The Semi-annually Insurance Premium Excel Template for Family Accounts streamlines tracking and managing insurance payments over six-month periods. It allows users to easily organize premium due dates, amounts, and payment statuses for multiple family members in one place. This template enhances financial planning by providing clear visibility into upcoming expenses and ensuring timely payments.

Semi-Annually Insurance Premium Tracker for Family Accounts

What information is typically included in a Semi-Annually Insurance Premium Tracker for Family Accounts? This document usually contains detailed records of insurance premiums paid every six months for various family members, including policy numbers, payment dates, and amounts. It helps families monitor their expenses, ensure timely payments, and manage their insurance coverage effectively.

What important features should be incorporated for better tracking and management? It is essential to include due dates, total premium amounts, and reminders for upcoming payments. Additionally, categorizing premiums by policy type and maintaining a summary of coverage benefits can enhance clarity and financial planning.

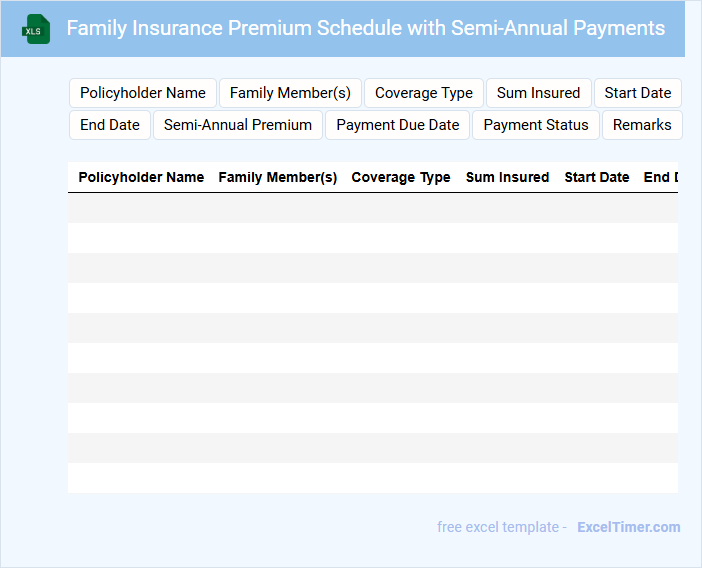

Family Insurance Premium Schedule with Semi-Annual Payments

A Family Insurance Premium Schedule with Semi-Annual Payments details the payment amounts and due dates for insurance coverage over a six-month period. It typically includes information on policyholder details, coverage limits, and payment breakdowns. This document helps families manage their insurance budget by providing clear, scheduled payment expectations.

When reviewing this schedule, it is important to verify the payment frequencies and the total premium amount to avoid missed payments and lapses in coverage. Tracking due dates and understanding the implications of late payments can ensure continuous protection for all insured family members. Always keep this document accessible for reference during the policy term.

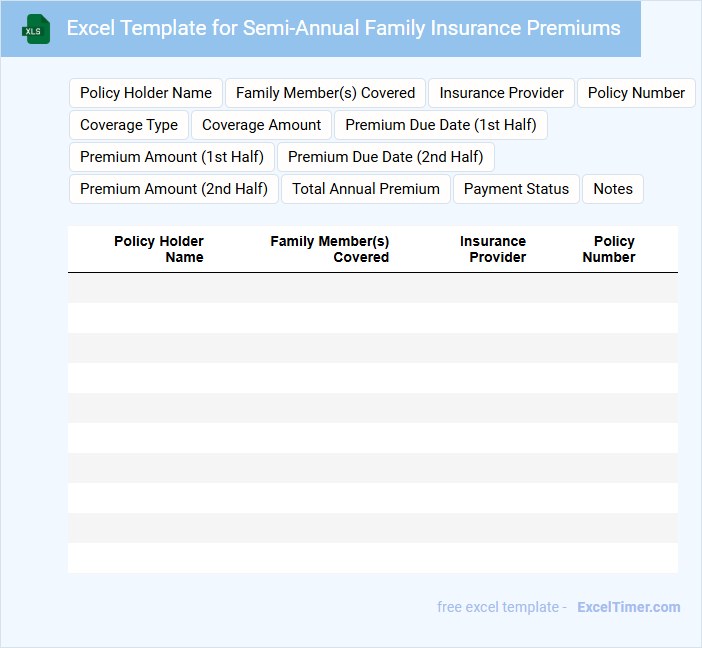

Excel Template for Semi-Annual Family Insurance Premiums

What information is typically included in an Excel Template for Semi-Annual Family Insurance Premiums?

This type of document usually contains detailed data about insurance policyholders, coverage types, premium amounts, payment dates, and total costs for each family member. It helps organize and track semi-annual payments, ensuring timely billing and financial planning for families.

Important elements to include are clear headers, formulas to calculate total premiums automatically, sections for individual family members, and reminders for payment deadlines to optimize accuracy and ease of use.

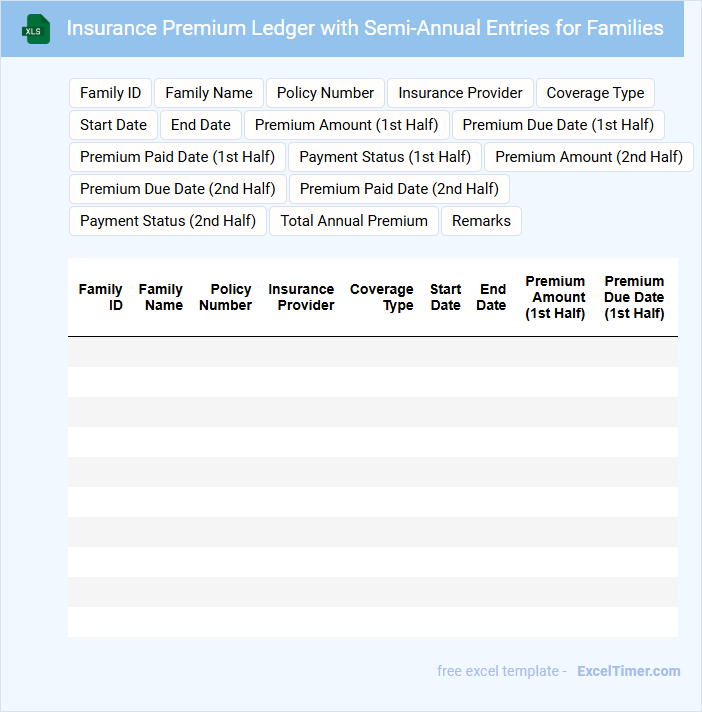

Insurance Premium Ledger with Semi-Annual Entries for Families

What information is typically contained in an Insurance Premium Ledger with Semi-Annual Entries for Families? This document usually lists the insurance premiums paid or due by families on a semi-annual basis, including payment dates, amounts, and coverage details. It helps track financial obligations and insurance coverage status over each half-year period.

Why is it important to maintain accuracy and timely updates in this ledger? Accurate entries ensure families are aware of their payment schedules and prevent lapses in coverage. Timely updates help insurance providers and families stay informed of payment statuses and reconcile accounts effectively.

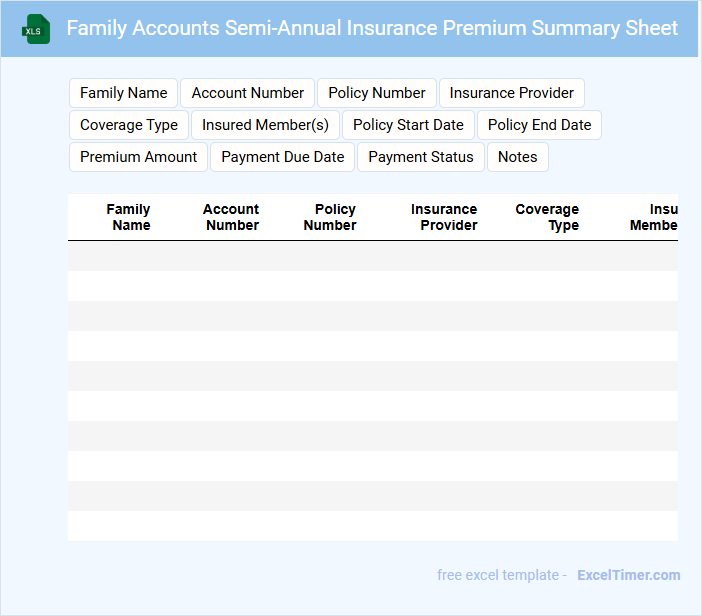

Family Accounts Semi-Annual Insurance Premium Summary Sheet

The Family Accounts Semi-Annual Insurance Premium Summary Sheet typically contains a detailed overview of all insurance premiums paid or due for the family within the six-month period. It highlights payment dates, amounts, and policy details to ensure clear financial tracking.

This document is crucial for monitoring expenses and maintaining accurate records for insurance claims and budgeting. Regularly reviewing the summary helps identify any discrepancies or missed payments early on.

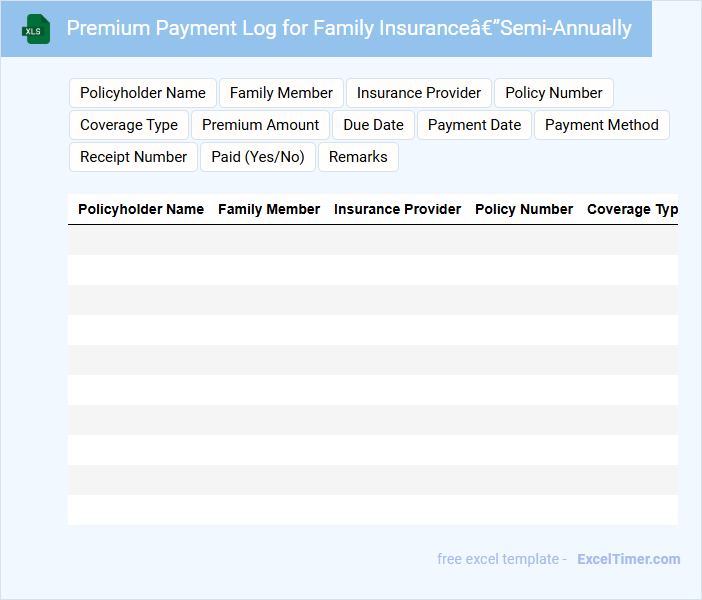

Premium Payment Log for Family Insurance—Semi-Annually

A Premium Payment Log for Family Insurance-Semi-Annually is a document used to record and track insurance premium payments made every six months for a family insurance policy. It helps ensure timely payments and provides a clear history for financial and insurance purposes.

- Include the payment date, amount paid, and payment method for each transaction.

- Maintain records of policy number and coverage details for easy reference.

- Note any outstanding balances or missed payments to avoid coverage lapses.

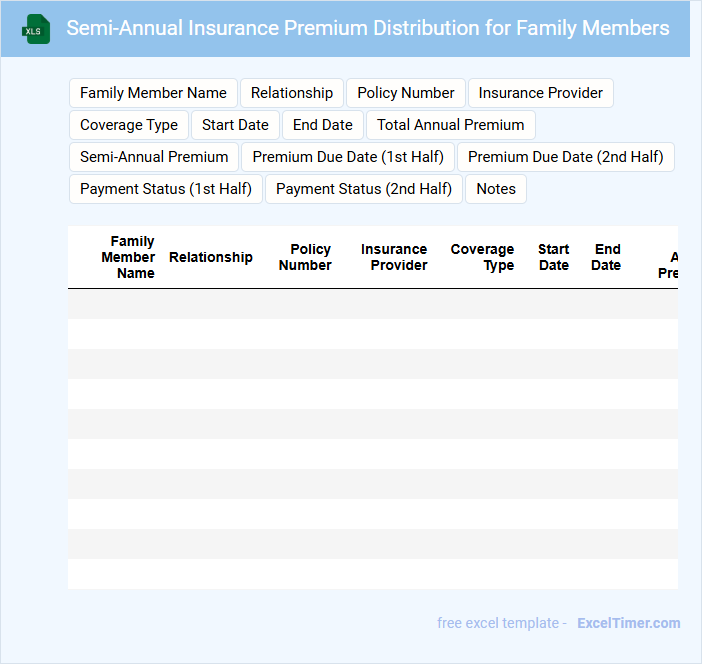

Semi-Annual Insurance Premium Distribution for Family Members

The Semi-Annual Insurance Premium Distribution document typically outlines the allocation of insurance premium payments made biannually for family members. It details the amounts paid, coverage periods, and beneficiary information. This record ensures transparency and accountability in insurance contributions.

Important for maintaining clear financial tracking, this document helps families and insurers monitor payment schedules and avoid missed premiums. Accurate distribution records also support effective claim processing and policy management. Including contact information for policyholders and insurers is recommended for quick resolution of discrepancies.

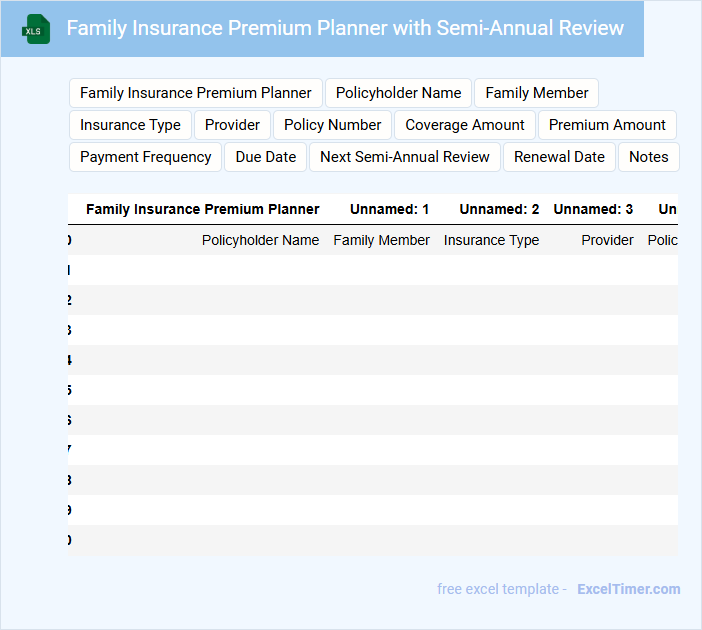

Family Insurance Premium Planner with Semi-Annual Review

The Family Insurance Premium Planner is a document designed to help families organize and forecast their insurance payments systematically. It typically contains details on various insurance policies, coverage amounts, premium due dates, and payment schedules.

An essential feature is the Semi-Annual Review section, which encourages periodic evaluation of the insurance needs to adjust coverage and premiums accordingly. This helps ensure that the family remains adequately protected as their circumstances change.

Including reminders for review dates and notes on potential policy updates can enhance the planner's effectiveness.

Excel Workbook for Tracking Semi-Annually Family Insurance Premiums

What information is typically contained in an Excel Workbook for Tracking Semi-Annually Family Insurance Premiums? This type of document usually includes detailed records of insurance premium payments made every six months for each family member, policy numbers, due dates, and payment statuses. It helps in organizing and managing financial obligations by providing a clear overview of upcoming and past payments.

What is an important feature to include in such a workbook? It is essential to incorporate automated reminders or conditional formatting to highlight upcoming or overdue payments, ensuring timely renewals and avoiding coverage lapses.

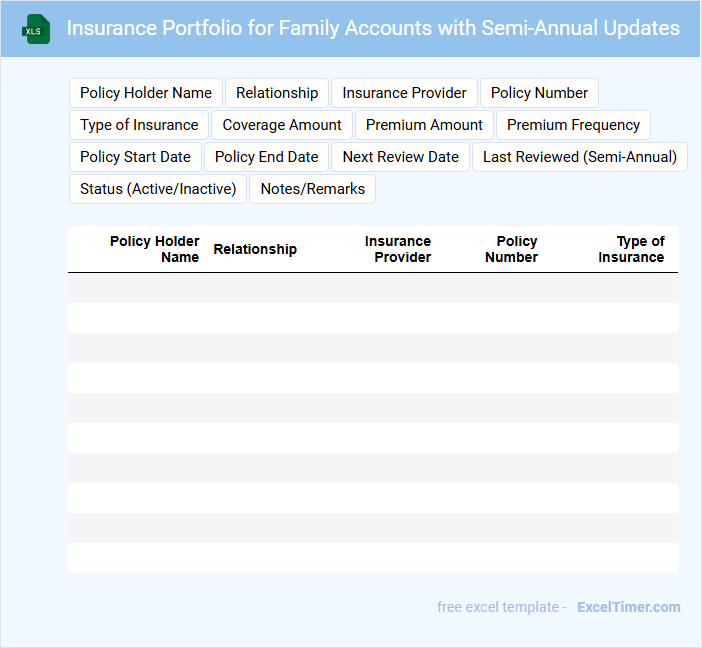

Insurance Portfolio for Family Accounts with Semi-Annual Updates

An Insurance Portfolio for Family Accounts is a comprehensive document outlining various insurance policies covering family members. It typically contains policy details, coverage amounts, beneficiary information, and renewal dates. Semi-annual updates ensure that the portfolio remains accurate and reflects any changes in coverage or family circumstances.

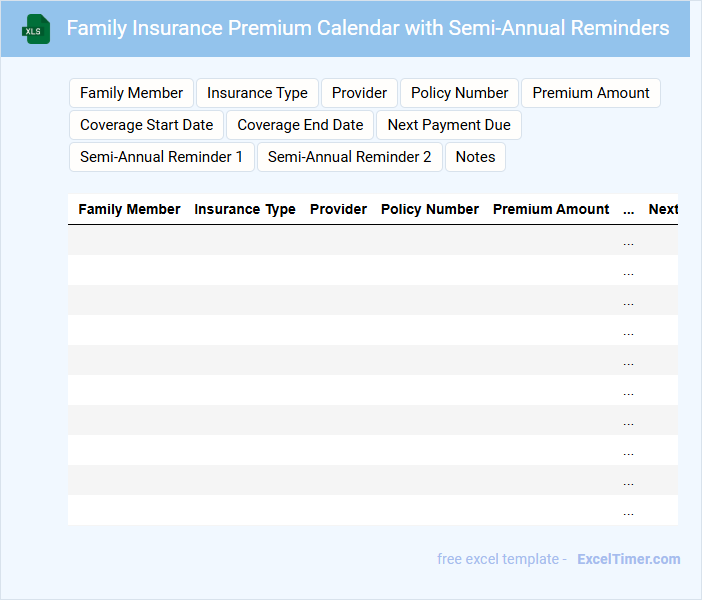

Family Insurance Premium Calendar with Semi-Annual Reminders

This document typically contains a schedule of family insurance premium due dates along with semi-annual reminders to ensure timely payments.

- Payment Dates: Clearly listed premium due dates for each family member's insurance plan.

- Reminder Notifications: Semi-annual alerts to prevent missed payments and policy lapses.

- Coverage Details: Summary of coverage types and amounts associated with each premium.

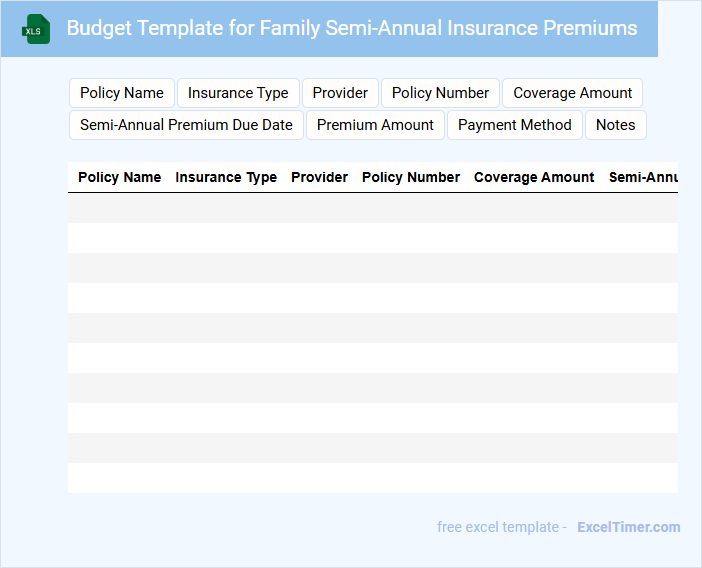

Budget Template for Family Semi-Annual Insurance Premiums

What information is typically included in a budget template for family semi-annual insurance premiums? This type of document usually contains detailed entries for each family member's insurance policies, premium amounts, and due dates over a six-month period. It helps families organize and plan their finances to ensure timely payments and avoid lapses in coverage.

What is an important consideration when using this budget template? It is crucial to regularly update the template with any changes in premium costs or policy adjustments to maintain accurate financial tracking and avoid unexpected expenses. Additionally, setting reminders for payment deadlines can help prevent missed premiums and lapses in insurance protection.

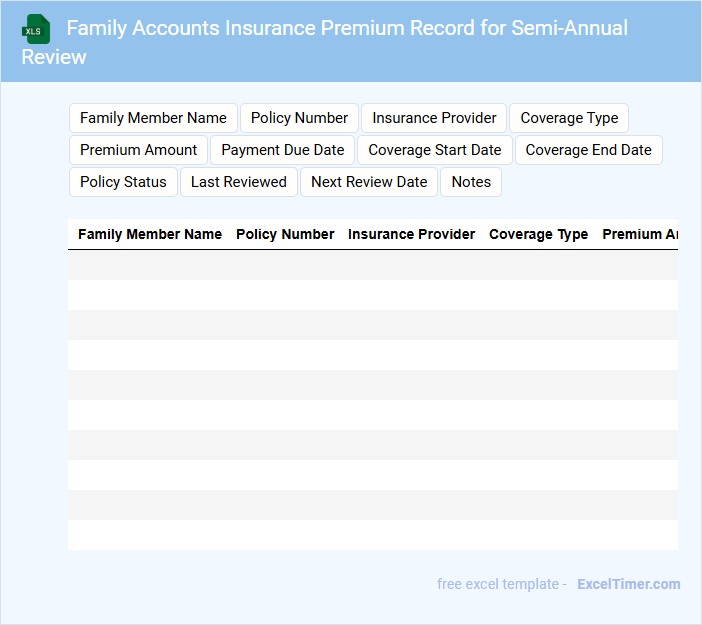

Family Accounts Insurance Premium Record for Semi-Annual Review

A Family Accounts Insurance Premium Record typically contains detailed information about the insurance premiums paid by a family over a specific period. It includes data such as payment dates, amounts, and policy details to help track expenses accurately. For a semi-annual review, it is important to ensure all entries are up to date and verify any changes in coverage or premium rates.

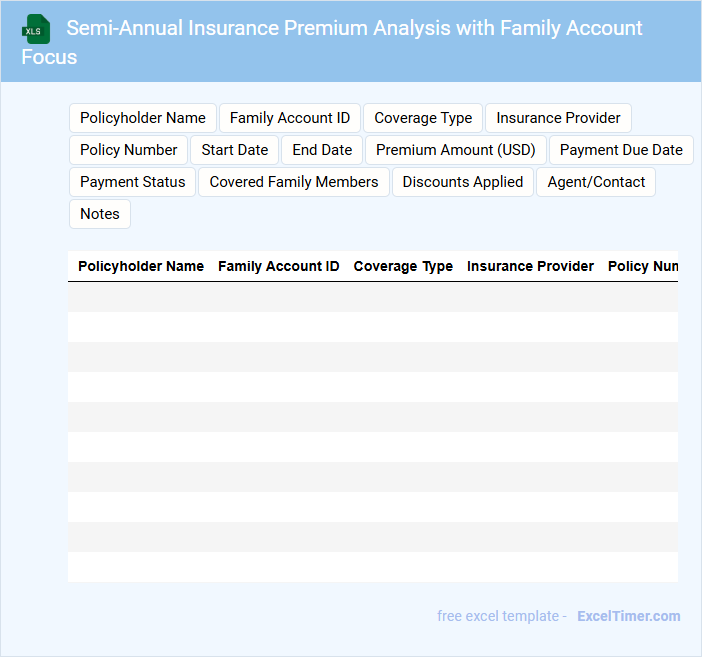

Semi-Annual Insurance Premium Analysis with Family Account Focus

This document typically contains a detailed review and assessment of insurance premiums paid over a six-month period, highlighting trends and cost-saving opportunities. It focuses on a family account to ensure coverage adequacy and financial efficiency.

- Summarize premium payments and policy changes within the family account.

- Identify discrepancies or unusual premium increases for further investigation.

- Provide actionable recommendations to optimize insurance costs and benefits.

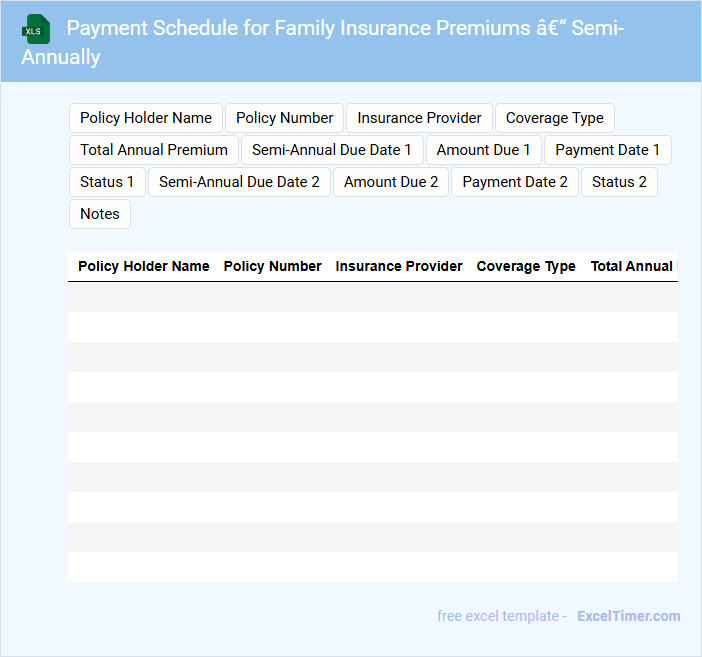

Payment Schedule for Family Insurance Premiums – Semi-Annually

A Payment Schedule for Family Insurance Premiums – Semi-Annually outlines the dates and amounts due for insurance premium payments every six months. It helps families manage their financial planning by providing clear payment timelines.

- The document usually contains the total premium amount, payment due dates, and coverage period details.

- It is important to verify the premium amounts and due dates to avoid lapses in coverage.

- Keeping a copy of the schedule for reference can ensure timely payments and help resolve any billing disputes.

How do you calculate the total semi-annual insurance premium for multiple family members in one Excel sheet?

To calculate the total semi-annual insurance premium for multiple family members in one Excel sheet, sum the individual premiums listed in each member's premium cell using the SUM function. For example, if premiums are in cells B2 to B10, use the formula =SUM(B2:B10) to get the total. Ensure all premiums are entered on a semi-annual basis to maintain accurate aggregation.

Which Excel formula can automatically update premium amounts when adding or removing family members?

Use the SUMIF formula to automatically update semi-annual insurance premiums for family accounts by summing premiums based on member status. Your Excel sheet can dynamically adjust total premiums when adding or removing family members by referencing their individual premium entries. This formula ensures accurate and efficient premium management in your family insurance document.

How can you use conditional formatting to highlight overdue semi-annual premium payments in a family account spreadsheet?

To highlight overdue semi-annual insurance premium payments in your family account Excel spreadsheet, apply conditional formatting with a formula comparing the payment due date against the current date. Use a formula like =AND(TODAY()>DueDateCell, PaymentStatusCell="Unpaid") to format cells where premiums are overdue and unpaid. This approach ensures you instantly identify late payments for prompt follow-up.

What is the most efficient way to summarize semi-annual premium payment history for each family member using Excel functions?

Use the SUMIFS function in Excel to efficiently summarize semi-annual insurance premium payments by filtering amounts based on each family member and the corresponding semi-annual period. Create a dynamic date range with EDATE to define six-month intervals for accurate aggregation. PivotTables also offer an effective way to group and summarize these payments by family member and half-year periods.

How can Excel's Data Validation feature prevent entry errors when recording semi-annual insurance premiums for family accounts?

Excel's Data Validation feature ensures accurate entry of semi-annual insurance premiums for family accounts by restricting inputs to numerical values within a specified range, such as minimum and maximum premium amounts. Custom validation rules can enforce correct date formats for premium periods, preventing errors in payment scheduling. Drop-down lists for predefined family account names streamline data consistency and reduce typos.