The Semi-annually Asset Depreciation Excel Template for Accountants streamlines the calculation of asset depreciation every six months, ensuring accurate financial reporting and tax compliance. This template allows accountants to track asset values, calculate depreciation expenses, and generate detailed reports efficiently. Its user-friendly interface supports various depreciation methods, making it an essential tool for managing fixed asset accounting.

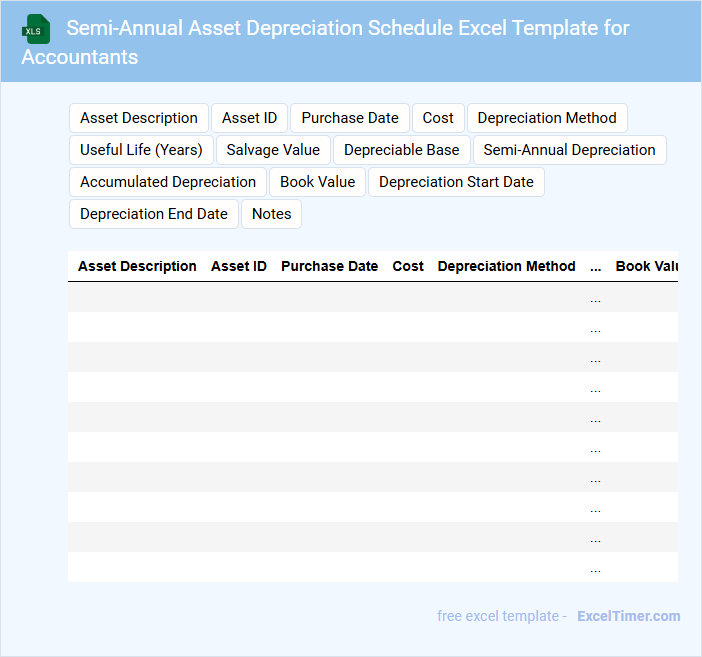

Semi-Annual Asset Depreciation Schedule Excel Template for Accountants

This document usually contains detailed records of asset depreciation over six-month periods, designed to assist accountants in tracking and managing asset value reductions efficiently.

- Asset Identification: Clearly lists all fixed assets with relevant details such as purchase date and cost.

- Depreciation Calculations: Includes formulas and schedules to compute semi-annual depreciation expenses accurately.

- Summary Reports: Provides consolidated views for financial statement preparation and compliance.

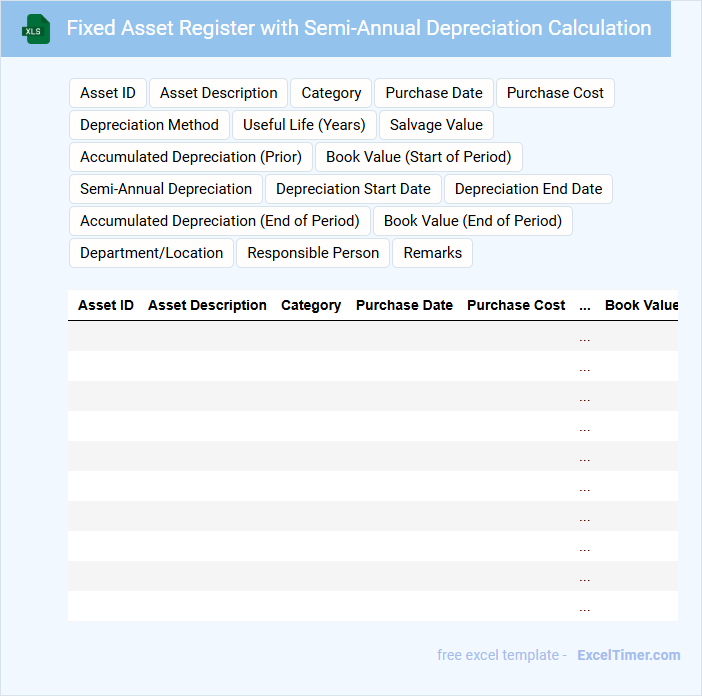

Fixed Asset Register with Semi-Annual Depreciation Calculation

What information is typically included in a Fixed Asset Register with Semi-Annual Depreciation Calculation? This document usually contains detailed records of all fixed assets owned by a company, including purchase dates, costs, and asset descriptions. It also tracks accumulated depreciation over time, calculated on a semi-annual basis, to provide accurate asset valuation and financial reporting.

Why is it important to maintain a Fixed Asset Register with Semi-Annual Depreciation Calculation? Keeping this register up-to-date ensures compliance with accounting standards and tax regulations, while helping in asset management and budgeting. Regular semi-annual depreciation calculations allow for more precise financial statements and better decision-making regarding asset utilization and replacement.

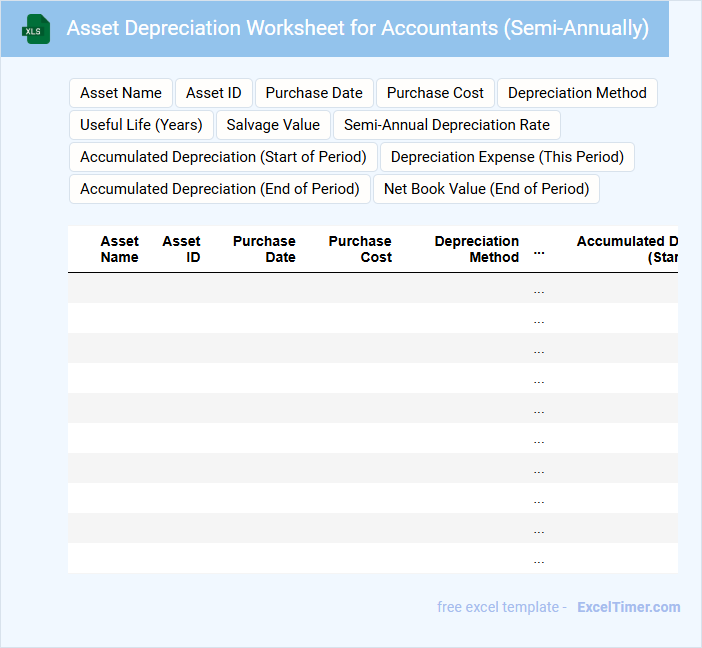

Asset Depreciation Worksheet for Accountants (Semi-Annually)

An Asset Depreciation Worksheet is a crucial document used by accountants to track the value reduction of fixed assets over time. It typically contains detailed information such as asset descriptions, purchase dates, cost, depreciation methods, and accumulated depreciation. For semi-annual periods, accuracy in recording depreciation schedules and reviewing asset lifespans is essential to ensure proper financial reporting and compliance.

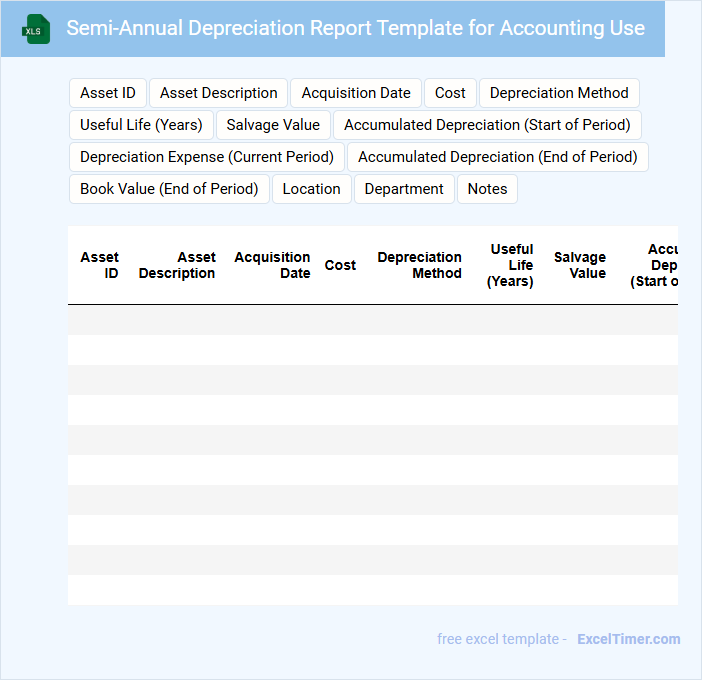

Semi-Annual Depreciation Report Template for Accounting Use

This Semi-Annual Depreciation Report Template is designed to track and record the depreciation of company assets over a six-month period. It typically contains detailed asset information, depreciation methods, accumulated depreciation, and book values. For accounting accuracy, it is important to include clear categorization of assets and consistent calculation methods throughout the report.

Asset Management Excel Template with Semi-Annual Depreciation Tracking

An Asset Management Excel Template with Semi-Annual Depreciation Tracking is designed to help organizations efficiently monitor their fixed assets and calculate depreciation over specific periods. This document typically contains asset details, purchase dates, costs, and a depreciation schedule updated twice a year. It ensures accurate financial reporting and asset valuation through systematic tracking and adjustment.

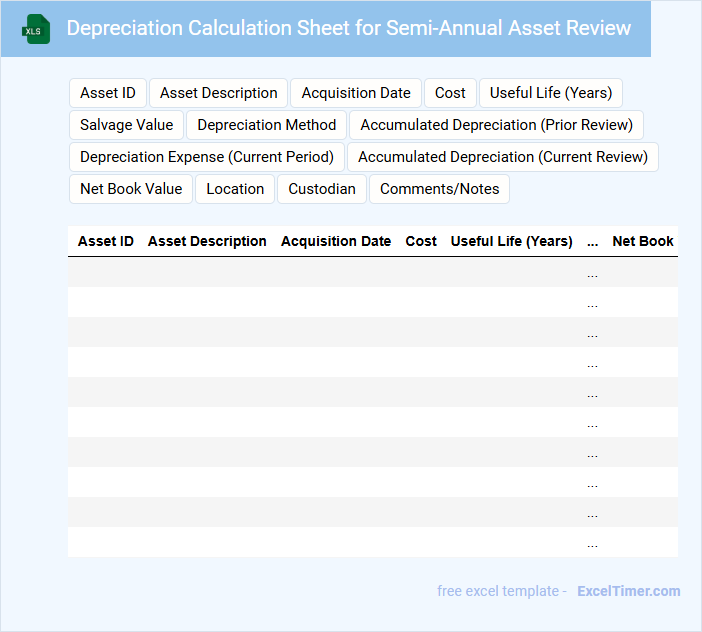

Depreciation Calculation Sheet for Semi-Annual Asset Review

A Depreciation Calculation Sheet for Semi-Annual Asset Review typically contains detailed asset values and depreciation adjustments to accurately reflect asset worth over the review period.

- Asset Identification: List each asset clearly with its purchase date, cost, and depreciation method.

- Calculation Accuracy: Use precise formulas to compute depreciation for the six-month period, ensuring compliance with accounting standards.

- Review Documentation: Include notes or comments on asset condition or changes affecting depreciation assumptions.

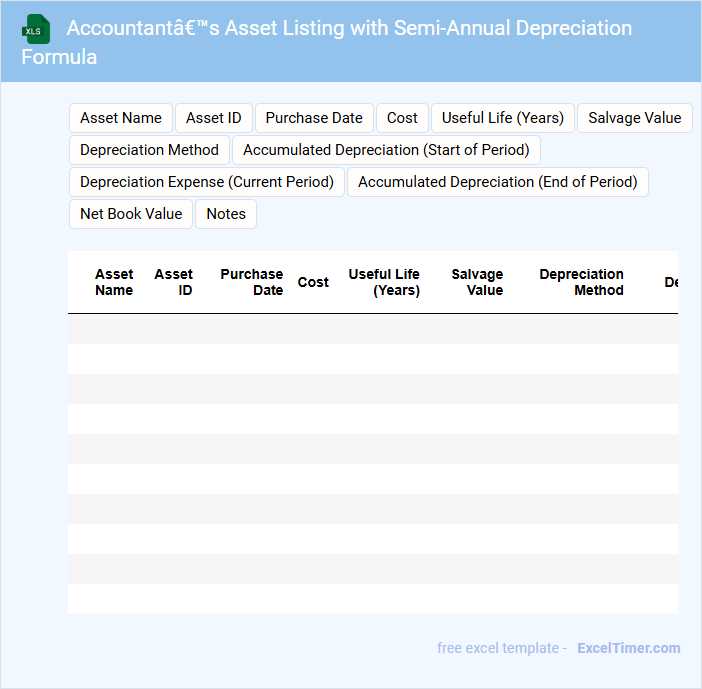

Accountant’s Asset Listing with Semi-Annual Depreciation Formula

An Accountant's Asset Listing typically contains a detailed inventory of all fixed assets owned by a company, including purchase dates, costs, and identification numbers. This document helps in tracking the assets' values over time and is essential for accurate financial reporting. The inclusion of a semi-annual depreciation formula allows for precise calculation of asset value reduction every six months, aiding in better tax and expense management.

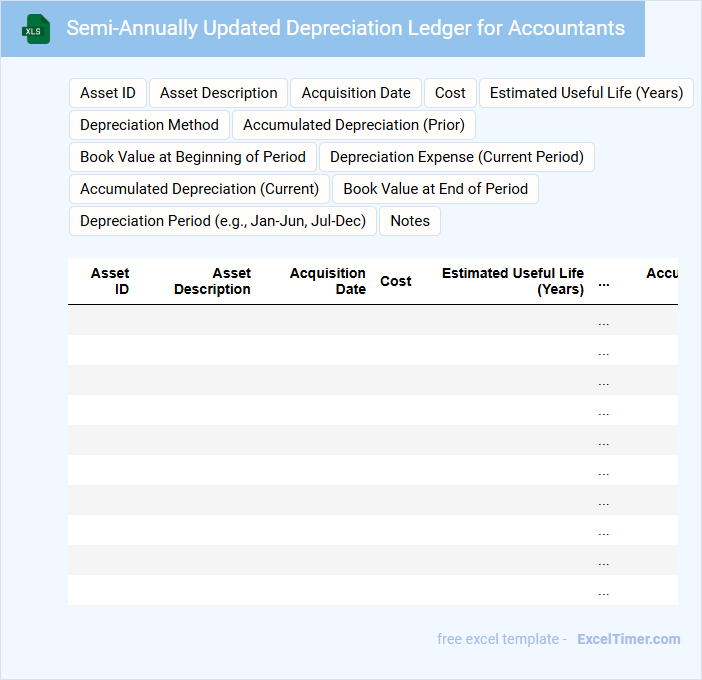

Semi-Annually Updated Depreciation Ledger for Accountants

A Semi-Annually Updated Depreciation Ledger for Accountants is a financial record that tracks the depreciation of assets over six-month periods. It provides an organized summary to assist in accurate financial reporting and asset management.

- Include detailed asset descriptions and acquisition dates for clarity.

- Record both accumulated and current period depreciation values accurately.

- Ensure updates align with accounting periods and depreciation methods used.

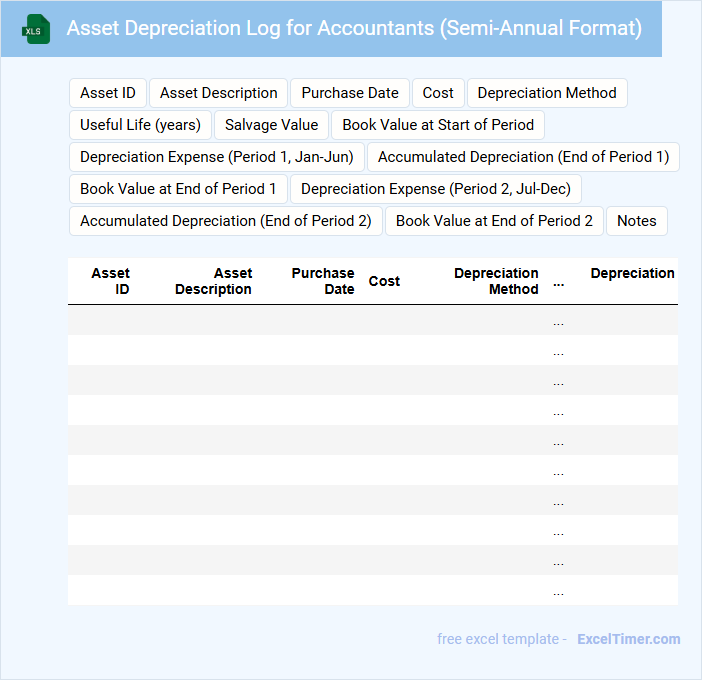

Asset Depreciation Log for Accountants (Semi-Annual Format)

An Asset Depreciation Log for Accountants (Semi-Annual Format) typically contains detailed records of asset values, depreciation calculations, and adjustment entries to track the reduction in asset value over time.

- Asset Identification: Clearly list each asset with description, purchase date, and original cost for accurate tracking.

- Depreciation Method: Specify the chosen depreciation method (e.g., straight-line or declining balance) applied to each asset.

- Semi-Annual Entries: Include semi-annual depreciation calculations and summary totals to ensure timely financial reporting.

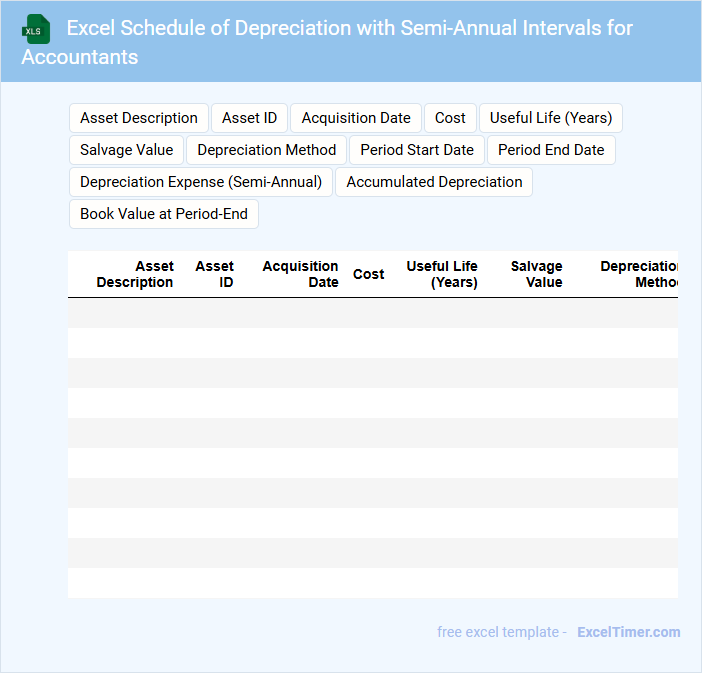

Excel Schedule of Depreciation with Semi-Annual Intervals for Accountants

The Excel Schedule of Depreciation is a financial document used to track the allocation of an asset's cost over time. It typically contains details such as asset description, acquisition date, cost, depreciation method, and accumulated depreciation. Accountants use this to ensure accurate financial reporting and compliance with accounting standards.

For schedules with Semi-Annual Intervals, it is important to include exact dates and calculate depreciation amounts for each six-month period. This method helps in precise expense matching and tax planning. Accurate interval setup and formula integrity are essential for maintaining reliable accounting records.

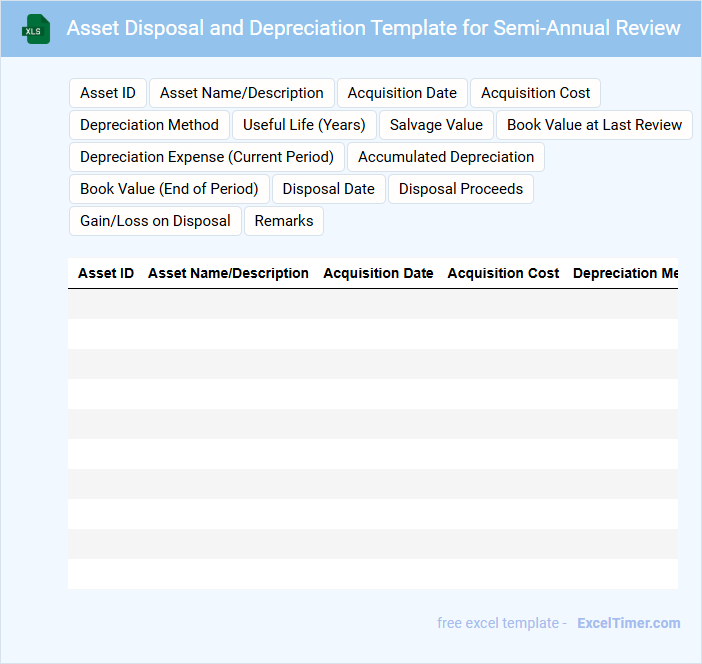

Asset Disposal and Depreciation Template for Semi-Annual Review

This document typically contains detailed records of asset disposals and depreciation calculations prepared for a semi-annual financial review. It helps in tracking asset value adjustments and ensuring accurate financial reporting.

- Include a summary ofdisposed assets with dates and reasons for disposal.

- Provide depreciation schedules showing accumulated and current depreciation amounts.

- Ensure compliance with relevant accounting standards and company policies.

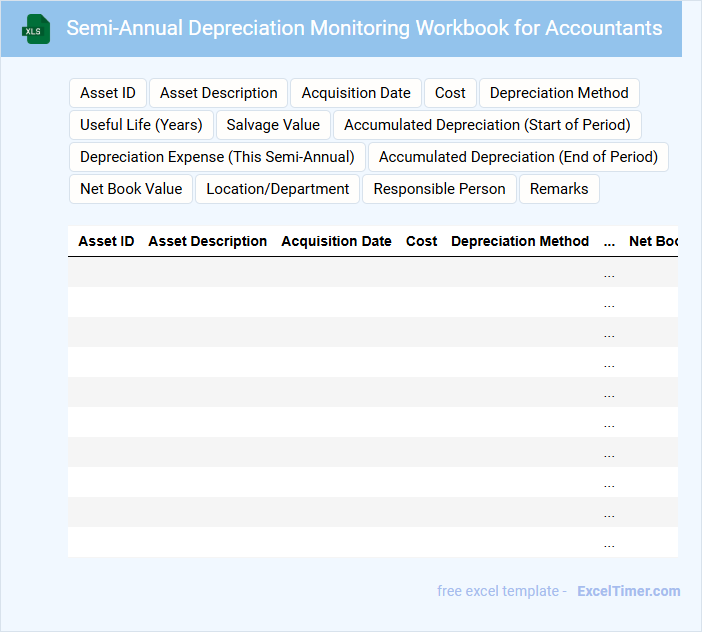

Semi-Annual Depreciation Monitoring Workbook for Accountants

This Semi-Annual Depreciation Monitoring Workbook for Accountants is a structured document designed to track and report asset depreciation over six-month periods. It aids in maintaining accurate financial records and ensuring compliance with accounting standards.

- Include detailed asset information to enhance tracking accuracy.

- Regularly update depreciation calculations to reflect current financial status.

- Incorporate summary reports for streamlined decision-making and audit purposes.

Asset Life Tracking With Semi-Annual Depreciation Excel Sheet

An Asset Life Tracking document typically contains detailed records of an asset's acquisition, usage, and depreciation over time. It helps organizations monitor the value and condition of their assets systematically, ensuring accurate financial reporting. A Semi-Annual Depreciation Excel Sheet specifically tracks depreciation biannually, providing updated asset valuations twice each year.

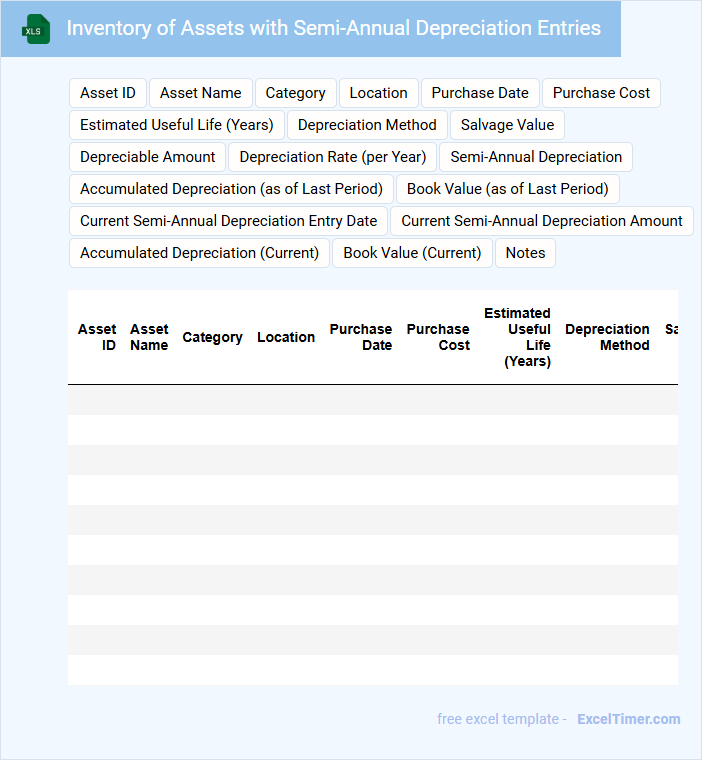

Inventory of Assets with Semi-Annual Depreciation Entries

What information is typically included in an Inventory of Assets with Semi-Annual Depreciation Entries? This document usually contains a detailed list of all company assets, including purchase dates, costs, and accumulated depreciation recorded every six months. It helps track the current value of assets and supports accurate financial reporting and tax calculations.

What important aspects should be considered when maintaining this inventory? Ensure timely and consistent depreciation entries are recorded semi-annually, and regularly verify asset conditions and valuations for accuracy. Including clear categories and updated documentation improves asset management and audit readiness.

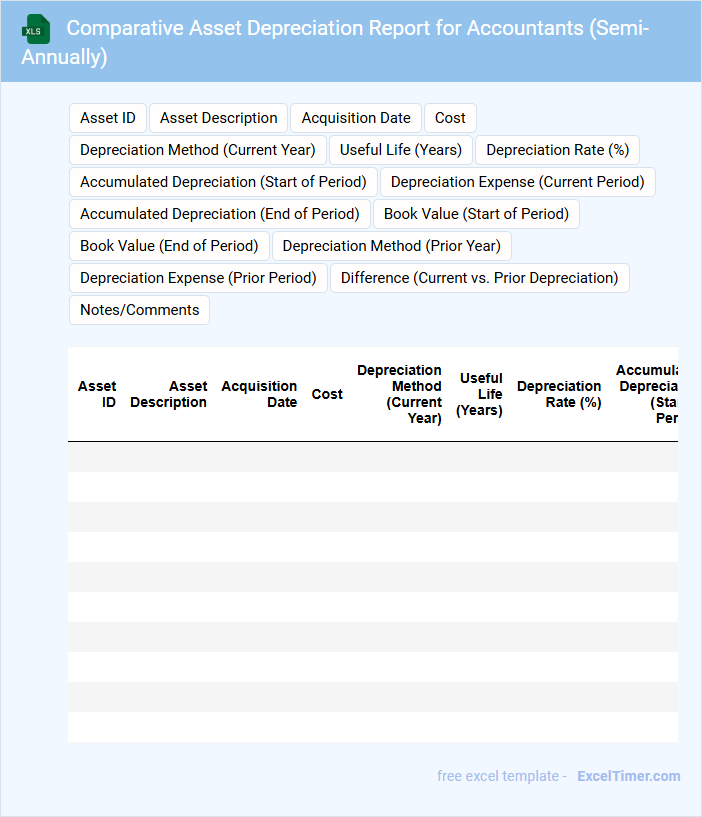

Comparative Asset Depreciation Report for Accountants (Semi-Annually)

A Comparative Asset Depreciation Report for Accountants (Semi-Annually) provides an analysis of asset values and their depreciation over a six-month period, aiding in accurate financial reporting. It highlights trends and discrepancies in asset depreciation to ensure compliance with accounting standards.

- Include clear categories for asset types and depreciation methods used.

- Present comparative figures from previous periods to identify changes.

- Highlight any anomalies or unusual depreciation patterns for review.

What is the formula used in Excel to calculate semi-annual straight-line depreciation of an asset?

The Excel formula to calculate semi-annual straight-line depreciation is `=Cost - Salvage Value / Useful Life in Years * 0.5`. You input your asset's initial cost, salvage value, and useful life to find the depreciation expense for each six-month period. This method helps accountants accurately track asset value reduction on a semi-annual basis.

How do you set up a depreciation schedule in Excel to reflect semi-annual periods?

To set up a semi-annual depreciation schedule in Excel, divide the asset's annual depreciation expense by two and create periods labeled as six-month intervals. Use formulas to calculate depreciation values for each semi-annual period, ensuring cumulative depreciation does not exceed the asset's cost minus salvage value. Incorporate Excel functions like DATE and EDATE to accurately reflect the semi-annual timeline for asset depreciation tracking.

Which Excel function allows you to compute book value of an asset after each semi-annual depreciation?

The Excel function SLV (Straight Line Depreciation) calculates the book value of an asset after each semi-annual depreciation by spreading the cost evenly over the asset's useful life. You use the SLV function with arguments including cost, salvage value, and the number of periods to reflect accurate asset valuation. This method ensures precise tracking of your asset's decreasing value in semi-annual accounting cycles.

How can you use Excel to differentiate between annual and semi-annual depreciation methods for fixed assets?

Excel allows you to apply formulas that calculate asset depreciation based on either annual or semi-annual periods by adjusting the depreciation rate and period inputs. Using functions like SLN or DB, you can accurately model straight-line or declining balance methods tailored to your semi-annual schedule. This approach ensures precise tracking of your asset's value and aids in financial reporting compliance.

What key columns should be included in an Excel worksheet for tracking semi-annual asset depreciation?

Your Excel worksheet for tracking semi-annual asset depreciation should include key columns such as Asset Name, Acquisition Date, Cost, Useful Life, Depreciation Rate, Accumulated Depreciation, Depreciation Expense per Period, and Book Value. These columns allow accurate calculation, scheduling, and monitoring of asset values over time. Including a column for Depreciation Method ensures consistency with your accounting policies.