The Semi-annually Excel Template for Loan Repayment Schedule provides a structured format to track loan payments occurring every six months. This template helps users calculate interest and principal amounts accurately, ensuring effective financial planning. Its automated formulas simplify amortization, reducing errors and saving time.

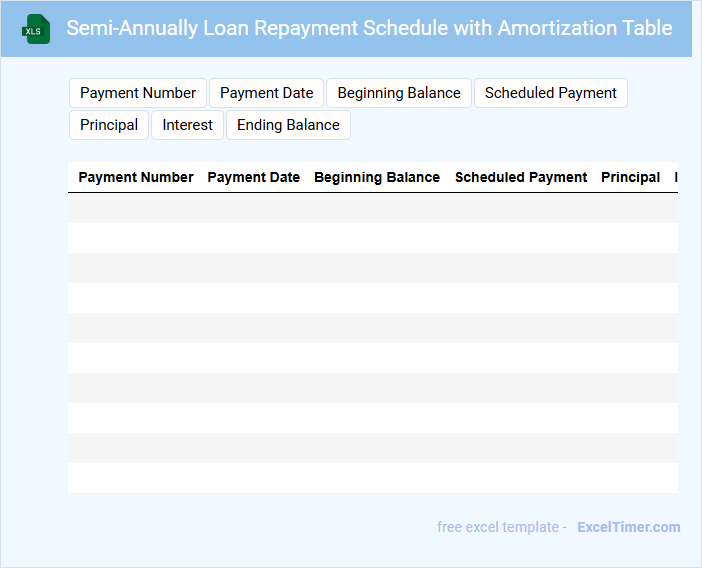

Semi-Annually Loan Repayment Schedule with Amortization Table

A Semi-Annually Loan Repayment Schedule typically outlines the payment dates and amounts due every six months for a loan. It helps borrowers understand their financial obligations and track their repayment progress effectively.

The Amortization Table details each payment's breakdown between principal and interest over the loan term. Including the total interest paid and remaining balance after each payment is essential for clarity.

For accuracy, always verify interest rates and adjust payment amounts accordingly to avoid discrepancies in the schedule.

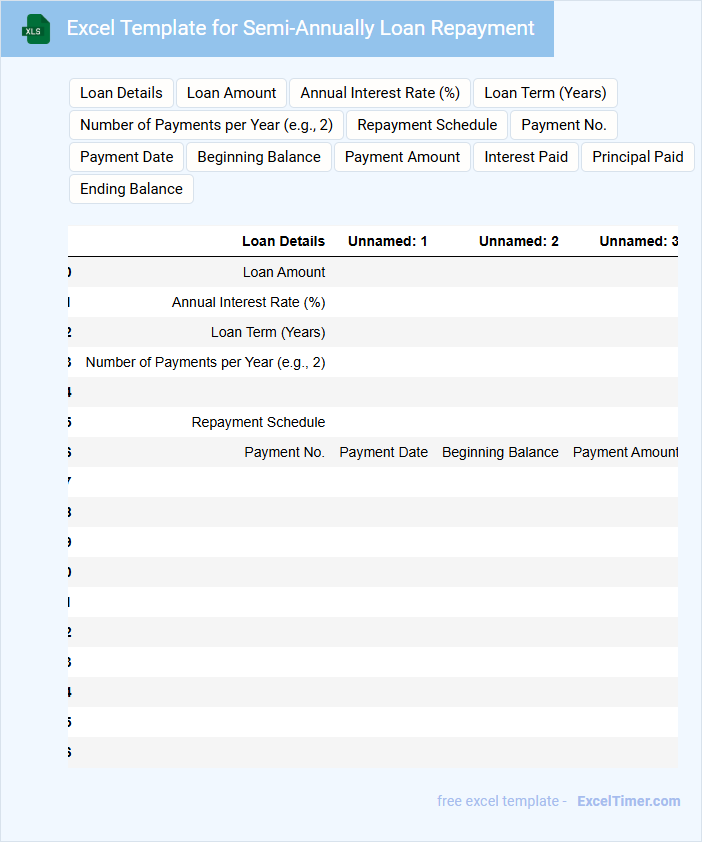

Excel Template for Semi-Annually Loan Repayment

An Excel Template for Semi-Annually Loan Repayment typically contains detailed amortization schedules that outline payment dates, principal, interest amounts, and remaining balances. It helps borrowers and lenders track loan repayment progress accurately over each six-month period.

Key features include customizable interest rates, loan terms, and automatic calculation formulas for ease of use. For optimal results, ensure to input accurate loan details and update payment records promptly.

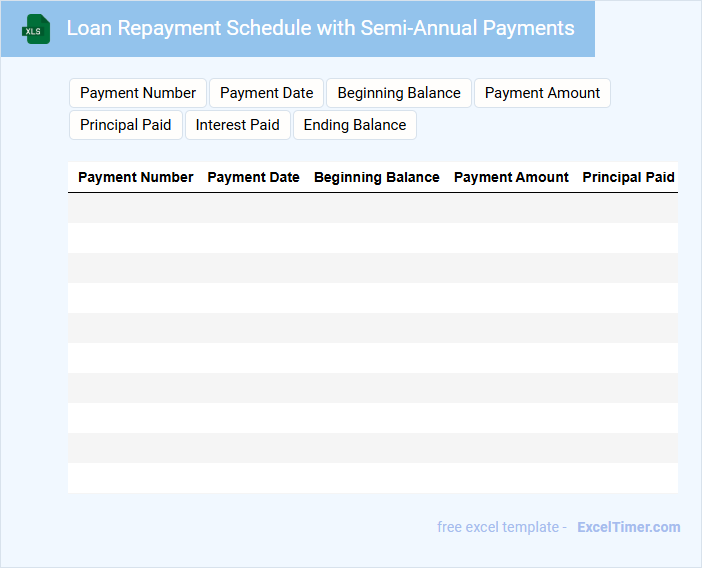

Loan Repayment Schedule with Semi-Annual Payments

A Loan Repayment Schedule with Semi-Annual Payments outlines the specific dates and amounts due every six months to pay off a loan. It provides a clear timeline for borrowers to manage their financial obligations effectively.

This document typically contains details such as the payment due dates, amounts of principal and interest, and the remaining balance after each payment. For accuracy, it is important to ensure the schedule accounts for interest compounding and any fees associated with late payments.

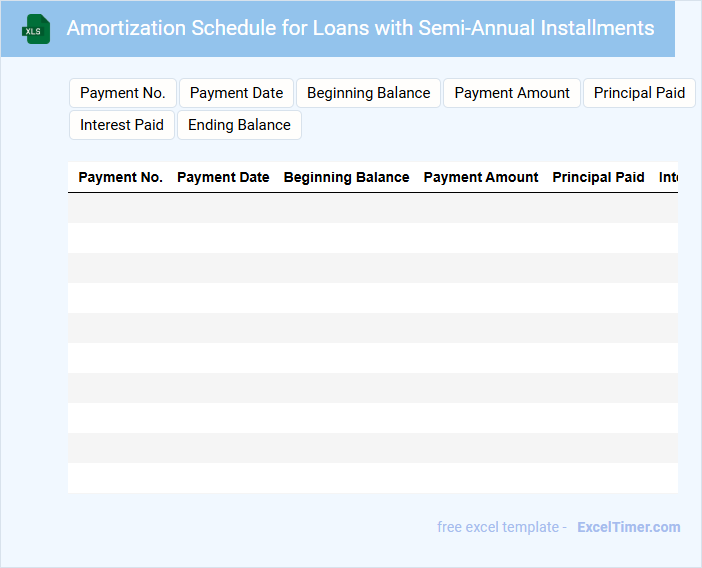

Amortization Schedule for Loans with Semi-Annual Installments

An Amortization Schedule for Loans with Semi-Annual Installments typically contains detailed information about payment dates, principal and interest amounts, and remaining loan balance.

- Payment Structure: Lists all semi-annual payment dates and amounts due.

- Principal vs. Interest Breakdown: Shows how each payment is split between reducing the loan balance and interest costs.

- Remaining Balance Tracking: Displays outstanding loan balance after each payment throughout the loan term.

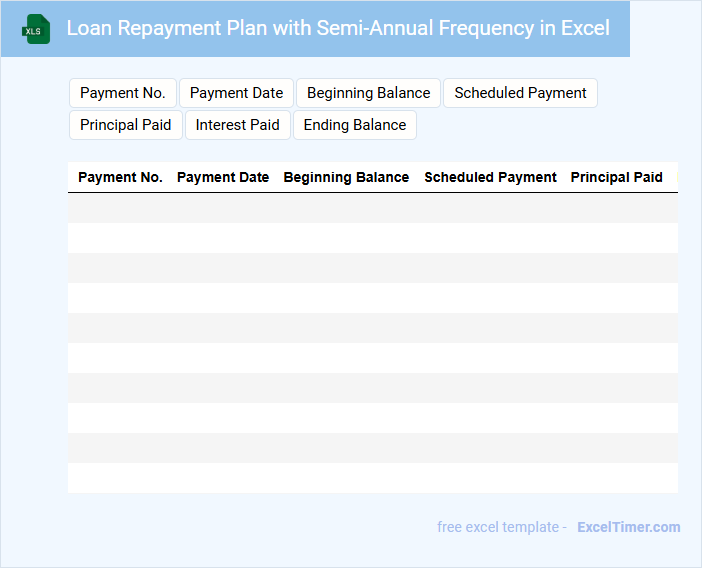

Loan Repayment Plan with Semi-Annual Frequency in Excel

A Loan Repayment Plan with Semi-Annual Frequency in Excel typically outlines the schedule and amounts for repaying a loan every six months. It helps borrowers and lenders track payments, interest, and principal over the life of the loan.

- Include clear dates and amounts for each semi-annual payment.

- Break down payments into principal and interest components.

- Incorporate automatic calculations using Excel formulas to update balances.

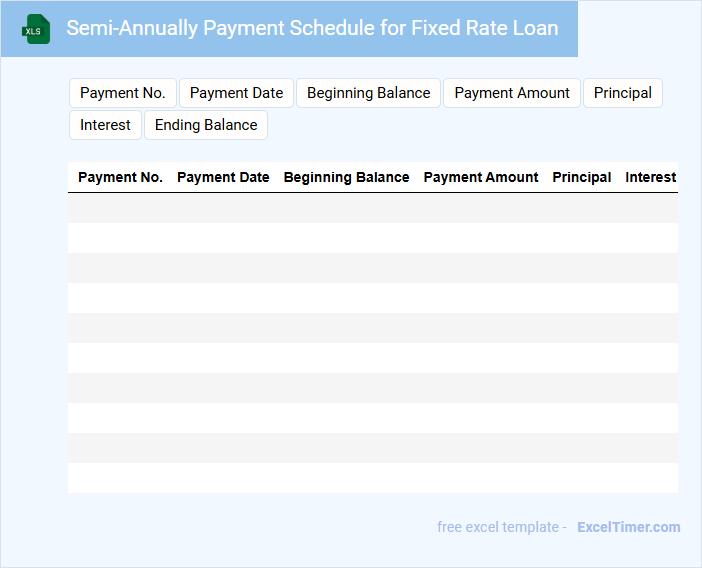

Semi-Annually Payment Schedule for Fixed Rate Loan

Semi-Annually Payment Schedule for Fixed Rate Loan typically outlines the repayment structure, due dates, and amounts for loan installments paid every six months.

- Payment Dates: Clearly specify the exact semi-annual due dates to avoid missed payments.

- Interest Rate Consistency: Confirm the fixed interest rate remains unchanged throughout the loan term.

- Principal and Interest Breakdown: Provide a detailed allocation of each payment toward principal and interest.

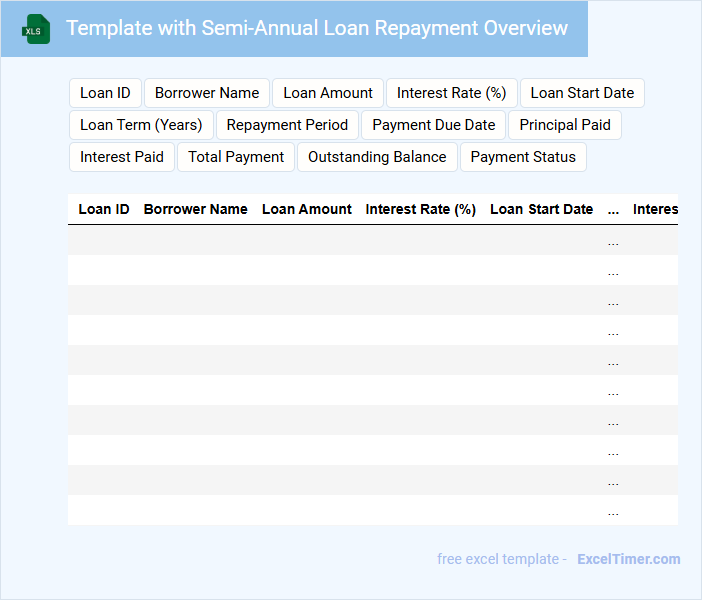

Template with Semi-Annual Loan Repayment Overview

This type of document typically provides a detailed summary of loan repayments made every six months. It helps borrowers and lenders track payment progress and outstanding balances efficiently.

Key suggestions for this template include:

- Include clear dates for each repayment period.

- Highlight principal and interest amounts separately.

- Provide a running balance after each payment.

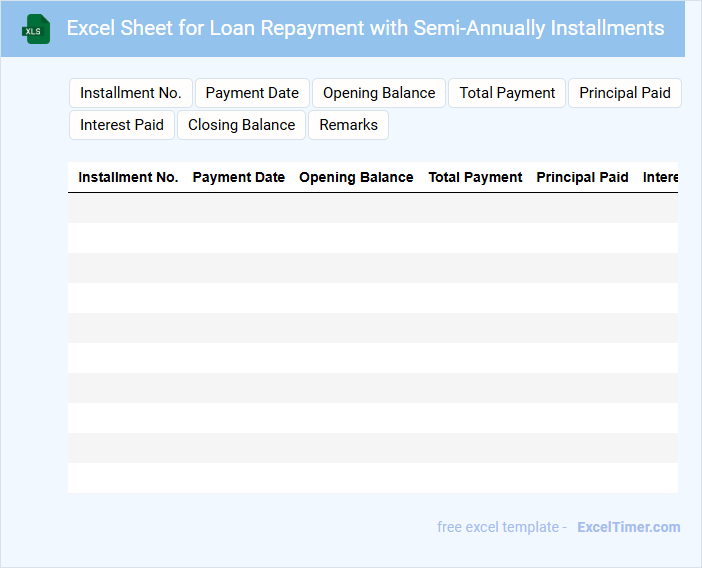

Excel Sheet for Loan Repayment with Semi-Annually Installments

An Excel Sheet for Loan Repayment with semi-annually installments is designed to track the amortization schedule, showing both principal and interest payments over the loan term. It helps borrowers visualize how each payment affects the outstanding balance and overall interest paid.

This document typically contains loan details such as principal amount, interest rate, payment dates, and installment amounts calculated every six months. To ensure accuracy, it's important to include formulas that automatically update balances and highlight missed or late payments.

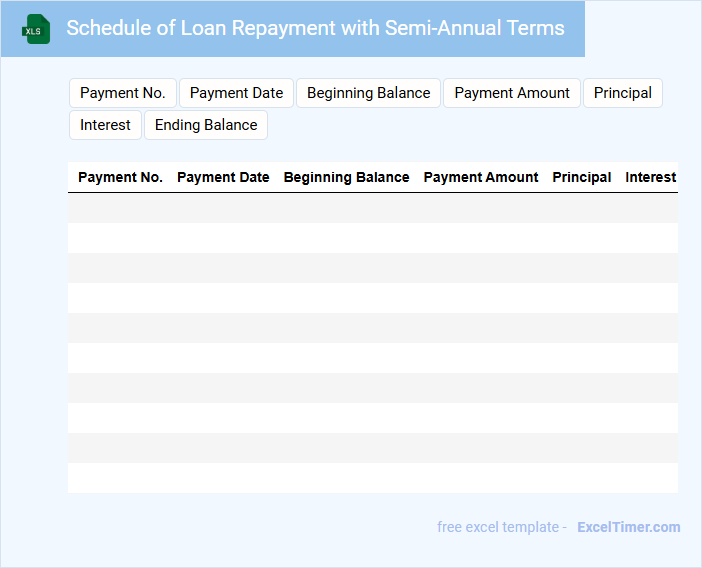

Schedule of Loan Repayment with Semi-Annual Terms

What information is typically included in a Schedule of Loan Repayment with Semi-Annual Terms? This document usually outlines the dates and amounts of payments due every six months, detailing principal and interest components. It serves as a clear guide for both lenders and borrowers to track repayment progress efficiently.

Semi-Annual Loan Amortization Template for Repayment Tracking

A Semi-Annual Loan Amortization Template typically contains a detailed schedule outlining loan repayment amounts over six-month intervals. It includes columns for principal, interest, total payment, and remaining balance to help track repayment progress efficiently. This document is essential for maintaining transparency and ensuring timely loan servicing.

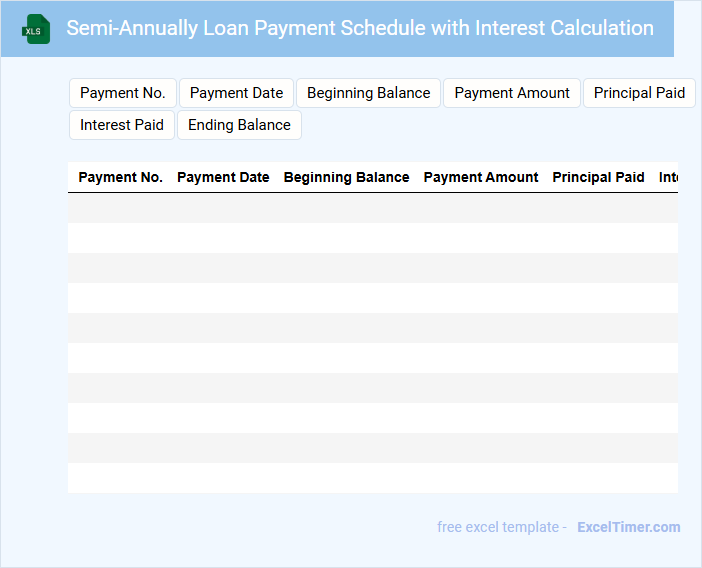

Semi-Annually Loan Payment Schedule with Interest Calculation

A Semi-Annually Loan Payment Schedule typically includes detailed information about the payment dates, principal amounts, and interest calculations to be paid every six months. It outlines the repayment structure, showing how each payment reduces the loan balance over time. This document is essential for borrowers and lenders to track loan amortization and ensure timely payments.

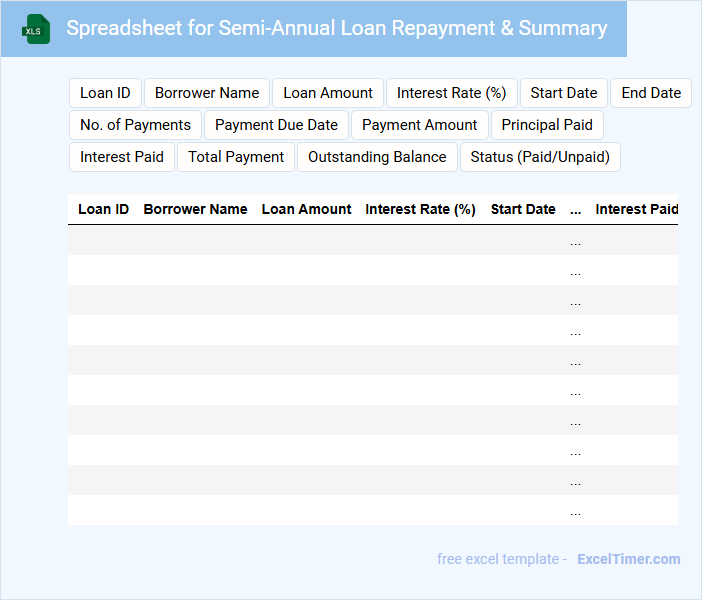

Spreadsheet for Semi-Annual Loan Repayment & Summary

This type of document typically contains detailed records of loan payments and a summarized financial overview for a six-month period.

- Payment Schedule: Clearly lists each repayment date and amount for tracking consistency.

- Outstanding Balance: Displays ongoing loan balance after each payment to monitor progress.

- Summary Section: Provides a concise overview of total payments made and interest accrued for quick reference.

Semi-Annually Loan Repayment Tracker with Charts

What information does a Semi-Annually Loan Repayment Tracker with Charts typically contain? This type of document usually includes detailed records of loan amounts, repayment dates, and interest calculations occurring every six months. It also features visual charts to illustrate repayment progress and outstanding balances, helping users easily monitor their financial commitments.

Why is it important to include clear labels and consistent data formatting in this tracker? Clear labels ensure that users can quickly identify key information such as payment due dates and amounts, while consistent formatting improves readability and accuracy. Additionally, incorporating summary sections for total repayments and remaining loan balance enhances decision-making and financial planning.

Template for Repayment Schedule of Semi-Annual Loan

A repayment schedule document typically outlines the terms and structure for loan repayments over a specified period. It includes details such as the principal amount, interest rates, installment amounts, and due dates. This type of document is essential for both lenders and borrowers to ensure timely and clear repayment tracking.

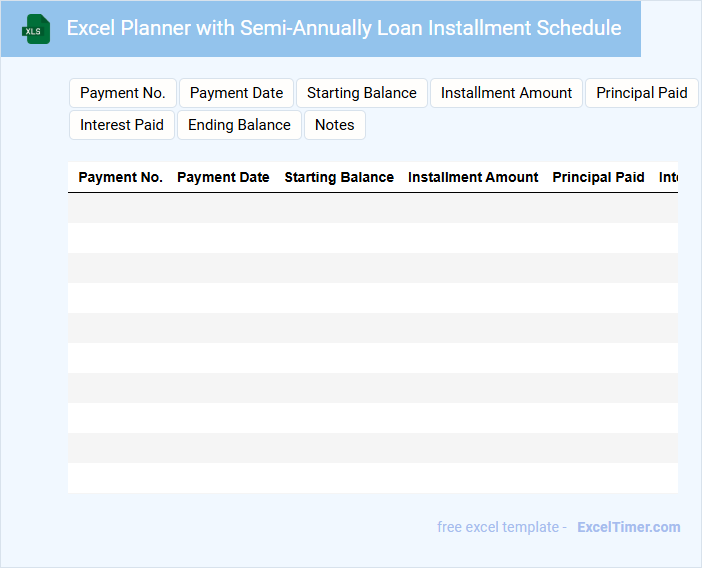

Excel Planner with Semi-Annually Loan Installment Schedule

An Excel Planner with a Semi-Annually Loan Installment Schedule typically contains detailed tables outlining payment dates, principal amounts, interest calculations, and remaining balances for each installment period. It is designed to help users track loan repayments efficiently and forecast financial obligations over time.

This type of document often includes formulas for automatic calculations and visual aids such as charts to enhance understanding of the loan progress. To optimize its usefulness, ensure accurate input of loan terms and regularly update the schedule for any changes in payment or interest rates.

What formula calculates the semi-annual payment amount for a loan in Excel?

The PMT function in Excel calculates the semi-annual payment amount for a loan by using the formula =PMT(rate/2, nper*2, -pv), where rate is the annual interest rate, nper is the total number of years, and pv is the loan principal. Your loan repayment schedule updates automatically when you adjust these values for semi-annual payments. This formula ensures precise calculation of your periodic loan payments based on semi-annual intervals.

How do you configure the payment frequency to "semi-annually" in an Excel loan amortization schedule?

To configure the payment frequency to semi-annually in your Excel loan amortization schedule, set the payment interval to 6 months or 2 payments per year. Adjust the loan term and interest calculations accordingly to reflect semi-annual periods. Ensure that payment dates increment every six months to match the semi-annual repayment schedule.

Which Excel function can be used to determine the remaining principal after each semi-annual payment?

The Excel function PMT calculates the payment amount for a loan based on constant interest and payments. To determine the remaining principal after each semi-annual payment, use the CUMPRINC or PPMT function specific to each period. These functions account for loan terms, interest rates, and payment frequency in a semi-annual loan repayment schedule.

How are the interest and principal portions separated for each semi-annual installment in Excel?

Your semi-annual loan repayment schedule in Excel separates interest and principal portions using formulas that calculate interest on the outstanding balance for each period, while the remainder of the payment reduces the principal. The interest portion is typically computed by multiplying the beginning loan balance by the semi-annual interest rate. The principal portion equals the total installment amount minus the interest calculated for that period.

What adjustments are needed in Excel formulas to account for semi-annual compounding in a loan repayment schedule?

To account for semi-annual compounding in your loan repayment schedule, adjust the interest rate by dividing the annual rate by two and multiply the number of periods by two in Excel formulas. Use the PMT function with these semi-annual values to accurately calculate payment amounts. This ensures your loan schedule reflects the correct compounding frequency and repayment structure.