. It typically contains details of invoices issued, payments received, as well as tracked expenses over a six-month period. This document helps freelancers manage cash flow, prepare for taxes, and evaluate business performance efficiently.

Semi-Annual Expense Statement of Freelance Work

The Semi-Annual Expense Statement for freelance work typically contains a detailed summary of all expenses incurred over a six-month period related to freelance projects. It includes categories such as equipment purchases, software subscriptions, and travel costs essential for project completion. Maintaining accurate records in this document helps freelancers track their expenditures and simplifies tax filing processes.

Tracking Freelance Expenses Semi-Annually with Excel

Tracking freelance expenses semi-annually using Excel helps maintain organized records for accurate financial management. This document typically contains categorized expense entries, dates, payment methods, and totals. It is important to regularly update data and reconcile expenses with invoices to ensure precise tracking and tax preparation.

Freelancers’ Financial Organizer with Semi-Annual Expense Tracker

What information is typically included in a Freelancers' Financial Organizer with Semi-Annual Expense Tracker? This document usually contains detailed records of income, expenses, invoices, and tax-related information tailored for freelancers. It helps track financial performance over six months to optimize budgeting and tax preparation.

What essential categories should be included in a semi-annual expense tracker for freelancers?

A semi-annual expense tracker for freelancers should include essential categories such as income, project costs, software subscriptions, office supplies, marketing expenses, taxes, and miscellaneous business expenses. Tracking these categories helps freelancers monitor cash flow, identify tax-deductible expenses, and manage budgeting effectively. Including payment dates and client details enhances financial organization and simplifies semi-annual financial reviews.

How can automated formulas in Excel simplify tracking recurring and one-time expenses?

Automated formulas in Excel streamline expense tracking by instantly categorizing and calculating both recurring and one-time costs, reducing manual errors. Functions like SUMIFS and IF enable dynamic expense summaries tailored to semi-annual periods, enhancing financial overview accuracy for freelancers. This automation saves time and ensures precise budgeting and cash flow management in the Semi-annually Expense Tracker.

What columns are crucial for accurately monitoring payment methods and client-specific expenses?

Crucial columns for accurately monitoring payment methods and client-specific expenses in a Semi-annually Expense Tracker for Freelancers include Client Name, Payment Method, Expense Category, Date of Expense, Amount, and Description. Including a column for Project or Job Reference enhances specificity, while a Status column helps track payment completion. Accurate categorization and detailed entries ensure efficient financial analysis and reporting.

How can conditional formatting highlight irregular expense trends over six months?

Conditional formatting in your Semi-annually Expense Tracker can highlight irregular expense trends by automatically changing cell colors when expenses exceed predefined thresholds or deviate from average levels over six months. This visual cue allows you to quickly identify and analyze unusual spikes or drops in spending patterns. Tracking such anomalies helps improve budgeting accuracy and financial decision-making for freelancers.

What summary metrics or visualizations best reflect overall financial health for freelancers semi-annually?

Your semi-annual expense tracker should include total income, total expenses, and net profit to clearly reflect financial health. Visualizations like a stacked bar chart for expense categories and a line graph for cash flow trends provide insightful overviews. Ratio metrics such as expense-to-income ratio further highlight spending efficiency over six months.