The Semi-annually Excel Template for Financial Reporting streamlines the tracking and analysis of financial data every six months, enhancing accuracy and efficiency. It includes pre-built formulas and customizable sections to help businesses monitor revenue, expenses, and profitability trends over biannual periods. Utilizing this template ensures consistent, clear financial presentations that facilitate informed decision-making and compliance with reporting standards.

Semi-Annual Financial Report with Income Statement

A Semi-Annual Financial Report typically contains key financial statements, including the Income Statement, Balance Sheet, and Cash Flow Statement, providing a snapshot of a company's financial performance over six months. It highlights revenues, expenses, profits, and losses to help stakeholders evaluate operational efficiency and profitability. An important aspect is ensuring the data's accuracy and consistency for reliable decision-making.

Excel Template for Semi-Annual Budget Tracking

The Excel Template for Semi-Annual Budget Tracking is designed to streamline financial management by organizing income and expenses over a six-month period. It typically includes sections for categorizing costs, tracking fund allocations, and summarizing variances between projected and actual spending. This document aids in maintaining financial discipline and enhancing budget visibility for better decision-making.

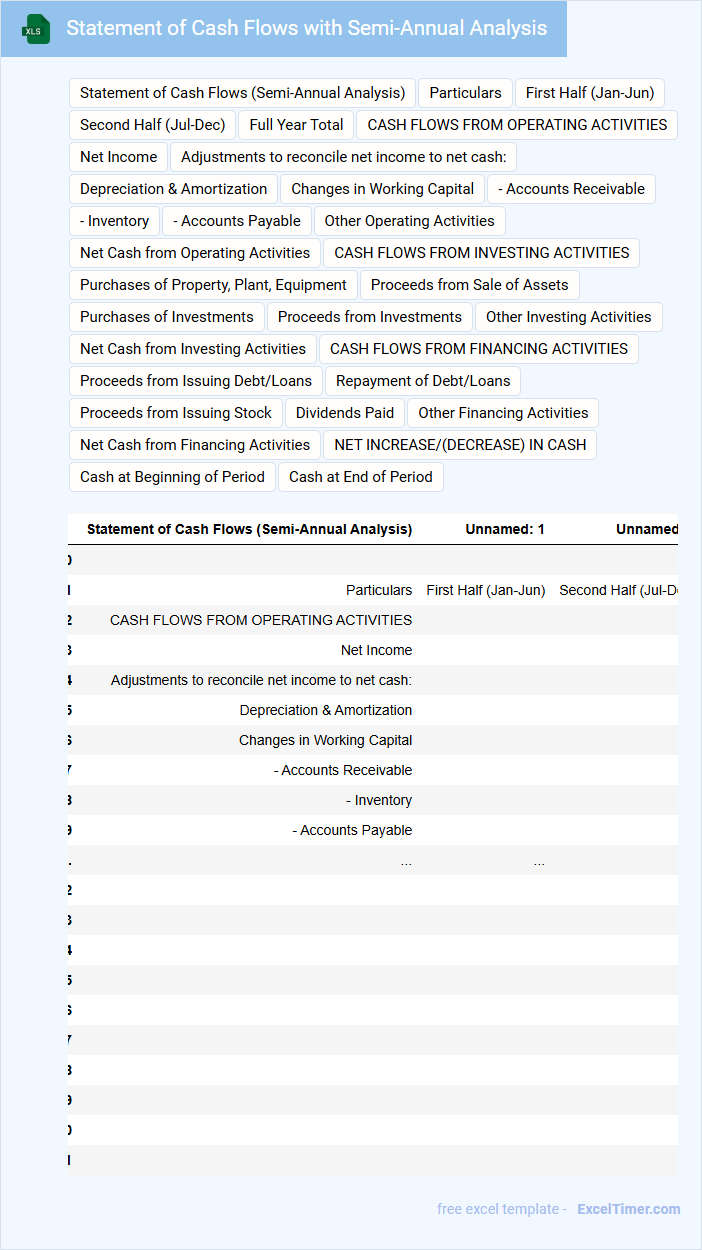

Statement of Cash Flows with Semi-Annual Analysis

What information is typically included in a Statement of Cash Flows with Semi-Annual Analysis? This type of document usually contains detailed data on cash inflows and outflows from operating, investing, and financing activities over two six-month periods. It provides a comparative overview that helps in assessing the company's liquidity and financial performance on a semi-annual basis.

Why is a semi-annual breakdown important in cash flow analysis? A semi-annual analysis allows stakeholders to detect seasonal trends and changes in cash management strategies within the year. It is also important to highlight significant cash flow variations and ensure accurate timing of cash movements for better decision-making.

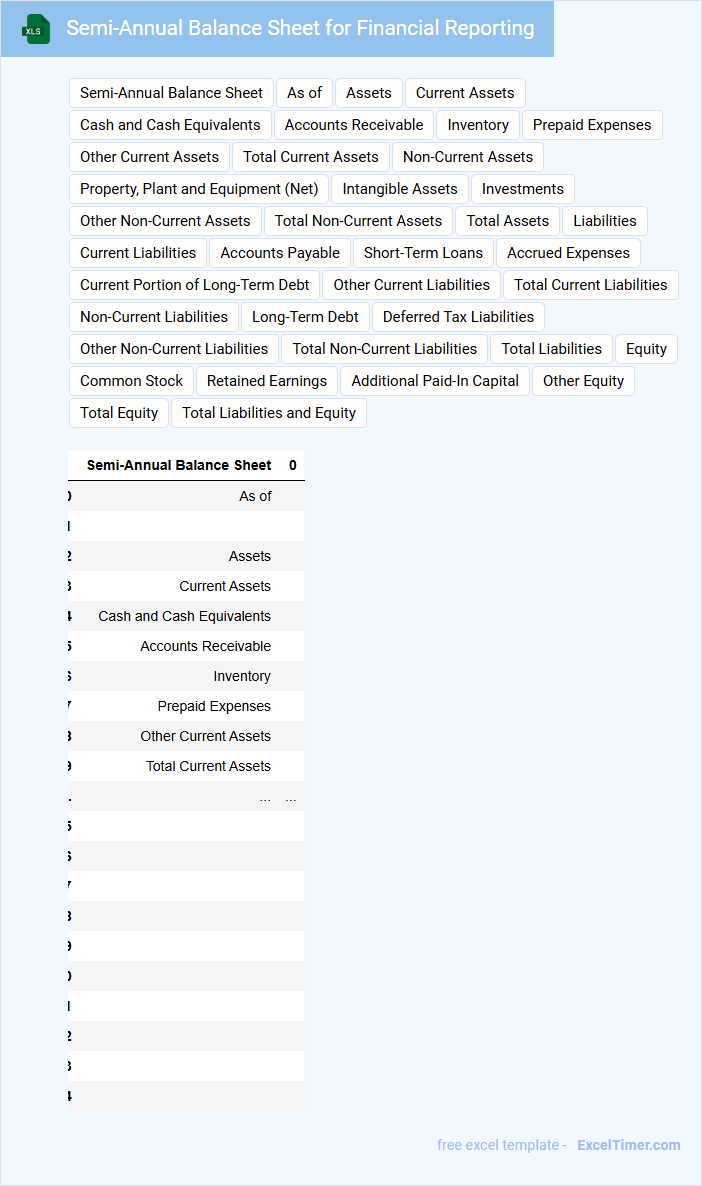

Semi-Annual Balance Sheet for Financial Reporting

What information does a Semi-Annual Balance Sheet for Financial Reporting typically contain?

A Semi-Annual Balance Sheet usually contains detailed financial data reflecting a company's assets, liabilities, and equity as of the mid-year mark. It provides a snapshot of the company's financial position, helping stakeholders assess financial health and make informed decisions.

What important considerations should be taken when preparing a Semi-Annual Balance Sheet?

Accuracy and consistency in recording financial transactions are critical to ensure reliability and comparability with previous reports. Additionally, it is important to follow regulatory standards and disclose any significant changes or events impacting the financial position.

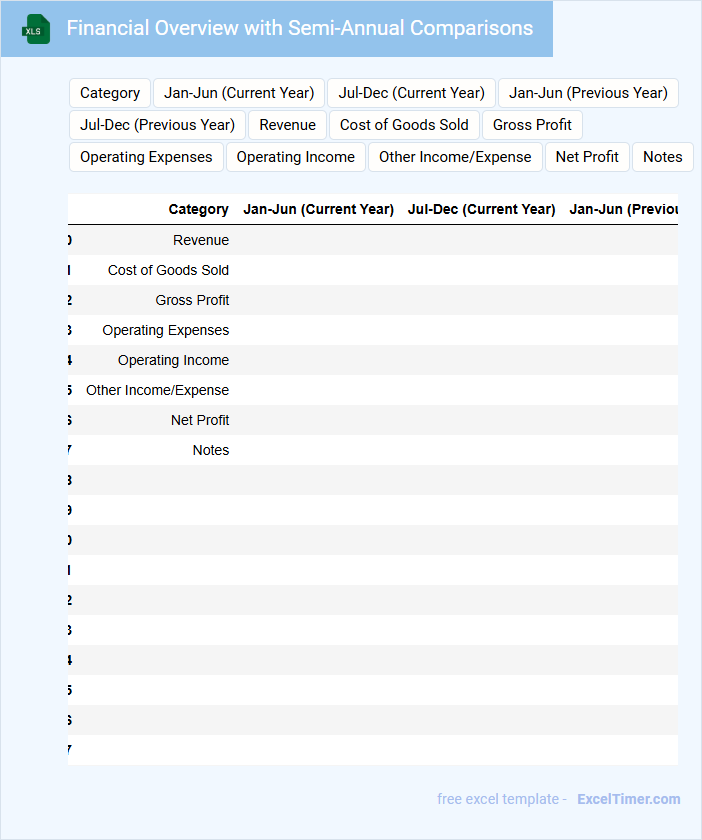

Financial Overview with Semi-Annual Comparisons

A Financial Overview with Semi-Annual Comparisons typically summarizes a company's financial performance across two six-month periods within a year. It highlights trends and changes in key financial metrics to inform stakeholders.

- Include comparative data of revenue, expenses, and profit margins for both periods.

- Provide clear visual aids such as charts or graphs to illustrate financial trends.

- Highlight any significant changes or anomalies that impact overall financial health.

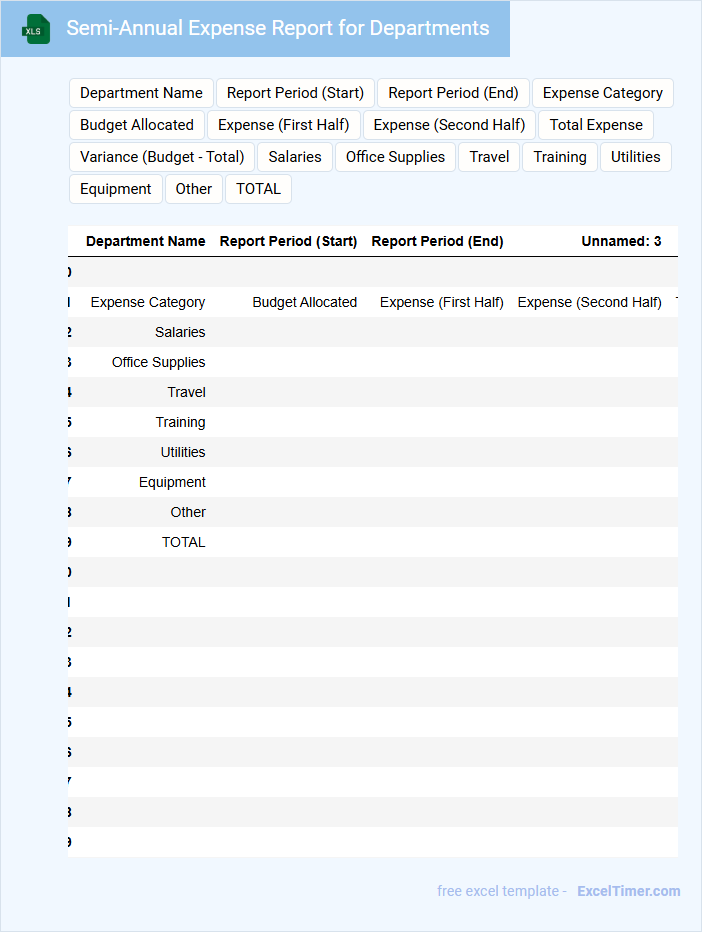

Semi-Annual Expense Report for Departments

A Semi-Annual Expense Report for Departments typically contains a detailed overview of expenditures incurred by various departments within a six-month period.

- Expense Categories: Break down expenses into categories such as operational, travel, and equipment costs for clarity.

- Comparative Analysis: Include comparisons with previous periods to track budget adherence and spending trends.

- Summary and Recommendations: Provide a concise summary highlighting key findings and suggestions for cost optimization.

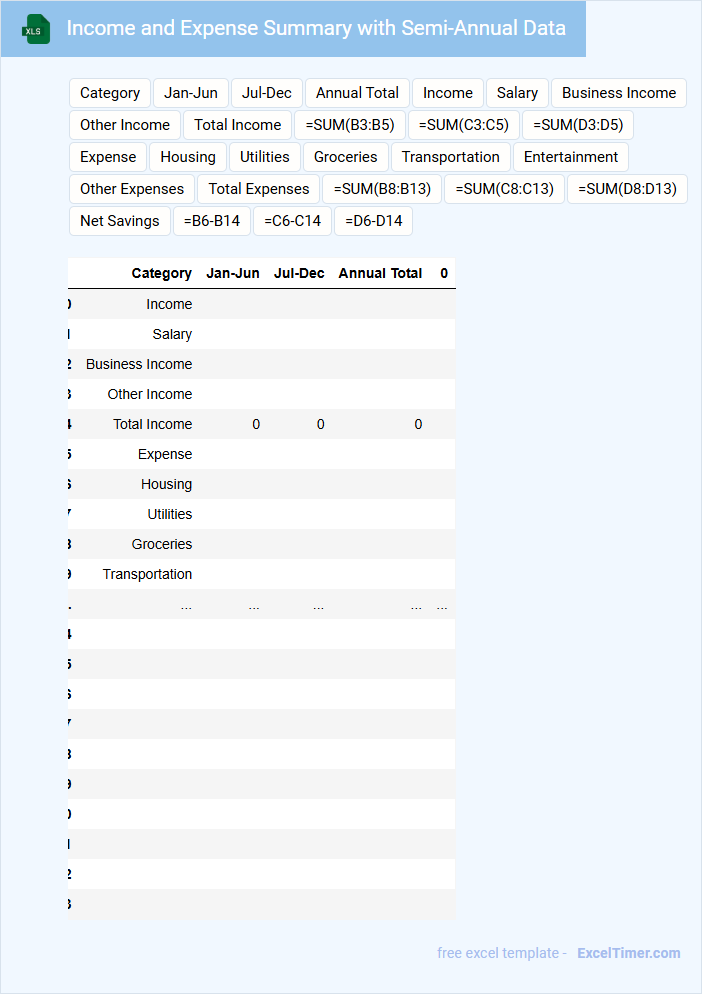

Income and Expense Summary with Semi-Annual Data

The Income and Expense Summary with semi-annual data is a financial document that provides a concise overview of revenues and costs over two six-month periods within a fiscal year. It helps stakeholders quickly assess the financial performance in distinct time frames.

Typically, this document includes categorized income sources and expense details, allowing for comparison between the two halves of the year. When preparing this summary, it is important to ensure accurate data segregation and consistent categorization for meaningful analysis.

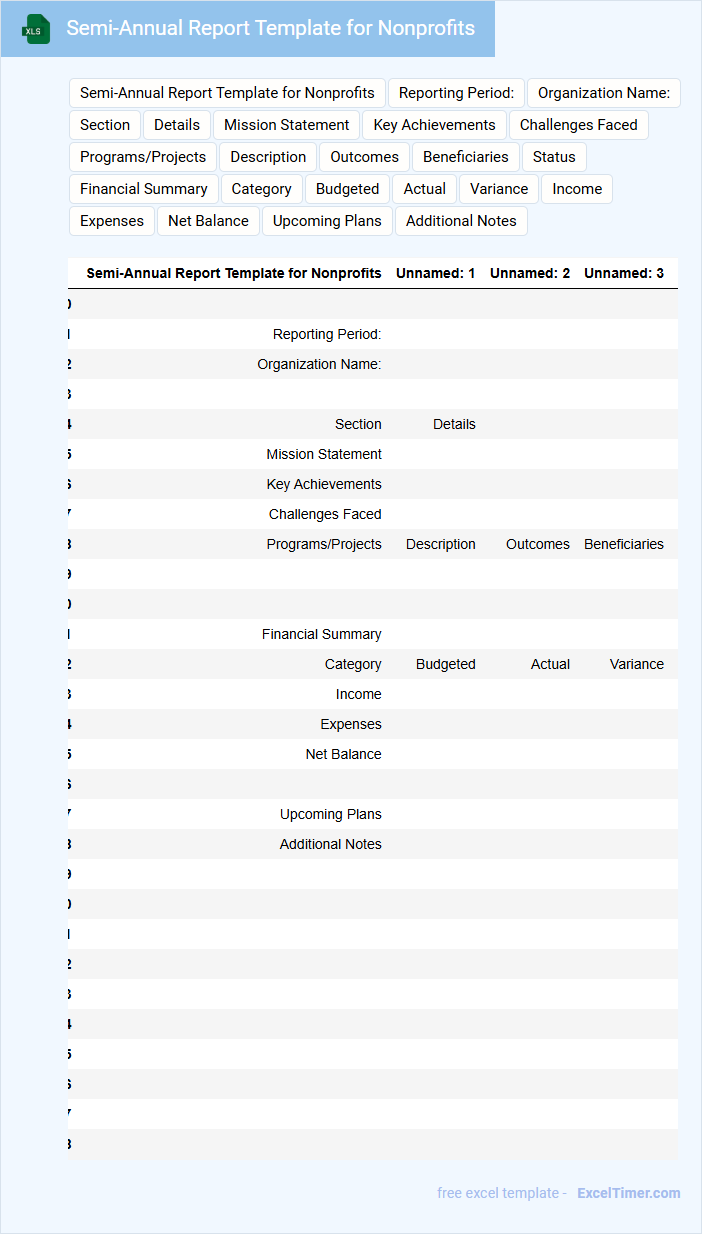

Semi-Annual Report Template for Nonprofits

A Semi-Annual Report for nonprofits typically contains detailed financial statements, program updates, and donor acknowledgments. This document provides transparency and accountability by showcasing progress towards organizational goals within a six-month period. Including both quantitative data and impactful stories helps engage stakeholders effectively.

It is important to emphasize clear financial summaries, highlight key program achievements, and include calls to action for continued support. Ensuring accessibility through well-organized sections and concise language will maximize reader engagement. Visual aids such as charts or infographics also enhance comprehension and interest.

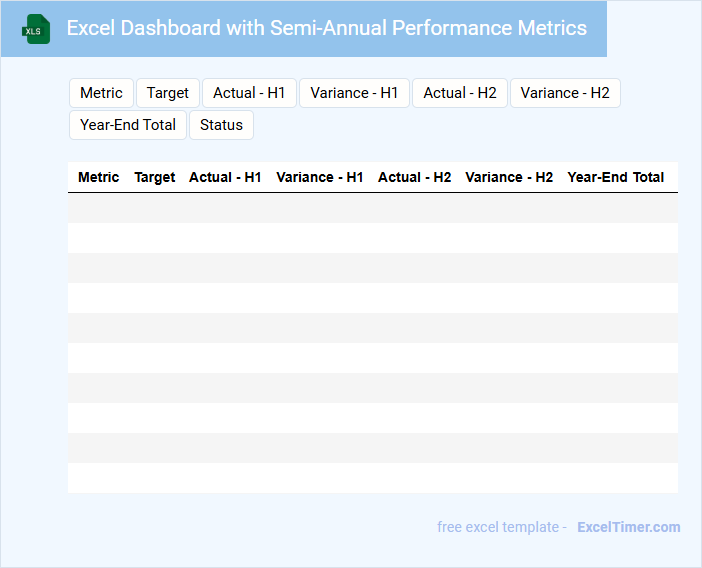

Excel Dashboard with Semi-Annual Performance Metrics

An Excel Dashboard with Semi-Annual Performance Metrics typically contains key performance indicators, data visualizations, and trend analysis to provide a clear overview of business progress every six months. It consolidates raw data into concise charts and graphs that highlight strengths and areas for improvement. Essential elements include data accuracy, interactive filters, and summary statistics to facilitate quick decision-making by stakeholders.

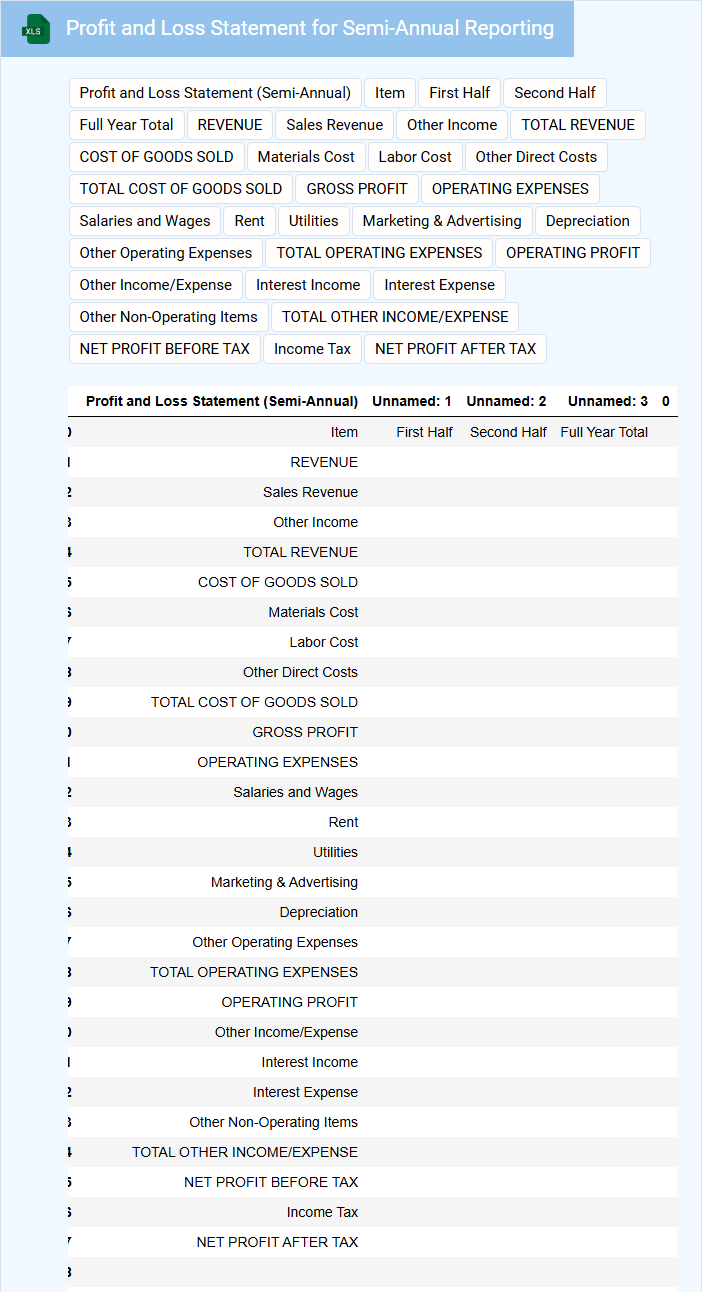

Profit and Loss Statement for Semi-Annual Reporting

A Profit and Loss Statement for Semi-Annual Reporting typically contains detailed summaries of revenues, expenses, and net income over a six-month period. It highlights the financial performance and operational efficiency of a business during this timeframe. Ensuring accuracy in revenue recognition and expense categorization is essential for meaningful analysis.

Variance Analysis with Semi-Annual Financial Data

Variance analysis with semi-annual financial data is a process used to compare actual financial performance against budgeted or expected results for the first and second halves of the fiscal year.

- Identification of Variances: Highlight and categorize significant deviations between actual and planned figures to understand performance gaps.

- Trend Analysis Over Periods: Examine patterns and shifts between the first and second half to detect seasonal effects or operational changes.

- Actionable Insights: Provide targeted recommendations based on findings to improve financial planning and control in subsequent periods.

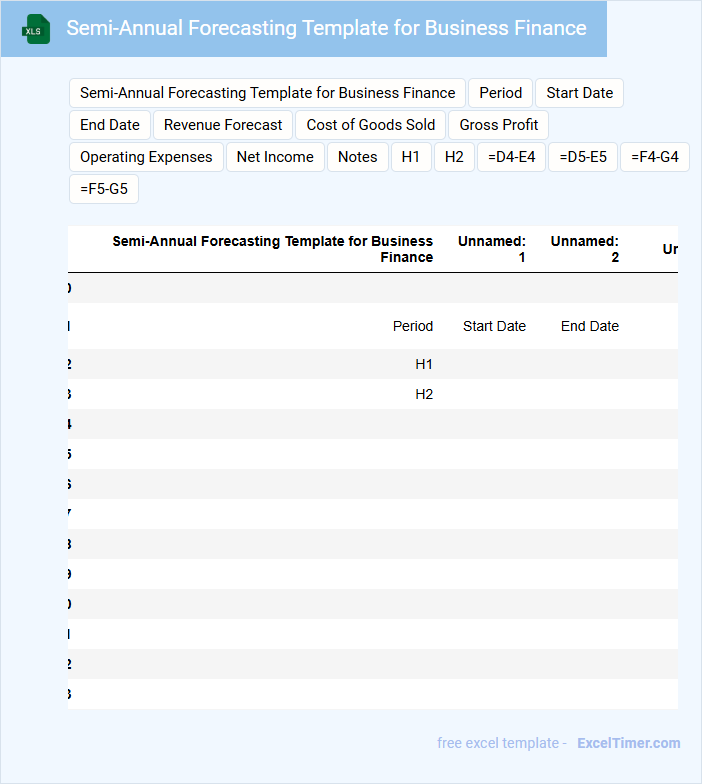

Semi-Annual Forecasting Template for Business Finance

A Semi-Annual Forecasting Template for Business Finance typically contains projected revenue, expenses, and cash flow data over two six-month periods. It helps businesses anticipate financial performance and allocate resources effectively. Key components include sales forecasts, budget assumptions, and variance analysis to monitor financial health.

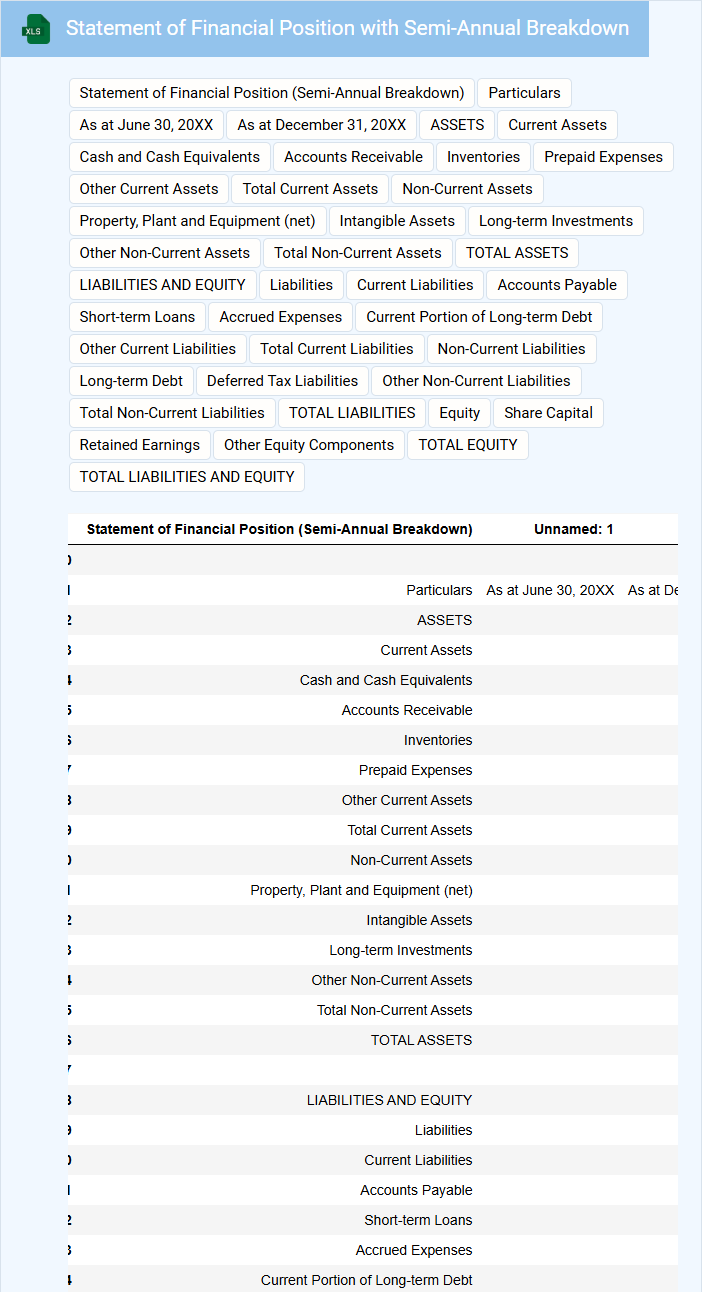

Statement of Financial Position with Semi-Annual Breakdown

The Statement of Financial Position provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It highlights the financial stability and liquidity of the business.

Including a Semi-Annual Breakdown allows stakeholders to track changes and trends across two periods within the fiscal year. This detailed comparison aids in strategic decision-making and financial analysis.

KPI Tracker with Semi-Annual Financial Results

A KPI Tracker with Semi-Annual Financial Results is a document used to monitor and evaluate key performance indicators alongside financial data over a six-month period. It typically contains metrics such as revenue, profit margins, expenses, and growth rates, allowing stakeholders to assess overall business health. Tracking these indicators regularly helps in making informed decisions and identifying areas for improvement.

For optimal use, ensure the document includes clear time frames, targets for each KPI, and comparisons with previous periods to highlight trends effectively. Incorporate visual aids like graphs and charts for better data interpretation. Consistent updates and accuracy are crucial for maintaining the document's relevance and usefulness.

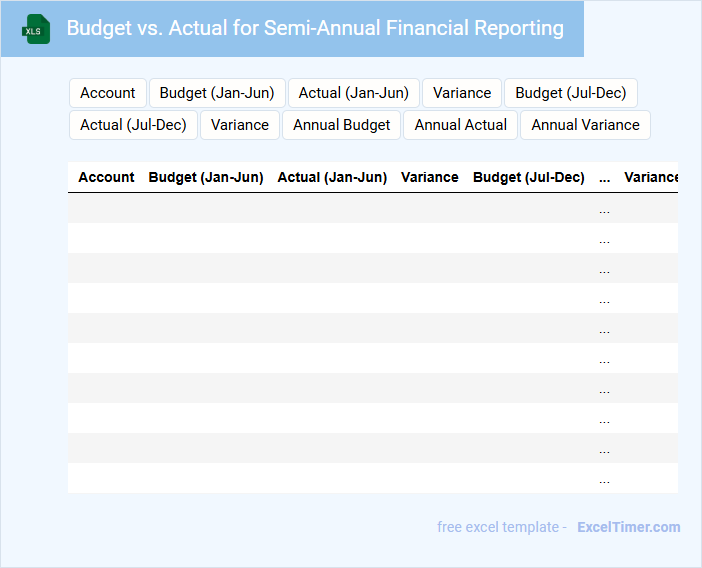

Budget vs. Actual for Semi-Annual Financial Reporting

What information is typically included in a Budget vs. Actual report for Semi-Annual Financial Reporting? This document usually contains a detailed comparison of projected revenues and expenses against the actual financial outcomes over a six-month period. It helps organizations assess their financial performance and make informed adjustments to future budgets and strategies.

What is an important consideration when preparing a Budget vs. Actual report for semi-annual reviews? Ensuring accurate data collection and consistent categorization of financial items is crucial for meaningful analysis. Additionally, highlighting significant variances and providing explanatory notes can enhance the report's usefulness for stakeholders and decision-makers.

How is interest compounded and reported semi-annually in Excel financial statements?

Interest compounded semi-annually in Excel financial statements is calculated by applying the interest rate twice per year, using the formula =(Principal)*(1+(Rate/2))^(2*Years). Your financial reports reflect this by summarizing earnings and balances every six months, ensuring accurate cash flow and interest recognition. Excel functions like FV and EFFECT support precise semi-annual compounding for clear financial analysis.

What Excel formulas calculate semi-annual revenue or expense accruals?

Excel formulas using the EDATE function and monthly revenue or expense data calculate semi-annual accruals by summing values over six-month intervals. The formula =SUM(OFFSET(start_cell,0,0,6,1)) aggregates six months of data for each semi-annual period. Alternatively, the formula =SUMIFS(range, date_range, ">=start_date", date_range, "<=end_date") computes accruals between specified semi-annual dates.

How does semi-annual reporting affect period-end adjustments in Excel?

Semi-annual reporting requires you to record financial data twice a year, impacting period-end adjustments by focusing on six-month intervals in Excel. This approach streamlines data entry and ensures accuracy in summarizing revenue, expenses, and other key financial metrics for each half-year period. Using Excel's date functions and formulas enhances the precision of these adjustments, aligning them with your semi-annual reporting schedule.

What are key Excel functions for summarizing semi-annual financial data?

Key Excel functions for summarizing semi-annual financial data include SUMIFS to aggregate values based on date ranges, EDATE to calculate semi-annual periods, and TEXT to format dates for grouping. PivotTables provide dynamic summaries by period, while DATE, YEAR, and MONTH functions assist in extracting and organizing data within six-month intervals. These tools enable precise, efficient semi-annual financial reporting and analysis.

How does semi-annual reporting impact financial ratio analysis in Excel?

Semi-annual reporting in Excel provides a detailed snapshot of your financial performance every six months, enhancing the accuracy of financial ratio analysis. It allows you to track trends and variations more precisely compared to annual reports, improving decision-making based on liquidity, profitability, and solvency ratios. Incorporating semi-annual data ensures your financial insights are timely and relevant for strategic planning.