The Semi-annually Audit Checklist Excel Template for Financial Departments streamlines the auditing process by providing a structured format to track compliance and identify discrepancies. It ensures thorough review of financial records, internal controls, and regulatory adherence every six months, facilitating accuracy and accountability. This template enhances efficiency by allowing easy customization and clear documentation of audit findings.

Semi-Annual Audit Checklist Excel Template for Financial Departments

The Semi-Annual Audit Checklist Excel Template is designed to streamline the audit process within financial departments by organizing crucial review points. This document typically contains a list of key compliance requirements, control checks, and financial statement verifications to ensure accuracy and regulatory adherence. Important elements to include are risk assessments, transaction sampling, and documentation of findings for effective auditing and accountability.

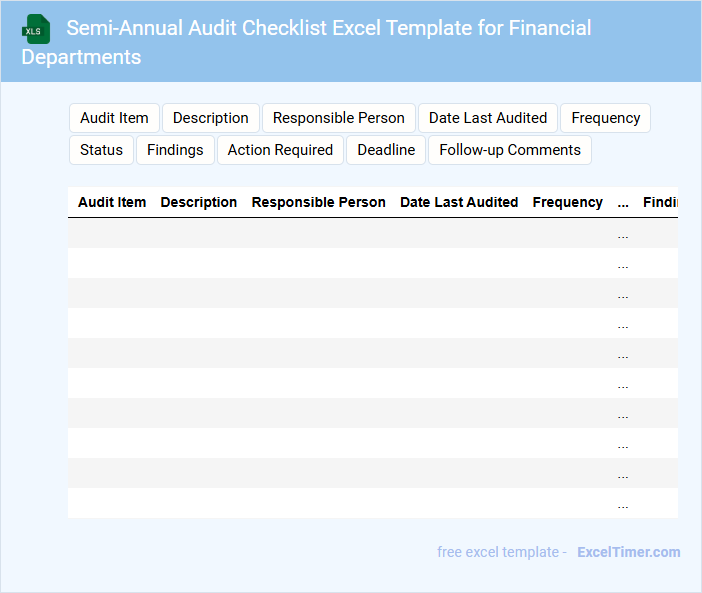

Compliance Audit Checklist with Risk Assessment for Finance Teams

A Compliance Audit Checklist with Risk Assessment is a crucial document for finance teams, designed to systematically evaluate adherence to regulatory requirements and internal policies. It typically contains detailed criteria for auditing financial processes, controls, and reporting accuracy to mitigate risks. This checklist ensures that potential compliance issues are identified early, enhancing the organization's risk management framework.

Important elements to include are a comprehensive list of applicable regulations, predefined risk ratings for various compliance areas, and clear documentation of audit findings. Emphasizing real-time updates based on regulatory changes keeps the checklist relevant and effective. Additionally, integrating a risk assessment matrix helps prioritize issues that require immediate attention, improving the team's overall compliance strategy.

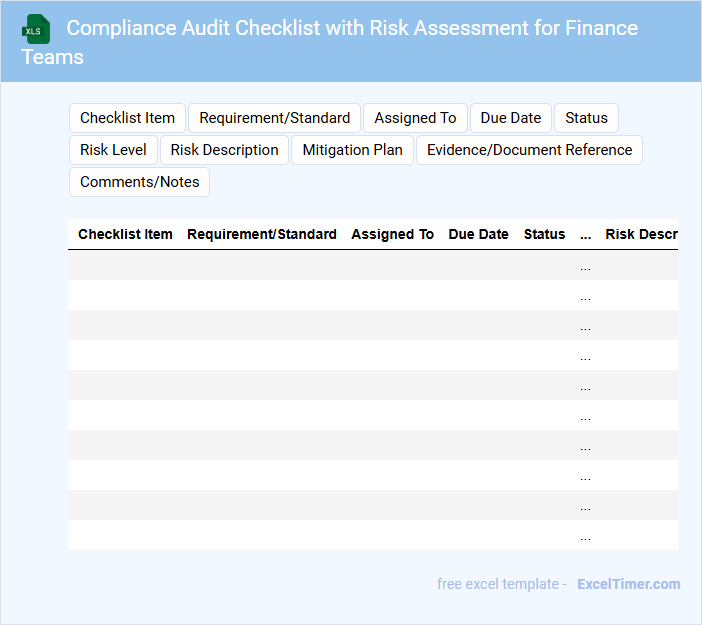

Internal Control Checklist Excel Template for Semi-Annual Financial Audits

What key elements should be included in an Internal Control Checklist Excel Template for Semi-Annual Financial Audits? This type of document usually contains a structured list of control activities such as authorization, verification, reconciliation, and segregation of duties to ensure financial accuracy and compliance. It also includes spaces for auditors to mark compliance status, note exceptions, and provide comments to facilitate thorough and efficient semi-annual review processes.

Why is it important to regularly update and customize the checklist for each audit cycle? Regular updates ensure that the checklist reflects current organizational policies, regulatory requirements, and identified risks. Customizing the template helps auditors focus on relevant controls, improving audit effectiveness and supporting continuous improvement in financial governance.

Semi-Annual Departmental Audit Report Template with Action Tracker

What does a Semi-Annual Departmental Audit Report Template with Action Tracker usually contain? This type of document typically includes a detailed summary of audit findings, compliance status, and departmental performance over the past six months. It also incorporates an action tracker section to monitor the implementation and progress of corrective measures and recommendations.

What is an important thing to consider when using this template? Ensuring clear, measurable action items with assigned responsibilities and deadlines is crucial for effective follow-up. Consistent updates to the action tracker promote accountability and help in evaluating the success of implemented changes.

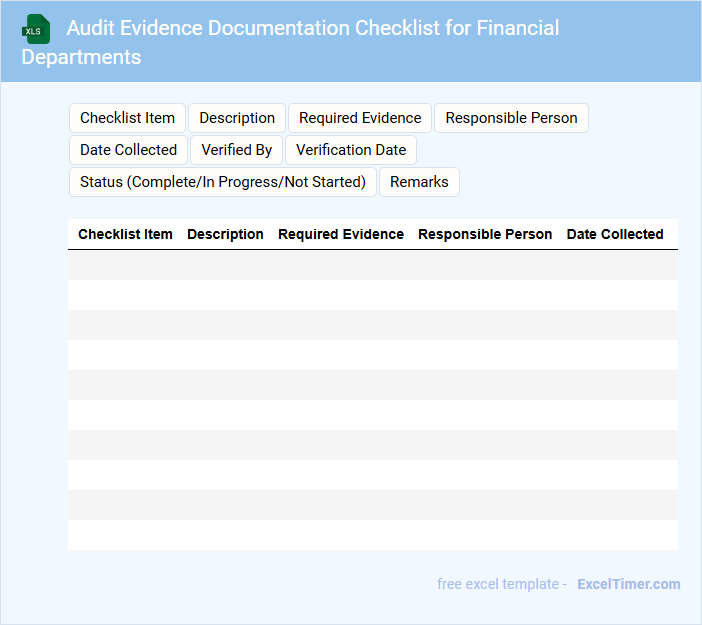

Audit Evidence Documentation Checklist for Financial Departments

The Audit Evidence Documentation Checklist is a structured guide used by financial departments to systematically collect and verify the evidence required during an audit. It ensures that all relevant financial documents, transactions, and compliance records are accurately reviewed and recorded. This checklist helps improve transparency and accountability in financial reporting processes.

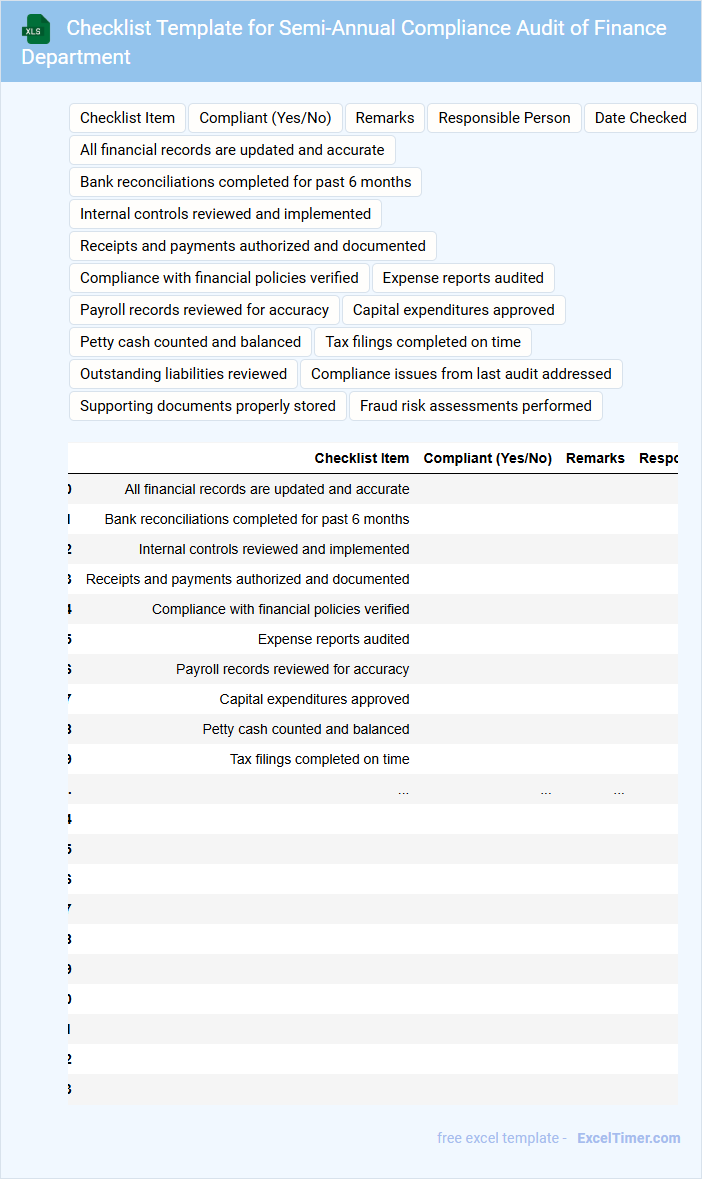

Checklist Template for Semi-Annual Compliance Audit of Finance Department

A Checklist Template for a Semi-Annual Compliance Audit typically contains a structured list of audit items to assess adherence to internal policies and regulatory requirements within the Finance Department. It ensures that all necessary financial controls and procedures are reviewed systematically to identify potential risks.

Important elements include documentation verification, transaction accuracy, and regulatory compliance checks. Maintaining clarity and updating the checklist regularly are vital for effective audit outcomes.

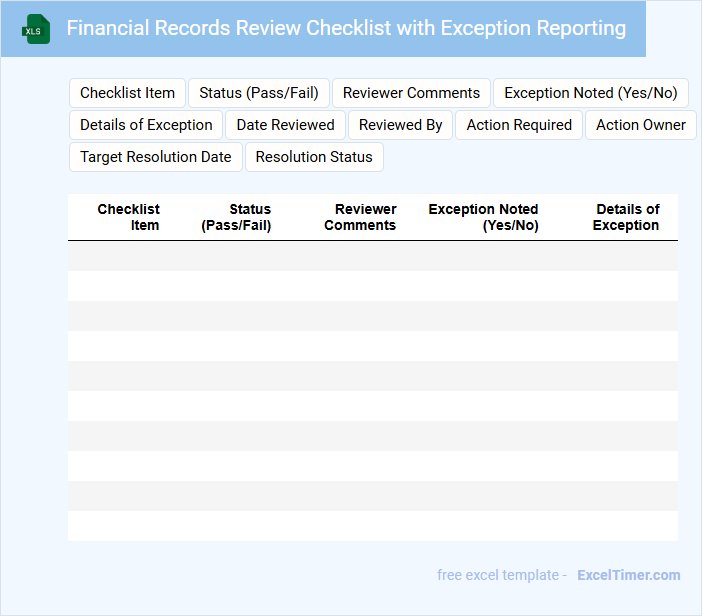

Financial Records Review Checklist with Exception Reporting

A Financial Records Review Checklist is typically used to systematically examine financial documents for accuracy and compliance. It helps identify discrepancies, errors, or anomalies through detailed exception reporting. This type of document ensures transparency and supports effective financial auditing processes.

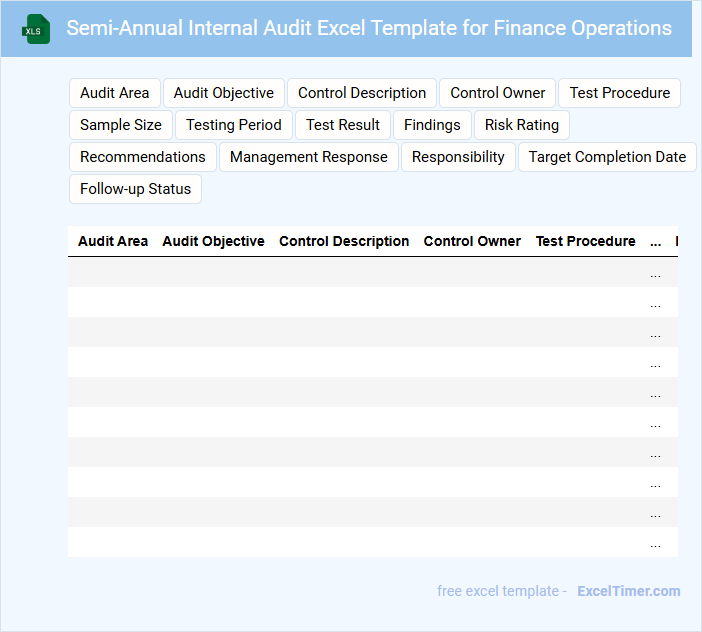

Semi-Annual Internal Audit Excel Template for Finance Operations

The Semi-Annual Internal Audit Excel Template for Finance Operations is designed to systematically review financial processes and controls every six months. It typically contains sections for risk assessment, compliance checks, and audit findings. This document helps organizations ensure accuracy and transparency in their financial reporting.

Important elements to include are clear audit objectives, detailed checklists tailored to finance operations, and a summary of identified issues with recommended actions. Regular use of this template promotes accountability and helps identify areas for continuous improvement. Embedding formulas to automate calculations can enhance efficiency and accuracy.

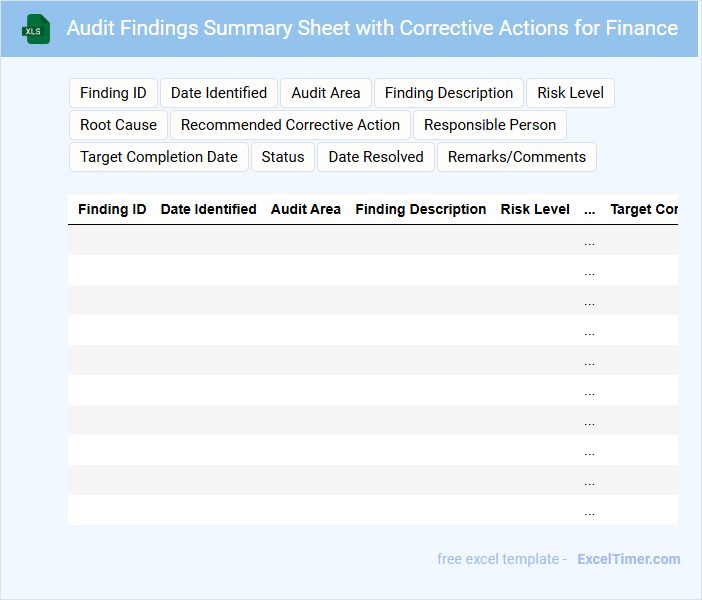

Audit Findings Summary Sheet with Corrective Actions for Finance

What information is typically included in an Audit Findings Summary Sheet with Corrective Actions for Finance? This document usually contains a detailed summary of audit findings related to financial processes, including identified discrepancies, compliance issues, and areas needing improvement. It also outlines specific corrective actions assigned to responsible parties, timelines for implementation, and follow-up measures to ensure resolution and prevent recurrence.

Why is it important to focus on corrective actions in this document? Emphasizing corrective actions ensures that financial risks are addressed promptly, compliance standards are maintained, and internal controls are strengthened. Clear, actionable steps help the finance team improve accuracy, transparency, and accountability in financial reporting and operations.

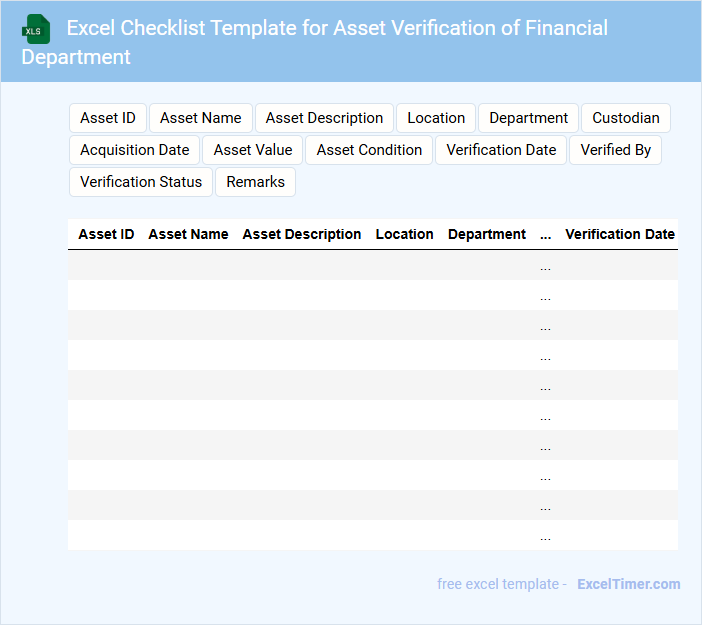

Excel Checklist Template for Asset Verification of Financial Department

This document typically contains a structured table to track and verify the physical and financial details of assets held by the financial department.

- Asset Identification: Unique asset codes and descriptions to ensure accurate tracking and avoid duplication.

- Verification Status: Columns to mark the current status, such as verified, pending, or discrepancies found.

- Responsible Personnel: Names or signatures of employees responsible for verifying and authorizing asset information.

Risk-Based Audit Checklist with Frequency Tracking for Finance

A Risk-Based Audit Checklist for finance typically contains a structured set of audit criteria focusing on areas with the highest financial risks. It includes detailed checkpoints that assess compliance, controls, and potential vulnerabilities within financial processes. Additionally, it features frequency tracking to ensure audits occur regularly and risks are monitored over time.

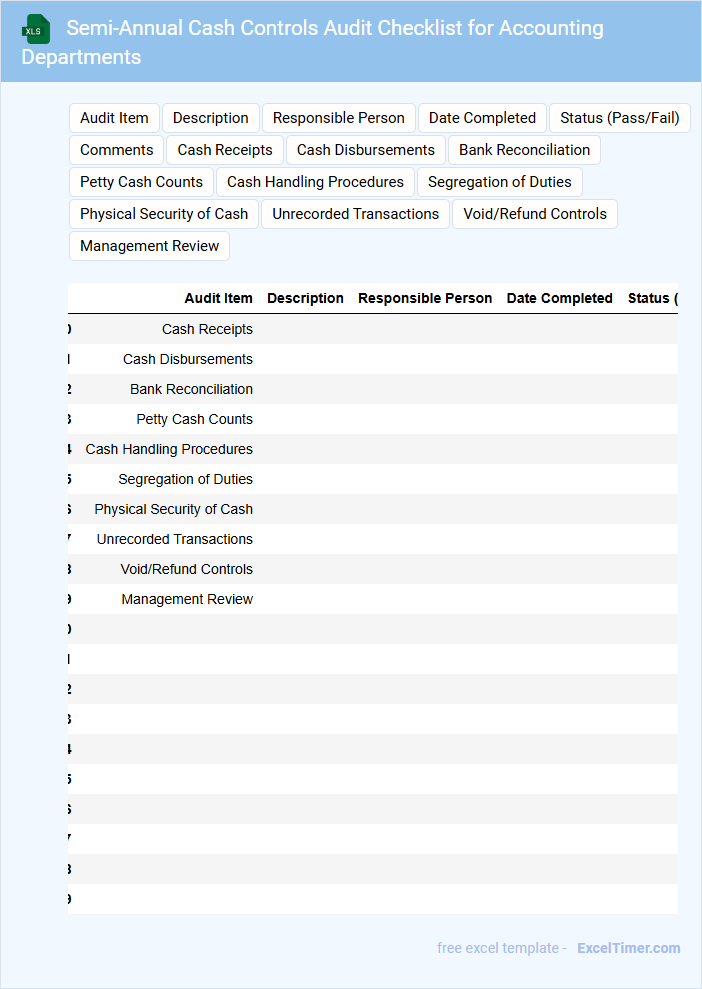

Semi-Annual Cash Controls Audit Checklist for Accounting Departments

This document typically contains a comprehensive list of procedures and checkpoints designed to evaluate the effectiveness and accuracy of cash handling and recording within an accounting department. It serves to ensure compliance with internal policies and external regulations while identifying areas for improvement.

- Verify the accuracy of cash balances against bank statements and ledger accounts.

- Review adherence to cash handling procedures to prevent fraud or misappropriation.

- Assess the segregation of duties among personnel responsible for cash transactions.

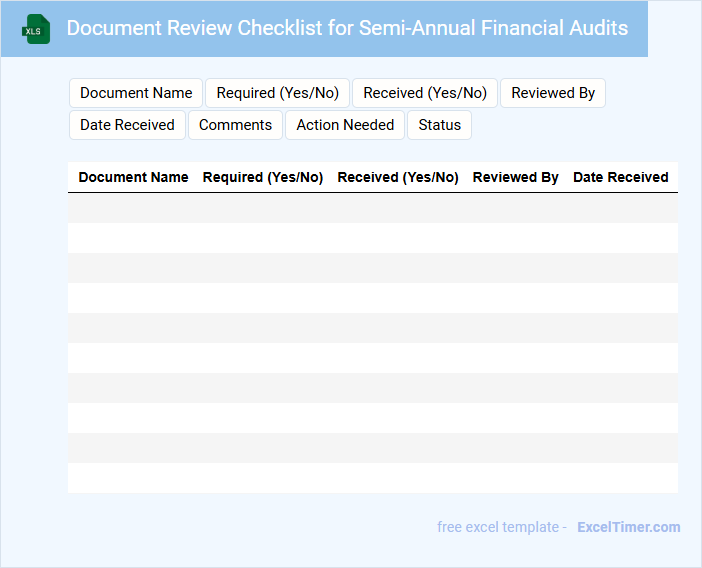

Document Review Checklist for Semi-Annual Financial Audits

The Document Review Checklist for Semi-Annual Financial Audits typically contains a comprehensive list of documents necessary to verify accurate financial reporting. It ensures all relevant financial statements, supporting schedules, and compliance records are thoroughly examined. This checklist helps auditors maintain consistency and completeness throughout the review process.

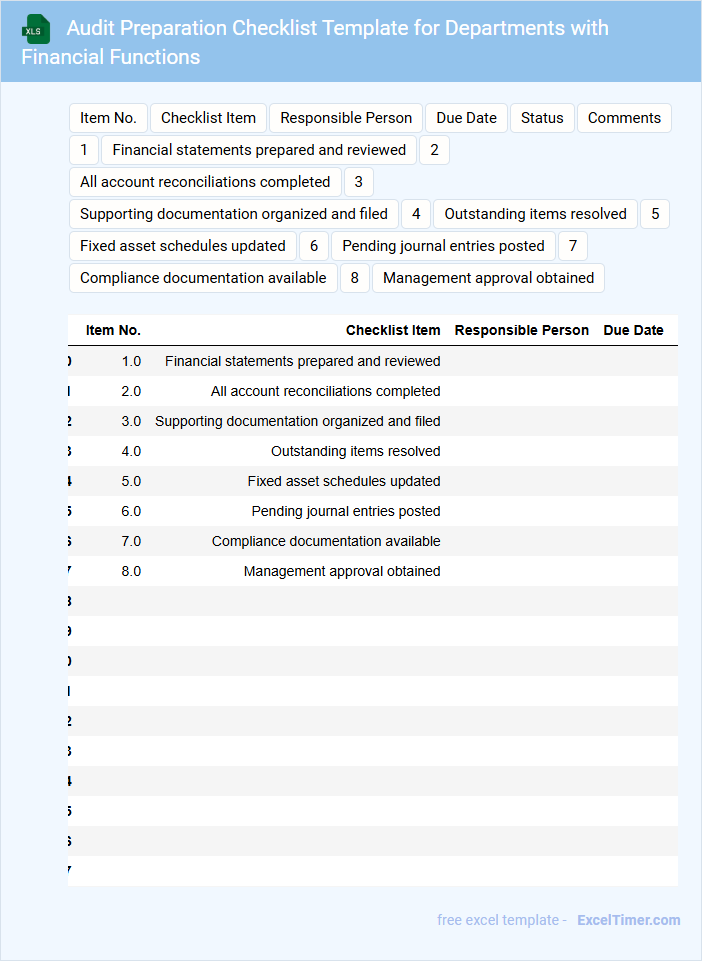

Audit Preparation Checklist Template for Departments with Financial Functions

What does an Audit Preparation Checklist Template for Departments with Financial Functions usually contain? It typically includes a detailed list of documents, records, and procedures needed to ensure compliance and readiness for financial audits. This helps departments systematically organize their financial data and internal controls.

What is an important consideration when using this template? Ensuring accuracy and completeness in financial documentation is crucial, as well as verifying that all departmental responsibilities are clearly assigned and understood. This reduces the risk of errors and supports a smooth audit process.

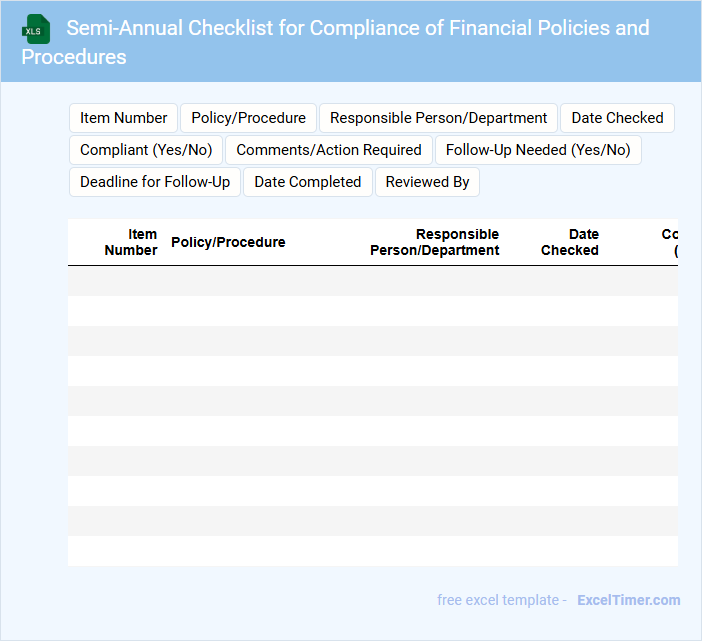

Semi-Annual Checklist for Compliance of Financial Policies and Procedures

The Semi-Annual Checklist for Compliance of Financial Policies and Procedures is a crucial document used to ensure adherence to established financial guidelines within an organization. It typically contains a detailed list of compliance tasks, verification points, and documentation requirements to be reviewed every six months. This helps in identifying any deviations and reinforcing internal controls effectively.

To maximize its effectiveness, it is important to include clear deadlines, assign responsible personnel for each task, and regularly update the checklist to reflect changes in financial regulations or company policies. Consistent use of this checklist supports transparency and accountability in financial management. Prioritizing accuracy and thorough documentation ensures ongoing compliance and risk mitigation.

What key financial controls and processes are reviewed during the semi-annual audit?

The semi-annual audit reviews key financial controls including revenue recognition, expense authorization, and segregation of duties. It assesses processes such as cash flow monitoring, account reconciliations, and compliance with financial policies. These evaluations ensure accuracy, prevent fraud, and maintain regulatory adherence within financial departments.

How are discrepancies or irregularities in financial records identified and documented?

Your semi-annual audit checklist includes detailed procedures to identify discrepancies or irregularities in financial records through systematic data reconciliation and variance analysis. Each identified issue is documented using standardized audit forms within the Excel document, ensuring clear tracking and accountability. This process enhances accuracy and supports compliance in your financial department.

Are all reconciliations, such as bank and subsidiary ledgers, properly completed and reviewed?

Ensure all reconciliations, including bank statements and subsidiary ledgers, are thoroughly completed and reviewed semi-annually. Accurate reconciliation is critical for identifying discrepancies and maintaining financial integrity. Document review processes must align with audit standards for the financial department checklist.

What measures are in place to ensure compliance with internal policies and regulatory requirements?

The Semi-annually Audit Checklist for Financial Departments includes comprehensive verification of transaction accuracy, internal controls adherence, and regulatory compliance. Key measures consist of documenting audit trails, reviewing expense reports, and validating approval workflows against established policies. Regular cross-checks of financial statements ensure alignment with both internal standards and external regulations.

How is supporting documentation for financial transactions verified and archived for the audit period?

You ensure supporting documentation for financial transactions is verified through cross-referencing invoices, receipts, and approval records against ledger entries. All verified documents are systematically archived using a secure, indexed digital or physical filing system for easy retrieval during the audit period. This process guarantees accuracy and compliance with financial auditing standards.