The Semi-annually Loan Repayment Excel Template for Property Investors provides a precise tool to track loan repayments every six months, helping investors manage cash flow efficiently. It calculates interest and principal payments automatically, offering clear insights into outstanding balances over time. This template is essential for property investors aiming to plan repayments while optimizing investment returns.

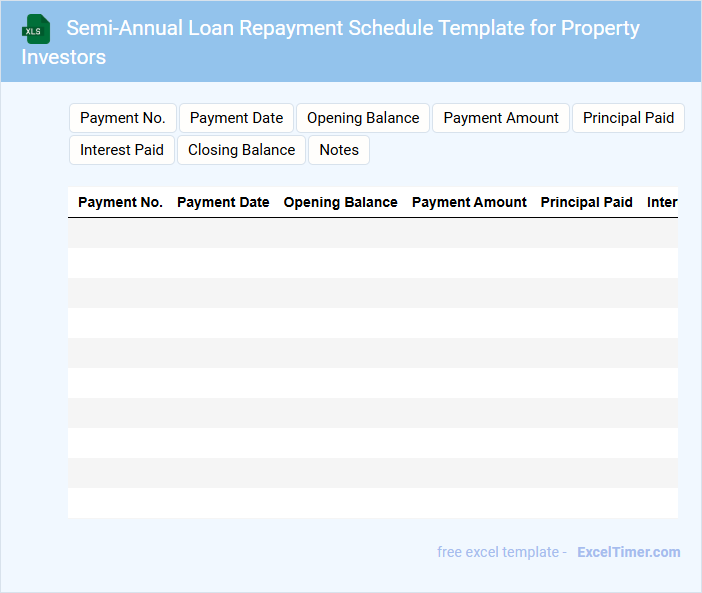

Semi-Annual Loan Repayment Schedule Template for Property Investors

This document typically outlines a semi-annual repayment plan designed specifically for property investors to manage their loan payments efficiently.

- Repayment Details: It includes precise dates and amounts for each loan installment to avoid any missed payments.

- Interest Calculation: The template highlights the interest portion of each payment separately to ensure clear financial tracking.

- Investor Guidelines: Provides strategic advice for maintaining cash flow and optimizing returns through timely loan repayments.

Excel Tracker for Semi-Annually Loan Repayment of Property Investments

This document typically contains detailed financial data and schedules for tracking semi-annual loan repayments related to property investments.

- Payment Schedule: Clear dates and amounts for each semi-annual loan repayment to ensure timely payments.

- Loan Balance Tracking: Updated loan balances after each payment to monitor outstanding debt.

- Investment Performance: Summary of property income and expenses linked to loan repayments for financial analysis.

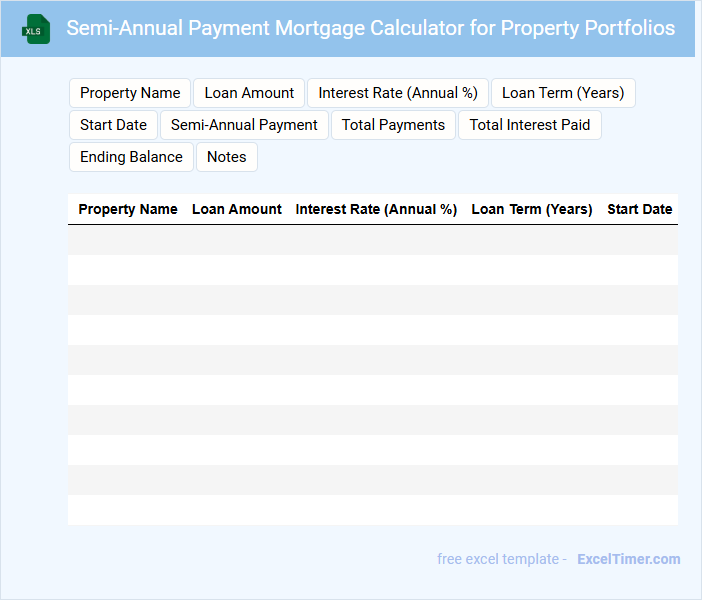

Semi-Annual Payment Mortgage Calculator for Property Portfolios

A Semi-Annual Payment Mortgage Calculator for Property Portfolios is typically used to estimate mortgage payments that are made twice a year, specifically tailored for multiple property investments. It helps investors understand the financial commitments involved in managing a portfolio with semi-annual payment schedules.

- Include input fields for property values, interest rates, and loan terms to provide accurate calculations.

- Incorporate amortization schedules that reflect semi-annual compounding and payment intervals.

- Provide summaries that highlight total interest paid and remaining balances for the entire portfolio.

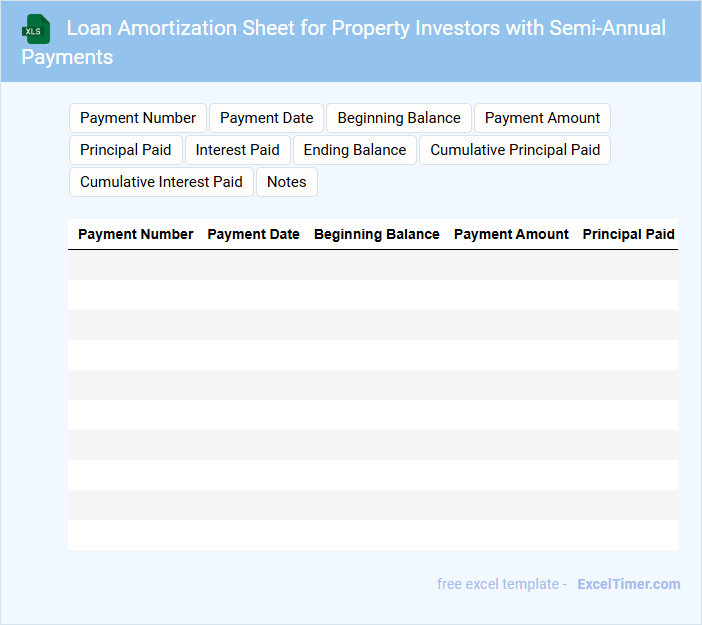

Loan Amortization Sheet for Property Investors with Semi-Annual Payments

What information is typically included in a Loan Amortization Sheet for Property Investors with Semi-Annual Payments? This document usually contains a detailed schedule of payments including principal and interest amounts due every six months. It helps investors understand their payment timeline, remaining balance, and interest expense over the life of the loan.

Important factors to consider include accurately calculating the semi-annual payment amounts and ensuring the amortization schedule aligns with the loan terms. Additionally, tracking the impact of each payment on the principal balance is crucial for effective financial planning and investment analysis.

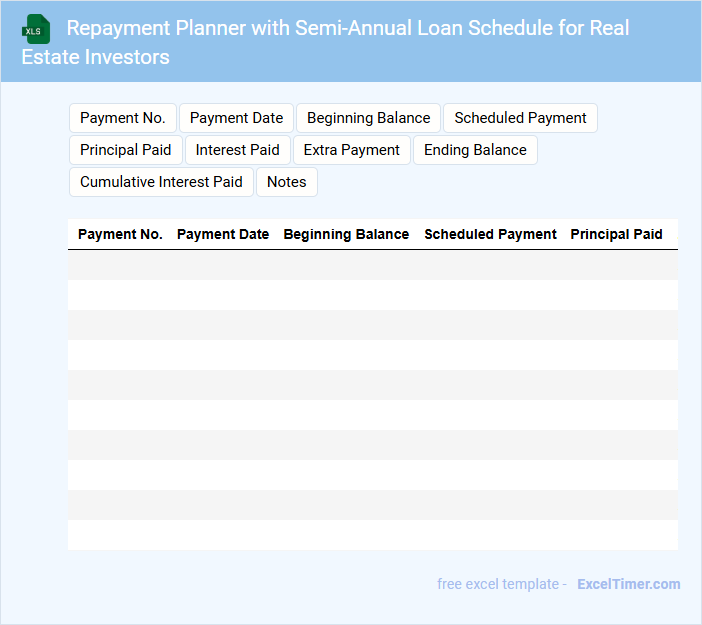

Repayment Planner with Semi-Annual Loan Schedule for Real Estate Investors

A Repayment Planner with a Semi-Annual Loan Schedule is a crucial document for real estate investors, outlining the structured repayment of loan principal and interest every six months. It typically contains detailed timelines, payment amounts, and interest calculations tailored to investment property loans. Ensuring accuracy and clear visibility of due dates helps investors manage cash flow and avoid defaults effectively.

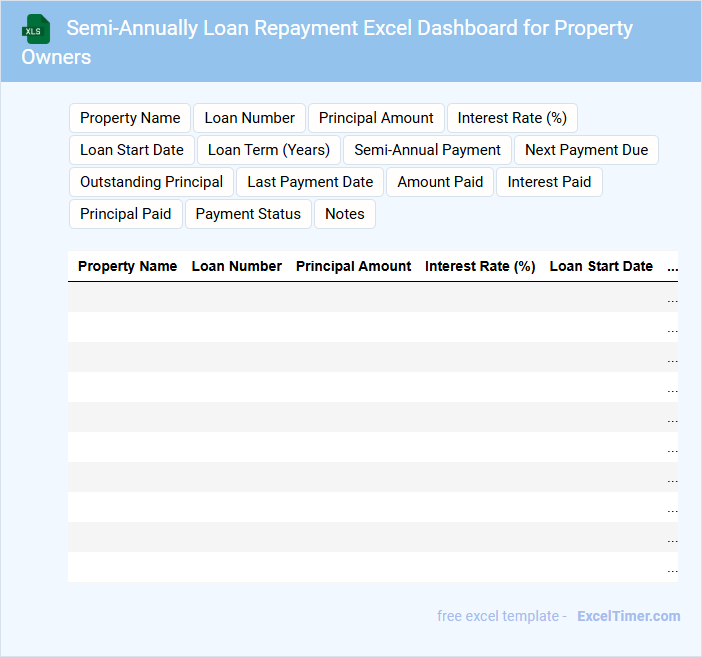

Semi-Annually Loan Repayment Excel Dashboard for Property Owners

What information is typically included in a Semi-Annually Loan Repayment Excel Dashboard for Property Owners? This type of document usually contains detailed loan repayment schedules, including principal and interest amounts due every six months. It also features visual summaries such as charts or graphs to help property owners track their repayment progress and outstanding balances efficiently.

What are some important considerations when creating this dashboard? Accuracy in inputting loan terms and payment dates is essential to ensure reliable tracking. Additionally, including alerts for upcoming payments and summaries of total interest paid can help property owners manage their finances more effectively.

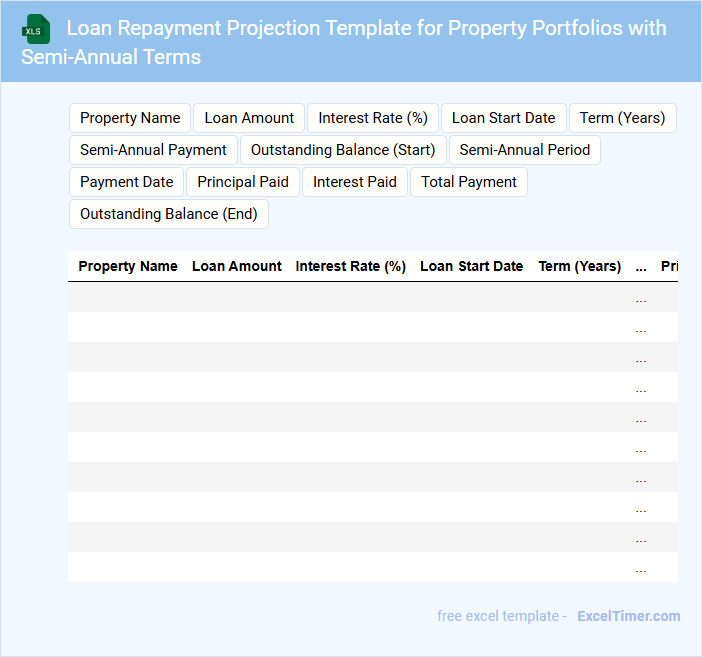

Loan Repayment Projection Template for Property Portfolios with Semi-Annual Terms

A Loan Repayment Projection Template for property portfolios with semi-annual terms is a financial document designed to estimate and track loan repayments over specified periods. It usually contains detailed loan schedules, interest calculations, and payment timelines tailored to the semi-annual payment structure. This template aids investors and property managers in forecasting cash flows and managing loan obligations effectively.

Important elements to include are the principal loan amount, interest rates, payment due dates every six months, and any applicable fees or penalties. Additionally, incorporating a breakdown of each property's contribution to the portfolio's total loan helps in precise financial planning. Regularly updating the template with actual payments ensures accurate projections and better loan management.

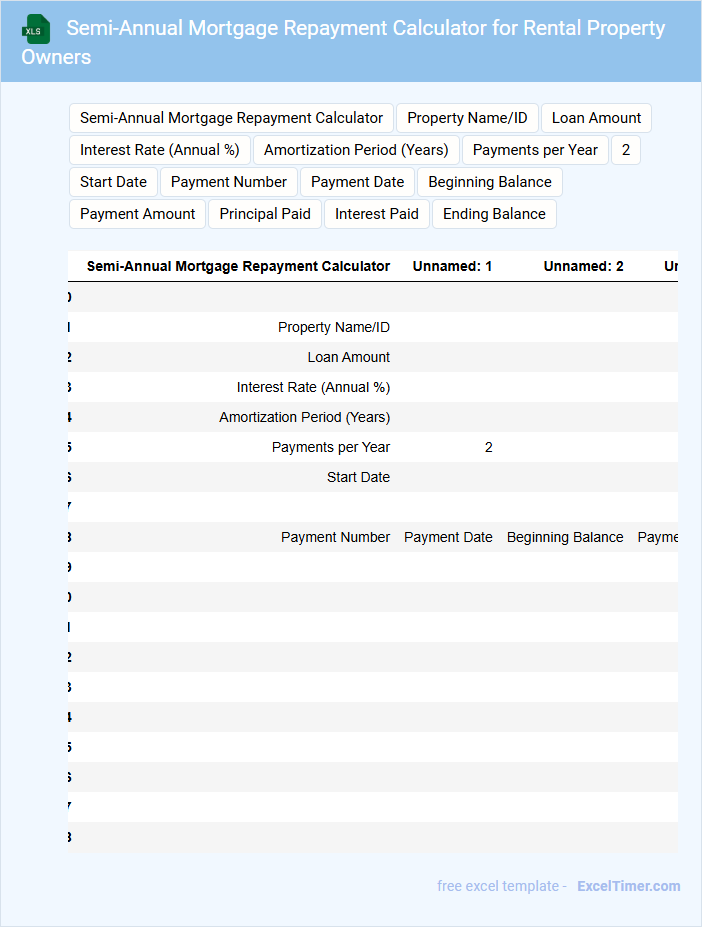

Semi-Annual Mortgage Repayment Calculator for Rental Property Owners

What information is typically included in a Semi-Annual Mortgage Repayment Calculator for Rental Property Owners? This document usually contains fields for the loan amount, interest rate, loan term, and payment frequency tailored to semi-annual schedules. It helps rental property owners estimate their periodic mortgage repayments, factoring in specific payment intervals and potential rental income considerations.

What important aspects should rental property owners consider when using this calculator? They should input accurate loan details and account for potential changes in interest rates or rental income fluctuations. Additionally, understanding tax implications and including maintenance costs can provide a more comprehensive financial outlook.

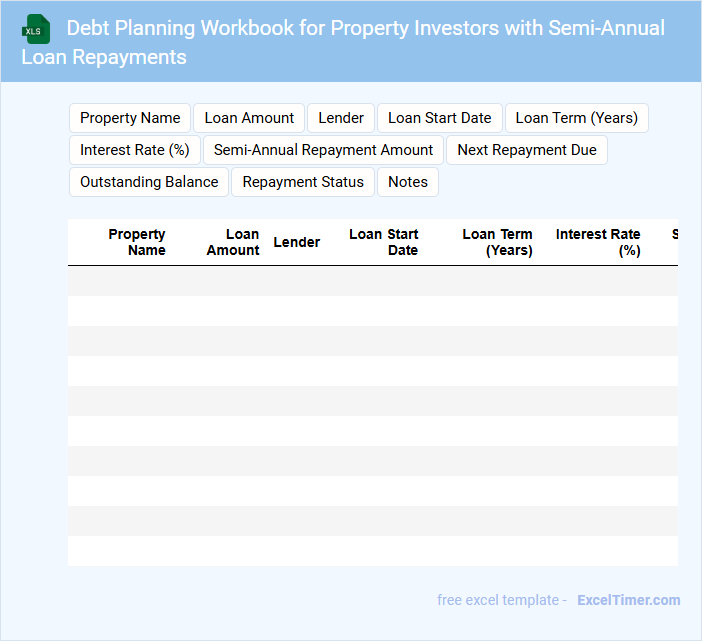

Debt Planning Workbook for Property Investors with Semi-Annual Loan Repayments

The Debt Planning Workbook for property investors is a comprehensive tool designed to help manage and organize loan repayment schedules effectively. It typically contains detailed sections for tracking semi-annual loan repayments, interest calculations, and cash flow projections. Key recommendations include regularly updating payment records and reviewing loan terms to optimize financial strategies.

Semi-Annually Interest and Principal Tracker for Real Estate Loans

This document typically contains detailed payment schedules that outline the interest and principal amounts due every six months for real estate loans. It helps borrowers and lenders track the progress of loan repayment over time to ensure accuracy.

An important suggestion is to regularly update the tracking data after each payment to reflect any changes in principal or interest. Maintaining clarity and accuracy in records supports financial planning and audit readiness.

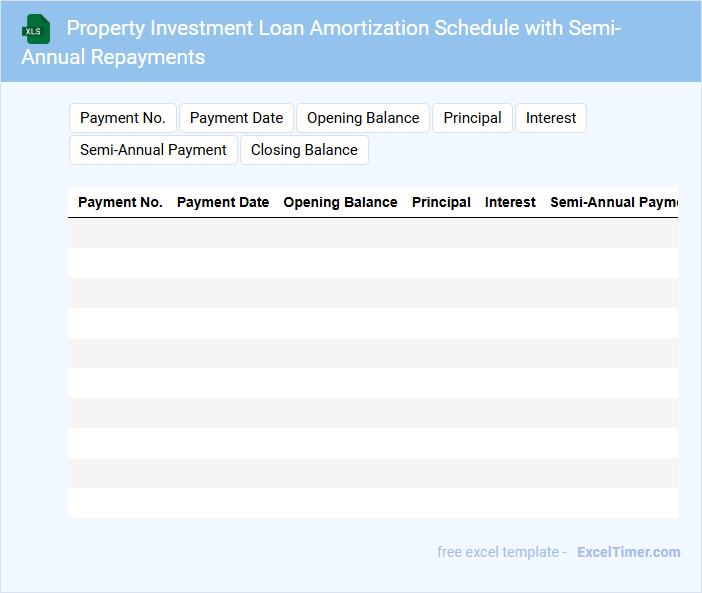

Property Investment Loan Amortization Schedule with Semi-Annual Repayments

A Property Investment Loan Amortization Schedule details the repayment plan of a loan specifically used for property investments. It outlines each payment's breakdown between principal and interest over the loan term. This schedule with semi-annual repayments helps investors plan cash flow by clearly showing payment dates and amounts twice a year.

Important suggestions include ensuring accuracy in interest rate application and staying consistent with semi-annual payment intervals. Maintaining updated records of repayments will help monitor loan progress efficiently. Additionally, reviewing the schedule periodically allows for adjustments in case of interest rate changes or refinancing opportunities.

Excel Template for Tracking Semi-Annually Loan Repayment of Multiple Properties

An Excel Template for tracking semi-annually loan repayments is a structured spreadsheet designed to monitor payment schedules and outstanding balances for multiple properties. It helps users organize financial data efficiently and ensures timely tracking of all loan-related transactions.

This document typically contains sections for property details, loan amounts, interest rates, repayment dates, and payment statuses. Including automated calculations and summary dashboards is suggested to enhance accuracy and ease of use.

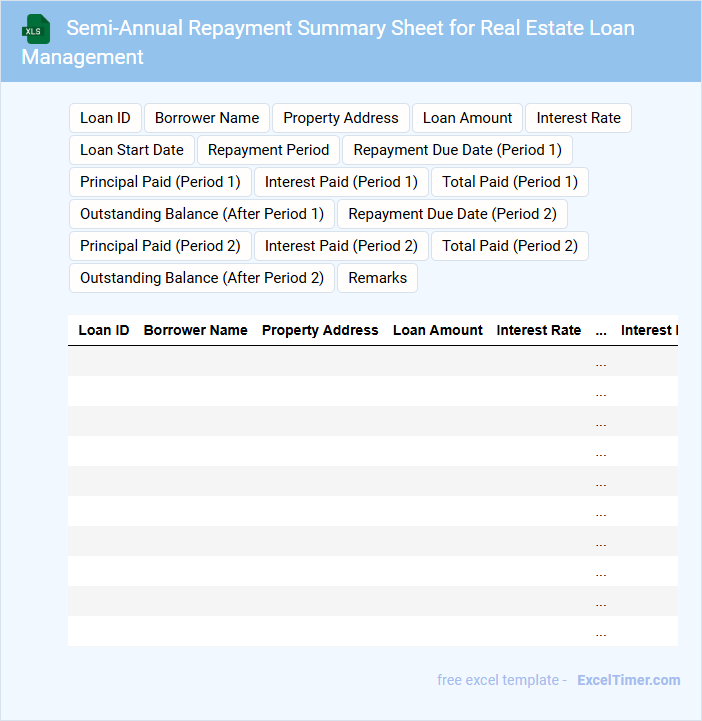

Semi-Annual Repayment Summary Sheet for Real Estate Loan Management

A Semi-Annual Repayment Summary Sheet typically contains detailed records of the payments made towards a real estate loan over a six-month period. It summarizes principal and interest paid, remaining balance, and any additional fees or adjustments. This document is essential for both borrowers and lenders to track repayment progress and ensure loan terms are met.

Important elements to include are accurate loan details, clear payment dates, and a breakdown of amounts applied to principal and interest. Additionally, highlighting any late payments or penalties can improve transparency. Maintaining this summary regularly helps in effective real estate loan management and financial planning.

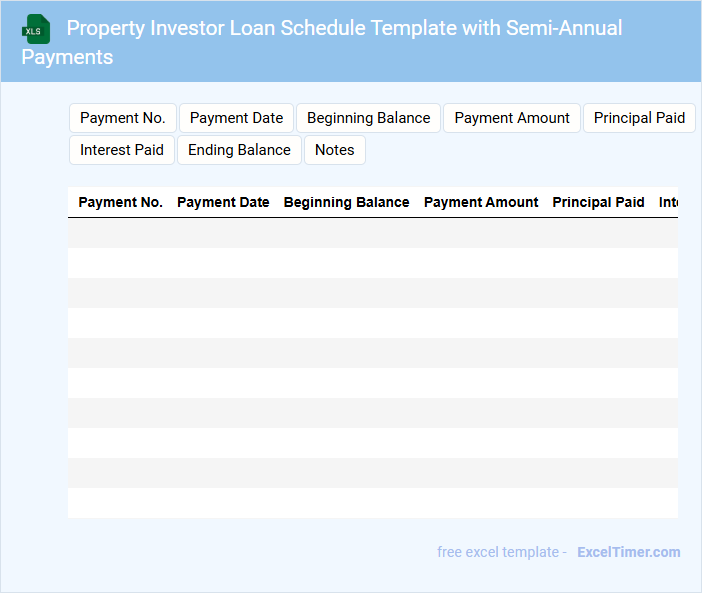

Property Investor Loan Schedule Template with Semi-Annual Payments

A Property Investor Loan Schedule Template with semi-annual payments typically contains a detailed breakdown of loan repayment dates, principal and interest amounts due, and the remaining balance after each payment. This document helps property investors track their loan obligations and manage cash flow effectively. It is crucial for accurately forecasting financial commitments over a specified loan term and ensuring timely payments.

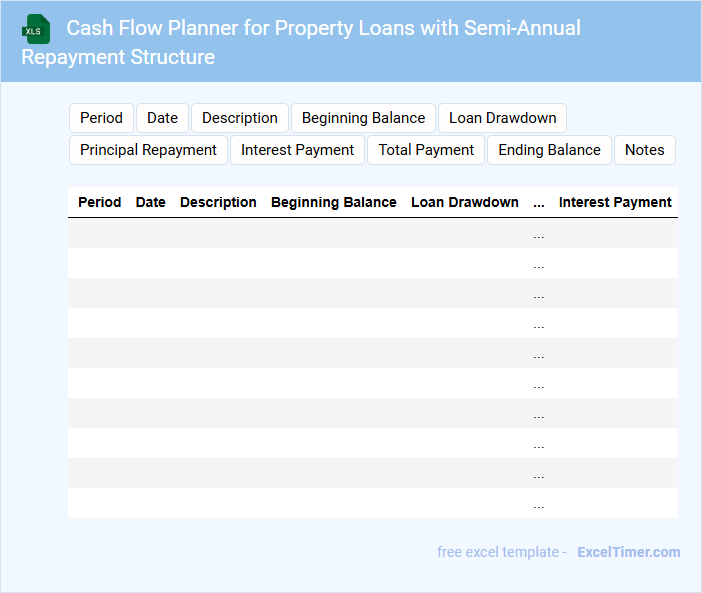

Cash Flow Planner for Property Loans with Semi-Annual Repayment Structure

The Cash Flow Planner for property loans is a critical document that outlines the inflows and outflows of cash to ensure timely repayments, especially with a semi-annual repayment structure. It typically contains detailed repayment schedules, interest calculations, and projected income from the property. Ensuring accuracy and including contingency plans for unexpected expenses are essential for effective financial management.

What formula calculates the semi-annual loan repayment amount for property investors in Excel?

The PMT function in Excel calculates the semi-annual loan repayment amount for property investors. Use the formula =PMT(rate/2, nper*2, -pv), where rate is the annual interest rate, nper is the loan term in years, and pv is the loan principal. This formula helps You accurately determine Your semi-annual payment schedule.

How does changing the interest rate affect the semi-annual repayment schedule in an Excel amortization table?

Changing the interest rate directly impacts the semi-annual repayment amount in an Excel amortization table by altering the interest portion of each payment. Higher interest rates increase overall interest paid and extend the loan term if payments remain fixed, while lower rates reduce interest expenses and shorten repayment duration. Excel formulas recalculate installment amounts based on the updated rate, reflecting changes in principal and interest allocation each period.

How can you use Excel functions to distinguish between principal and interest in each semi-annual payment?

You can use Excel functions like IPMT and PPMT to distinguish between interest and principal in each semi-annual loan repayment for property investors. IPMT calculates the interest portion of a specific payment period based on the loan rate, term, and payment number, while PPMT returns the principal portion. Utilizing these functions helps you accurately track how your payments reduce loan balance over time.

Which Excel tools help visualize the outstanding loan balance over each semi-annual period?

Excel's built-in chart tools, such as Line Charts and Area Charts, effectively visualize your outstanding loan balance over each semi-annual period. Using PivotTables with Slicers enables easy filtering and dynamic updates of loan repayment data. Conditional Formatting highlights key balance thresholds, enhancing your understanding of repayment progress.

What Excel technique enables scenario analysis for different loan terms and semi-annual repayment frequencies?

The Excel technique of Data Tables enables scenario analysis for different loan terms and semi-annual repayment frequencies in your semi-annual loan repayment schedule. It allows you to input various interest rates, loan durations, and repayment amounts to observe their impact on your loan balance and cash flow. Using this method enhances financial planning and decision-making for property investors.