The Semi-annually Budget Excel Template for Non-Profit Organizations provides a structured and easy-to-use format for tracking income and expenses every six months. It helps non-profits maintain financial transparency, improve planning, and ensure funds are allocated effectively to meet organizational goals. Customizable features allow organizations to tailor the template to specific needs, enhancing accuracy and efficiency in budget management.

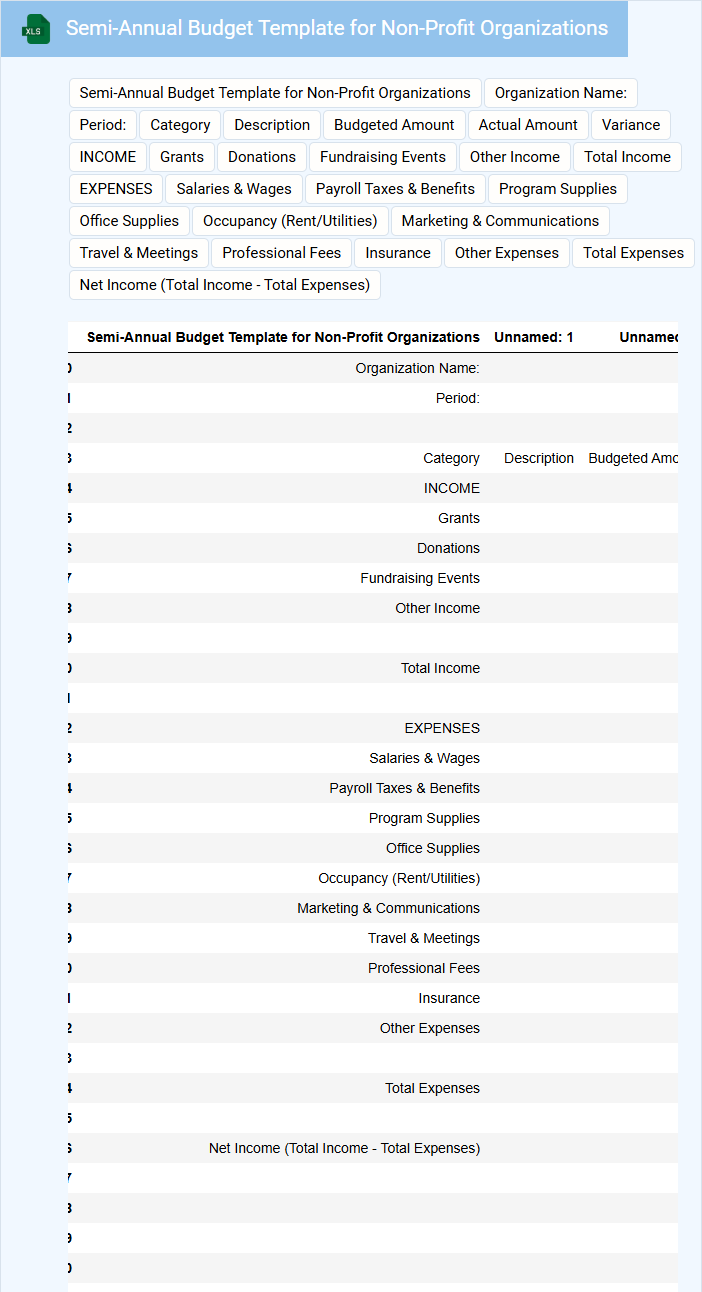

Semi-Annual Budget Template for Non-Profit Organizations

What does a Semi-Annual Budget Template for Non-Profit Organizations usually contain? This document typically includes sections for projected income, expenses, and funding sources for a six-month period, helping organizations plan and monitor their financial activities. It also outlines key budget categories like program costs, administrative expenses, and fundraising efforts to ensure transparency and accountability.

What is an important consideration when using this budget template? It is essential to regularly update and review budget estimates against actual performance to maintain financial health and adjust strategies. Accurate tracking and realistic forecasting support effective resource allocation and help achieve organizational goals.

Excel Budget Spreadsheet for Non-Profits with Semi-Annual Tracking

The Excel Budget Spreadsheet for Non-Profits is designed to track income and expenses efficiently, ensuring financial transparency. It typically contains sections for donations, grants, and operational costs organized in a clear, easy-to-understand layout.

Including semi-annual tracking allows organizations to monitor financial performance over two main periods within the year, helping with timely adjustments. Regular updates and accurate data entry are crucial for maximizing its effectiveness and supporting strategic planning.

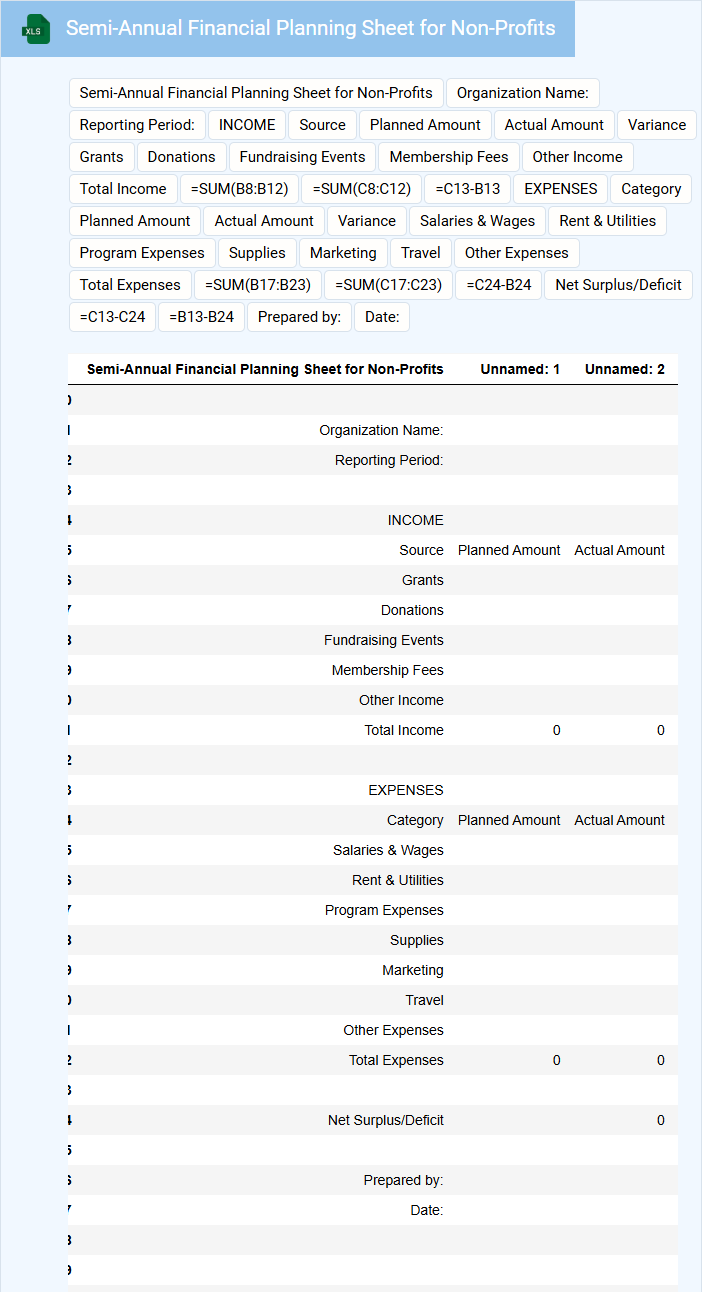

Semi-Annual Financial Planning Sheet for Non-Profits

A Semi-Annual Financial Planning Sheet for non-profits typically contains detailed budget forecasts, expense tracking, and revenue projections for a six-month period. It helps organizations monitor financial health, ensure accountability, and make informed strategic decisions. Important items to include are fund allocation, cash flow analysis, and contingency reserves to maintain operational stability.

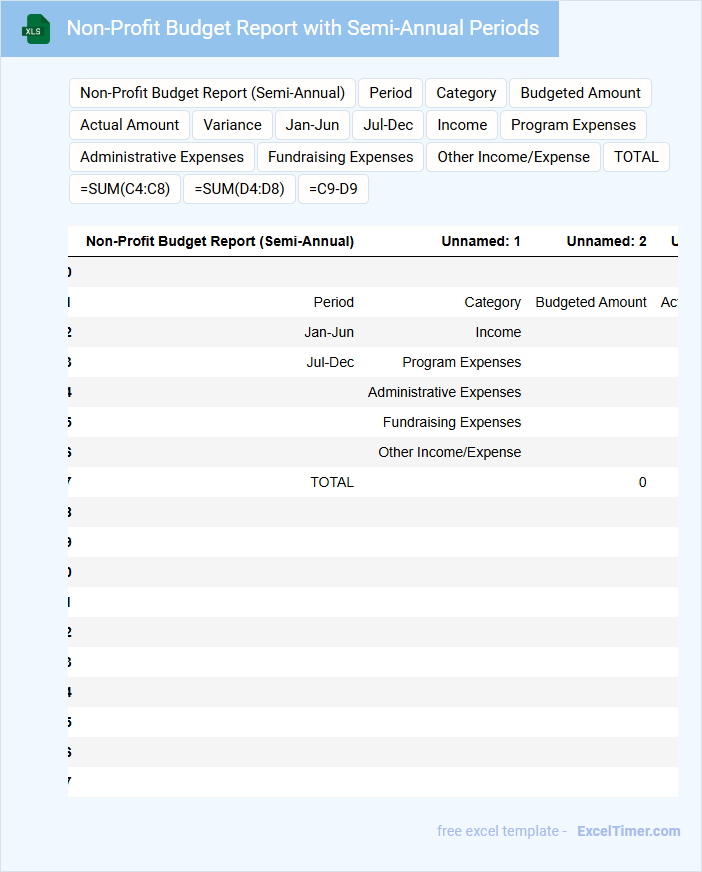

Non-Profit Budget Report with Semi-Annual Periods

What information is typically included in a Non-Profit Budget Report with Semi-Annual Periods? This document usually contains detailed financial data reflecting income, expenses, and budget allocations over two six-month intervals. It helps organizations track their financial health and adjust their strategies accordingly during the fiscal year.

What important considerations should be taken when preparing this report? Accuracy in categorizing revenue and expenditures is crucial, as is providing clear comparisons between the two semi-annual periods. Additionally, including narrative explanations for significant variances enhances transparency and supports informed decision-making.

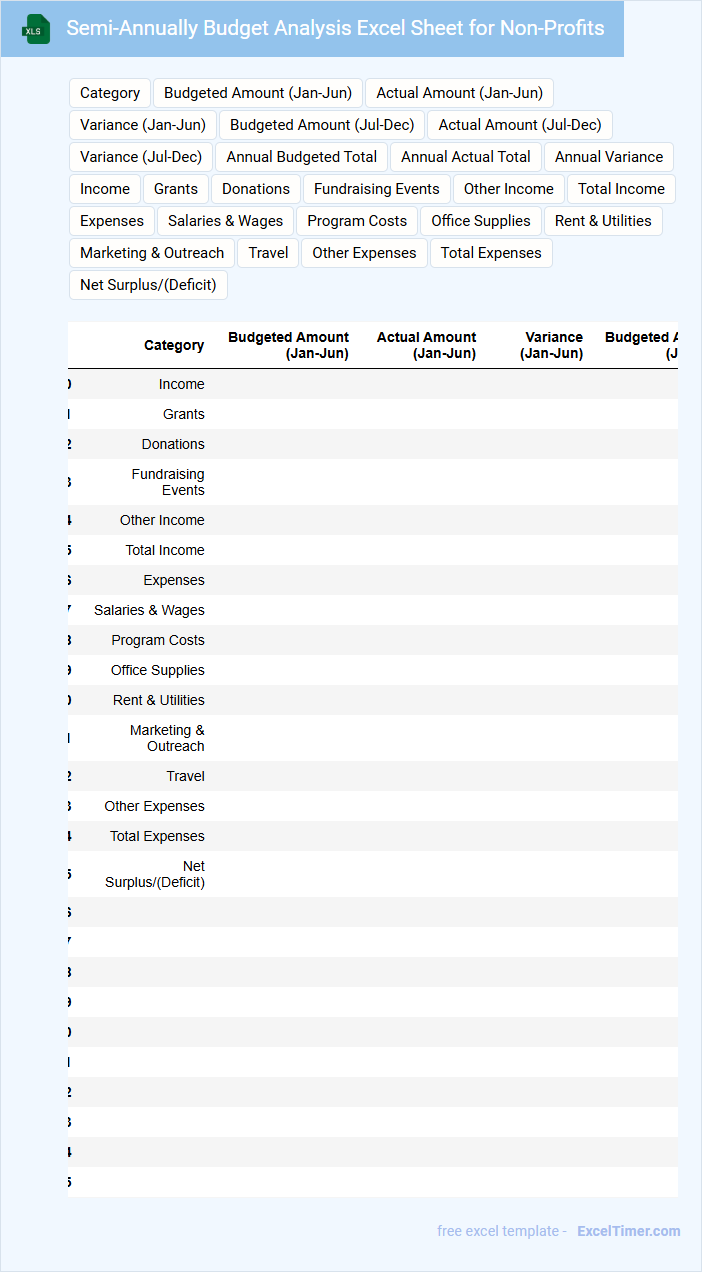

Semi-Annually Budget Analysis Excel Sheet for Non-Profits

The Semi-Annually Budget Analysis Excel Sheet for non-profits typically contains detailed financial data, including income, expenses, and cash flow summaries over a six-month period. It helps organizations track their financial performance and ensure funds are allocated efficiently.

Important information usually includes budget versus actual comparisons, donor contributions, and program-specific expenditures. To maximize its usefulness, ensure the sheet is updated regularly and includes clear visualizations like charts or graphs for better decision-making.

Expense Tracker with Semi-Annual Overview for Non-Profit Organizations

An Expense Tracker for non-profit organizations is a crucial document designed to monitor and record financial expenditures efficiently. It usually contains detailed expense categories, dates, amounts, and vendor information to ensure transparency and accountability. Incorporating a semi-annual overview helps organizations evaluate spending patterns and adjust budgets accordingly to maintain financial health.

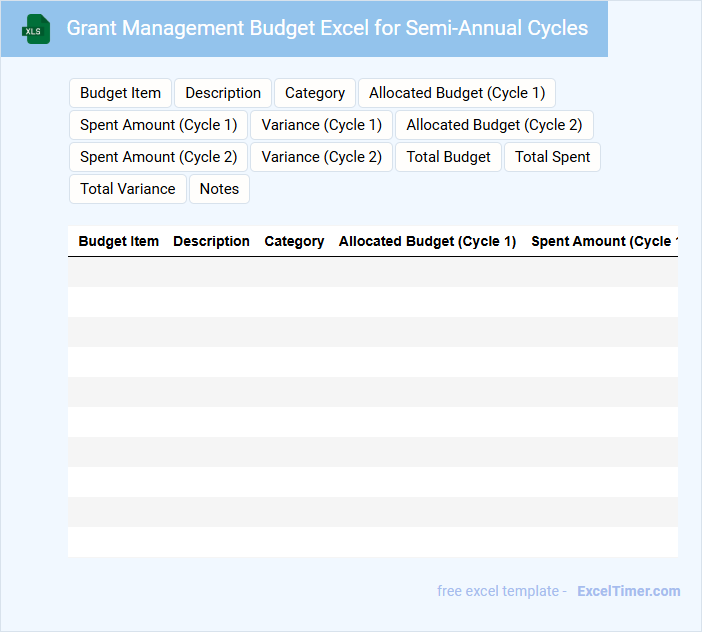

Grant Management Budget Excel for Semi-Annual Cycles

Grant Management Budget Excel for Semi-Annual Cycles is a detailed financial document designed to track and allocate funds over two six-month periods. It typically contains categorized expenses, income sources, and timeline-specific budget adjustments to ensure accuracy and compliance. Effective budget planning helps organizations optimize resource use and meet funding requirements efficiently.

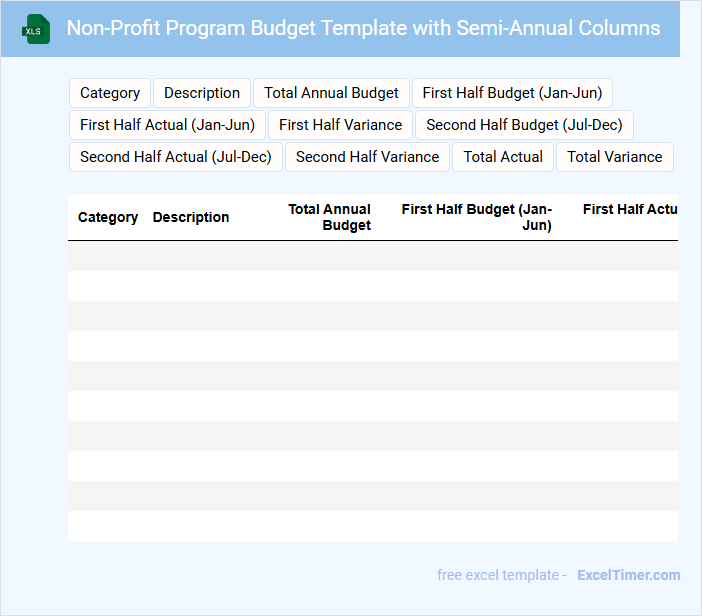

Non-Profit Program Budget Template with Semi-Annual Columns

A Non-Profit Program Budget Template with semi-annual columns is designed to help organizations plan and track their financial activities over two six-month periods within a year. It typically includes income sources, expense categories, and allocations specific to the program's goals. Using this template ensures clear visibility into cash flow and funding usage, aiding transparency and accountability. Important elements to focus on are the clear categorization of expenses and accurate estimation of revenues to avoid overspending. The semi-annual format allows for better mid-year adjustments and reforecasting based on actual performance. Maintaining updated records in this template supports strategic decision-making and donor reporting.

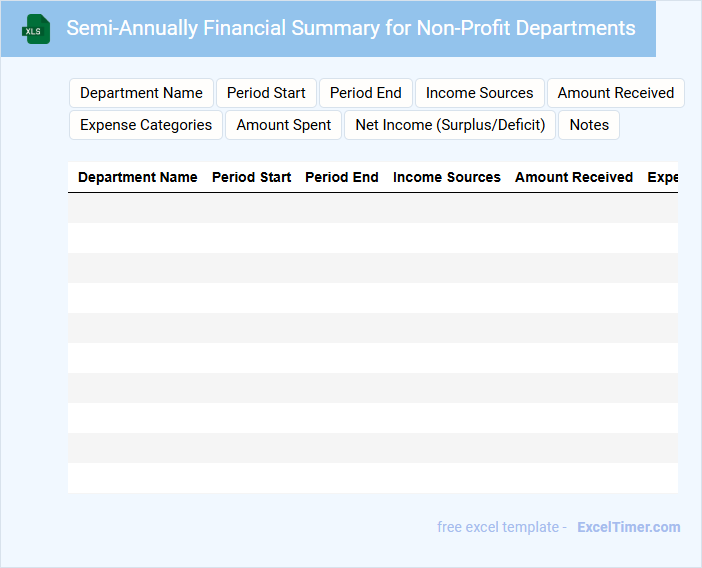

Semi-Annually Financial Summary for Non-Profit Departments

A Semi-Annually Financial Summary for Non-Profit Departments typically contains detailed financial data covering income, expenses, and budget comparisons for the past six months. It highlights funding sources, expenditures, and any variances from the planned budget to ensure transparency and accountability. This document is essential for informing stakeholders about the financial health and sustainability of the department.

Important elements include accurate revenue tracking, clear categorization of expenses, and an overview of program-specific financial performance. Including explanations for any significant budget deviations helps maintain trust and supports strategic decision-making. It is also recommended to incorporate visual aids such as charts or graphs for easier comprehension by board members and donors.

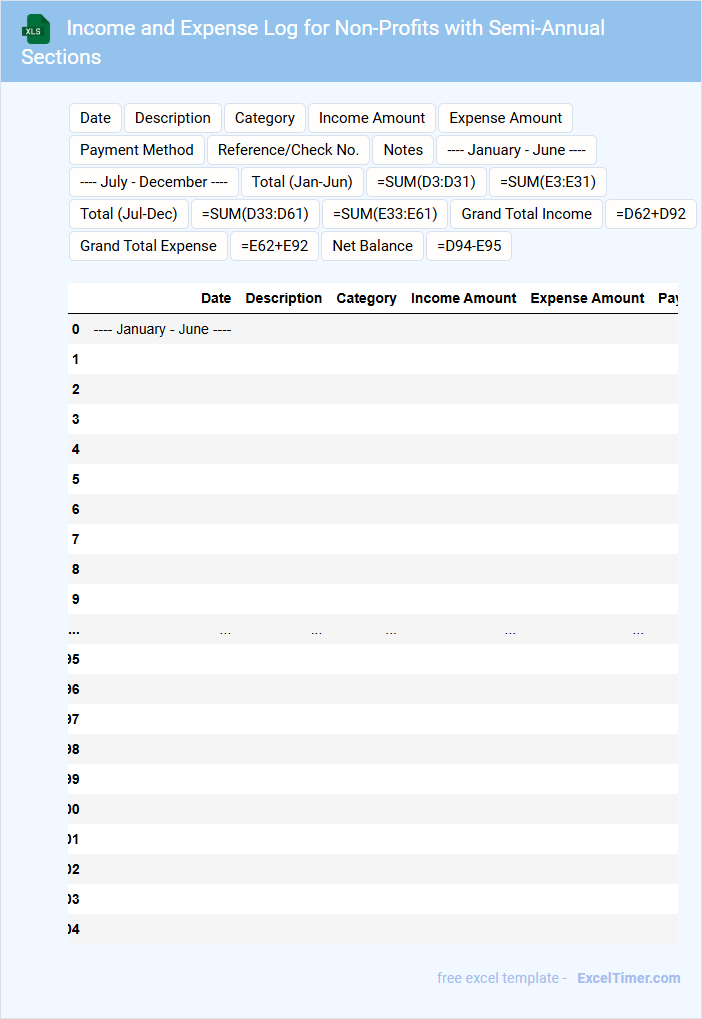

Income and Expense Log for Non-Profits with Semi-Annual Sections

An Income and Expense Log for non-profits is a detailed record that tracks all financial transactions, helping organizations maintain transparency and accountability. This document typically includes sources of income such as donations and grants, along with expenses like operational costs and program funding.

Non-profits benefit from dividing the log into Semi-Annual Sections to better analyze financial trends and prepare mid-year reports. It is important to include dates, descriptions, and amounts clearly, ensuring accurate and organized financial data.

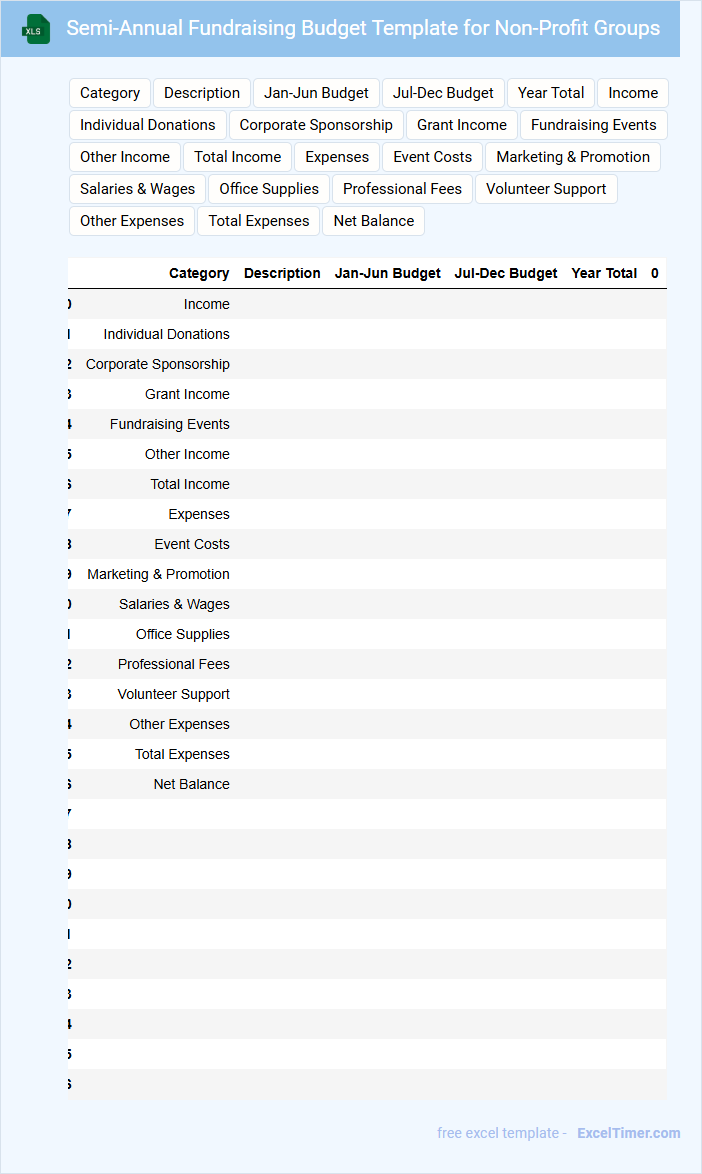

Semi-Annual Fundraising Budget Template for Non-Profit Groups

The Semi-Annual Fundraising Budget Template for Non-Profit Groups typically contains financial projections and expense tracking tailored for fundraising activities over a six-month period.

- Income Sources: Outline all expected donations, grants, and event revenues.

- Expense Categories: Track costs such as marketing, event logistics, and administrative fees.

- Financial Goals: Set clear fundraising targets and monitor progress regularly.

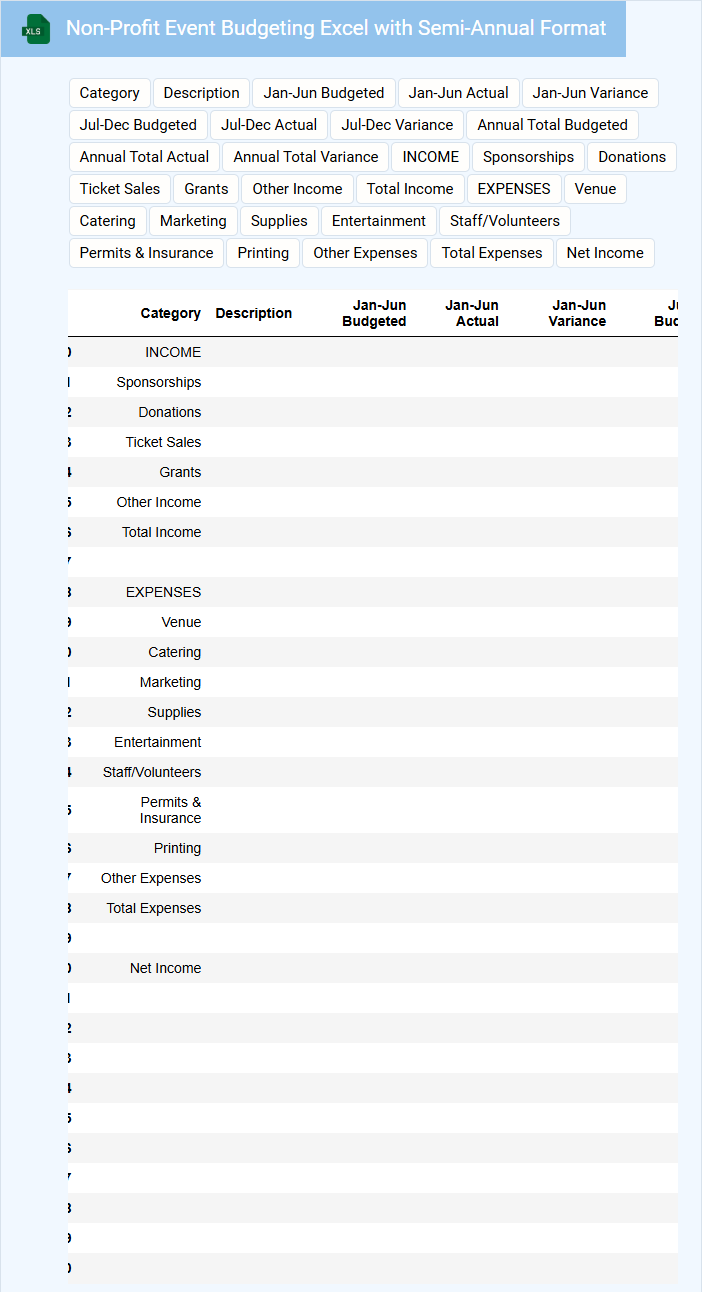

Non-Profit Event Budgeting Excel with Semi-Annual Format

What does a Non-Profit Event Budgeting Excel file with a Semi-Annual format usually contain? This document typically includes detailed financial projections and expense tracking for events planned over two six-month periods within a year. It helps organizations allocate funds efficiently, monitor costs, and plan for fundraising goals across multiple events.

What important aspects should be considered when using this budget format? Ensuring accurate categorization of income and expenses, regular updates to reflect changes in funding or costs, and inclusion of contingency funds are vital for effective financial management. Additionally, integrating clear timelines and responsible persons for each budget item enhances accountability and transparency.

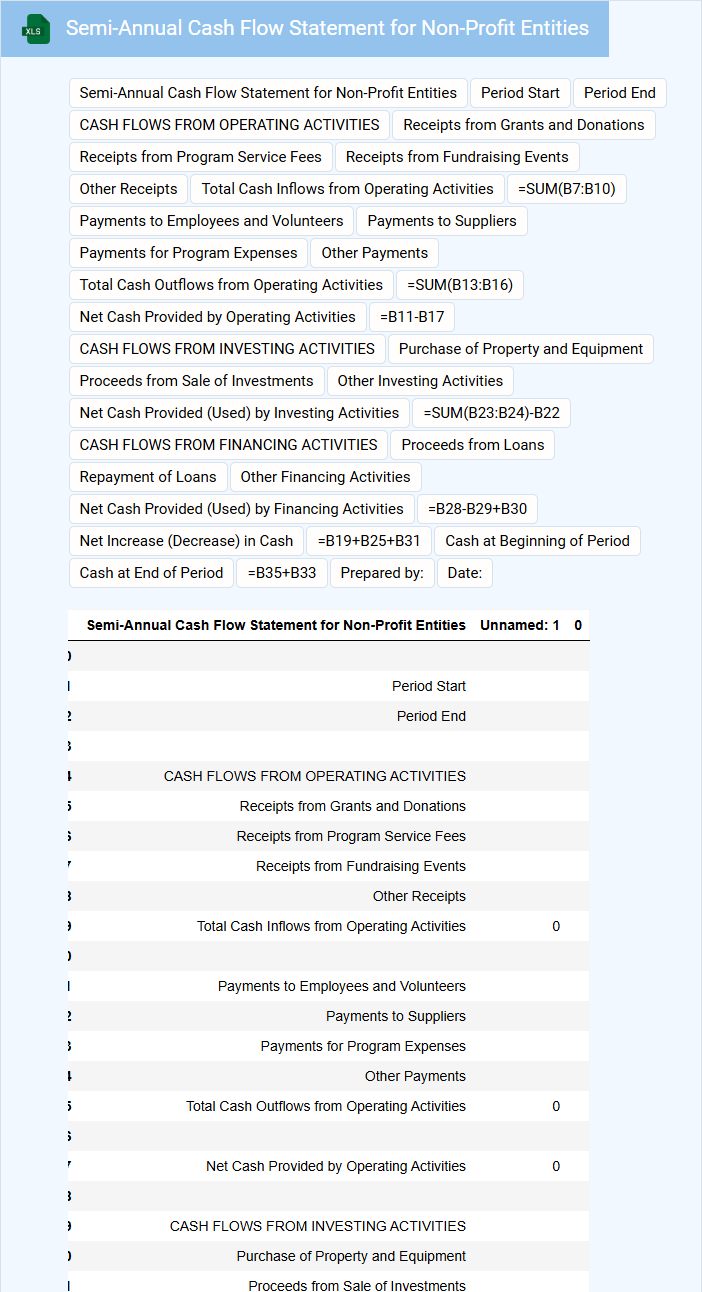

Semi-Annual Cash Flow Statement for Non-Profit Entities

A Semi-Annual Cash Flow Statement for Non-Profit Entities summarizes the cash inflows and outflows over a six-month period, highlighting the organization's liquidity and financial health. It is essential for assessing how well the entity manages its cash to fulfill its mission.

- Include detailed categorization of cash receipts and payments related to operating, investing, and financing activities.

- Highlight any significant changes in cash position compared to previous periods for transparency.

- Ensure the statement complies with relevant accounting standards and nonprofit financial reporting requirements.

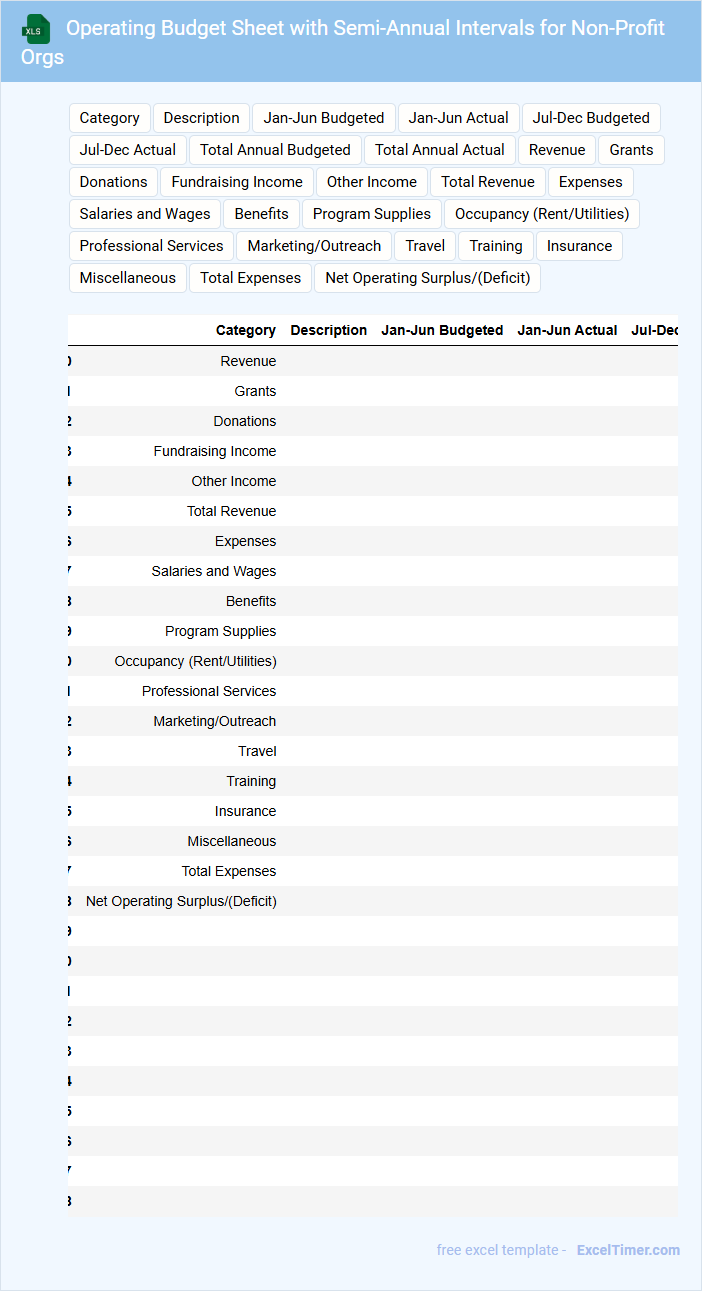

Operating Budget Sheet with Semi-Annual Intervals for Non-Profit Orgs

An Operating Budget Sheet with Semi-Annual Intervals for Non-Profit Organizations typically contains detailed revenue and expense projections divided into two six-month periods within the fiscal year. It helps nonprofits monitor financial performance, allocate resources effectively, and plan for upcoming activities. Emphasizing transparency and accuracy in this document is crucial for stakeholder confidence and regulatory compliance.

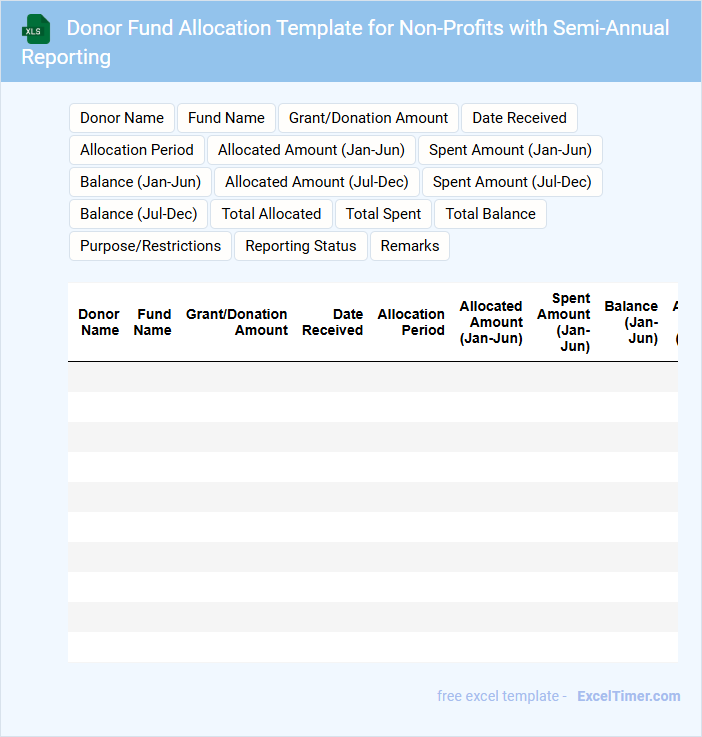

Donor Fund Allocation Template for Non-Profits with Semi-Annual Reporting

A Donor Fund Allocation Template for non-profits is a structured document that tracks the distribution of donated funds across various projects and operational needs. It ensures transparency and accountability by detailing how contributions are spent and supporting semi-annual reporting requirements. Including clear budget categories, updated expenditure records, and impact summaries is essential for maintaining donor trust and complying with reporting standards.

What are the key components to include in a semi-annual budget for a non-profit organization in Excel?

Key components of a semi-annual budget for a non-profit organization in Excel include revenue sources such as donations, grants, and fundraising events, alongside detailed expense categories like program costs, administrative expenses, and marketing. Your budget should also feature a cash flow projection and variance analysis to track actual spending against planned allocations. Incorporate clear labels and formulas to ensure accurate data calculation and easy updates throughout the six-month period.

How do you allocate restricted and unrestricted funds in a semi-annual non-profit budget document?

In a semi-annual budget for non-profit organizations, allocate restricted funds strictly according to donor-imposed purposes, ensuring transparency and compliance. Unrestricted funds should be distributed based on operational needs and strategic priorities within the six-month period. Your budget document must clearly separate and track both fund types to maintain accurate financial accountability.

What formulas can be used to track variances between projected and actual income/expenses in a semi-annual budget?

Use the formula =Actual Income - Projected Income to calculate income variance. For expense variance, apply =Projected Expenses - Actual Expenses in your Excel sheet. Incorporate =IF(Variance>0, "Under Budget", "Over Budget") to quickly identify budget status for each category.

How is donor contribution tracking managed within a semi-annual budget Excel spreadsheet for non-profits?

Your semi-annual budget Excel spreadsheet for non-profit organizations tracks donor contributions by categorizing gifts by date, amount, and donor type to ensure accurate financial reporting. Built-in formulas automatically update total contributions and compare them against budgeted targets for each six-month period. Customizable pivot tables and charts provide clear visual summaries of donation trends and funding gaps within the semi-annual timeframe.

What are best practices for organizing expense categories and program allocations in a semi-annual non-profit budget Excel file?

Organize expense categories by grouping fixed, variable, and program-specific costs for clear tracking and analysis. Allocate program funds based on historical spending patterns and strategic priorities to ensure balanced resource distribution. Use separate sheets or tables for each program and expense type, incorporating formulas for semi-annual totals and variance analysis.