![]()

The Semi-annually Excel Template for Budget Tracking is designed to help users efficiently monitor their financial activities every six months. It simplifies expense categorization and income analysis, enabling better long-term financial planning. Key features include automated calculation fields and customizable categories for precise budget management.

Semi-Annual Budget Tracking Sheet for Departments

The Semi-Annual Budget Tracking Sheet for departments is a crucial document that helps monitor and control expenditures over a six-month period. It typically contains detailed records of allocated budgets, actual spending, and variances for each department. This document enables efficient financial management and ensures departments stay within their budget limits. An important suggestion is to regularly update the tracking sheet for accuracy and to conduct monthly reviews to identify potential overspending early.

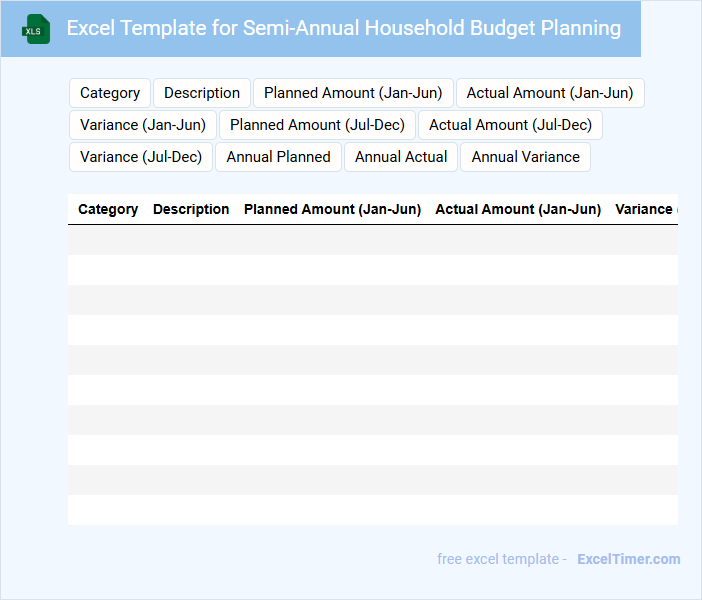

Excel Template for Semi-Annual Household Budget Planning

An Excel Template for Semi-Annual Household Budget Planning typically contains detailed income and expense categories that help track financial activities over six months. It includes sections for fixed costs, variable expenses, and savings goals to provide a clear overview of household finances.

Such templates often feature automated calculations and visual charts for better analysis and decision-making. When using this template, it is important to regularly update expenses and review budget variances to maintain accurate financial control.

Budget Tracking Document with Semi-Annual Overview

A Budget Tracking Document typically contains detailed records of income, expenses, and financial allocations over a specific period. It organizes data to help monitor spending patterns and ensure alignment with financial goals.

The Semi-Annual Overview section provides a summarized analysis of financial performance every six months, highlighting trends and discrepancies. This snapshot aids in strategic adjustments and informed decision-making for future budgeting.

Ensure to include accurate timestamps and clear category labels for easy reference and effective monitoring.

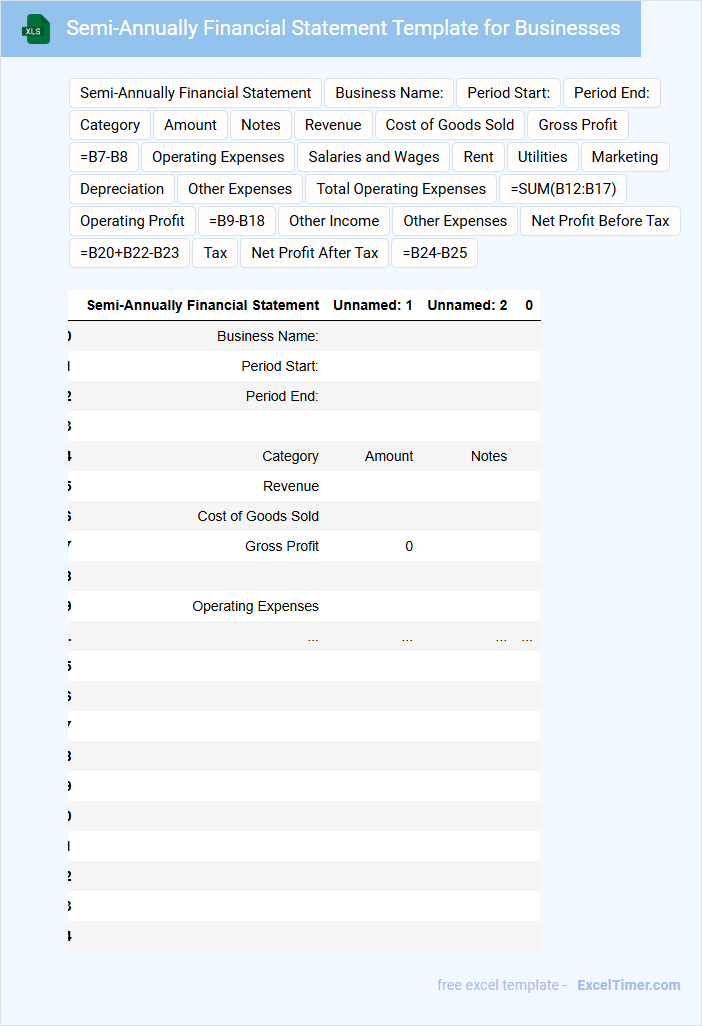

Semi-Annually Financial Statement Template for Businesses

A Semi-Annually Financial Statement Template typically contains key financial data such as revenue, expenses, assets, and liabilities reported over a six-month period. It serves as a critical tool for businesses to assess their financial health and track performance trends. Accurate and timely preparation of these statements ensures informed decision-making and regulatory compliance.

For businesses using this template, it is important to consistently update financial figures and include notes explaining significant changes or anomalies. Including comparative data from prior periods can enhance clarity and context. Additionally, ensuring adherence to accounting standards and incorporating key metrics like cash flow and profit margins will optimize the document's effectiveness.

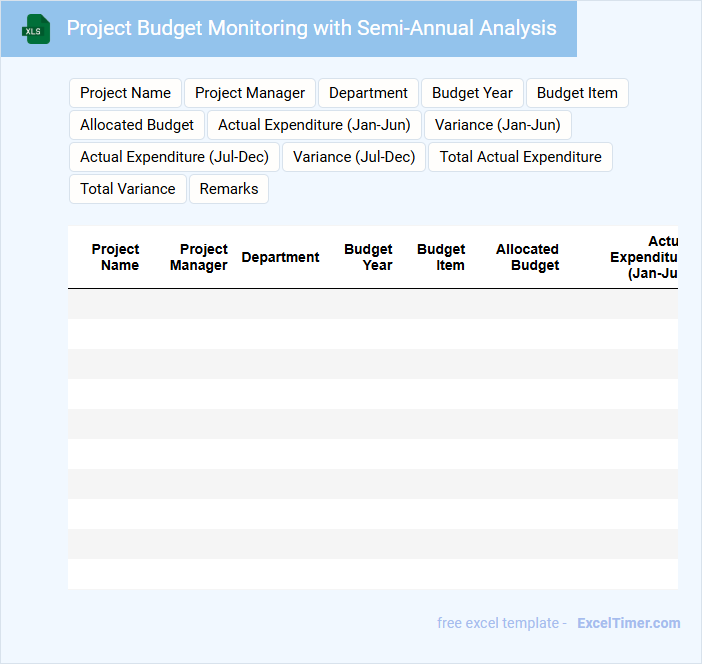

Project Budget Monitoring with Semi-Annual Analysis

What does a Project Budget Monitoring document with Semi-Annual Analysis usually contain?

This document typically includes detailed tracking of budget expenditures against planned allocations over a six-month period. It provides insights into financial performance, highlighting variances, cost overruns, and savings, helping stakeholders make informed decisions. Important elements to include are clear budget categories, timelines for reviews, variance explanations, and actionable recommendations for adjustments.

Personal Budget Tracking with Semi-Annual Summary

A personal budget tracking document typically contains detailed records of income, expenses, and savings goals to help individuals manage their finances effectively. It often includes categorized entries for bills, groceries, entertainment, and other spending to provide clarity on where money is allocated.

Additionally, it features a semi-annual summary that consolidates financial data every six months, highlighting trends and progress toward financial goals. This summary aids in adjusting budgets and making informed decisions for the upcoming periods.

Including sections for notes and future financial goals can further enhance the usefulness of the document.

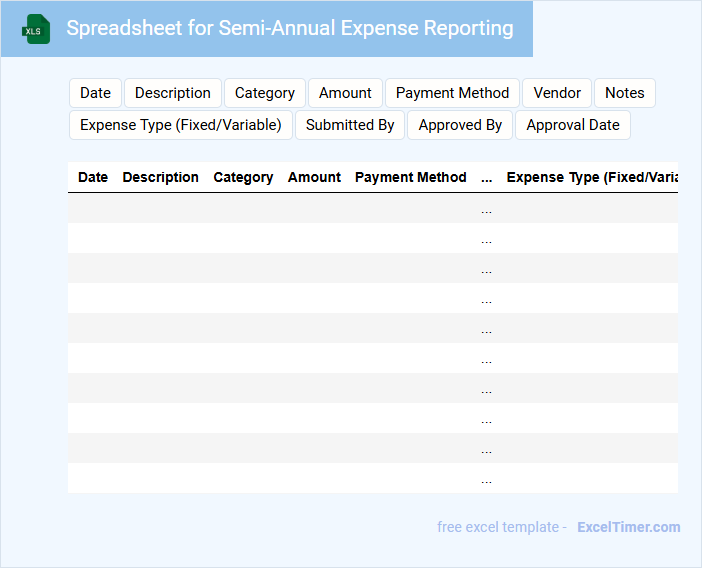

Spreadsheet for Semi-Annual Expense Reporting

A Spreadsheet for Semi-Annual Expense Reporting typically contains categorized expense entries, dates, and corresponding amounts to track financial outflows over a six-month period. It often includes summary tables and charts to visualize spending patterns and assist in budget adjustments. Ensuring data accuracy and regular updates is crucial for reliable financial analysis and decision-making.

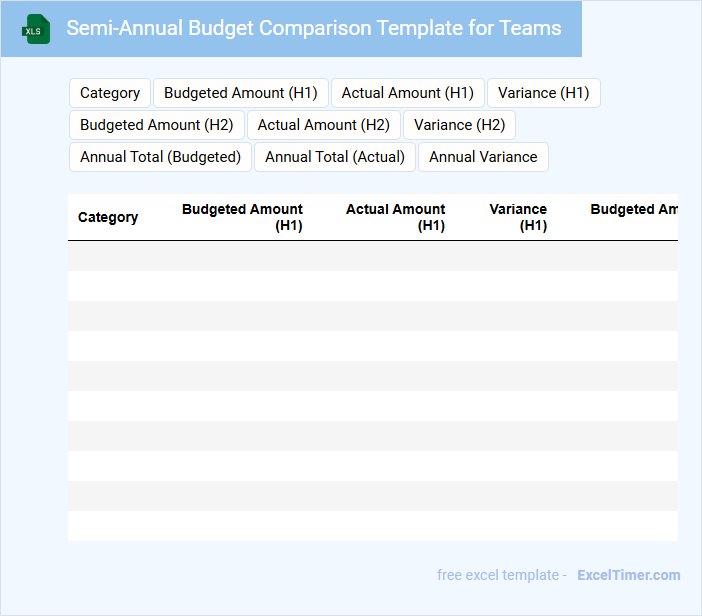

Semi-Annual Budget Comparison Template for Teams

The Semi-Annual Budget Comparison Template is designed to provide teams with a clear overview of financial performance over two consecutive periods. It typically includes key categories such as revenue, expenses, and variance analysis to track budget adherence.

Using this template promotes effective financial planning and helps identify spending trends or discrepancies early. Ensure accuracy by regularly updating figures and involving all relevant departments for comprehensive data input.

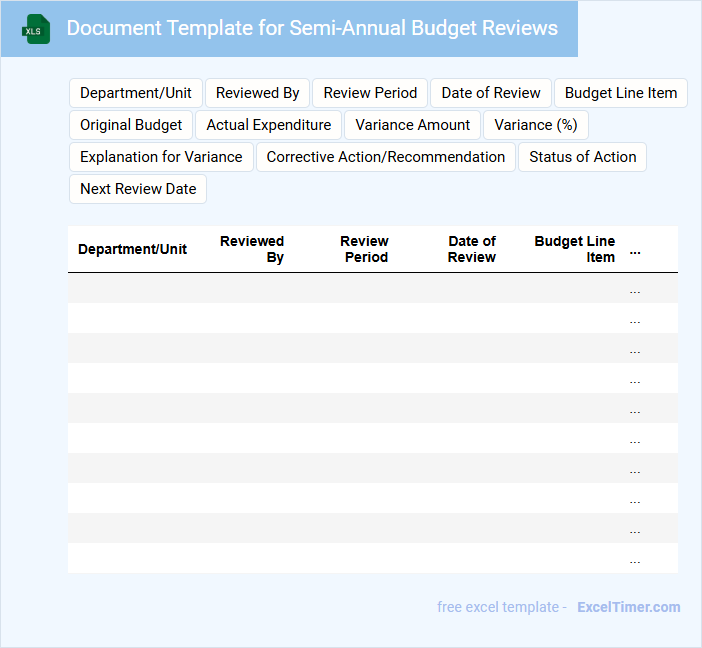

Document Template for Semi-Annual Budget Reviews

This type of document usually contains a comprehensive financial summary and detailed expenditure reports. It provides a clear overview of budget allocations and spending patterns over the past six months. Keeping track of deviations from the planned budget is crucial for informed decision-making.

A key feature is the inclusion of projected budget adjustments based on current performance and anticipated expenses. This helps stakeholders plan future budgets more accurately and identify potential savings. Ensuring data accuracy and timeliness is essential for effective semi-annual budget reviews.

Semi-Annually Forecasting Template with Budget Tracking

This document typically contains a semi-annual financial forecast that outlines anticipated revenues, expenses, and cash flows for a six-month period. It provides a structured way to project financial performance and identify potential variances. Key metrics are tracked against budgets to ensure alignment with organizational goals.

The template also includes detailed budget tracking sections to monitor actual spending versus planned allocations, helping to control costs. It facilitates timely adjustments to financial strategies based on performance insights. Regular updates and clear visualizations are important to maintain accuracy and stakeholder engagement.

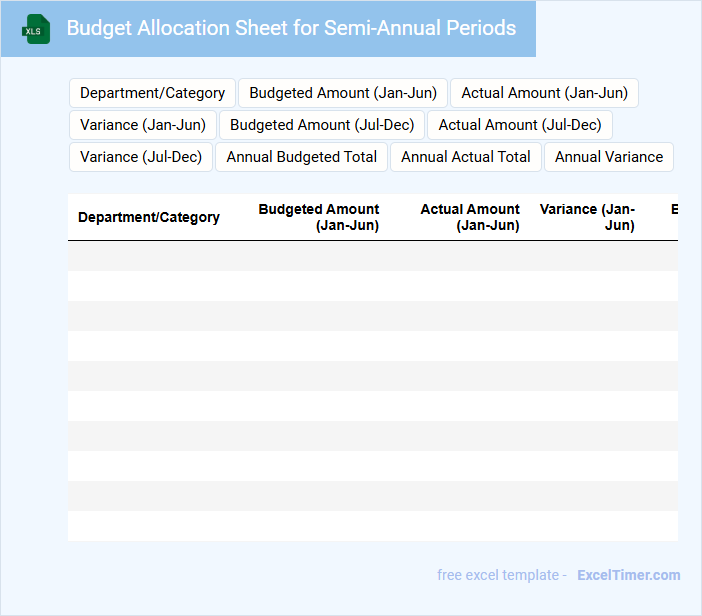

Budget Allocation Sheet for Semi-Annual Periods

A Budget Allocation Sheet for Semi-Annual Periods is a financial document that outlines the distribution of funds over two six-month intervals. It helps organizations plan and control their expenditures effectively throughout the year.

- Clearly categorize expenses to ensure accurate tracking of budget usage.

- Include both expected revenues and allocated costs for each period.

- Regularly update the sheet to reflect any financial changes or reallocation needs.

Excel Template with Charts for Semi-Annual Budget Tracking

An Excel Template with charts for semi-annual budget tracking typically contains predefined tables and dynamic charts that visualize income, expenses, and savings over six months. It helps users monitor financial performance and identify trends efficiently. Key features usually include budget categories, monthly input fields, and graphical summaries for quick analysis.

When creating or using this template, it's important to ensure clarity in category definitions, consistency in data entry, and accuracy in chart updates. Incorporating dropdown menus for expense categories and automated formulas will enhance usability and reduce errors. Additionally, setting alerts for budget overruns can help maintain financial discipline throughout the period.

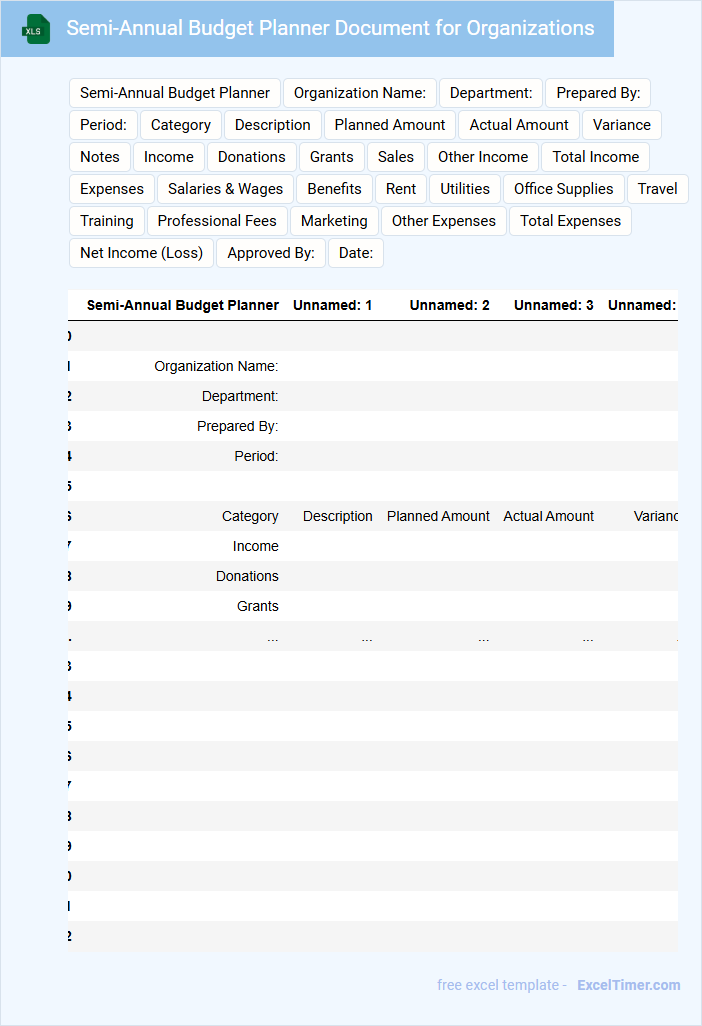

Semi-Annual Budget Planner Document for Organizations

The Semi-Annual Budget Planner Document for organizations typically contains detailed financial projections and allocations for a six-month period. It includes revenue forecasts, expense estimates, and planned investments to guide strategic decision-making. This document is essential for monitoring financial performance and ensuring alignment with organizational goals.

Important aspects to consider include thorough cost analysis, realistic revenue predictions, and contingency planning for unexpected expenses. Ensuring clarity and accuracy in these projections helps maintain organizational financial health. Regular reviews and adjustments based on actual performance improve budget reliability.

Income and Expense Tracking with Semi-Annual Breakdown

This document focuses on Income and Expense Tracking, providing a detailed overview of financial transactions over a specific period. It typically contains categorized records of incomes and expenses, allowing for clear visibility of cash flow. The semi-annual breakdown offers a biannual snapshot, helping to identify trends and adjust budgets effectively.

For optimal use, it's important to regularly update entries and reconcile with bank statements. Highlighting significant variances between the two halves of the year can pinpoint areas for cost-saving or revenue improvement. Maintaining accuracy ensures better financial planning and decision-making.

Simple Budget Tracker for Semi-Annual Financial Goals

What information does a Simple Budget Tracker for Semi-Annual Financial Goals typically include? It usually contains expense categories, income sources, and targeted savings for each semi-annual period to help monitor financial progress. This document helps users allocate resources effectively and adjust spending to meet their financial objectives.

How do you set up semi-annual budget categories and allocate funds in an Excel document?

To set up semi-annual budget categories in your Excel document, create separate columns for each six-month period and list all income and expense categories clearly. Allocate funds by inputting expected amounts for each category under the corresponding semi-annual column, using formulas to track totals and variances automatically. Use conditional formatting and pivot tables to visualize budget performance and ensure accurate semi-annual tracking.

Which Excel functions can automate tracking of semi-annual expenses versus budgeted amounts?

Use the SUMIFS function to sum expenses within specific semi-annual date ranges, allowing precise tracking against budgeted amounts. Combine IF and DATE functions to categorize transactions into semi-annual periods automatically. The VLOOKUP or INDEX-MATCH functions can retrieve budgeted values for comparison with actual expenses in each semi-annual period.

How can you visualize spending trends for two six-month periods using Excel charts or PivotTables?

Create a PivotTable summarizing expenditures by semi-annual periods, grouping dates into two six-month intervals. Use a line or column chart based on the PivotTable to visualize spending trends across the two semi-annual periods. This approach highlights budget fluctuations and assists in tracking financial performance effectively.

What method can you use to highlight budget variances each half-year in Excel?

You can use conditional formatting in Excel to highlight budget variances each half-year, enabling quick identification of deviations from your budget targets. Setting rules based on percentage differences or specific thresholds ensures clear visualization of variances in the semi-annual budget tracking document. This method streamlines budget management and supports timely financial decisions.

How do you create semi-annual summary reports to compare actual versus budgeted totals in Excel?

Create semi-annual summary reports in Excel by using PivotTables to group data by six-month periods and summarize actual versus budgeted amounts. Apply formulas like SUMIFS to calculate totals for each half-year and insert charts to visualize performance trends. Utilize Excel's built-in date functions to automate period classification and ensure accurate budget tracking.