The Semi-annually Excel Template for Investment Analysis simplifies tracking and evaluating investments by calculating returns and cash flows every six months. This template enhances decision-making through automated financial metrics, including rate of return and net present value, tailored for semi-annual periods. Its user-friendly design ensures efficient data input and accurate analysis for projecting long-term investment performance.

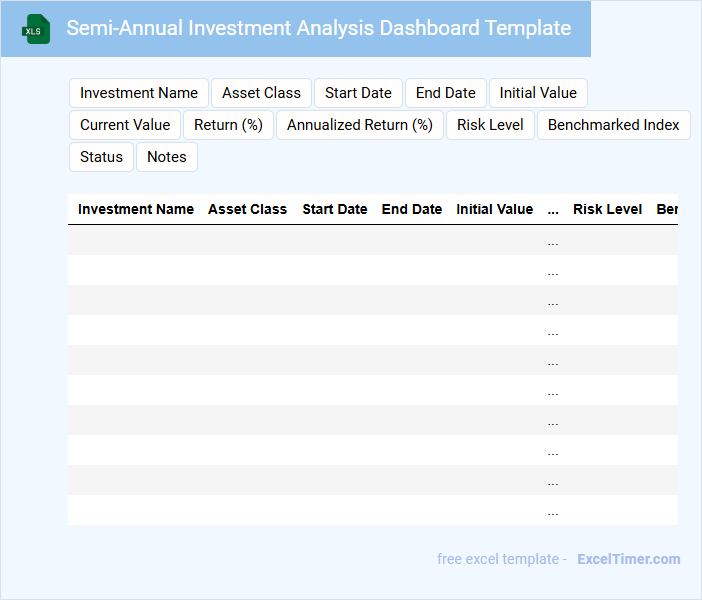

Semi-Annual Investment Analysis Dashboard Template

What information is typically included in a Semi-Annual Investment Analysis Dashboard Template? This type of document usually contains detailed financial data, performance metrics, and trend analysis of investments over a six-month period. It provides a clear overview to help stakeholders make informed decisions and adjust strategies accordingly.

What is an important aspect to consider when using this template? Ensuring real-time data accuracy and integrating visual elements like charts and graphs are crucial for quickly identifying key investment opportunities and risks. Additionally, customizing the dashboard to reflect specific investment goals enhances its effectiveness.

Excel Template for Semi-Annual Fund Performance Review

An Excel Template for Semi-Annual Fund Performance Review typically contains detailed financial data, charts, and key performance indicators to facilitate comprehensive analysis. It includes sections for asset allocation, returns comparison, and risk metrics, allowing for clear visualization of fund performance over the last six months. This type of document is essential for investors and fund managers to assess progress and make informed decisions.

Important elements to include are accurate historical data, benchmark comparisons, and automated calculation formulas to ensure efficiency and reliability. It is recommended to incorporate dynamic charts and summary sections for quick insights. Ensuring data validation and user-friendly formatting enhances usability and reduces errors during the review process.

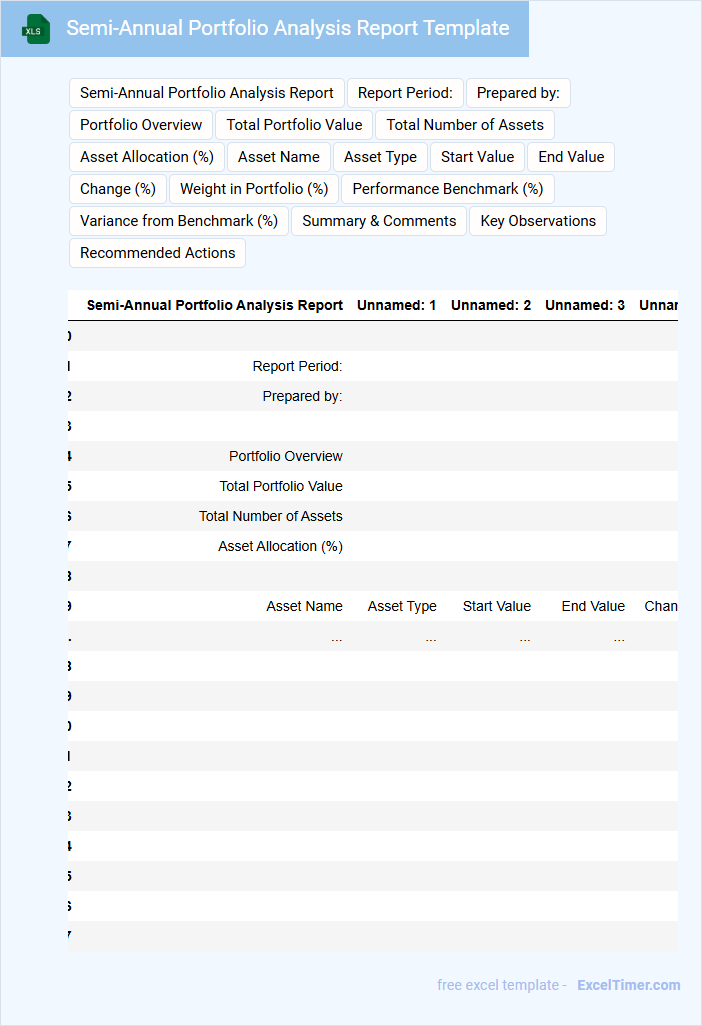

Semi-Annual Portfolio Analysis Report Template

What information is typically included in a Semi-Annual Portfolio Analysis Report Template? This document usually contains detailed assessments of investment performance, asset allocation, and risk metrics over a six-month period. It helps stakeholders understand the portfolio's progress and make informed decisions.

What is the most important aspect to focus on in this report? Emphasizing accurate performance data and clear visualizations of portfolio diversification ensures transparency and effective communication with clients or management.

Investment Income Tracker with Semi-Annual Comparison

What information is typically included in an Investment Income Tracker with Semi-Annual Comparison? This document usually contains detailed records of various investment income sources such as dividends, interest, and capital gains, tracked over a six-month period. It also features comparative analysis to help investors assess performance trends and make informed decisions based on semi-annual financial data.

What is an important consideration when using an Investment Income Tracker with Semi-Annual Comparison? Accuracy in recording income entries and consistent categorization are crucial to ensure meaningful comparisons and reliable insights. Additionally, including notes on market conditions or portfolio changes during each period can enhance the contextual understanding of income fluctuations.

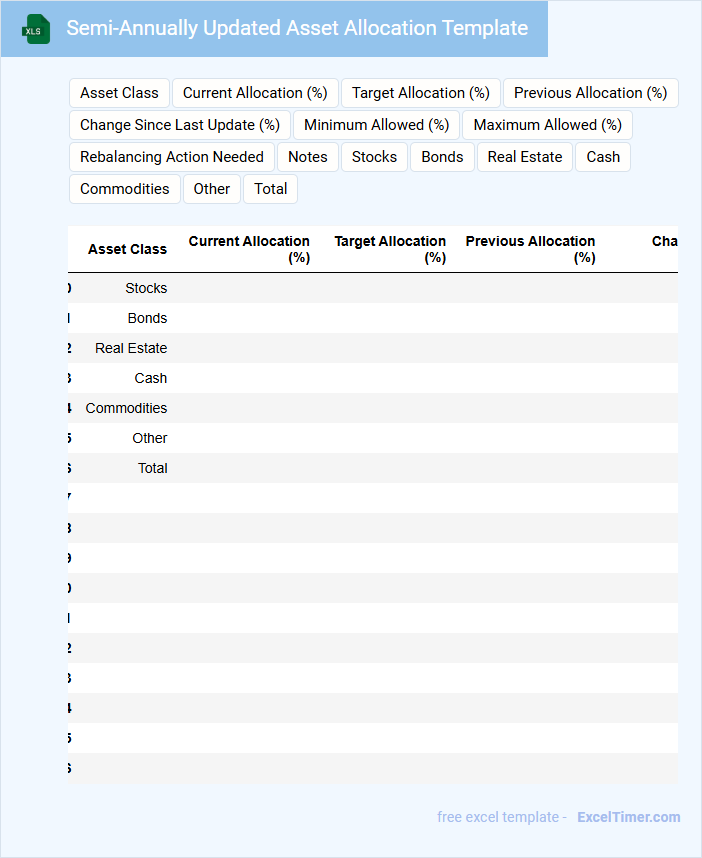

Semi-Annually Updated Asset Allocation Template

A Semi-Annually Updated Asset Allocation Template is a financial planning document used to periodically review and adjust investment portfolios. It helps in maintaining the desired risk level by reallocating assets based on market conditions and investment goals.

- Include current asset distribution and target allocation percentages.

- Incorporate performance summaries for each asset class over the past six months.

- Highlight recommended adjustments to align with changing market trends and personal objectives.

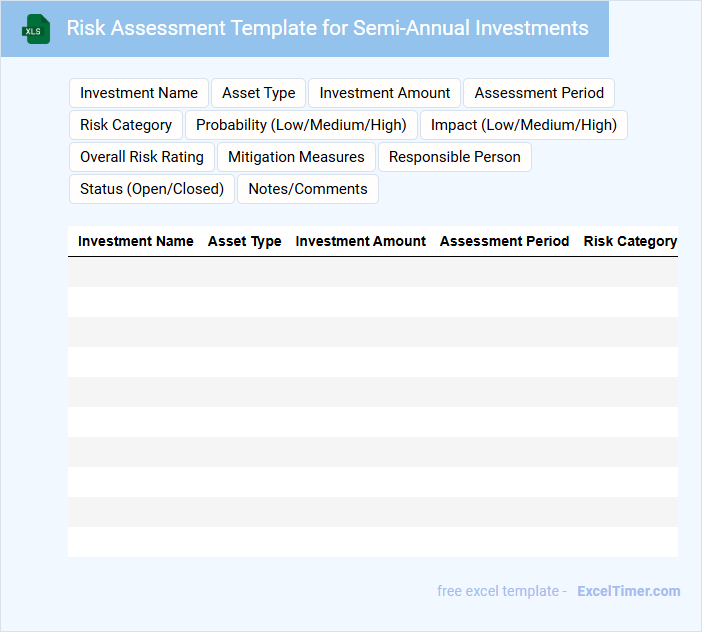

Risk Assessment Template for Semi-Annual Investments

What key elements does a Risk Assessment Template for Semi-Annual Investments typically include? This document usually contains identification of potential investment risks, analysis of their impact and likelihood, and strategies for mitigation. It ensures investors systematically evaluate and manage risks associated with their semi-annual investment portfolio to make informed decisions.

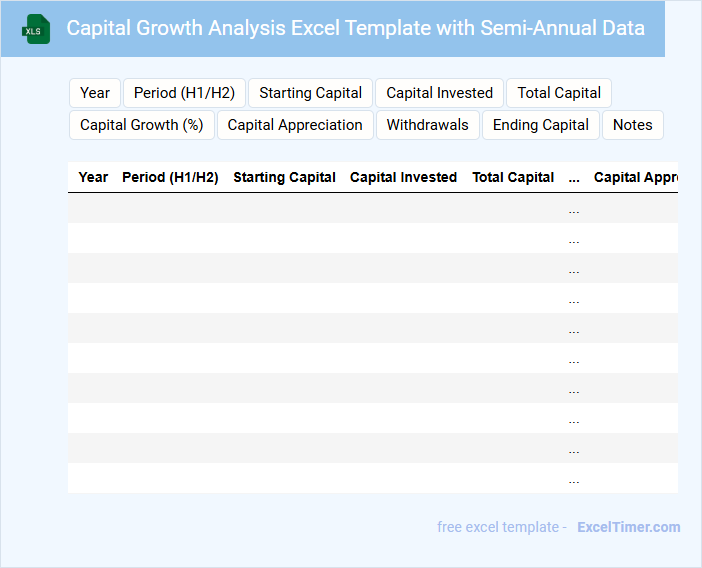

Capital Growth Analysis Excel Template with Semi-Annual Data

A Capital Growth Analysis Excel Template with semi-annual data is typically used to track and evaluate the increase in investment value over specific six-month periods. This document usually contains historical growth figures, projections, and comparative charts to help users understand trends and make informed financial decisions. An important suggestion is to ensure the template includes clearly labeled time intervals and dynamic formulas for accurate semi-annual calculations.

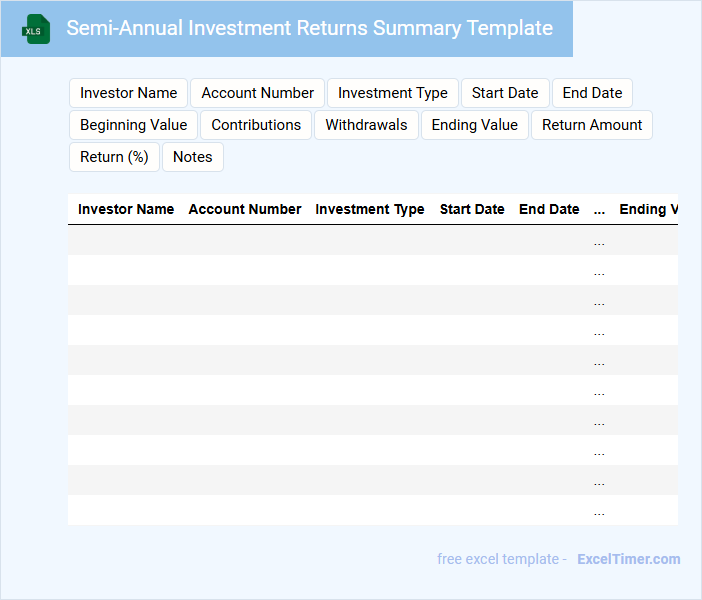

Semi-Annual Investment Returns Summary Template

A Semi-Annual Investment Returns Summary document typically contains a detailed overview of an investment portfolio's performance over the past six months. It includes key metrics such as total returns, asset allocation, and comparison against benchmarks. To enhance clarity, it is important to highlight any significant market events impacting returns within the period.

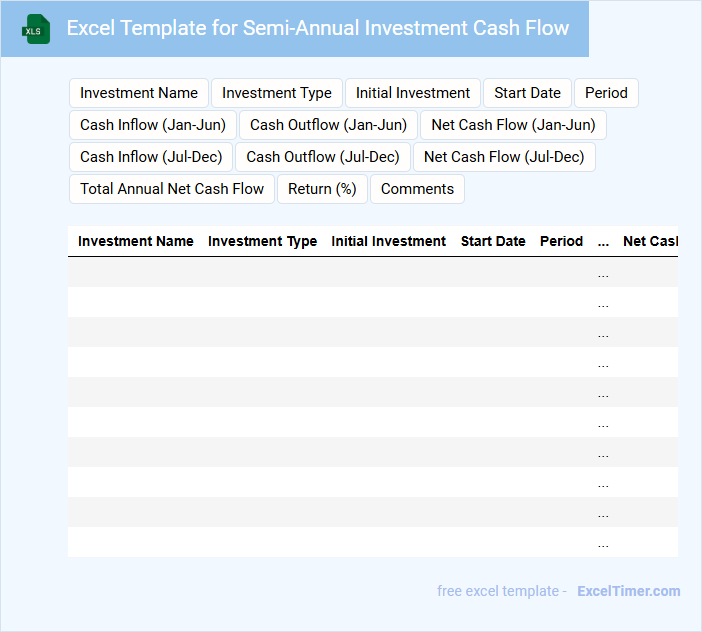

Excel Template for Semi-Annual Investment Cash Flow

An Excel Template for Semi-Annual Investment Cash Flow typically contains detailed inflows and outflows related to investments tracked every six months. It helps investors and analysts monitor financial performance over specific periods efficiently.

- Ensure capture of all relevant cash inflows such as dividends, interest, and returns from investments.

- Include comprehensive outflows like purchases, fees, and other expenses to maintain accuracy.

- Incorporate formulas for automatic calculation of net cash flow and cumulative balances.

Dividend Tracking Spreadsheet with Semi-Annual Overview

A Dividend Tracking Spreadsheet typically contains detailed records of dividend payments from various investments, including amounts, dates, and stock symbols. It helps investors monitor their income and assess the performance of their dividend portfolio over time.

The Semi-Annual Overview summarizes dividend income and trends every six months, providing a clear snapshot for making informed financial decisions. Regular updates and accurate data entry are crucial for maintaining the spreadsheet's reliability.

Important features to include are dividend yield calculations, payment date tracking, and sector diversification analysis to optimize investment strategies.

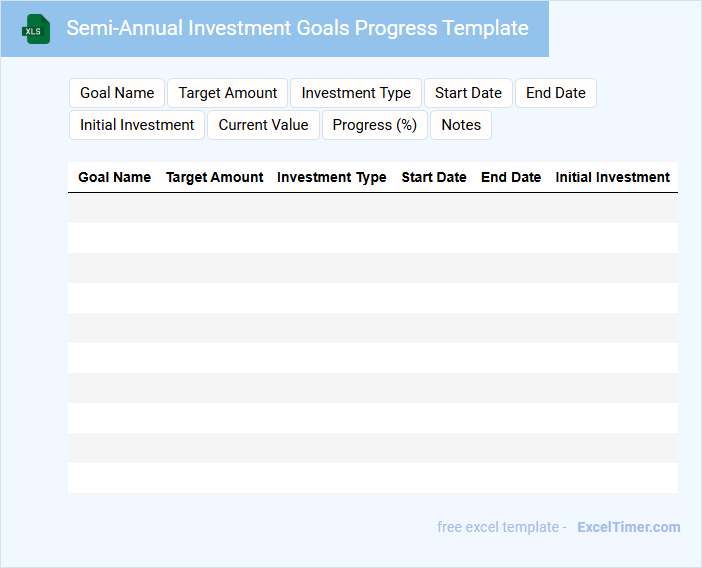

Semi-Annual Investment Goals Progress Template

A Semi-Annual Investment Goals Progress Template typically contains a summary of investment performance and milestones achieved over a six-month period.

- Goal Tracking: Clearly outlines progress towards the specific investment goals set at the start of the period.

- Performance Metrics: Includes key financial indicators and returns to assess the effectiveness of the investment strategy.

- Action Plan: Suggests adjustments and next steps based on the current progress and market conditions.

ROI Calculation Template for Semi-Annual Periods

An ROI Calculation Template for semi-annual periods is a structured document used to evaluate the financial performance of an investment over six months. It typically includes sections for initial investment, net returns, and the formula to calculate the return on investment. This template helps businesses make informed decisions by providing clear, periodic financial insights.

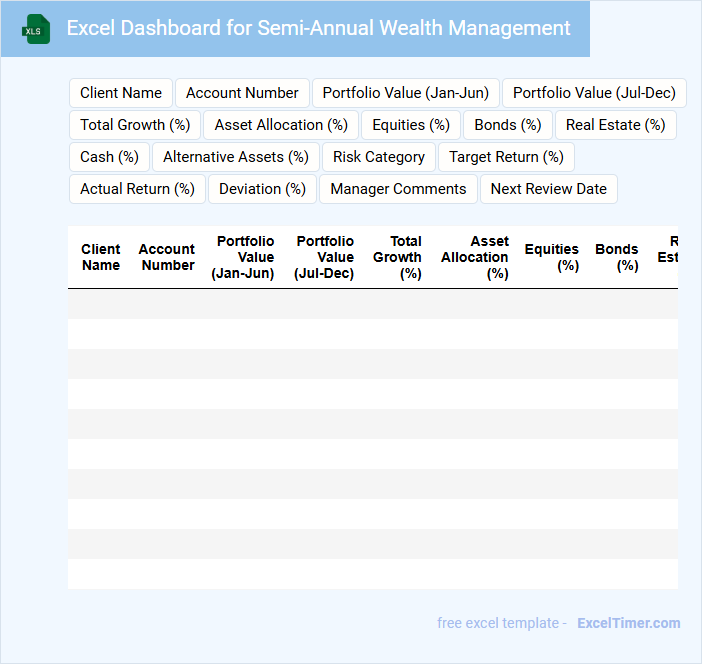

Excel Dashboard for Semi-Annual Wealth Management

An Excel Dashboard typically contains visual summaries of financial data, including charts, tables, and key performance indicators for quick analysis. It is designed to provide a comprehensive overview of wealth management metrics in an easily digestible format.

For a Semi-Annual Wealth Management dashboard, it is important to focus on tracking portfolio performance, asset allocation, and risk assessment over the six-month period. Including trend analysis and comparison against benchmarks can enhance decision-making.

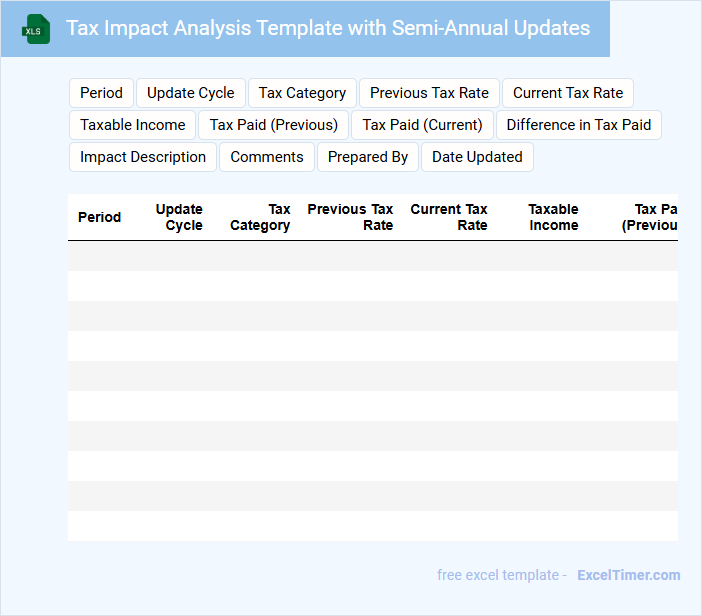

Tax Impact Analysis Template with Semi-Annual Updates

A Tax Impact Analysis Template typically contains detailed assessments of how tax changes affect financial outcomes over a specified period. It often includes projections, tax rate variations, and compliance considerations tailored for semi-annual updates.

This document emphasizes accuracy in reflecting regulatory changes and financial implications within each six-month cycle. Ensuring timely data input and clear summary reports is essential for effective decision-making and strategic tax planning.

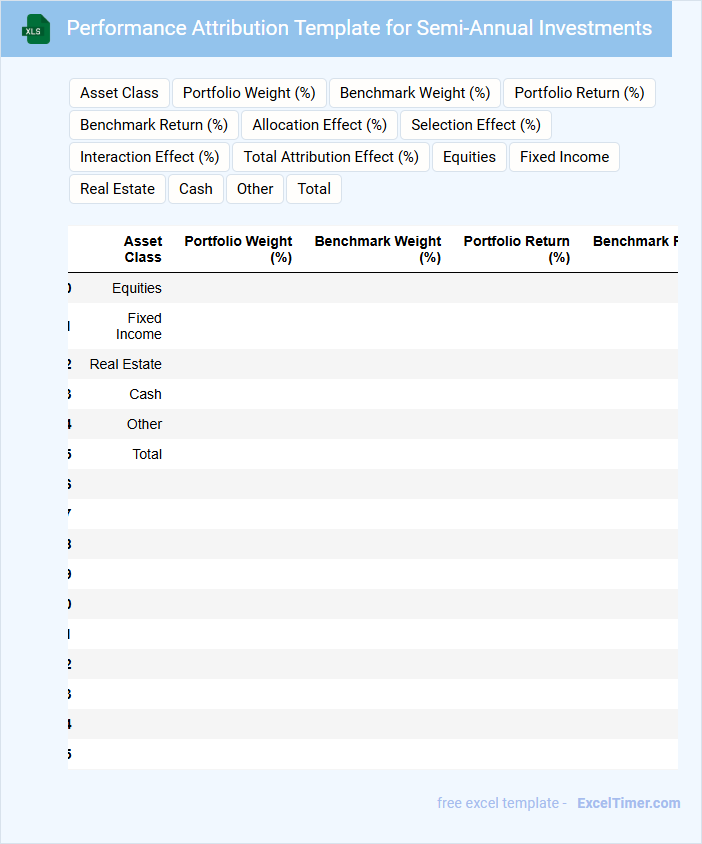

Performance Attribution Template for Semi-Annual Investments

What key information is typically contained in a Performance Attribution Template for Semi-Annual Investments? This document usually includes detailed breakdowns of investment returns, segmented by various factors such as asset allocation, sector performance, and individual security contributions. It provides a clear analysis of how different components influenced overall portfolio performance during the six-month period, enabling investors to understand the sources of gains or losses.

What important elements should be included to enhance the effectiveness of this template? It is crucial to incorporate consistent metrics like benchmark comparisons, risk-adjusted returns, and clear visualizations such as charts or graphs. Additionally, including commentary on market conditions and investment decisions will provide comprehensive insight and facilitate informed review and decision-making.

How is semi-annual compounding calculated and reflected in Excel formulas (e.g., FV, PV) for investment analysis?

Semi-annual compounding in Excel is calculated by adjusting the interest rate and number of periods to reflect two compounding periods per year, using formulas like FV(rate/2, nper*2, pmt, pv) and PV(rate/2, nper*2, pmt, fv). Your investment's growth is captured by dividing the annual interest rate by two and multiplying the number of years by two, ensuring accurate semi-annual calculations. This method allows precise modeling of future and present values in investment analysis.

What is the difference between annual and semi-annual interest rates in Excel financial models for investments?

Annual interest rates represent the total percentage earned or paid over one year, while semi-annual interest rates are applied twice per year, reflecting compounding periods within the annual cycle. In Excel investment analysis, semi-annual rates require conversion by dividing the annual rate by two and adjusting the number of periods accordingly to accurately calculate compound interest. Properly distinguishing these rates ensures precise computation of investment returns and financial projections.

How do you adjust the period and rate arguments for semi-annual payments in Excel financial functions?

For semi-annual payments in Excel financial functions, divide the annual interest rate by 2 to adjust the rate argument. Multiply the number of years by 2 to convert the period argument into semi-annual terms. This ensures calculations like PMT, PV, and FV accurately reflect semi-annual compounding.

Which Excel functions best handle cash flows that occur on a semi-annual basis for investment decision-making?

The Excel functions XIRR and PMT effectively handle cash flows occurring on a semi-annual basis for investment decision-making. XIRR calculates the internal rate of return for irregular cash flows with specific dates, while PMT computes the payment for a loan or investment based on constant periodic payments. Using these functions allows accurate modeling of semi-annual cash flow schedules and investment returns.

How do you compare investments with varying compounding frequencies (e.g., semi-annual vs. annual) using Excel?

Use Excel's EFFECT function to convert different nominal interest rates with varying compounding frequencies into an equivalent annual rate for accurate comparison. Calculate the effective annual rate (EAR) by inputting the nominal rate and compounding frequency (e.g., 2 for semi-annual) to standardize returns. This approach enables consistent investment analysis regardless of whether compounding occurs semi-annually, annually, or quarterly.