![]()

The Semi-annually Expense Tracker Excel Template for Nonprofits is designed to simplify financial management by organizing expenses every six months for nonprofit organizations. This template enhances budgeting accuracy and ensures compliance with reporting requirements by providing clear, categorized expense tracking. Easy to customize and user-friendly, it helps nonprofits maintain transparency and control over their financial resources.

Semi-Annual Expense Tracker with Category Breakdown for Nonprofits

This type of document typically contains a detailed record of expenses incurred by a nonprofit organization over a six-month period. It organizes costs into specific categories to facilitate easy tracking and analysis.

Its main purpose is to provide transparency and help in budgeting by highlighting spending patterns. A key suggestion is to regularly update each category to maintain accuracy and accountability throughout the reporting period.

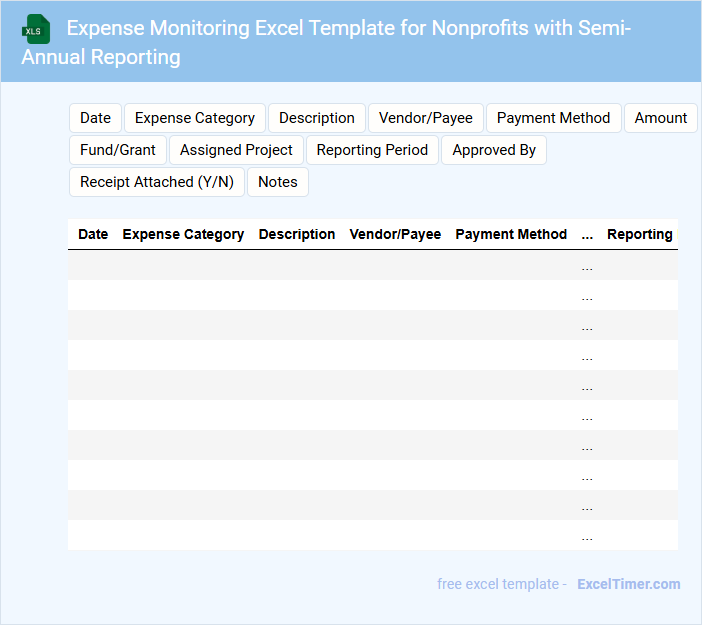

Expense Monitoring Excel Template for Nonprofits with Semi-Annual Reporting

What information does an Expense Monitoring Excel Template for Nonprofits with Semi-Annual Reporting typically contain? This type of document usually includes detailed expense categories, dates of transactions, and allocated budget versus actual spending to help nonprofits track their financial health. It is designed to provide clear visibility into organizational expenditures over six-month periods to ensure accountability and informed decision-making.

What important features should be included when using this template? Key elements include automated calculations for total expenses, customizable categories specific to nonprofit activities, and built-in charts or summaries for easy semi-annual reporting. Additionally, including sections for notes or comments can help contextualize unusual expenses or variances.

Semi-Annual Budget vs Actuals Tracker for Nonprofit Expenses

What is typically included in a Semi-Annual Budget vs Actuals Tracker for Nonprofit Expenses? This type of document usually contains a detailed comparison of the planned budget and the actual expenses incurred over a six-month period. It helps nonprofits monitor financial performance, identify variances, and ensure resources are allocated efficiently to meet organizational goals.

What important factors should be considered when using this tracker? It is essential to include comprehensive categories of expenses, regularly update actual costs, and analyze discrepancies to improve future budgeting accuracy and transparency for stakeholders.

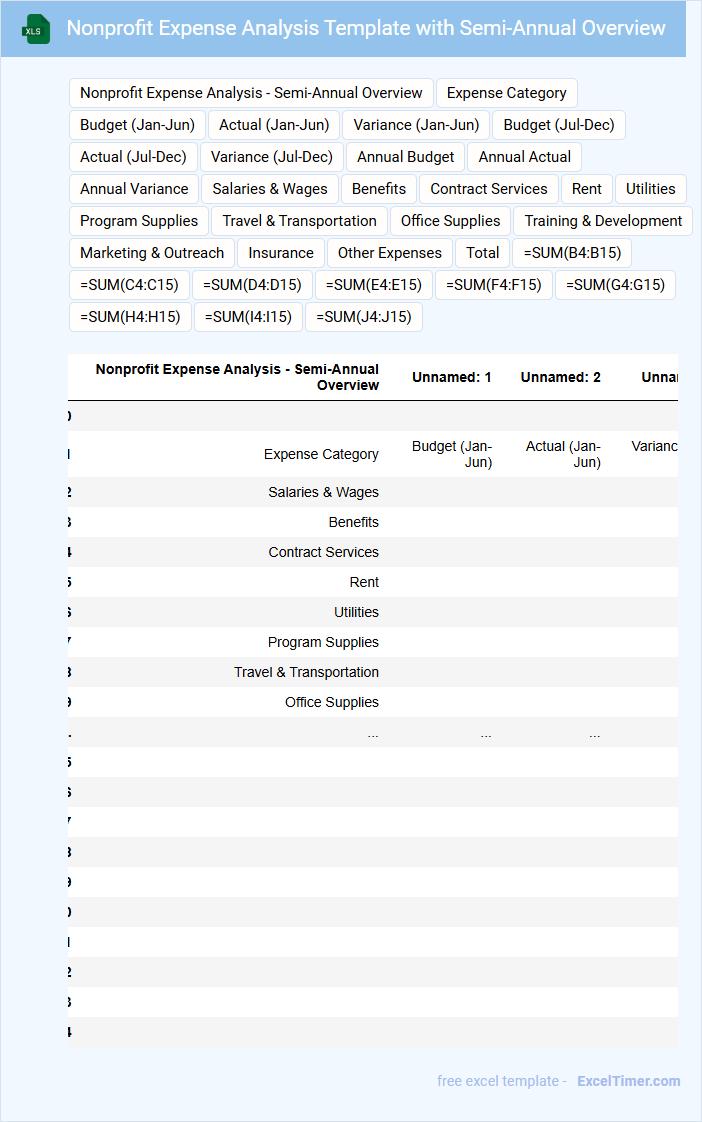

Nonprofit Expense Analysis Template with Semi-Annual Overview

A Nonprofit Expense Analysis Template with a Semi-Annual Overview typically contains detailed records of expenditures categorized by program, administrative, and fundraising activities for a six-month period. It helps organizations track spending trends, identify areas for cost optimization, and ensure compliance with budgetary goals. This type of document is essential for transparent financial reporting and strategic planning in nonprofit management.

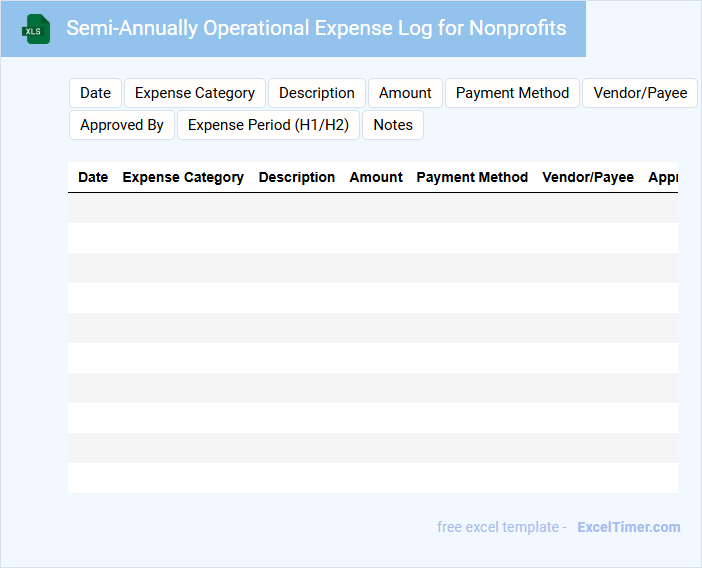

Semi-Annually Operational Expense Log for Nonprofits

The Semi-Annual Operational Expense Log is a crucial document that nonprofits use to track all operational costs incurred over a six-month period. It provides a detailed record of expenses to ensure transparency and budget adherence.

Maintaining an accurate expense log helps organizations identify spending patterns and areas for potential cost savings. Regularly reviewing this document supports effective financial planning and accountability.

It is essential to include dates, descriptions, amounts, and categories for each expense to maintain clarity and ease of auditing.

Excel Template for Semi-Annual Expense Tracking of Nonprofits

This document typically contains structured spreadsheets designed to help nonprofits monitor and manage their expenses every six months efficiently.

- Detailed Expense Categories: Break down costs into specific categories like operational, program, and administrative expenses for clear tracking.

- Accurate Date Segmentation: Organize expenses according to semi-annual periods to review financial patterns and budget adherence.

- Summary and Reporting Features: Include summary tables and charts for quick visualization and reporting to stakeholders.

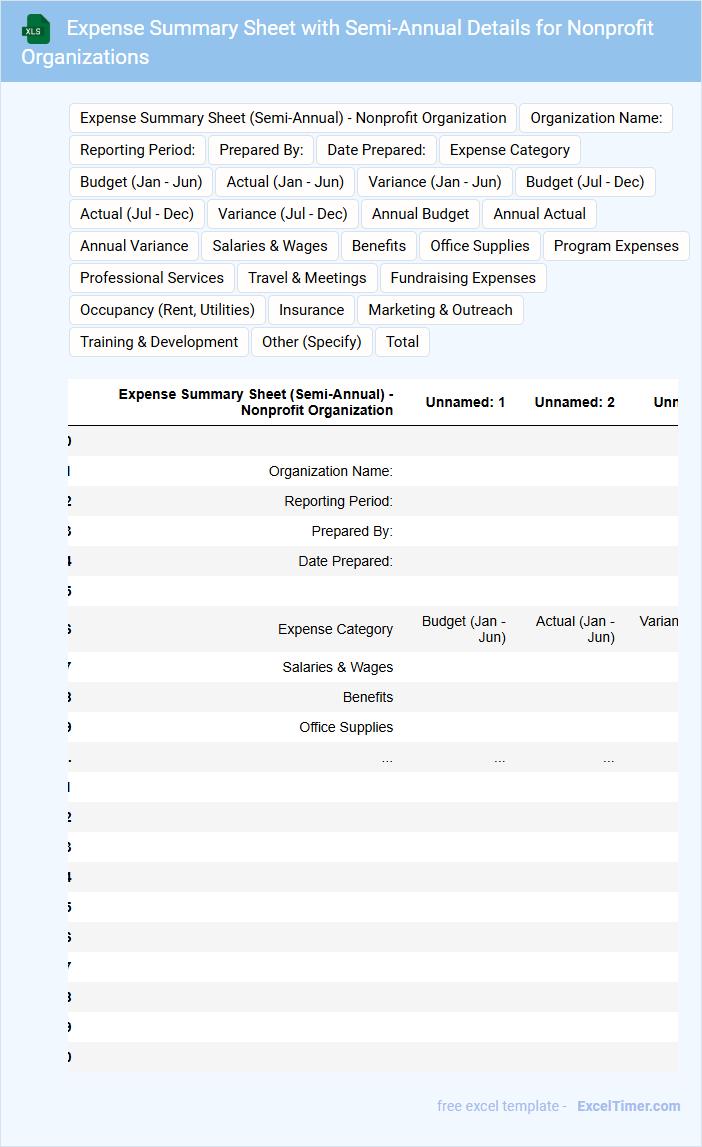

Expense Summary Sheet with Semi-Annual Details for Nonprofit Organizations

Expense Summary Sheet with Semi-Annual Details for Nonprofit Organizations typically contains a comprehensive overview of all expenses incurred by the organization over a six-month period.

- Expense Categories: Detailed breakdown of different types of expenses such as program costs, administrative expenses, and fundraising expenditures.

- Date and Amount: Chronological record of transactions with accurate dates and amounts for clarity and transparency.

- Budget Comparison: Summary comparing actual expenses against the budget to monitor financial health and ensure accountability.

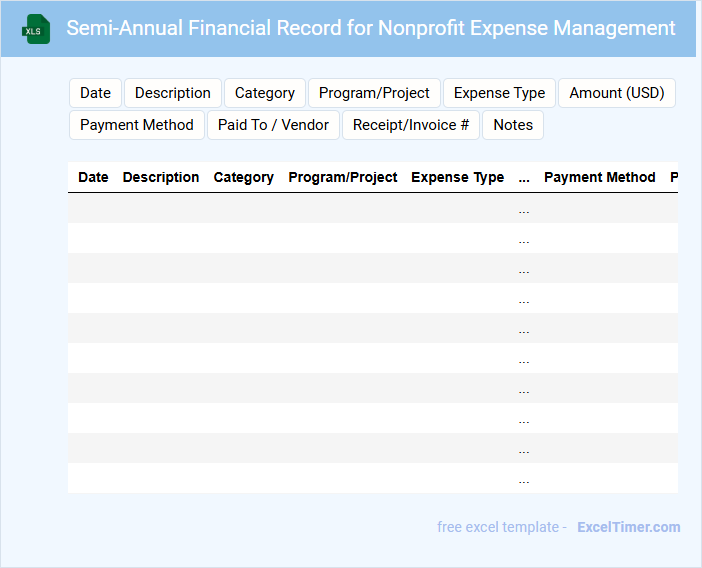

Semi-Annual Financial Record for Nonprofit Expense Management

The Semi-Annual Financial Record for nonprofit expense management typically includes detailed reports of all income and expenditures within a six-month period. It helps organizations maintain transparency and accountability by recording donations, grants, and operational costs. Regular review of these records is crucial for effective budgeting and compliance with regulatory requirements.

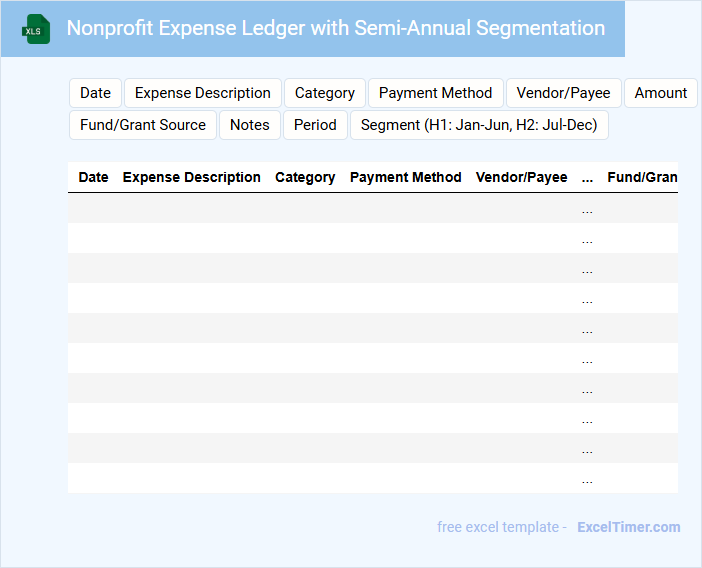

Nonprofit Expense Ledger with Semi-Annual Segmentation

A Nonprofit Expense Ledger with Semi-Annual Segmentation is a financial document that tracks the organization's expenditures split into two periods within the fiscal year. This segmentation helps in detailed financial analysis and reporting for better budget management.

- Include categorized expense entries for each semi-annual period for clear comparison.

- Ensure accuracy by linking expenses to specific programs or projects.

- Regularly update totals and reconcile with bank statements to maintain transparency.

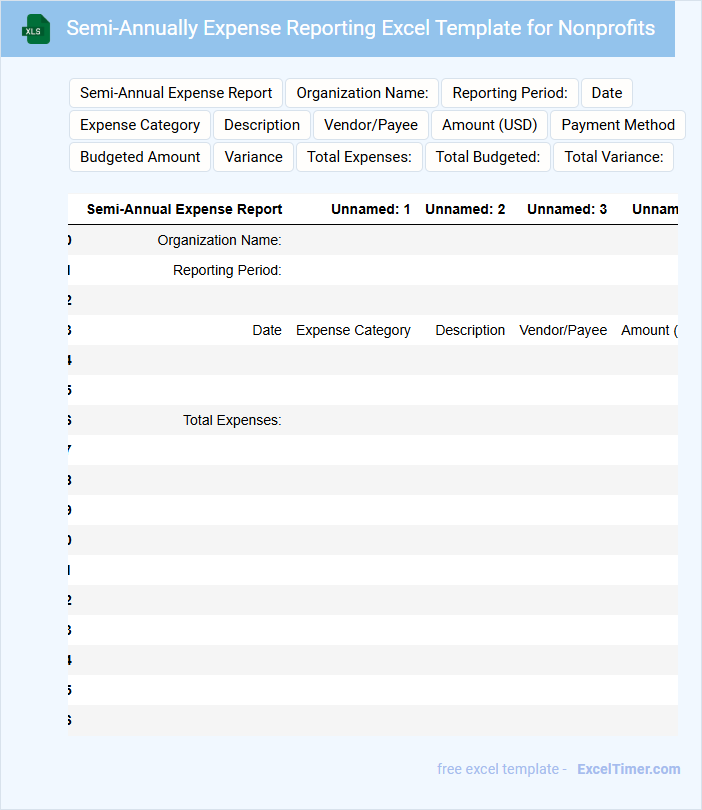

Semi-Annually Expense Reporting Excel Template for Nonprofits

This document typically contains detailed financial records of expenses incurred by a nonprofit organization over a six-month period to ensure transparency and effective budget management.

- Accurate Expense Tracking – It is crucial to diligently record all expenditure to maintain clear financial accountability.

- Categorized Reporting – Organizing expenses into specific categories helps in analyzing spending patterns effectively.

- Regular Review – Conducting timely reviews aids in identifying discrepancies and improving future budget planning.

Financial Tracker with Semi-Annual Expense Tabs for Nonprofits

A Financial Tracker document typically contains detailed records of income, expenses, and budget allocations over a specific period. It helps organizations maintain transparency and accountability in their financial management.

For nonprofits, including Semi-Annual Expense Tabs allows for organized tracking of expenditures every six months, aiding in timely audits and reporting. This structure supports efficient financial planning and resource allocation.

It is important to ensure accurate categorization of expenses and regular updates to maintain the integrity of the financial tracker.

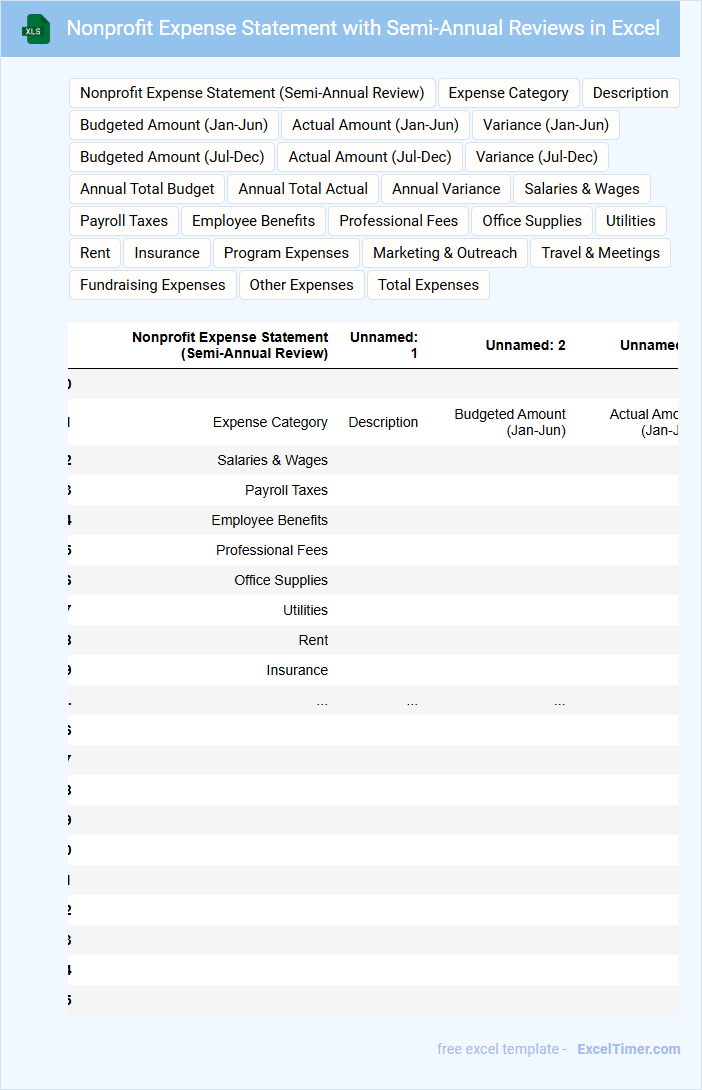

Nonprofit Expense Statement with Semi-Annual Reviews in Excel

A Nonprofit Expense Statement typically details all expenditures related to the organization's activities over a specified period. It helps track financial health and ensures transparency for donors and stakeholders.

When using Semi-Annual Reviews in Excel, it allows for periodic assessment and adjustments to budgets based on the actual expenses incurred. This practice improves financial planning and accountability throughout the year.

Ensure accurate categorization of expenses and consistent data entry to maintain clear and actionable financial reports.

Semi-Annual Grant Expense Tracker for Nonprofit Projects

What information is typically included in a Semi-Annual Grant Expense Tracker for Nonprofit Projects? This document usually contains detailed records of the expenses incurred over a six-month period related to specific grant-funded activities. It tracks how funds are allocated and spent to ensure compliance with grant requirements and to provide transparency for stakeholders.

Why is accurate tracking important in a Semi-Annual Grant Expense Tracker? Maintaining precise and up-to-date financial data helps nonprofits demonstrate responsible fund management and supports reporting to grantors. Key elements to focus on include categorizing expenses, documenting dates and descriptions, and reconciling totals against budgeted amounts.

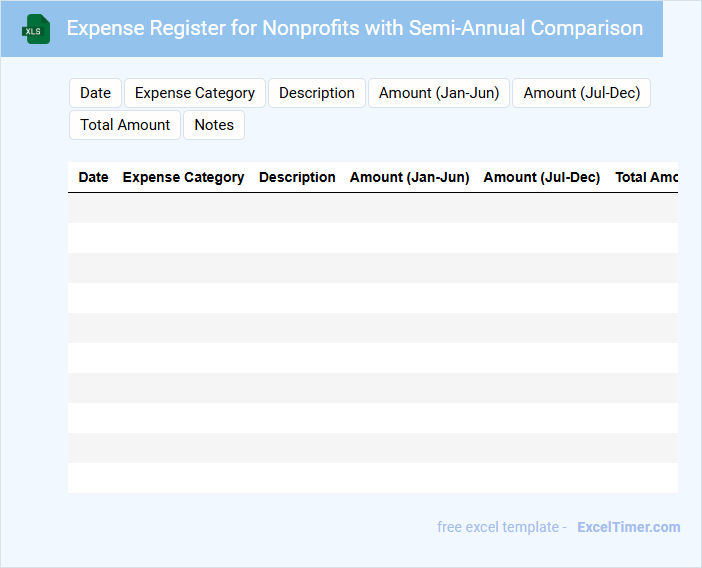

Expense Register for Nonprofits with Semi-Annual Comparison

An Expense Register for Nonprofits typically contains detailed records of all expenditures to ensure transparency and accountability. It usually includes categories, dates, amounts, and descriptions of each expense for accurate financial tracking.

A Semi-Annual Comparison highlights changes in spending patterns over two consecutive six-month periods, helping organizations identify trends and budget adjustments. Regular reviews of this comparison are essential for strategic financial planning and maintaining donor trust.

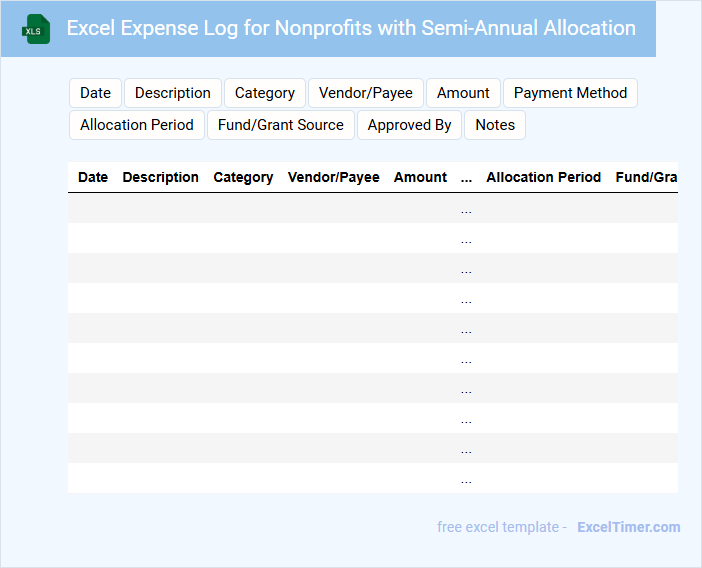

Excel Expense Log for Nonprofits with Semi-Annual Allocation

An Excel Expense Log for Nonprofits with Semi-Annual Allocation is a spreadsheet designed to track and manage organizational expenses over specific six-month periods. This document typically includes detailed records of expenditures categorized by program or department to ensure financial transparency and accountability. It is crucial for nonprofits to regularly update and review this log to monitor budget adherence and allocate resources effectively.

What key expense categories should be included in a semi-annual tracker tailored for nonprofit organizations?

Key expense categories for a semi-annual expense tracker tailored for nonprofits include Program Services, Fundraising Expenses, Administrative Costs, Salaries and Benefits, Office Supplies, Rent and Utilities, Marketing and Outreach, Professional Fees, Travel and Meetings, and Technology Expenses. Tracking these categories ensures comprehensive financial oversight aligned with nonprofit operational needs. Detailed categorization supports accurate budgeting, grant reporting, and compliance with nonprofit financial regulations.

How should the expense tracker differentiate between restricted and unrestricted funds for reporting accuracy?

The Semi-annually Expense Tracker for Nonprofits should include separate columns or categories for restricted and unrestricted funds to ensure precise allocation and monitoring. Each expense entry must be tagged to reflect fund type, enabling accurate reporting and compliance with donor restrictions. Implementing formulas to summarize totals by fund category improves transparency and financial management.

What formulas or functions can automate the calculation of budget variance and expense totals per category?

Use the SUMIFS function to calculate total expenses per category by summing amounts based on specific criteria. Apply the formula =BudgetedAmount - SUMIFS(ExpensesRange, CategoryRange, Category) to automate budget variance for each category. Incorporate conditional formatting to highlight significant variances, enhancing expense tracking accuracy for nonprofits.

How can the tracker be designed to clearly present expenses by both project/program and funding source?

Design the Semi-Annually Expense Tracker with dedicated columns for project/program names, funding sources, and corresponding expense amounts. Include filters or pivot tables to enable dynamic sorting and summarization by project and funding source. Use color-coded categories to enhance visual clarity and facilitate quick identification of expense distributions.

What data validation or control measures should be implemented in Excel to ensure data accuracy and reduce entry errors?

Implement drop-down lists using Data Validation to standardize expense categories and prevent invalid entries. Utilize conditional formatting to highlight outliers and duplicate records for easy error detection. Protect key formula cells with worksheet protection to avoid unintended modifications and maintain data integrity.