The Semi-annually Payroll Excel Template for Contractors streamlines payment tracking and calculation for contractors paid twice a year. This template ensures accurate tax deductions, simplifies record-keeping, and aids in timely payroll processing. Its user-friendly format enhances financial management and reduces errors in contractor compensation.

Semi-Annual Payroll Tracker for Contractors

This document typically contains detailed records of payments made to contractors over a six-month period to ensure accurate financial tracking and compliance.

- Contractor Information: Essential details such as names, identification numbers, and contact information are recorded.

- Payment Records: Dates, amounts, and payment methods for each contractor are meticulously tracked.

- Tax and Compliance Data: Information related to tax deductions, filings, and relevant compliance requirements is included.

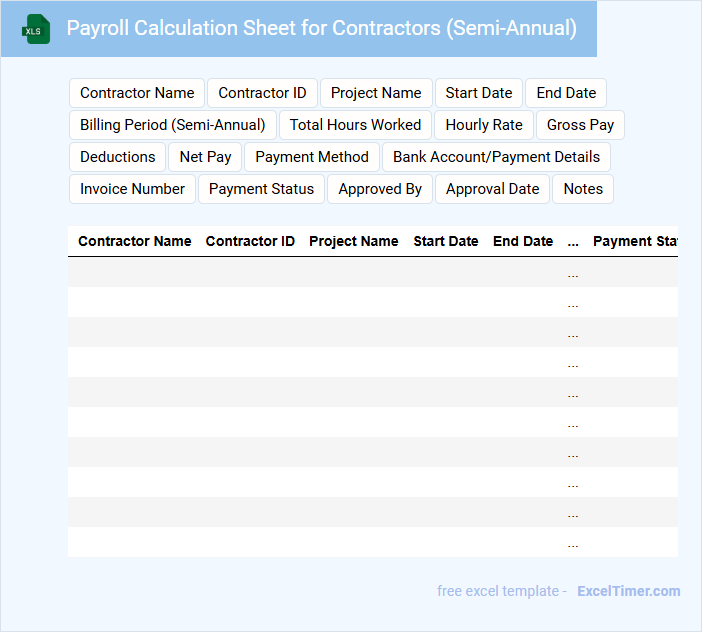

Payroll Calculation Sheet for Contractors (Semi-Annual)

A Payroll Calculation Sheet for Contractors (Semi-Annual) typically contains detailed records of payments made to contractors over a six-month period. It includes information such as hours worked, hourly rates, total earnings, and tax deductions. This document is essential for accurate financial tracking and ensuring compliance with tax regulations.

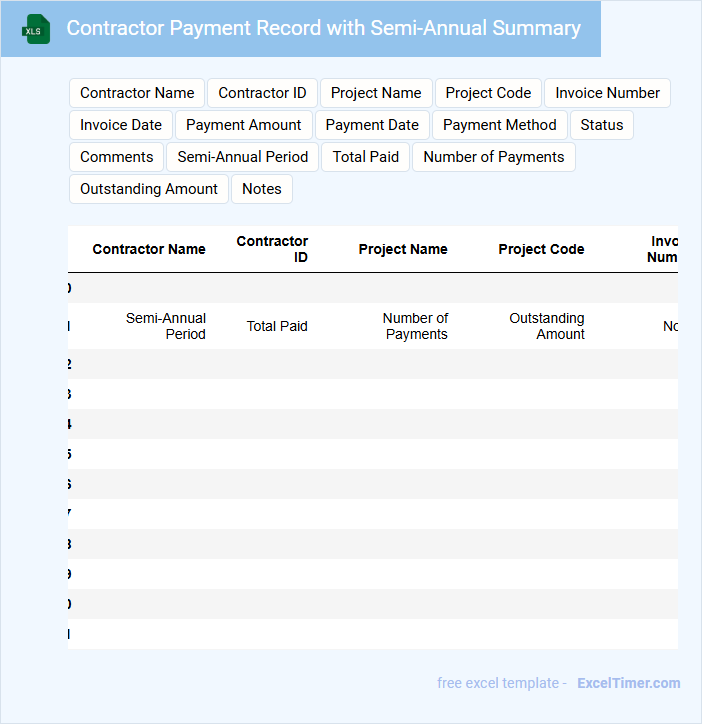

Contractor Payment Record with Semi-Annual Summary

What information does a Contractor Payment Record with Semi-Annual Summary typically contain? This document usually includes detailed payment transactions made to contractors over a six-month period, along with a summarized total of all payments. It serves as an essential financial record for tracking contractor expenses and ensuring accountability within a specific timeframe.

Why is it important to maintain accuracy and completeness in a Contractor Payment Record with Semi-Annual Summary? Maintaining precise records helps prevent discrepancies and supports transparent financial reporting, which is crucial for audits and budgeting purposes. Additionally, ensuring all payments are documented with proper authorization and dates promotes clear communication between contractors and the organization.

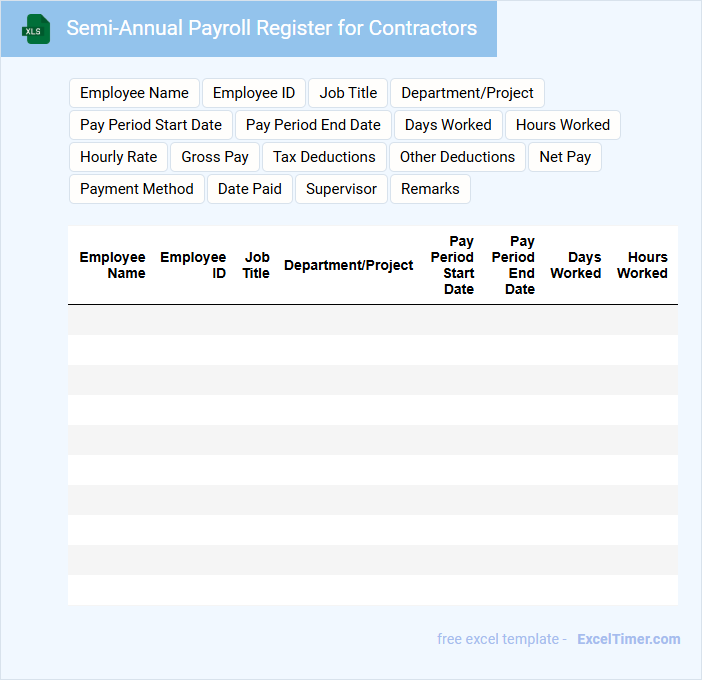

Semi-Annual Payroll Register for Contractors

The Semi-Annual Payroll Register for Contractors is a document that typically contains detailed records of all payments made to contractors over a six-month period. It includes essential information such as contractor names, payment dates, amounts paid, and tax withholdings. Maintaining accuracy in this document is crucial for financial reporting and tax compliance.

Earnings Statement Template for Contractors with Semi-Annual Period

What information is typically included in an Earnings Statement Template for Contractors with a Semi-Annual Period? This document usually contains detailed records of income earned, taxes withheld, and deductions relevant to contractors over a six-month timeframe. It provides a clear financial overview helping contractors track their earnings and comply with tax regulations.

What important elements should be included to optimize this template? Key components such as contractor details, payment periods, total earnings, tax withholdings, and net pay must be clearly outlined, along with spaces for signatures and dates. Including a summary section and consistent formatting improves clarity and usability for both contractors and financial managers.

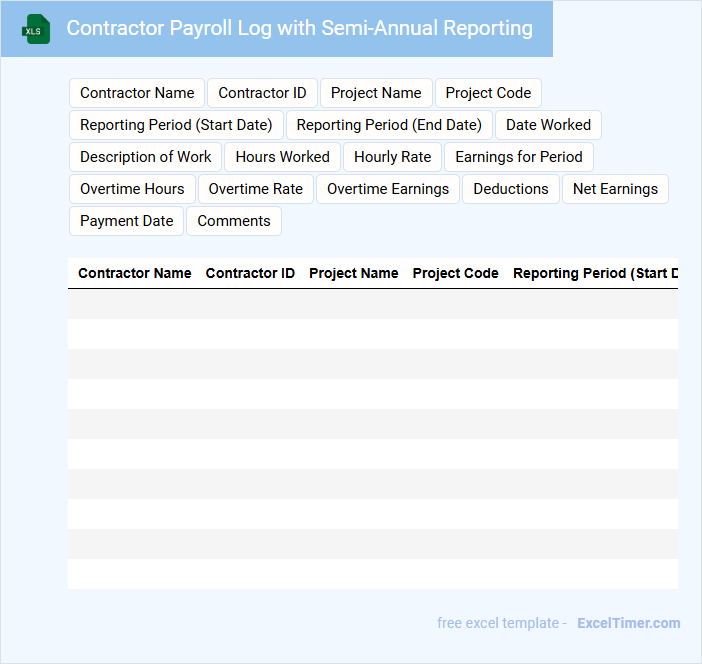

Contractor Payroll Log with Semi-Annual Reporting

Contractor Payroll Logs with Semi-Annual Reporting typically contain detailed records of payments made to contractors and are essential for accurate financial tracking and compliance.

- Comprehensive Payment Records: Ensure all contractor payments are documented with dates, amounts, and project references.

- Compliance Tracking: Include verification of tax withholdings and adherence to labor laws for audit purposes.

- Timely Reporting: Maintain consistent entries to facilitate seamless semi-annual reporting and avoid penalties.

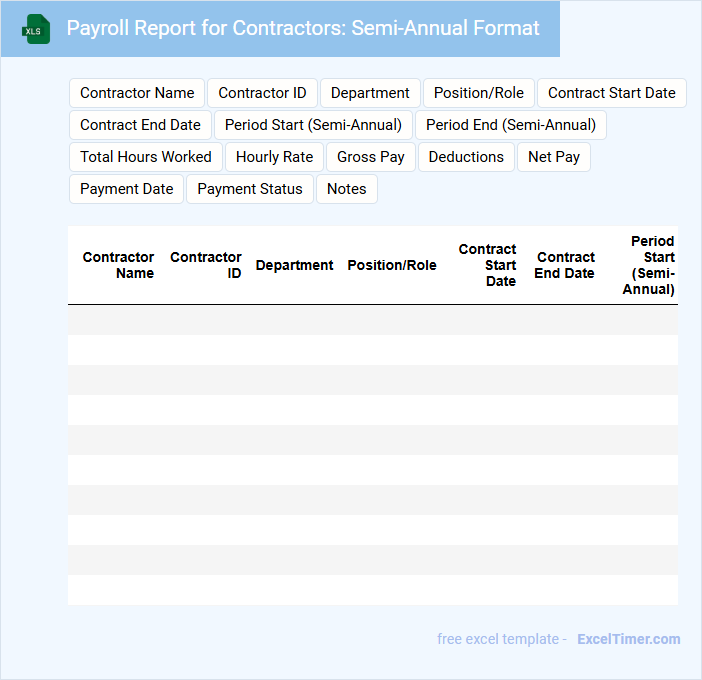

Payroll Report for Contractors: Semi-Annual Format

Payroll Report for Contractors: Semi-Annual Format is a crucial document summarizing payments made to contractors over a six-month period. It ensures accuracy in financial records and compliance with tax regulations.

- Include detailed payment dates and amounts for each contractor.

- Verify contractor identification and tax information for accuracy.

- Summarize total payments to assist in budget reviews and audits.

Semi-Annually Processed Payroll Spreadsheet for Contractors

The Semi-Annually Processed Payroll Spreadsheet for contractors typically contains detailed payment records, contract durations, and tax withholding information. It serves as a crucial document to track earnings and ensure accurate financial reporting over six-month intervals. Maintaining its accuracy is essential for both compliance and streamlined payroll management.

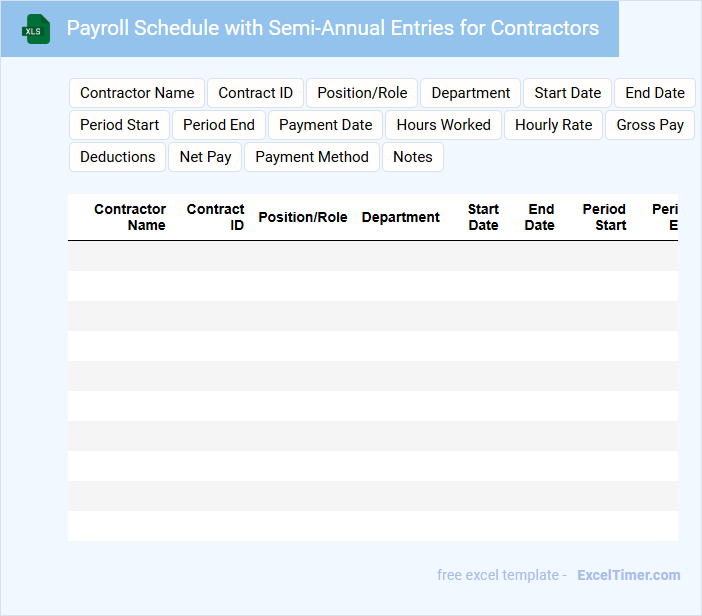

Payroll Schedule with Semi-Annual Entries for Contractors

What information does a Payroll Schedule with Semi-Annual Entries for Contractors typically contain? This type of document outlines the specific dates and amounts for payroll disbursements made to contractors on a semi-annual basis. It details payment periods, contractor names, payment amounts, and any relevant tax or deduction information to ensure accurate and timely compensation.

What is an important consideration when managing a Payroll Schedule with Semi-Annual Entries for Contractors? It is crucial to maintain clear records of payment dates and comply with contractual agreements and tax regulations. Ensuring accurate documentation and transparent communication with contractors helps avoid disputes and supports efficient financial planning.

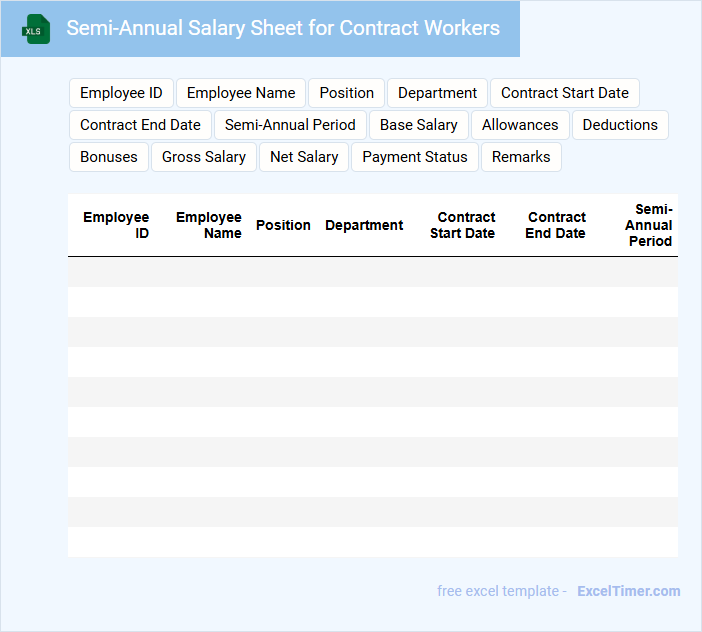

Semi-Annual Salary Sheet for Contract Workers

What information is typically included in a Semi-Annual Salary Sheet for Contract Workers? This document usually contains detailed records of each contract worker's earnings over a six-month period, including base salary, bonuses, and deductions. It serves as a crucial tool for payroll management, financial auditing, and ensuring accurate compensation for contract workers.

What important aspects should be considered in this salary sheet? It is essential to include precise worker identification details, clear breakdowns of payment components, and any contract-specific terms or conditions affecting salary. Additionally, verifying the accuracy of data and maintaining confidentiality are important to uphold transparency and trust.

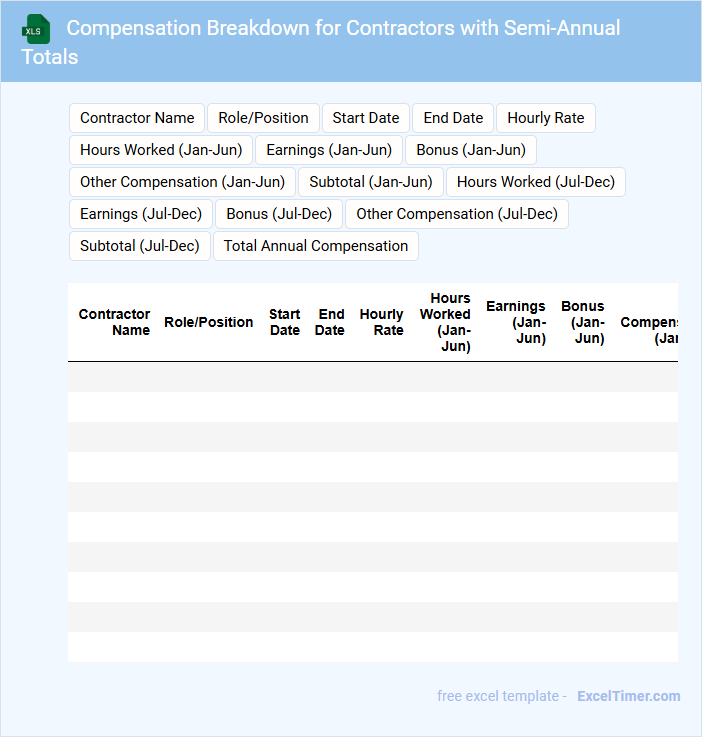

Compensation Breakdown for Contractors with Semi-Annual Totals

What information is typically included in a Compensation Breakdown for Contractors with Semi-Annual Totals? This document usually contains detailed records of payments made to contractors, categorized by project or service, along with deductions and bonuses. It also summarizes the total compensation earned over six-month periods, providing clear financial insights for both contractors and management.

Why is it important to include semi-annual totals in this compensation breakdown? Including semi-annual totals helps track cumulative earnings, ensures accurate tax reporting, and facilitates budget planning. It also assists contractors in understanding their payment trends and supports transparent financial communication.

Contractor Timesheet and Payroll for Semi-Annual Review

Contractor Timesheet and Payroll documents typically contain detailed records of hours worked and payment information for contractors. These documents are essential for accurate financial and labor reporting during reviews.

- Ensure all time entries are accurately recorded and approved before submission.

- Verify payment rates and tax deductions comply with contractual agreements and regulations.

- Maintain organized records to facilitate transparency and audit readiness during the semi-annual review.

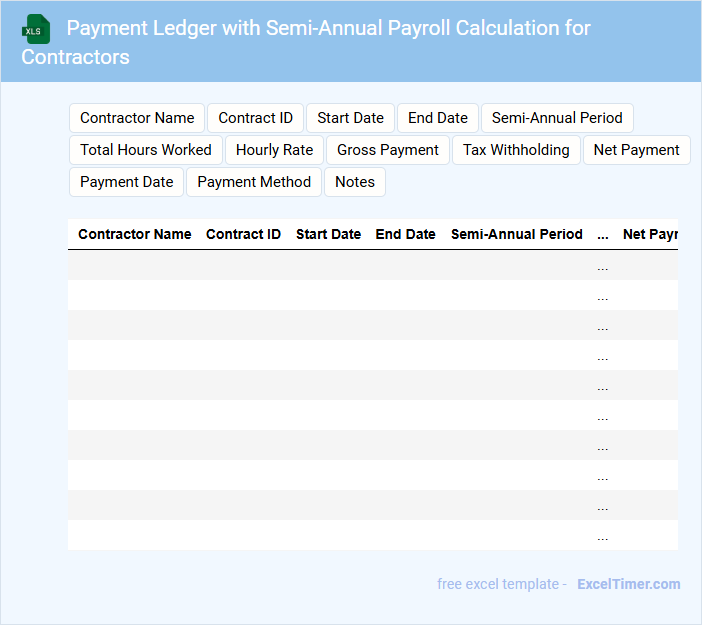

Payment Ledger with Semi-Annual Payroll Calculation for Contractors

Payment Ledger with Semi-Annual Payroll Calculation for Contractors is a financial document that records all payment transactions and calculates payroll twice a year for contracted workers. It provides a clear overview of payments made and ensures compliance with tax and legal requirements.

- Include detailed contractor information such as names, payment dates, and amounts for transparency.

- Ensure accurate semi-annual payroll calculations to reflect proper deductions and contributions.

- Maintain organized records for auditing and financial reporting purposes.

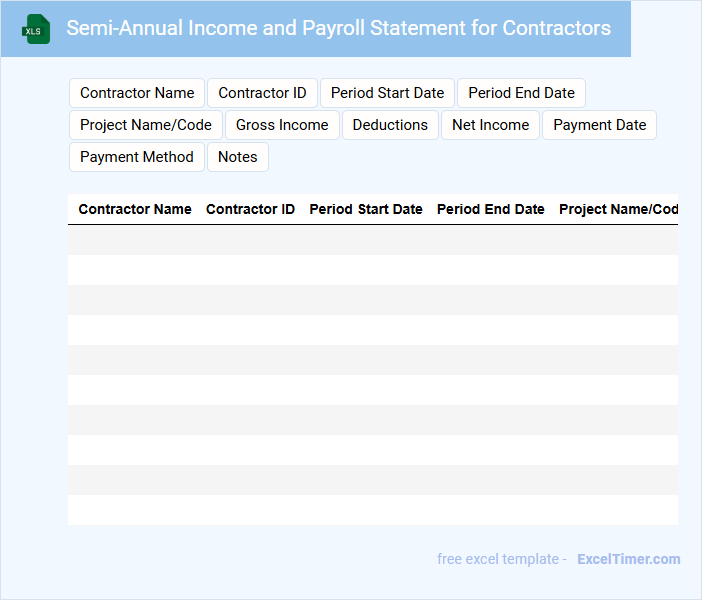

Semi-Annual Income and Payroll Statement for Contractors

The Semi-Annual Income and Payroll Statement for contractors is a vital financial document summarizing earnings and payroll details over a six-month period. It typically contains information such as total income, deductions, and payment dates, ensuring transparency and accurate record-keeping. Including clear contractor identification and detailed transaction records is essential for compliance and auditing purposes.

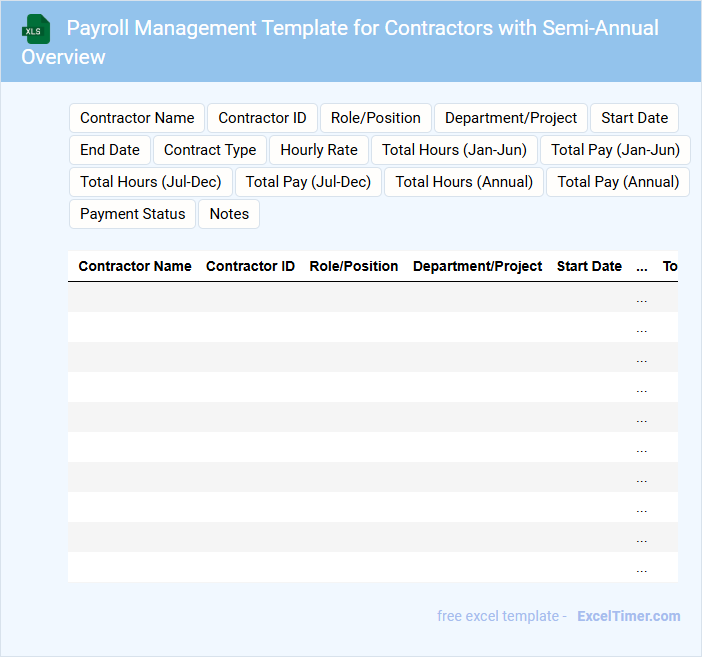

Payroll Management Template for Contractors with Semi-Annual Overview

A Payroll Management Template for Contractors with Semi-Annual Overview is typically used to organize and track payments for contractors over a six-month period. It provides a clear summary of earnings, deductions, and net pay to ensure accurate financial records.

- Include contractor details such as name, ID, and payment rate for clarity.

- Ensure sections for payment dates, hours worked, and total amounts are accurate and up to date.

- Incorporate a semi-annual summary to review total payments, tax deductions, and any outstanding balances.

What are the key columns required in an Excel sheet to process semi-annual payroll for contractors?

Key columns in an Excel sheet for processing semi-annual payroll for contractors include Contractor Name, Contractor ID, Payment Period, Hours Worked, Hourly Rate, Total Earnings, Tax Withholdings, Deductions, and Net Payment. Your sheet should also have columns for Payment Date and Payment Method to ensure comprehensive payroll tracking. Organizing these data points enables accurate calculation and timely payment processing for contractors semi-annually.

How do you calculate prorated contractor payments for a semi-annual payroll cycle in Excel?

To calculate prorated contractor payments for a semi-annual payroll cycle in Excel, multiply the contractor's annual contract amount by the fraction of the semi-annual period they worked. Use the formula: =Annual_Contract_Amount * (Days_Worked / Total_Days_in_Semi_Annual_Period). You can automate this by inputting start and end dates to accurately reflect the prorated amount.

What formulas efficiently track tax deductions for contractors paid semi-annually?

Use the formula =IF(PaymentFrequency="Semi-Annual",GrossPay*TaxRate/2,0) to calculate tax deductions for contractors paid semi-annually. Employ SUMIFS to aggregate total tax deductions per contractor by filtering payment dates within six-month intervals. Implement NETWORKDAYS or EDATE functions to validate semi-annual payment schedules and ensure accurate deduction tracking.

How can Excel automatically flag payment due dates within a semi-annual payroll schedule?

Excel can automatically flag payment due dates within a semi-annual payroll schedule by using conditional formatting combined with date functions like TODAY() and EDATE(). You can set rules to highlight cells where payment dates are approaching or overdue, ensuring timely contractor payments. This method streamlines tracking and helps maintain compliance with payroll deadlines.

Which Excel features help summarize total contractor costs over multiple semi-annual periods?

Excel features like PivotTables efficiently summarize total contractor costs across multiple semi-annual periods by grouping and aggregating payment data. The SUMIFS function calculates precise totals based on contractor names and date ranges within semi-annual intervals. Conditional Formatting highlights cost trends or anomalies to enhance payroll analysis for contractors.