The Semi-annually Excel Template for Tax Estimation simplifies tracking and calculating taxes every six months, ensuring accurate financial planning. This template allows users to input income and deductible expenses, automatically estimating tax liabilities based on current regulations. Its ease of use and customization options make it an essential tool for businesses and individuals managing semi-annual tax payments.

Semi-Annually Excel Template for Tax Estimation

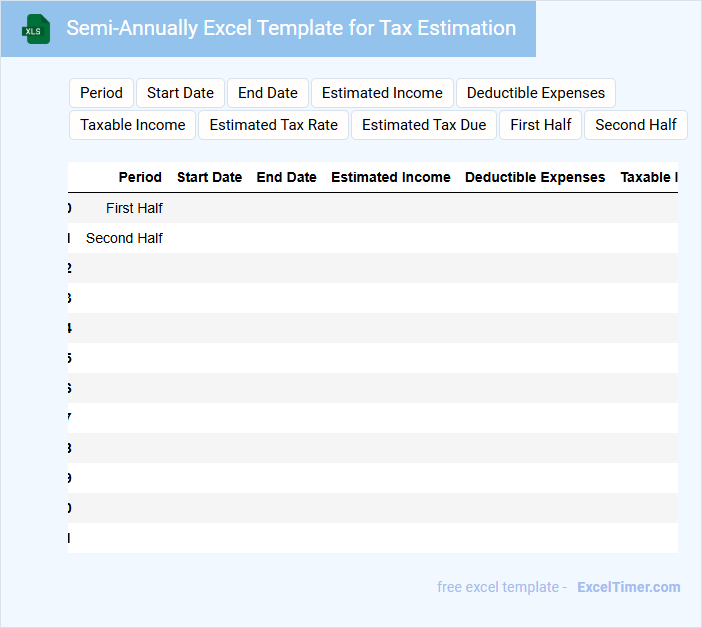

A Semi-Annually Excel Template for Tax Estimation typically contains organized financial data divided into two periods within the year, enabling users to monitor and calculate estimated taxes accurately. It includes income entries, expense categories, and tax rate applications tailored to semi-annual reporting.

This template helps in forecasting tax liabilities and ensuring compliance with tax deadlines, reducing the risk of penalties. Important features to include are automatic tax calculations, error checks, and clear summary reports for efficient tax planning.

Tax Estimation Spreadsheet with Semi-Annual Format

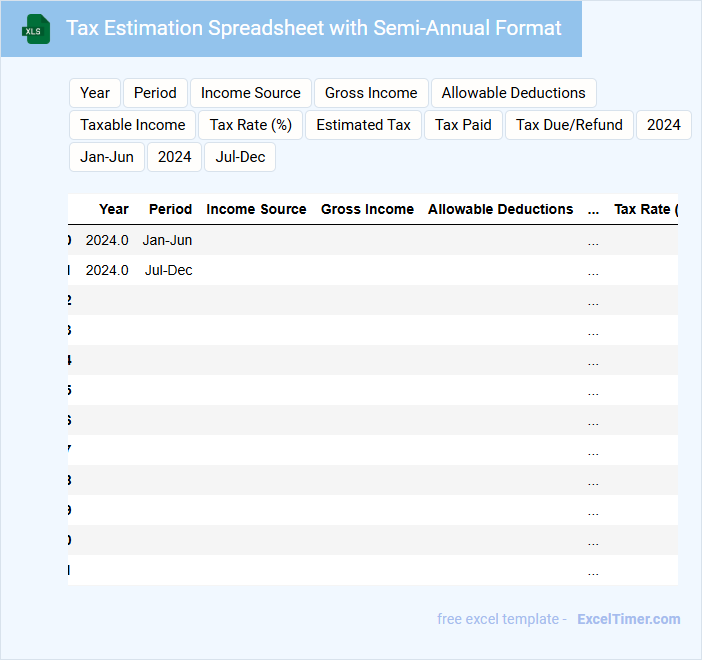

A Tax Estimation Spreadsheet with a Semi-Annual Format is a document used to project tax liabilities over two six-month periods within a fiscal year. It typically contains income summaries, deductible expenses, and estimated tax payments to help individuals or businesses manage their tax obligations more effectively. Properly organizing this spreadsheet ensures compliance and aids in strategic financial planning.

Excel Document for Semi-Annual Tax Calculation

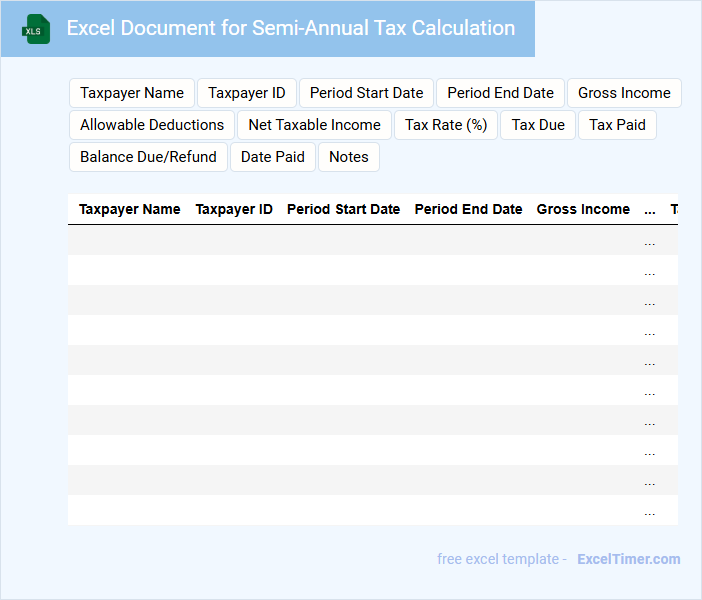

An Excel Document for Semi-Annual Tax Calculation typically contains detailed financial data organized into rows and columns, including income, expenses, and applicable tax rates. This document is designed to automate complex tax computations, ensuring accuracy and efficiency during tax season. It is important to maintain updated formulas and validate data entries regularly to avoid errors and discrepancies.

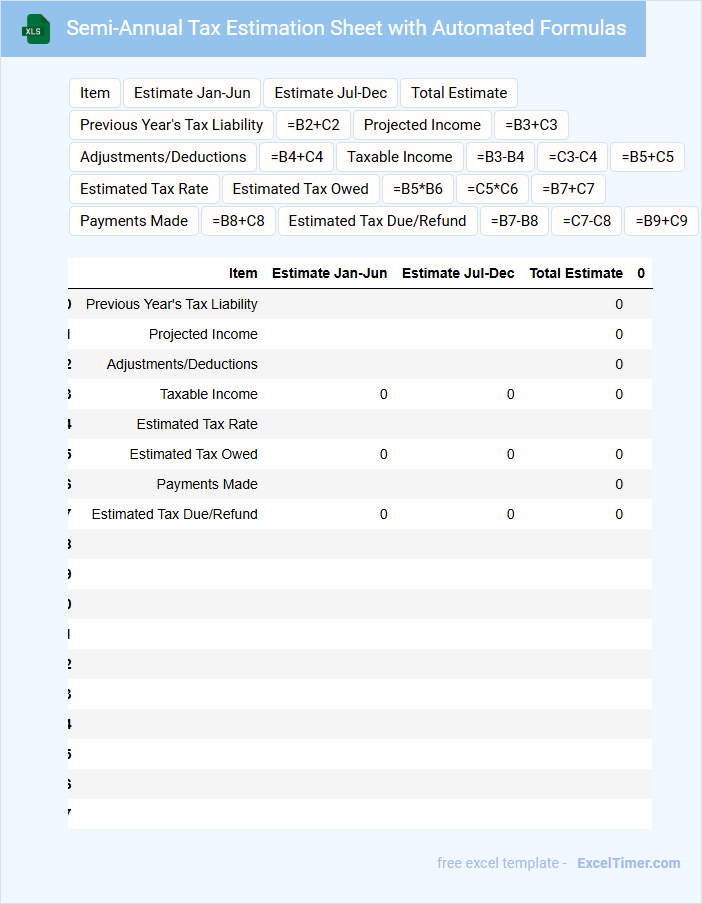

Semi-Annual Tax Estimation Sheet with Automated Formulas

The Semi-Annual Tax Estimation Sheet is a financial document used to estimate tax liabilities over a six-month period. It typically contains income details, taxable expenses, and preliminary tax calculations derived from automated formulas.

The primary benefit of using automated formulas is the increased accuracy and efficiency in estimating tax dues. Ensuring that all data inputs are up-to-date is essential for reliable projections and compliance with tax regulations.

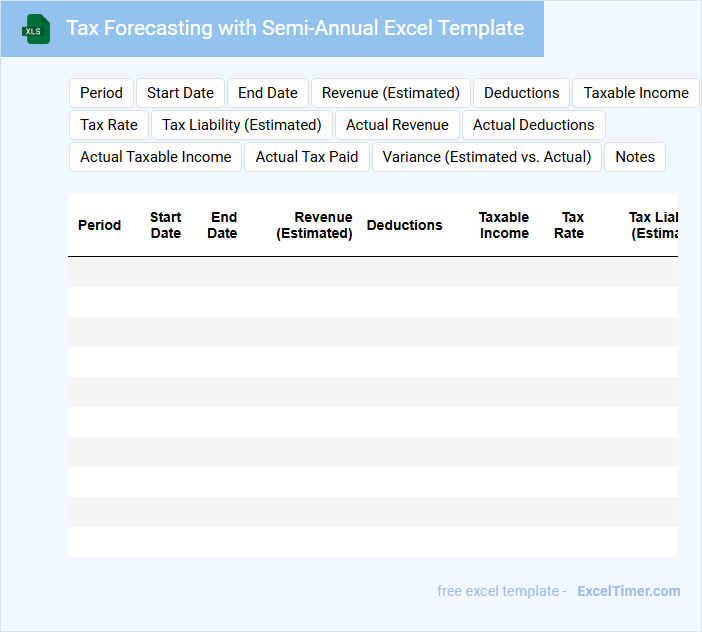

Tax Forecasting with Semi-Annual Excel Template

Tax Forecasting with a Semi-Annual Excel Template is a practical tool for estimating tax liabilities over a six-month period. This document typically contains income projections, tax rate tables, and pre-filled formulas to calculate expected taxes owed. It is essential for businesses and individuals to maintain accuracy in data entry to ensure reliable forecasts and avoid penalties.

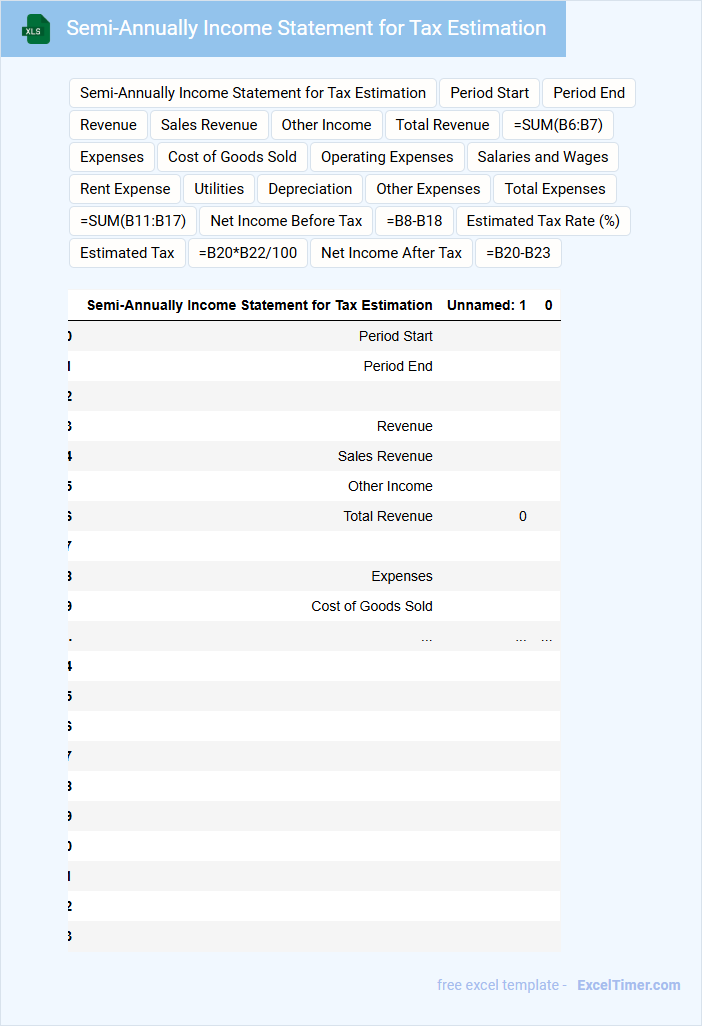

Semi-Annually Income Statement for Tax Estimation

A Semi-Annually Income Statement typically includes detailed revenues and expenses recorded over a six-month period. It provides a snapshot of an organization's profitability and financial performance during this timeframe.

For Tax Estimation, accurate categorization of taxable income and deductible expenses is crucial. Ensuring all relevant financial transactions are included helps in precise tax liability calculation.

Maintaining clear records and regularly updating the statement can streamline tax preparation and minimize errors.

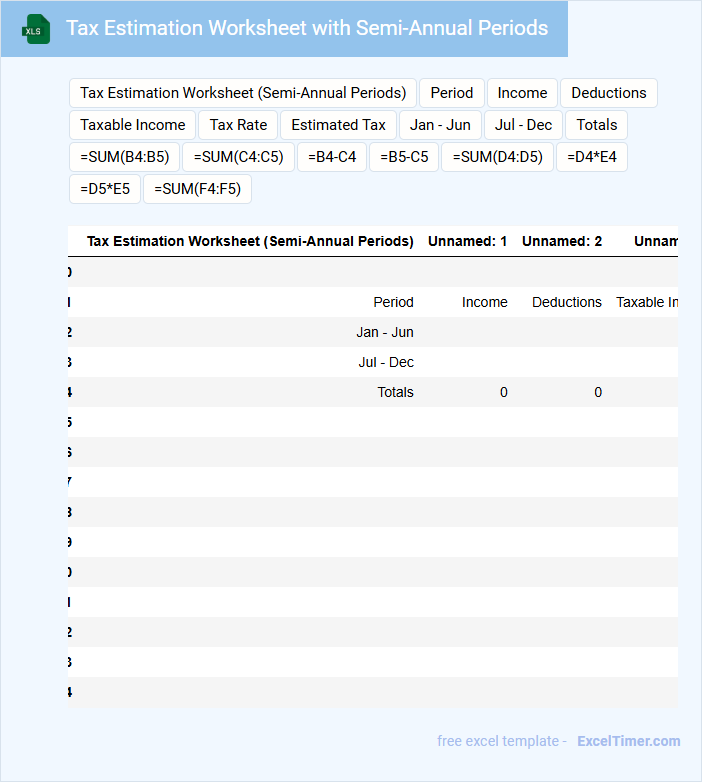

Tax Estimation Worksheet with Semi-Annual Periods

What is typically included in a Tax Estimation Worksheet with Semi-Annual Periods? This document usually contains detailed income data, deductible expenses, and estimated tax payments organized in six-month intervals to facilitate accurate tax planning. It helps individuals or businesses forecast their tax liabilities and manage cash flow effectively throughout the year using periodic assessments.

What important considerations should be kept in mind when using this worksheet? It is crucial to ensure all income sources and eligible deductions are accurately recorded for each semi-annual period to avoid underpayment or penalties. Additionally, regularly updating the worksheet with actual financial figures enhances precision and aids in strategic tax decision-making.

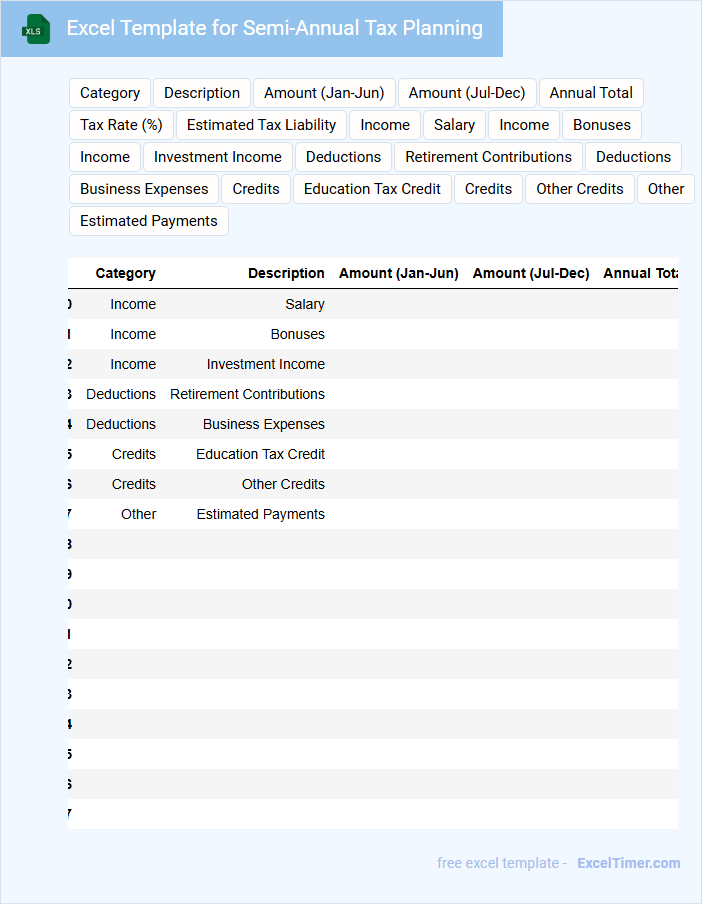

Excel Template for Semi-Annual Tax Planning

An Excel Template for Semi-Annual Tax Planning is typically used to organize and analyze tax-related financial data for two periods within a fiscal year. It helps individuals or businesses prepare for tax filings and optimize tax liabilities.

- Include clear sections for income, deductions, and estimated tax payments.

- Ensure automated calculations to reduce errors and save time.

- Incorporate customizable fields to accommodate different tax scenarios.

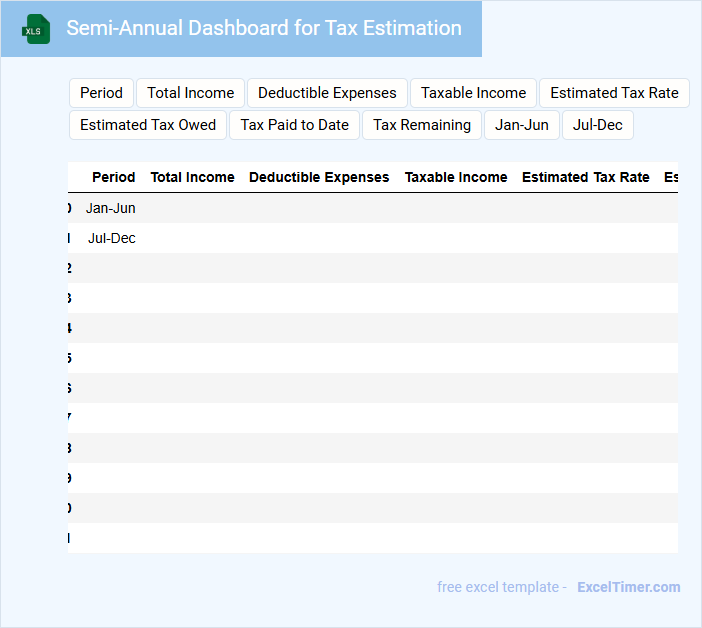

Semi-Annual Dashboard for Tax Estimation

What information is typically included in a Semi-Annual Dashboard for Tax Estimation? This document usually contains summarized financial data, estimated tax liabilities, and key performance indicators for the past six months. It helps businesses and individuals track their tax obligations and adjust their financial planning accordingly.

What are important considerations when preparing this dashboard? Accurate data collection, clear visualization of tax estimates, and timely updates are essential to ensure effective tax planning and compliance. Including comparisons with previous periods also aids in identifying trends and making informed decisions.

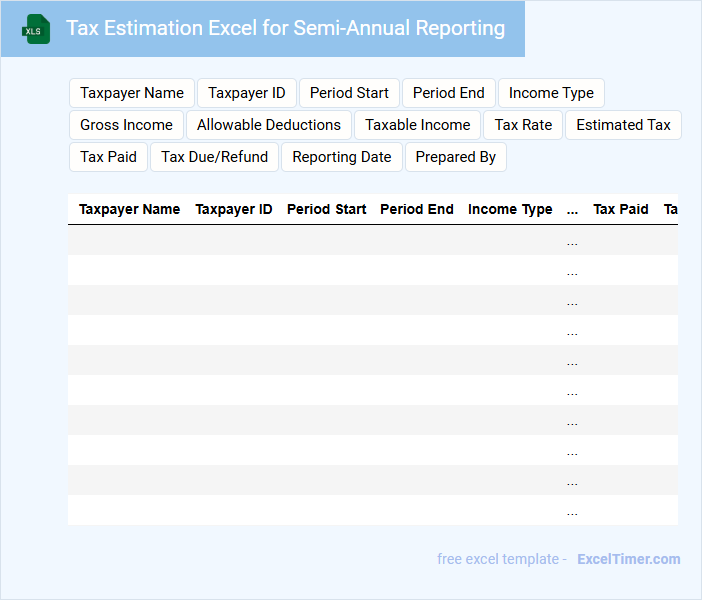

Tax Estimation Excel for Semi-Annual Reporting

This Tax Estimation Excel document typically contains detailed financial data, projected tax liabilities, and semi-annual income summaries. It is designed to help businesses or individuals estimate their tax obligations accurately for the period. Ensuring that the document is frequently updated with the latest tax rates and financial figures is crucial for precise reporting.

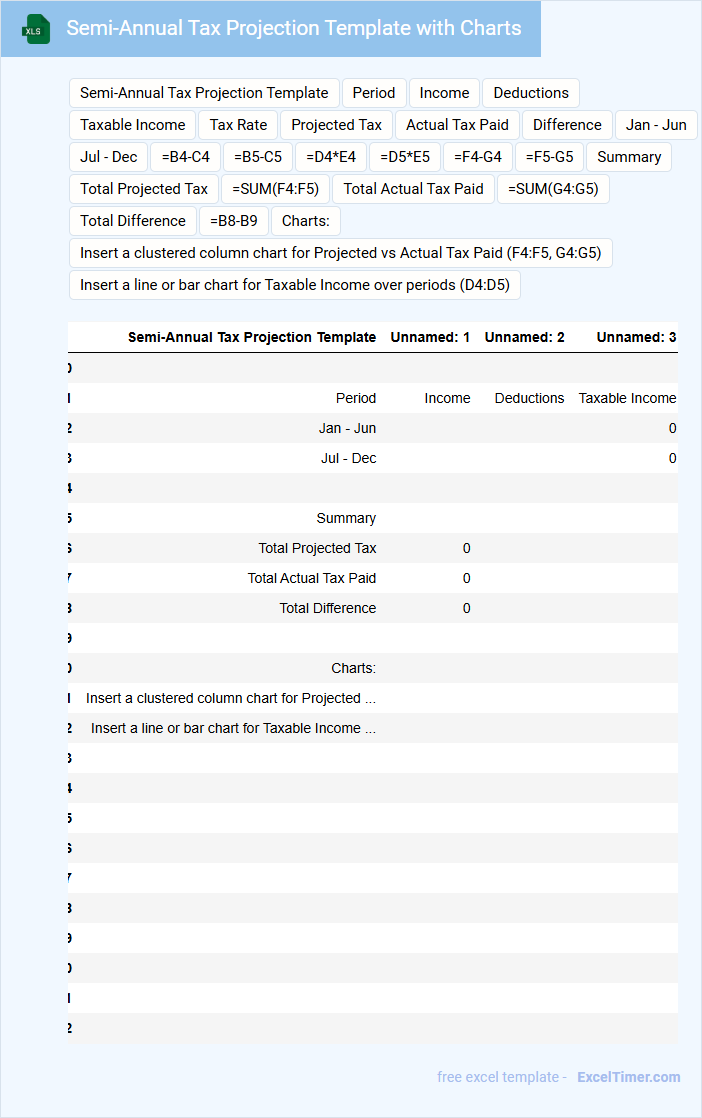

Semi-Annual Tax Projection Template with Charts

What information is typically included in a Semi-Annual Tax Projection Template with Charts? This document usually contains estimated income, deductible expenses, and projected tax liabilities for the first and second halves of the year. Additionally, it features visual charts to help users quickly understand tax trends and anticipate payments.

Why is it important to include detailed income categories and regular updates in the template? Accurate categorization ensures precise tax calculations, while updating the template regularly reflects changes in financial circumstances or tax laws, allowing for better financial planning and avoidance of underpayment penalties.

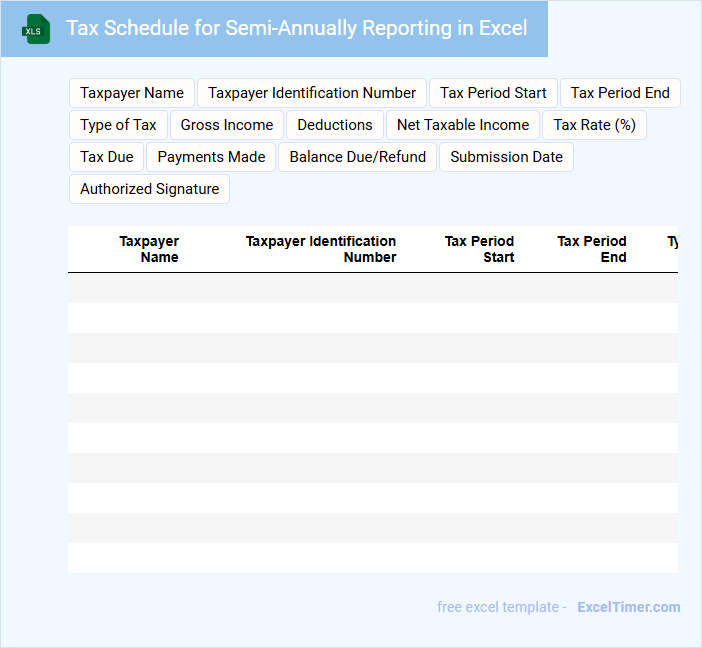

Tax Schedule for Semi-Annually Reporting in Excel

What does a Tax Schedule for Semi-Annually Reporting in Excel typically contain?

This document usually contains detailed records of income, deductions, credits, and tax payments reported twice a year. It organizes financial data to help accurately calculate tax obligations and ensure compliance with tax authorities. Key components often include deadlines, summary tables, and validation formulas for easy review.

Important Suggestions

Ensure accuracy by double-checking figures and formulas, and keep all supporting documents well-organized. Automate calculations with Excel functions where possible to minimize errors and facilitate timely submissions.

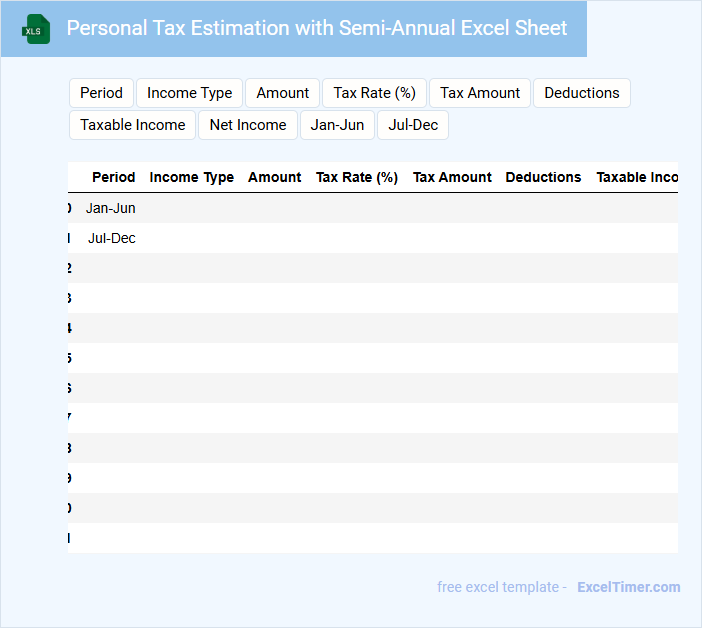

Personal Tax Estimation with Semi-Annual Excel Sheet

What information does a Personal Tax Estimation document with a Semi-Annual Excel Sheet usually contain? This type of document typically includes detailed income records, deductions, and tax liabilities calculated over a six-month period to help individuals anticipate their tax obligations. It offers a clear overview of financial data to ensure accurate tax planning and timely payments.

What important factors should be considered when using a Semi-Annual Excel Sheet for tax estimation? It is essential to regularly update income and expense entries to reflect real-time financial changes, ensuring precise tax calculations. Additionally, reviewing applicable tax rates and potential deductions periodically enhances the accuracy and usefulness of the estimation.

Semi-Annually Worksheet for Corporate Tax Estimation

A Semi-Annually Worksheet for Corporate Tax Estimation typically contains detailed financial data including revenue, expenses, and tax liabilities for a six-month period. It is used to project the corporate tax owed and ensure timely compliance with tax regulations. Important elements include accurate income statements, deductible expenses, and applicable tax credits to optimize tax planning.

Comprehensive Excel Template for Semi-Annual Tax Estimation

This document typically contains detailed financial data and formulas designed to estimate taxes semi-annually with precision.

- Accurate Income Records: Ensure all income streams are clearly itemized for precise tax calculations.

- Expense Categorization: Properly classify deductible expenses to maximize tax benefits.

- Tax Rate Updates: Regularly update the template with current tax rates to maintain accuracy.

What is the significance of choosing a semi-annual period for tax estimation in Excel?

Choosing a semi-annual period for tax estimation in Excel allows you to accurately track and calculate taxes twice a year, ensuring timely and organized financial reporting. This method helps identify tax liabilities and cash flow needs more effectively compared to annual estimates. Your tax obligations become easier to manage with regular updates, reducing the risk of underpayment or penalties.

How do you set up formulas to calculate tax liability for semi-annual reporting?

To set up formulas for semi-annual tax liability in Excel, input your total annual income and applicable tax rates, then divide the calculated annual tax by two for each period. Use the formula `=Annual_Income * Tax_Rate / 2` to estimate tax for each semi-annual report. Ensure your spreadsheet includes cells for adjustments and prior payments to reflect accurate liability for Your tax estimation.

Which Excel functions are most effective for tracking and projecting semi-annual taxable income?

Excel functions like SUMIFS and EDATE provide precise tracking and date manipulation for semi-annual periods. Using DSUM enables dynamic summation based on tax criteria, while FORECAST.LINEAR supports projecting taxable income trends. Combining these functions ensures accurate semi-annual tax estimation and financial analysis.

How can Excel be used to compare semi-annual tax estimates against actual payments?

Excel can be used to compare semi-annual tax estimates against actual payments by creating a spreadsheet that lists estimated tax amounts for each period alongside corresponding actual payment values. Formulas can calculate variances and percentage differences to highlight discrepancies between estimates and payments. Pivot tables and conditional formatting can further visualize and analyze the accuracy of semi-annual tax forecasts.

What key data must be updated in your Excel document to ensure accurate semi-annual tax estimates?

Update your Excel document with accurate income figures, tax withholding amounts, and applicable tax rates to ensure precise semi-annual tax estimates. Including estimated deductions and credits also improves the accuracy of your tax projections. Regularly adjusting these key data points helps maintain up-to-date tax liability calculations.