![]()

The Semi-annually Excel Template for Dividend Tracking helps investors efficiently monitor dividend payments received every six months. This template organizes dividend data, calculates total income, and provides a clear overview of dividend growth over time. Accurate tracking with this tool enables better financial planning and investment decision-making.

Semi-Annual Dividend Tracking Excel Template

What information is typically included in a Semi-Annual Dividend Tracking Excel Template? This type of document usually contains columns for company names, dividend payment dates, dividend amounts, and payment frequencies. It helps investors monitor and organize their dividend income over six-month periods efficiently.

What is an important feature to include in a Semi-Annual Dividend Tracking Excel Template? Including automated calculations for total dividends received and estimated future payouts can significantly enhance tracking accuracy and financial planning. Additionally, incorporating charts or summary tables provides a clear visual representation of dividend trends over time.

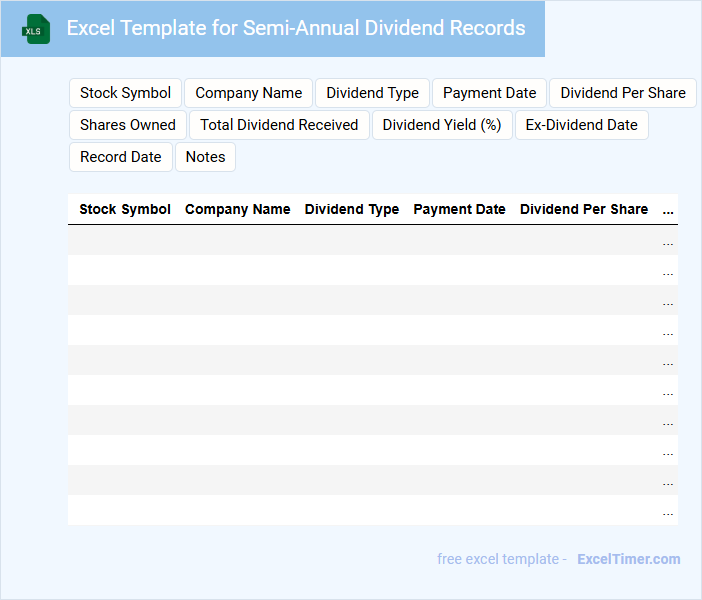

Excel Template for Semi-Annual Dividend Records

An Excel Template for Semi-Annual Dividend Records is designed to help users systematically track and manage dividend payments received twice a year. It simplifies financial record-keeping by organizing data in a clear, accessible format.

- Include columns for dividend dates, amounts, and stock details to ensure comprehensive tracking.

- Incorporate formulas to automatically calculate total dividends and averages per period.

- Use clear headers and consistent formatting for easy readability and data entry.

Dividend Tracker with Semi-Annual Reporting

A Dividend Tracker is a financial document that records and monitors dividend payments received from various investments. It helps investors stay organized by consolidating dividend information for easy reference.

This type of tracker typically features Semi-Annual Reporting to summarize dividend performance every six months, allowing for better investment analysis. Regular updates ensure accurate tracking of income variations and yield calculations.

For effective use, ensure the tracker includes payment dates, amounts, and sources, along with a clear semi-annual summary to optimize portfolio management decisions.

Statement of Dividends with Semi-Annual Periods

What information is typically included in a Statement of Dividends with Semi-Annual Periods? This document usually contains detailed records of dividend payments made to shareholders over two specified six-month periods within a fiscal year. It highlights the dividend amounts, payment dates, and any relevant adjustments or declarations important for accurate financial reporting and shareholder transparency.

What are the key considerations when preparing a Statement of Dividends with Semi-Annual Periods? It is important to ensure precise calculation of dividend amounts for each period and to clearly document the declaration dates and payment schedules. Additionally, including notes on any changes in dividend policy or special dividends enhances clarity for investors and regulatory compliance.

Portfolio Dividend Tracking for Semi-Annual Analysis

A Portfolio Dividend Tracking document typically contains detailed records of dividend payments received from various investments over specific periods, focusing on accuracy and consistency. It includes data such as dividend amounts, payment dates, and the companies distributing the dividends, essential for performance evaluation. For semi-annual analysis, it's important to ensure timely updates and reconcile dividends received with expected payments to identify trends and potential discrepancies.

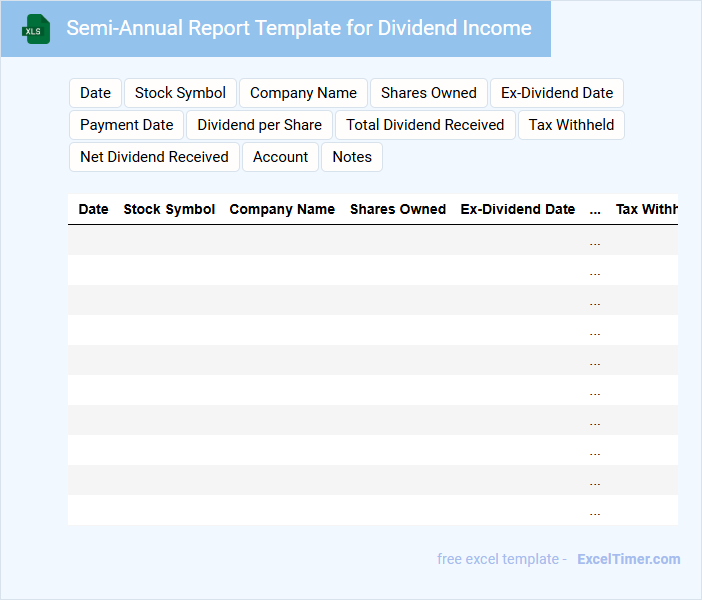

Semi-Annual Report Template for Dividend Income

A Semi-Annual Report for Dividend Income typically contains detailed financial information reflecting the dividend earnings and distributions over six months. It includes summaries of dividend sources, payment dates, and total income received during the period.

This report helps investors track their dividend performance and assess the stability of their income stream. It is important to provide clear statements of dividend amounts, relevant dates, and any changes in dividend policies.

Including a comparison with previous periods and an explanation of factors affecting dividend income enhances the report's usefulness.

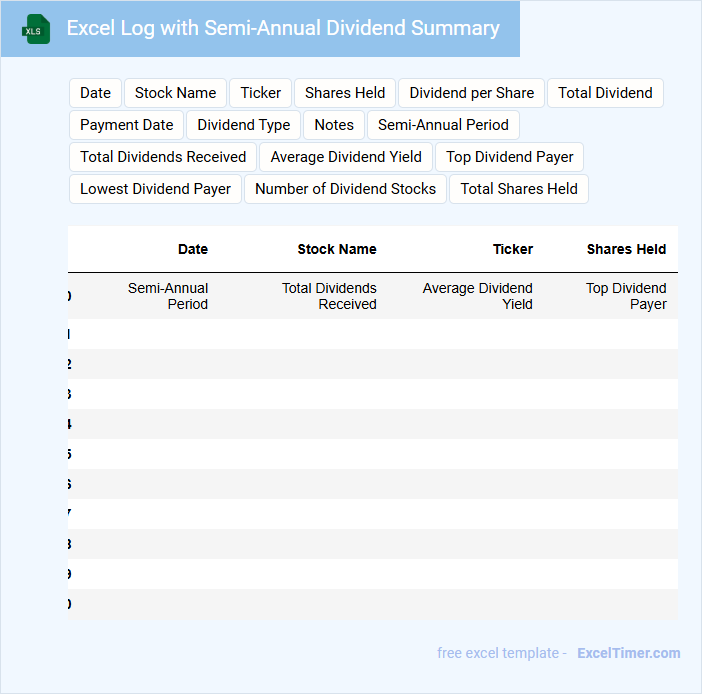

Excel Log with Semi-Annual Dividend Summary

What information is typically contained in an Excel Log with a Semi-Annual Dividend Summary? This document generally includes detailed records of dividend payments received from various investments over a six-month period. It helps investors track income streams, compare dividend yields, and analyze the performance of their portfolio effectively.

Investment Dividends Tracker for Semi-Annual Cycles

An Investment Dividends Tracker for Semi-Annual Cycles is a document designed to monitor dividend payments received from investments twice a year. It typically contains detailed records of dividend amounts, payment dates, and corresponding investment sources. The tracker helps investors efficiently manage their income streams and assess the performance of their investment portfolio over specific periods.

Schedule for Semi-Annual Dividend Tracking in Excel

A Schedule for Semi-Annual Dividend Tracking in Excel typically contains detailed payment dates and amounts for dividends distributed twice a year.

- Payment Dates: Clearly list all dividend payment dates to ensure timely tracking and forecasting.

- Dividend Amounts: Record the exact dividend amounts received to monitor income accurately.

- Company Details: Include the company names and ticker symbols for proper identification and analysis.

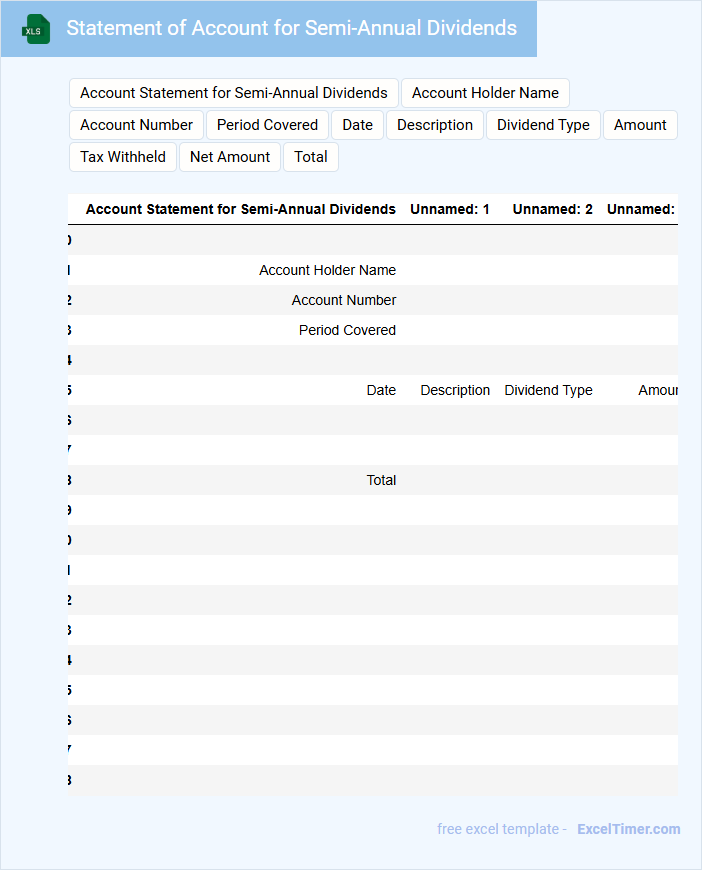

Statement of Account for Semi-Annual Dividends

A Statement of Account for Semi-Annual Dividends typically summarizes dividend earnings and transactions within a six-month period.

- Dividend Amounts: Clearly list the total dividends credited for each payment date.

- Account Holder Details: Include precise shareholder information for accurate identification.

- Transaction Dates: Provide specific dates for dividend declaration and payment.

Worksheet for Dividend Tracking with Semi-Annual Intervals

A Worksheet for Dividend Tracking with Semi-Annual Intervals typically contains fields for recording dividend payment dates, amounts, and stock information. It helps investors systematically monitor the income generated from their investments over six-month periods. Important details to include are the dividend declaration date, payment date, and the ex-dividend date to ensure accurate tracking and reporting.

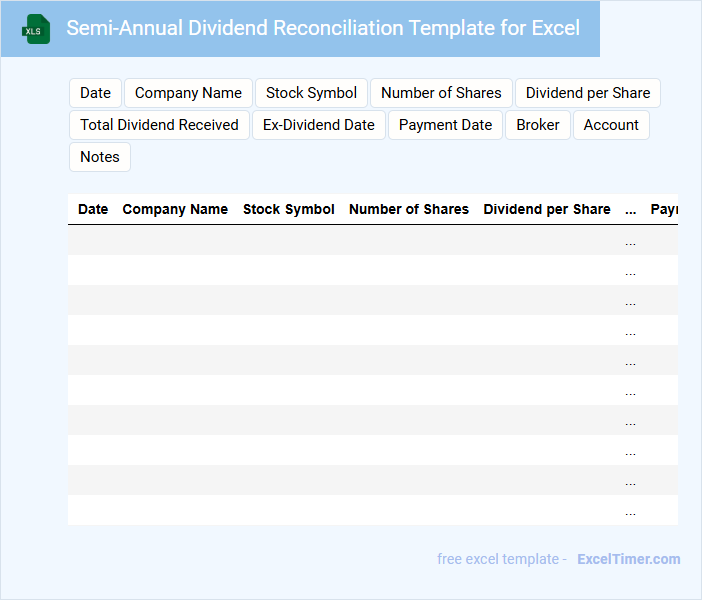

Semi-Annual Dividend Reconciliation Template for Excel

This document typically contains detailed financial data for tracking and reconciling dividend payments on a semi-annual basis.

- Clear dividend records: Ensure all dividend payments and dates are accurately recorded.

- Consistent formatting: Use uniform date and currency formats for easy comparison.

- Summary calculations: Include totals and differences to highlight discrepancies quickly.

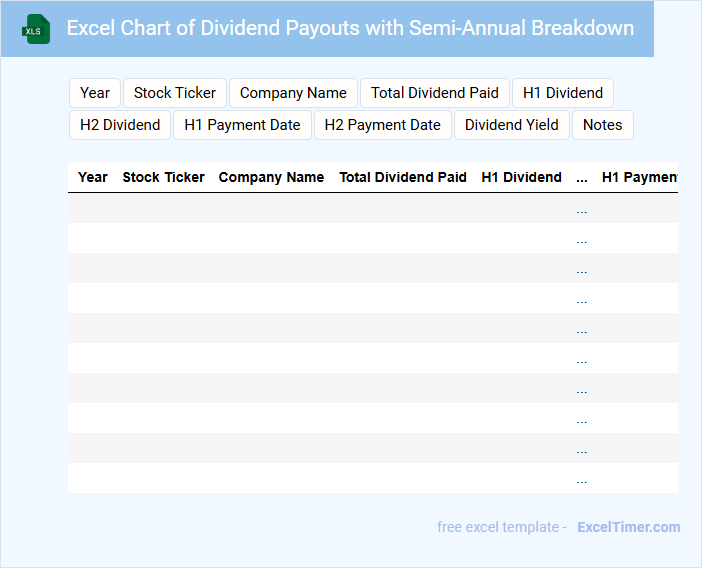

Excel Chart of Dividend Payouts with Semi-Annual Breakdown

What does an Excel Chart of Dividend Payouts with Semi-Annual Breakdown usually contain?

This type of document typically contains graphical representations of dividend payments distributed by a company over each half of the year, highlighting trends in earnings returned to shareholders. It provides both numeric data and visual insights for better analysis of payment frequency and amount changes over time.

An important suggestion for this chart is to clearly label each semi-annual period and include comparison metrics such as year-over-year percentage changes, enhancing the understanding of dividend growth or declines. Additionally, incorporating average payout ratios and total dividends per share can offer valuable context for investors.

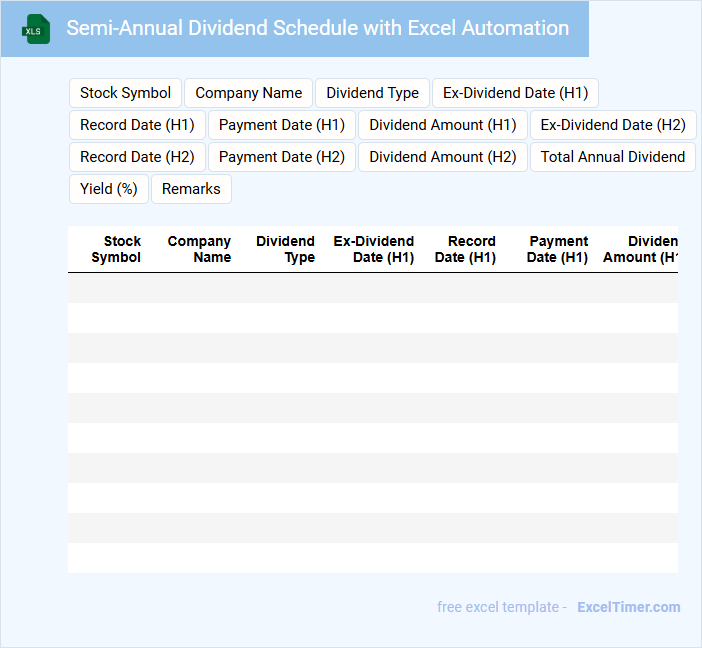

Semi-Annual Dividend Schedule with Excel Automation

A Semi-Annual Dividend Schedule document typically outlines the dates and amounts of dividend payments made twice a year by a corporation to its shareholders. It contains important financial details such as payment dates, dividend rates, and record dates to ensure accurate tracking and distribution. Utilizing Excel Automation can streamline updating schedules, reduce errors, and enable efficient data management for financial planning.

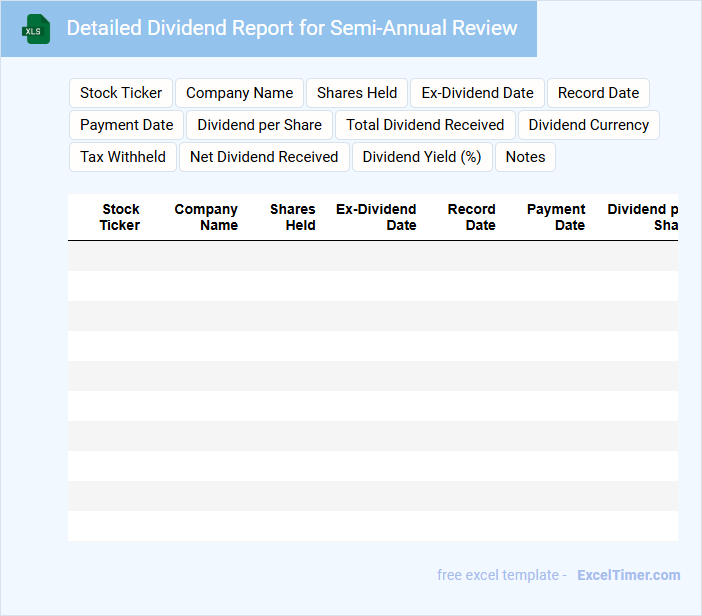

Detailed Dividend Report for Semi-Annual Review

A Detailed Dividend Report for a semi-annual review typically contains comprehensive financial data and analysis related to dividend payments made by a company over the past six months. It includes dividend amounts, payment dates, payout ratios, and comparisons with previous periods to assess trends. Such reports are crucial for investors and stakeholders to evaluate the company's profitability and dividend sustainability.

Important elements to include are clear breakdowns of dividend sources, explanations for any changes in dividend policies, and projections for future payouts. Transparency in reporting and accuracy in financial figures enhance stakeholder confidence. Additionally, highlighting any relevant market or regulatory impacts on dividends is essential for a thorough review.

How do you set up formulas to calculate semi-annual dividend payments in Excel?

To set up formulas for semi-annual dividend payments in Excel, input your dividend amount in one cell and use a formula like =DividendAmount/2 to calculate each payment. Use date functions such as EDATE to track payment dates exactly six months apart. Ensure your spreadsheet mirrors your specific dividend schedule to accurately monitor your semi-annual income.

Which Excel functions are most effective for tracking and summarizing dividends paid semi-annually?

Excel functions such as SUMIF and SUMIFS efficiently aggregate dividend payments based on specific semi-annual date ranges. The EDATE function helps calculate precise semi-annual intervals for tracking dividend payment schedules. PivotTables provide dynamic summaries and insights into dividend patterns across multiple periods.

How can conditional formatting highlight missed or upcoming semi-annual dividend dates?

Use Excel conditional formatting to highlight missed semi-annual dividend dates by applying a rule that marks dates earlier than TODAY() in red. Set another rule to highlight upcoming dividend dates within the next 30 days by formatting cells in yellow. This visual differentiation helps track and manage dividend payments efficiently on a semi-annual schedule.

What is the best way to structure a table for portfolio holdings with semi-annual dividend frequency?

Structure the portfolio holdings table with columns for Security Name, Ticker Symbol, Number of Shares, Dividend Rate per Share, Ex-Dividend Dates (two per year), Payment Dates, and Total Dividend Amount. Include a semi-annual frequency column to clearly indicate dividend intervals and facilitate tracking. Use separate rows for each security to enable precise calculation and monitoring of semi-annual dividend payments.

How do you automate reminders or alerts for semi-annual dividend payment dates in Excel?

You can automate reminders for semi-annual dividend payment dates in Excel by creating conditional formatting rules that highlight upcoming dates and using Excel's built-in notification features or VBA macros to trigger alerts. Setting up a dynamic date calculation formula based on dividend payment schedules ensures your spreadsheet updates automatically. Integrating these methods keeps your dividend tracking precise and timely without manual monitoring.