The Semi-annually Financial Report Excel Template for School Districts offers a streamlined way to track budget allocations, expenditures, and financial performance every six months. It ensures transparent and accurate financial reporting, aiding in compliance with regulatory requirements and facilitating informed decision-making. The template's customizable features allow school districts to easily monitor fiscal health and plan future budgets effectively.

Semi-Annual Financial Report Excel Template for School Districts

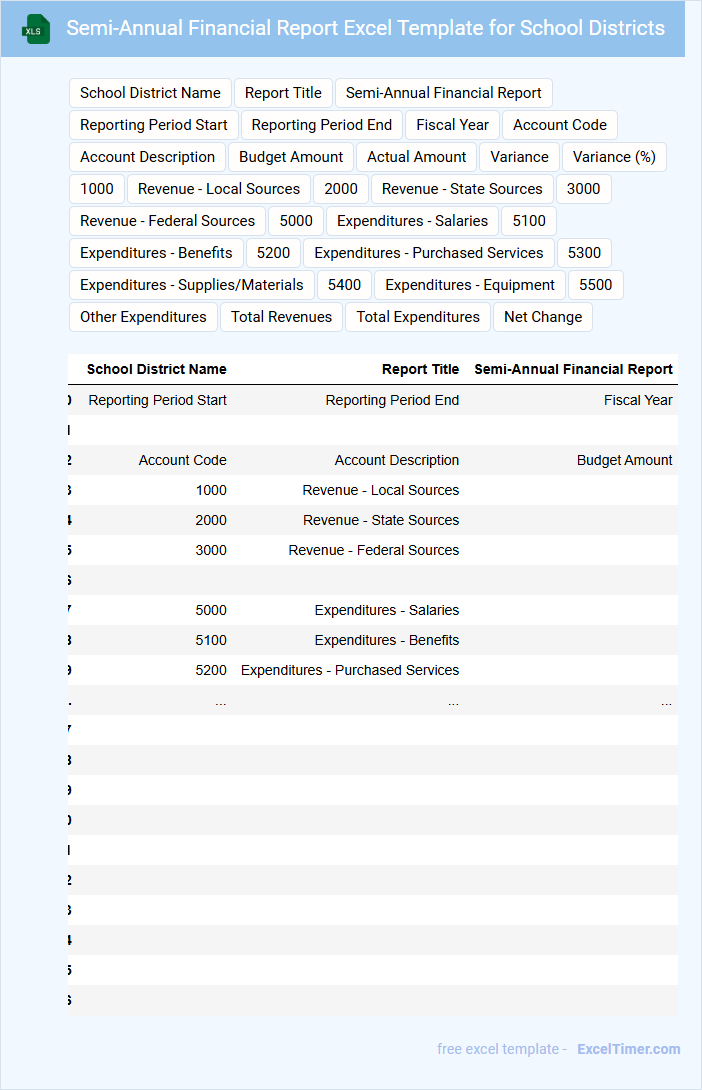

Semi-Annual Financial Report Excel Templates for School Districts typically contain detailed financial data that tracks income, expenses, and budget performance over a six-month period to ensure transparent fiscal management.

- Comprehensive Budget Overview: Provides a clear summary of allocated versus spent funds for accurate financial planning.

- Revenue and Expenditure Breakdown: Details sources of income and categorizes expenses for precise financial tracking.

- Compliance and Reporting: Facilitates adherence to regulatory requirements and supports transparent communication with stakeholders.

Income and Expense Tracking Sheet for School Districts (Semi-Annual)

An Income and Expense Tracking Sheet for school districts is a vital financial document used semi-annually to record all sources of income and categorize expenses accurately. It helps administrators maintain transparency and ensure compliance with budgetary regulations. Additionally, this document serves as a tool for monitoring financial performance and making informed decisions for future planning.

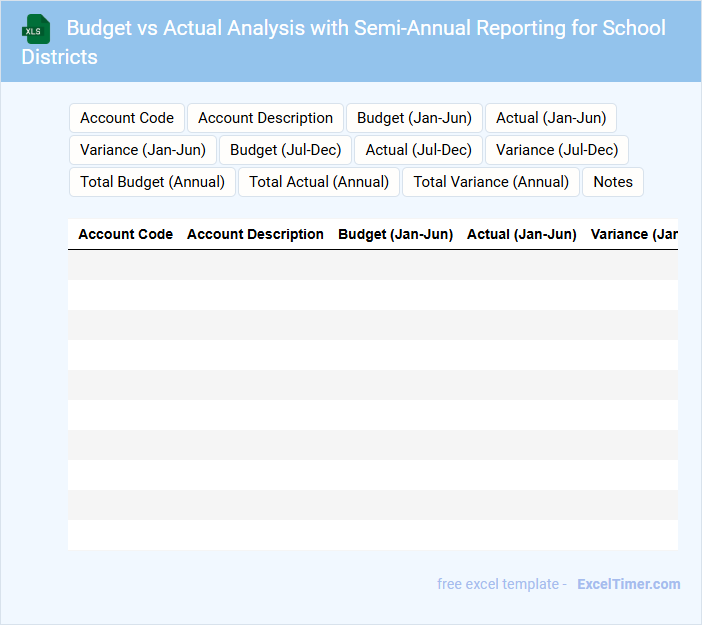

Budget vs Actual Analysis with Semi-Annual Reporting for School Districts

What information is typically included in a Budget vs Actual Analysis with Semi-Annual Reporting for School Districts? This document usually contains a comparison between the planned budget amounts and the actual expenditures or revenues recorded during the first half of the fiscal year. It provides insights into financial performance, highlighting variances and helping stakeholders understand how funds are being managed relative to expectations.

What key aspects should be considered when preparing this report? It is important to focus on clear categorization of expenses and revenues, ensuring accuracy in data collection, and presenting variances with explanations to support strategic decision-making. Additionally, including visual aids like graphs or tables can effectively communicate financial trends and support transparency within the school district.

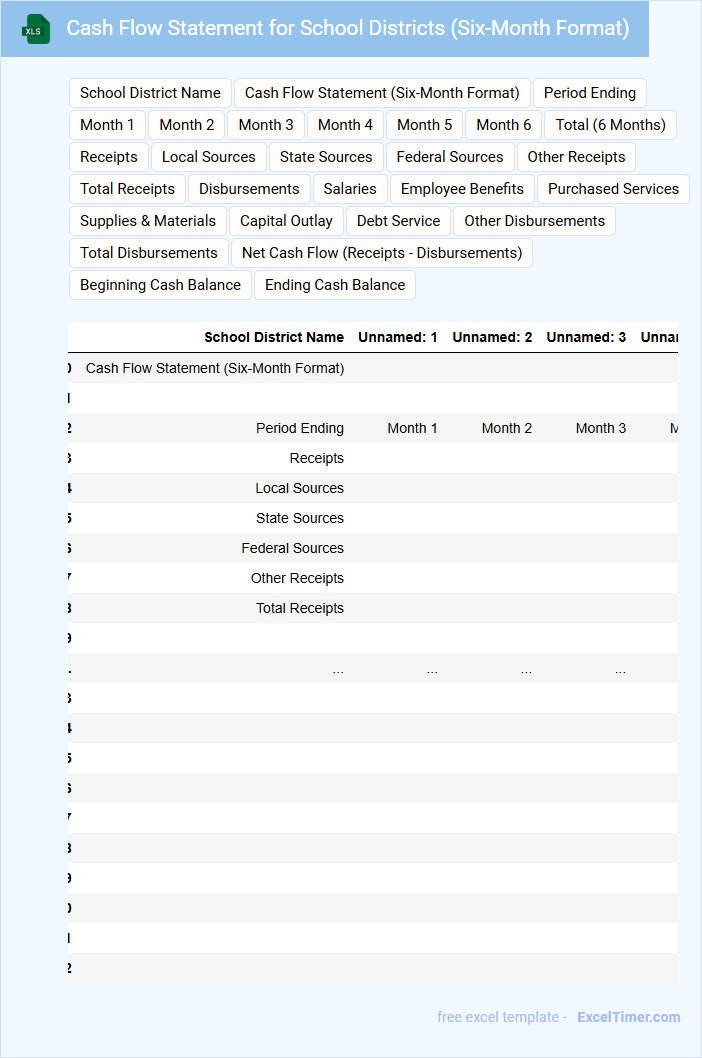

Cash Flow Statement for School Districts (Six-Month Format)

What information is typically included in a Cash Flow Statement for School Districts (Six-Month Format)? This document usually contains detailed records of cash inflows and outflows over a six-month period, focusing on operating, investing, and financing activities. It helps school districts monitor liquidity, ensure adequate funds for essential services, and plan financial strategies effectively.

What important considerations should be taken when preparing this cash flow statement? Accuracy in recording timing of cash transactions and categorizing them correctly is crucial to reflect the true financial position. Additionally, highlighting significant variances from the budget can aid in prompt decision-making and maintaining fiscal responsibility.

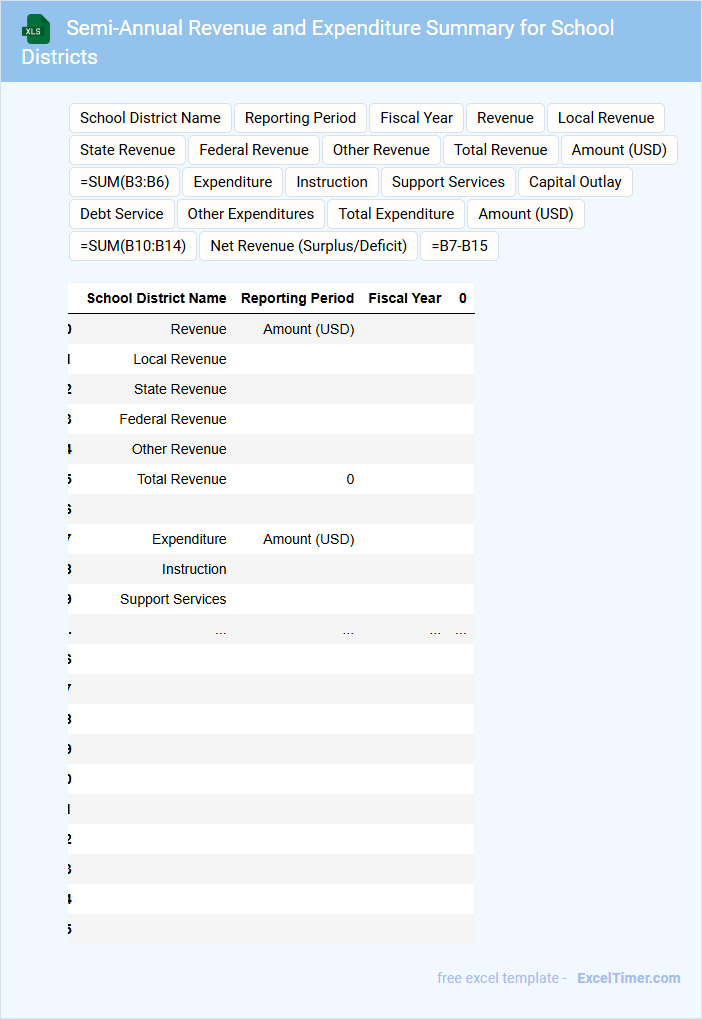

Semi-Annual Revenue and Expenditure Summary for School Districts

The Semi-Annual Revenue and Expenditure Summary provides an overview of the financial status of school districts, detailing income sources and spending within a six-month period. This document helps stakeholders understand budget adherence and fiscal health. It is important to ensure data accuracy and timely reporting.

Typically, this summary includes categorized revenues such as state funding, local taxes, and federal grants, alongside expenditures like salaries, facilities maintenance, and instructional costs. Emphasizing transparency supports informed decision-making and community trust. Including comparative analysis with previous periods enhances financial insight.

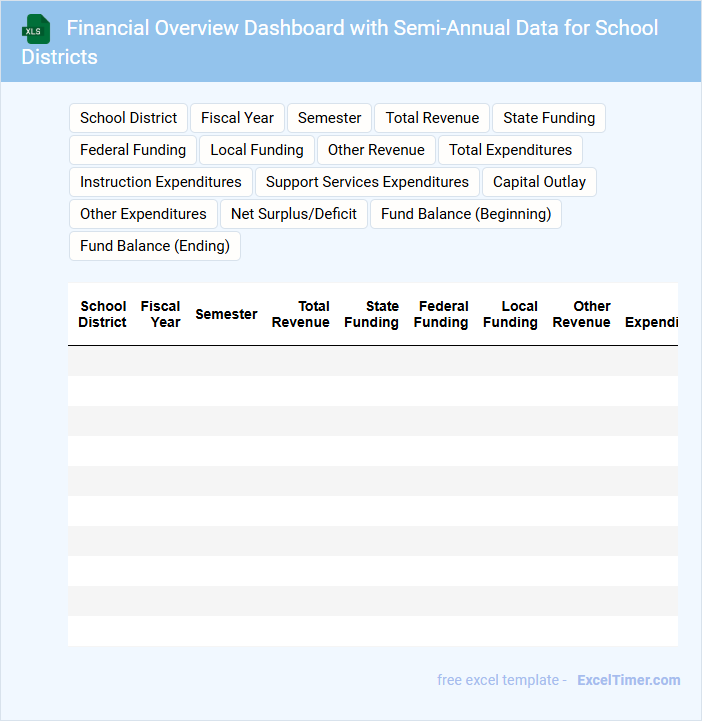

Financial Overview Dashboard with Semi-Annual Data for School Districts

This Financial Overview Dashboard typically contains summarized fiscal data presented semi-annually to provide clear insights into a school district's financial health. It includes revenue sources, expenditure categories, and budget variance reports to facilitate strategic planning.

A well-designed dashboard emphasizes data visualization to enhance quick interpretation and decision-making by stakeholders. Important elements to include are trend analysis, comparative charts, and alerts for budget deviations, ensuring effective financial management.

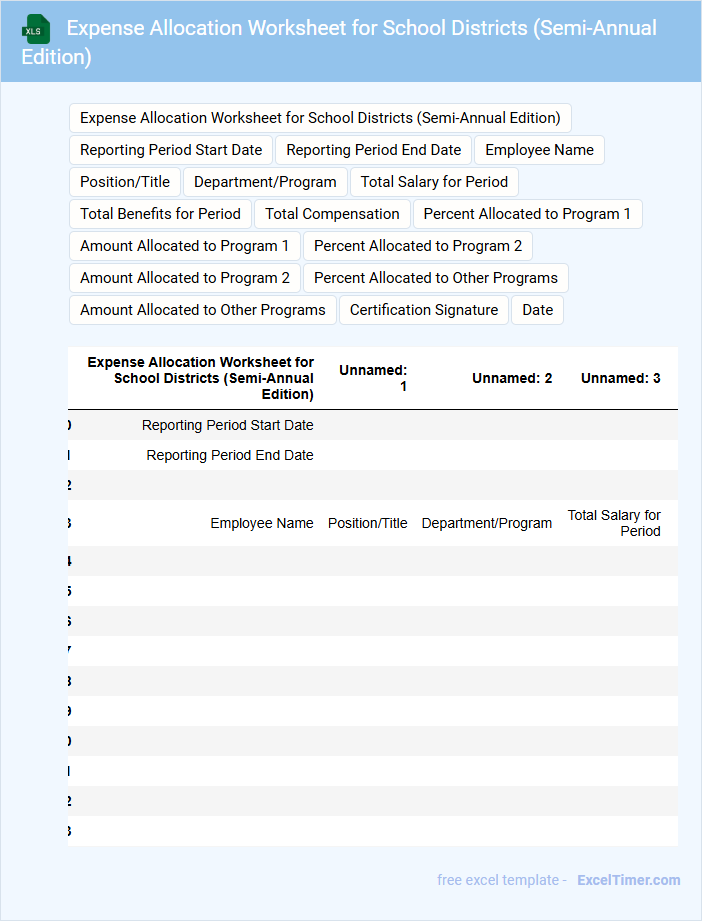

Expense Allocation Worksheet for School Districts (Semi-Annual Edition)

An Expense Allocation Worksheet for School Districts (Semi-Annual Edition) typically contains detailed records of all financial expenditures categorized by department or function within the district. It helps ensure proper budgeting and compliance with state and federal funding requirements. Accurate allocation of expenses is crucial for transparent financial reporting and effective resource management.

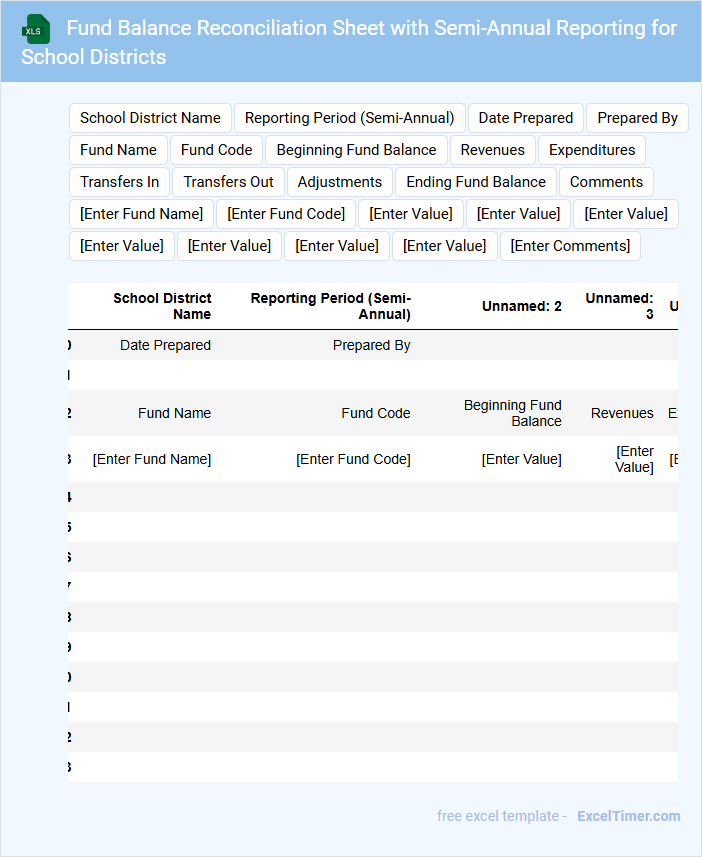

Fund Balance Reconciliation Sheet with Semi-Annual Reporting for School Districts

Fund Balance Reconciliation Sheets with Semi-Annual Reporting for School Districts typically contain detailed records of financial activities to ensure transparency and accuracy.

- Fund Balance Overview: Summarizes the beginning and ending fund balances to track financial health.

- Adjustments and Reconciliations: Details necessary corrections and reconciliations to align records with actual transactions.

- Reporting Period Accuracy: Ensures timely and consistent reporting for each semi-annual period to aid in financial decision-making.

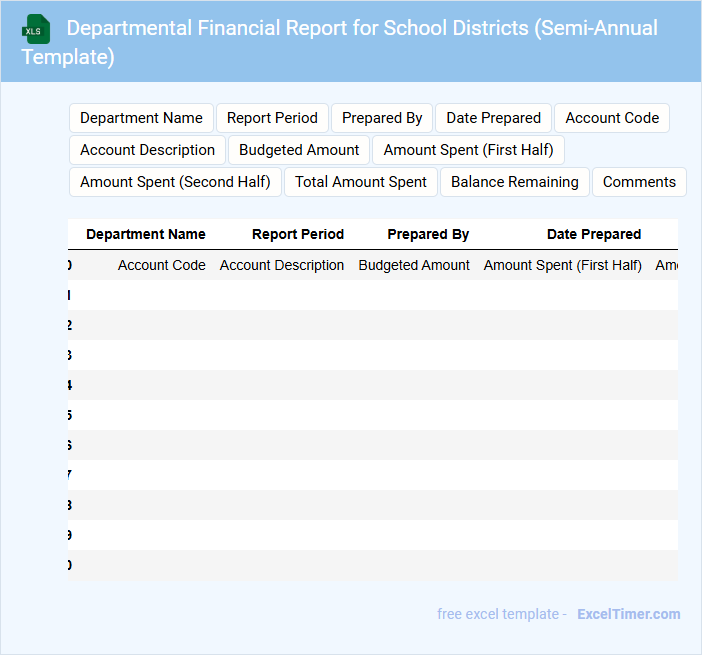

Departmental Financial Report for School Districts (Semi-Annual Template)

The Departmental Financial Report for School Districts typically contains detailed accounts of revenues, expenditures, and budget adjustments related to specific departments within the district. This semi-annual template helps in monitoring financial health and ensures compliance with state and federal funding requirements.

It is essential to include clear categorization of funds, accurate tracking of expenses, and timely updates to reflect any changes during the reporting period. Proper documentation and transparency in these reports support informed decision-making and fiscal accountability.

Semi-Annual Grant Tracking and Reporting Template for School Districts

What information does a Semi-Annual Grant Tracking and Reporting Template for School Districts usually contain? This document typically includes detailed records of grant allocations, expenditures, and progress updates within the school district. It helps ensure transparency and accountability by tracking how funds are utilized and reporting outcomes to stakeholders.

What important elements should be included in this template? Key components include clear budget categories, timelines for spending and reporting, and sections for narrative explanations of grant impacts. Additionally, incorporating deadlines and contact information ensures timely communication and effective grant management.

Comparative Financial Statement with Semi-Annual Data for School Districts

What information is typically contained in a Comparative Financial Statement with Semi-Annual Data for School Districts? This type of document usually includes detailed financial data comparing revenues, expenditures, and fund balances over two semi-annual periods. It highlights trends and changes in the school district's financial health to support informed decision-making.

What important factors should be considered when reviewing these financial statements? Accuracy in data reporting and clear categorization of financial sources and uses are crucial to ensure transparency. Additionally, analyzing variances between the periods can reveal significant financial developments or concerns.

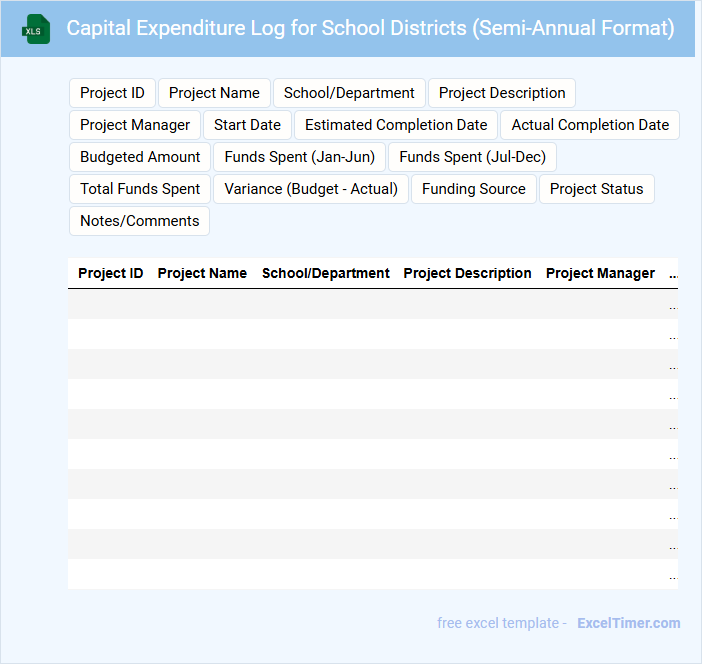

Capital Expenditure Log for School Districts (Semi-Annual Format)

The Capital Expenditure Log for school districts typically contains detailed records of significant financial outlays for acquiring or maintaining fixed assets. This semi-annual document helps in monitoring and managing large-scale investments effectively. Maintaining accuracy and consistency in entries ensures clarity and accountability.

Important elements include the date of purchase, project description, allocated budget, and vendor details. Emphasizing clear categorization of expenditures enhances transparency and simplifies audit processes. It is crucial to regularly update and review the log to align with district financial goals and compliance requirements.

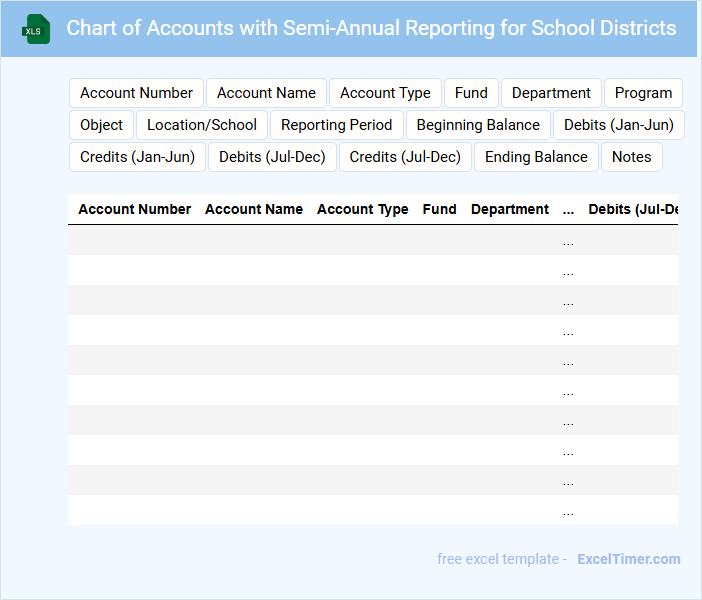

Chart of Accounts with Semi-Annual Reporting for School Districts

The Chart of Accounts is a systematic listing of all account titles and numbers used by a school district to organize financial transactions. It typically contains categories for assets, liabilities, revenues, and expenditures tailored to educational funding and operations. For Semi-Annual Reporting, it is essential to maintain accuracy and consistency in coding to ensure clear financial tracking and compliance with regulatory requirements.

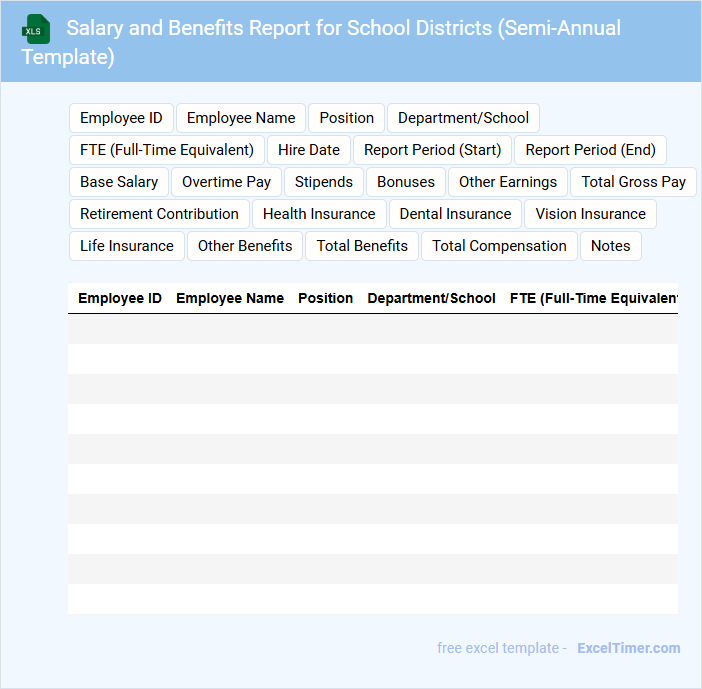

Salary and Benefits Report for School Districts (Semi-Annual Template)

This Salary and Benefits Report for school districts typically includes detailed data on employee compensation, benefits allocation, and budgetary impacts. It serves as a crucial tool for transparency and strategic planning within the district. School administrators should prioritize accuracy, timeliness, and clarity when preparing this semi-annual template.

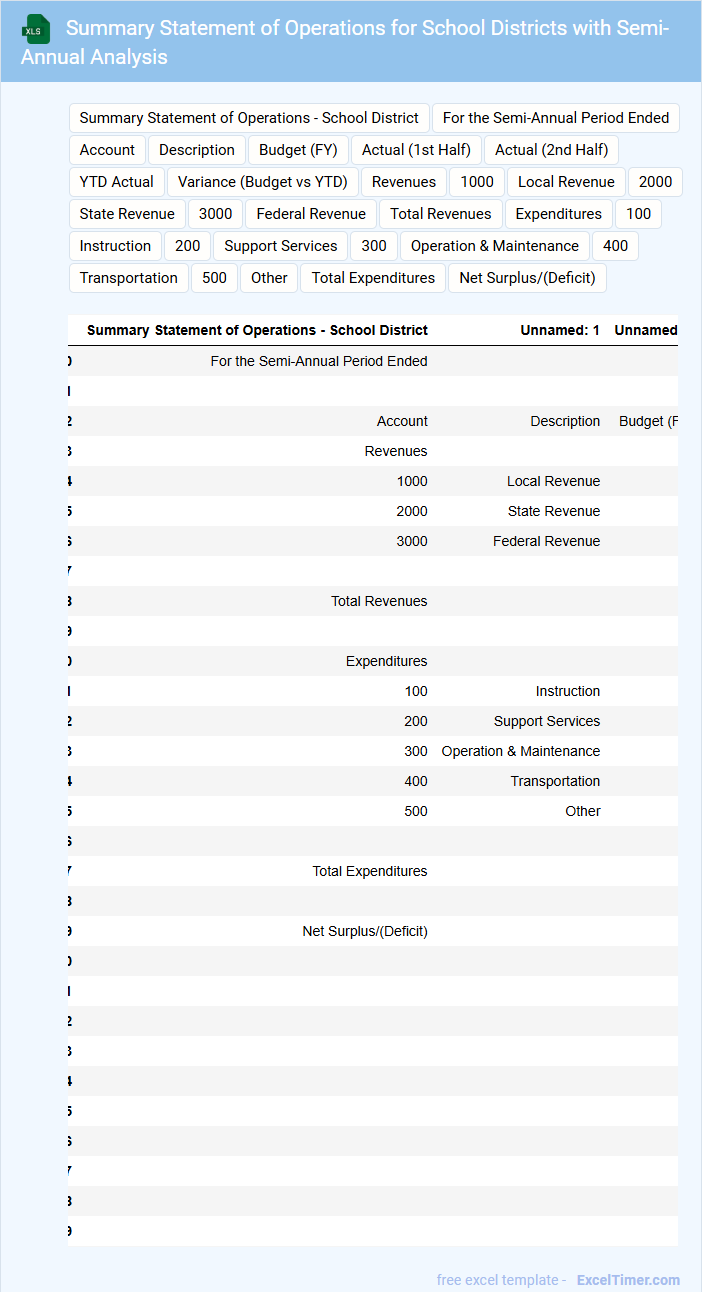

Summary Statement of Operations for School Districts with Semi-Annual Analysis

The Summary Statement of Operations for school districts provides a clear overview of financial activities over a specific period. It typically includes revenue sources, expenditures, and net financial positions related to educational operations.

This document often features a Semi-Annual Analysis to monitor mid-year fiscal performance against budgets and forecasts. Regular updates help school boards and stakeholders make informed decisions and maintain financial transparency.

For best use, ensure accurate data entry, timely updates, and clear presentation of variances to highlight key financial trends and potential areas of concern.

What key financial metrics should be included in a semi-annual financial report for school districts?

Your semi-annual financial report for school districts should include key metrics such as revenue sources, expenditure categories, fund balances, and debt obligations. Detailed analyses of budget variances and cash flow statements enhance financial transparency. Enrollment figures and per-pupil spending also provide crucial insights into resource allocation.

How does the report address budget versus actual expenditures for major fund categories?

The Semi-annually Financial Report for School Districts provides a detailed comparison of budgeted versus actual expenditures across major fund categories such as the General Fund, Special Revenue Fund, and Capital Projects Fund. Your report highlights variances to help identify overspending or savings in each category, enabling more effective fiscal management. This ensures transparency and supports informed decision-making for district financial planning.

What methods are used to account for revenue sources and timing differences within the reporting period?

The Semi-annually Financial Report for School Districts uses accrual accounting and cash basis methods to accurately record revenue sources and timing differences within the reporting period. You can expect detailed tracking of deferred revenues and receivables to ensure proper period matching. This approach provides a clear financial picture aligned with fiscal accountability standards.

How are capital projects and debt obligations presented and assessed in the report?

The Semi-Annually Financial Report for School Districts presents capital projects by detailing expenditures and current project statuses alongside budget allocations. Debt obligations are assessed through comprehensive summaries of outstanding balances, payment schedules, and interest rates. This allows you to evaluate financial commitments and project progress clearly within the reporting period.

What internal controls and compliance measures are detailed to ensure transparency and accountability?

Your Semi-annually Financial Report for School Districts outlines key internal controls such as segregated duties, regular audits, and budgetary adherence to maintain accuracy. Compliance measures include strict adherence to state regulations, timely financial disclosures, and comprehensive documentation of expenditures. These protocols ensure transparency and accountability in managing school district funds.