The Semi-annually Excel Template for Payroll Reporting simplifies tracking employee salaries and deductions over a six-month period, ensuring accurate and timely financial records. This template enhances payroll management by automating calculations and generating organized reports for regulatory compliance. Users benefit from its user-friendly layout, which minimizes errors and improves overall payroll efficiency.

Semi-Annual Payroll Summary Report Template for Excel

What information is typically included in a Semi-Annual Payroll Summary Report Template for Excel? This type of document generally contains employee payment details, tax withholdings, and benefits information for a six-month period. It serves as an essential tool for accurate payroll tracking and financial reporting to ensure compliance with tax regulations.

Why is it important to use an optimized template for this report? Utilizing a well-structured Excel template helps streamline data entry, reduces errors, and facilitates quick analysis of payroll trends over the semi-annual period. Key features should include clear categorization of earnings, deductions, and summarized totals to support efficient decision-making and auditing processes.

Payroll Data Analysis Template for Semi-Annual Reporting

Payroll Data Analysis Template for Semi-Annual Reporting typically contains detailed employee compensation records, including salaries, bonuses, deductions, and tax withholdings. This document is essential for tracking and evaluating payroll costs over a six-month period to ensure accuracy and compliance. A well-structured template helps streamline data collection and facilitates precise financial analysis for management review.

Excel Template for Semi-Annual Payroll Tax Filing

An Excel Template for Semi-Annual Payroll Tax Filing is a structured spreadsheet designed to streamline the calculation and organization of payroll taxes due every six months. It typically contains employee wage details, tax withholdings, and summary totals for accurate reporting.

This type of document ensures compliance with tax regulations by consolidating all relevant data in one place, reducing errors and saving time during filing periods. Important features to include are clear tax category breakdowns and automatic calculation formulas for accuracy.

Semi-Annual Payroll Statement with Employee Details

A Semi-Annual Payroll Statement with Employee Details typically contains comprehensive information about employee earnings and deductions over a six-month period.

- Employee Identification: Includes full names, employee IDs, and job titles for accurate record-keeping.

- Earnings Summary: Details gross pay, bonuses, and overtime to reflect total compensation.

- Deductions and Taxes: Lists all relevant tax withholdings and benefit deductions to ensure compliance.

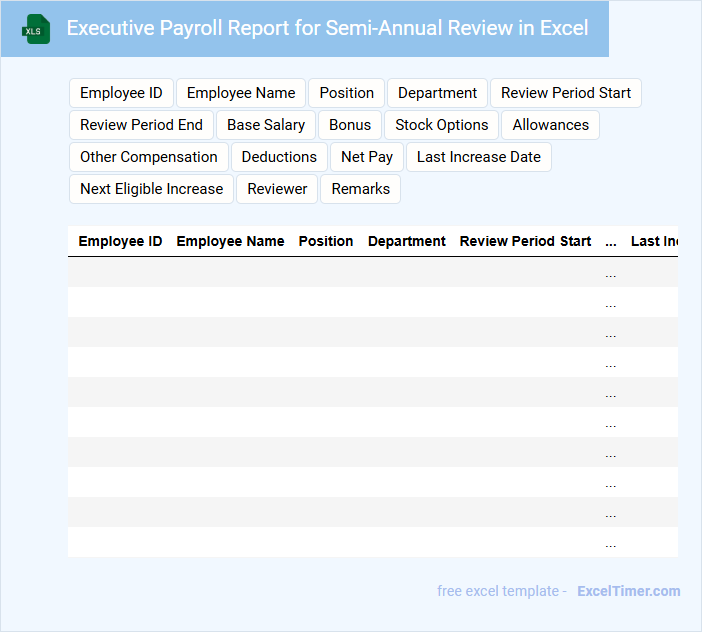

Executive Payroll Report for Semi-Annual Review in Excel

Executive Payroll Report for Semi-Annual Review in Excel typically contains detailed salary information, employee bonuses, and deductions over a six-month period. This document helps in analyzing payroll trends and ensuring compliance with company policies and tax regulations. It is essential for streamlining payroll management and supporting financial decision-making at an executive level.

Semi-Annual Salary Reconciliation Template for Payroll

Semi-Annual Salary Reconciliation Templates for Payroll typically contain detailed records of employee earnings and deductions reviewed every six months to ensure accuracy. This document helps in identifying discrepancies between the payroll records and actual payments made.

- Verify all employee salary inputs against bank statements for consistency.

- Include columns for bonuses, overtime, and other compensation variations.

- Ensure compliance with tax regulations and update any changes in deductions accordingly.

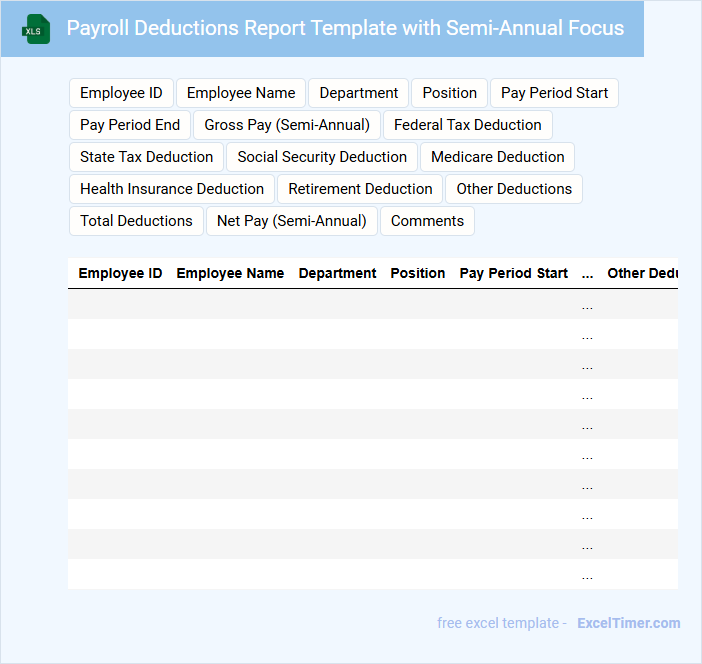

Payroll Deductions Report Template with Semi-Annual Focus

A Payroll Deductions Report Template with Semi-Annual Focus typically contains detailed information about various deductions made from employees' salaries over a six-month period. It includes data on tax withholdings, benefits contributions, and other mandatory or voluntary deductions. This template helps organizations track and manage payroll deductions efficiently for accurate financial reporting and compliance.

Semi-Annual Overtime Tracking Report for Payroll in Excel

The Semi-Annual Overtime Tracking Report is a crucial document used to monitor and record employee overtime hours over a six-month period. It typically contains detailed entries of dates, employee names, hours worked beyond regular shifts, and corresponding pay rates. Accurate tracking ensures compliance with labor laws and aids in precise payroll processing. Important considerations include maintaining consistent data entry, verifying overtime eligibility, and regularly updating the report to reflect any changes in employee schedules or rates.

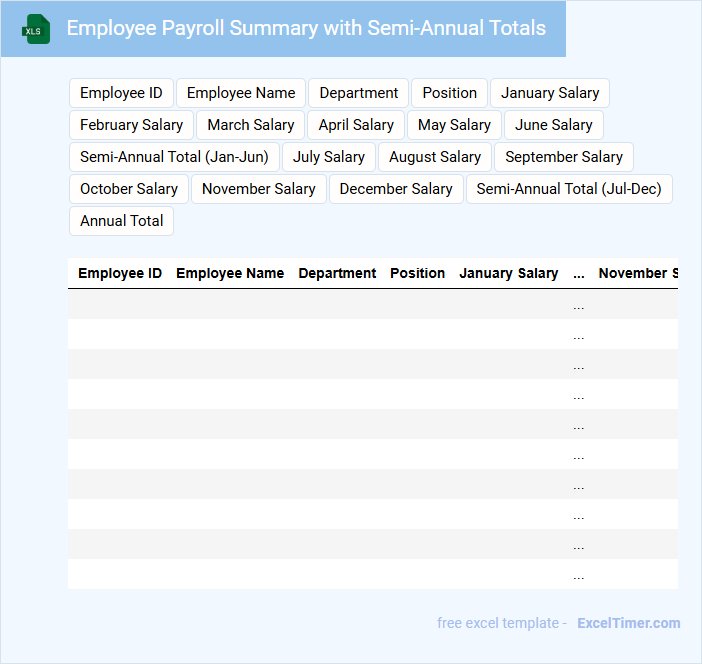

Employee Payroll Summary with Semi-Annual Totals

What information does an Employee Payroll Summary with Semi-Annual Totals typically contain? This document usually includes detailed records of employee salaries, wages, deductions, and net pay aggregated over each half of the year. It helps employers and employees track compensation trends and ensure accurate tax and benefit calculations.

Why is accuracy important in an Employee Payroll Summary with Semi-Annual Totals? Precise data prevents discrepancies in tax reporting and compliance with labor laws, reducing the risk of penalties. It is essential to verify all entries and reconcile totals to maintain financial integrity and support audit readiness.

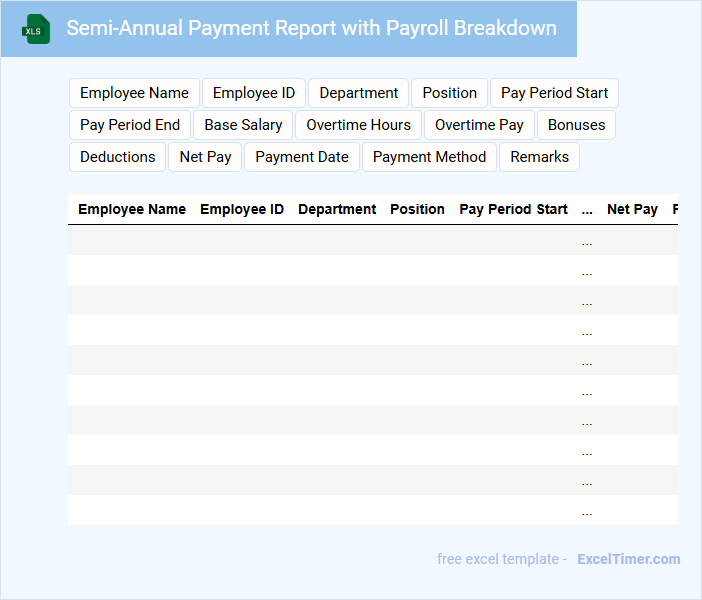

Semi-Annual Payment Report with Payroll Breakdown

What information is typically contained in a Semi-Annual Payment Report with Payroll Breakdown? This document usually includes detailed records of employee payments made over a six-month period, itemizing salaries, bonuses, deductions, and tax withholdings. It helps organizations maintain transparency, ensure compliance with tax regulations, and provide an accurate financial overview for internal and external audits.

What important aspects should be considered when preparing this report? Accuracy in payroll data is crucial to avoid discrepancies and potential legal issues, while clear categorization of payment types enhances readability. Additionally, including summaries and visual aids like charts can improve understanding for stakeholders reviewing the report.

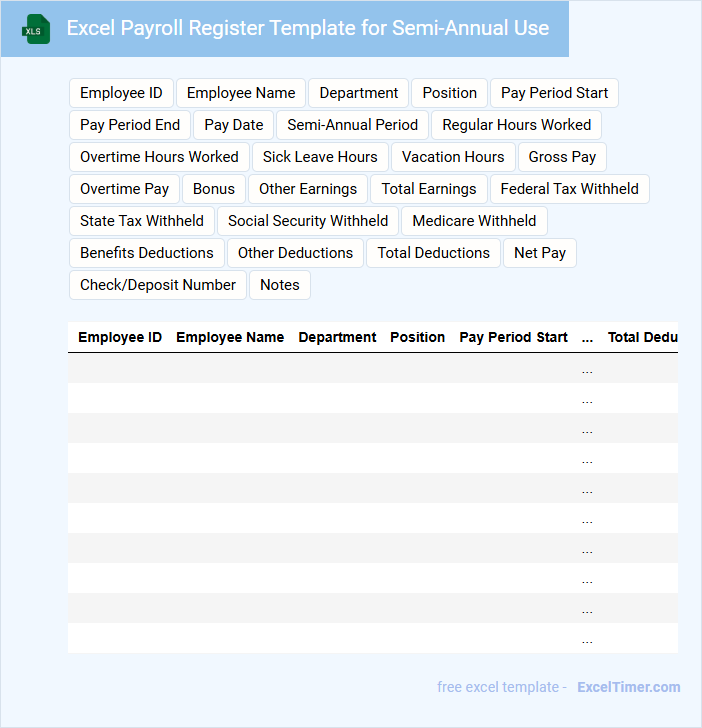

Excel Payroll Register Template for Semi-Annual Use

An Excel Payroll Register Template is typically used to organize and track employee payroll information over a specific period, such as semi-annually. It usually contains details like employee names, hours worked, pay rates, taxes withheld, and net pay. For semi-annual use, it's important to ensure accuracy in cumulative tax calculations and timely updating of salary adjustments.

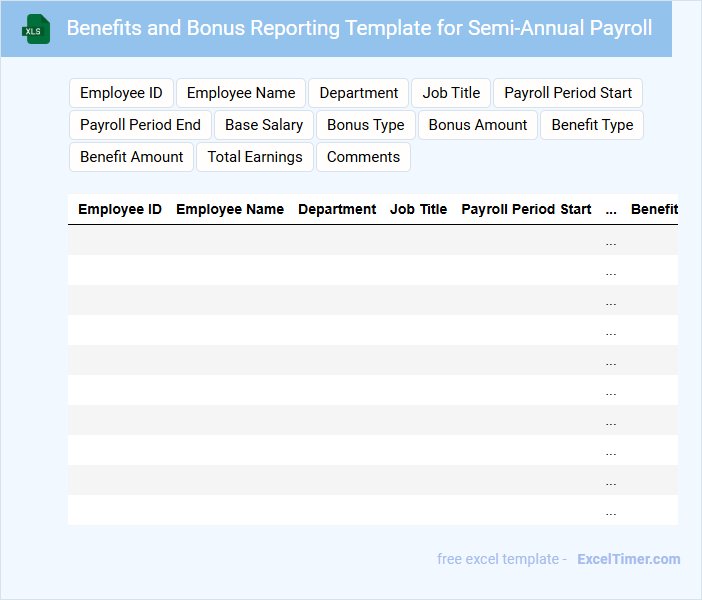

Benefits and Bonus Reporting Template for Semi-Annual Payroll

The Benefits and Bonus Reporting Template for Semi-Annual Payroll is designed to systematically track employee compensations beyond regular salaries. It typically includes details on bonuses, benefits, eligibility criteria, and payout timelines. Ensuring accuracy and compliance in this document helps organizations maintain transparency and streamline payroll processes.

Departmental Payroll Costs with Semi-Annual Overview

What information is typically contained in a Departmental Payroll Costs document with a Semi-Annual Overview?

This document usually includes detailed records of employee wages, benefits, and deductions categorized by department over a six-month period. It provides a consolidated view of payroll expenses to help track budget adherence and identify cost-saving opportunities within each department.

An important consideration is ensuring accuracy in data entry and regular reconciliation with financial accounts. Additionally, including trend analysis and comparisons with previous periods enhances the document's usefulness for strategic planning.

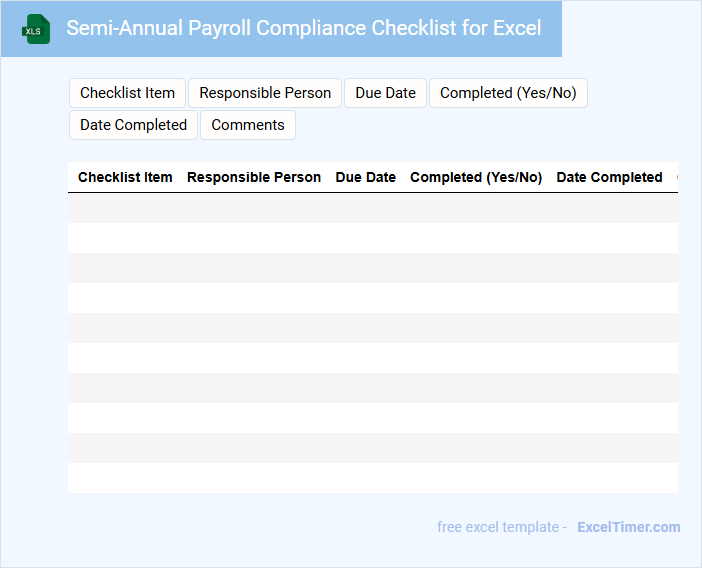

Semi-Annual Payroll Compliance Checklist for Excel

The Semi-Annual Payroll Compliance Checklist is a document that typically contains detailed tasks and deadlines to ensure payroll processes align with legal and regulatory requirements every six months. It helps payroll teams verify tax filings, employee compensation accuracy, and regulatory reporting. Maintaining this checklist is crucial to avoid penalties and ensure timely payroll operations.

Gross and Net Payroll Report for Semi-Annual Analysis

The Gross Payroll Report typically contains total earnings of employees before any deductions, including wages, bonuses, and overtime. This report is essential for understanding the company's overall salary expenses during the specified period.

The Net Payroll Report shows the actual take-home pay after taxes, benefits, and other deductions are subtracted, providing insights into employee compensation. It is crucial for budgeting and financial planning purposes.

For a semi-annual analysis, ensure accuracy in data aggregation and highlight any significant changes or trends impacting payroll costs over the six months.

What defines a semi-annual payroll reporting period in Excel documentation?

A semi-annual payroll reporting period in Excel documentation is defined as a six-month timeframe used to summarize and report payroll data twice per year. This period typically spans from January to June for the first half and July to December for the second half. Excel templates often include date functions and predefined ranges to automate calculations and ensure accurate semi-annual payroll reporting.

Which formulas are essential to calculate semi-annual gross and net payroll totals?

To calculate semi-annual gross payroll totals in Excel, use the SUMIFS formula to aggregate gross pay amounts within the specified six-month periods. For net payroll totals, apply SUMIFS on net pay columns filtered by the corresponding date ranges. Incorporate date functions like EOMONTH and DATE to dynamically define semi-annual periods for accurate payroll reporting.

How do you structure Excel sheets to track earnings and deductions for two reporting periods per year?

Structure your Excel sheet with separate columns for each semi-annual period, including detailed rows for earnings, deductions, and tax withholdings. Use formulas to automatically calculate totals for each period and a summary section for year-to-date amounts. Organize data consistently to ensure accurate payroll reporting and compliance for both six-month intervals.

What key columns should be included to ensure compliance with semi-annual payroll summaries?

Your semi-annually payroll reporting document should include key columns such as Employee ID, Pay Period Start and End Dates, Gross Wages, Taxes Withheld, Benefits Deductions, and Net Pay. Including Earnings Year-to-Date and Tax Filing Status ensures accurate compliance with IRS reporting requirements. Accurate data in these columns supports timely submission of semi-annual payroll summaries and maintains regulatory adherence.

How can you automate tax and benefit calculations for semi-annual payroll reports in Excel?

Automate tax and benefit calculations for semi-annual payroll reports in Excel by using built-in formulas such as SUMIFS and VLOOKUP paired with custom tax rate tables. Incorporate Excel functions like IF and DATE to dynamically adjust calculations based on pay periods and employee data. Your spreadsheet can also integrate macros or VBA scripts to streamline repetitive data entry and ensure accurate semi-annual payroll reporting.