The Semi-annually Excel Template for Loan Repayment Scheduling allows users to efficiently track and manage loan payments made every six months. This template calculates principal and interest amounts, helping to ensure accurate financial planning and timely repayments. Its user-friendly design simplifies monitoring loan balances and payment dates, reducing the risk of errors and missed payments.

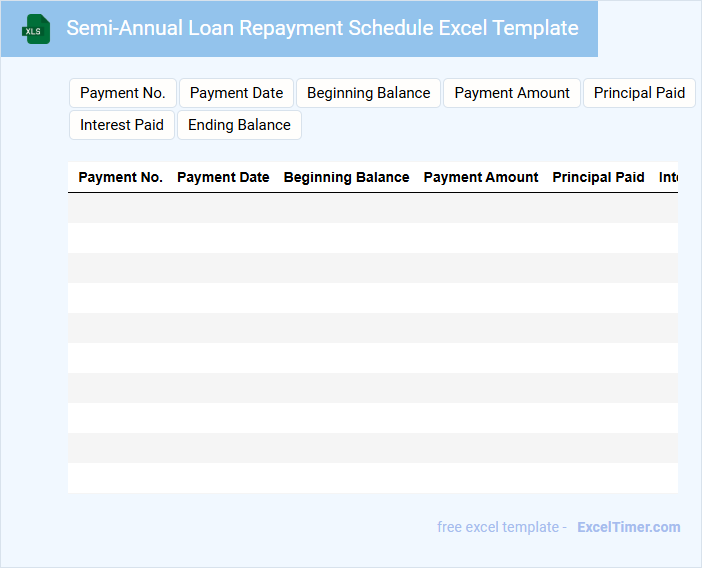

Semi-Annual Loan Repayment Schedule Excel Template

A Semi-Annual Loan Repayment Schedule Excel Template typically contains a detailed timeline of loan repayments split into two periods per year, tracking principal and interest amounts. It helps borrowers and lenders manage and forecast loan balances effectively.

- Include clear column headers for payment dates, principal paid, interest paid, and remaining balance.

- Incorporate formulas to automatically calculate interest and update balances after each payment.

- Ensure the template can accommodate varying interest rates or payment adjustments if needed.

Excel Template for Semi-Annually Loan Payment Tracker

What information is typically included in an Excel Template for a Semi-Annually Loan Payment Tracker? This document usually contains fields for loan amount, interest rate, payment dates, and payment amounts scheduled every six months. It helps users monitor outstanding balances and track timely loan payments efficiently.

Which important features should be included in this template? Accurate formulas for calculating interest and remaining balance, clear date indicators for semi-annual payments, and summary sections for total payments made and outstanding amounts are essential for effective tracking.

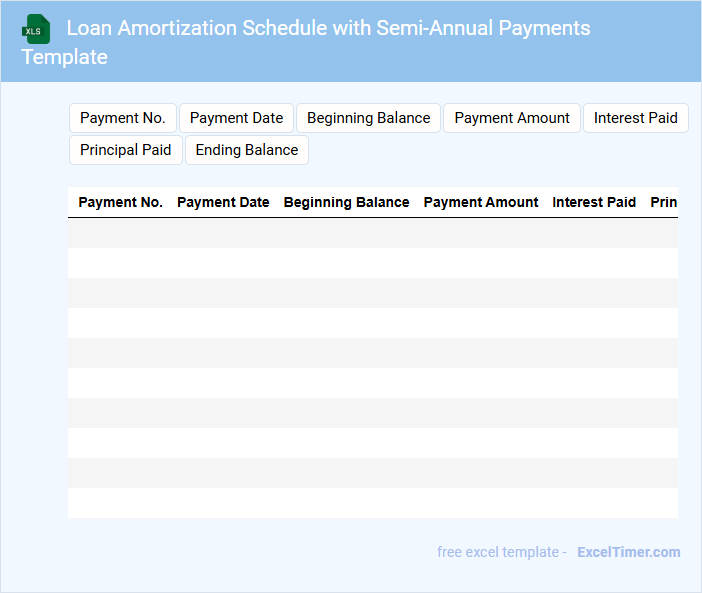

Loan Amortization Schedule with Semi-Annual Payments Template

What information is typically included in a Loan Amortization Schedule with Semi-Annual Payments Template? This document usually contains details about the loan principal, interest rate, payment intervals, and breakdown of each payment into principal and interest over time. It helps borrowers understand how their loan balance decreases with each semi-annual payment and the total interest paid throughout the loan term.

What is an important aspect to consider when using this template? Ensuring accurate input of the loan amount, interest rate, and payment frequency is crucial for precise calculations. Additionally, regularly updating the schedule to reflect any changes in payment amounts or extra payments can provide a clearer financial outlook.

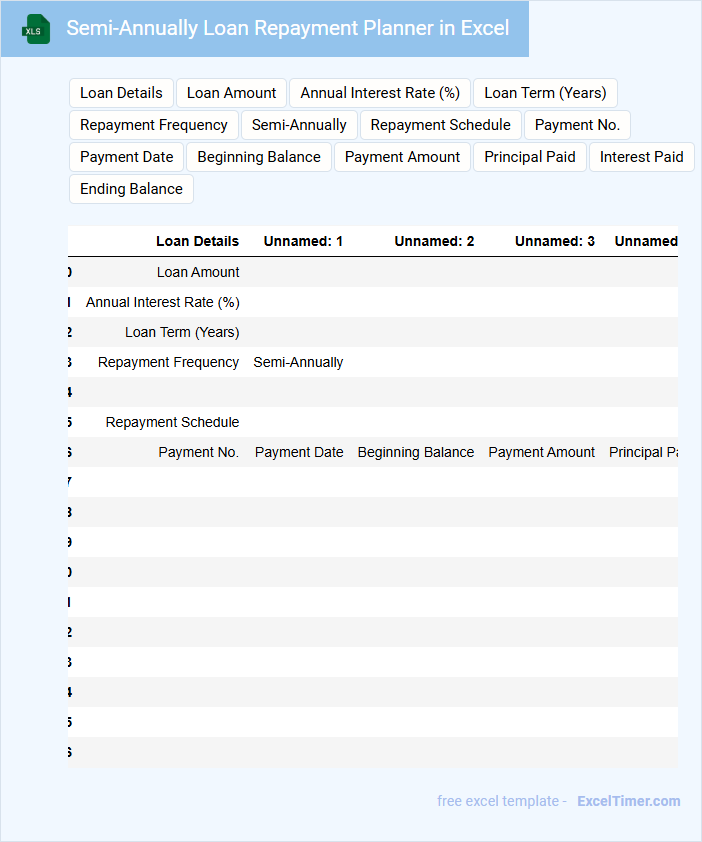

Semi-Annually Loan Repayment Planner in Excel

A Semi-Annually Loan Repayment Planner in Excel typically contains detailed schedules and calculations to help users manage their loan repayments every six months effectively.

- Amortization Schedule: Displays the breakdown of each semi-annual payment into principal and interest.

- Payment Tracking: Allows users to record and monitor actual payments against the planned schedule.

- Interest Calculations: Accurately computes accrued interest for semi-annual periods to ensure correct payment amounts.

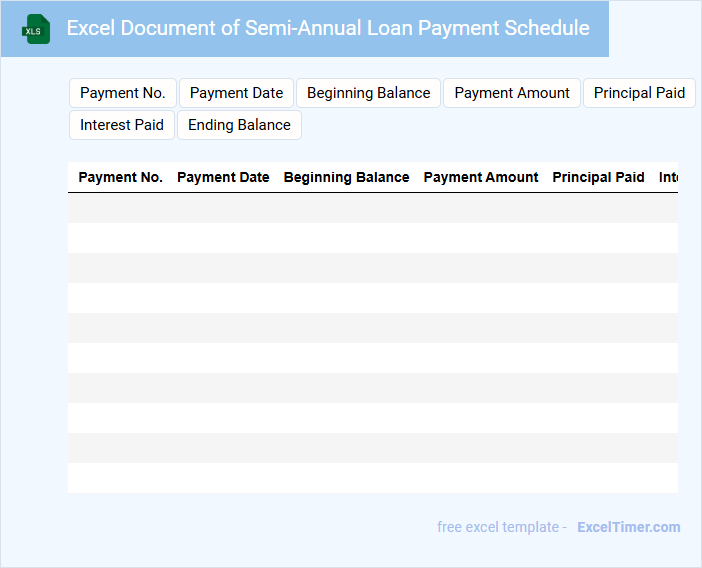

Excel Document of Semi-Annual Loan Payment Schedule

What information is typically included in an Excel document of a semi-annual loan payment schedule? This type of document usually contains detailed payment dates, principal and interest amounts for each semi-annual installment. It helps borrowers track their repayment plan and understand the distribution of payments over the loan term.

What are some important things to consider when creating or using this document? Accuracy in dates and payment calculations is crucial to avoid confusion or missed payments. Additionally, including a summary of total interest paid and remaining balance improves financial clarity and planning.

Loan Repayment Tracker with Semi-Annual Frequency Excel

A Loan Repayment Tracker with semi-annual frequency in Excel is designed to help individuals or businesses monitor their loan payments every six months. It typically contains columns for payment dates, amounts paid, outstanding balance, and interest accrued. Maintaining accurate records in this tracker ensures timely payments and better financial planning.

Excel Template for Tracking Semi-Annually Loan Payments

An Excel Template for Tracking Semi-Annually Loan Payments typically contains fields for loan details, payment schedules, and outstanding balances. It helps users systematically record and monitor their loan repayments every six months. Important elements include payment dates, amounts, interest calculations, and summary charts for quick financial insights.

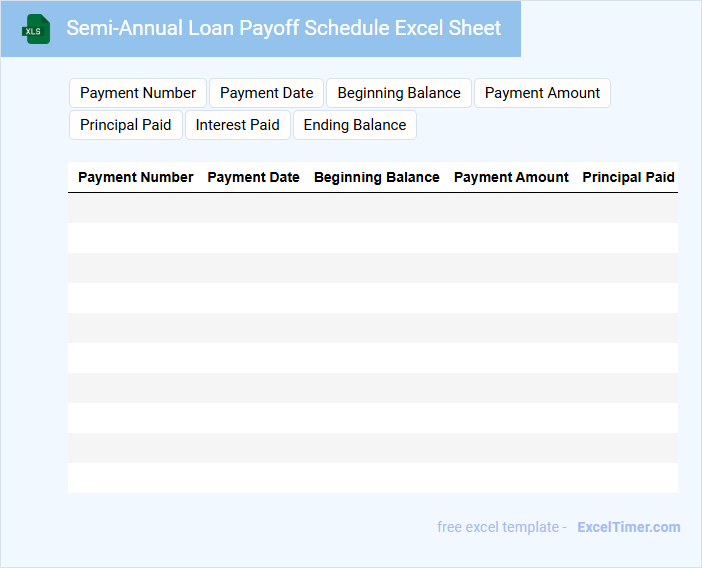

Semi-Annual Loan Payoff Schedule Excel Sheet

A Semi-Annual Loan Payoff Schedule Excel Sheet typically contains detailed payment dates, principal and interest breakdowns, and outstanding loan balances over time. It helps borrowers track their progress in repaying the loan on a semi-annual basis. Including accurate interest rates and payment frequencies is crucial for precise calculations and effective financial planning.

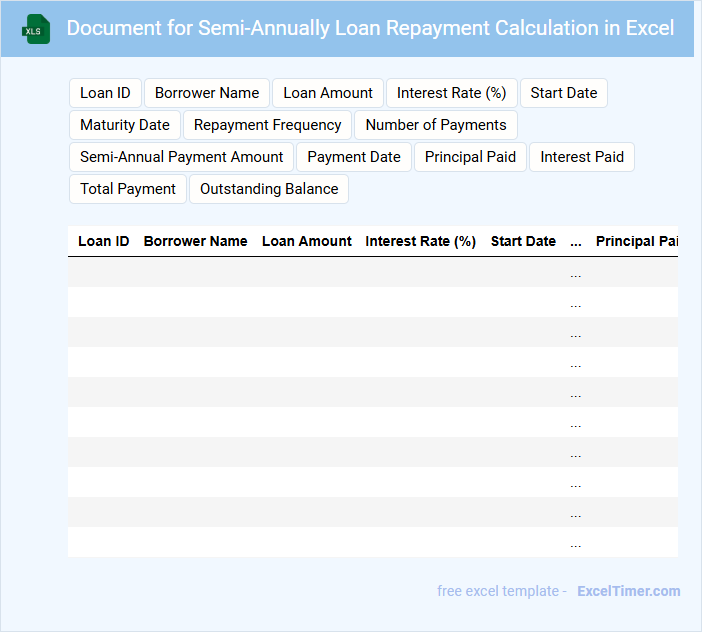

Document for Semi-Annually Loan Repayment Calculation in Excel

This document typically contains detailed calculations for loan repayments scheduled on a semi-annual basis, including principal, interest, and remaining balance. It is designed to help borrowers and lenders track payment schedules and financial obligations accurately.

To optimize its use, ensure all formulas are correctly linked to input data and audit for accuracy. Additionally, the document should be user-friendly with clear labels and concise instructions.

- Include a summary table showing total payments and interest over the loan term.

- Verify the date intervals align with semi-annual payment periods.

- Incorporate dynamic charts to visualize repayment progress.

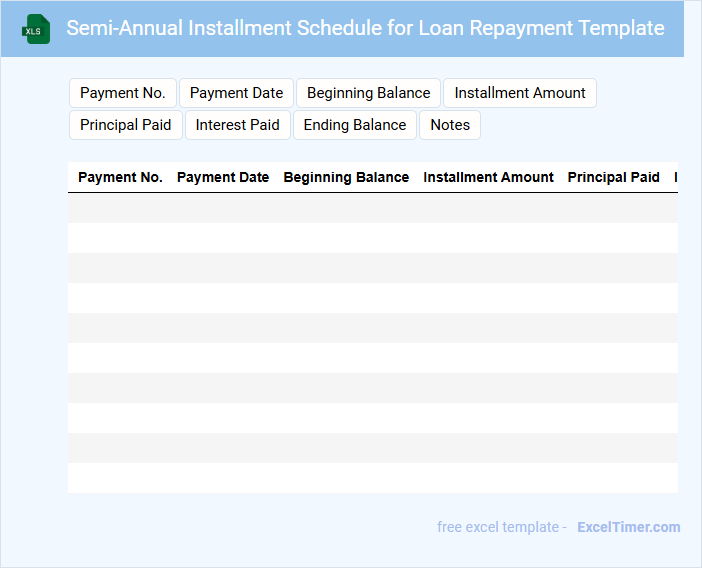

Semi-Annual Installment Schedule for Loan Repayment Template

The Semi-Annual Installment Schedule for loan repayment is a structured document outlining the repayment plan divided into six-month intervals. It typically includes details such as the payment amounts, due dates, and remaining balance after each installment. This template helps borrowers and lenders keep track of loan progress and ensure timely payments.

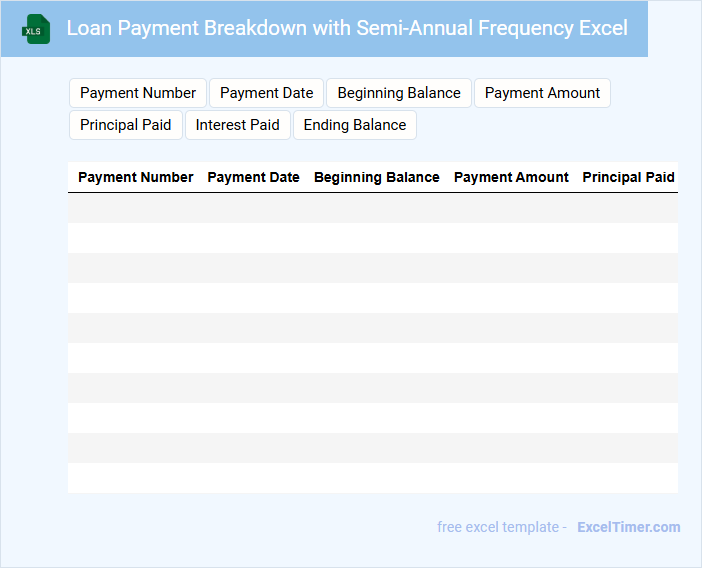

Loan Payment Breakdown with Semi-Annual Frequency Excel

A Loan Payment Breakdown document typically details the distribution of each loan payment into principal and interest components over time. It helps borrowers understand how their debt decreases with each installment.

For an Excel sheet with Semi-Annual Frequency, payments are scheduled twice a year, impacting the amortization schedule and interest calculations. Ensure accurate date intervals and use formulas to automate payment updates for clarity.

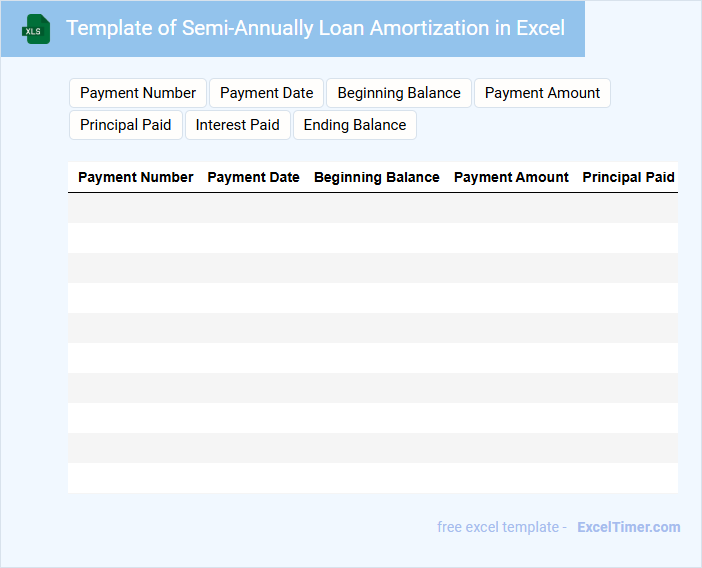

Template of Semi-Annually Loan Amortization in Excel

A Semi-Annually Loan Amortization Template in Excel is a structured document used to detail loan repayment schedules over six-month periods. It typically contains principal and interest breakdowns, payment dates, and remaining balances. This template helps borrowers and lenders track payments and understand the total cost of the loan. For optimal use, ensure the template includes accurate interest rate calculations and clear sections for both principal and interest components.

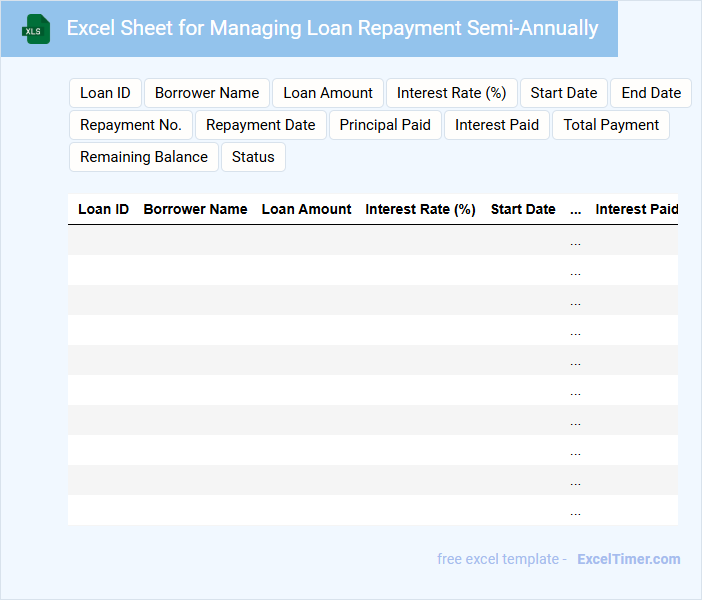

Excel Sheet for Managing Loan Repayment Semi-Annually

An Excel Sheet for managing loan repayment semi-annually typically contains detailed loan information including principal amount, interest rate, and payment schedule. It often features columns for payment dates, amounts due, interest accrued, and balances remaining. This sheet helps users track repayments systematically and avoid missed payments.

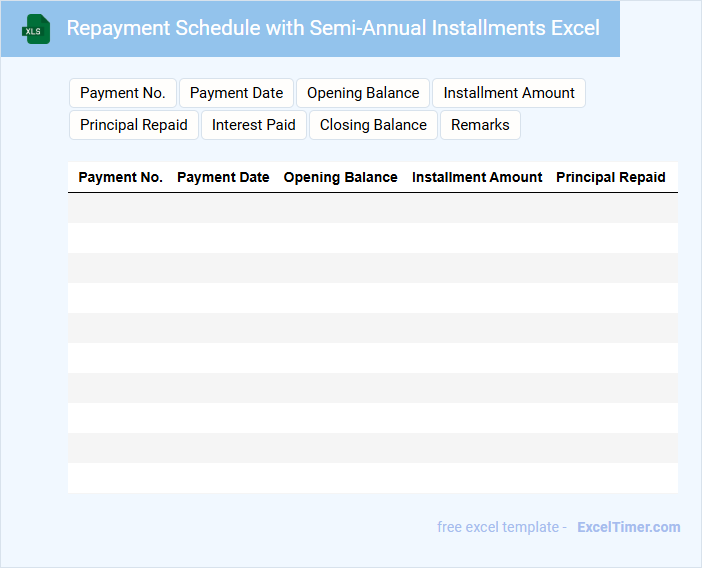

Repayment Schedule with Semi-Annual Installments Excel

A Repayment Schedule with Semi-Annual Installments Excel document typically contains a detailed timeline of payments, including principal and interest amounts due every six months.

- Payment Dates: Clearly outlined semi-annual due dates for each installment to track payment timing.

- Installment Amounts: Specific breakdowns of principal and interest components to understand payment allocation.

- Total Repayment Summary: A cumulative total of all payments, ensuring transparency of the loan's overall cost.

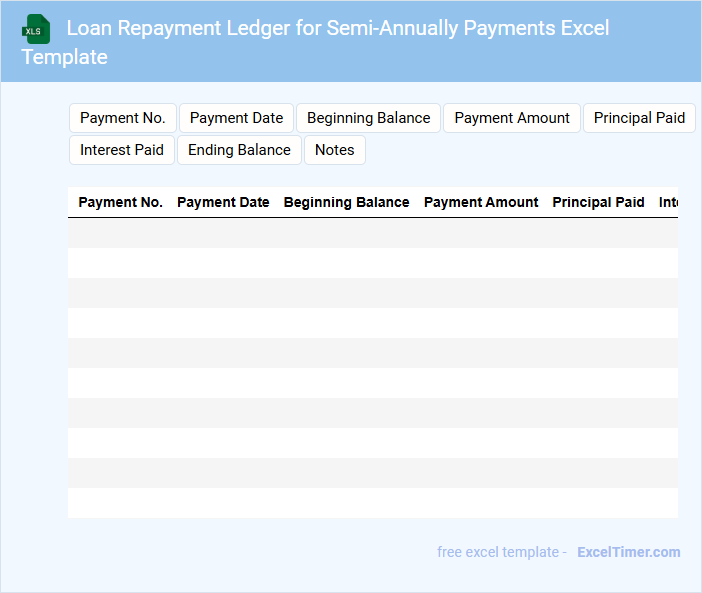

Loan Repayment Ledger for Semi-Annually Payments Excel Template

A Loan Repayment Ledger for Semi-Annually Payments Excel Template typically contains detailed records of loan disbursements, scheduled semi-annual payment dates, and outstanding balances. It helps users track interest calculations, principal reductions, and cumulative payments over time. This document is essential for maintaining accurate financial records and ensuring timely loan repayments.

Important elements to include are clear payment schedules, interest rate details, and automated calculations for principal and interest allocation. Incorporating dynamic charts or summaries can enhance visualization for better financial analysis. Additionally, ensuring data validation and error-proof formulas improves reliability and ease of use.

How does using a semi-annual schedule impact the total interest paid on a loan compared to other frequencies in Excel?

Using a semi-annual loan repayment schedule in Excel results in fewer interest compounding periods compared to monthly or quarterly schedules, which can reduce the total interest paid over the loan term. Your loan's interest calculation reflects these longer intervals between payments, leading to a lower cumulative interest cost. This schedule is particularly effective for loans with compound interest formulas set to semi-annual periods in Excel.

What Excel functions can calculate semi-annual payment amounts for a fixed-rate loan?

Excel functions such as PMT and RATE are essential for calculating semi-annual payment amounts for fixed-rate loans. You can use PMT to determine the payment for each period based on the loan amount, interest rate divided by two, and total number of semi-annual periods. The RATE function helps find the interest rate per semi-annual period if not directly provided in your loan schedule.

How do you set up an amortization table in Excel for semi-annual loan repayments?

Create an Excel amortization table for semi-annual loan repayments by first entering your loan amount, interest rate, and loan term in years. Calculate the semi-annual interest rate by dividing the annual rate by two, and determine the total number of payments by multiplying the loan term by two. Use the PMT function to find your payment amount, then build columns for payment number, payment date, beginning balance, payment amount, interest portion, principal portion, and ending balance to track each semi-annual repayment accurately.

How is the semi-annual interest rate derived from the annual interest rate in Excel formulas?

The semi-annual interest rate in Excel is derived by dividing the annual interest rate by 2 using the formula =AnnualInterestRate/2. Your loan repayment schedule benefits from this conversion, ensuring accurate semi-annual payment calculations. This method optimizes financial modeling and repayment forecasting in Excel.

Which columns are essential in an Excel sheet for monitoring semi-annual loan repayments and balances?

Your Excel sheet for monitoring semi-annual loan repayments should include essential columns such as Payment Date, Principal Payment, Interest Payment, Total Payment, and Remaining Balance. Including Loan ID and Borrower Name helps in tracking multiple loans efficiently. Accurate data entry in these fields ensures precise scheduling and balance calculations.