![]()

The Semi-annually Excel Template for Investment Tracking provides a simple, organized way to monitor investment performance every six months. It allows users to input data, calculate returns, and analyze growth trends efficiently. Using this template helps ensure timely reviews and informed decision-making for long-term financial planning.

Semi-Annual Investment Tracking Spreadsheet

What information is typically included in a Semi-Annual Investment Tracking Spreadsheet? This document usually contains detailed records of investment transactions, portfolio performance metrics, and asset allocation summaries over a six-month period. It is essential to include accurate dates, amounts invested or withdrawn, and up-to-date market values to effectively monitor growth and make informed decisions.

What should be prioritized when creating or maintaining this spreadsheet? Ensuring data accuracy and consistency is vital, along with incorporating automated formulas for calculating returns and risk assessments. Additionally, including visual aids like charts or graphs can enhance clarity and support strategic investment reviews.

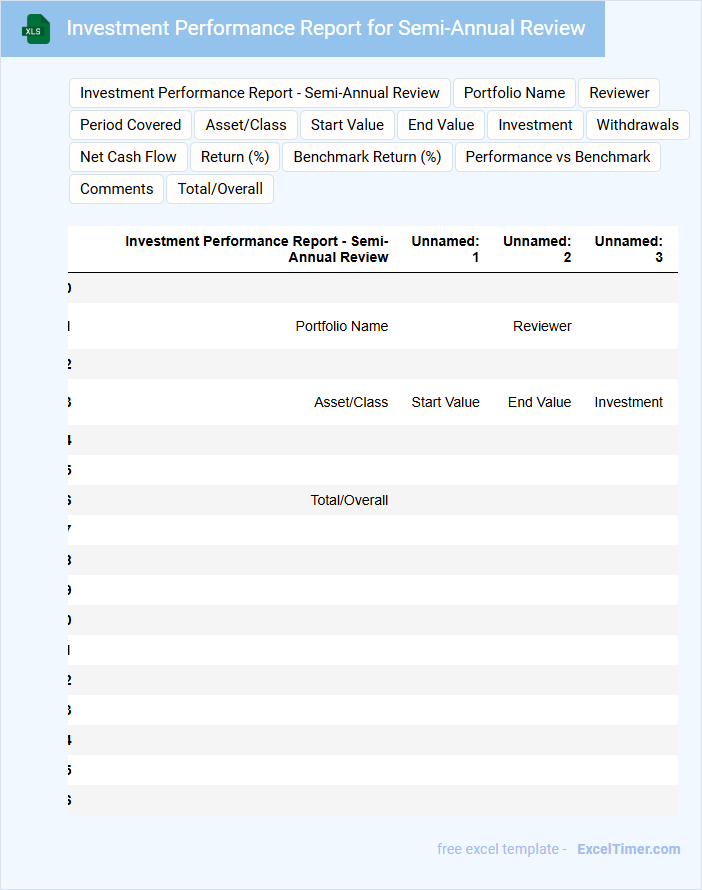

Investment Performance Report for Semi-Annual Review

An Investment Performance Report typically contains a detailed analysis of portfolio returns, asset allocations, and benchmark comparisons over a specific period. It highlights key financial metrics and performance drivers to provide a clear understanding of investment outcomes.

For a Semi-Annual Review, the report should emphasize changes in market conditions and their impact on the portfolio. Including risk assessments and future outlooks is important to guide informed decision-making.

Semi-Annual Portfolio Tracker with Summary Charts

What information is typically included in a Semi-Annual Portfolio Tracker with Summary Charts? This document usually contains detailed records of investment performance and asset allocation over a six-month period. It includes visual summary charts that highlight key trends and overall portfolio health for easier analysis and decision-making.

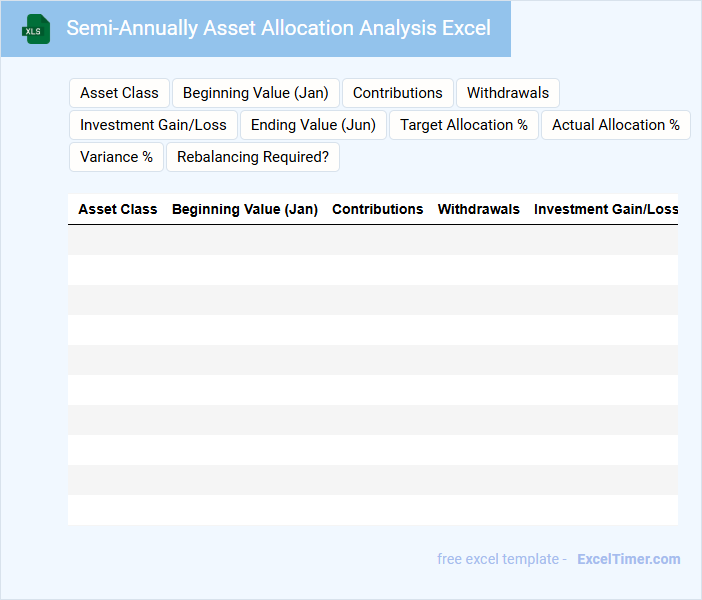

Semi-Annually Asset Allocation Analysis Excel

The Semi-Annually Asset Allocation Analysis Excel document typically contains detailed data on the distribution of investments across various asset classes every six months. It provides insights into portfolio performance, risk assessment, and rebalancing needs. This type of analysis helps investors make informed decisions to optimize returns and minimize risks over time.

Important elements to include are current asset allocations, historical performance comparisons, and clear visualizations such as pie charts or bar graphs. Additionally, incorporating a summary of market trends and suggested action points can enhance the document's value. Accurate data input and regular updates ensure the analysis remains relevant and actionable.

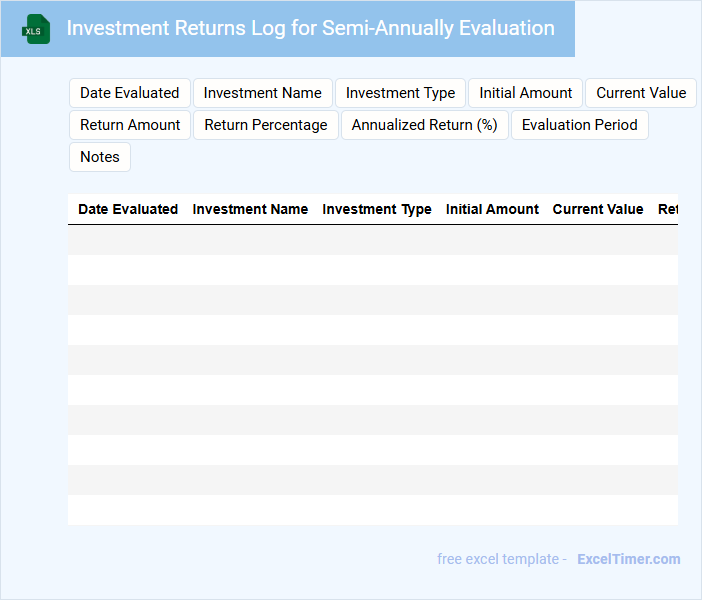

Investment Returns Log for Semi-Annually Evaluation

An Investment Returns Log for Semi-Annually Evaluation typically contains detailed records of portfolio performance and transaction summaries over six-month periods. It tracks gains, losses, and yields to help investors assess growth and make informed decisions. Including clear metrics and consistent updates is crucial for accurate semi-annual assessment and strategic planning.

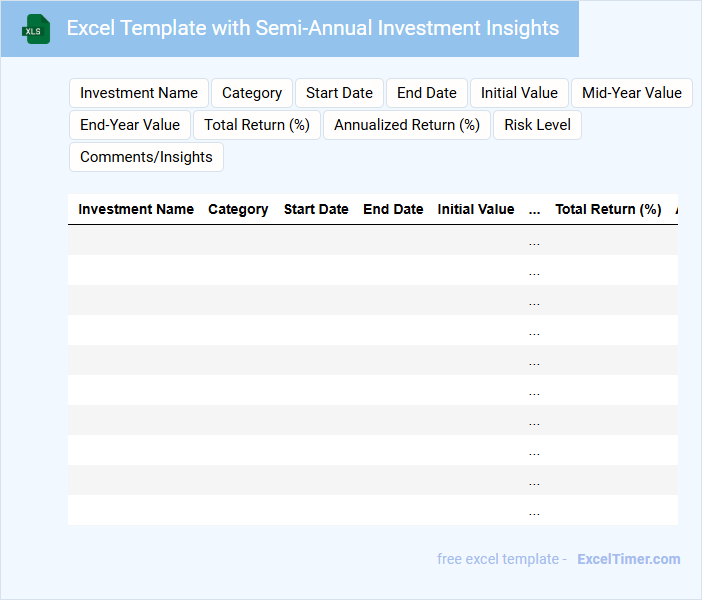

Excel Template with Semi-Annual Investment Insights

An Excel Template with Semi-Annual Investment Insights typically contains structured financial data, performance metrics, and strategic analyses to assist in investment decision-making.

- Data Organization: Clear categorization of investment types and timelines is essential for easy tracking and comparison.

- Performance Metrics: Include key indicators such as ROI, risk assessment, and growth projections for comprehensive insight.

- Visualization Tools: Incorporate charts and graphs to highlight trends and support strategic investment planning.

Semi-Annual Tracking Sheet for Investment Diversification

A Semi-Annual Tracking Sheet for Investment Diversification typically contains detailed records of various asset allocations and performance metrics over a six-month period. This document helps investors monitor risk distribution and growth across different investment categories effectively.

Key components often include portfolio balances, percentage allocations, and transaction summaries. It is important to regularly update and review this sheet to ensure alignment with financial goals and to adjust strategies timely.

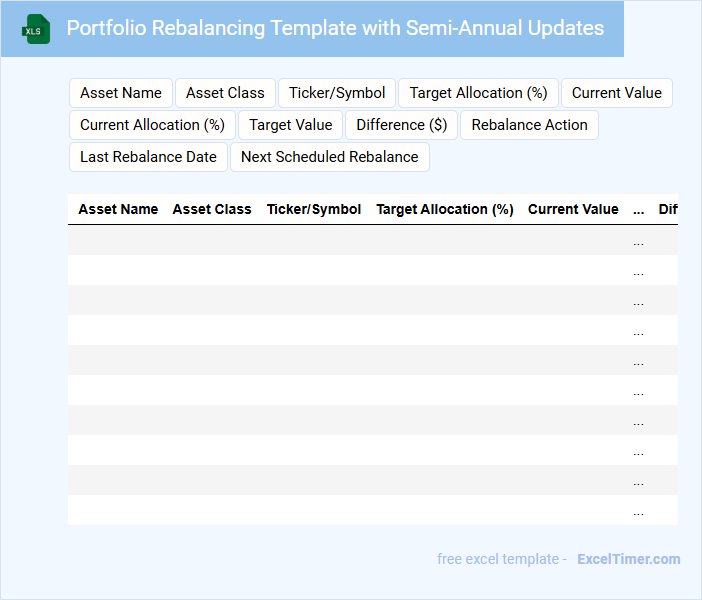

Portfolio Rebalancing Template with Semi-Annual Updates

A Portfolio Rebalancing Template is a structured document designed to help investors systematically adjust their investment allocations. It typically contains asset allocation targets, current portfolio values, and proposed adjustments to maintain desired risk levels. For semi-annual updates, it's important to include a schedule and notes on market conditions affecting portfolio shifts.

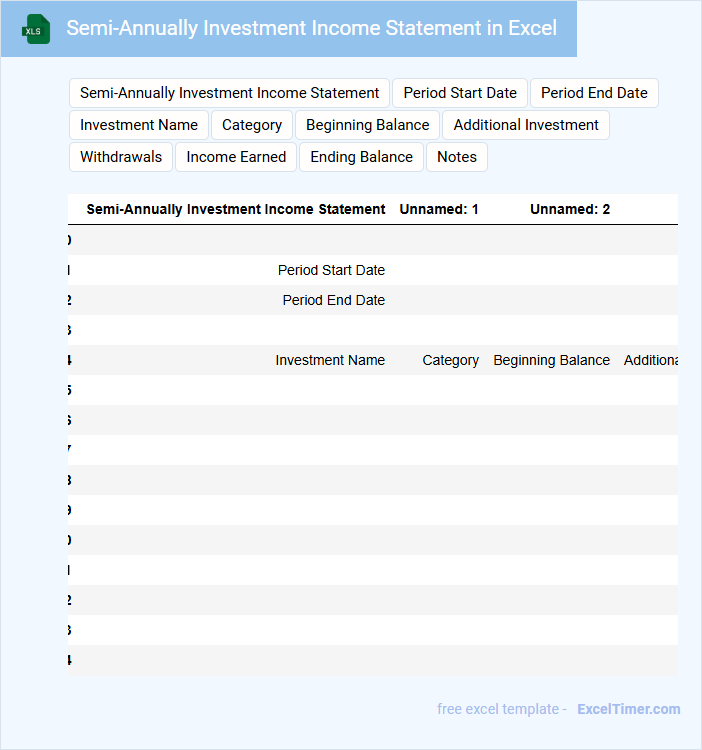

Semi-Annually Investment Income Statement in Excel

What information is typically contained in a Semi-Annually Investment Income Statement in Excel? This type of document usually includes detailed records of income earned from investments over a six-month period, such as dividends, interest, and capital gains. It is organized in a clear, tabular format that facilitates easy tracking and analysis of investment performance for the given timeframe.

What are important considerations when creating a Semi-Annually Investment Income Statement? Ensuring accurate categorization of income types and consistent date ranges is crucial for reliable reporting. Additionally, incorporating formulas for automatic calculations and summaries can enhance efficiency and reduce errors in financial analysis.

Capital Gains Report for Semi-Annual Period

What information is typically contained in a Capital Gains Report for a Semi-Annual Period? This document usually includes detailed records of all capital asset transactions within the six-month period, showing gains or losses realized from sales or exchanges. It also summarizes tax implications and may provide recommendations for tax planning or future investment adjustments.

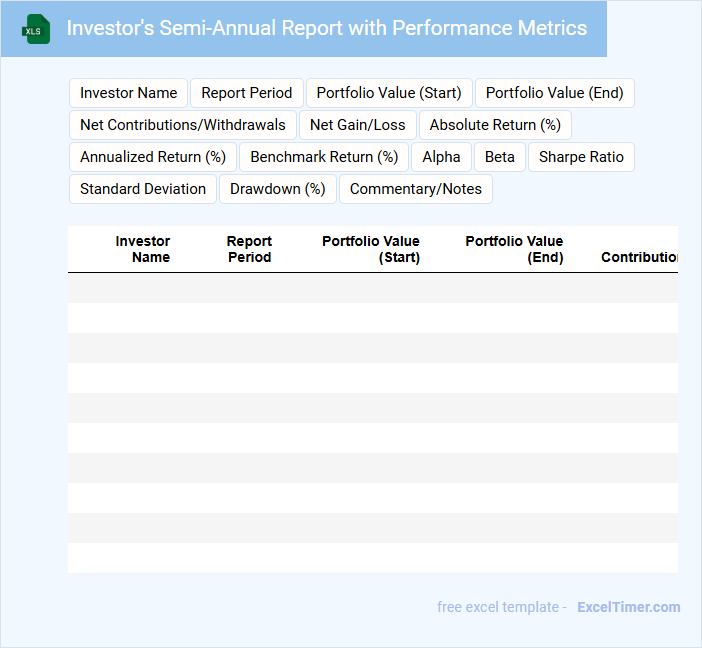

Investor's Semi-Annual Report with Performance Metrics

An Investor's Semi-Annual Report typically contains a comprehensive overview of a company's financial performance over the past six months. It includes detailed financial statements, management commentary, and key performance indicators that reflect the company's health and growth trajectory.

Performance metrics such as revenue growth, profit margins, and return on investment are crucial components of this report. Including clear visual representations of these metrics, like charts or graphs, significantly enhances investor understanding and engagement.

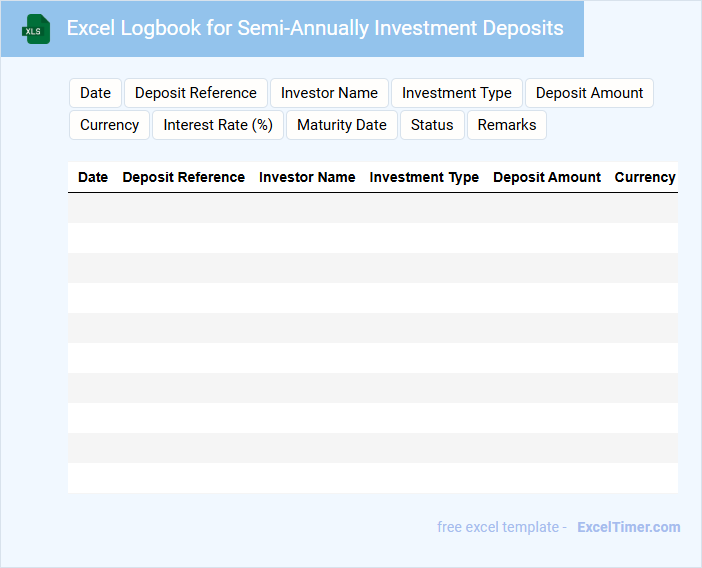

Excel Logbook for Semi-Annually Investment Deposits

An Excel Logbook for Semi-Annually Investment Deposits is a structured document used to systematically record and track investment activities occurring every six months. This logbook typically includes details such as deposit dates, amounts, interest rates, and maturity values to provide clear financial insights.

Such a logbook helps investors monitor their progress and make informed decisions based on historical data. It is important to ensure accurate data entry and regularly update the log to maintain its reliability and usefulness.

Dashboard for Semi-Annual Investment Growth

The Dashboard for Semi-Annual Investment Growth typically contains key financial metrics, such as overall portfolio performance, return on investment (ROI), and asset allocation summaries. It often includes visual elements like charts and graphs to illustrate trends and comparisons over the six-month period. Important components also cover risk assessments and alerts for any significant deviations from expected growth.

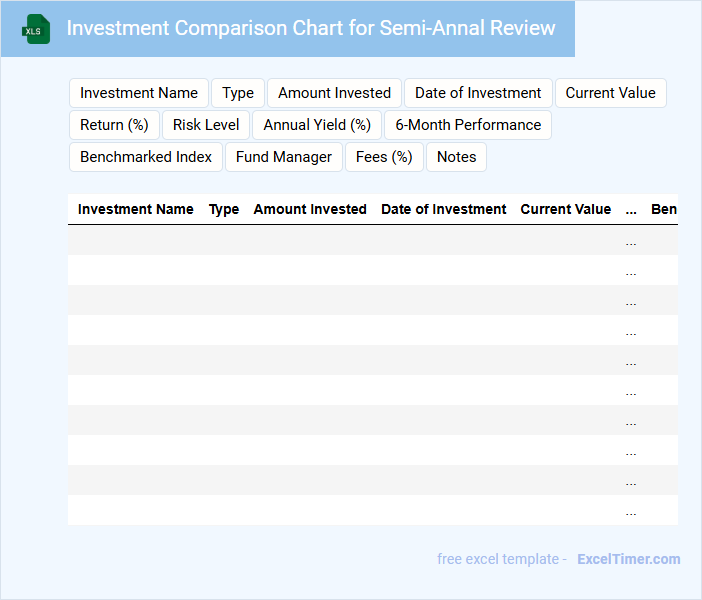

Investment Comparison Chart for Semi-Annal Review

An Investment Comparison Chart typically contains detailed data on multiple investment options, enabling clear side-by-side performance analysis. It includes metrics such as returns, risk levels, fees, and maturity periods to assist in informed decision-making. For a semi-annual review, it is important to ensure the data is up to date and highlights trends over the past six months.

Semi-Annually Dividend Tracking with Excel

What information is typically contained in a Semi-Annually Dividend Tracking document in Excel? This document usually includes details such as the dates dividends were received, the amount paid per share, and the total dividend income accumulated over each half-year period. It helps investors monitor their earnings and analyze dividend trends to make informed financial decisions.

How do you set up a semi-annual frequency for tracking investments in an Excel document?

To set up a semi-annual frequency for tracking investments in Excel, create a date column with entries every six months using the formula =EDATE(start_date, 6*n). Use this timeline to organize your investment data, such as contributions and returns, updating values twice a year for accurate tracking. Your semi-annual schedule enables clear performance analysis and investment planning over each half-year period.

What Excel formulas best calculate semi-annual interest or returns for different investment types?

You can use the Excel formula =FV(rate/2, n*2, payment, pv) to calculate semi-annual interest or returns, where rate is the annual interest rate, n is the number of years, payment is the periodic payment, and pv is the present value. For semi-annual compound interest, the formula =PV*(1+rate/2)^(2*n) accurately computes the investment growth over time. These formulas help track returns for bonds, savings accounts, and other investment types that compound interest twice a year.

How can you automate data entry for semi-annual investment updates in Excel?

Automate semi-annual investment updates in Excel by using VBA macros to trigger data entry tasks on predefined dates or by integrating Power Query to refresh data sources biannually. Employ dynamic formulas like INDEX and MATCH with date criteria to pull relevant semi-annual figures. Use conditional formatting and data validation to ensure accuracy and streamline investment tracking workflows.

Which Excel charts effectively visualize semi-annual investment performance?

Column charts and line charts effectively visualize semi-annual investment performance by clearly displaying trends and comparisons across two periods each year. Your Excel document can utilize these charts to track growth, returns, and fluctuations in investments every six months. Incorporating combination charts can also enhance insight by blending different data types within the same semi-annual timeframe.

What are the key columns and data points to include for semi-annual investment tracking in Excel?

You should include key columns such as Investment Name, Start Date, Semi-Annual Period, Principal Amount, Interest Rate, Semi-Annual Interest Earned, and Cumulative Earnings. Including columns for Payment Dates and Transaction Notes enhances clarity in semi-annual tracking. This structure allows precise monitoring of investment growth and performance every six months.