The Semi-annually Excel Template for Asset Depreciation simplifies tracking asset value reduction every six months, ensuring accurate financial reporting. It automates depreciation calculations based on specified methods like straight-line or declining balance, minimizing manual errors. Users benefit from customizable fields to fit various asset types and company policies efficiently.

Semi-Annually Excel Template for Asset Depreciation Tracking

A Semi-Annually Excel Template for Asset Depreciation Tracking is designed to help organizations monitor and calculate the depreciation of their fixed assets every six months. It typically contains asset details, purchase dates, depreciation methods, and accumulated depreciation values. Using this template ensures accurate financial reporting and efficient asset management over time.

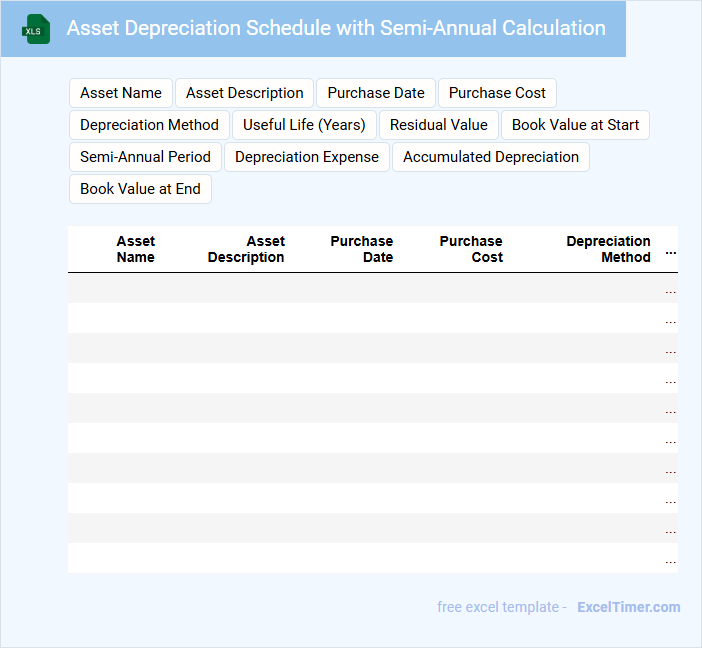

Asset Depreciation Schedule with Semi-Annual Calculation

An Asset Depreciation Schedule with Semi-Annual Calculation typically outlines the depreciation expenses for fixed assets over time, calculated twice a year. This document details the asset's initial cost, depreciation method, useful life, and accumulated depreciation. For accuracy, it's important to regularly update the schedule and ensure compliance with relevant accounting standards.

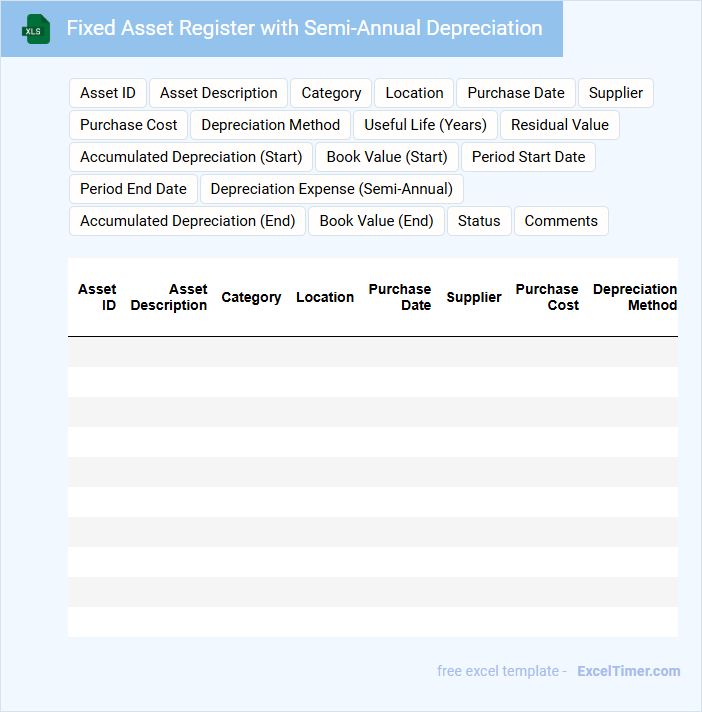

Fixed Asset Register with Semi-Annual Depreciation

A Fixed Asset Register with Semi-Annual Depreciation is a detailed record of an organization's fixed assets and their depreciation calculated twice a year. This document helps track asset value, useful life, and financial reporting compliance.

- Include asset descriptions, acquisition dates, and cost details.

- Update depreciation calculations accurately every six months.

- Ensure proper categorization of assets for tax and audit purposes.

Semi-Annually Depreciation Table for Office Equipment

The Semi-Annually Depreciation Table for office equipment typically contains a detailed schedule outlining the depreciation expense recognized every six months. It lists the original cost, accumulated depreciation, and the book value at each period, helping track the asset's declining value over time. This document is essential for accurate financial reporting and tax calculations related to office assets.

It is important to ensure that the depreciation method aligns with the company's accounting policies and complies with relevant tax regulations. Consistent updates and verification of asset details, such as purchase date and cost, are crucial for accuracy. Additionally, including clear notes on assumptions or changes in depreciation rates can improve transparency and decision-making.

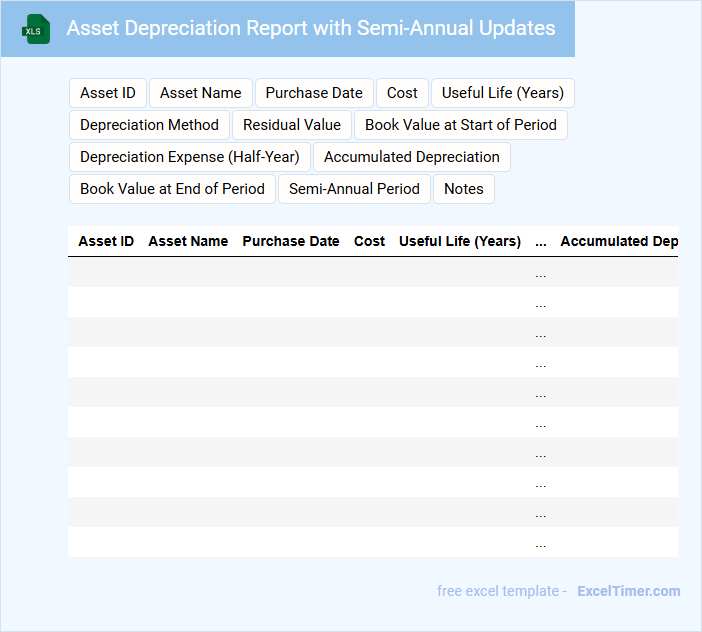

Asset Depreciation Report with Semi-Annual Updates

An Asset Depreciation Report typically contains detailed information on the depreciation schedules and values of company assets over time. It provides semi-annual updates to reflect changes in asset value, usage, or new acquisitions. This document is essential for accurate financial reporting and informed asset management decisions.

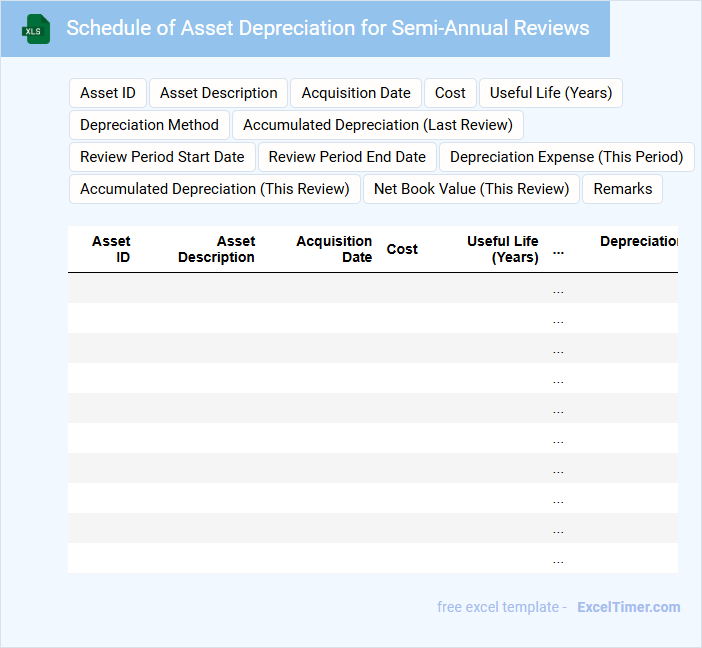

Schedule of Asset Depreciation for Semi-Annual Reviews

A Schedule of Asset Depreciation is a crucial document used to track the reduction in value of assets over time, particularly for accounting and tax purposes. It typically contains details such as the asset description, acquisition date, original cost, accumulated depreciation, and book value. For semi-annual reviews, it is important to ensure accurate calculation of depreciation methods and timely updates to reflect any asset disposals or impairments.

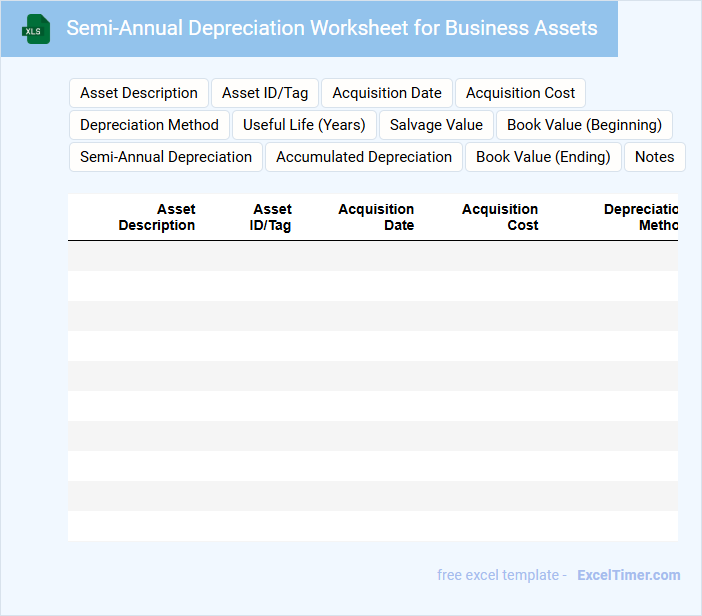

Semi-Annual Depreciation Worksheet for Business Assets

A Semi-Annual Depreciation Worksheet for Business Assets is a document used to track the depreciation of a company's assets over two six-month periods within a fiscal year. It typically contains details such as asset description, purchase date, cost, accumulated depreciation, and depreciation expense for each period. This worksheet helps businesses accurately report asset value for tax and accounting purposes.

Asset Depreciation Analysis with Semi-Annual Summary

This type of document typically contains detailed information about asset depreciation, including the calculation methods, depreciation schedules, and accumulated depreciation values. It provides a clear view of how asset values decrease over time, helping in accurate financial reporting. A semi-annual summary highlights key depreciation insights and any adjustments made within the six-month period.

Important elements to include are the asset description, purchase date, depreciation method used, accumulated depreciation to date, and remaining useful life. Additionally, summaries should clearly compare current and previous periods to identify trends or anomalies. Clear documentation of any changes in depreciation rates or asset disposals is crucial for transparency and audit purposes.

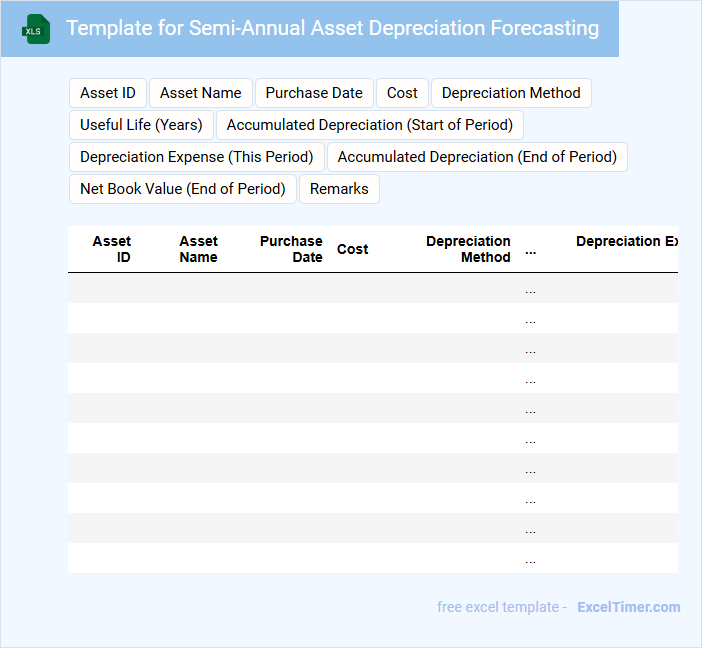

Template for Semi-Annual Asset Depreciation Forecasting

What information is typically included in a Template for Semi-Annual Asset Depreciation Forecasting? This type of document usually contains detailed records of asset values, depreciation methods, and scheduled deductions over the forecast period. It also includes assumptions, calculation formulas, and summaries to help businesses anticipate the financial impact of asset depreciation semi-annually.

What important considerations should be made when creating this template? Ensure accuracy by incorporating up-to-date asset valuations and appropriate depreciation methods aligned with accounting standards. Additionally, include clear documentation of calculation assumptions and provide flexibility for adjustments in asset life spans or residual values to accommodate changing business conditions.

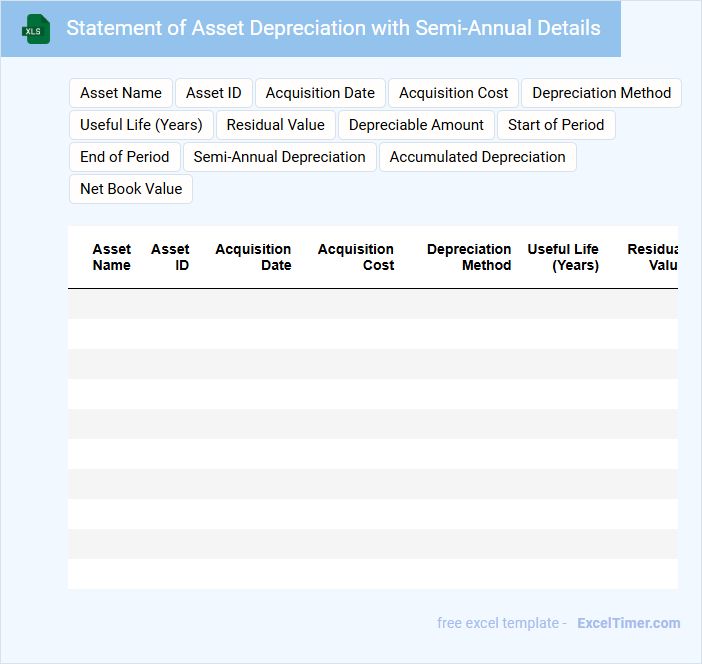

Statement of Asset Depreciation with Semi-Annual Details

What information is typically found in a Statement of Asset Depreciation with Semi-Annual Details? This document usually contains a detailed record of asset values and their depreciation amounts calculated over six-month periods. It helps businesses track the diminishing value of their assets for accurate accounting and tax reporting.

What important factors should be considered when preparing this statement? It is essential to ensure accurate asset valuation, apply consistent depreciation methods, and document dates of acquisition and disposal clearly for precise semi-annual calculations.

Asset Depreciation Tracking for Semi-Annual Periods

Asset Depreciation Tracking for Semi-Annual Periods documents the systematic allocation of asset costs over time to monitor value reduction and financial impact biannually.

- Asset Identification: Clearly list all assets subject to depreciation within the semi-annual period.

- Depreciation Method: Specify the chosen depreciation method (e.g., straight-line, declining balance) applied consistently.

- Reporting Periods: Record depreciation calculations separately for each half-year to ensure accurate financial reporting.

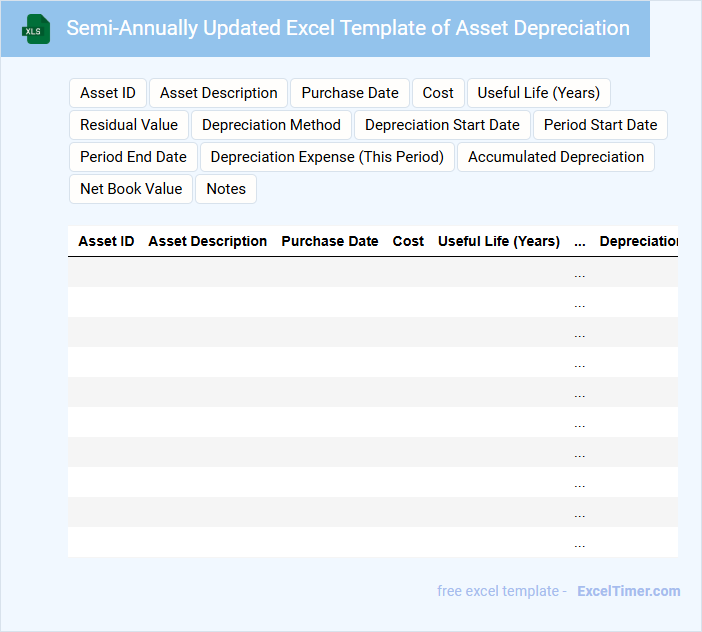

Semi-Annually Updated Excel Template of Asset Depreciation

This document typically contains detailed records and calculations for asset depreciation updated every six months to reflect changes in asset value. It helps in managing and tracking the depreciation of company assets systematically over time.

- Ensure accurate input of asset acquisition dates and cost values for precise depreciation calculation.

- Update depreciation methods and rates consistently with accounting standards semi-annually.

- Maintain clear documentation of adjustments or disposals to keep the asset register current and audit-ready.

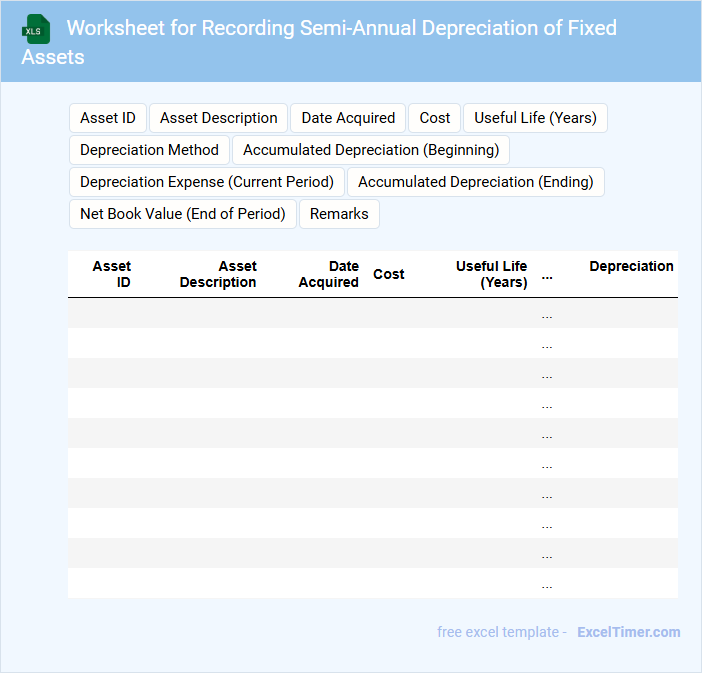

Worksheet for Recording Semi-Annual Depreciation of Fixed Assets

A worksheet for recording semi-annual depreciation of fixed assets is a financial document used to track the allocation of asset costs over time. It typically includes columns for asset details, depreciation rates, and accumulated depreciation values. Ensuring accuracy and consistency in this worksheet is crucial for proper financial reporting and asset management.

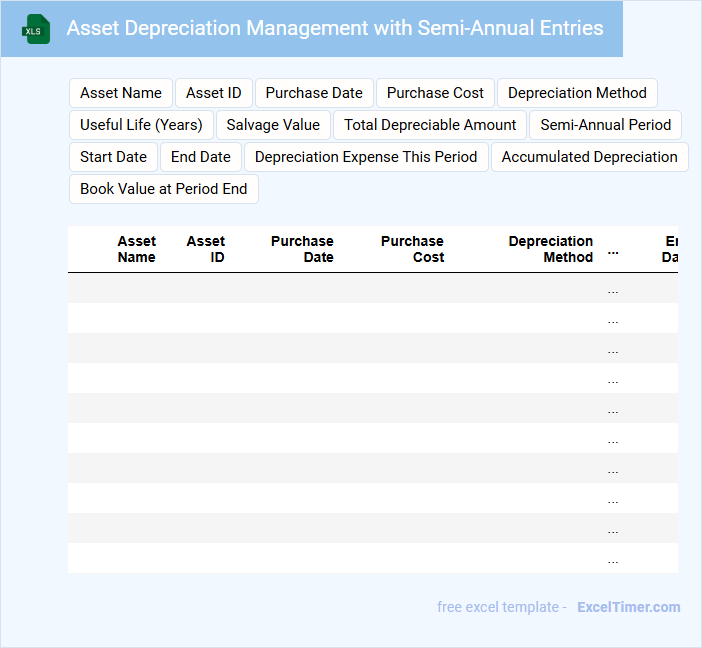

Asset Depreciation Management with Semi-Annual Entries

Asset Depreciation Management with Semi-Annual Entries typically contains detailed records of asset values, depreciation schedules, and periodic adjustment entries.

- Accurate asset listing: Ensure the document includes a comprehensive list of all depreciable assets with acquisition dates and costs.

- Consistent depreciation method: Clearly define and apply the chosen depreciation method for consistency in semi-annual calculations.

- Regular updating schedule: Maintain semi-annual entries to reflect asset value changes and comply with financial reporting standards.

Inventory of Assets with Semi-Annual Depreciation Tracking

What information is typically included in an Inventory of Assets with Semi-Annual Depreciation Tracking document? This document usually lists all company assets along with their purchase details, current value, and scheduled depreciation amounts calculated on a semi-annual basis. It helps organizations monitor asset value changes over time and make informed financial decisions related to asset management and budgeting.

How does semi-annual depreciation affect the calculation of asset book value in Excel?

Semi-annual depreciation divides the annual depreciation expense into two periods, allowing you to update the asset's book value every six months in Excel. Your calculation reflects a more frequent reduction in asset value, enhancing accuracy over shorter intervals. This method improves financial reporting by capturing intermediate asset value changes compared to annual depreciation.

What Excel formula is used to calculate semi-annual depreciation expense for assets?

You can calculate semi-annual depreciation expense in Excel using the formula =SLN(cost, salvage, life*2)/2, where SLN represents the straight-line depreciation function. This formula divides the annual depreciation by two to reflect semi-annual periods, considering the asset's cost, salvage value, and useful life in years. Using this approach helps accurately track your asset depreciation every six months.

How do you adjust a depreciation schedule in Excel to reflect semi-annual periods?

To adjust a depreciation schedule in Excel for semi-annual periods, divide the annual depreciation expense by two and update the period intervals to reflect six-month increments. Use functions like SUM or IF to consolidate amounts for each semi-annual period. You can customize your Excel formulas to accurately track asset depreciation on a semi-annual basis.

What built-in Excel functions assist in projecting semi-annual asset depreciation?

Excel functions like SLN and DB effectively calculate straight-line and declining balance depreciation on a semi-annual basis by adjusting the period inputs. The AMORDEGRC function provides depreciation values for assets with specific accounting methods, useful for semi-annual schedules. Using these functions with custom date intervals enables precise semi-annual asset depreciation projections.

How does using semi-annual depreciation impact financial statements when tracked in Excel?

Using semi-annual depreciation in Excel ensures asset value reduction is recorded twice yearly, improving accuracy in expense reporting. This method aligns depreciation expense with asset usage patterns more precisely than annual methods. Financial statements reflect more timely expense recognition, enhancing the reliability of net income and asset valuation.