The Semi-annually Loan Repayment Excel Template for Personal Finance enables users to efficiently track and manage loan payments scheduled every six months. This template simplifies calculating interest and principal amounts, ensuring accurate financial planning. It is ideal for personal budgeting by providing clear insights into repayment progress and outstanding loan balances.

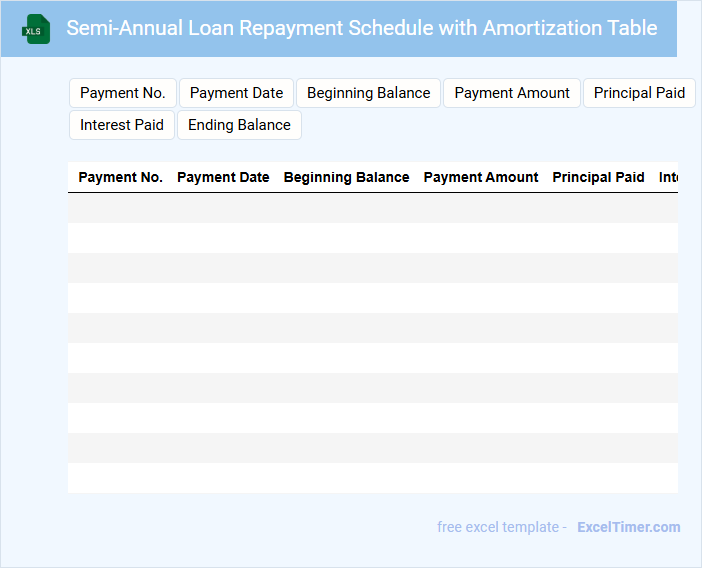

Semi-Annual Loan Repayment Schedule with Amortization Table

A Semi-Annual Loan Repayment Schedule with Amortization Table typically outlines the payment plan for repaying a loan in six-month intervals, detailing principal and interest amounts. It helps borrowers understand their payment obligations and track the loan balance over time.

- Include the loan amount, interest rate, and loan term for clarity.

- Clearly show each semi-annual payment amount along with principal and interest breakdown.

- Provide a running balance to illustrate how the loan is amortized over time.

Excel Template for Semi-Annual Loan Repayment Tracking

An Excel Template for Semi-Annual Loan Repayment Tracking is a structured document designed to monitor loan repayments made every six months. It typically contains fields for loan details, payment dates, amounts, outstanding balances, and interest calculations. This template helps users maintain organized records and ensures timely tracking of repayments to avoid defaults. Important considerations include ensuring accurate formula integration, clear labeling of all sections, and updating the template regularly to reflect payment status and remaining loan balance.

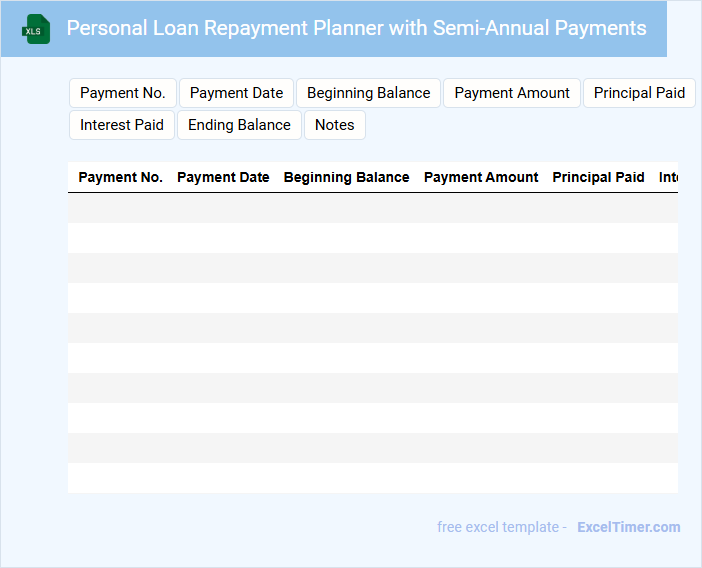

Personal Loan Repayment Planner with Semi-Annual Payments

A Personal Loan Repayment Planner with Semi-Annual Payments typically includes details about the loan amount, interest rate, payment schedule, and the due dates for each installment. It outlines a structured plan that helps borrowers track and manage their semi-annual payments effectively.

Important elements to focus on include the total interest payable over time and a clear amortization schedule. Ensuring timely payments and understanding the impact of payment frequency can help avoid penalties and reduce overall debt duration.

Loan Repayment Tracker for Semi-Annual Installments

A Loan Repayment Tracker for semi-annual installments is a document designed to monitor the progress of loan payments made every six months. It usually contains details such as payment dates, amounts paid, remaining balance, and interest accrued.

This type of tracker helps borrowers stay organized and ensures timely payments to avoid penalties. Important elements include a clear schedule, payment status updates, and a summary of total amounts paid and outstanding.

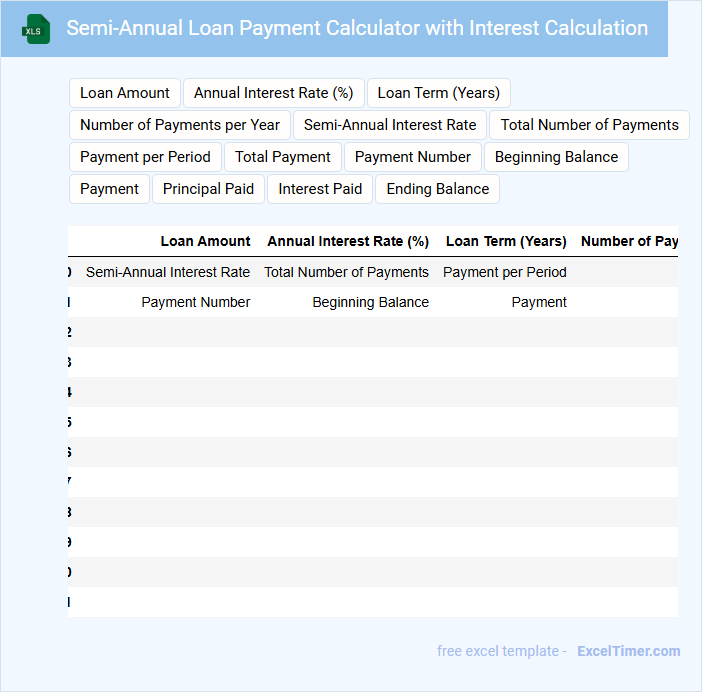

Semi-Annual Loan Payment Calculator with Interest Calculation

What information is typically included in a Semi-Annual Loan Payment Calculator with Interest Calculation document? This type of document usually contains details about the loan amount, interest rate, loan term, and payment frequency to compute the semi-annual payment amounts accurately. It also includes formulas or algorithms for interest calculation and amortization schedules to help users understand the repayment structure clearly.

What important considerations should be made when using this calculator? It is crucial to ensure that the interest rate input matches the compounding period and that the loan term and payment intervals are correctly defined to avoid miscalculations. Additionally, users should verify the inclusion of any fees or penalties that might affect the overall loan cost for precise payment planning.

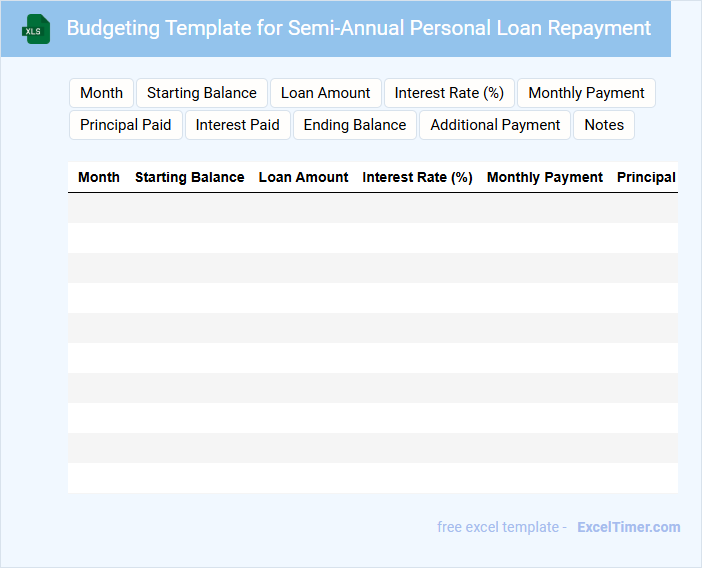

Budgeting Template for Semi-Annual Personal Loan Repayment

What is typically included in a Budgeting Template for Semi-Annual Personal Loan Repayment? This type of document usually contains sections for listing loan details, payment schedules, interest rates, and budget allocations for each repayment period. It helps individuals plan their finances effectively by tracking deadlines and ensuring timely semi-annual payments.

What important factors should be considered when using this budgeting template? It is crucial to accurately input loan terms and payment amounts to avoid missed payments and penalties. Additionally, incorporating contingency funds for unexpected expenses ensures a more realistic and manageable repayment plan.

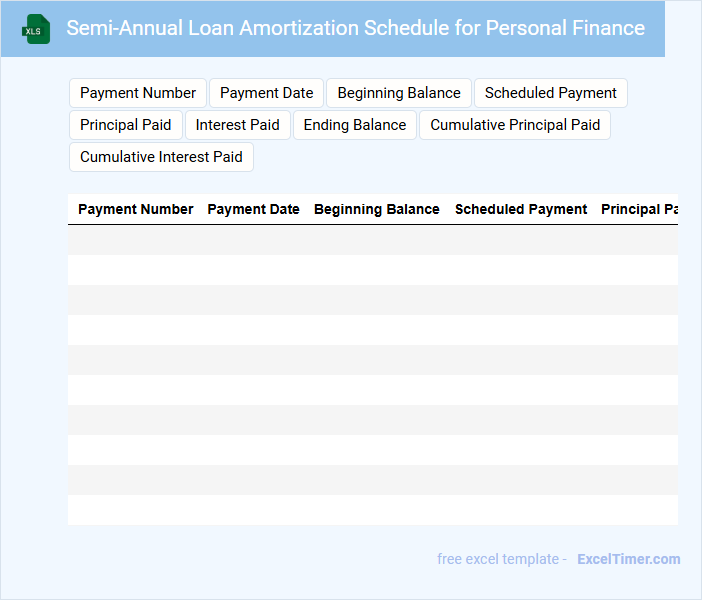

Semi-Annual Loan Amortization Schedule for Personal Finance

A Semi-Annual Loan Amortization Schedule typically contains a detailed breakdown of loan payments made every six months, showing principal and interest components separately. It helps borrowers track their repayment progress over time and understand how much interest they are paying. For personal finance management, it is crucial to monitor this schedule regularly to avoid missed payments and plan budgets effectively.

Excel Sheet for Tracking Semi-Annual Loan Repayments

An Excel Sheet for tracking semi-annual loan repayments is designed to organize and monitor payment schedules effectively. It usually contains columns for payment dates, amounts due, amounts paid, and remaining balances. Accurate tracking helps users stay on top of their financial obligations and avoid missed payments.

Important elements to include are clear headers, automatic calculation formulas for balances, and reminders for upcoming payments. Additionally, incorporating a summary section to display total paid and outstanding amounts enhances usability. Customizable date formats and conditional formatting can improve readability and alert users to late payments.

Personal Finance Planner with Semi-Annual Loan Payment Tracking

What information is typically included in a Personal Finance Planner with Semi-Annual Loan Payment Tracking? This type of document usually contains an overview of income, expenses, savings goals, and a detailed schedule of loan payments made every six months. It helps individuals monitor their financial health, manage debt efficiently, and plan for future financial stability.

What are the important aspects to focus on when using this planner? Prioritize accurately recording semi-annual loan payments along with interest rates and outstanding balances, and regularly update your income and expenses to get a clear financial snapshot. Additionally, setting realistic savings targets and reviewing progress can significantly improve long-term financial planning.

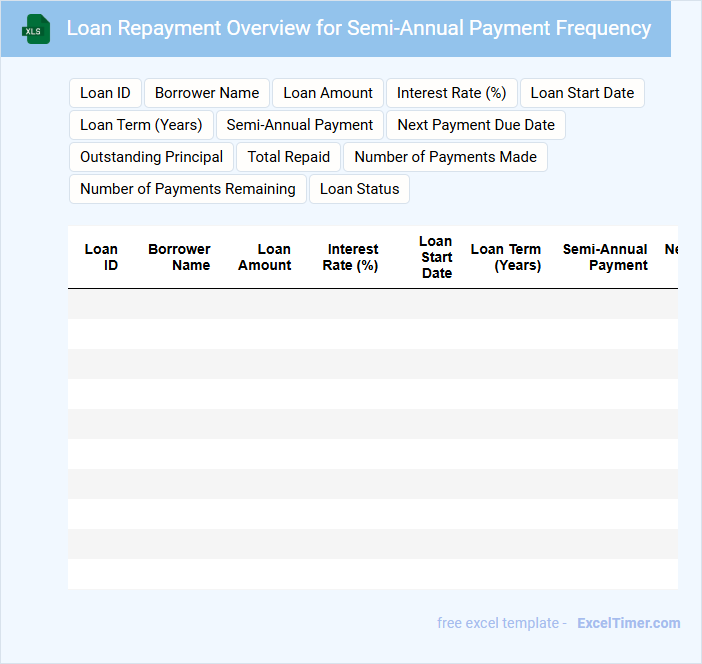

Loan Repayment Overview for Semi-Annual Payment Frequency

A Loan Repayment Overview for Semi-Annual Payment Frequency typically summarizes the key details and schedule of loan repayments made twice a year.

- Payment amount: outlines the exact sum due every six months including principal and interest.

- Due dates: specifies the semi-annual deadlines to ensure timely payments and avoid penalties.

- Outstanding balance: tracks the remaining loan amount after each semi-annual payment is applied.

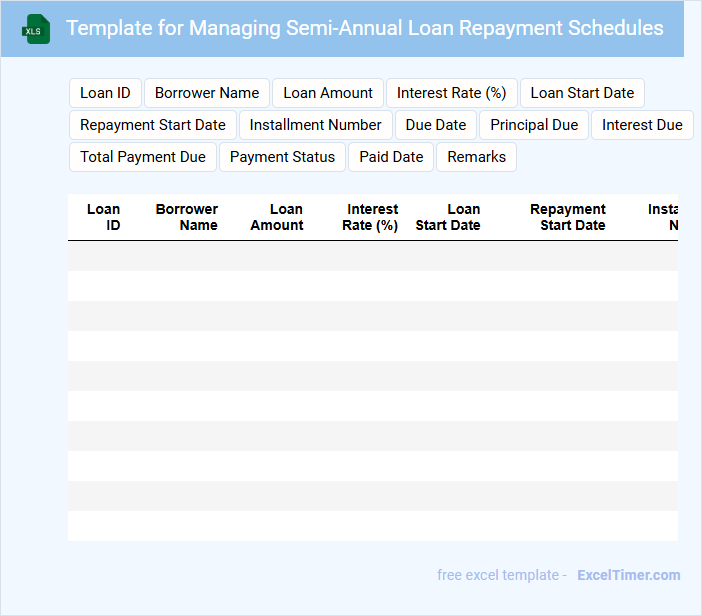

Template for Managing Semi-Annual Loan Repayment Schedules

What information is typically included in a template for managing semi-annual loan repayment schedules? Such templates usually contain details about the loan amount, interest rate, repayment dates, and payment amounts for each semi-annual period. They help in organizing and tracking the loan repayments efficiently to ensure timely payments and avoid penalties.

What is an important consideration when using this type of template? It is crucial to accurately input all loan terms and payment deadlines to maintain a clear schedule and avoid missed payments, which could affect credit rating and incur additional fees.

Semi-Annual Loan Balance Tracker with Payment History

A Semi-Annual Loan Balance Tracker typically contains detailed records of loan balances updated every six months, enabling clear visibility of outstanding principal amounts. It includes a comprehensive payment history section that documents all payments made, dates, and amounts for effective tracking and reconciliation. This document is essential for monitoring loan repayment progress and ensuring financial accountability over time.

For optimal use, it is important to regularly update the tracker with accurate payment data and include a summary of interest accrued to provide a full financial picture. Additionally, incorporating reminders for upcoming payments and specifying loan terms can enhance its functionality and user awareness. Clear labeling and organized presentation of data improve usability for both borrowers and financial institutions.

Yearly Overview Template for Personal Loans with Semi-Annual Repayment

A Yearly Overview Template for Personal Loans with Semi-Annual Repayment typically contains a detailed summary of all loan transactions within the year, including principal amounts, interest rates, and repayment schedules. It provides clear visibility on payment due dates and outstanding balances to help borrowers manage their finances effectively. An important suggestion is to regularly update the document after each repayment to maintain accuracy and ensure timely financial planning.

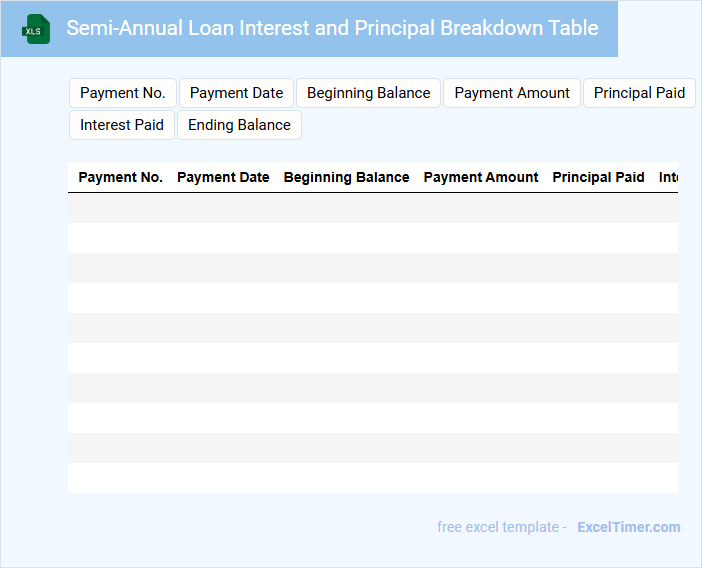

Semi-Annual Loan Interest and Principal Breakdown Table

This document typically contains a detailed breakdown of loan repayments, focusing on the interest and principal amounts paid every six months. It helps borrowers and lenders track repayment progress and understand the allocation of payments over time.

Important details to include are the interest rate, payment dates, and outstanding loan balance after each payment. Ensuring accuracy in these figures is crucial for transparent financial management and planning.

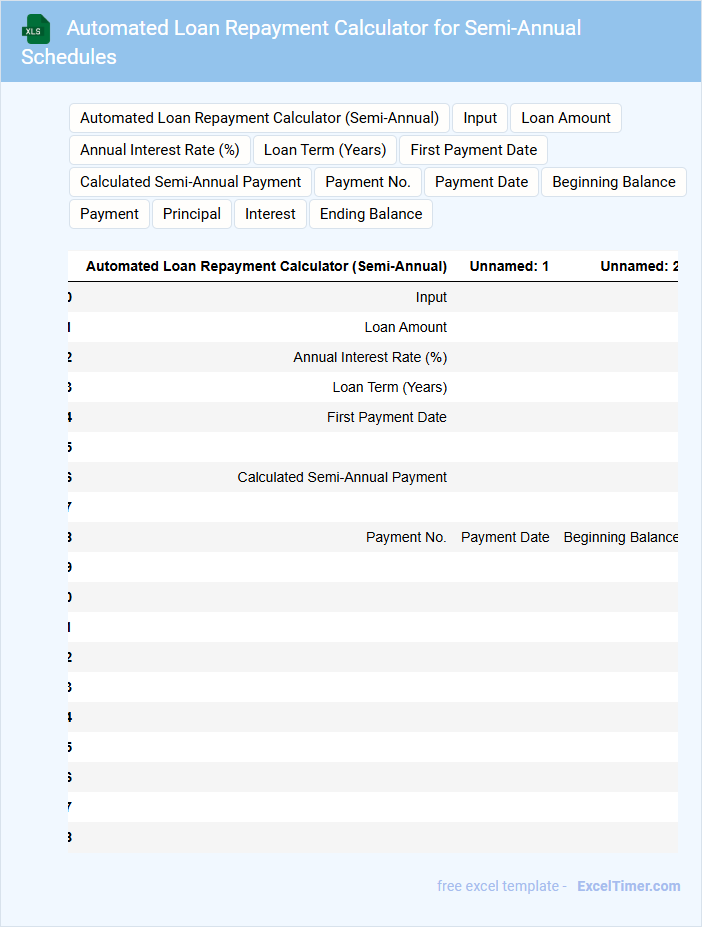

Automated Loan Repayment Calculator for Semi-Annual Schedules

This document typically contains detailed information about an automated loan repayment calculator designed for semi-annual schedules. It outlines the methodology, input parameters, and formulas used to calculate repayments accurately over specified intervals.

Key components often include user input fields, amortization tables, and result summaries highlighting payment amounts and interest breakdowns. It is important to ensure the calculator accommodates varying interest rates and principal values effectively.

What does "semi-annually" mean in the context of loan repayment schedules?

Semi-annually" in loan repayment schedules means making payments twice a year, usually every six months. This affects the total interest paid and the loan tenure compared to monthly or quarterly repayments. Understanding semi-annual repayment helps in accurate financial planning and managing personal cash flow.

How is interest calculated and applied for a semi-annual loan repayment plan?

In a semi-annual loan repayment plan, interest is calculated based on the outstanding principal balance at the start of each six-month period using the loan's annual interest rate divided by two. Interest accrued over the six months is added to the principal or paid along with principal repayments during each semi-annual payment. This method ensures that interest compounds semi-annually, affecting the total repayment amount in the Excel schedule.

What key Excel functions can calculate semi-annual loan payments and outstanding balances?

Excel's PMT function calculates your semi-annual loan payments based on interest rate, loan amount, and number of periods. The IPMT and PPMT functions break down interest and principal portions of each payment. Use the CUMIPMT function to determine outstanding loan balances over time.

How does a semi-annual repayment schedule impact the total interest paid compared to monthly repayment?

A semi-annual loan repayment schedule reduces the frequency of payments, often resulting in higher total interest paid compared to monthly repayments due to less frequent principal reduction. Your loan balance decreases slower, causing more interest to accrue over time. Choosing monthly repayments typically lowers overall interest costs and shortens the loan term.

Which or formula best summarizes a semi-annual repayment breakdown over the loan term?

The best Excel template for a semi-annual loan repayment breakdown is an amortization schedule template designed for semi-annual payments. Use the PMT function with a semi-annual interest rate (annual rate divided by 2) and total periods as twice the loan term in years to calculate each payment. The template should include columns for payment number, payment amount, interest paid, principal paid, and remaining balance for clear tracking.