![]()

The Semi-annually Excel Template for Financial Budget Tracking allows users to efficiently monitor income and expenses over six-month periods, ensuring detailed financial analysis and better budget control. It offers customizable categories, automated calculations, and visual charts to track spending patterns and forecast future budgets accurately. Using this template helps improve financial planning by highlighting trends and enabling timely adjustments in semi-annual intervals.

Semi-Annual Financial Budget Tracker with Expense Categories

A Semi-Annual Financial Budget Tracker is a document designed to monitor and manage expenses over a six-month period. It typically contains categorized expense data, income sources, and variance analysis. This helps individuals or businesses maintain financial discipline and plan for future expenditures.

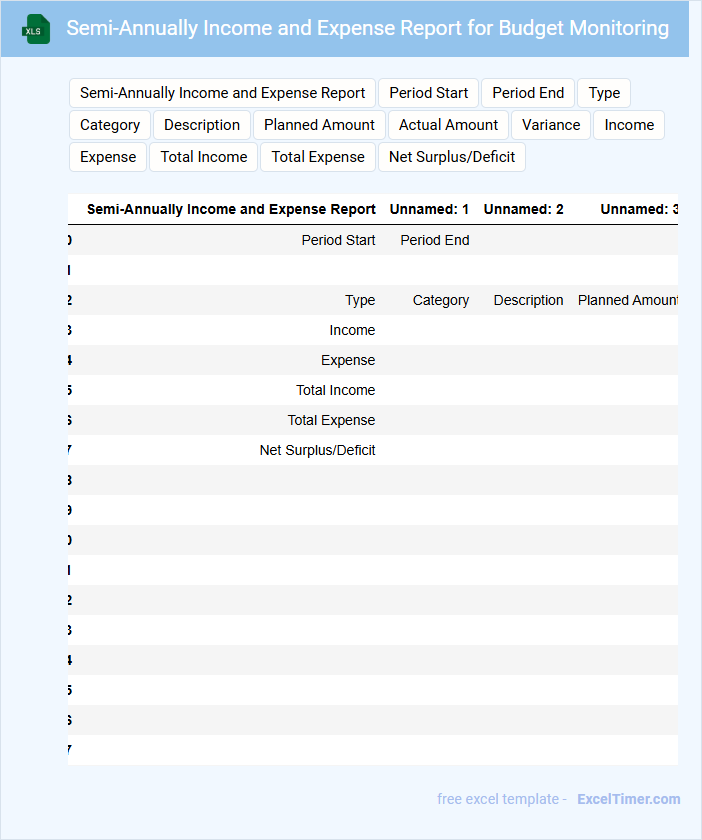

Semi-Annually Income and Expense Report for Budget Monitoring

This document summarizes the financial performance over a six-month period, highlighting income and expenses to monitor budget adherence. It serves as a tool for stakeholders to assess financial health and make informed decisions.

- Include detailed categories of income and expense to ensure clarity and accuracy.

- Highlight significant variances from the budget to identify potential issues early.

- Provide comparative data from previous periods to track financial trends effectively.

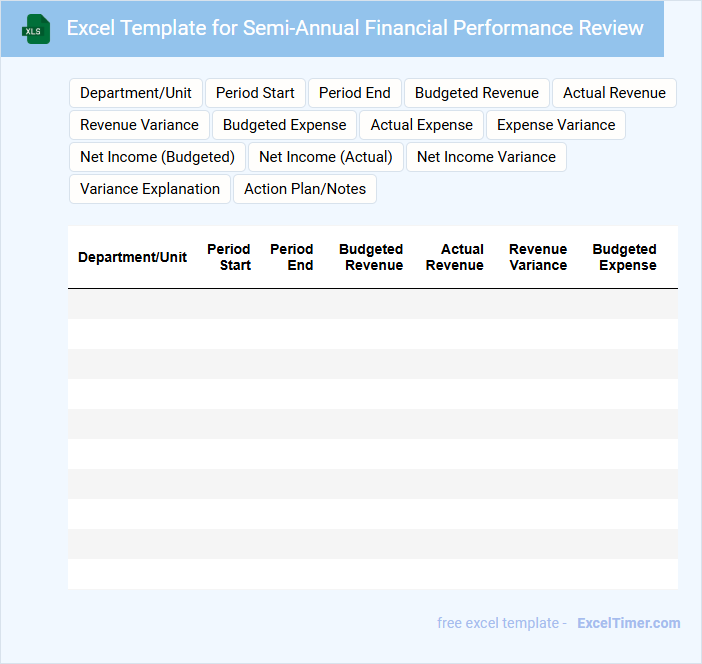

Excel Template for Semi-Annual Financial Performance Review

What does an Excel Template for Semi-Annual Financial Performance Review typically contain and what important features should it include? This document usually contains key financial metrics, revenue, expenses, profit margins, and comparison charts for two consecutive quarters. It is important to include clear data input areas, automated calculations, and visual summaries to facilitate accurate and efficient performance analysis.

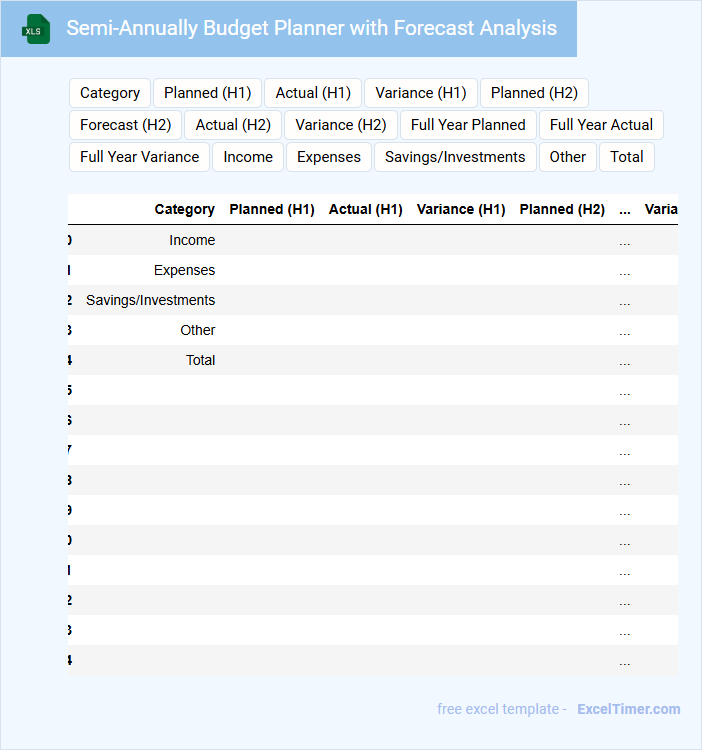

Semi-Annually Budget Planner with Forecast Analysis

A Semi-Annually Budget Planner with Forecast Analysis typically contains detailed income and expense projections for a six-month period, helping organizations or individuals manage finances effectively. It includes historical data, anticipated costs, and revenue forecasts to guide budgeting decisions and track financial performance. Important considerations include regularly updating the forecast to reflect changes, setting realistic goals, and identifying potential risks to ensure accurate and actionable financial planning.

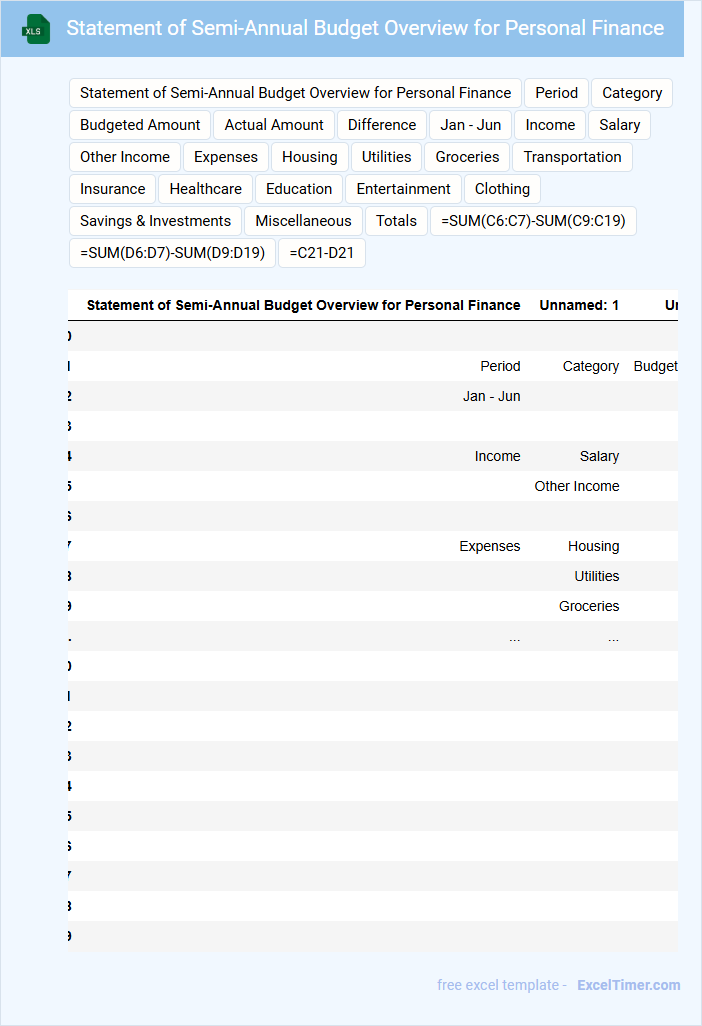

Statement of Semi-Annual Budget Overview for Personal Finance

The Statement of Semi-Annual Budget Overview for personal finance typically contains a summary of income, expenses, and savings over a six-month period. It highlights major spending categories and compares actual expenditures against planned budgets. This document helps individuals track financial progress and make informed decisions.

Important elements to include are detailed income sources, categorized expenses, and savings goals. Additionally, noting any unexpected costs or surplus funds can provide valuable insights for future budgeting. Regularly reviewing these statements enhances financial discipline and aids in long-term planning.

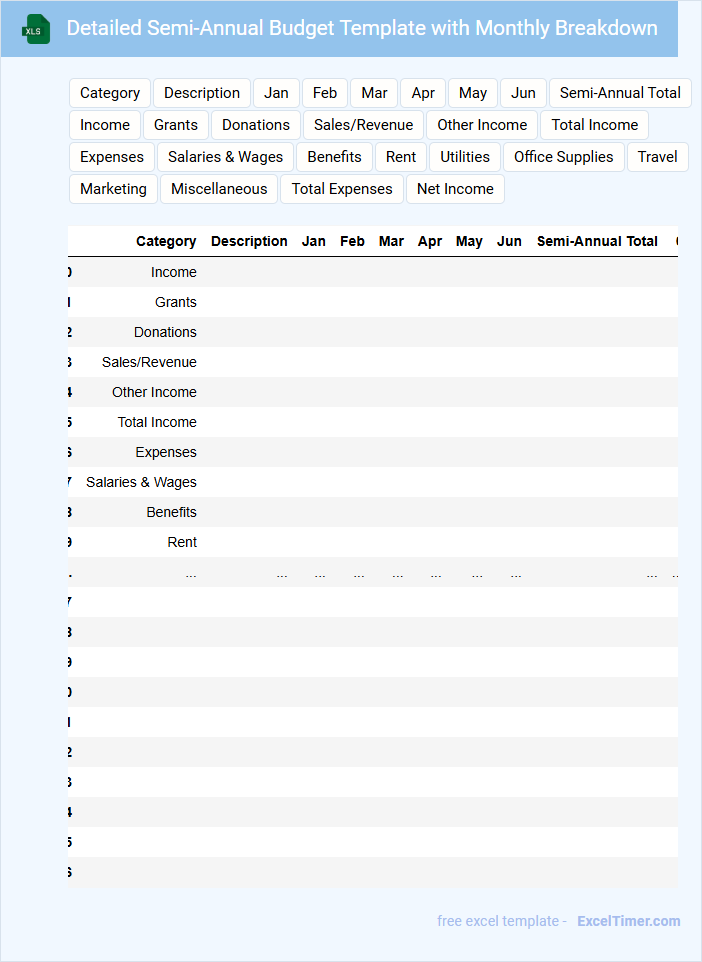

Detailed Semi-Annual Budget Template with Monthly Breakdown

A Detailed Semi-Annual Budget Template typically contains a comprehensive financial plan divided into two six-month periods, allowing for precise tracking and management of income and expenses. It includes a monthly breakdown to monitor cash flow, allocate resources effectively, and identify potential budgetary issues early.

Important elements to include are clear categories for revenue, fixed and variable expenses, and contingency funds to handle unexpected costs. Regularly updating and reviewing the template ensures accurate financial forecasting and helps maintain organizational financial health.

Semi-Annually Financial Tracking Spreadsheet for Businesses

A Semi-Annually Financial Tracking Spreadsheet is a crucial document used by businesses to monitor their financial performance every six months. It typically contains detailed records of income, expenses, profits, and losses within the half-year period, enabling better budget management and forecasting. This spreadsheet is essential for identifying trends and making informed decisions to enhance business growth.

Important elements to include are clear income and expense categories, accurate date tracking, and a summary section for quick financial insights. Ensuring the data is consistently updated and verified helps maintain reliability. Additionally, integrating charts or graphs can provide visual representation to simplify complex financial data.

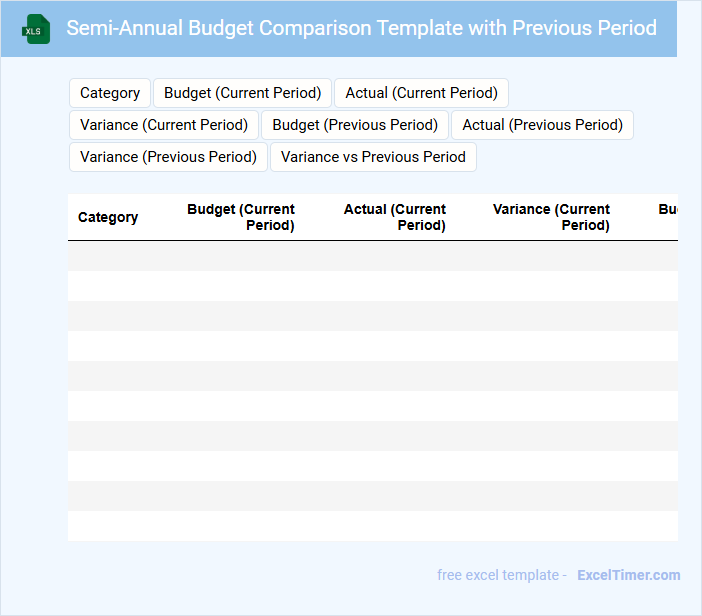

Semi-Annual Budget Comparison Template with Previous Period

A Semi-Annual Budget Comparison Template with Previous Period is a financial document that helps track and compare budget performance over two consecutive half-year periods. It is essential for identifying trends, variances, and areas for cost control within a business or project.

- Include detailed categories for revenue and expenses to ensure comprehensive analysis.

- Highlight significant variances between the current and previous periods for quick insights.

- Incorporate percentage changes to better visualize financial trends over time.

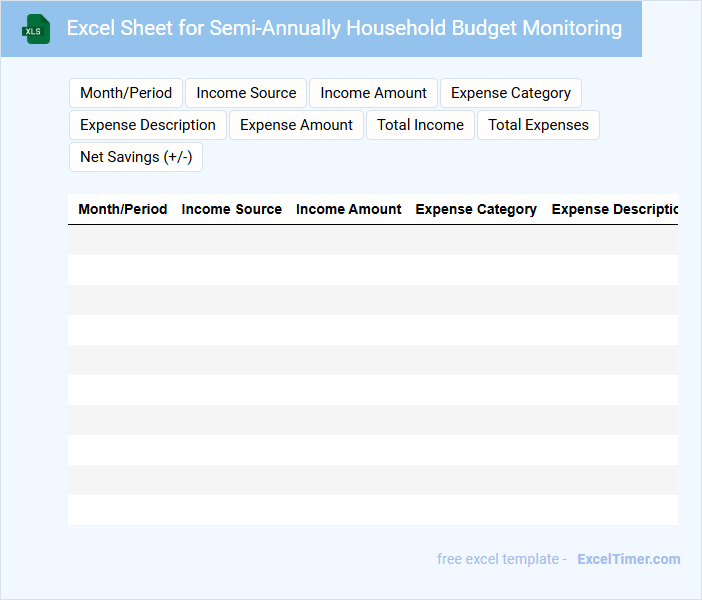

Excel Sheet for Semi-Annually Household Budget Monitoring

This type of document typically contains detailed financial data to track income and expenses over a six-month period for a household. It helps in understanding spending patterns and planning future budgets effectively.

- Include categorized expense and income entries for accurate tracking.

- Provide summary sections to highlight total income, expenses, and savings.

- Incorporate visual charts or graphs for easier trend analysis.

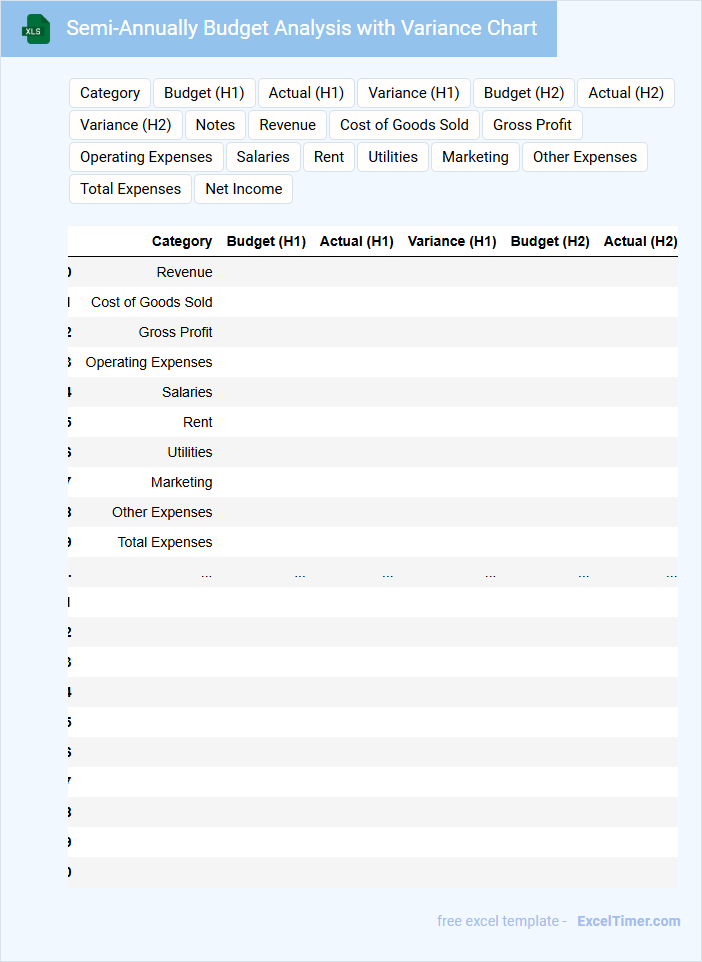

Semi-Annually Budget Analysis with Variance Chart

A Semi-Annually Budget Analysis with Variance Chart typically contains a comparative review of planned versus actual financial performance over six months.

- Variance Identification: Highlights significant deviations between expected and actual expenses or revenues.

- Trend Analysis: Displays financial trends using charts to visualize variances clearly.

- Actionable Insights: Suggests necessary adjustments or corrective measures based on variance data.

Corporate Financial Budget Tracking With Semi-Annual Reporting

Corporate Financial Budget Tracking documents typically contain detailed records of revenue, expenses, and budget variances over a specific period, allowing organizations to monitor financial performance closely. This type of document is essential for budget forecasting, enabling businesses to adjust strategies based on semi-annual financial insights. It often includes comparisons between actual and planned figures, helping management ensure resources are allocated effectively.

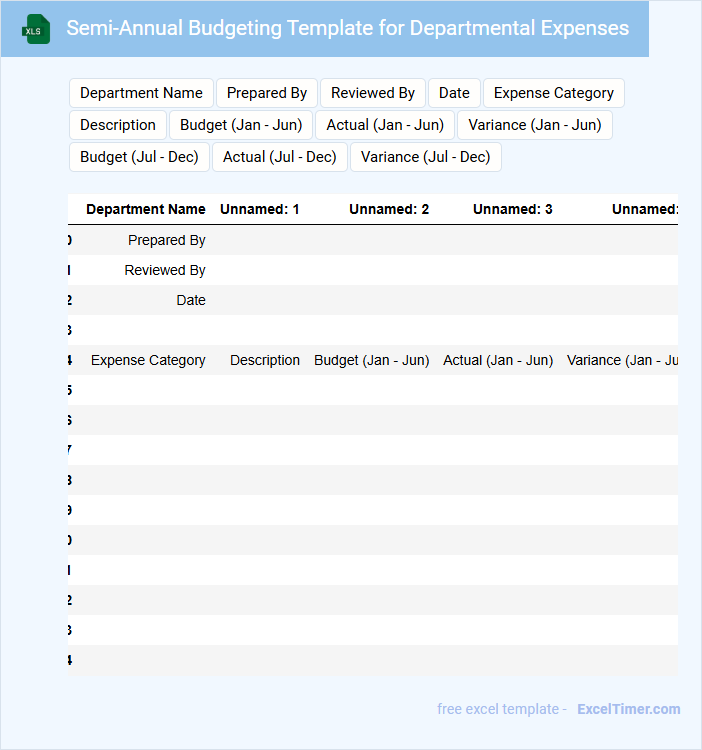

Semi-Annual Budgeting Template for Departmental Expenses

This Semi-Annual Budgeting Template is designed to track and plan departmental expenses over a six-month period. It typically contains detailed categories of expenditures, projected costs, and actual spending data to ensure financial accountability. Utilizing this template helps departments manage funds efficiently and align spending with organizational goals.

It is important to include comprehensive expense categories, regularly update actual costs against projections, and allow for adjustments based on department needs. Additionally, incorporating a summary section for quick financial insights enhances the document's usability. Clear labeling and consistent formatting improve clarity for all stakeholders involved.

Excel Tracker for Semi-Annual Revenue and Cost of Goods

An Excel Tracker for Semi-Annual Revenue and Cost of Goods is typically used to monitor financial performance over a six-month period. It contains detailed entries of revenue streams and associated costs of goods sold, enabling precise profit calculation.

This document is essential for comparing budgeted versus actual figures, identifying trends, and managing cash flow efficiently. Regular updates and accurate data input are crucial to ensure reliability and usefulness.

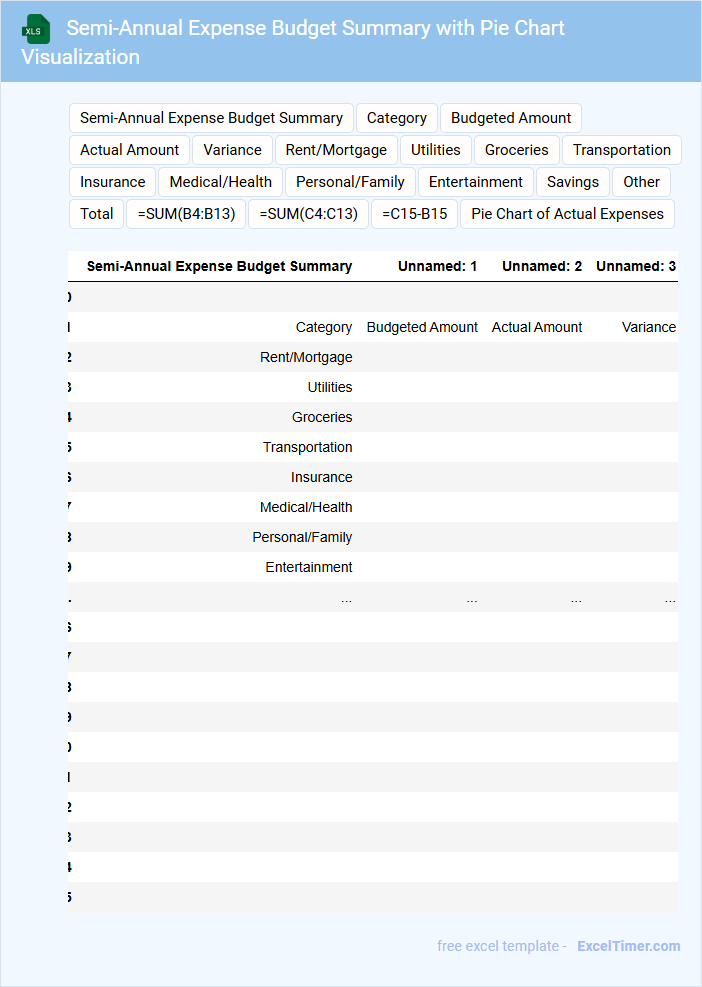

Semi-Annual Expense Budget Summary with Pie Chart Visualization

What information is typically included in a Semi-Annual Expense Budget Summary with Pie Chart Visualization? This document usually contains a detailed breakdown of expenses incurred over a six-month period, categorized by types such as operational costs, salaries, and utilities. It also includes a pie chart visual that provides a quick and clear overview of the proportion each expense category contributes to the total budget, aiding in visual analysis.

Why is it important to include accurate data and clear labels in this summary? Accurate data ensures reliable financial insights and helps in making informed budget decisions, while clear labels on the pie chart enhance readability and make it easier for stakeholders to quickly understand expense distributions and identify key areas of spending.

Project Budget Tracking for Semi-Annual Financial Planning

What information is typically included in a Project Budget Tracking document for Semi-Annual Financial Planning? This document usually contains detailed records of all projected and actual expenses related to the project over a six-month period, including labor, materials, and overhead costs. It helps monitor budget adherence, identify variances, and ensure financial resources are effectively allocated to meet project goals on time.

What is an important consideration when using Project Budget Tracking for Semi-Annual Financial Planning? It is essential to regularly update the tracking document with real-time financial data and review it periodically to make informed adjustments in spending. Consistent communication with stakeholders ensures transparency and supports proactive decision-making throughout the fiscal period.

How is semi-annual budgeting structured within an Excel financial tracking document?

Semi-annual budgeting in an Excel financial tracking document divides the fiscal year into two six-month periods with separate budget allocations and expense tracking. Each half-year section includes detailed categories such as income, expenditures, and variance analysis, facilitating focused financial review and adjustments. Formulas and pivot tables automate data summation and comparison between periods for accurate semi-annual budget management.

What formulas are used to calculate semi-annual totals and variances in Excel?

Excel formulas for semi-annual financial budget tracking typically sum monthly data using =SUM(range) for two consecutive quarters, such as =SUM(B2:G2) for months January to June. Variance calculations apply =Actual - Budget, represented as =C2 - D2, where C2 is the actual semi-annual total and D2 is the budgeted amount. Conditional formatting highlights deviations exceeding set thresholds to optimize budget control.

How can Excel conditional formatting highlight semi-annual over/under budget situations?

Excel conditional formatting can highlight semi-annual over/under budget situations by using rules that compare your actual expenses against budgeted amounts for each six-month period. This feature visually distinguishes over-budget values with colors such as red, while under-budget amounts might be highlighted in green, enabling quick identification of financial discrepancies. Setting conditions based on semi-annual thresholds ensures accurate tracking and improved management of your financial budget.

Which Excel charts best visualize semi-annual financial performance and trends?

Bar charts and line graphs in Excel effectively visualize semi-annual financial performance by displaying revenue, expenses, and profit trends over two periods per year. Clustered bar charts highlight comparative data between each half, while line charts track performance trends over multiple years. Combining these charts with data labels and trendlines enhances clarity and insight into budget tracking.

How does Excel handle the aggregation of monthly data into semi-annual budget reports?

Excel aggregates monthly data into semi-annual budget reports using functions like SUM and SUMIFS to total values for two consecutive quarters. PivotTables enable dynamic grouping and summarization of financial data by six-month periods. Custom formulas can automate semi-annual calculations based on date ranges within the budget tracking spreadsheet.