The Semi-annually Excel Template for Tax Filing Preparation streamlines the organization of financial data every six months, ensuring accurate tracking of income and expenses. It helps users maintain compliance with tax regulations by automatically calculating relevant tax obligations and deadlines. This template is essential for reducing errors and saving time during the tax filing process.

Semi-Annual Expense Tracker for Tax Filing Preparation

A Semi-Annual Expense Tracker for Tax Filing Preparation typically contains detailed records of all expenses incurred over six months to ensure accurate tax reporting.

- Detailed Categorization: Expenses should be categorized clearly to simplify tax deductions.

- Accurate Receipts: Keep all relevant receipts to support expense claims during filing.

- Regular Updates: Maintain and update the tracker consistently for precise and hassle-free tax preparation.

Income and Deductions Log for Semi-Annual Tax Preparation

The Income and Deductions Log typically contains detailed records of all income sources and deductible expenses over a specific period, essential for accurate semi-annual tax preparation. It helps track earnings and spending to ensure compliance with tax regulations.

Maintaining an organized and up-to-date log is crucial for minimizing errors and maximizing potential deductions. Regular entries and receipts management simplify the tax filing process, saving time and reducing audit risks.

Ensure you include all relevant income types and keep receipts or documentation for every deduction claimed.

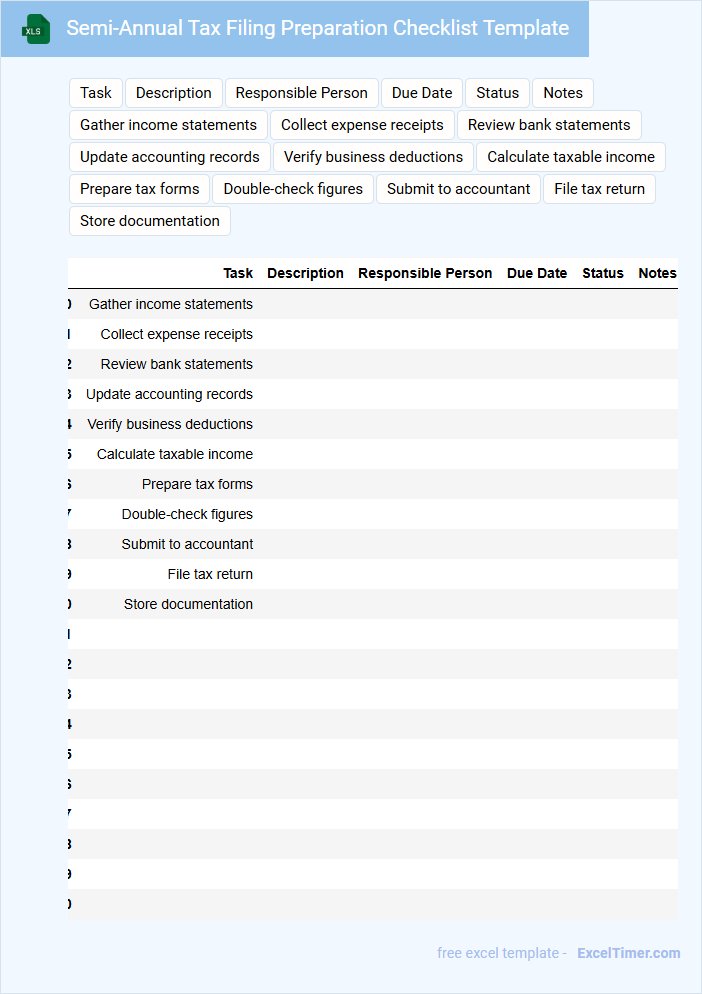

Semi-Annual Tax Filing Preparation Checklist Template

The Semi-Annual Tax Filing Preparation Checklist Template typically contains organized sections for tracking income, expenses, and deductible items relevant to the tax period. It helps ensure all necessary documents, such as receipts and financial statements, are compiled and reviewed accurately. This template is essential for simplifying the tax filing process and avoiding errors or omissions.

Important suggestions include regularly updating the checklist throughout the semi-annual period, double-checking for eligibility of deductions, and consulting with a tax professional to confirm compliance with current tax laws. Maintaining detailed records and timely entries can significantly reduce last-minute stress and potential penalties.

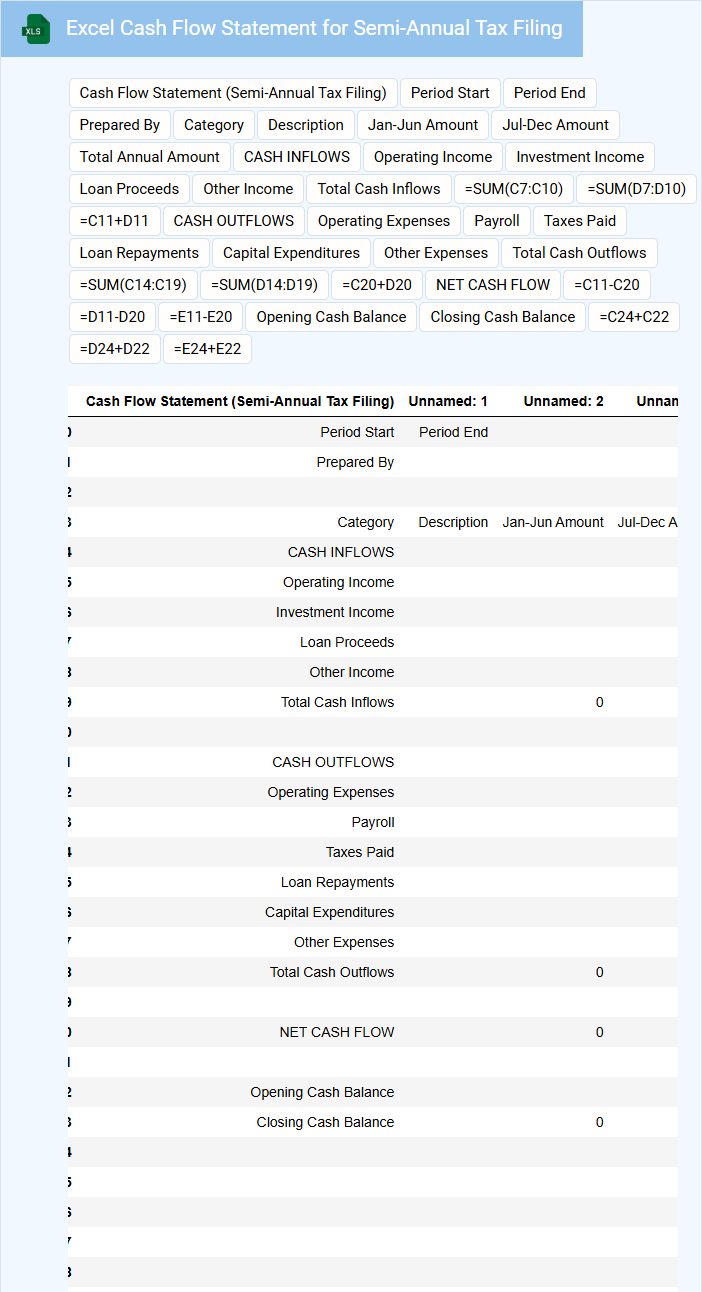

Excel Cash Flow Statement for Semi-Annual Tax Filing

An Excel Cash Flow Statement for Semi-Annual Tax Filing typically contains a detailed record of cash inflows and outflows over a six-month period to assist in accurate tax reporting.

- Cash Inflows: Document all sources of income including sales, loans, and investment returns.

- Cash Outflows: Track all payments such as expenses, salaries, and tax liabilities.

- Reconciliation: Ensure the opening and closing cash balances align with bank statements for accuracy.

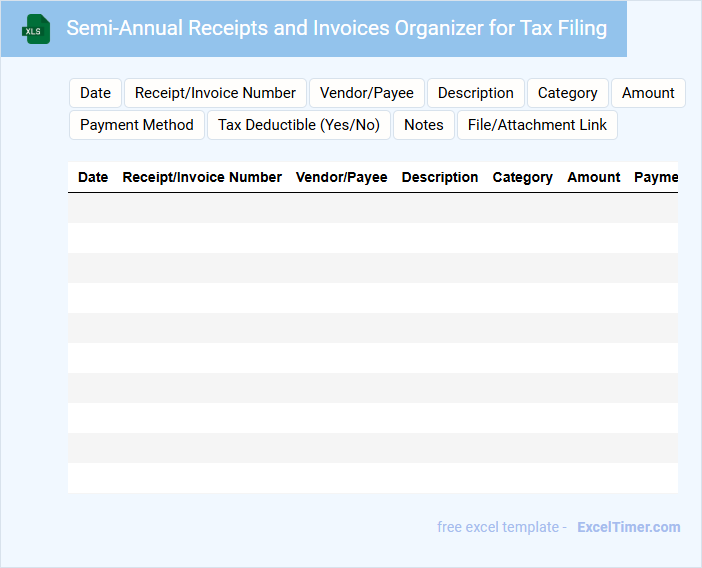

Semi-Annual Receipts and Invoices Organizer for Tax Filing

This document is a Semi-Annual Receipts and Invoices Organizer, designed to help individuals and businesses systematically collect and track their financial transactions every six months. It typically contains categorized entries of receipts, invoices, payment dates, and amounts to ensure accurate reporting.

Organizing these records is crucial for efficient Tax Filing, as it simplifies the process of claiming deductions and verifying income. Maintaining clear, chronological order and including supporting documents are important for accuracy and compliance.

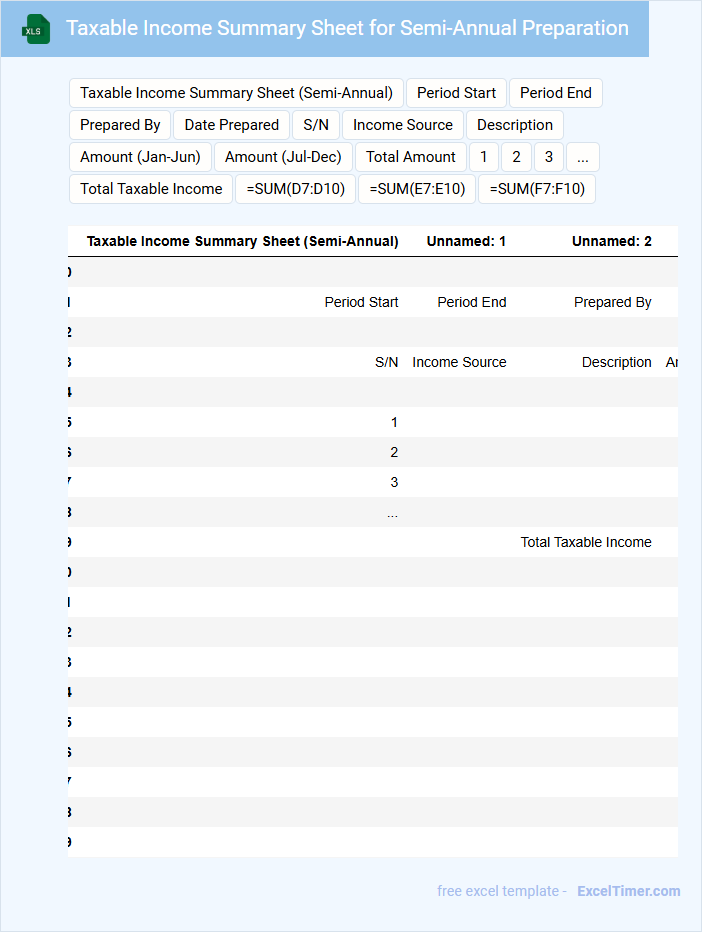

Taxable Income Summary Sheet for Semi-Annual Preparation

A Taxable Income Summary Sheet is a crucial document used in the semi-annual preparation of tax returns, consolidating all relevant income data. It typically contains summaries of earnings, deductions, and adjustments that affect the taxable income calculation. Ensuring accuracy in this sheet is vital for compliance and optimizing tax liabilities.

Semi-Annual Asset and Liability Register for Tax Filing

This document provides a detailed record of a company's assets and liabilities reviewed twice a year, essential for accurate tax reporting. It ensures compliance with tax laws by maintaining up-to-date financial information.

- Include all current assets and liabilities as of the reporting date.

- Verify the accuracy of each entry to avoid discrepancies during audits.

- Maintain supporting documents for all listed items to substantiate claims.

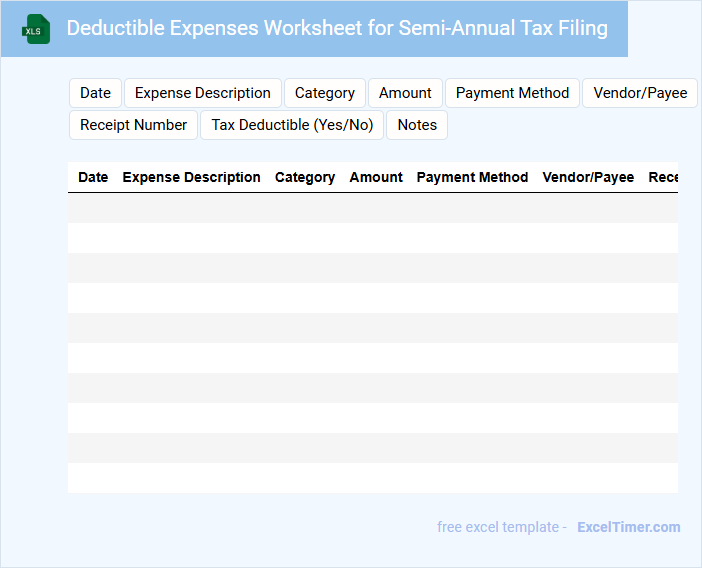

Deductible Expenses Worksheet for Semi-Annual Tax Filing

A Deductible Expenses Worksheet for Semi-Annual Tax Filing typically contains a detailed list of expenses that can be claimed to reduce taxable income when filing taxes twice a year.

- Expense Categories: It organizes expenses into categories such as travel, office supplies, and utilities for clarity.

- Documentation Needs: It emphasizes the importance of retaining receipts and invoices to substantiate claims.

- Accurate Totals: It ensures expenses are accurately totaled to maximize deductions without errors.

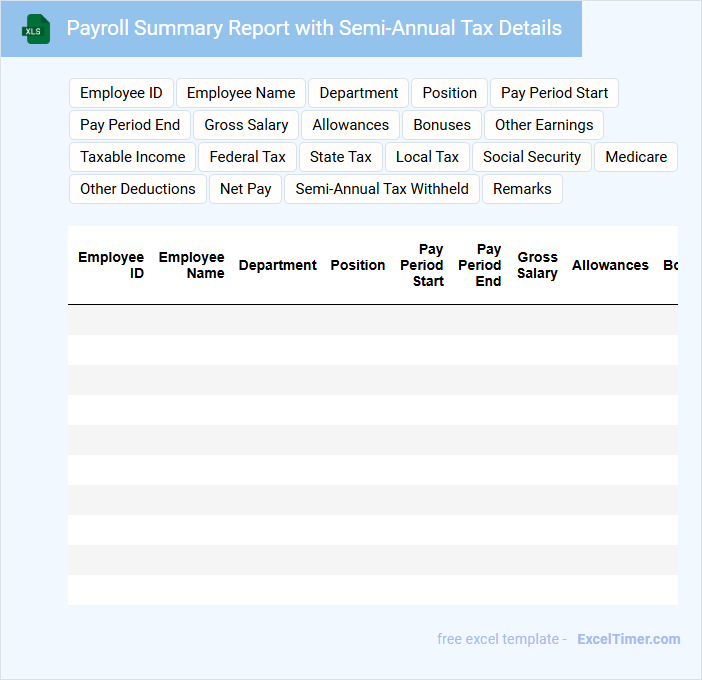

Payroll Summary Report with Semi-Annual Tax Details

The Payroll Summary Report consolidates employee salary data and tax deductions over a specific timeframe, providing a clear overview of payments made. It typically includes details such as gross wages, net pay, tax withholdings, and other deductions.

When this report features Semi-Annual Tax Details, it highlights tax liabilities and compliance status for the six-month period. Including accurate tax codes and employee identification ensures regulatory adherence and aids in financial auditing.

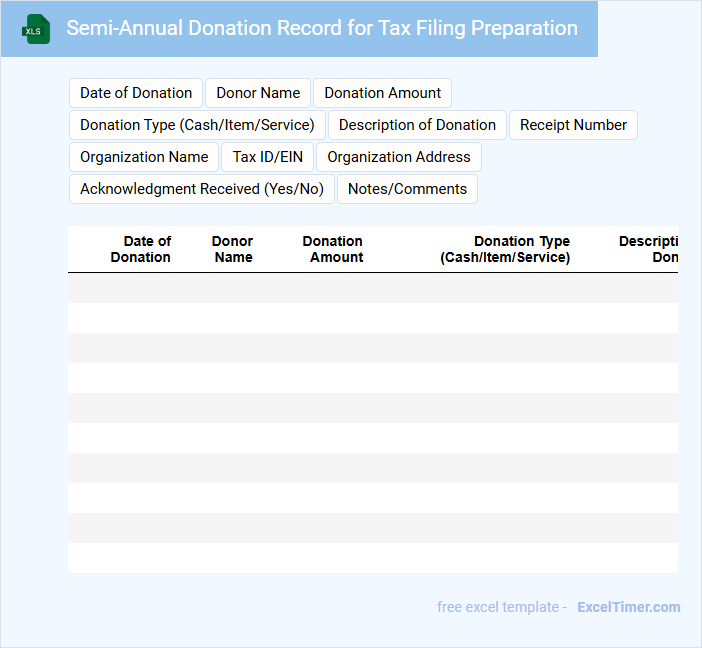

Semi-Annual Donation Record for Tax Filing Preparation

A Semi-Annual Donation Record is a crucial document that tracks all charitable contributions made over a six-month period. It typically includes donor details, donation amounts, dates, and receipts for tax purposes. Maintaining this record helps ensure accurate and efficient tax filing preparation by providing verified proof of donations.

Excel Template for Semi-Annual Capital Gains Tracking

An Excel Template for Semi-Annual Capital Gains Tracking is typically used to monitor and record investment gains over a six-month period. It contains various columns for asset details, purchase and sale dates, cost basis, and realized profits. Ensuring accurate data entry and regular updates is essential for effective financial analysis and tax reporting.

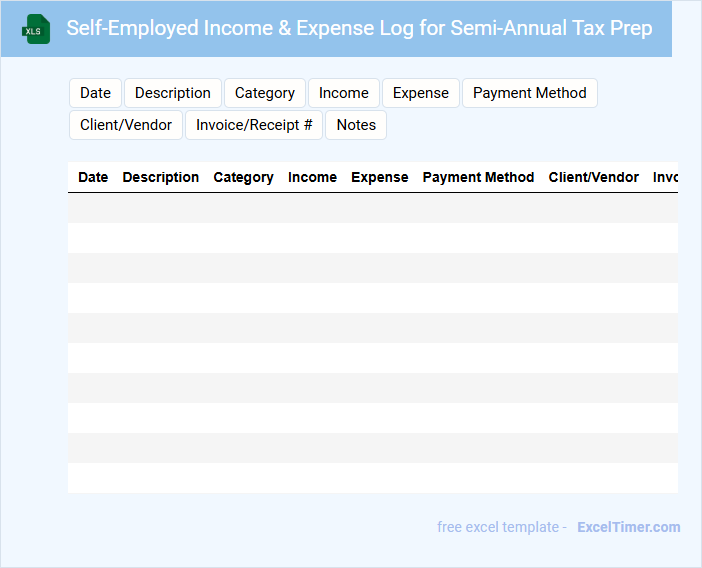

Self-Employed Income & Expense Log for Semi-Annual Tax Prep

This document typically contains detailed records of income and expenses to accurately report earnings and deductions for tax purposes.

- Income Tracking: Record all sources of self-employment income with dates and amounts for precise calculation.

- Expense Documentation: Log all business-related expenses with receipts and categories to maximize deductions.

- Regular Updates: Maintain the log consistently to ensure accuracy and ease during semi-annual tax preparation.

Budgeting Worksheet with Semi-Annual Tax Categories

Budgeting Worksheets with Semi-Annual Tax Categories typically contain detailed financial plans that help individuals or businesses allocate income and expenses while tracking tax obligations twice a year.

- Income tracking: Document all sources of income to ensure accurate tax calculations and budgeting.

- Expense categorization: Classify expenses to facilitate better financial analysis and tax deductions.

- Tax scheduling: Plan semi-annual tax payments to avoid penalties and maintain cash flow.

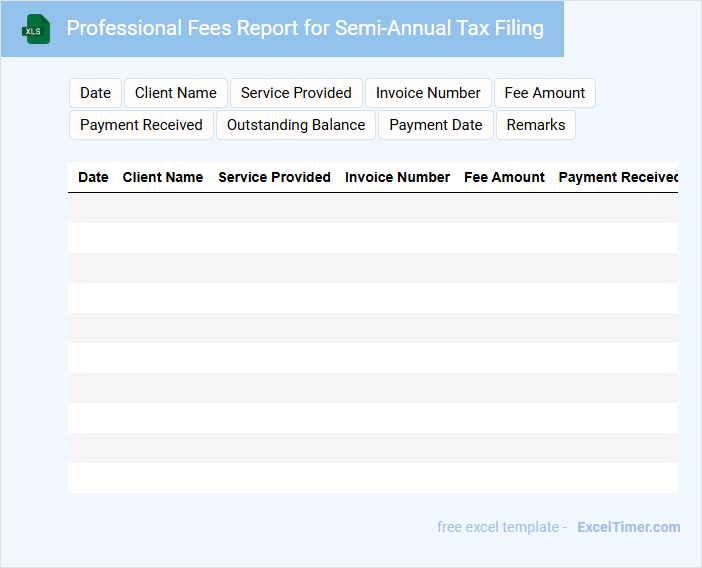

Professional Fees Report for Semi-Annual Tax Filing

A Professional Fees Report for semi-annual tax filing typically contains detailed records of all expenses related to professional services incurred within the reporting period. It summarizes invoices, payment statuses, and categorizes fees by service type for accurate tax deduction purposes. Ensuring clarity and completeness in documentation is crucial for compliance and audit readiness.

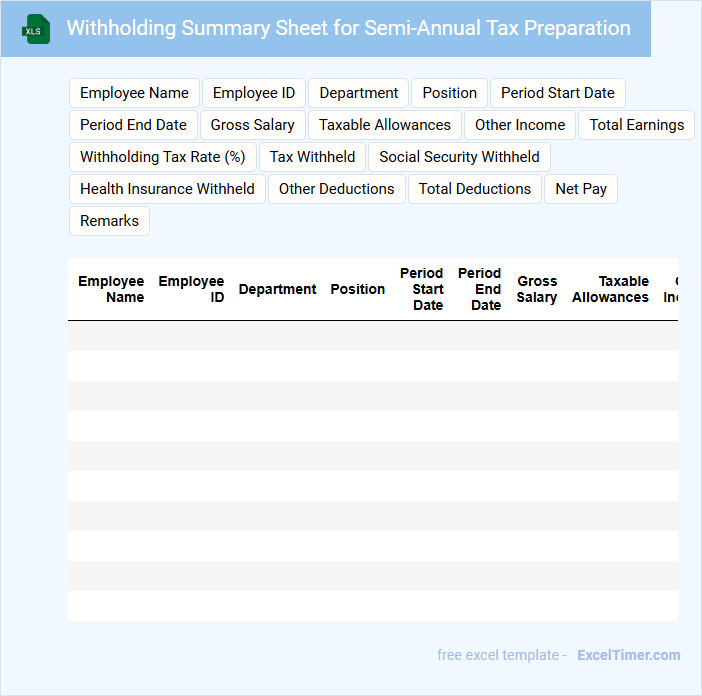

Withholding Summary Sheet for Semi-Annual Tax Preparation

What information is typically included in a Withholding Summary Sheet for Semi-Annual Tax Preparation? This document usually contains a detailed summary of all tax withholdings made over the past six months, including employee and employer contributions. It helps ensure accurate reporting and compliance with tax regulations during the semi-annual tax filing process.

Why is it important to review the Withholding Summary Sheet before finalizing tax documents? Reviewing ensures that all withheld amounts are correctly recorded and aligns with payroll records, reducing the risk of errors and penalties. Additionally, verifying this sheet supports accurate tax payments and simplifies the reconciliation process.

What semi-annual transactions or expenses need to be tracked for accurate tax filing preparation in Excel?

Track semi-annual transactions such as estimated tax payments, payroll tax deposits, and business expense reimbursements for accurate tax filing preparation. Your Excel document should include categories for interest income, asset depreciation, and invoice payments due every six months. Maintaining detailed records of these expenses ensures compliance and precise financial reporting.

How do you categorize semi-annual income and deductions within an Excel tax worksheet?

Categorize semi-annual income and deductions in an Excel tax worksheet by creating separate columns labeled with the specific six-month periods, such as "Jan-Jun" and "Jul-Dec." Use filters or pivot tables to summarize totals for each period, ensuring accurate tracking of income and deductions within those intervals. Apply consistent formulas to calculate semi-annual tax liabilities based on aggregated data.

Which Excel formulas or functions help calculate totals and averages for semi-annual tax data?

Use the SUM and AVERAGE functions in Excel to calculate totals and averages for your semi-annual tax filing preparation. The SUM function quickly adds values for each half-year period, while AVERAGE determines the mean tax data across six-month intervals. Combining these formulas streamlines accurate semi-annual tax calculations.

What templates or features can you use in Excel to set reminders for semi-annual tax filing tasks?

Excel offers built-in calendar templates and conditional formatting features to help you set reminders for semi-annual tax filing tasks. You can create custom alerts using formulas with dates and utilize Excel's data validation or Power Query to track deadlines. Setting up automated notifications with VBA macros enhances timely preparation and compliance for tax filing schedules.

How should you organize semi-annual supporting documents and receipts in Excel for efficient tax preparation?

Organize your semi-annual supporting documents and receipts in Excel by creating separate worksheets for each tax category such as income, expenses, and deductions. Use clearly labeled columns for dates, amounts, descriptions, and vendor details to ensure accurate tracking. Maintaining consistent data entry and regular updates enhances efficiency during tax filing preparation.